Broadcom Stock: Insider Trading Insights Reveal Critical Market Movements

Exceptional YTD Performance with Strong Institutional Support

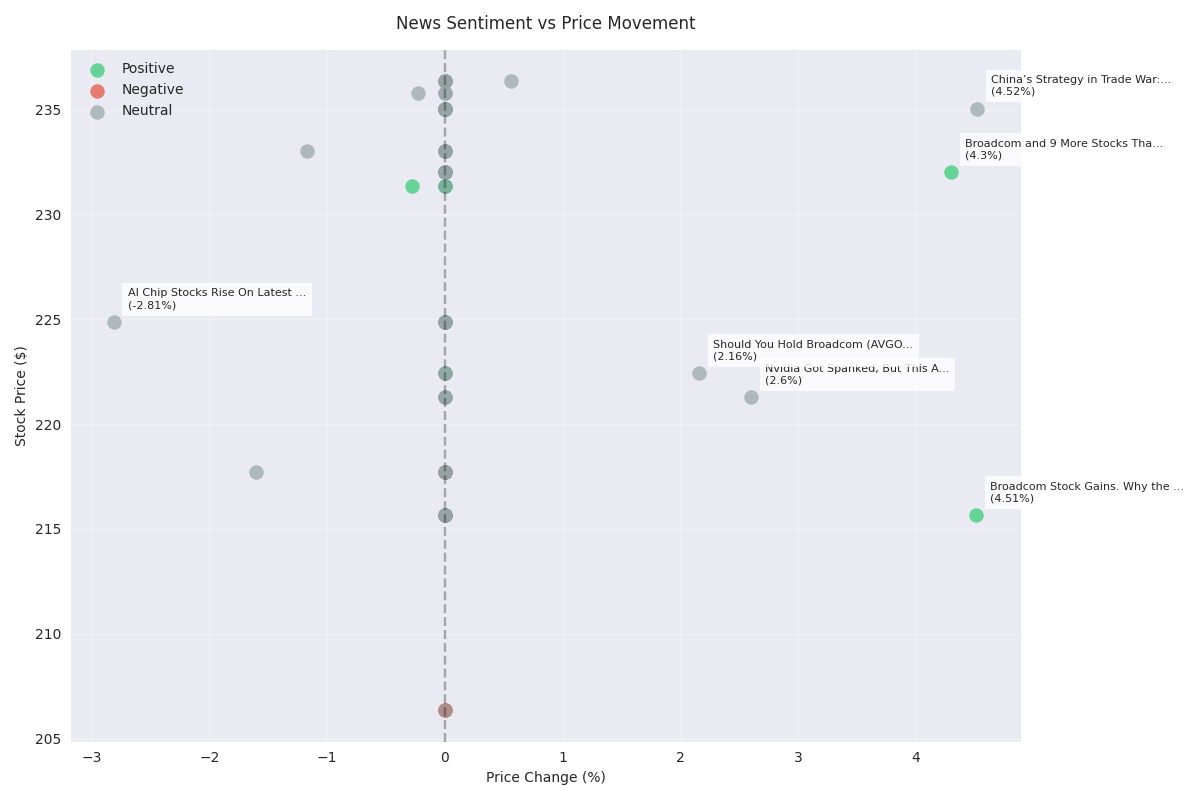

