S&P 500 Reveals Bullish Momentum and Key Market Drivers in Volatile Trading Landscape

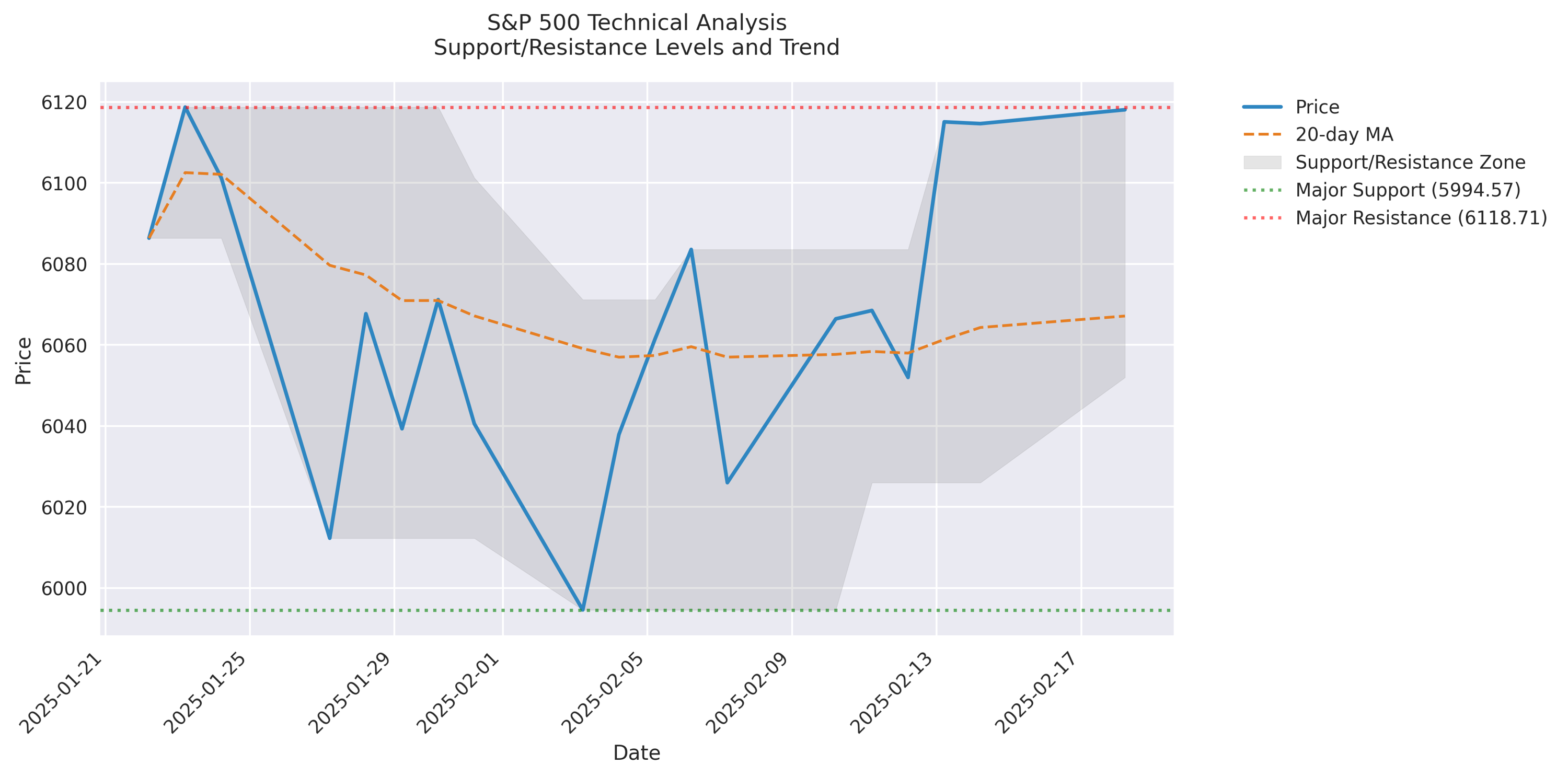

S&P 500 Shows Strong Bullish Momentum with Key Level at 6,125

