Sugar Market Heats Up: Traders Spot Bullish Momentum and Key Price Signals

Sugar Futures Break Higher with Strong Institutional Backing

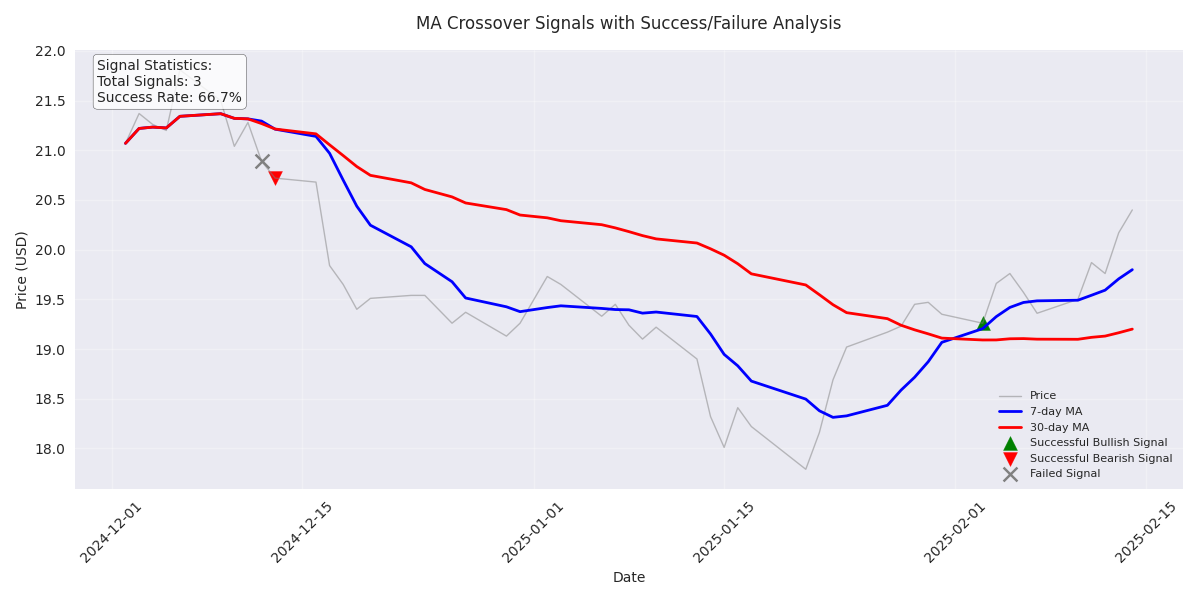

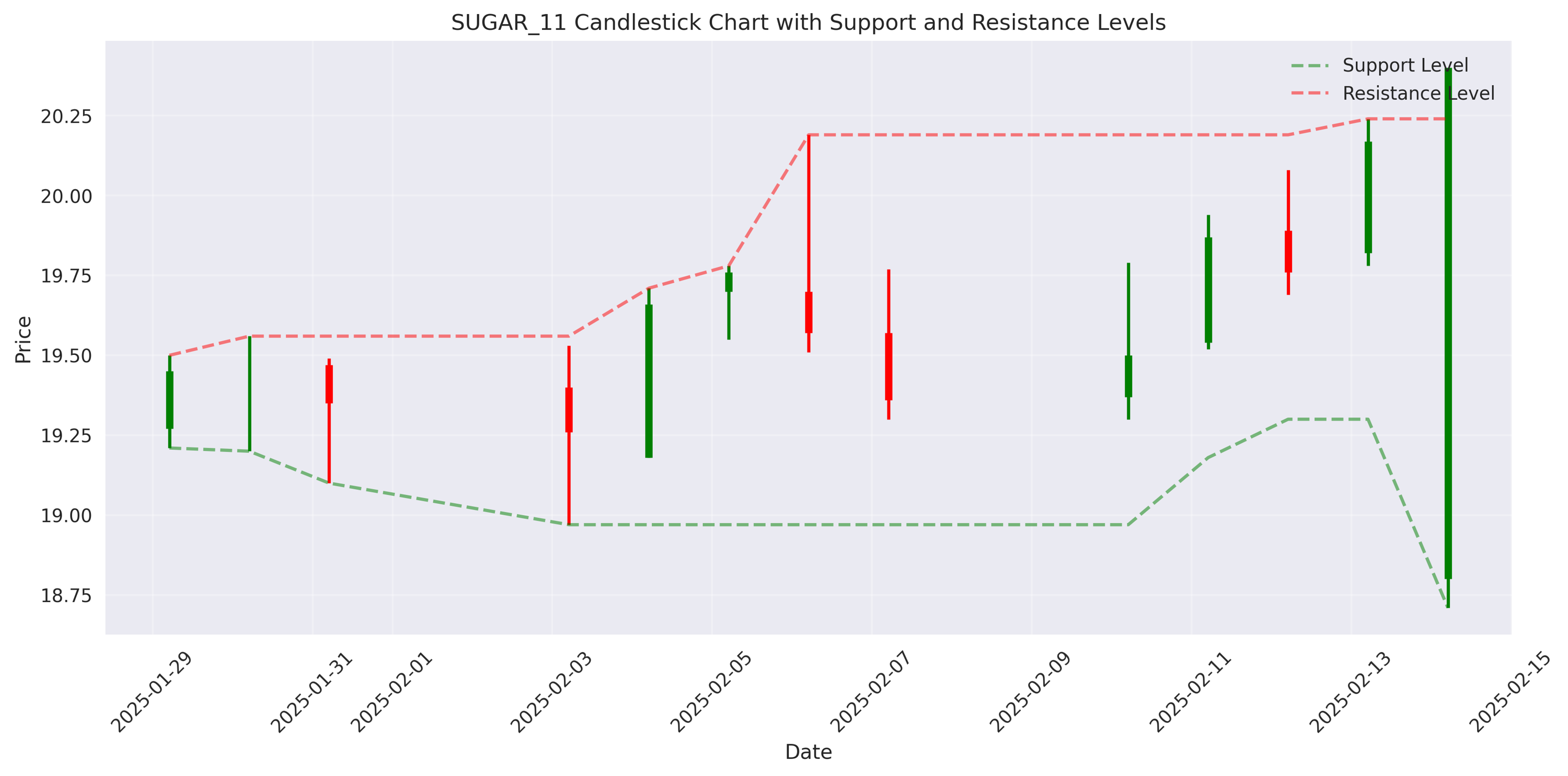