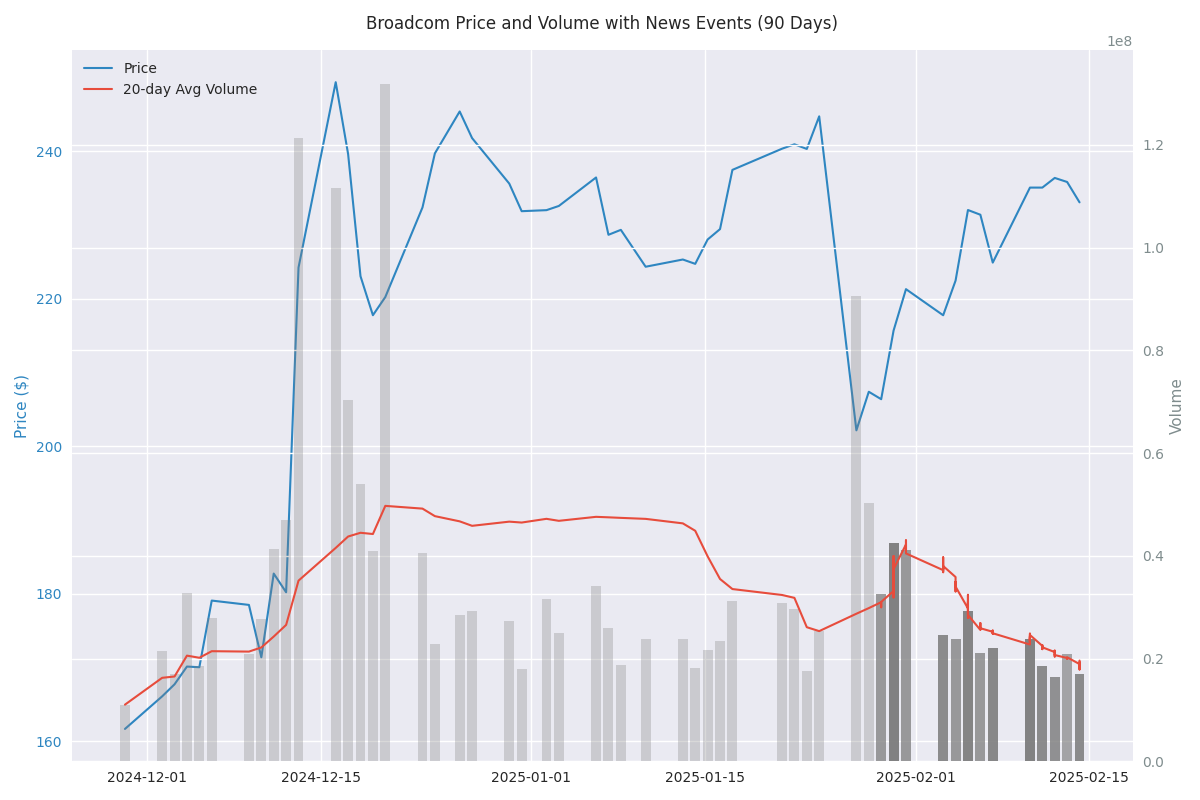

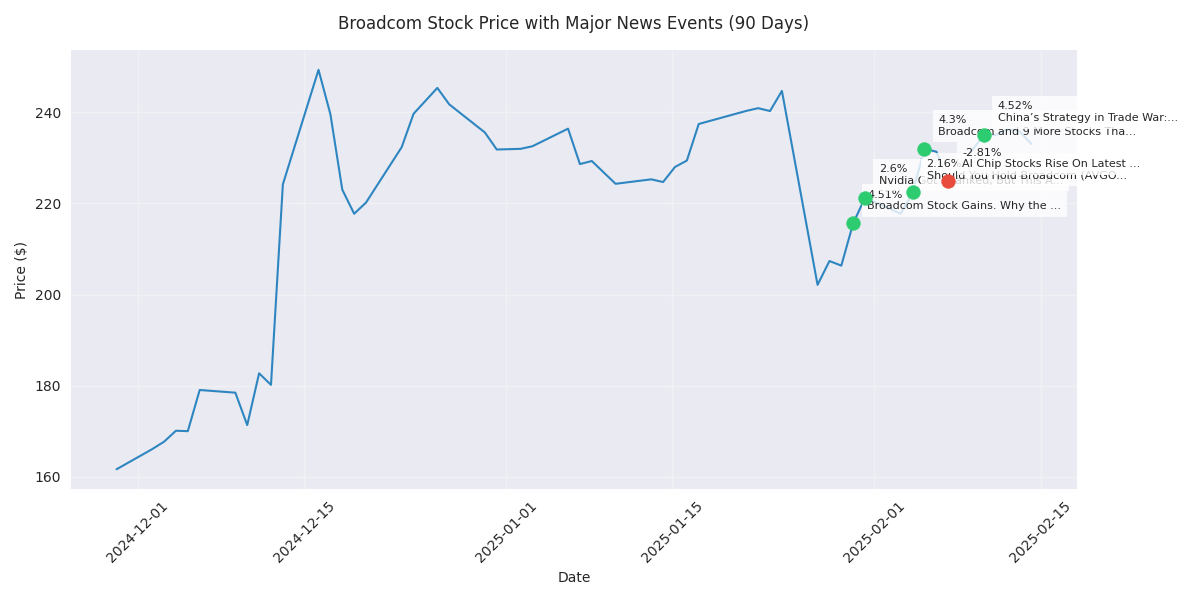

AI News Driving Significant Price Action

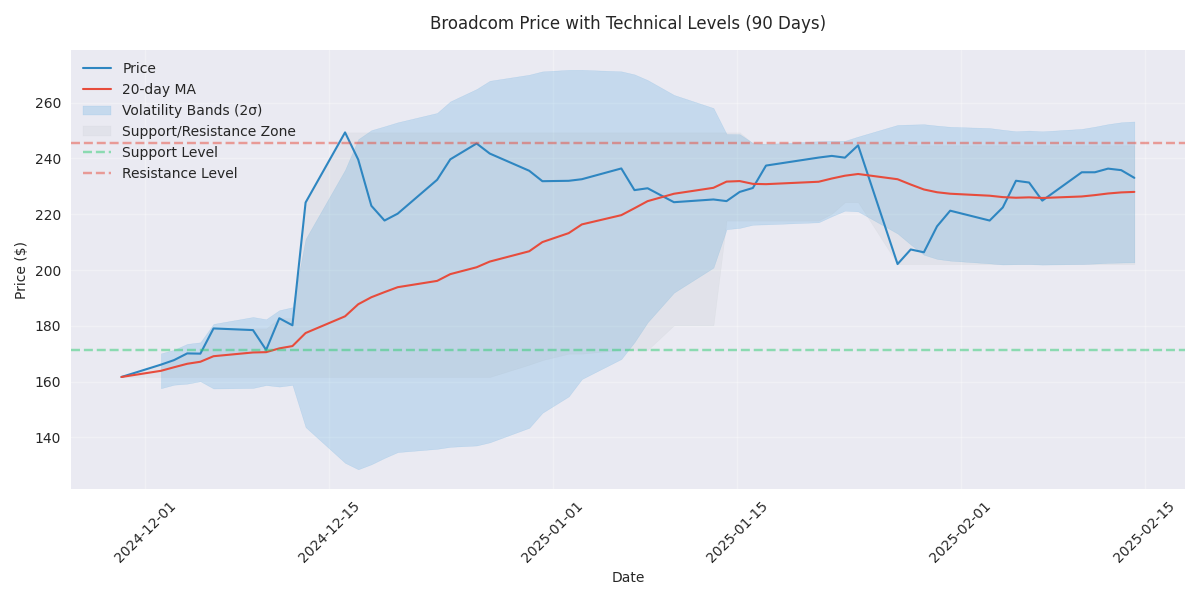

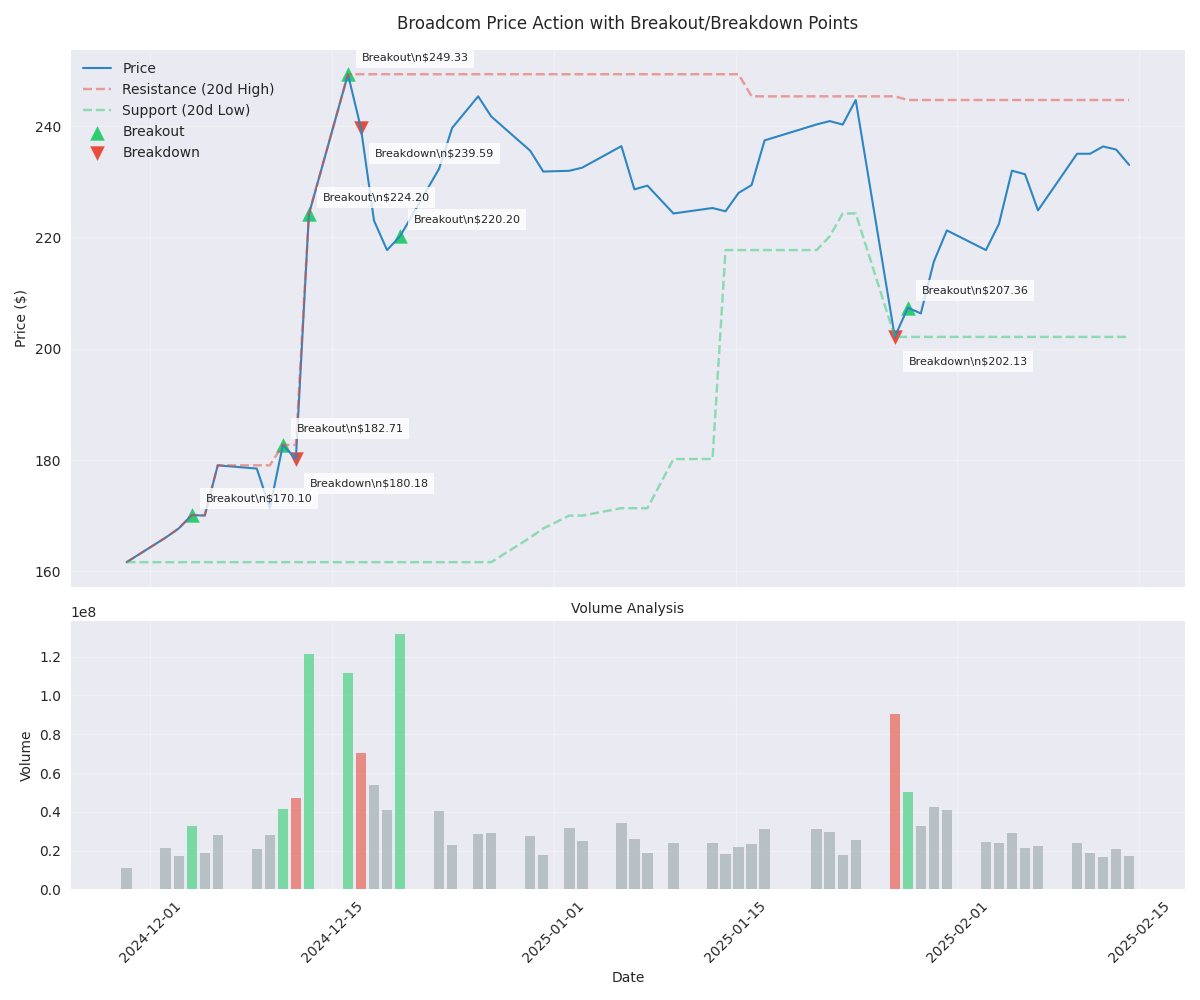

