NVIDIA Stock: Explosive Momentum and Critical Trading Signals Revealed

Saving...

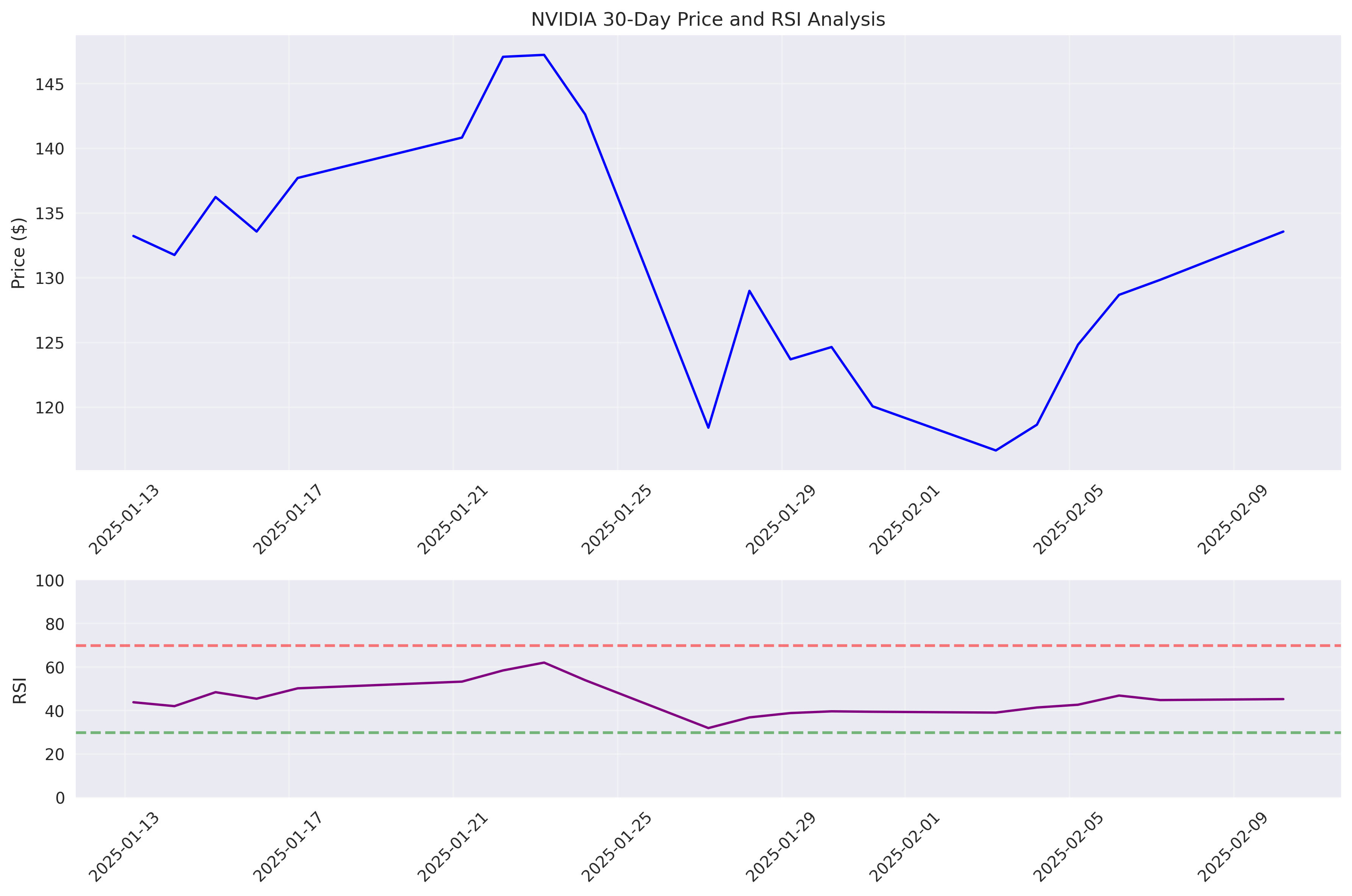

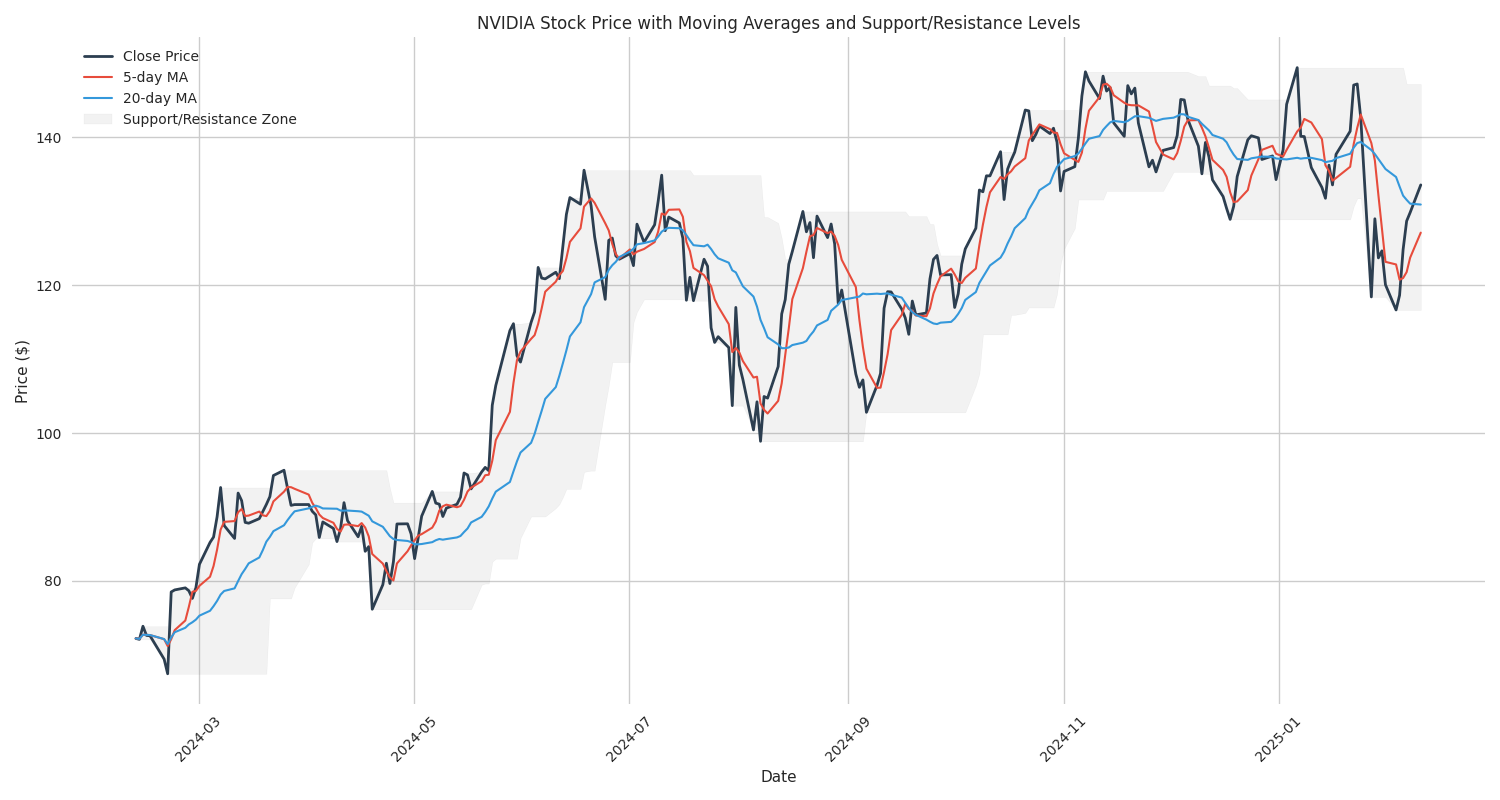

Short-Term Trading Setup: Bullish with Caution

Saving...