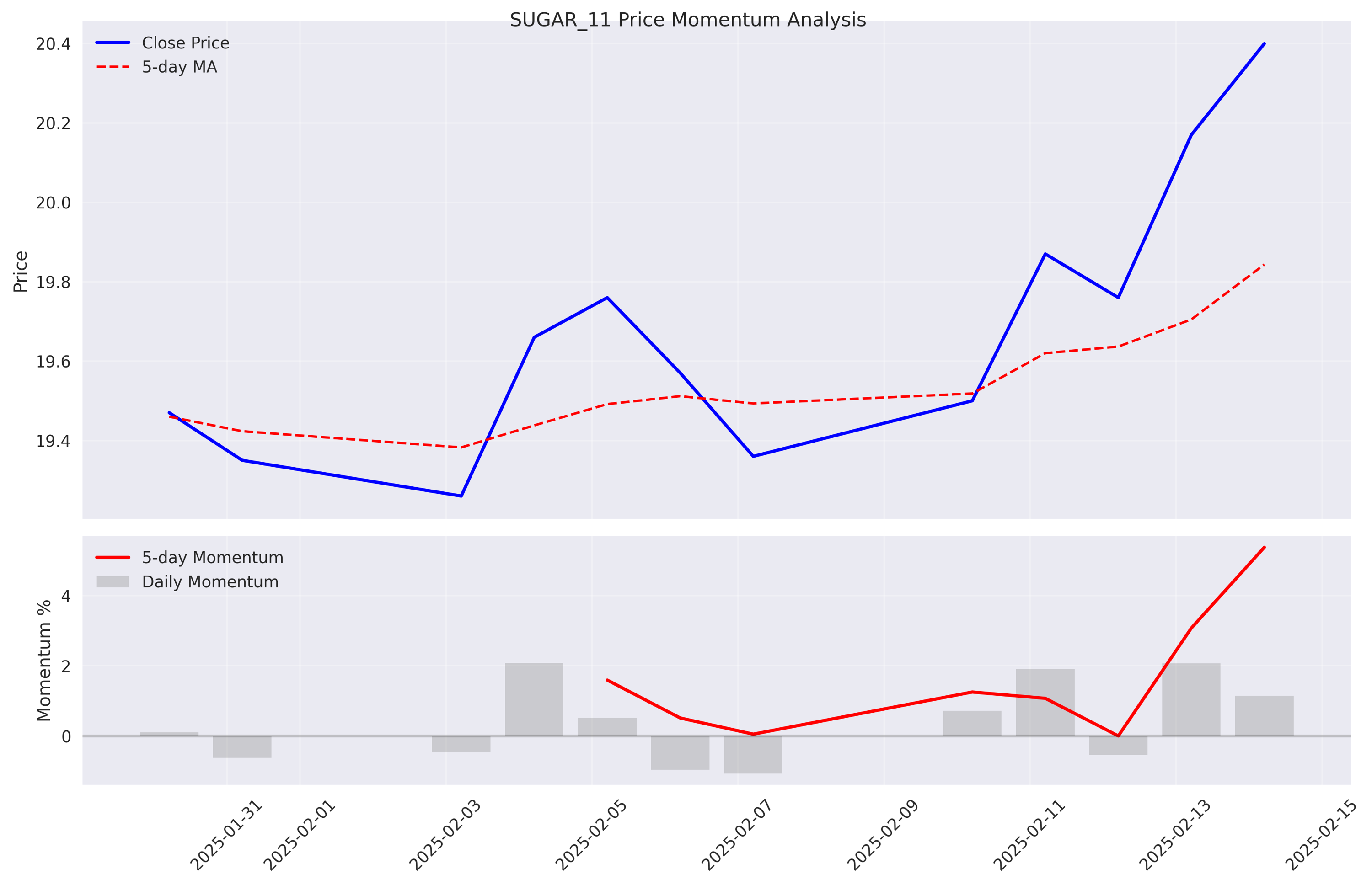

Technical Analysis Points to Further Upside with $22.30 Target

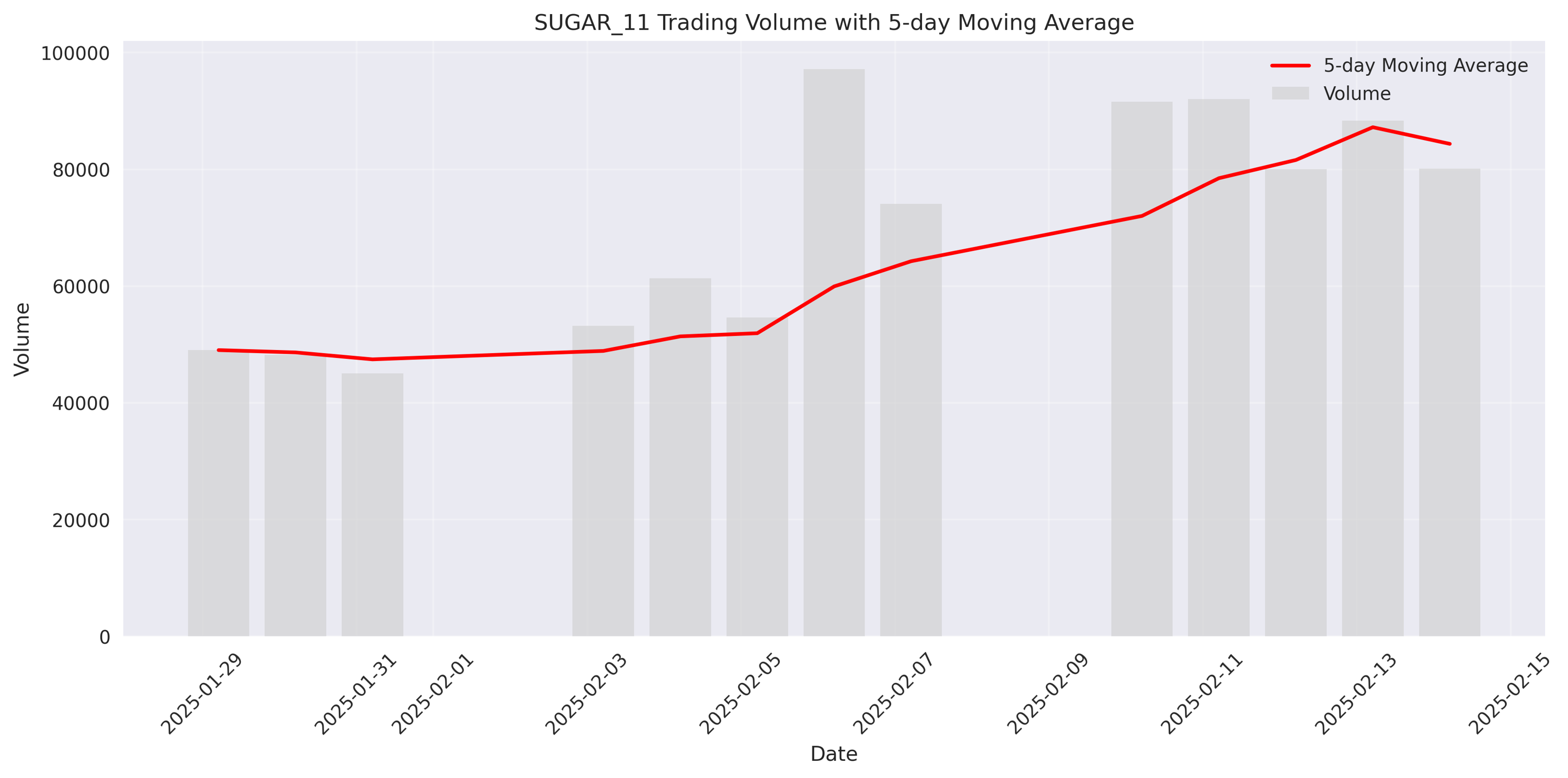

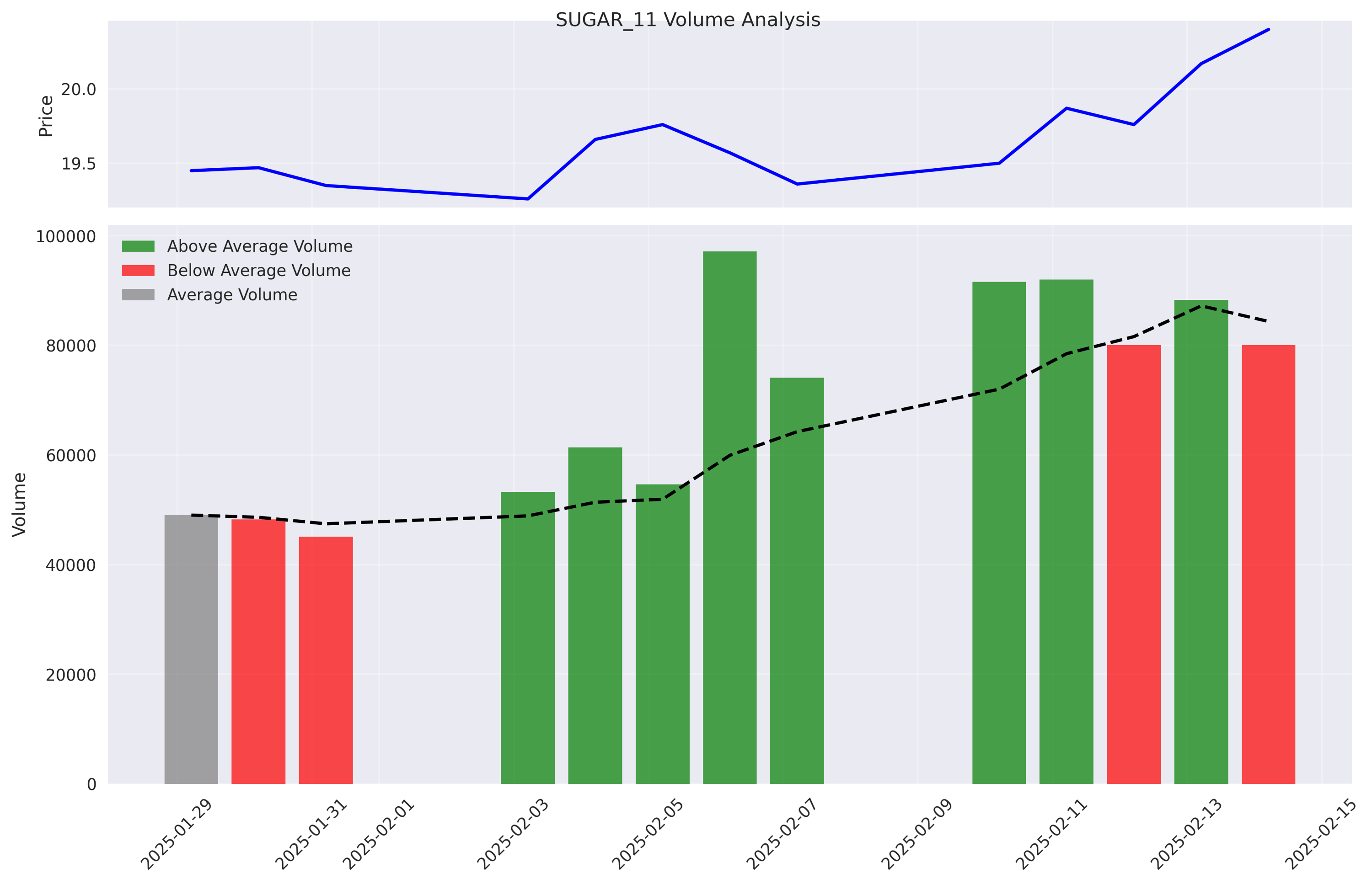