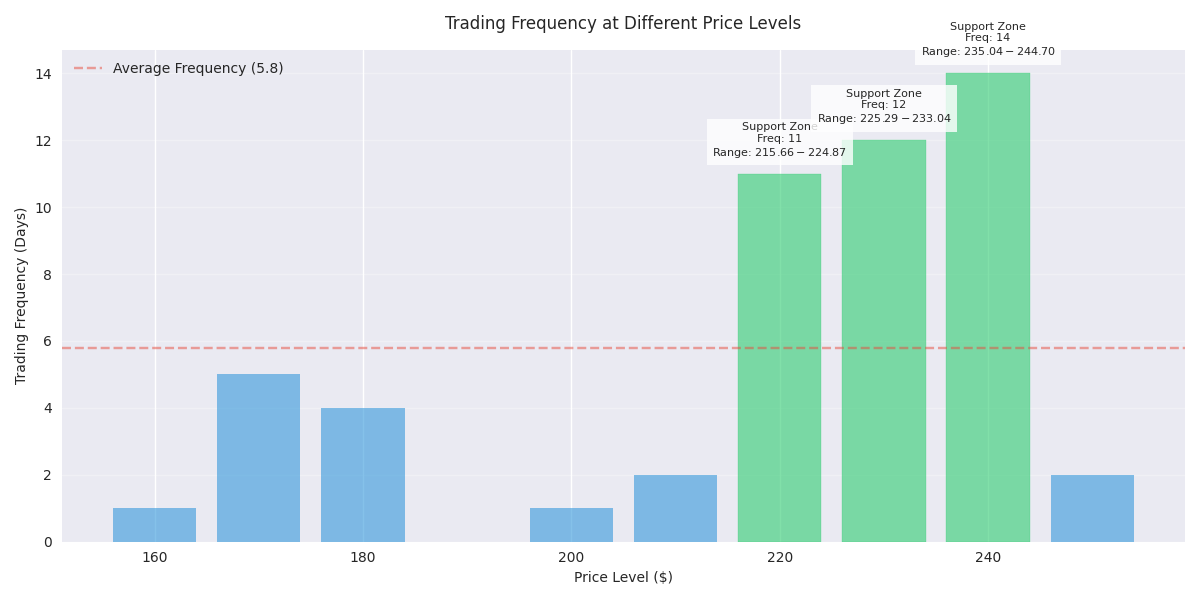

Key Technical Levels for Trading Strategy

Short-term Trading Outlook

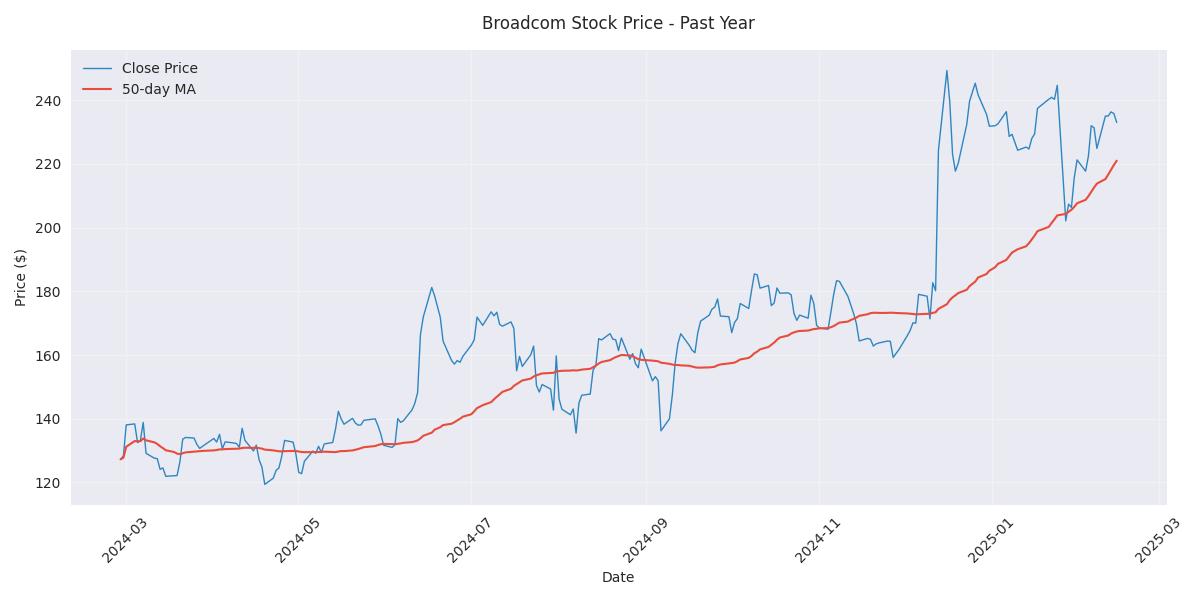

Broadcom Stock Analysis: Strong Performance with Positive Momentum

