USD/CNY Market Pulse: Traders' Quick Guide to Currency Movements and Opportunities

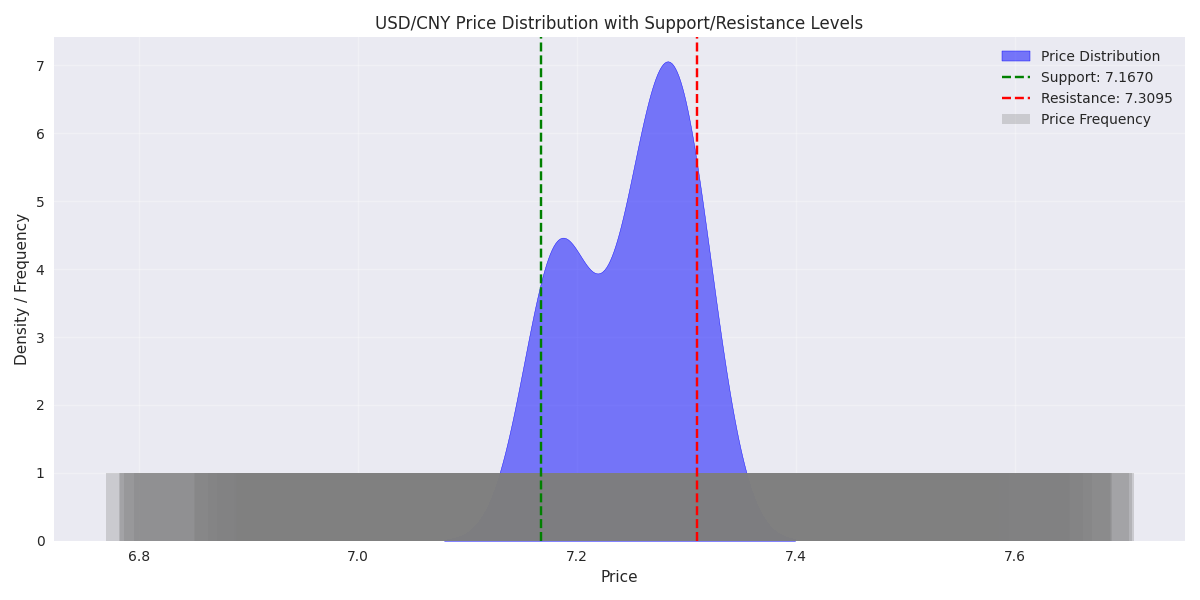