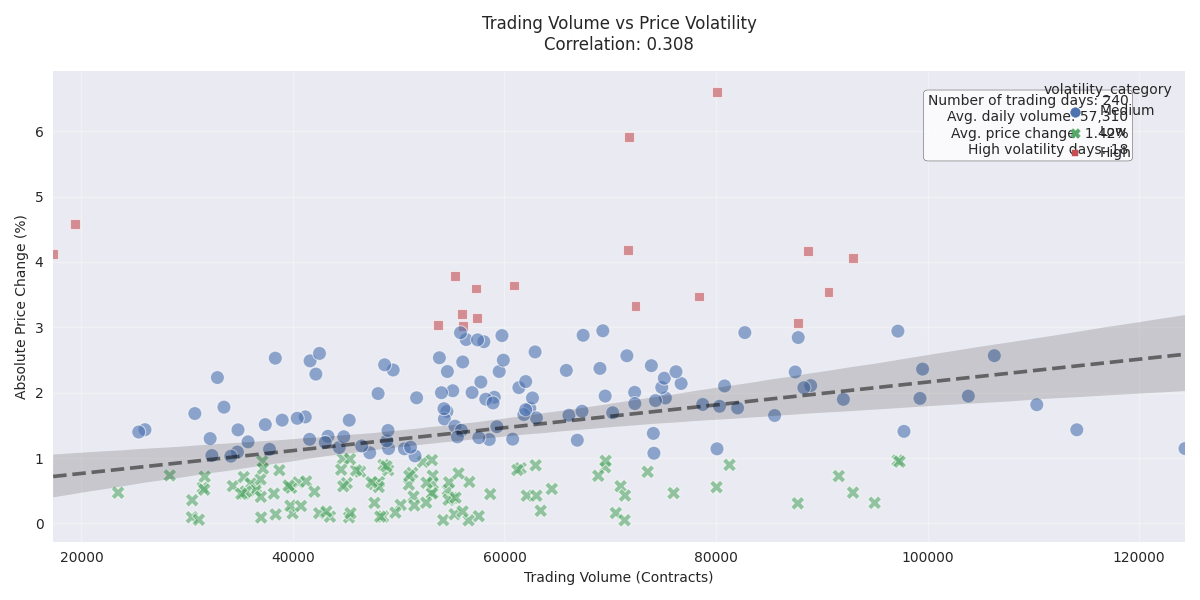

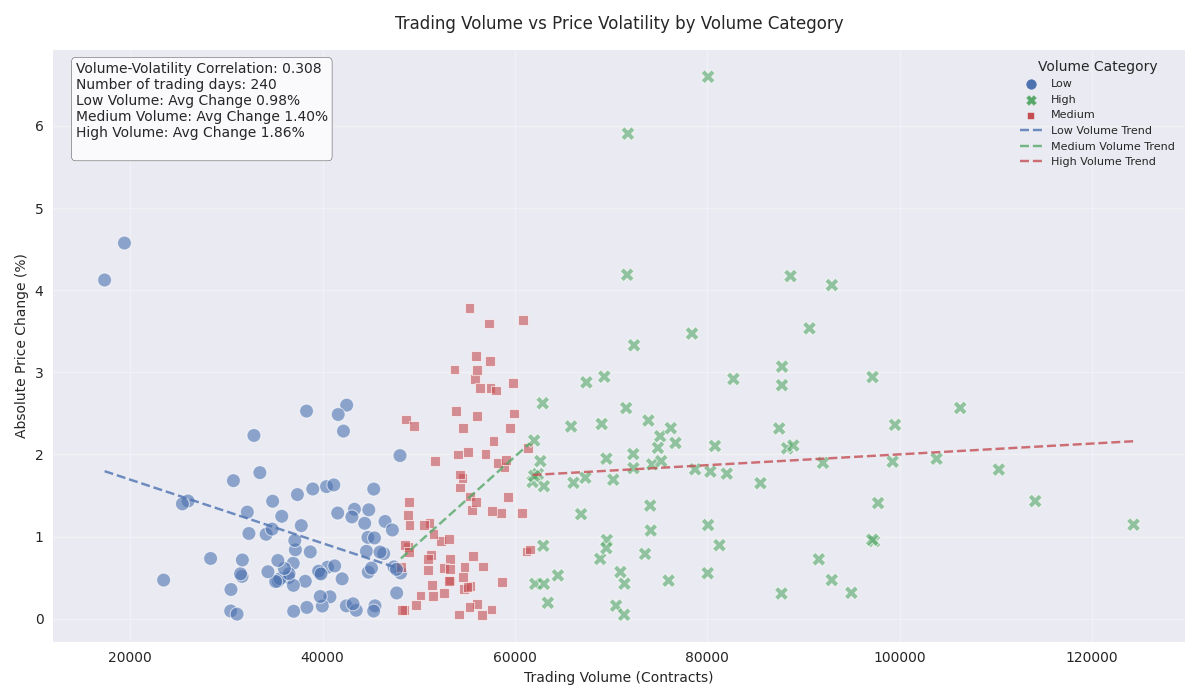

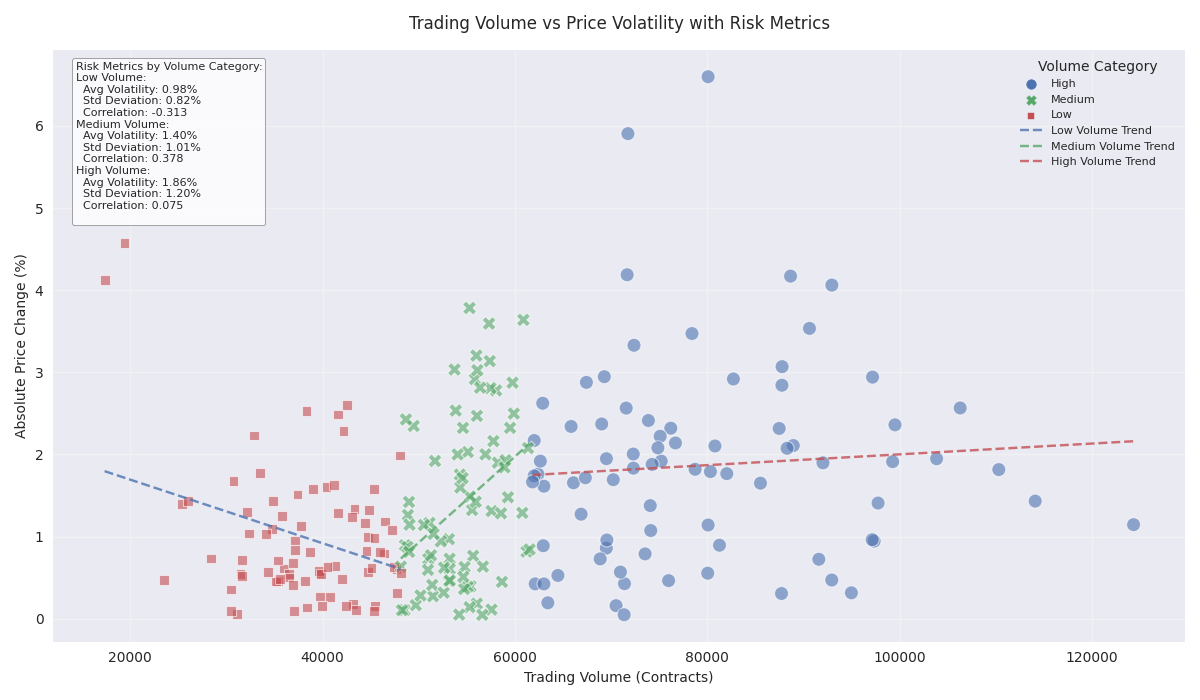

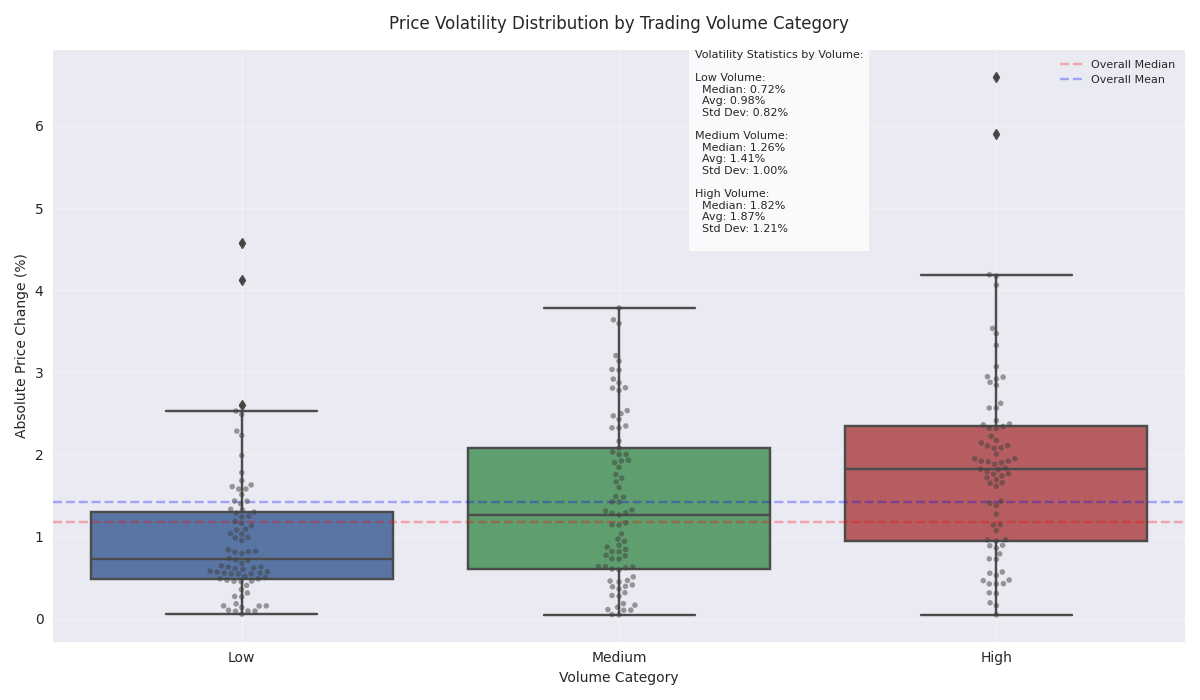

Trading Strategy: Volume-Based Risk Management Critical