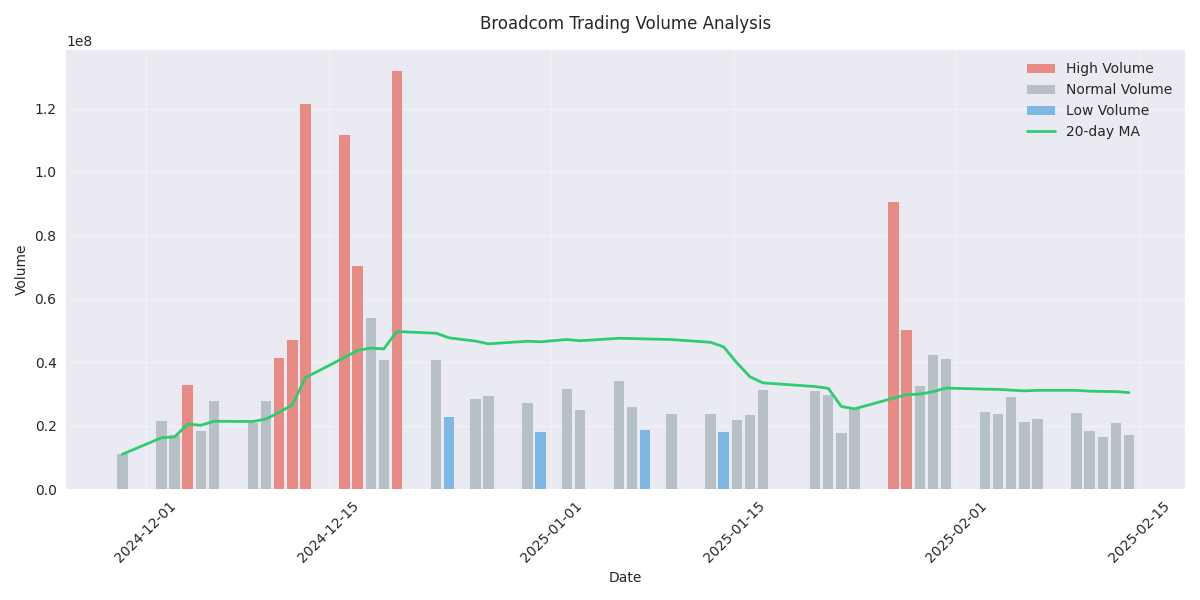

Market-Moving News and Price Volatility Analysis

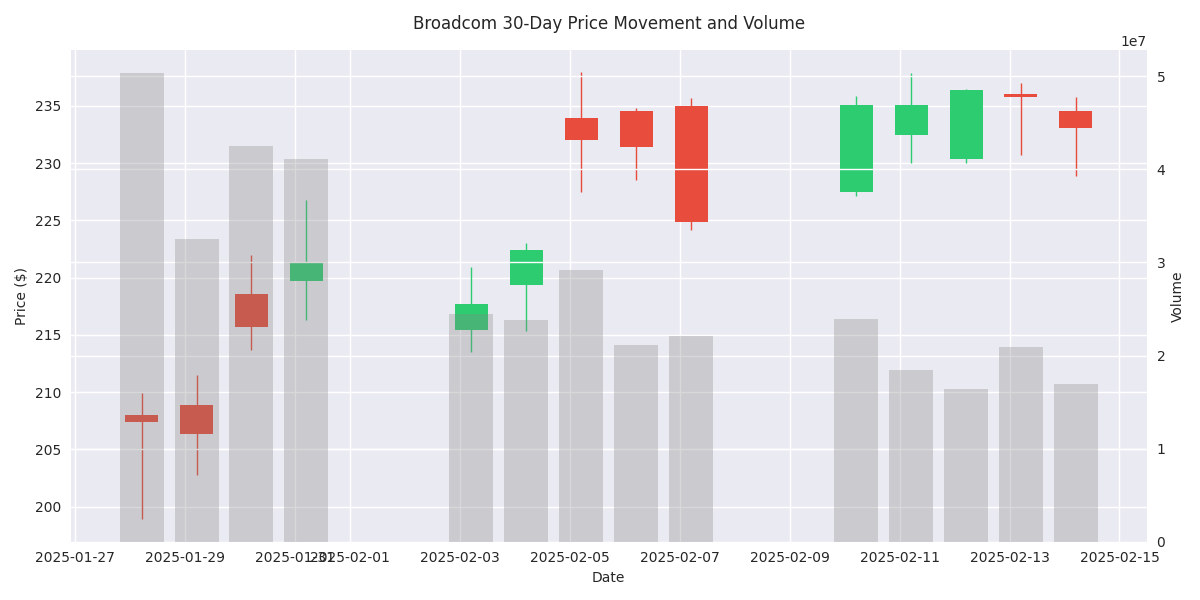

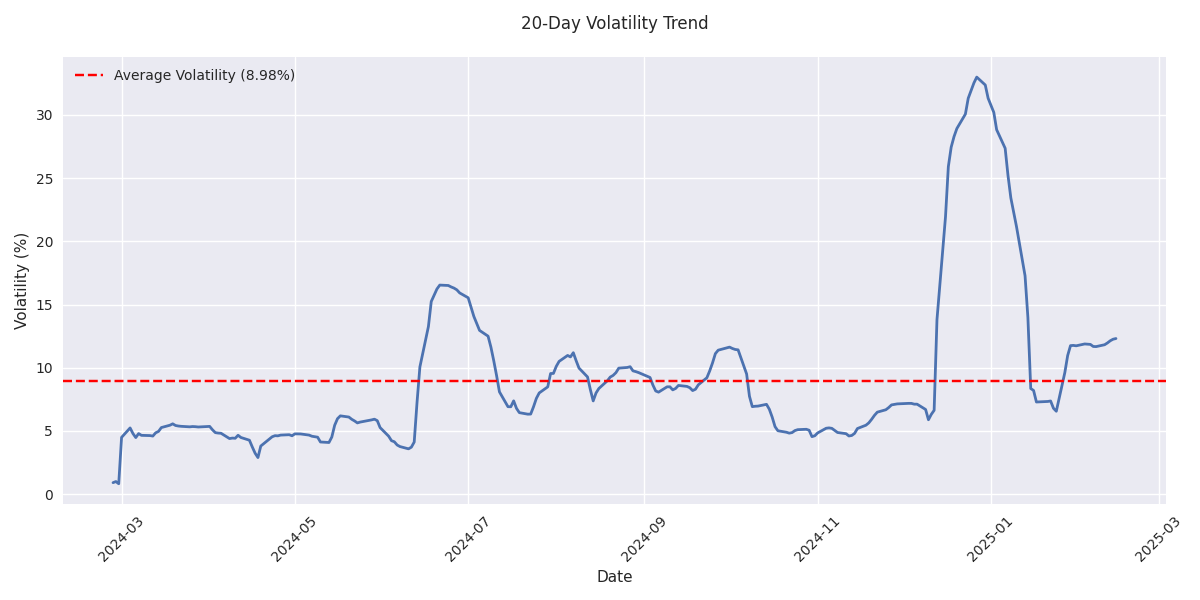