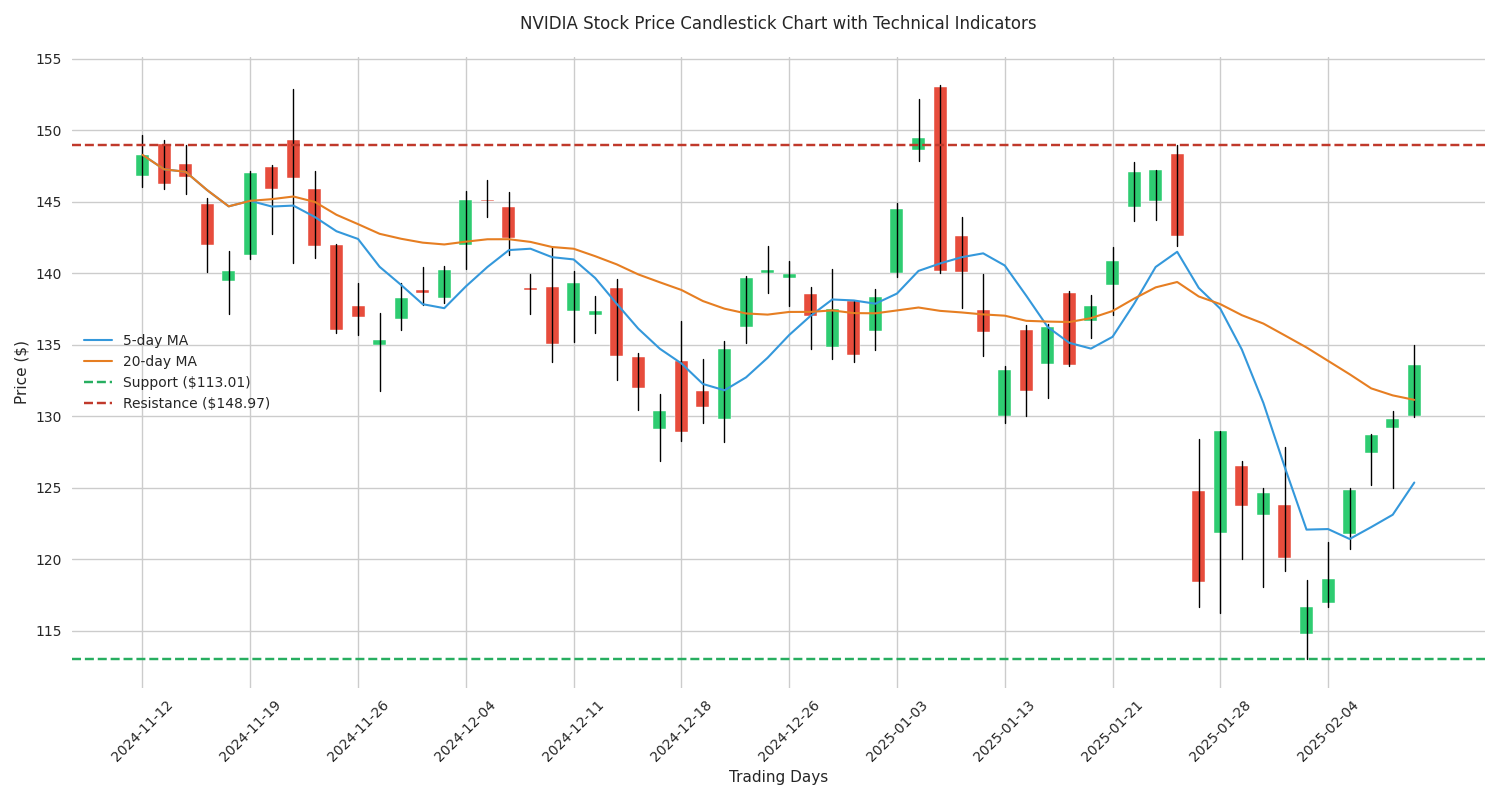

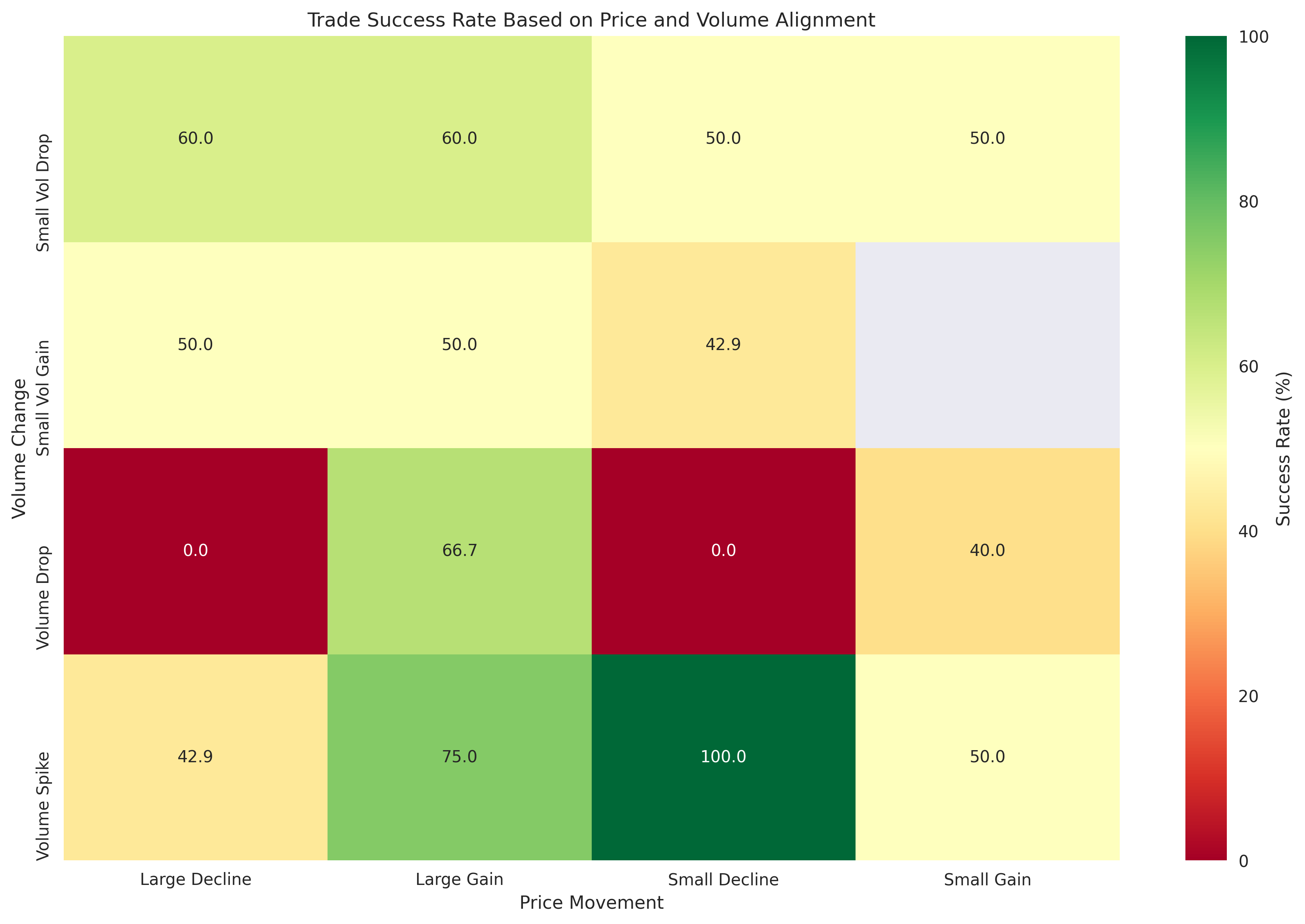

Critical Trading Strategy for Current Market