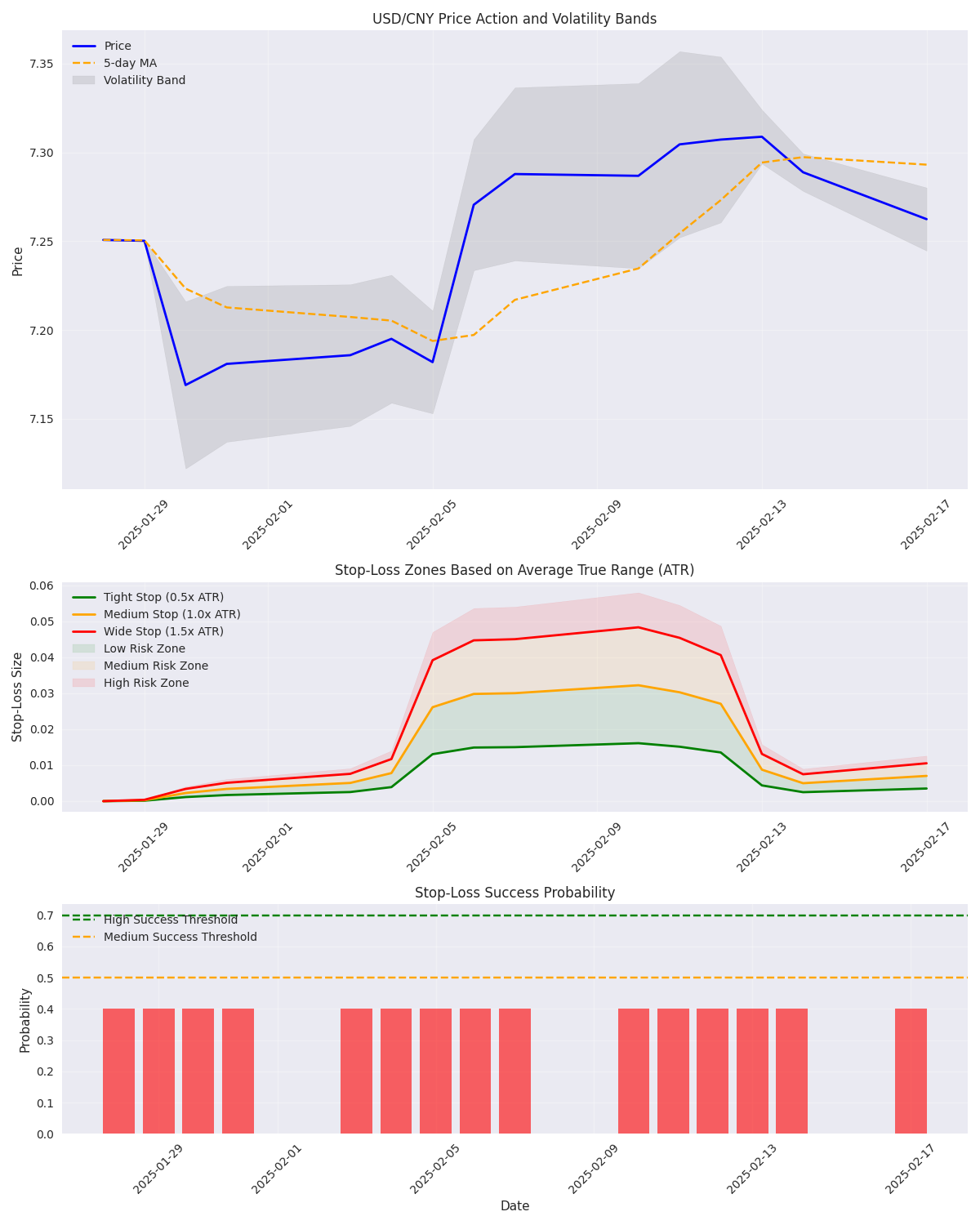

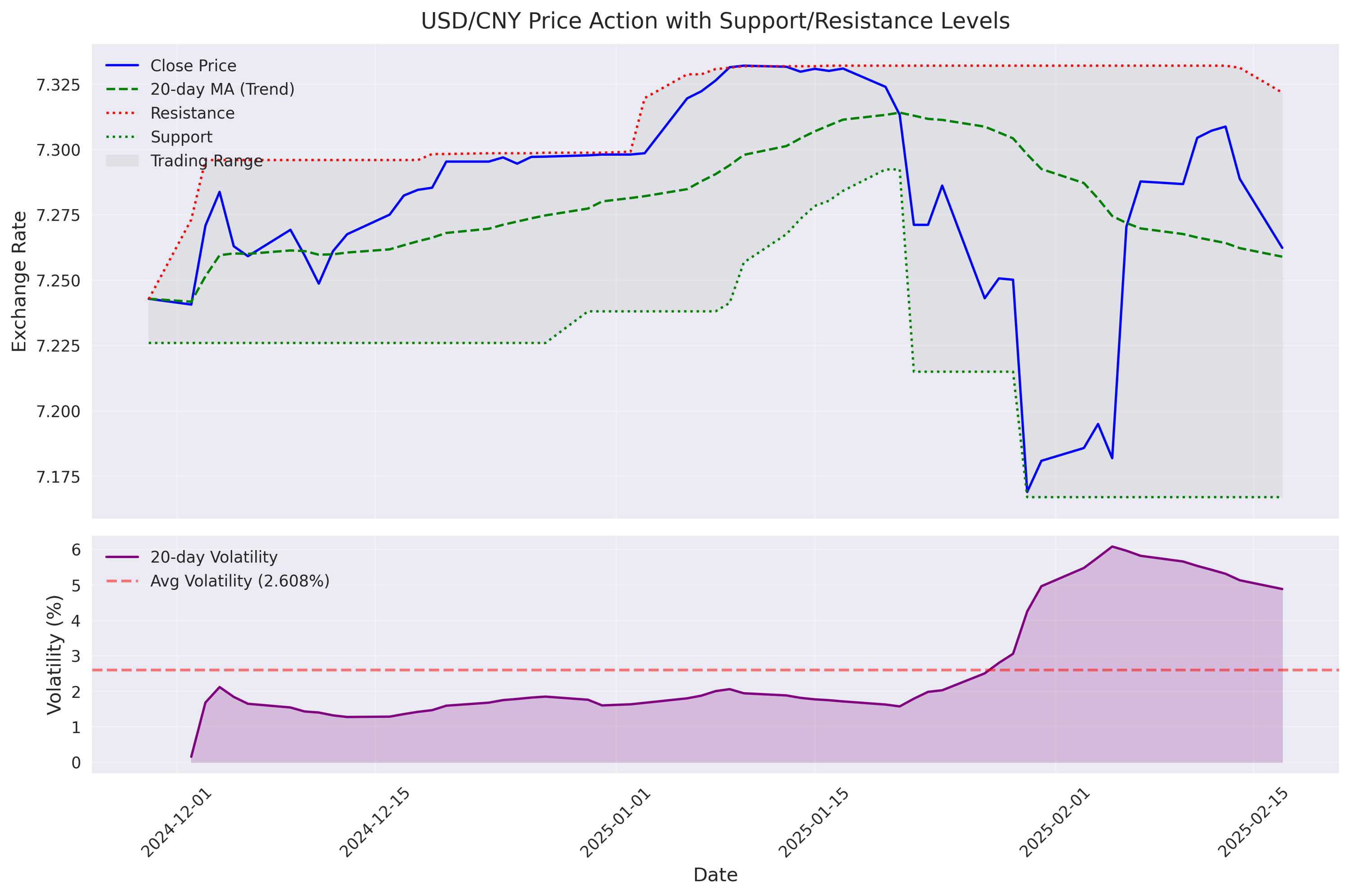

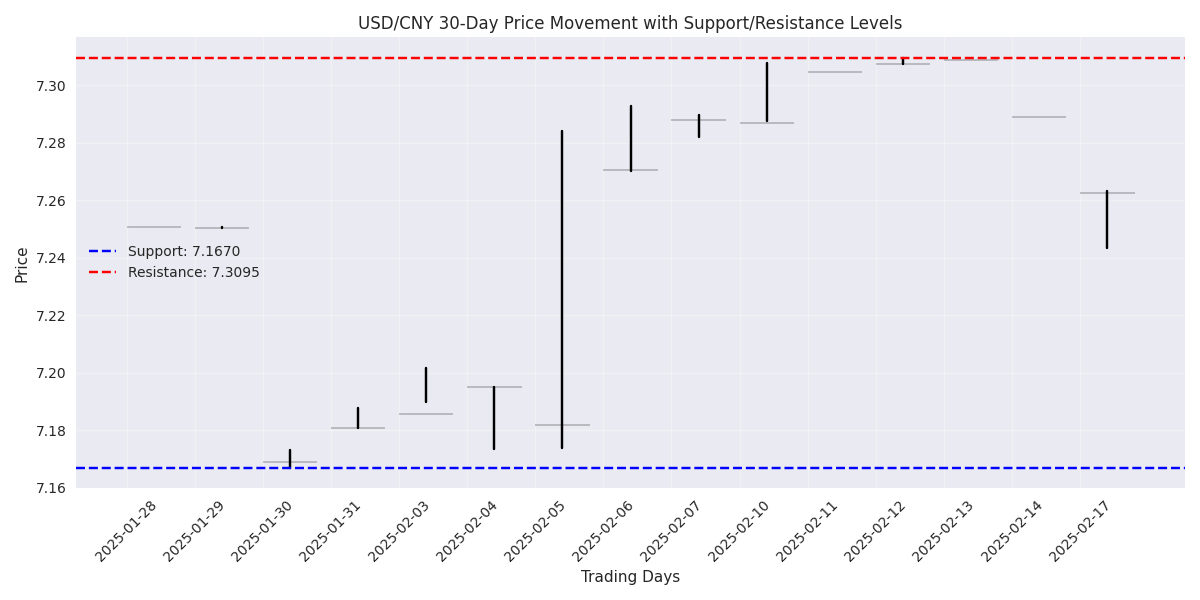

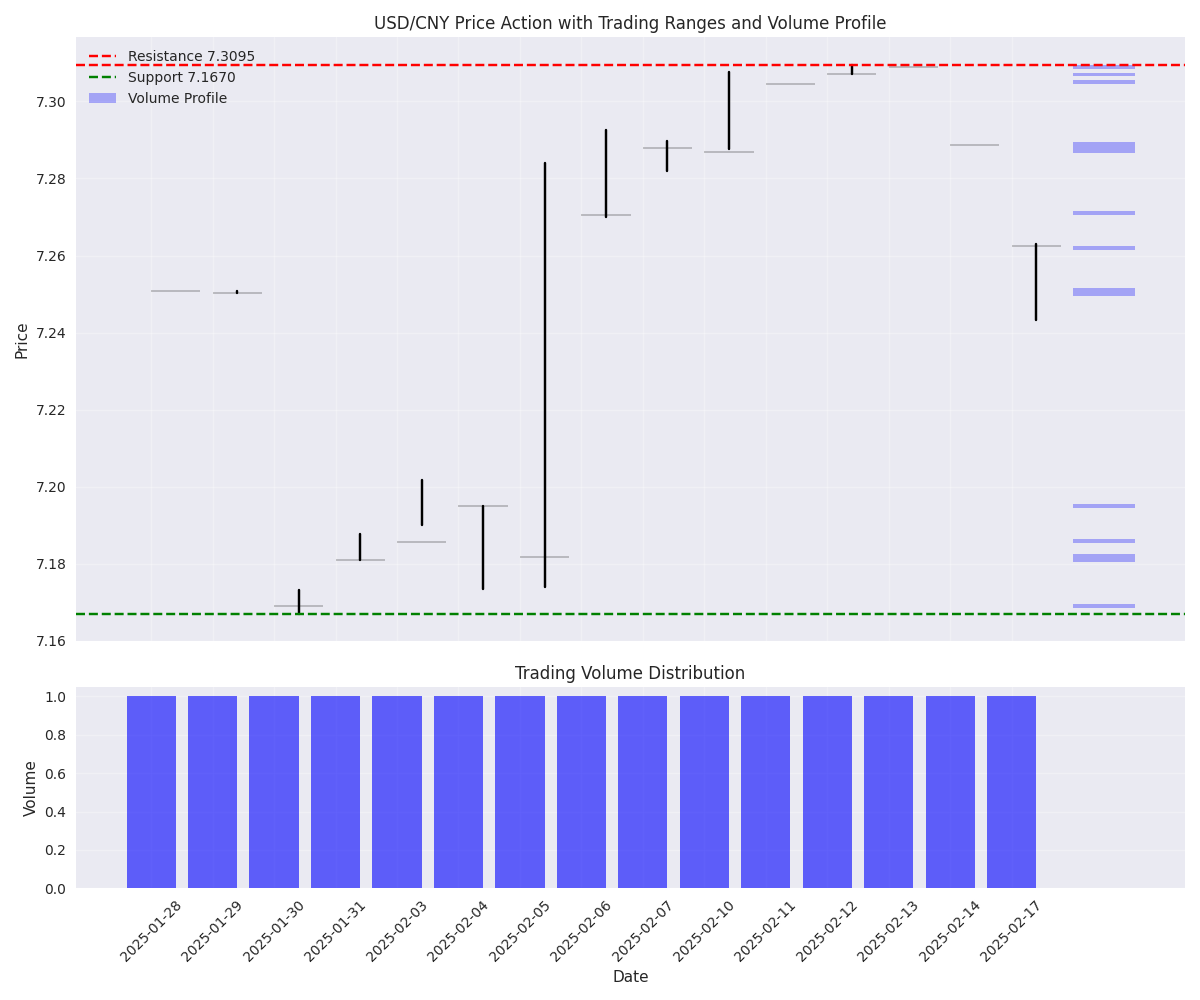