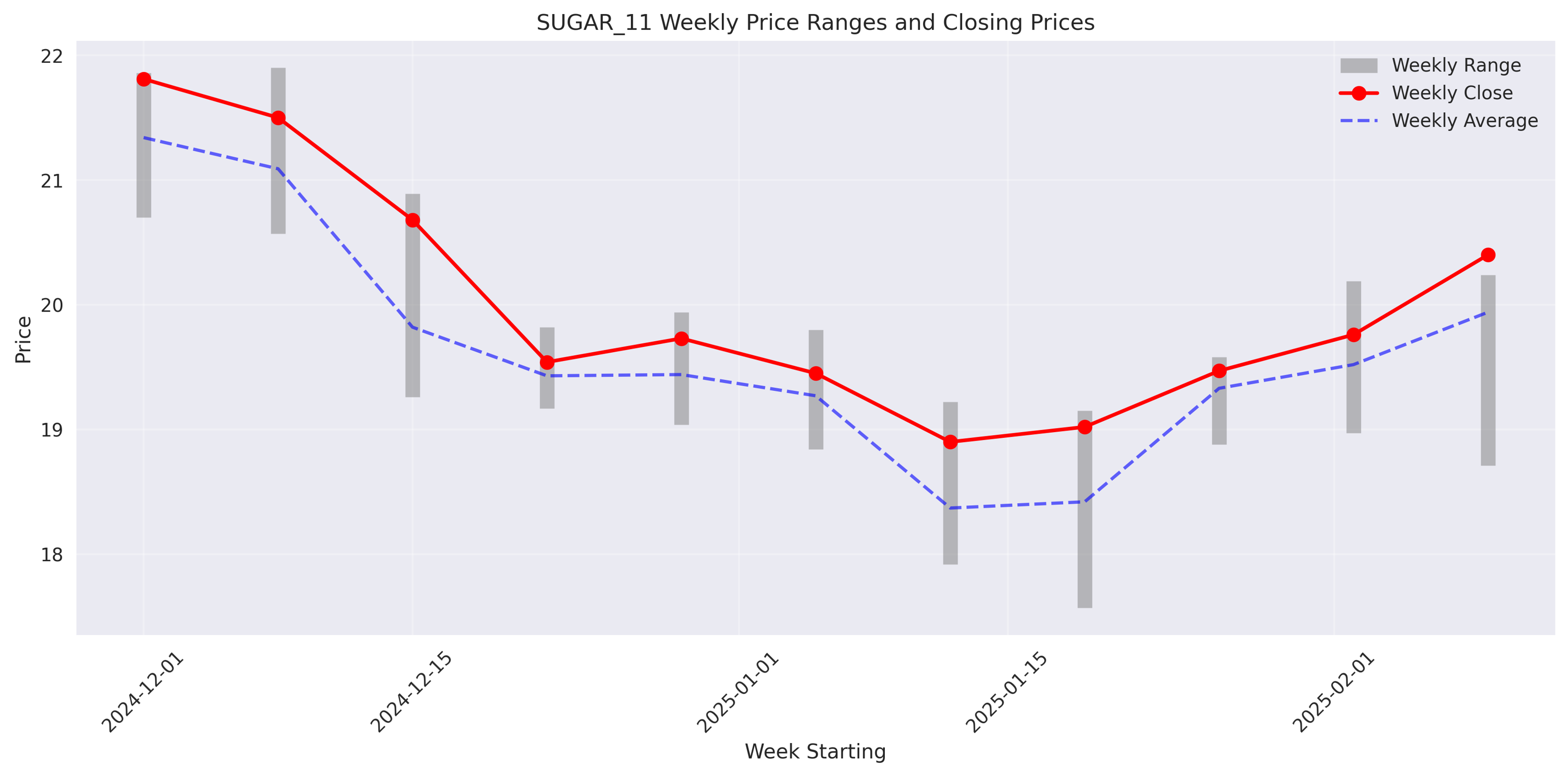

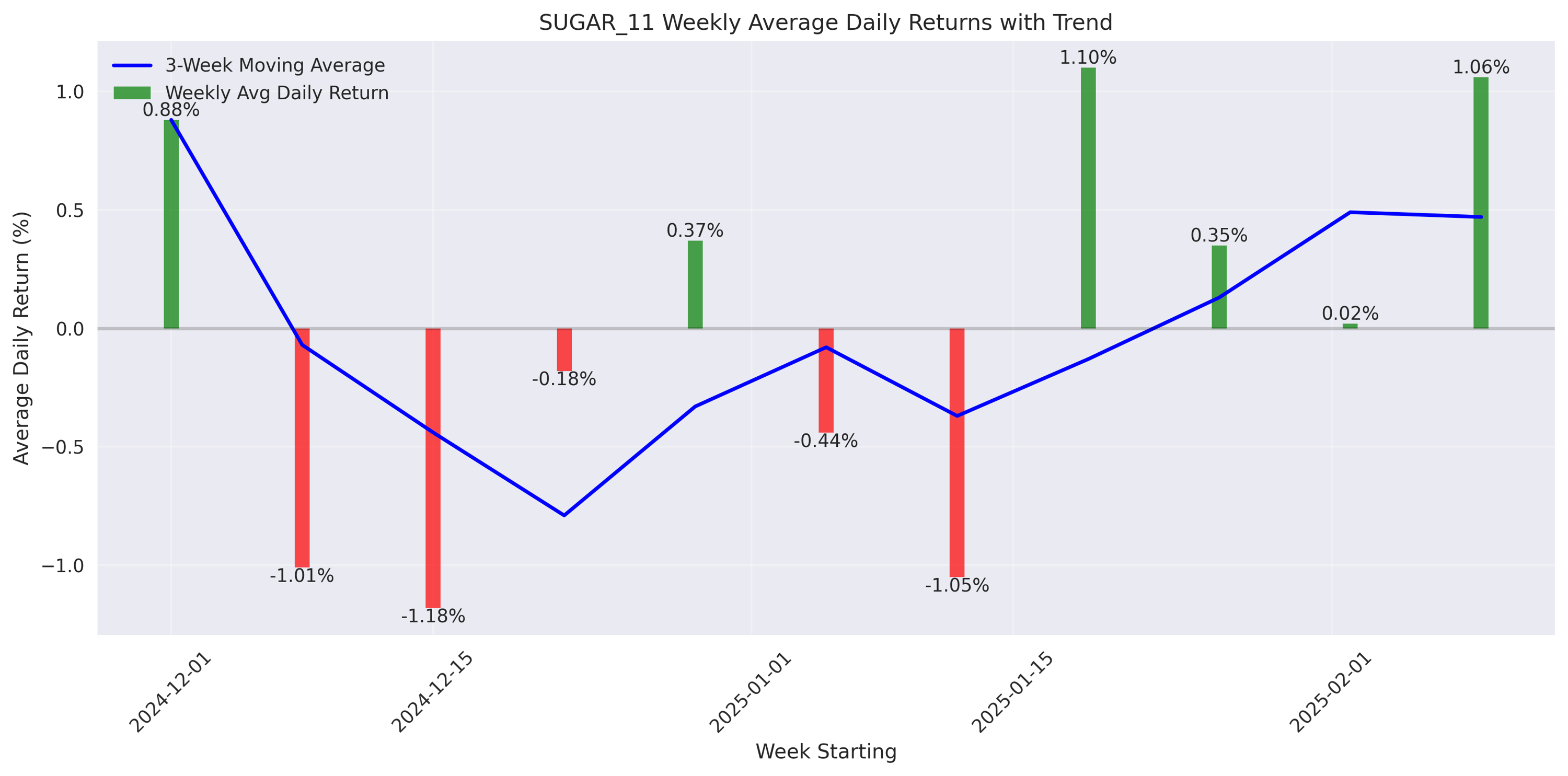

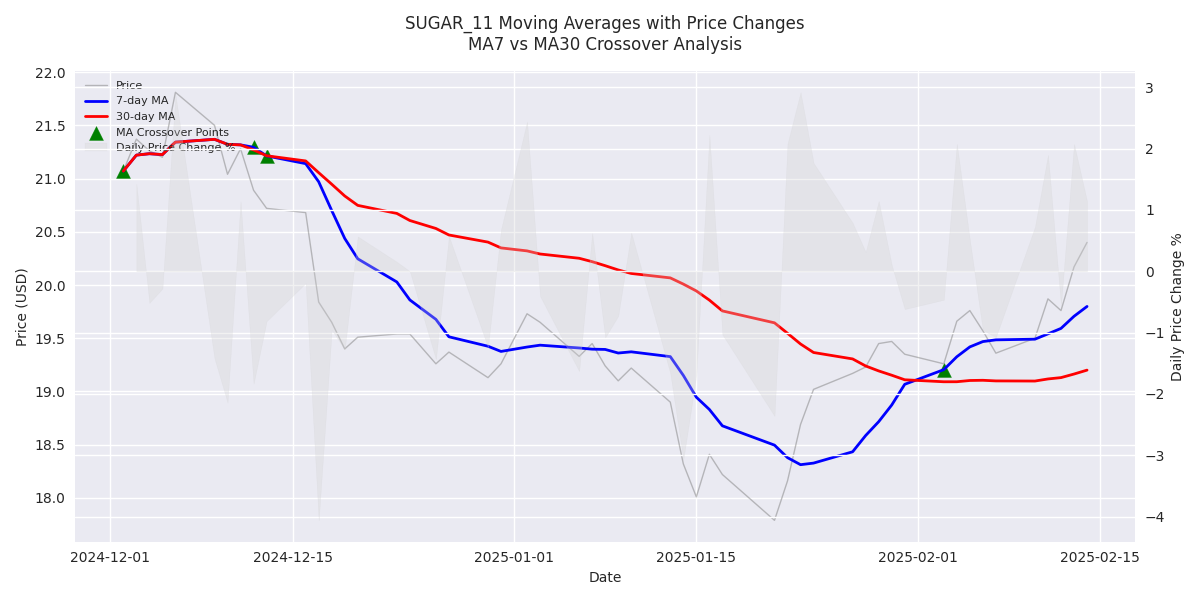

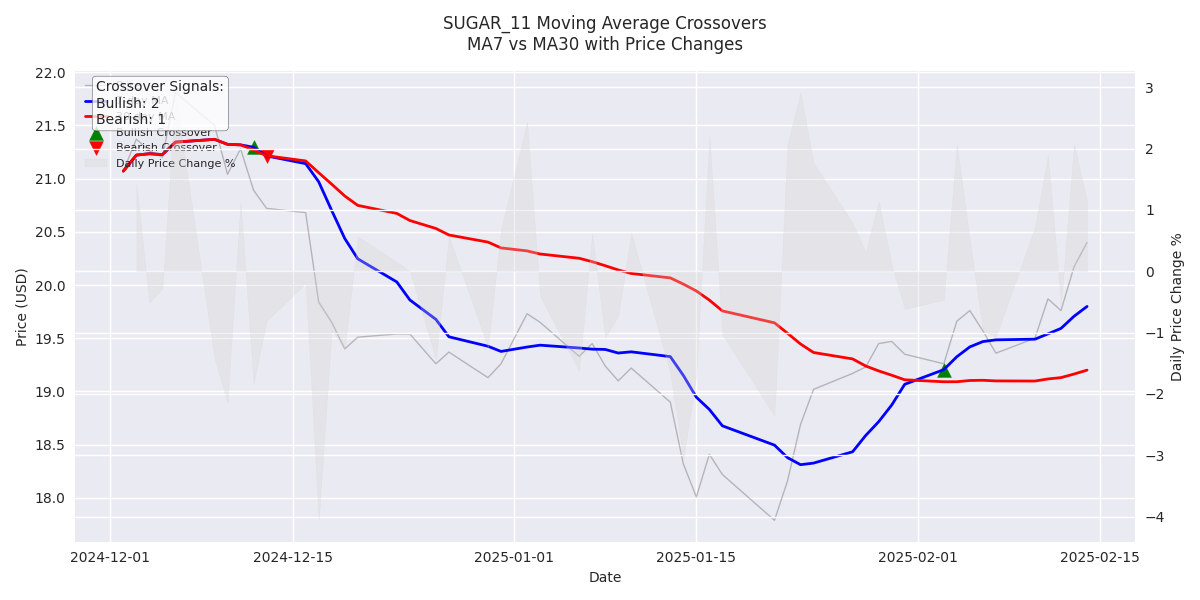

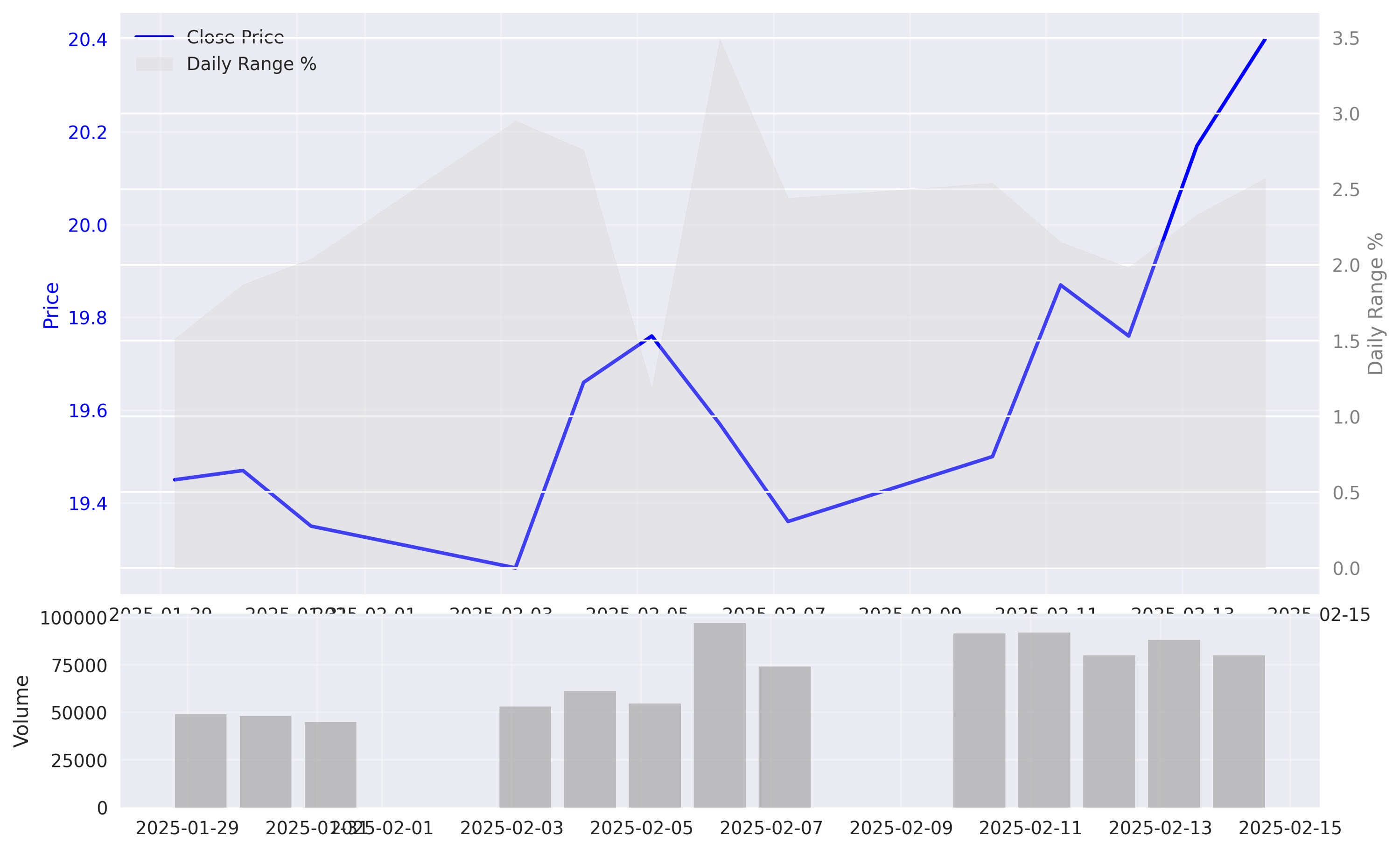