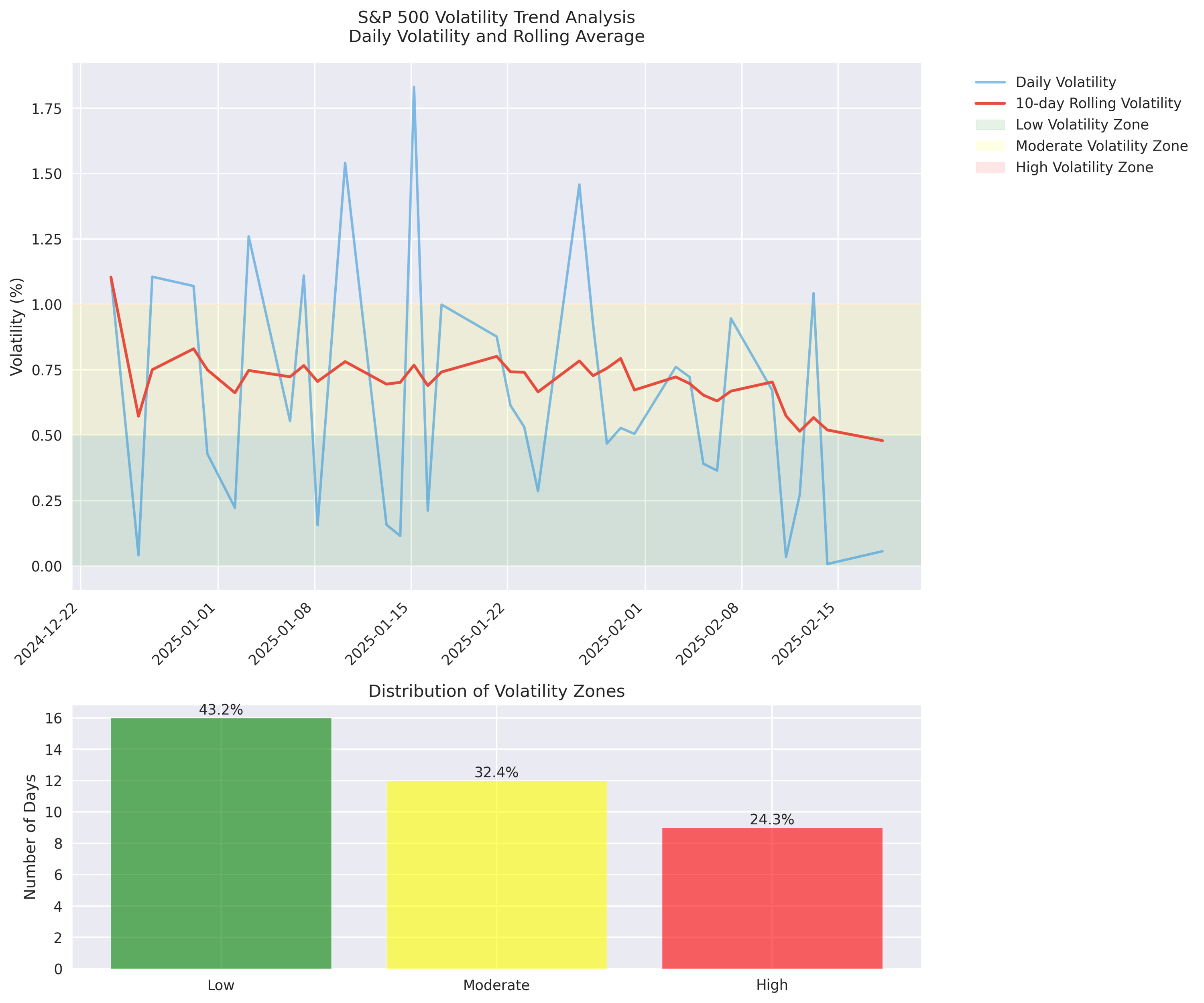

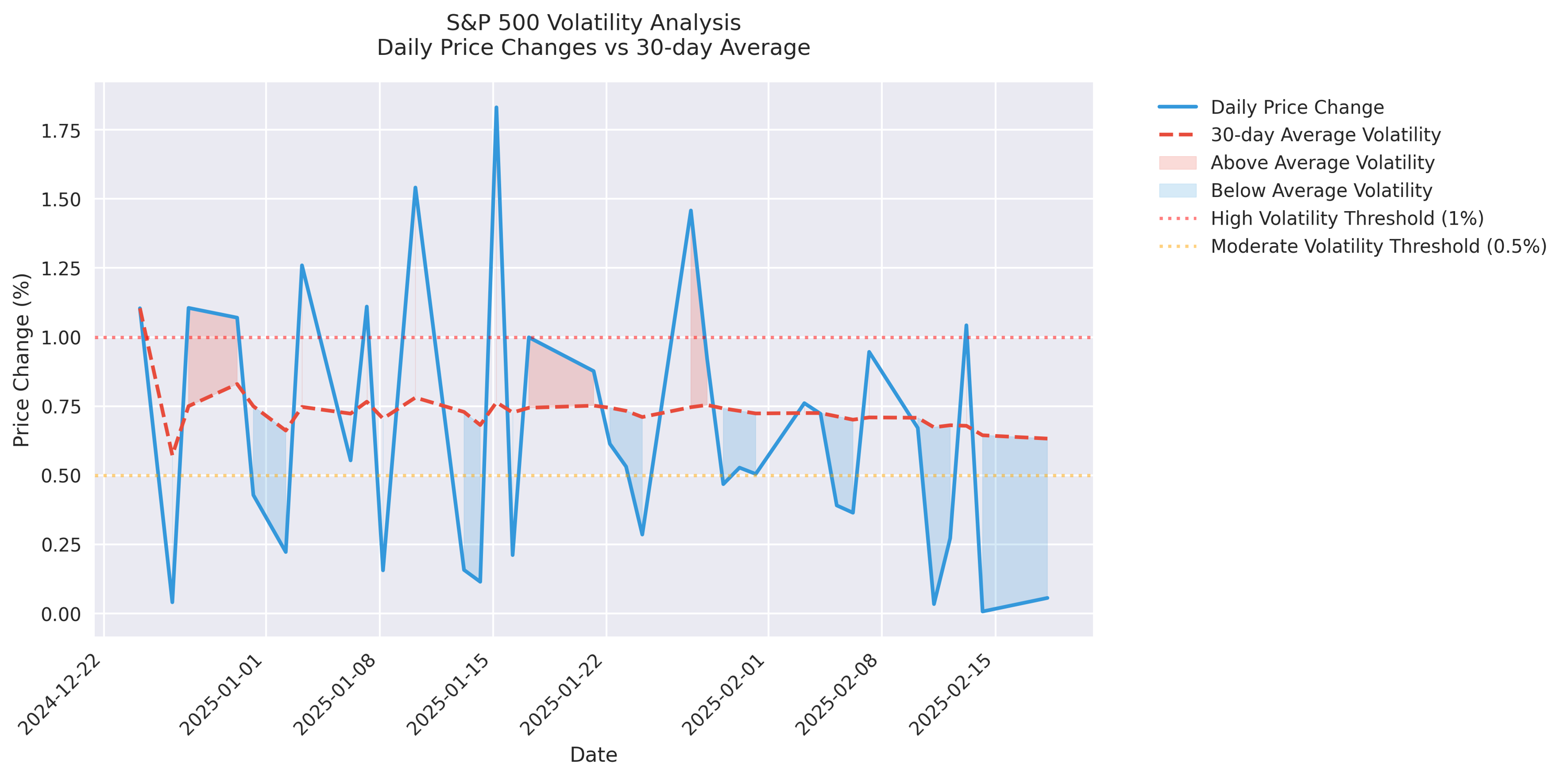

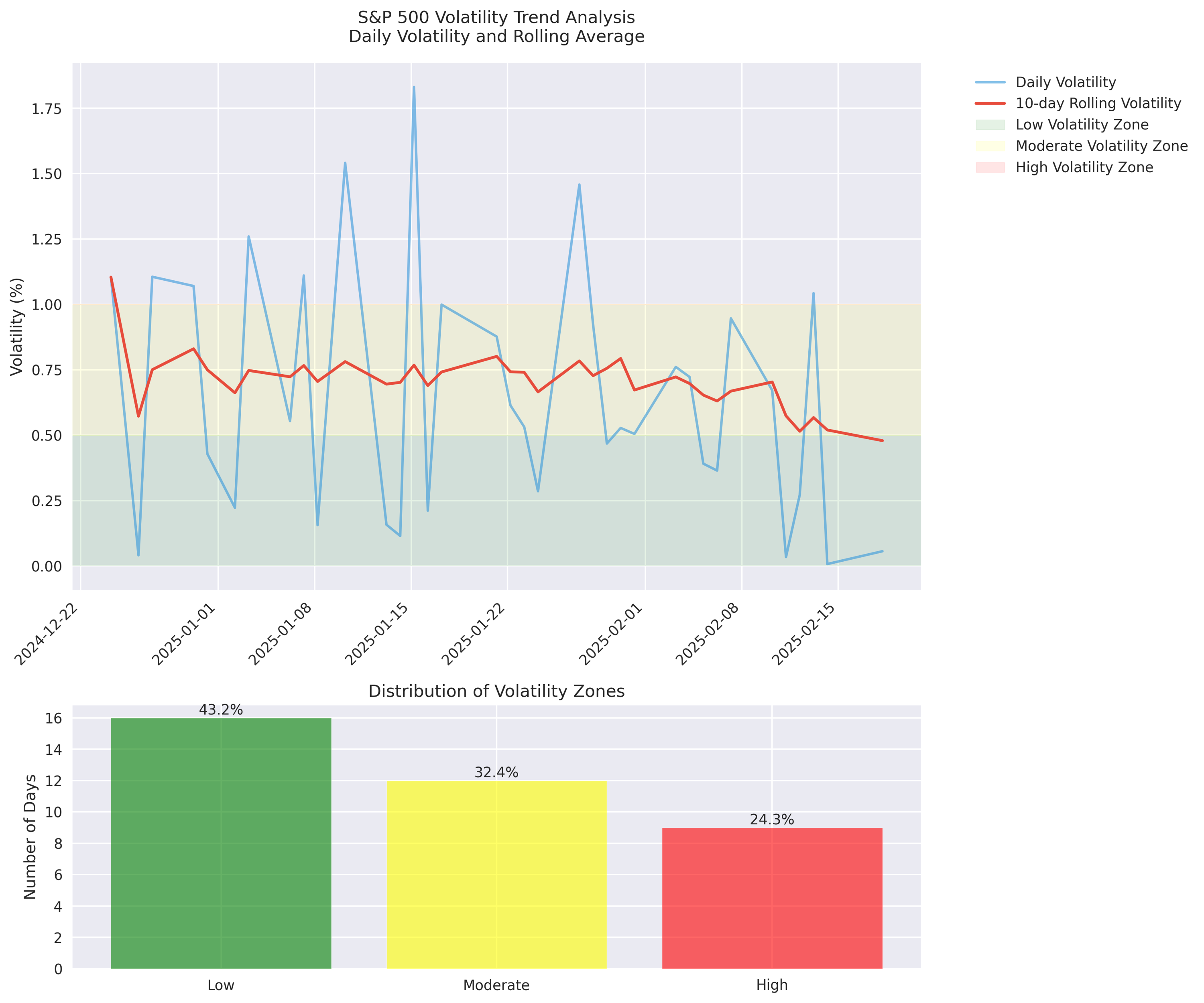

Market Volatility Decreasing as Trading Conditions Improve