USD/CNY Trading Range Presents Clear Short Opportunity

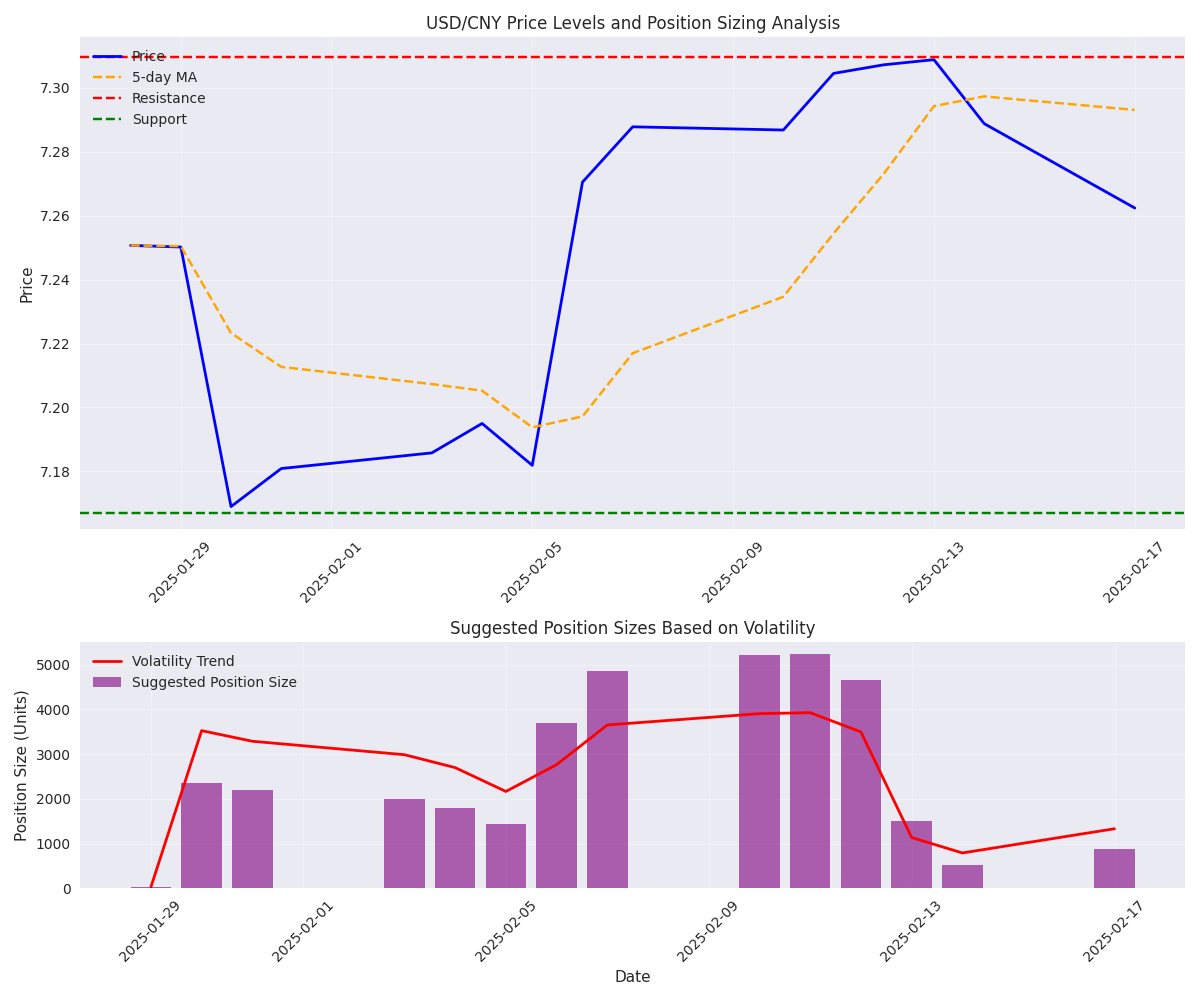

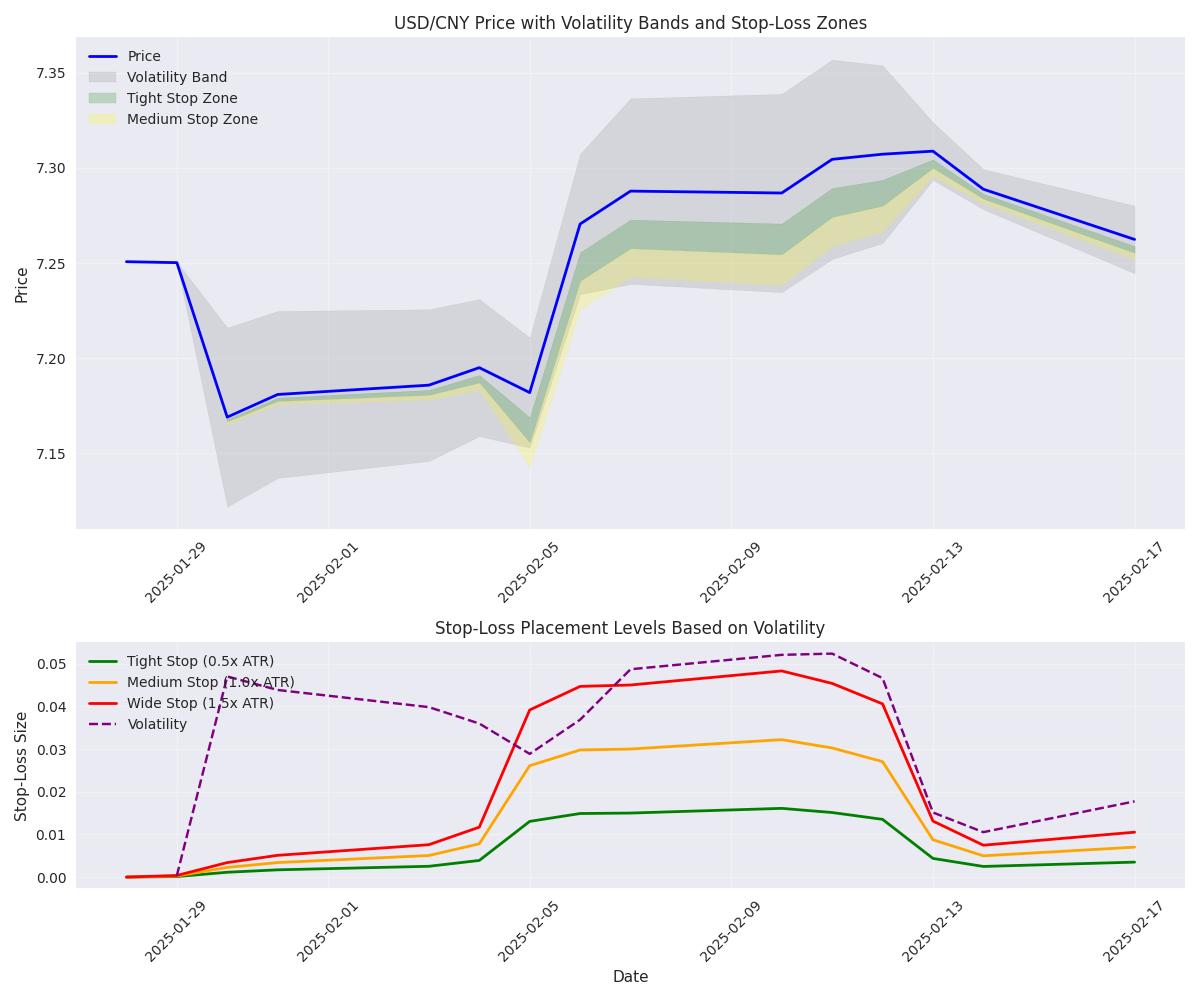