Saving...

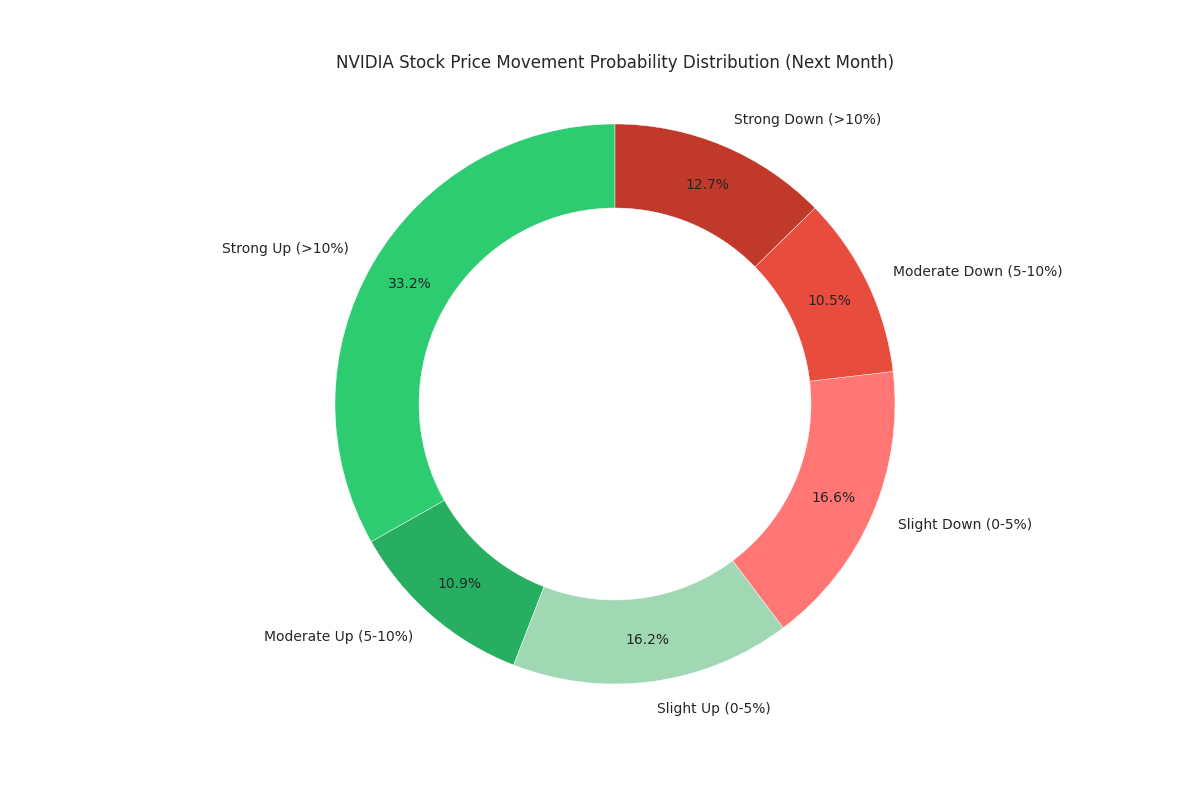

High-Confidence Price Prediction Model

Saving...