Technical Analysis Points to Continued Upside with Caution

Fed Policy and Walmart Earnings Driving Market Direction

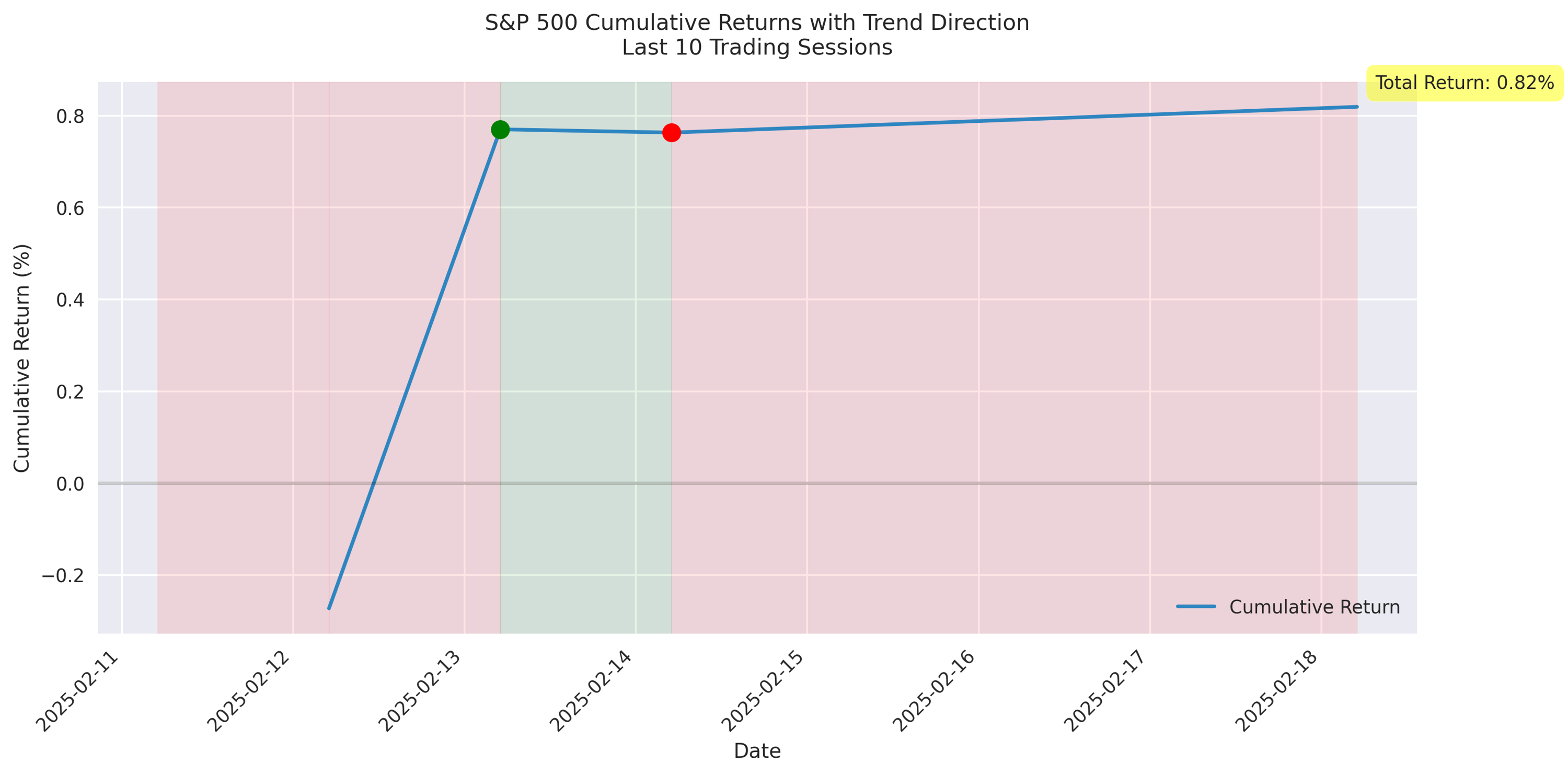