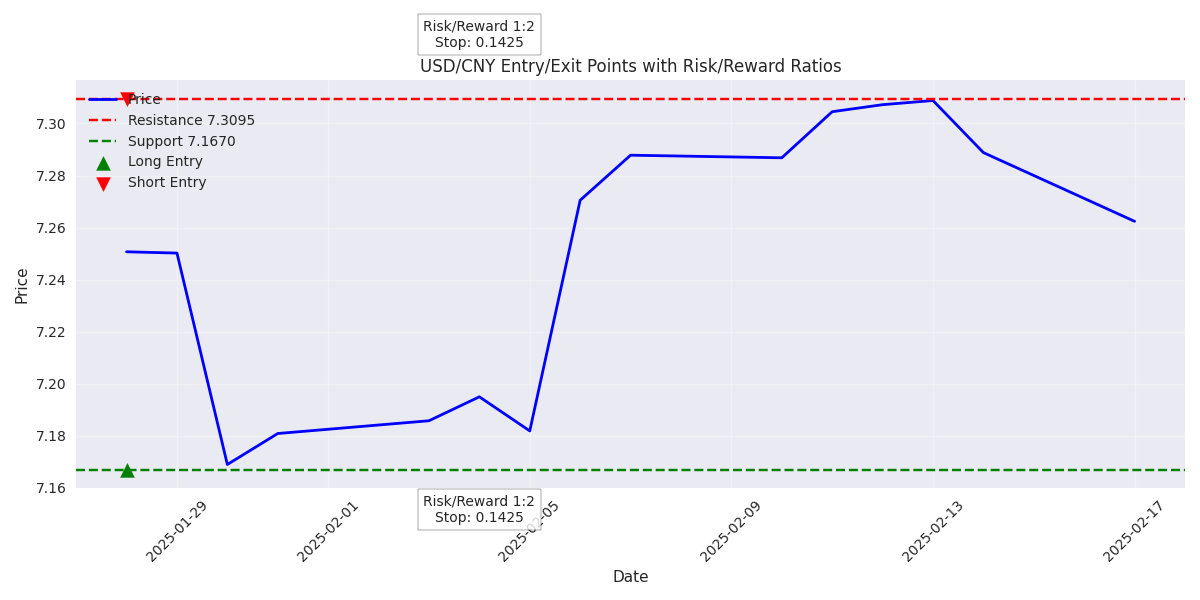

Optimal Position Sizing and Stop-Loss Strategy

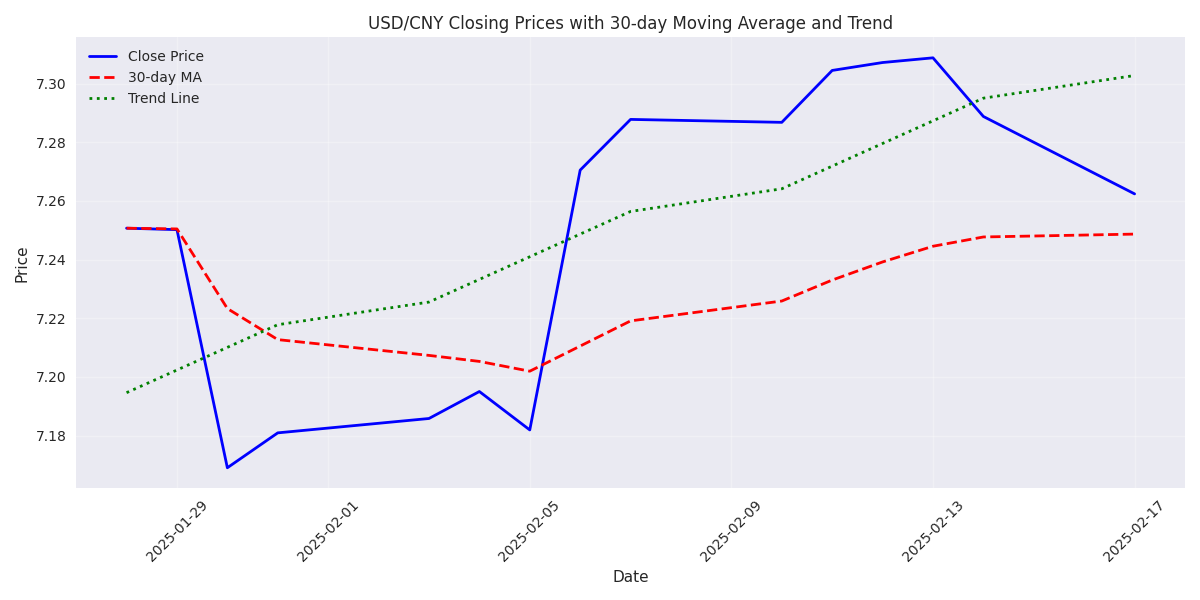