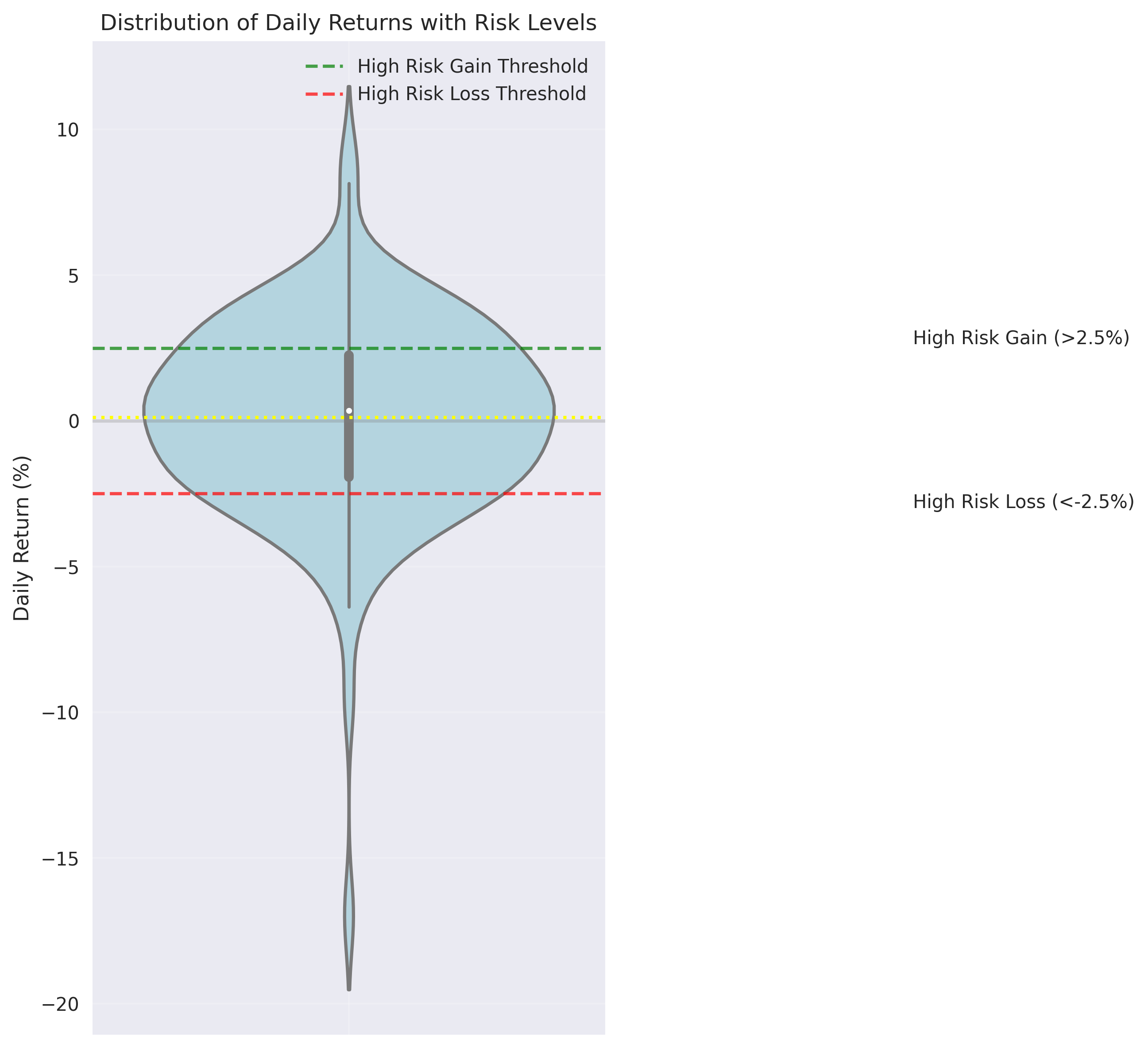

Essential Risk Management Alert

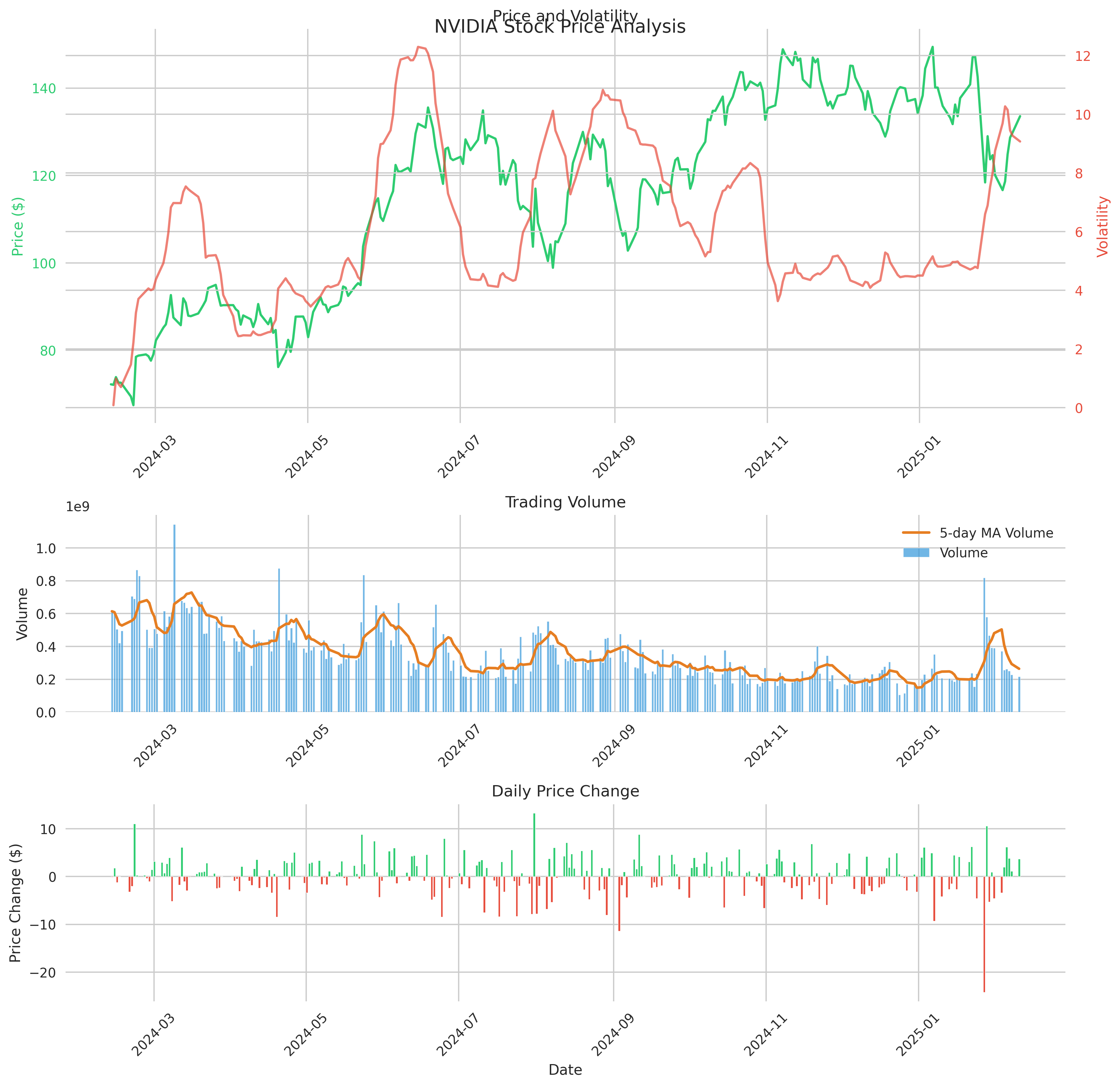