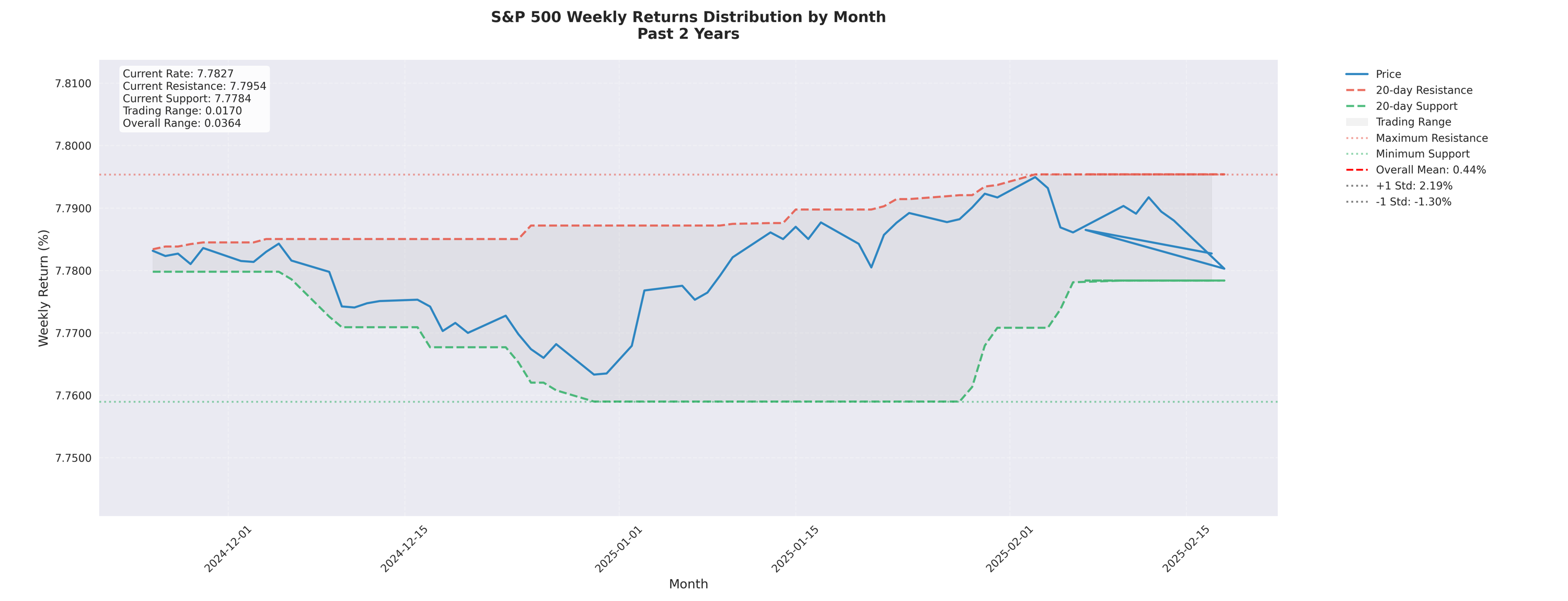

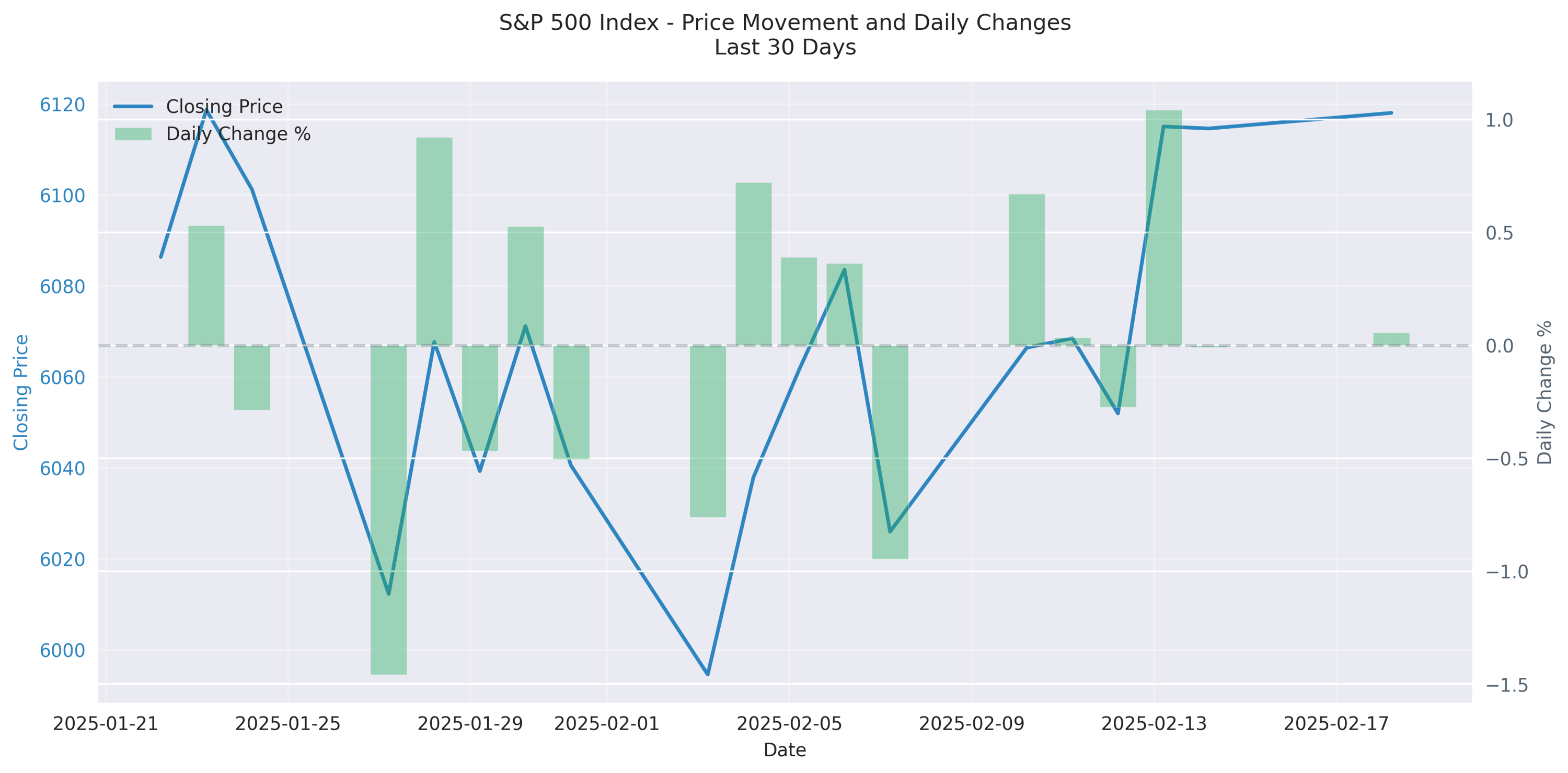

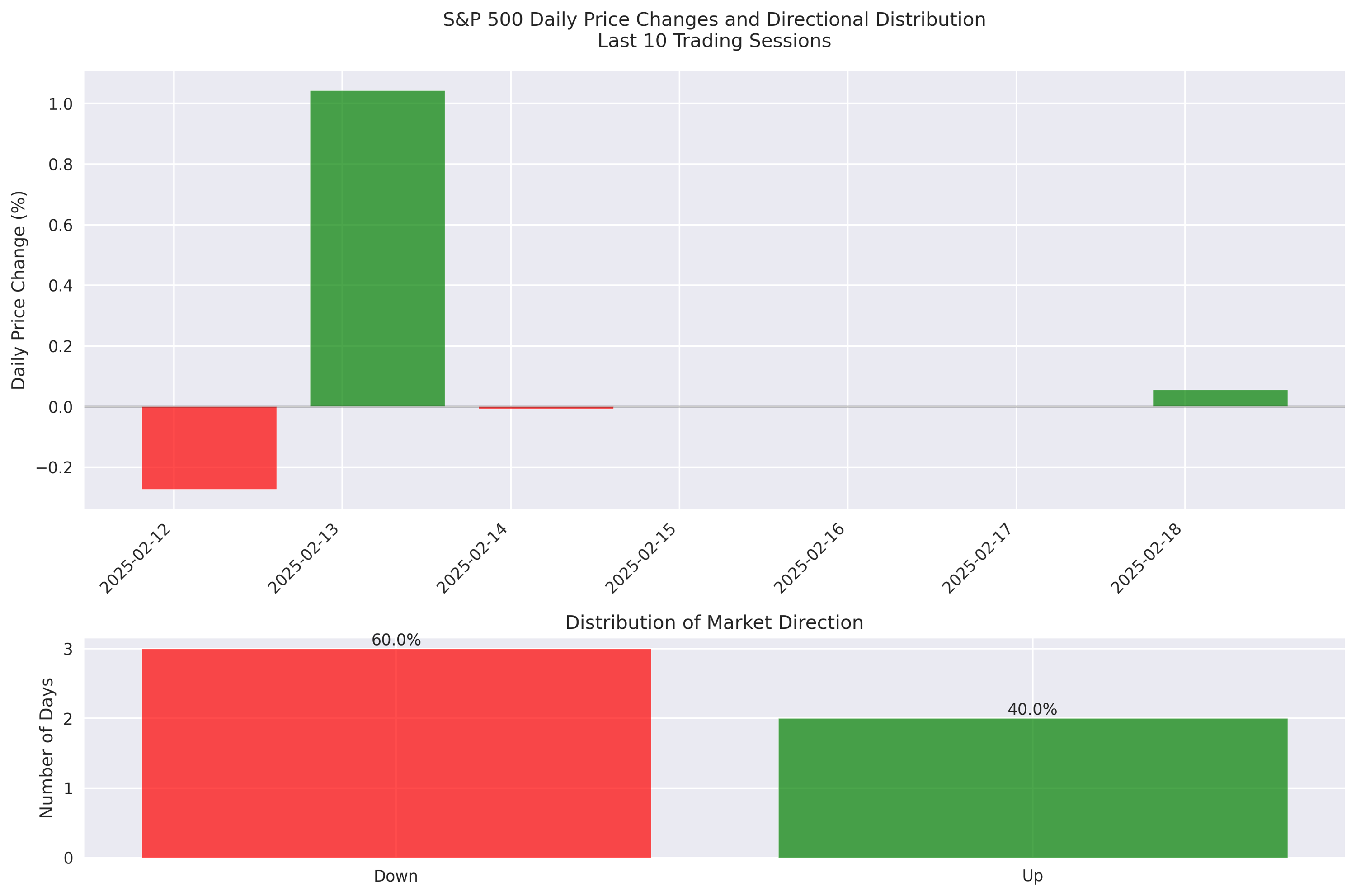

Recent S&P 500 Price Movement Analysis Shows Mixed Market Sentiment