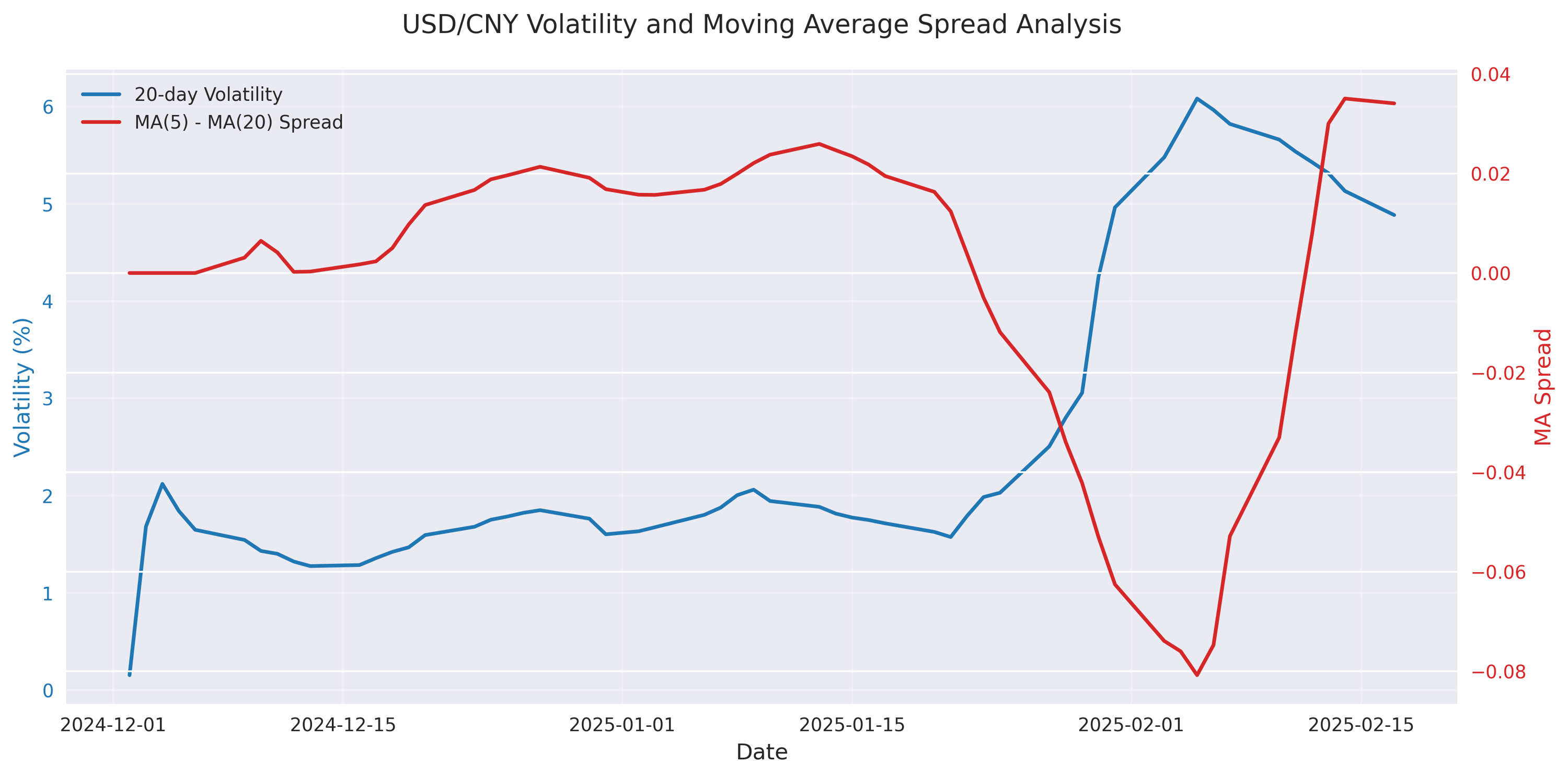

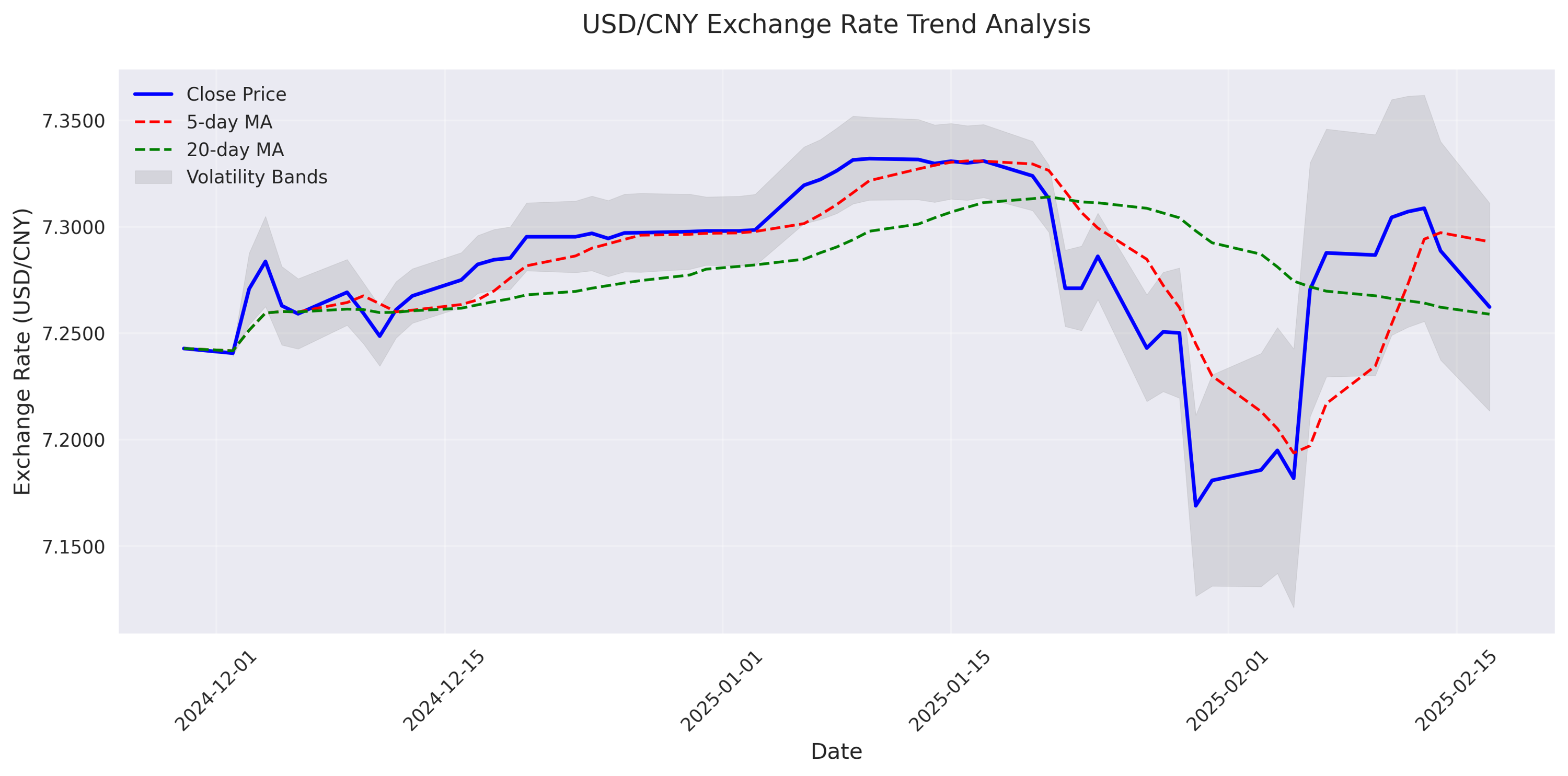

Short-term Bullish Momentum Building