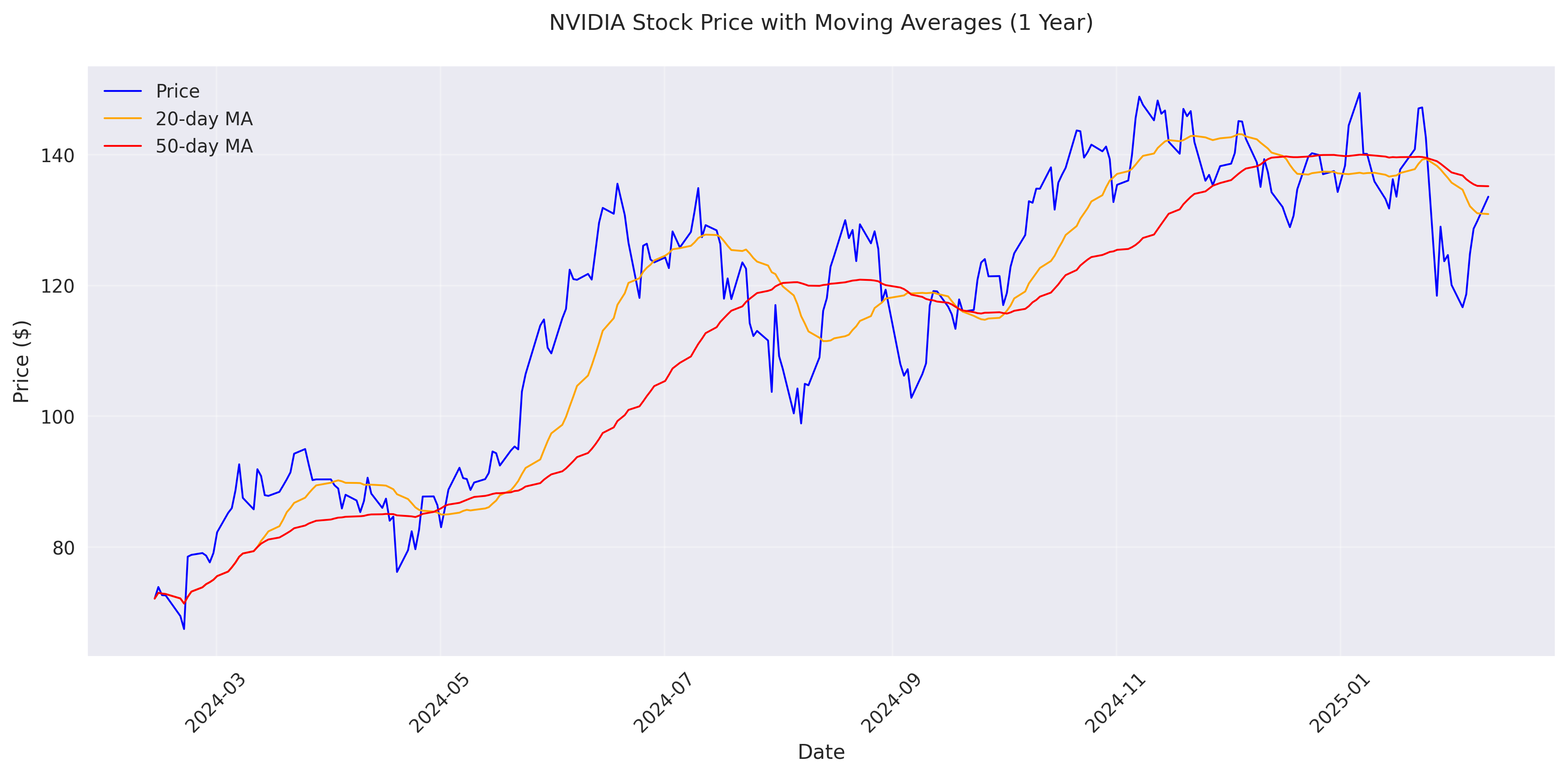

NVIDIA Stock Analysis: Strong Performance with High Volatility

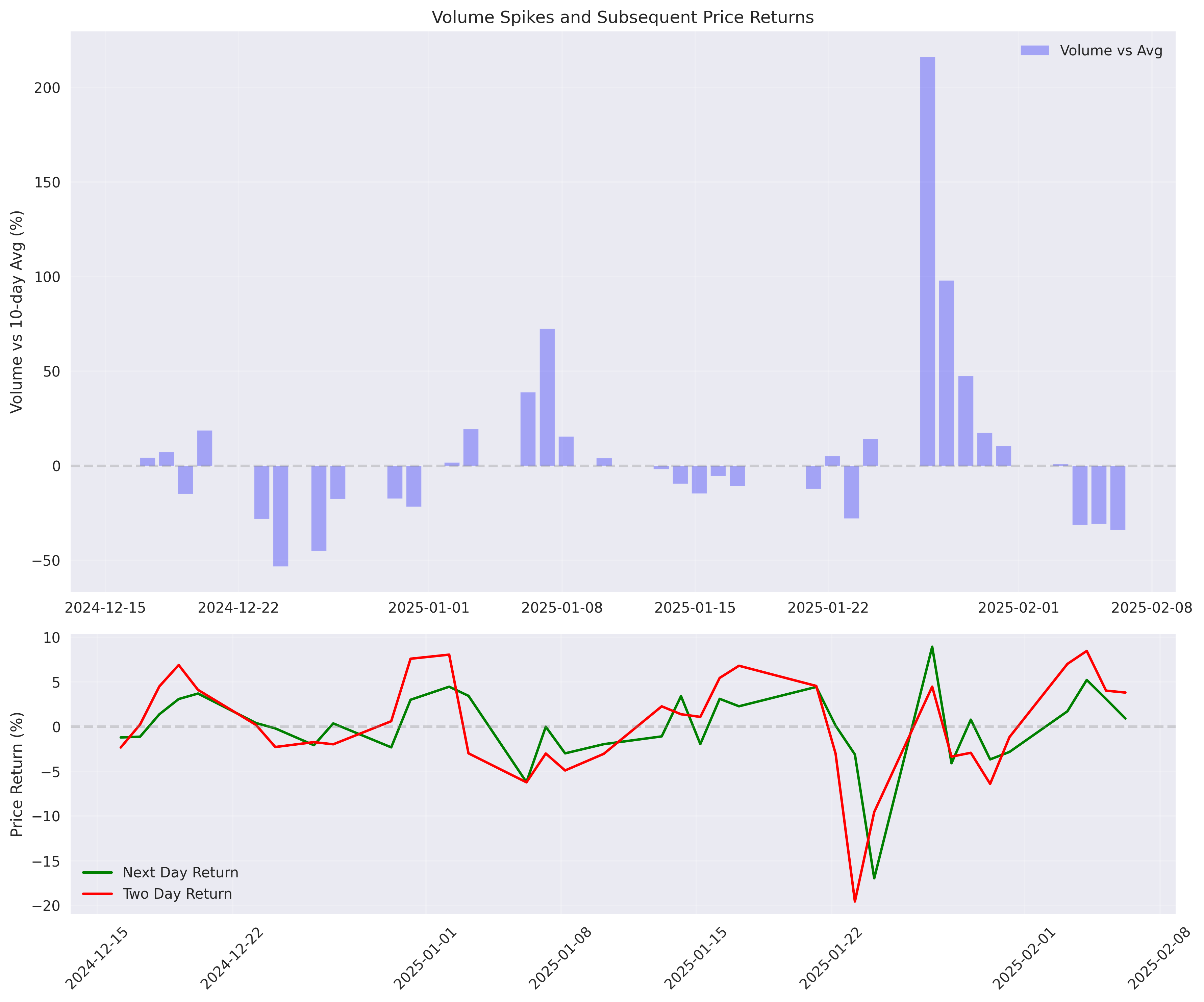