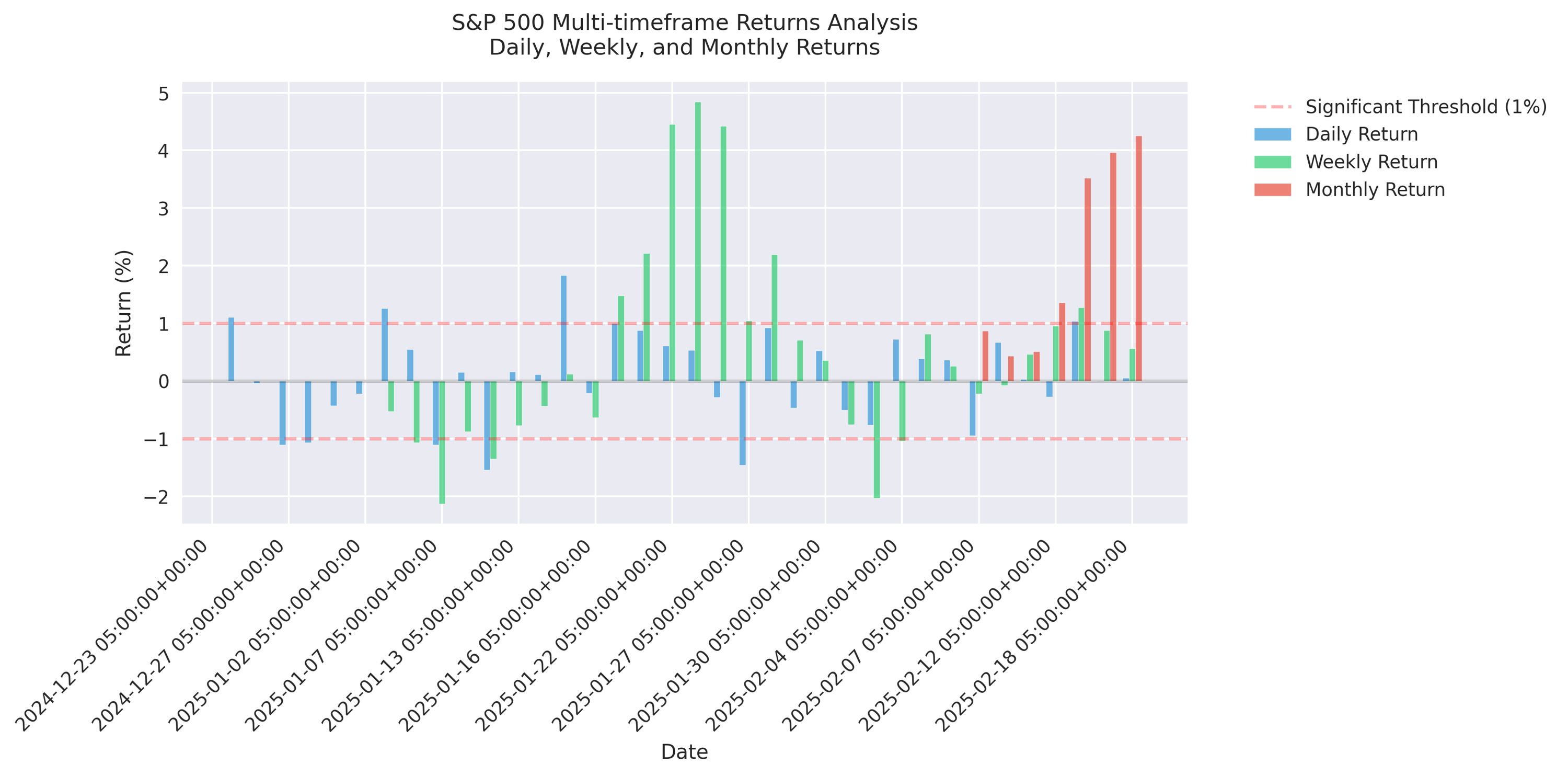

S&P 500 Shows Strong Monthly Gains with Recent Volatility Spikes

S&P 500 Shows Bullish Momentum Despite Recent Volatility