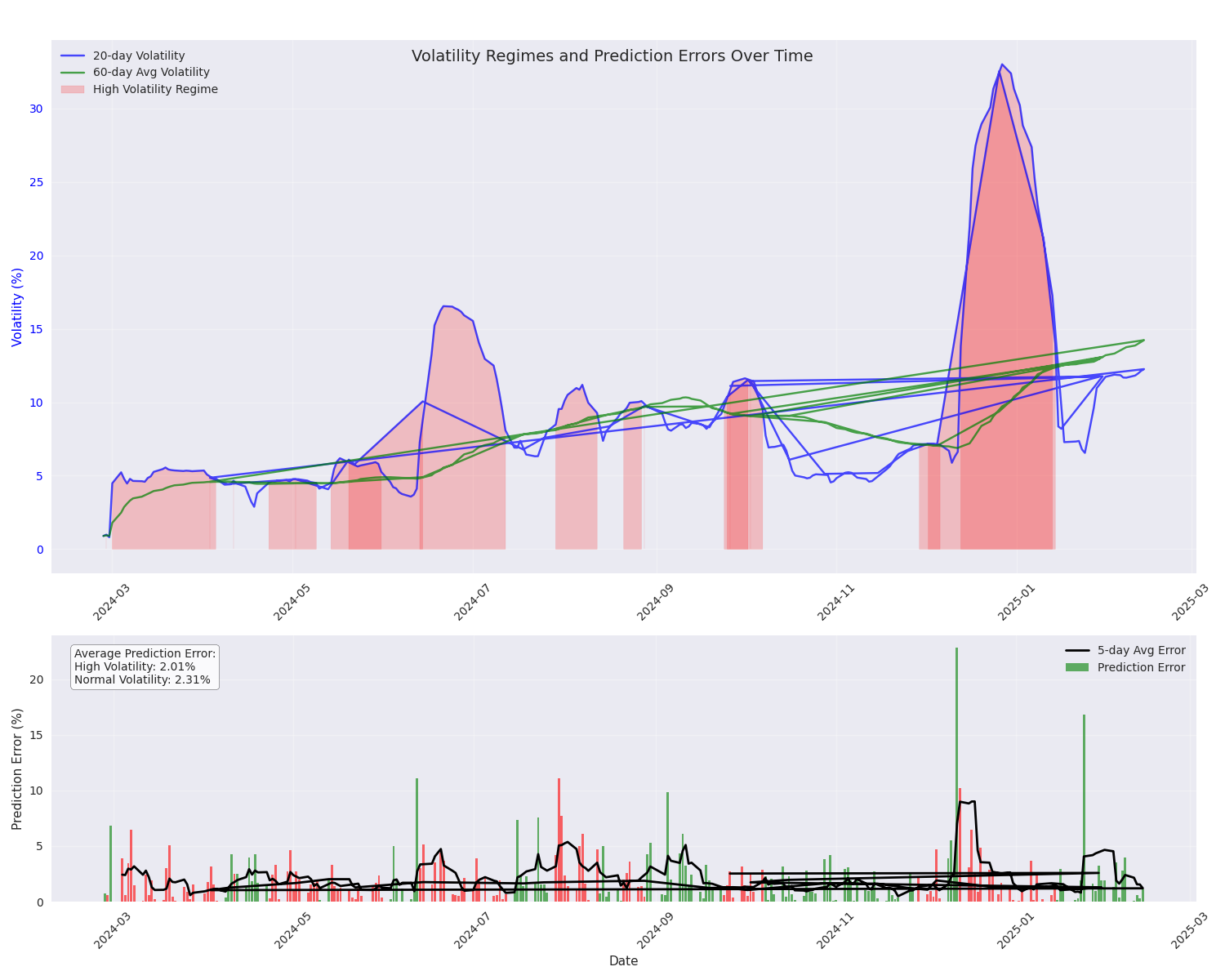

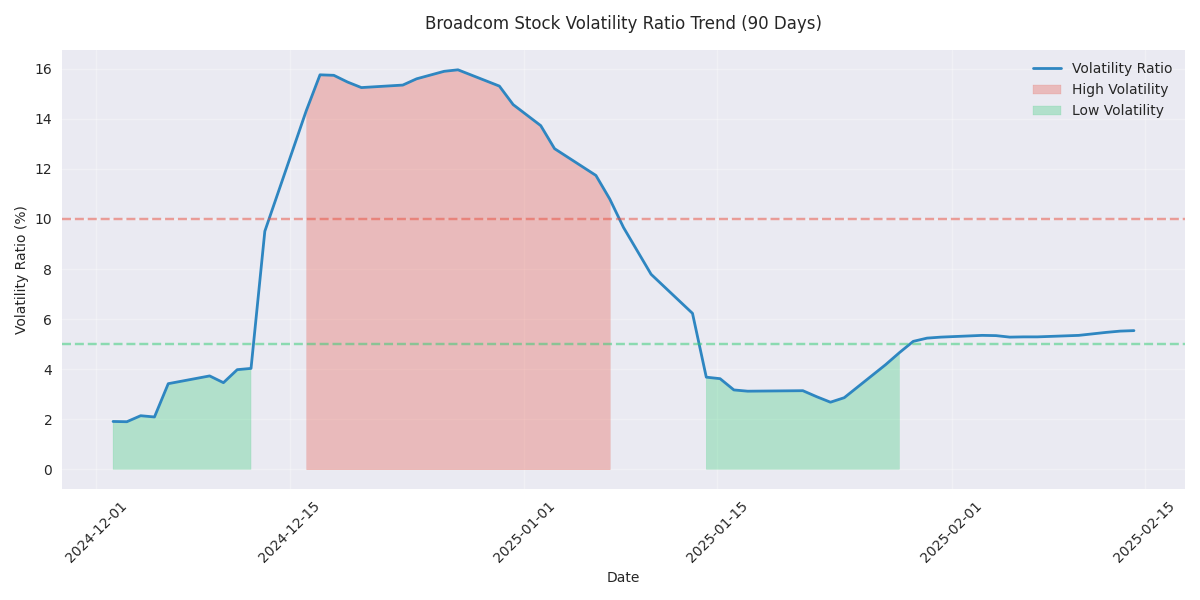

Volatility Analysis: Increased Market Activity and Price Stability Patterns

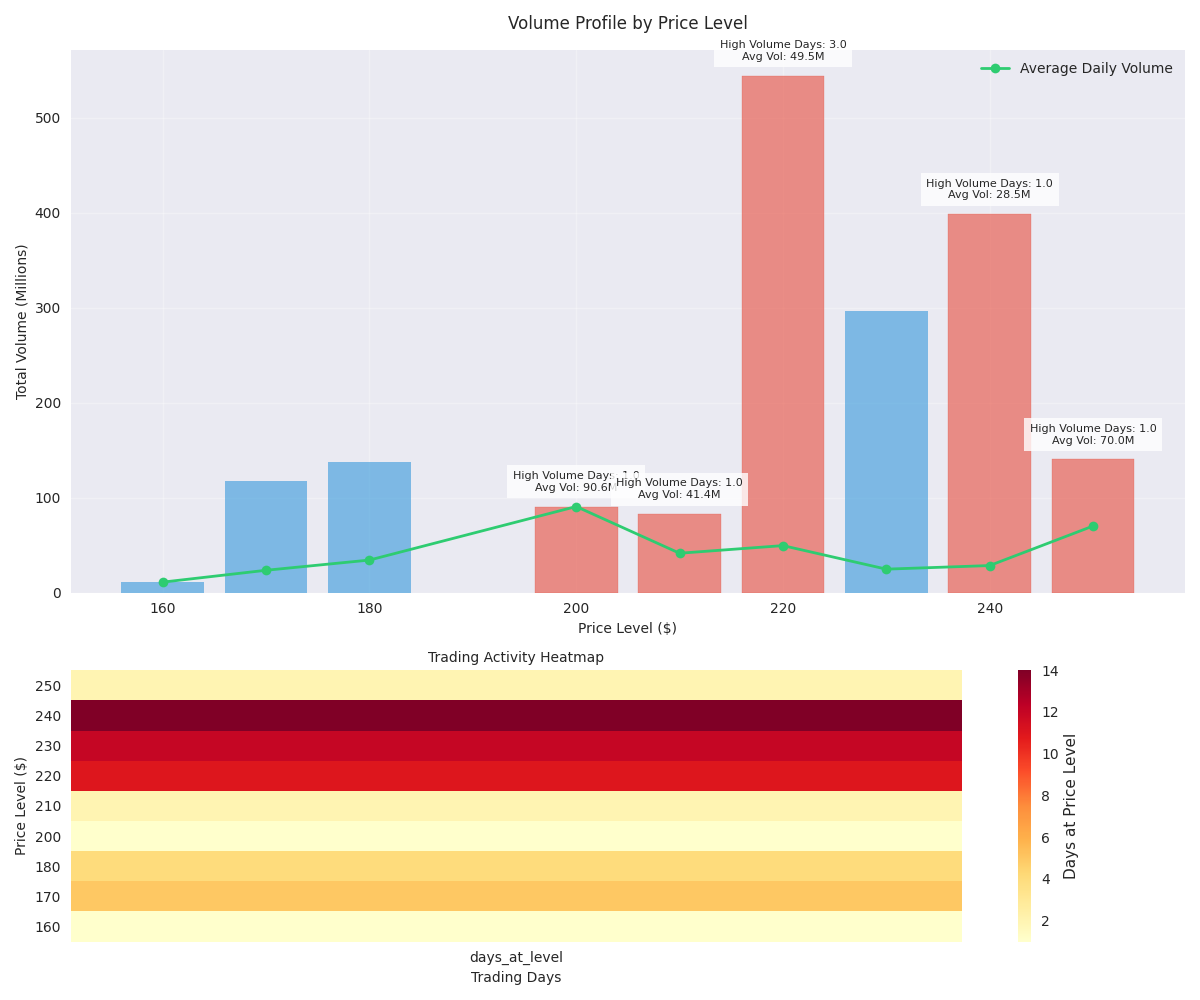