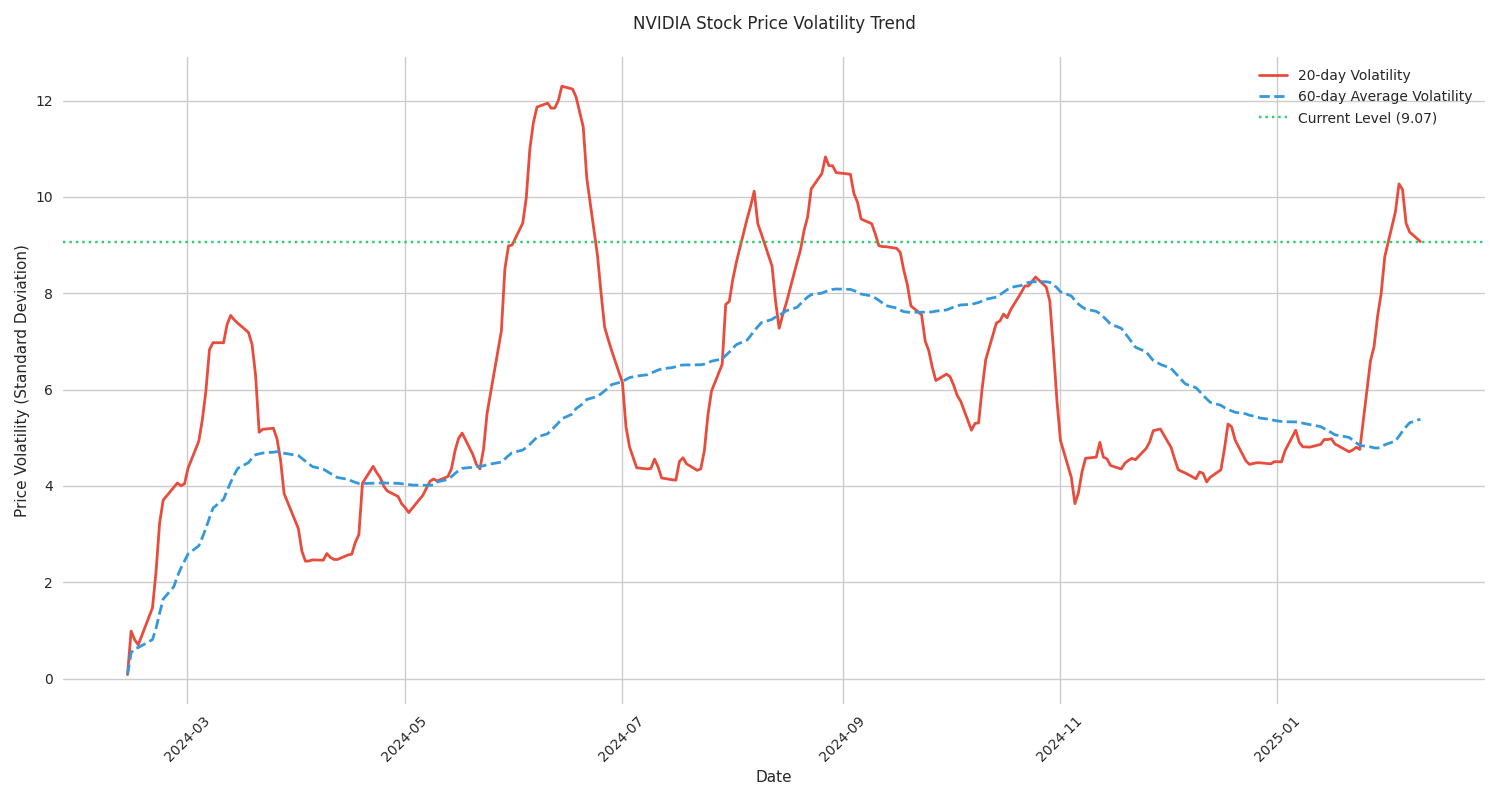

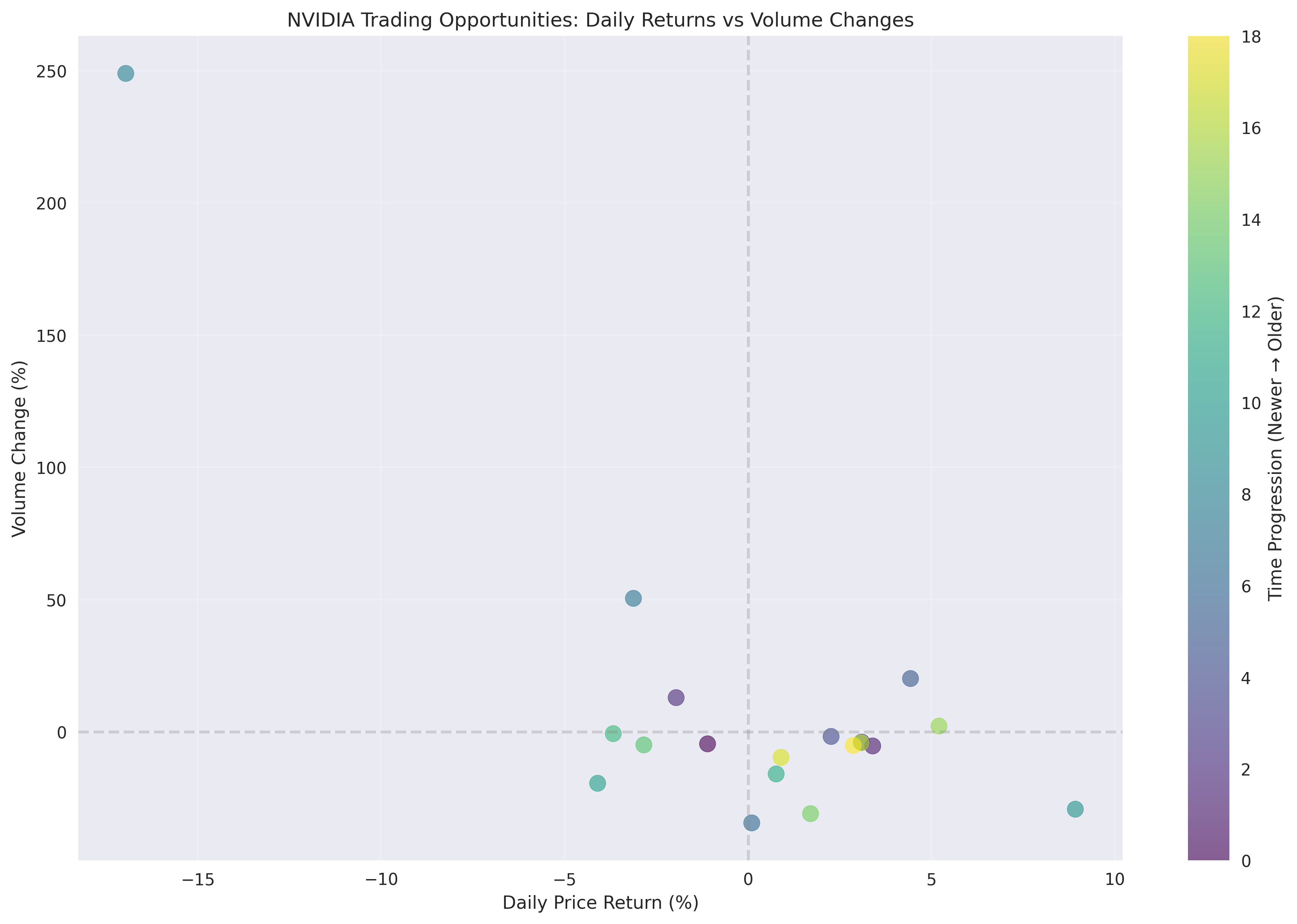

Recent Trading Dynamics: Volatility and Volume Analysis