Recent SUGAR_11 Price Analysis Shows Bullish Momentum with Increased Volatility

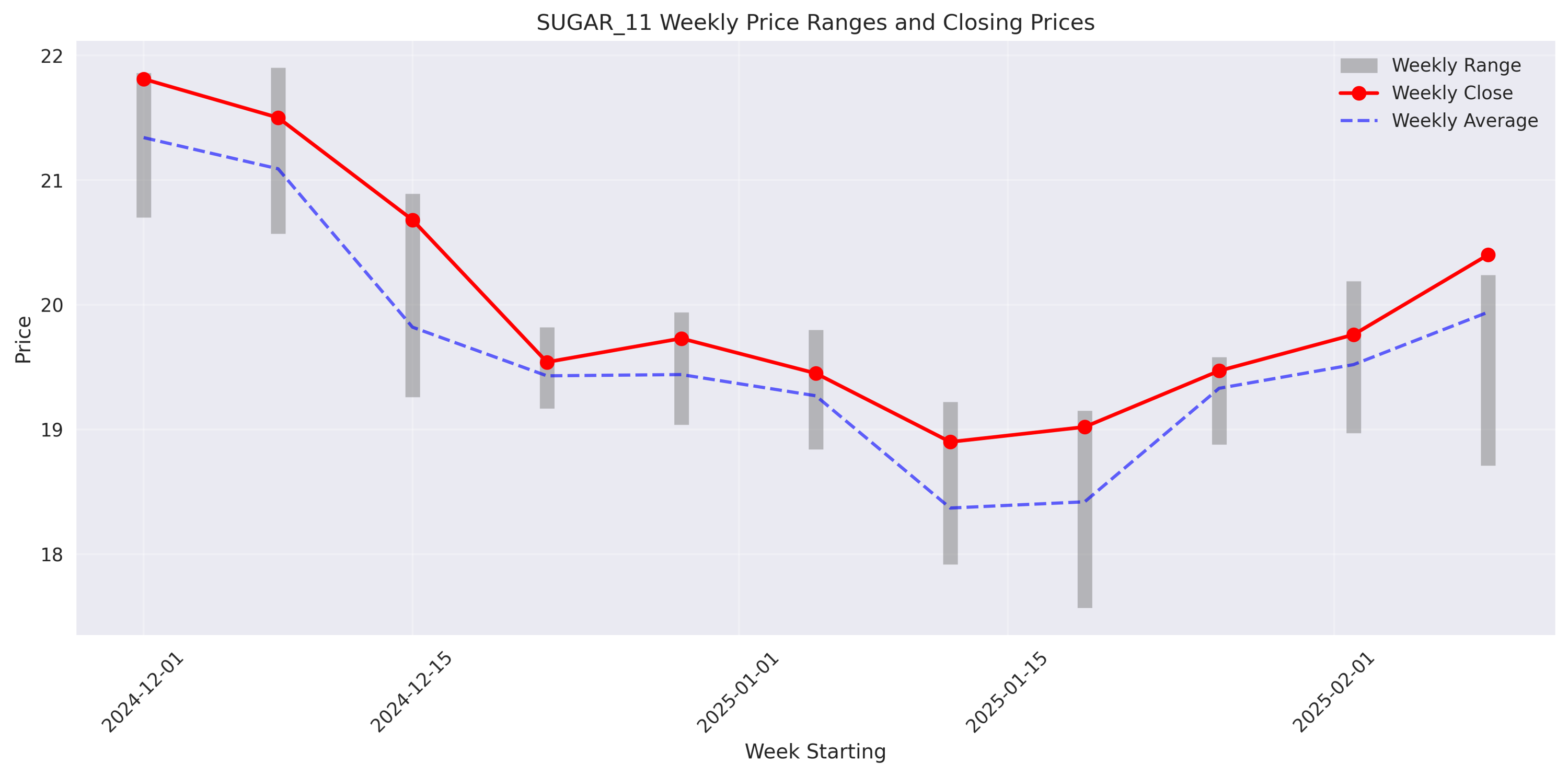

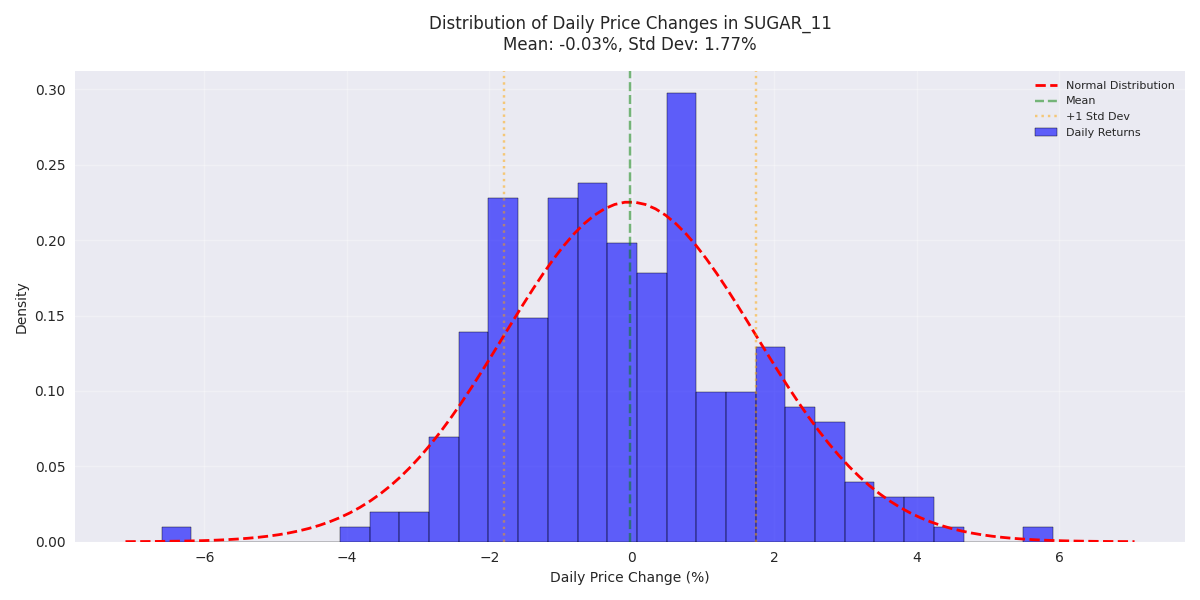

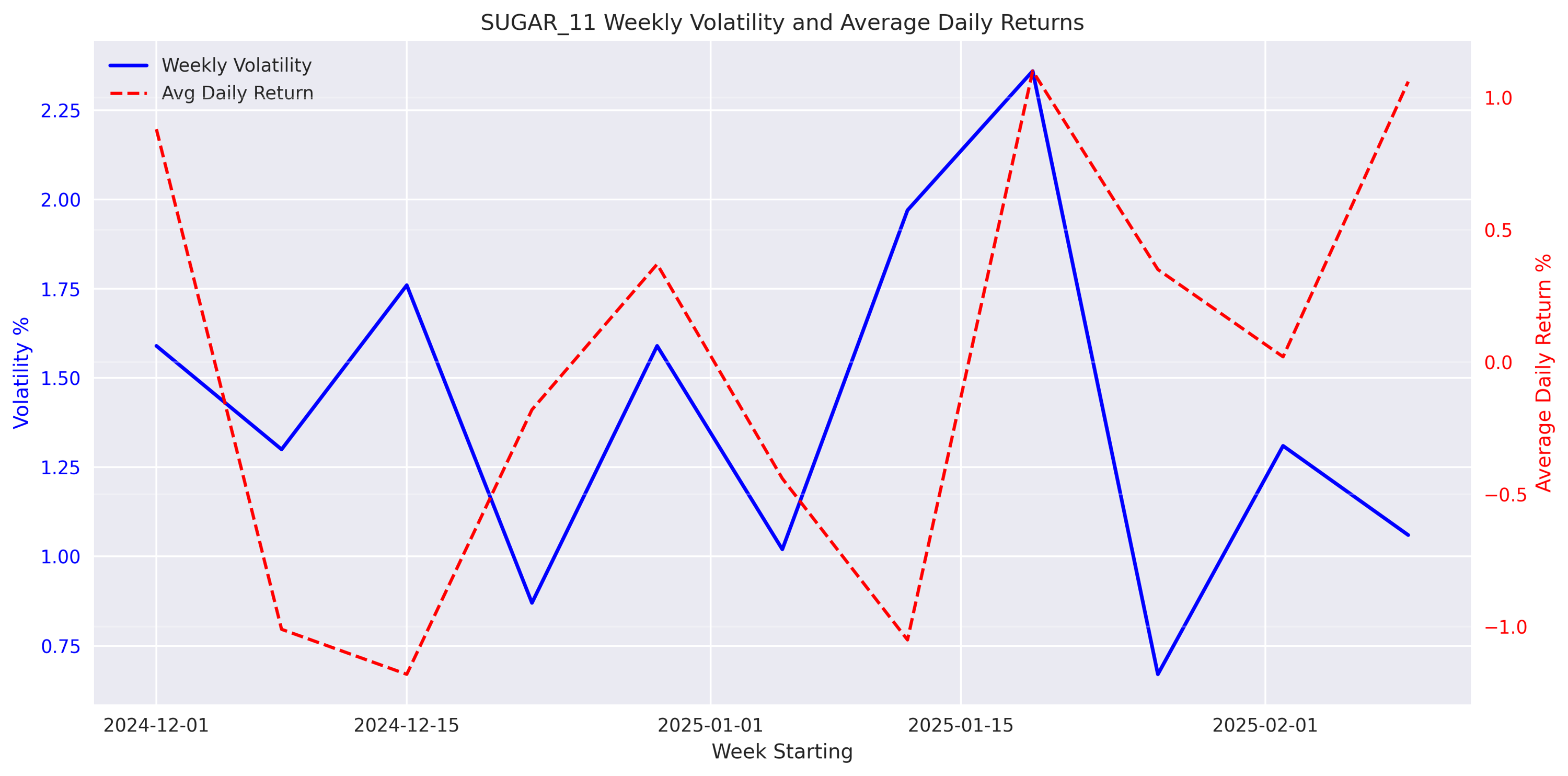