Key Support and Resistance Levels Show Strong Market Structure

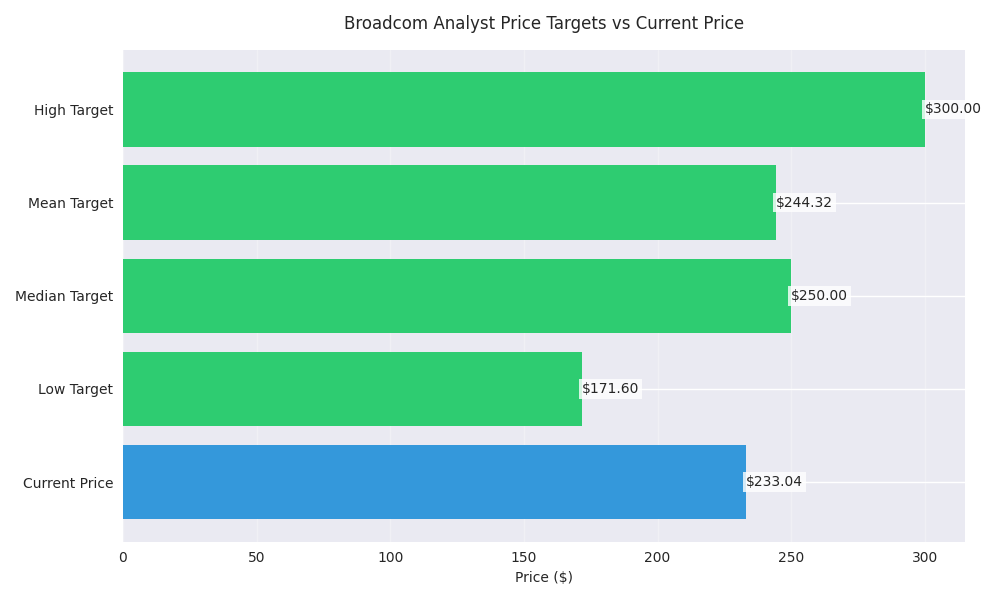

Short-term Price Prediction Analysis for Broadcom Stock

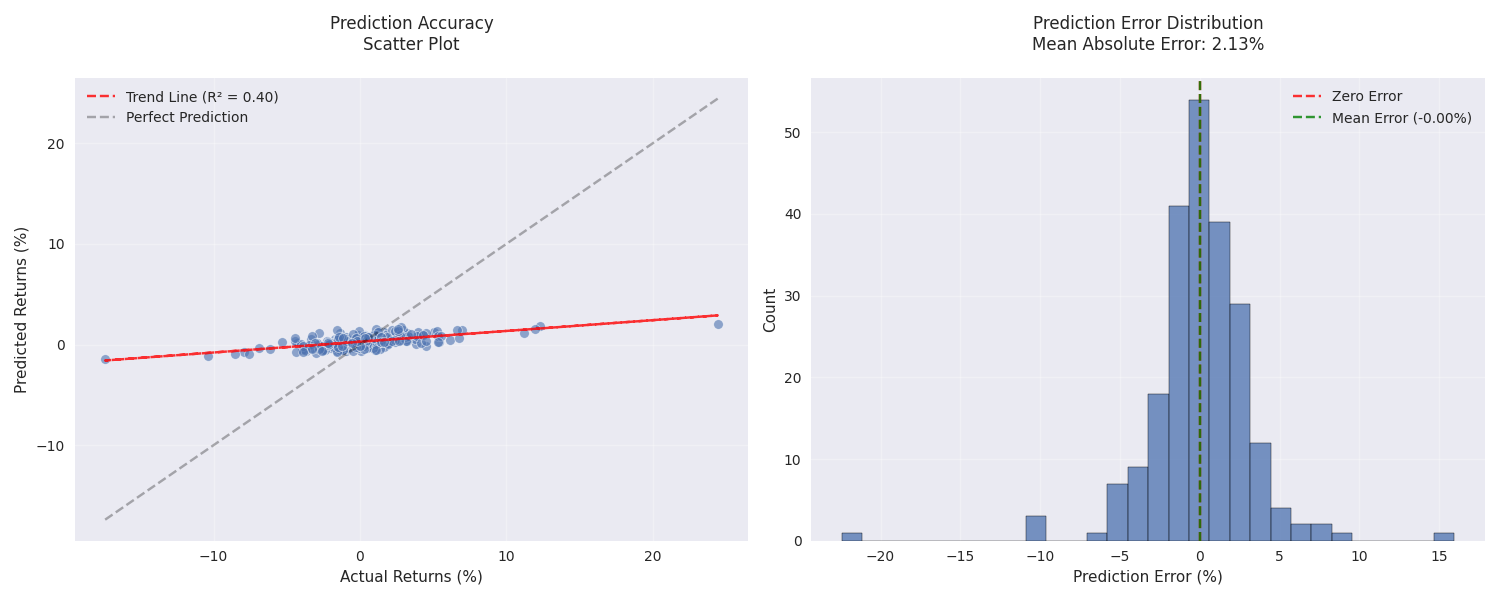