Key Trading Levels and Day Trading Strategy Recommendations

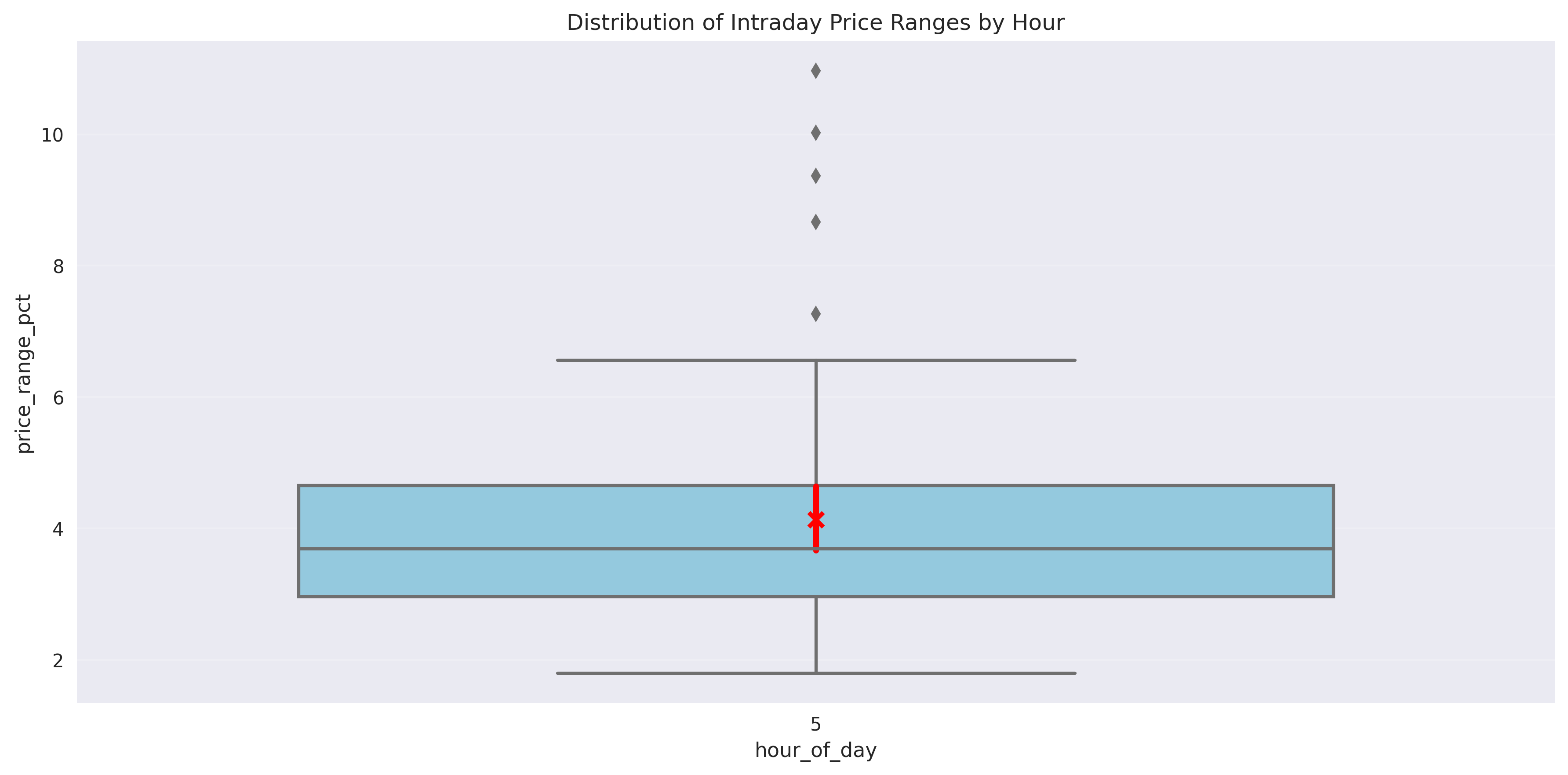

Intraday Trading Patterns and