Market News Analysis Reveals Key Drivers of Recent Price Action

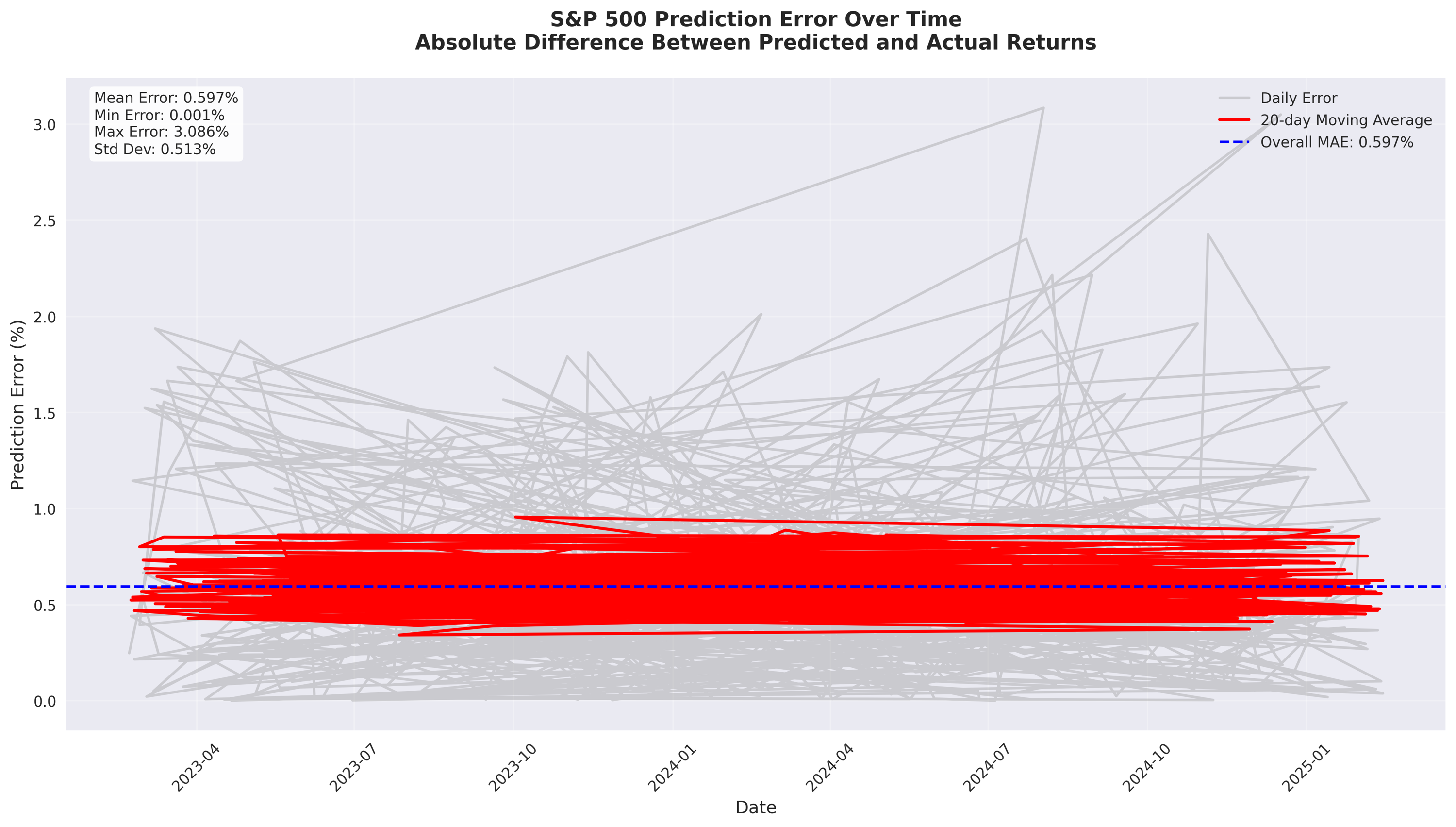

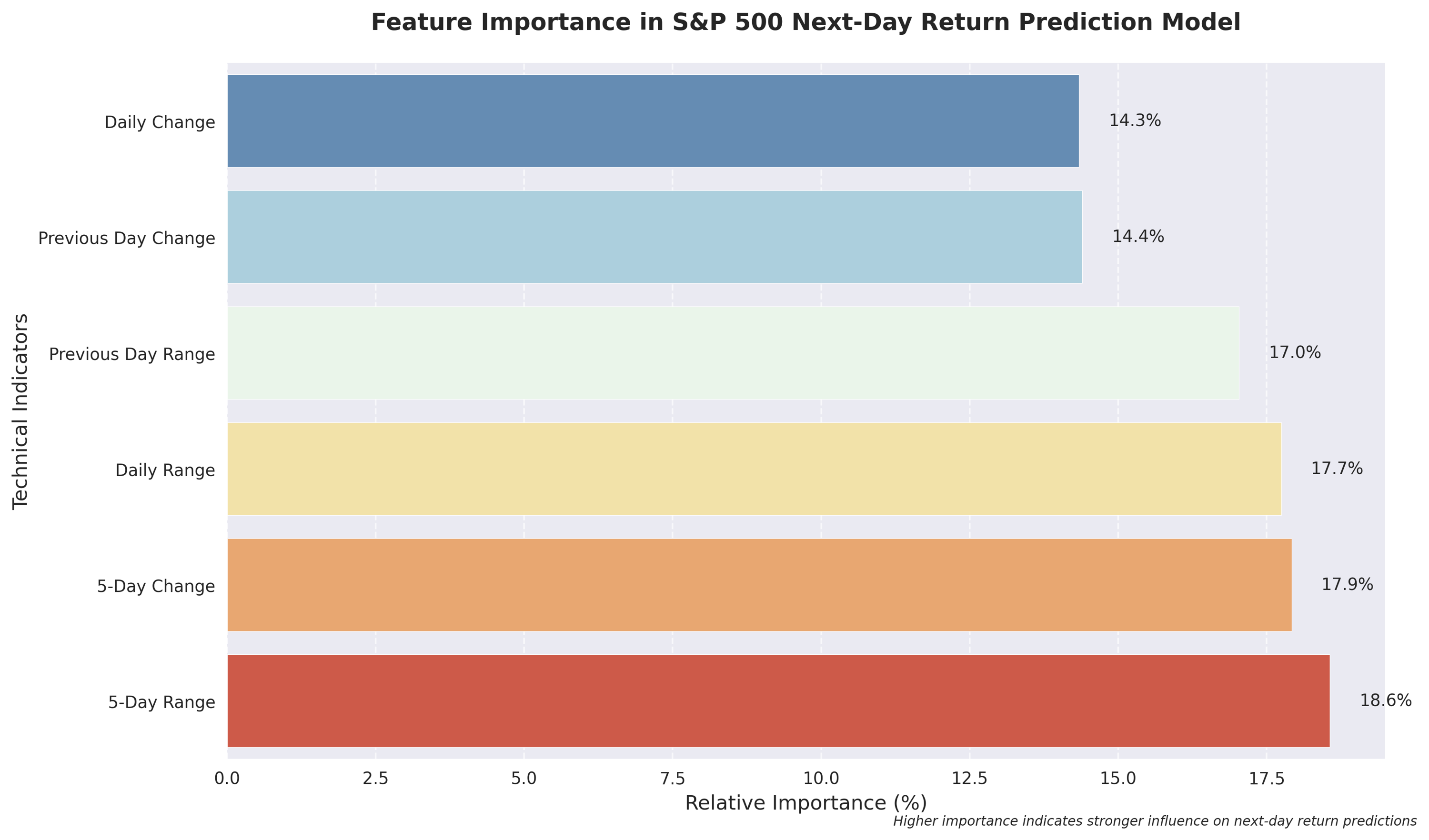

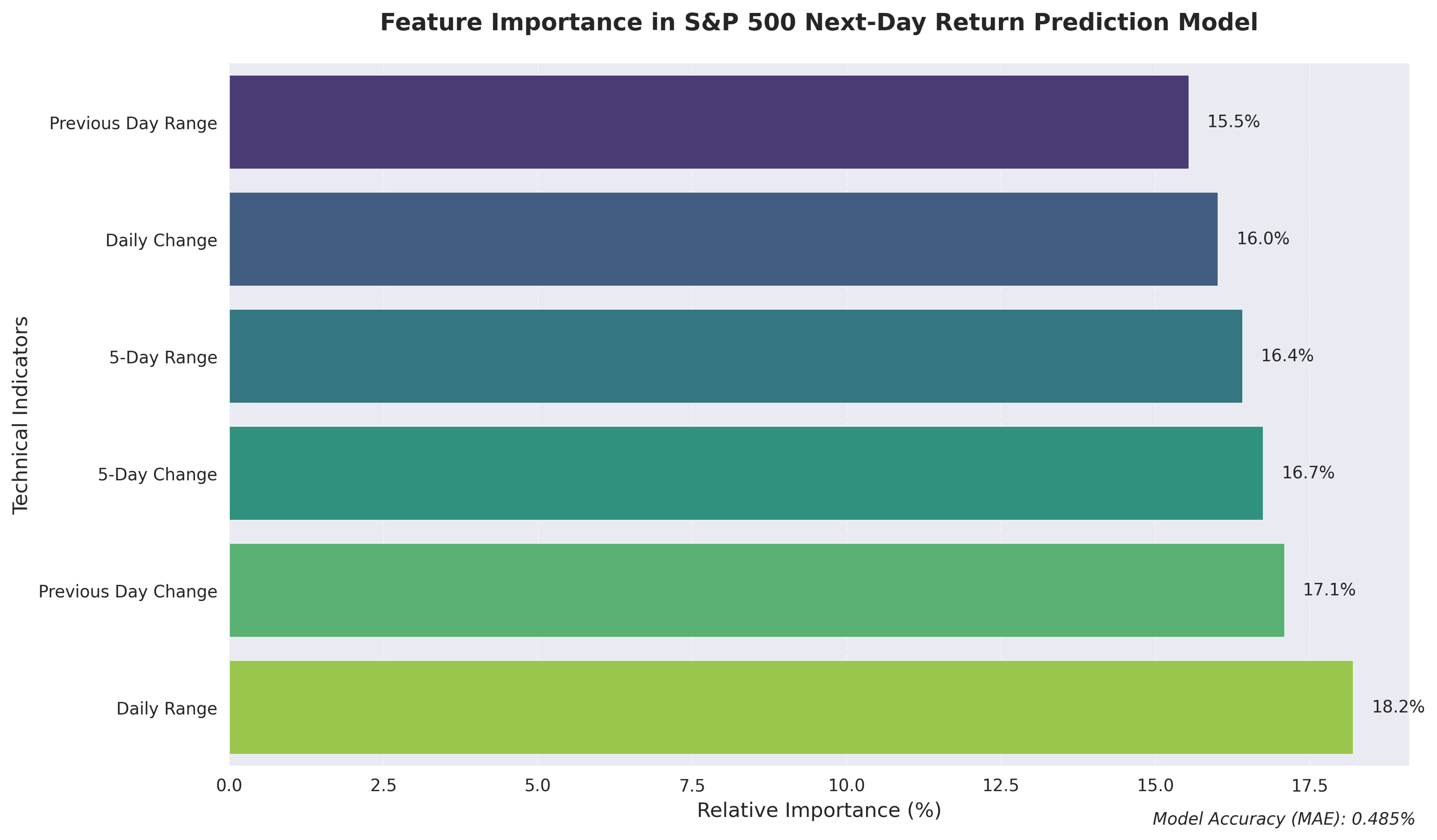