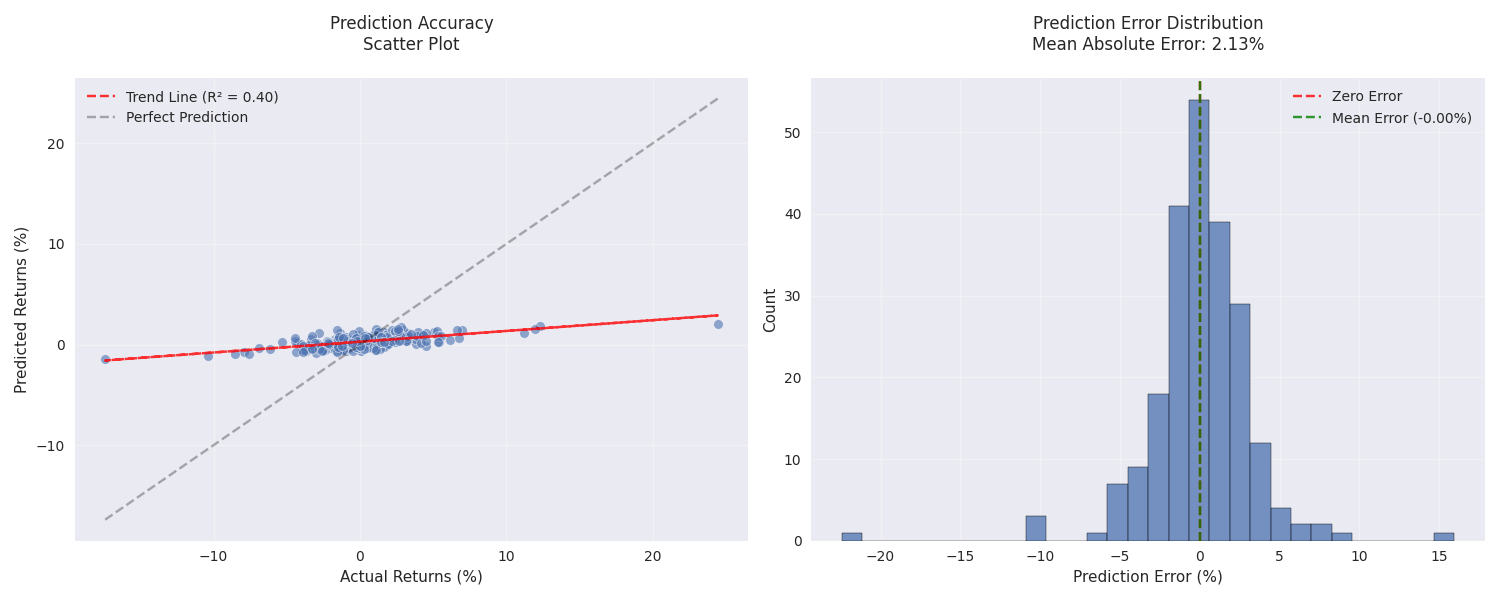

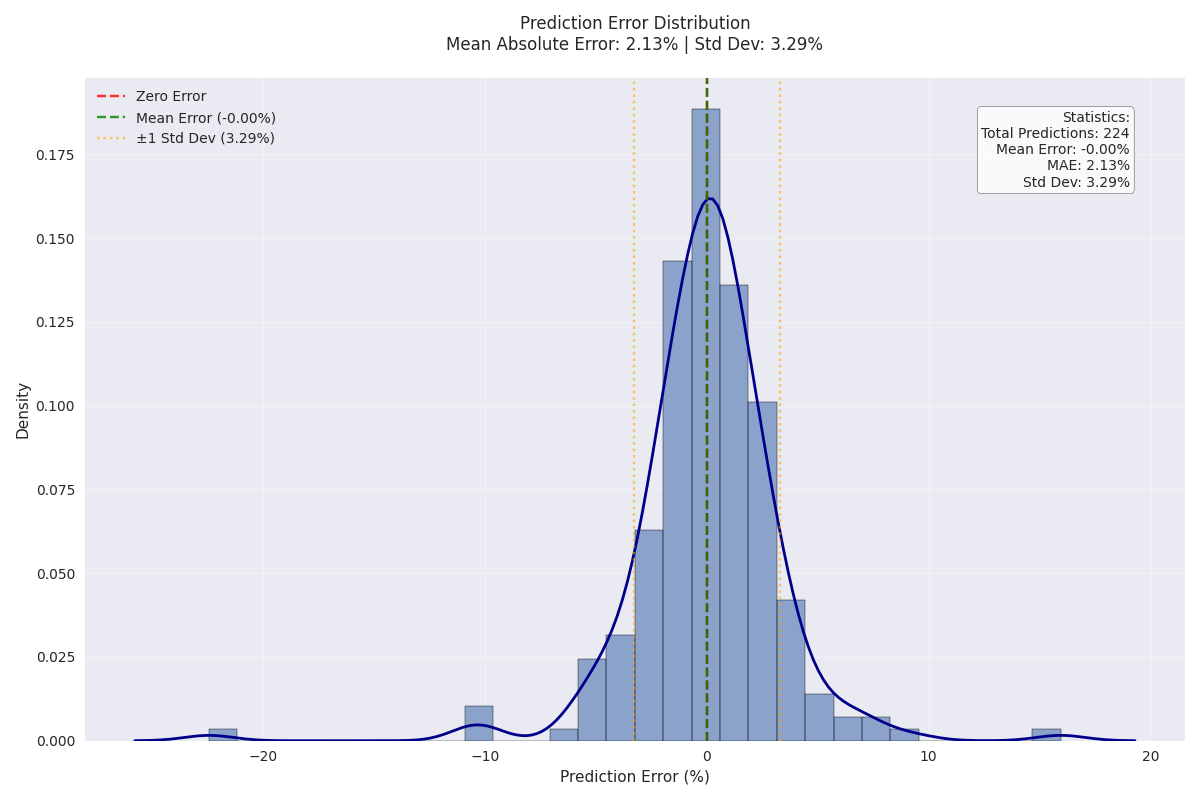

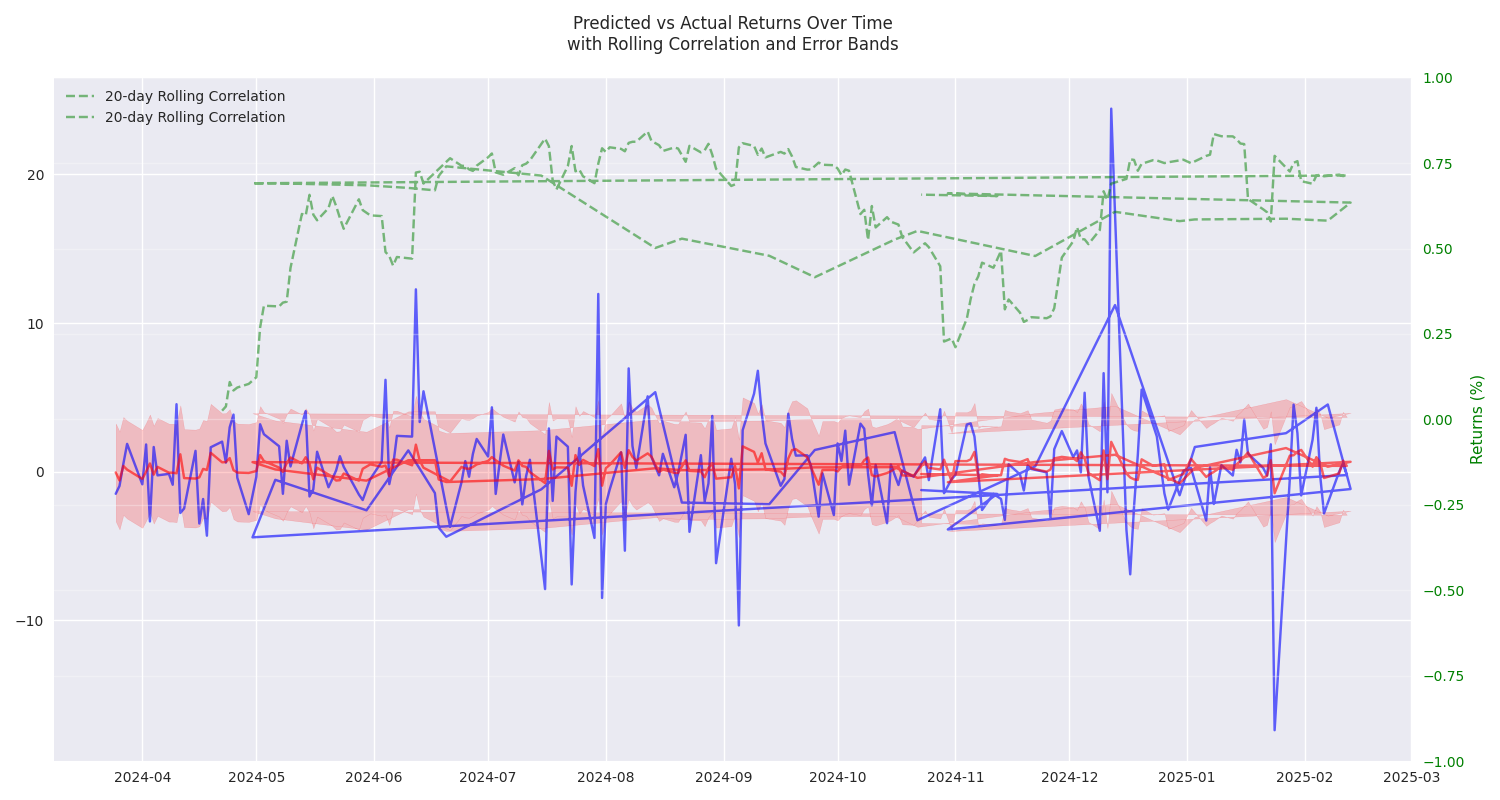

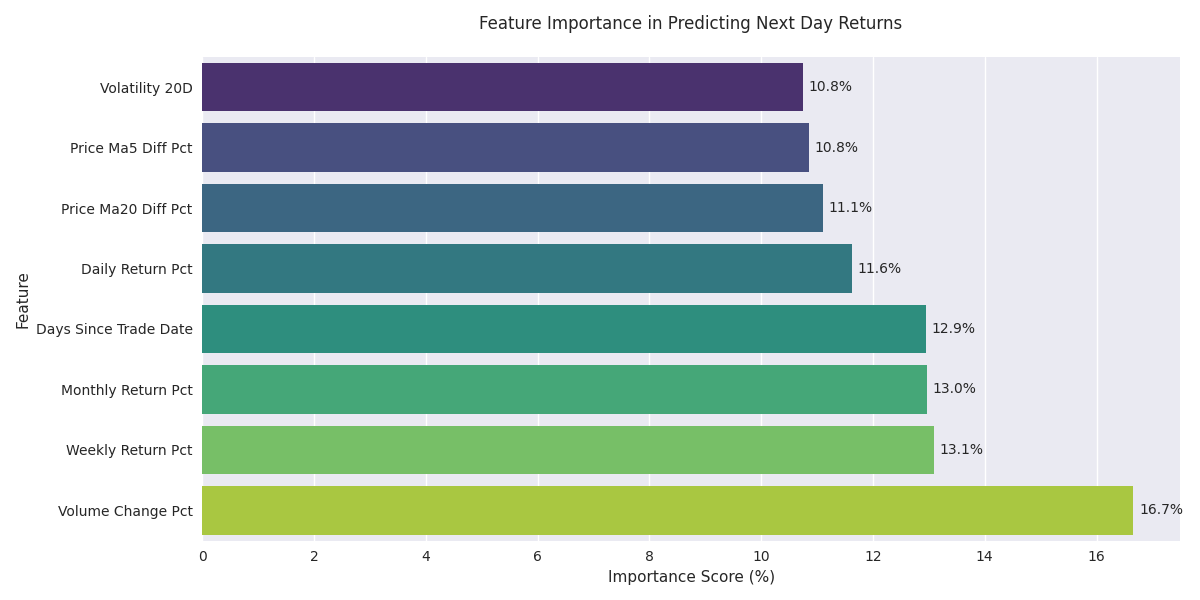

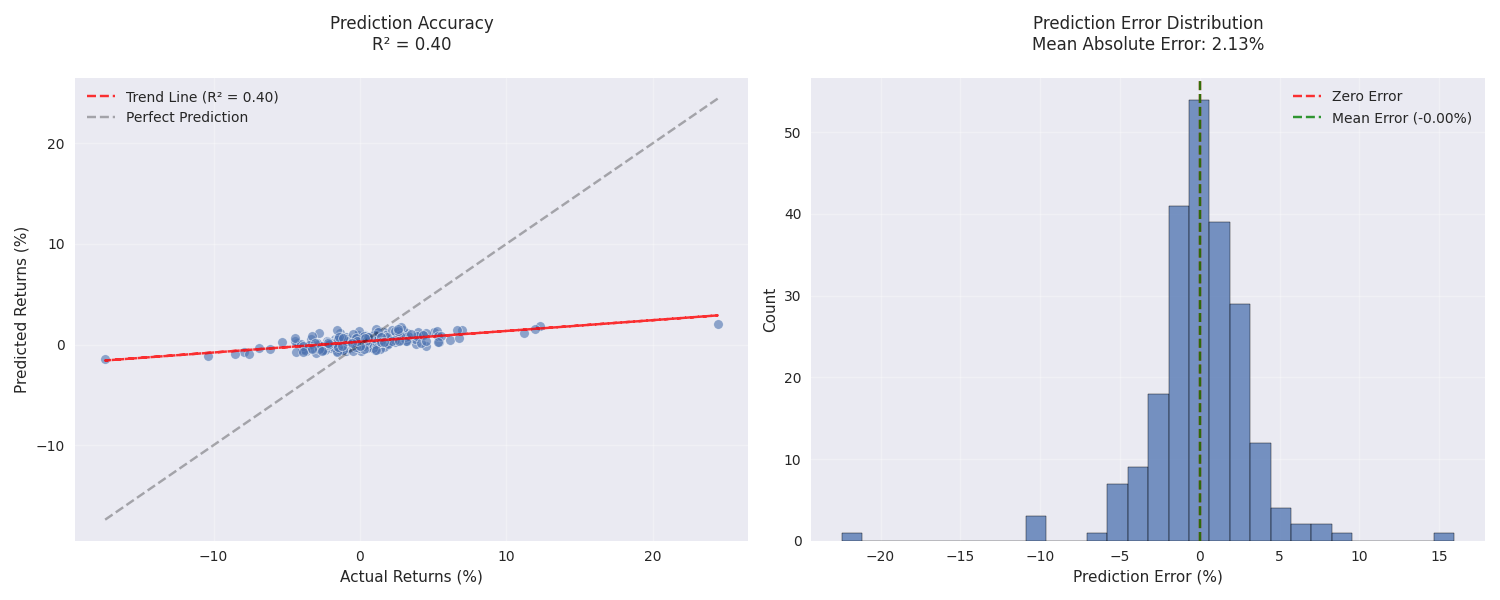