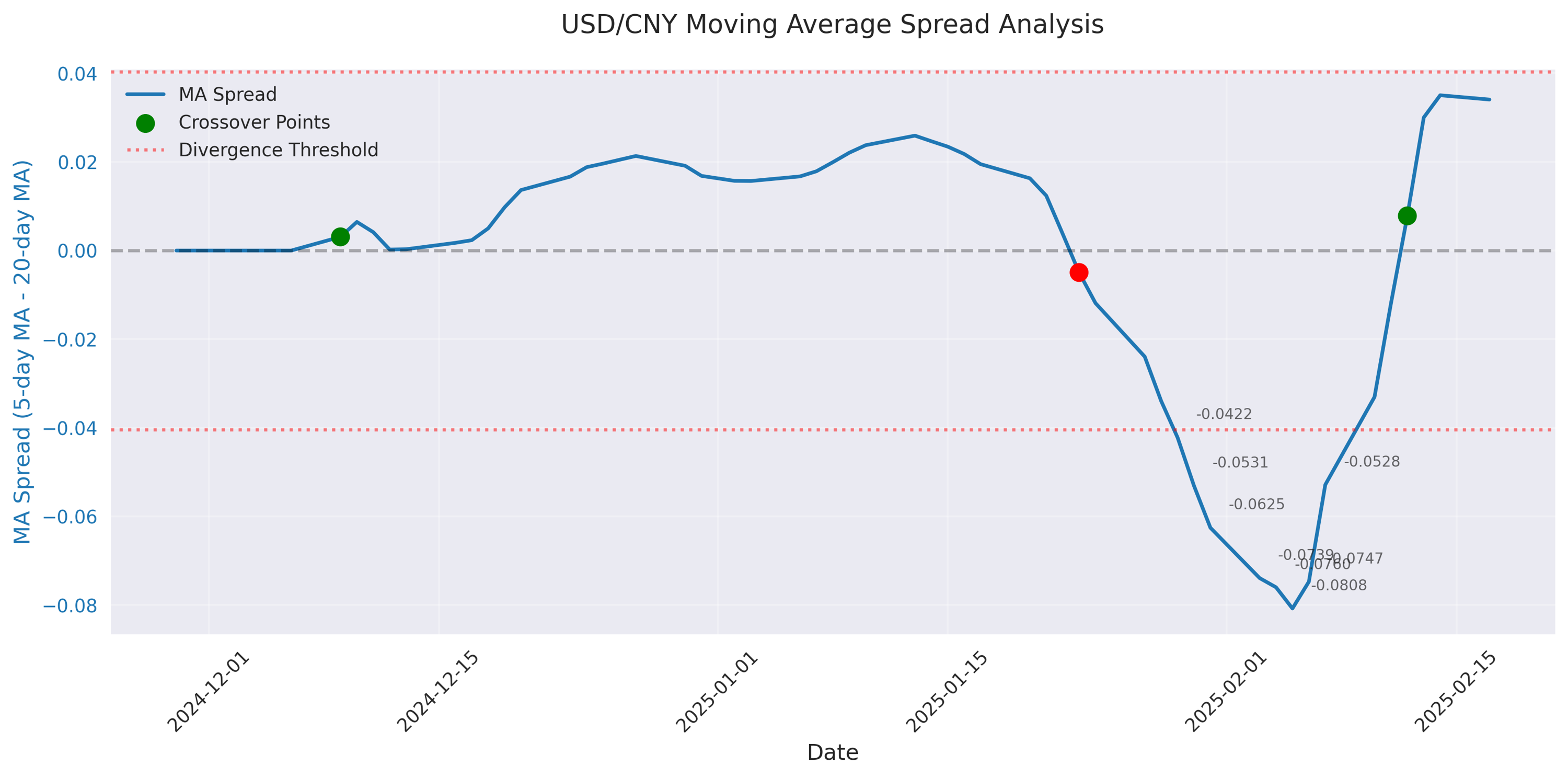

USD/CNY Technical Analysis: Consolidation Phase with Bearish Bias

USD/CNY Trading Opportunities: Key Levels