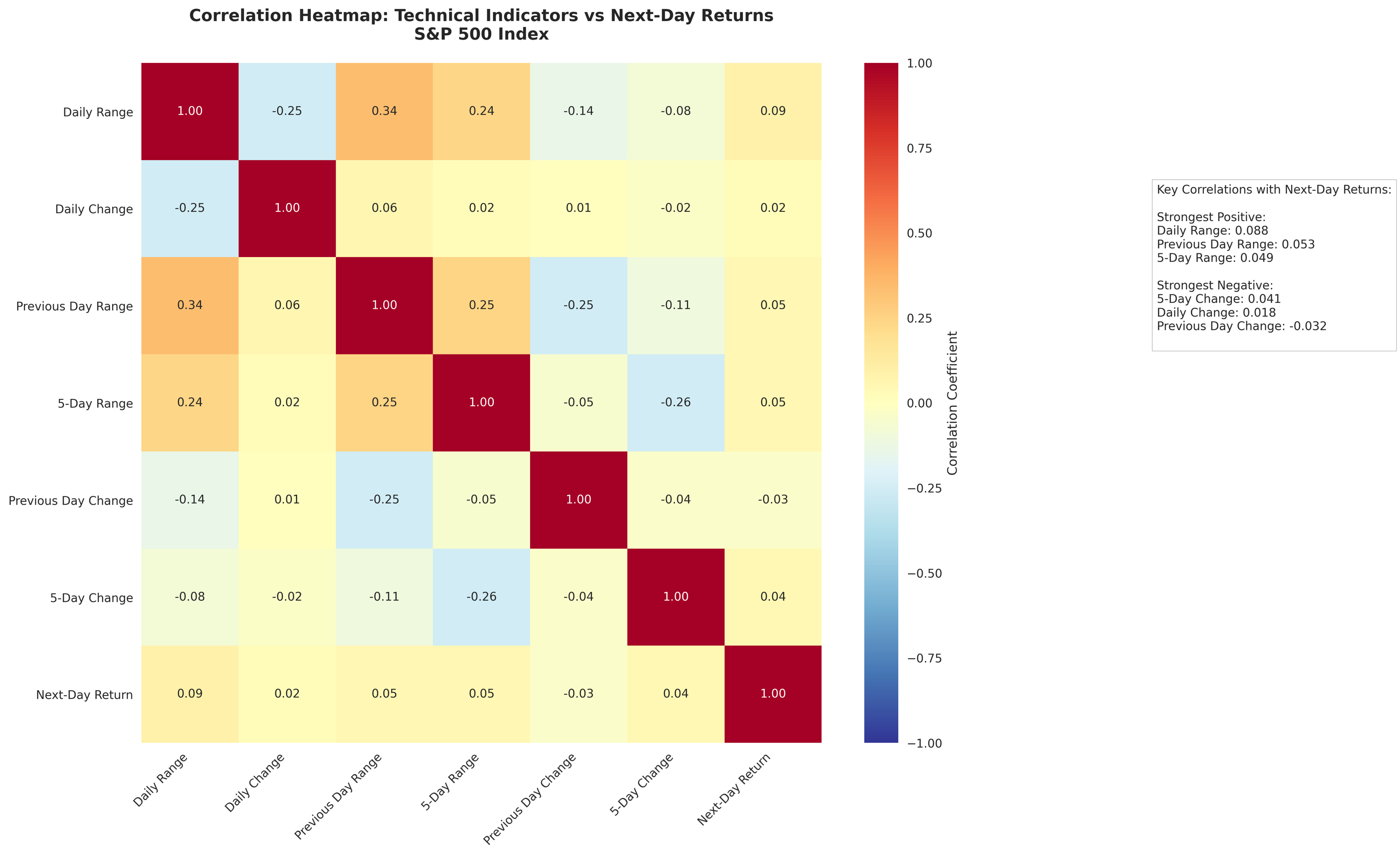

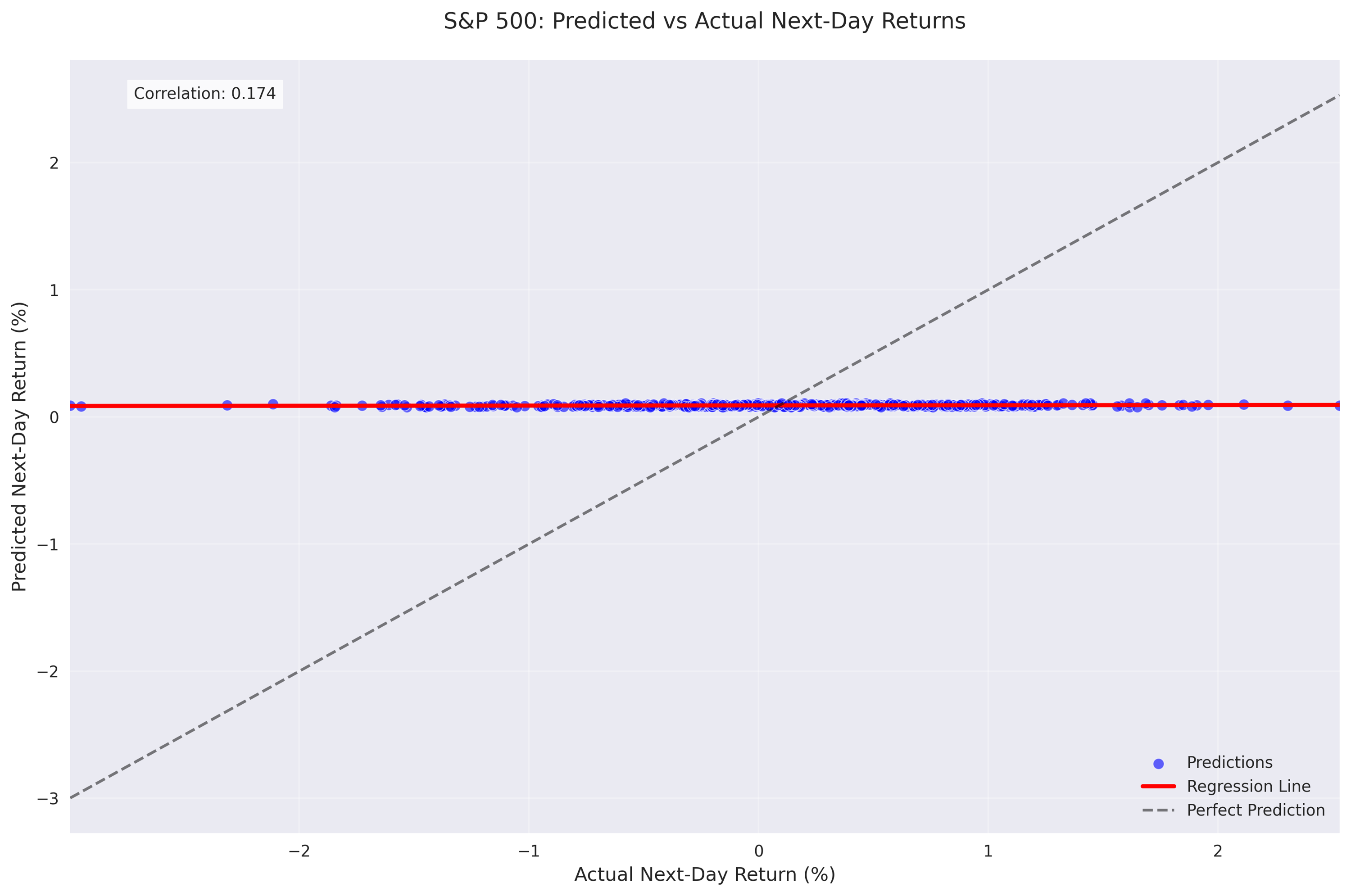

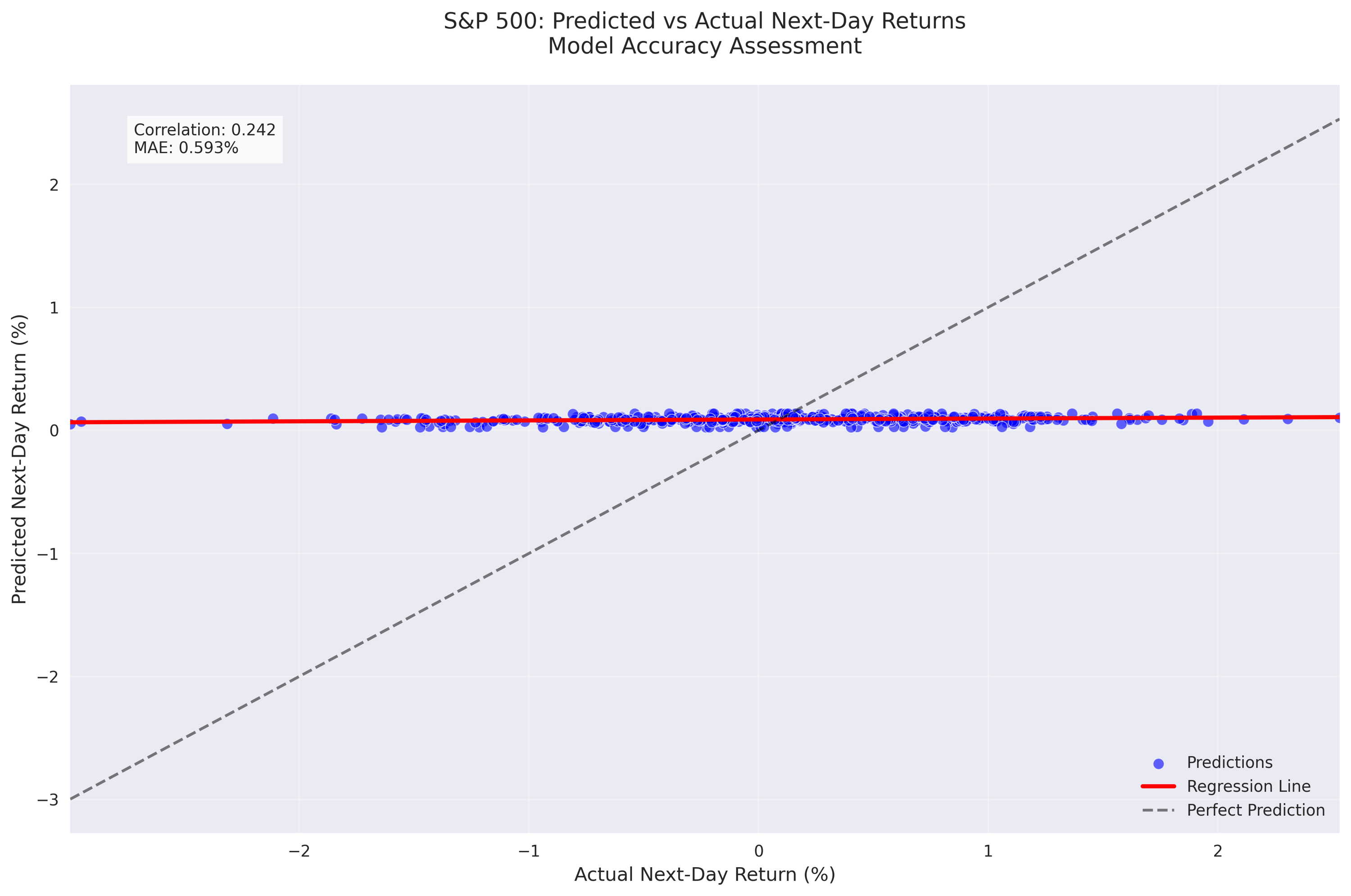

SP 500 Next-Day Return Prediction Model Analysis

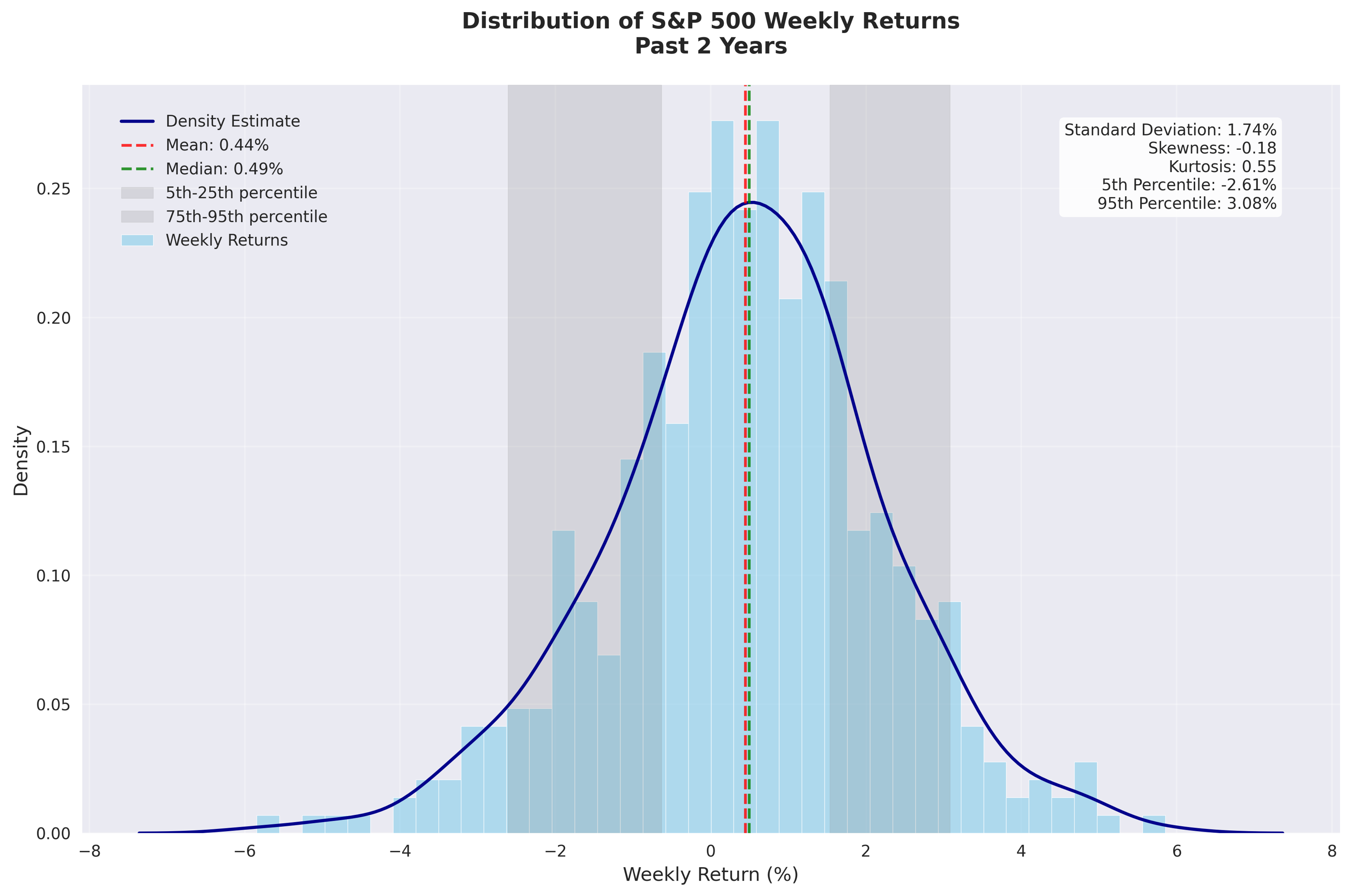