Stock Price Prediction Model Performance Analysis

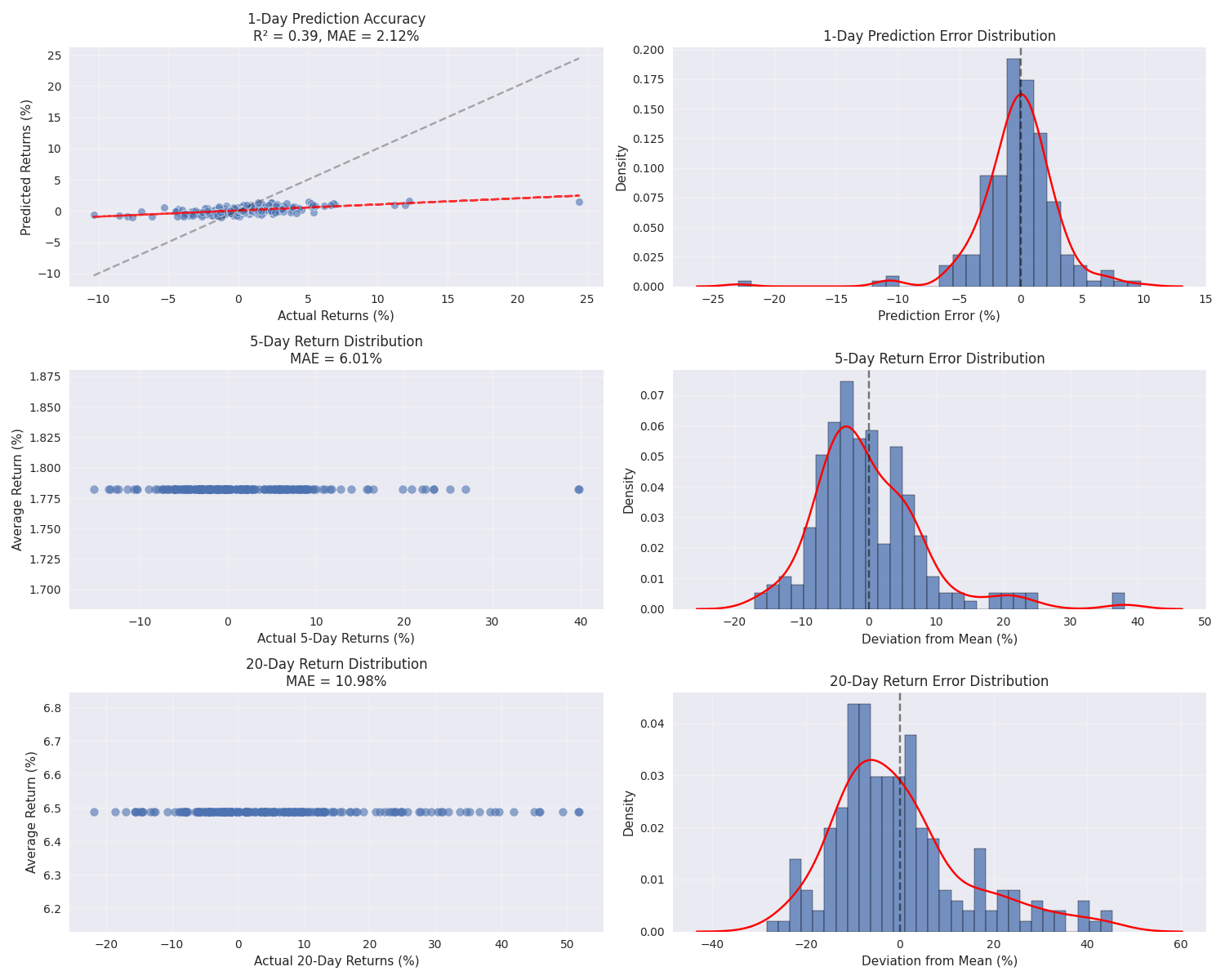

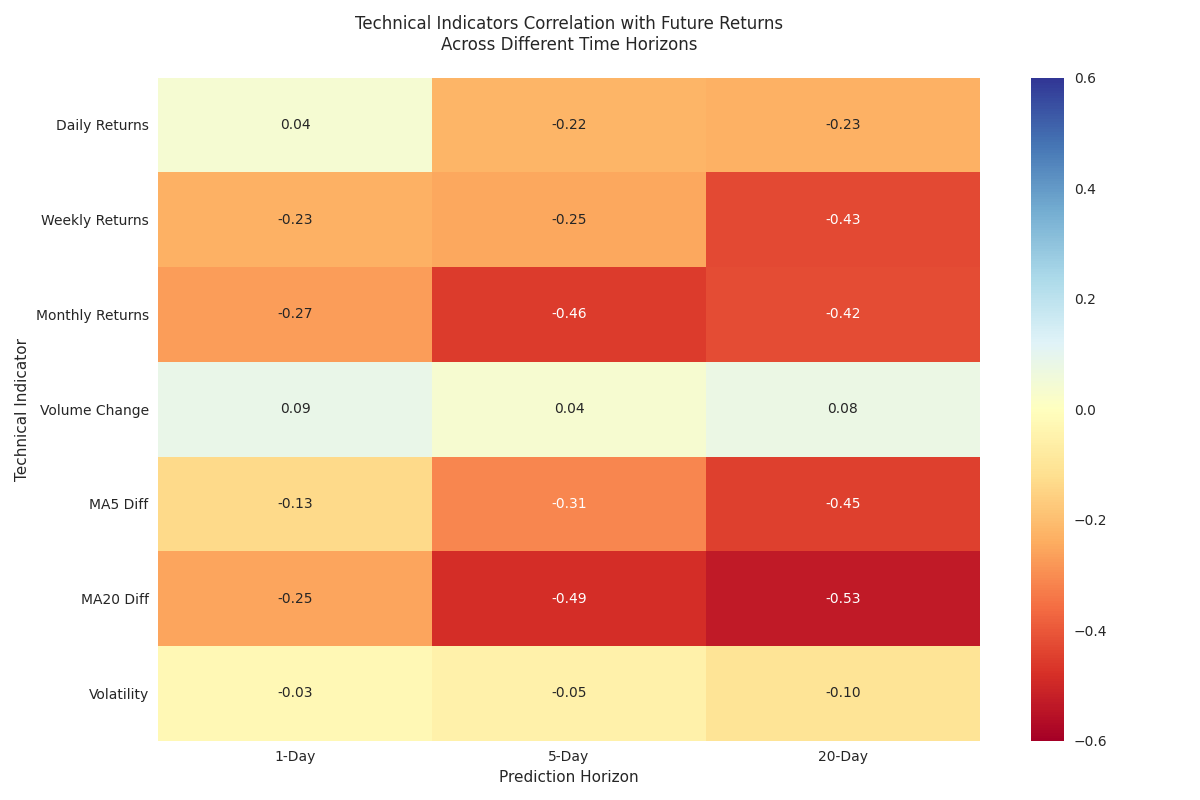

Multi-Horizon Price Prediction Analysis for Broadcom Stock