and Market Structure

USD/CNY Market Analysis: News Impact and Trading Implications

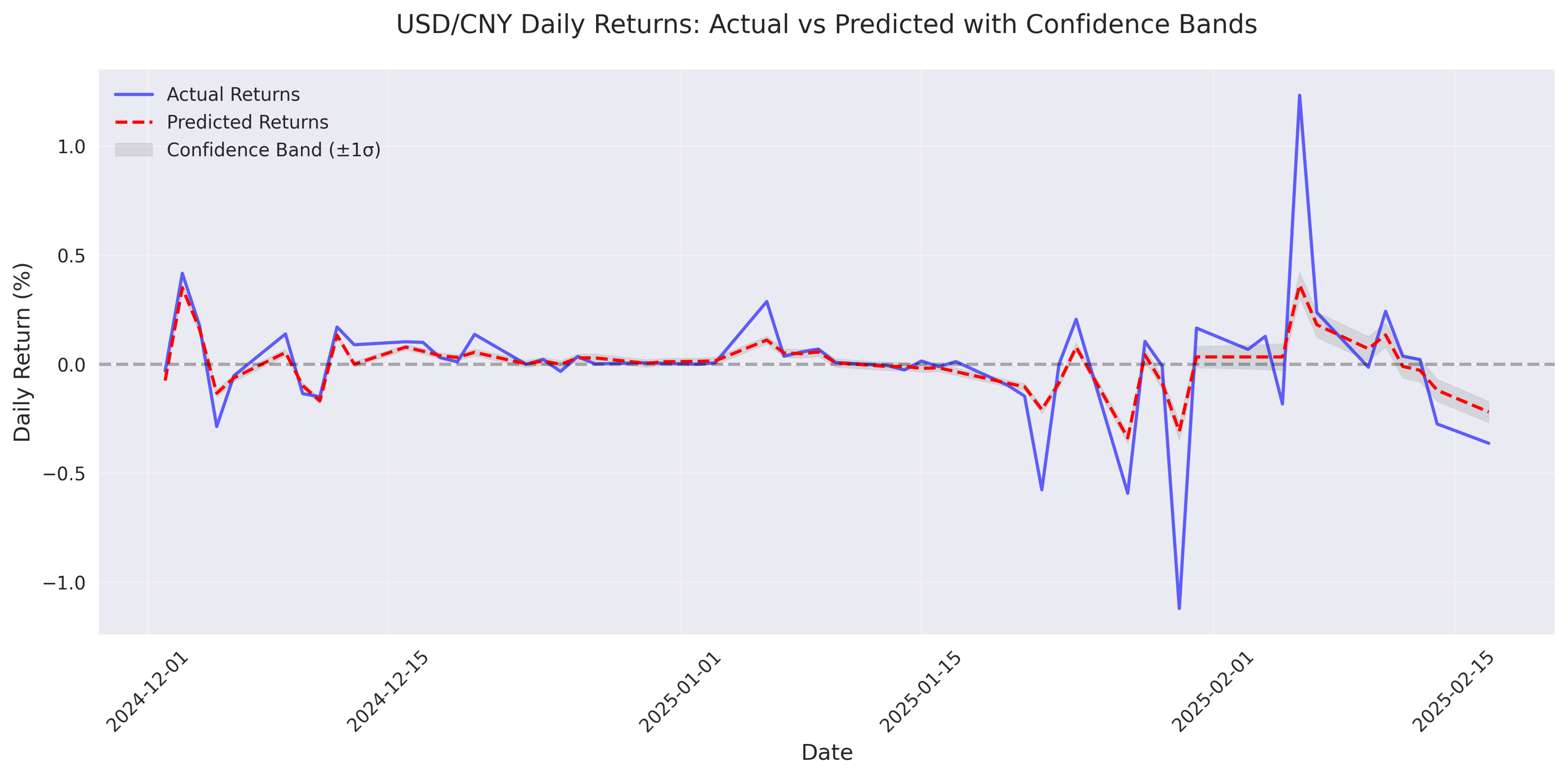