S&P 500 Predictive Analysis: Key Findings and Risk Assessment

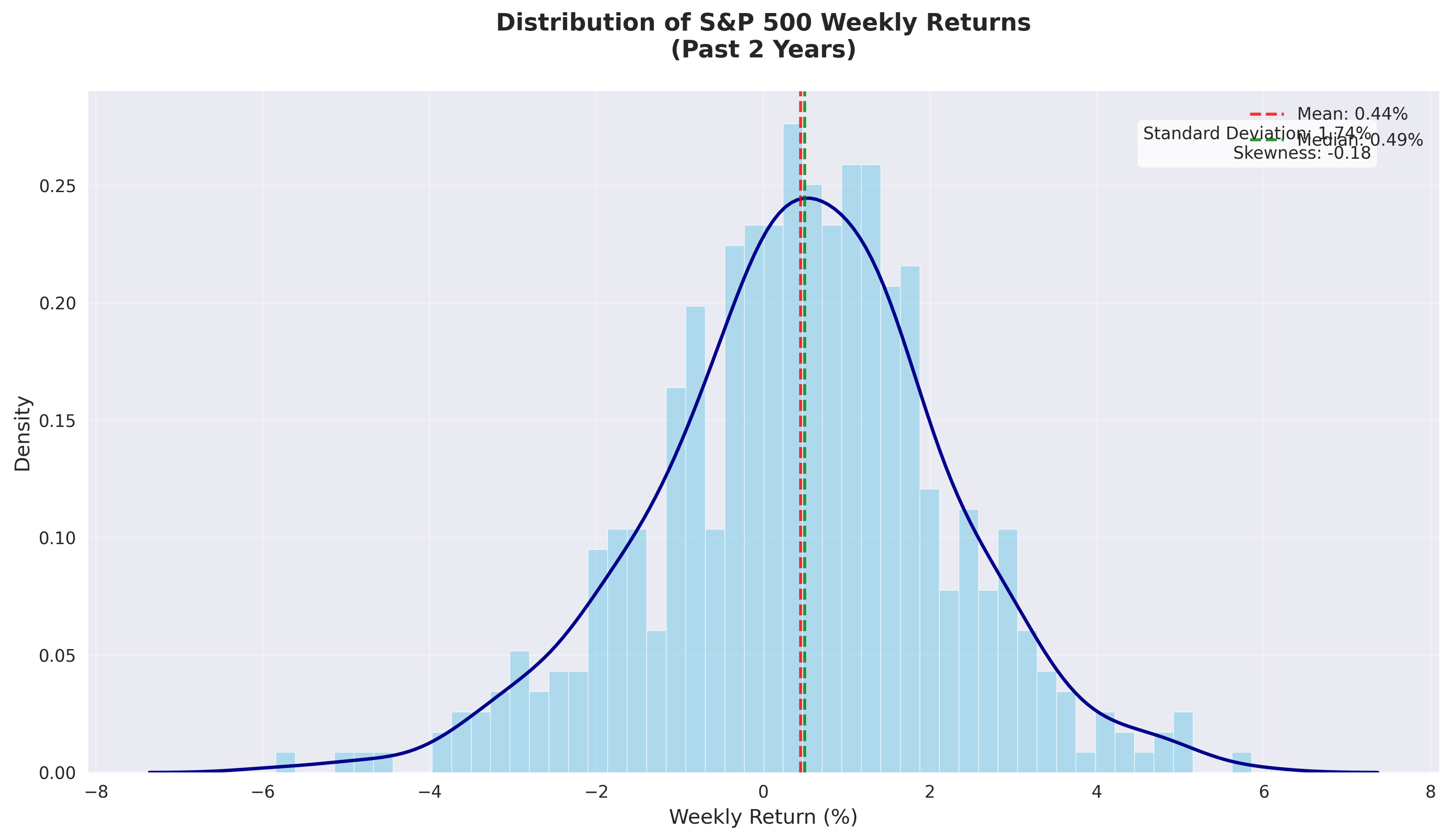

S&P 500 Predictive Analysis: Advanced Risk and Return Patterns