SUGAR_11 Shows Increasing Volatility with Recent Price Recovery

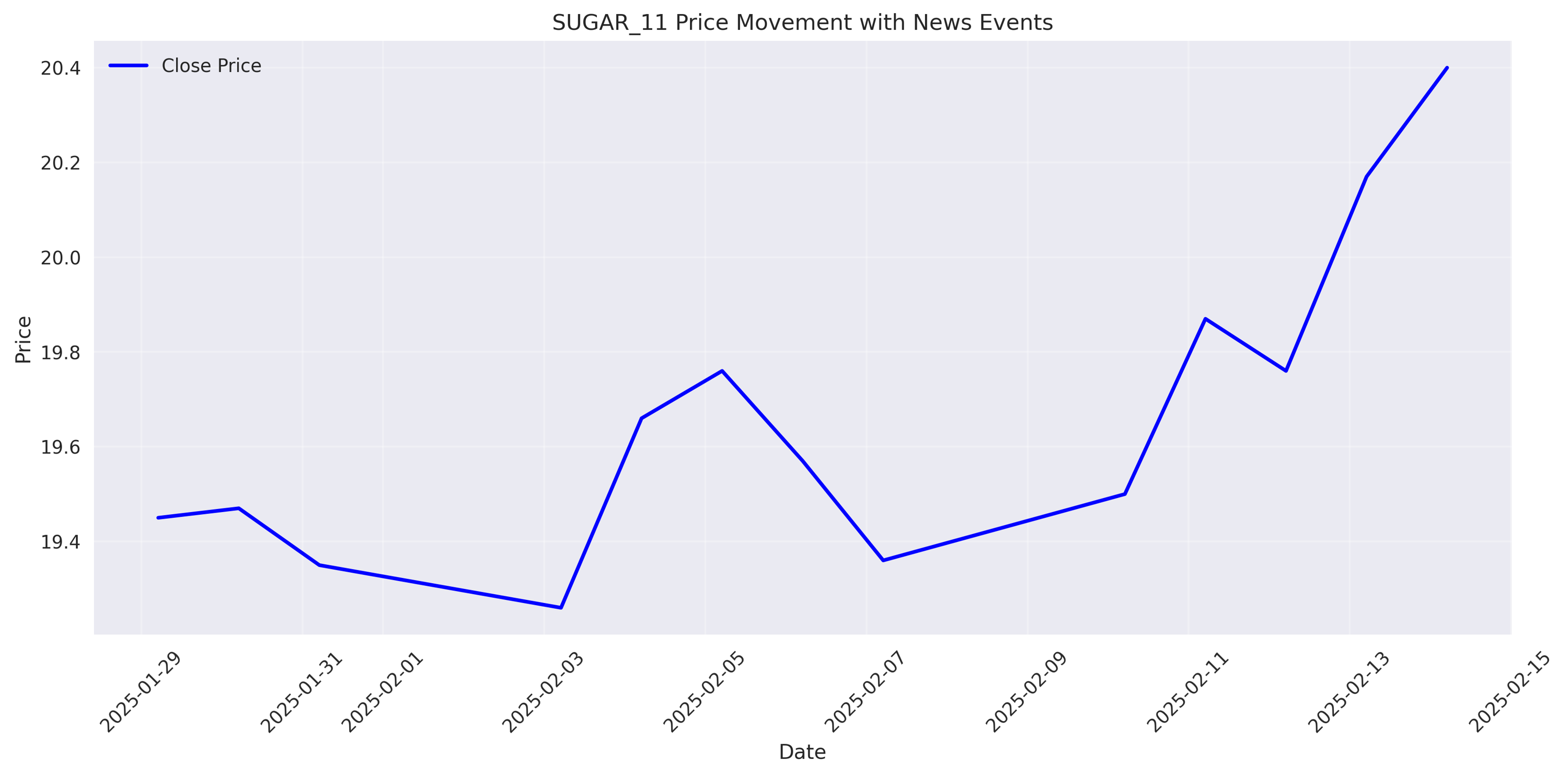

Market News Analysis Reveals Limited Direct Impact on SUGAR_11 Prices

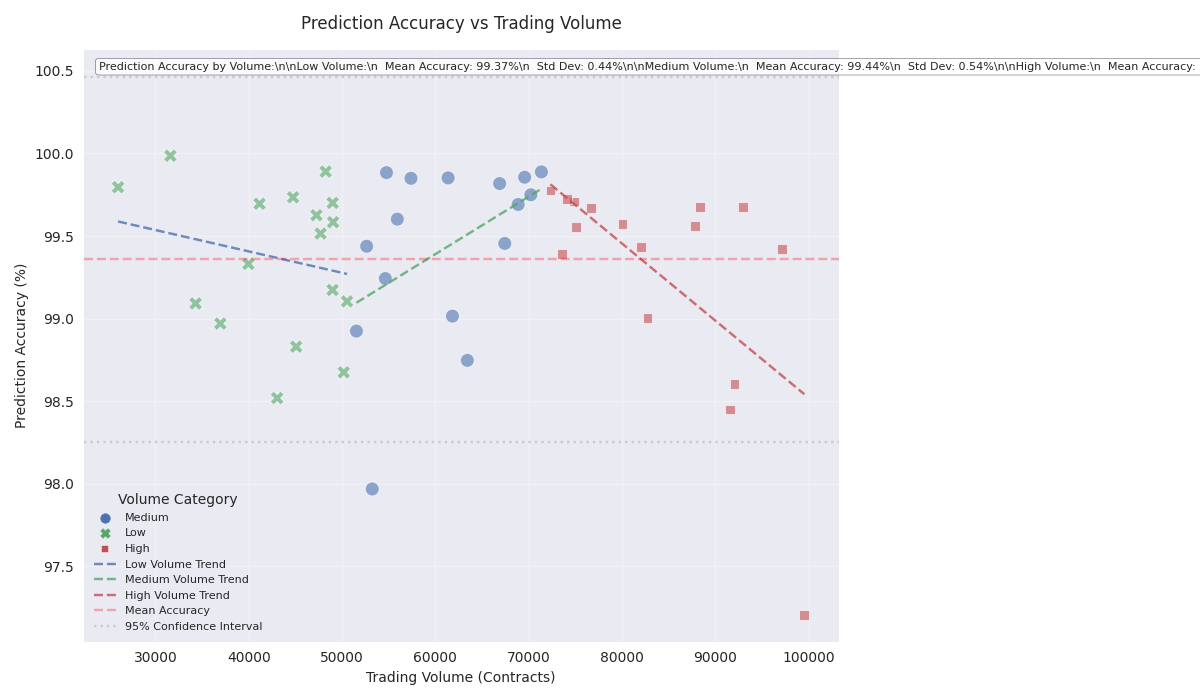