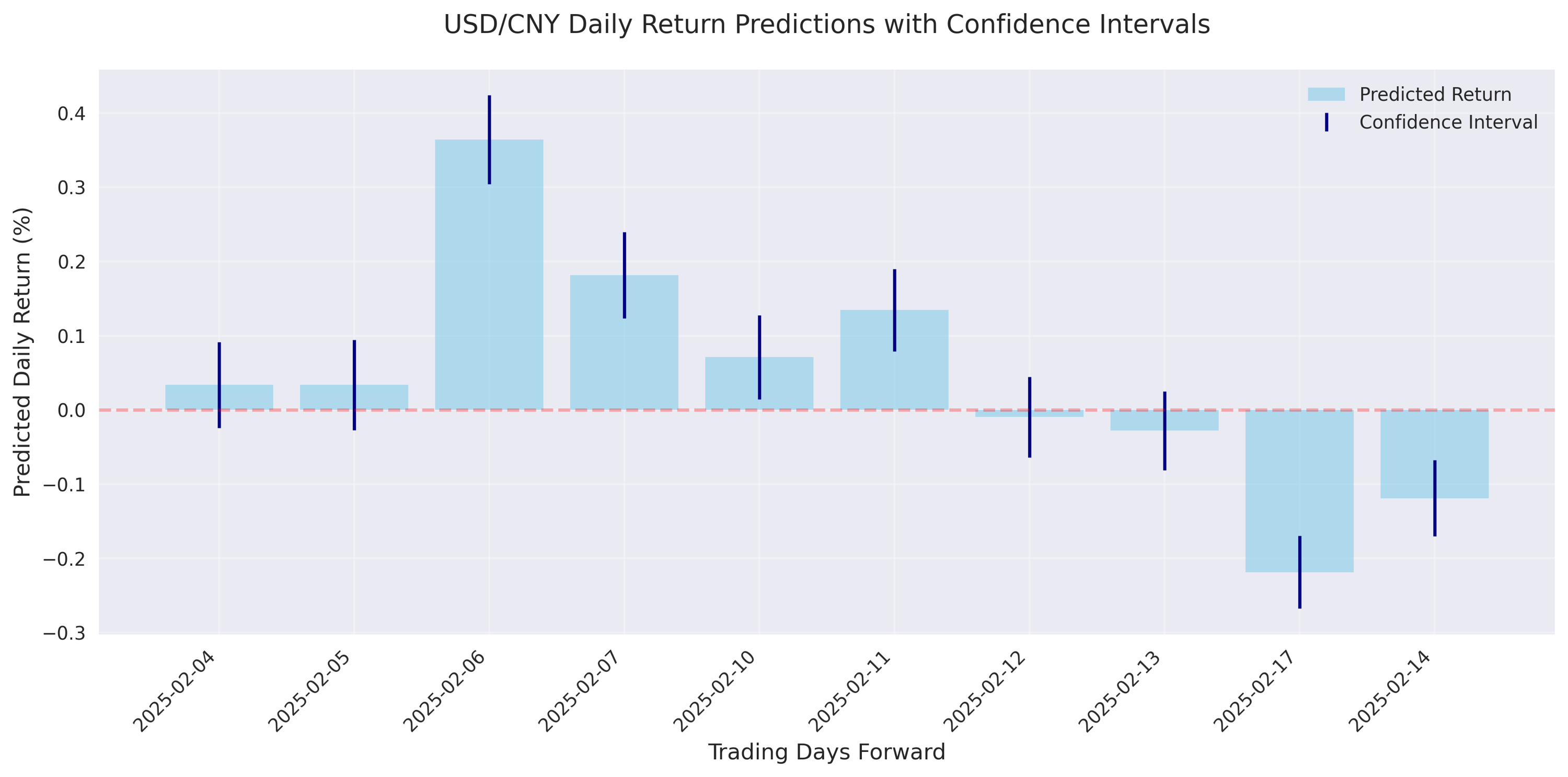

USD/CNY Exchange Rate Analysis and Short-term Predictions

USD/CNY Exchange Rate Predictions and Risk Analysis