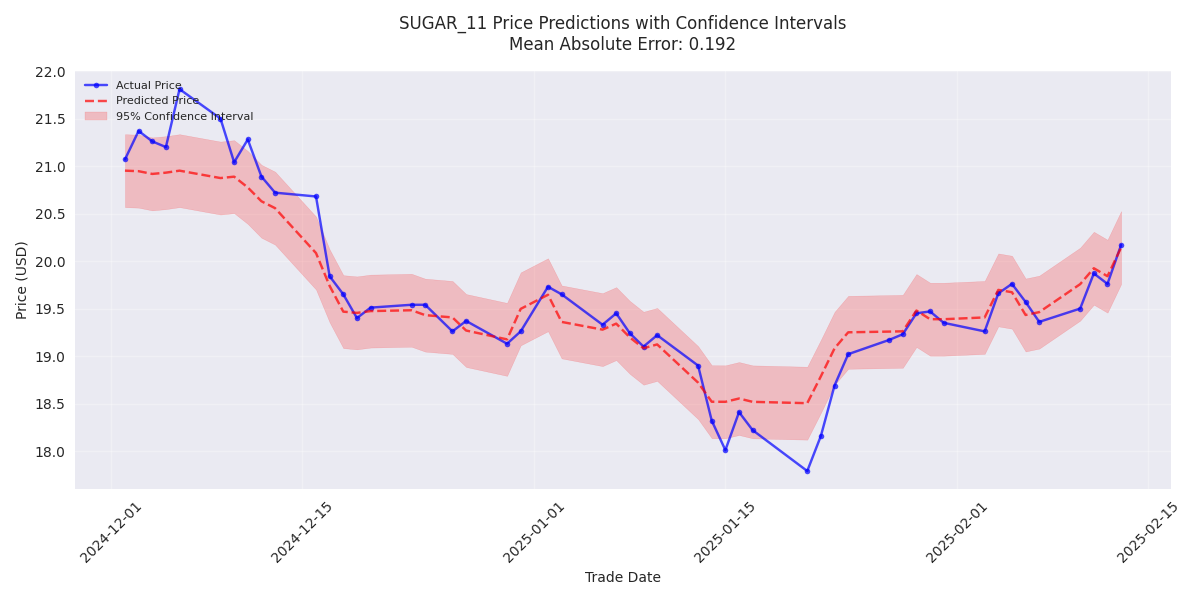

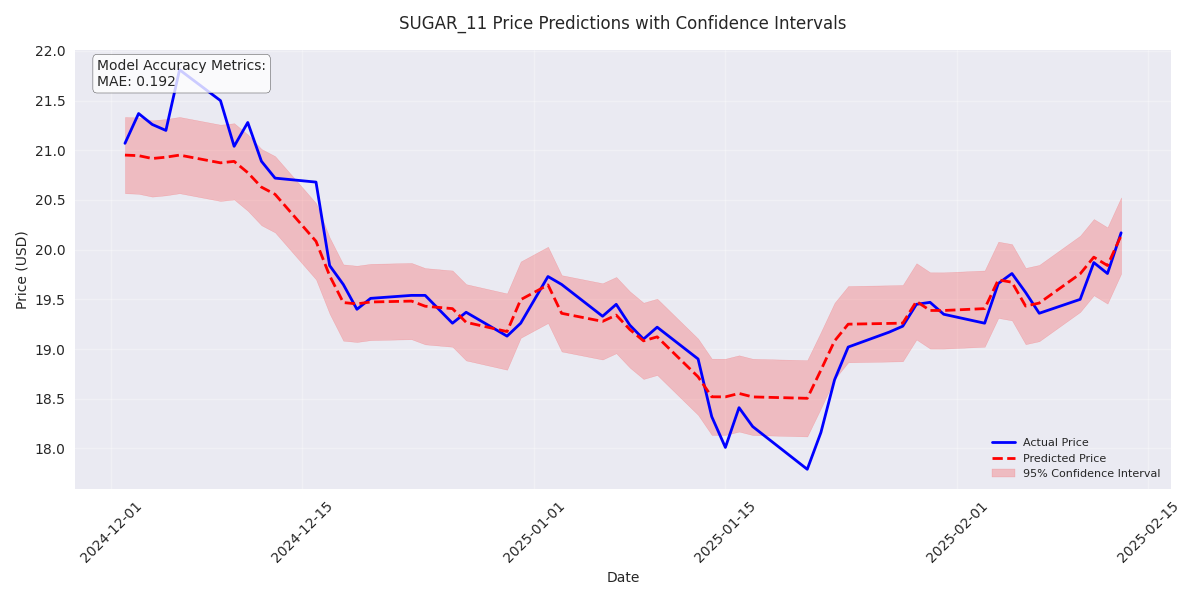

Initial SUGAR_11 Price Prediction Model Performance and Key Findings

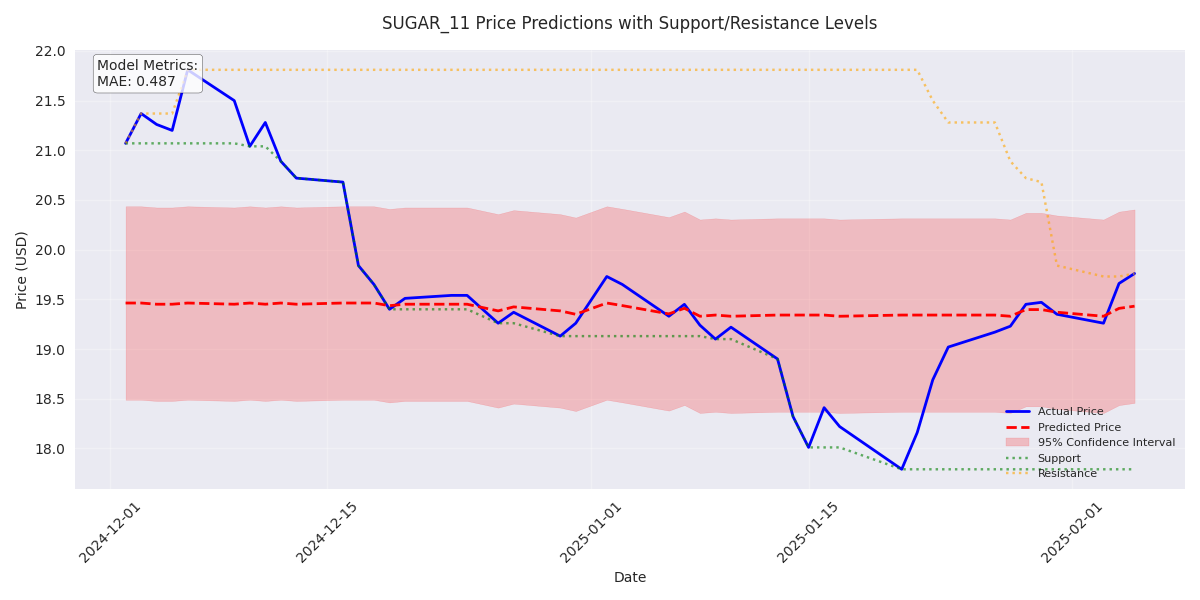

SUGAR_11 Price Prediction Analysis: Short-term Forecasts and Risk Assessment

SUGAR_11 Price Forecasting: Short-term and Risk Analysis

SUGAR_11 Trading Recommendations Based on Volume and Price Analysis