Risk Management Guidelines

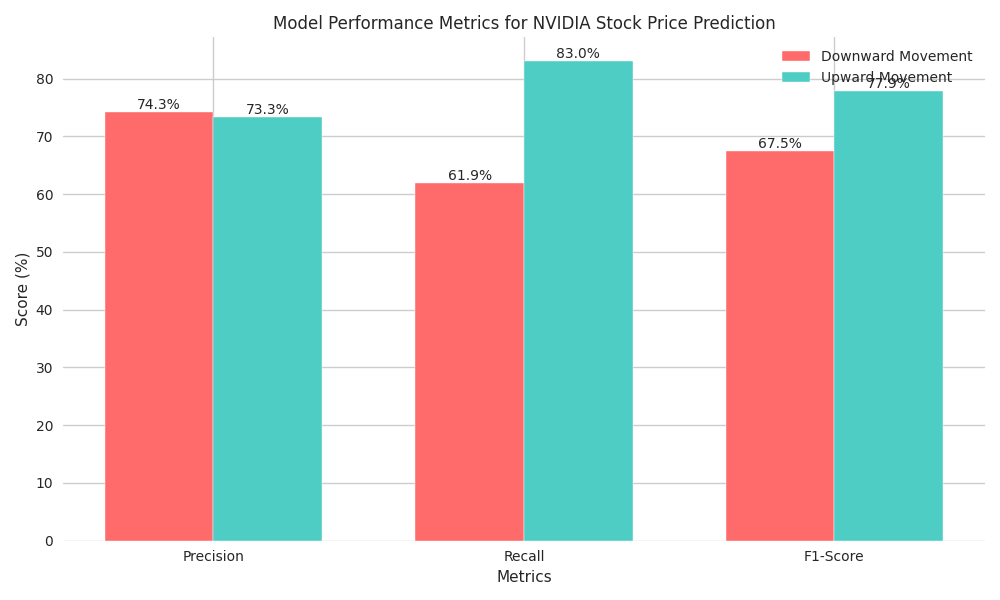

NVIDIA Stock Price Prediction Model Performance and Key Insights

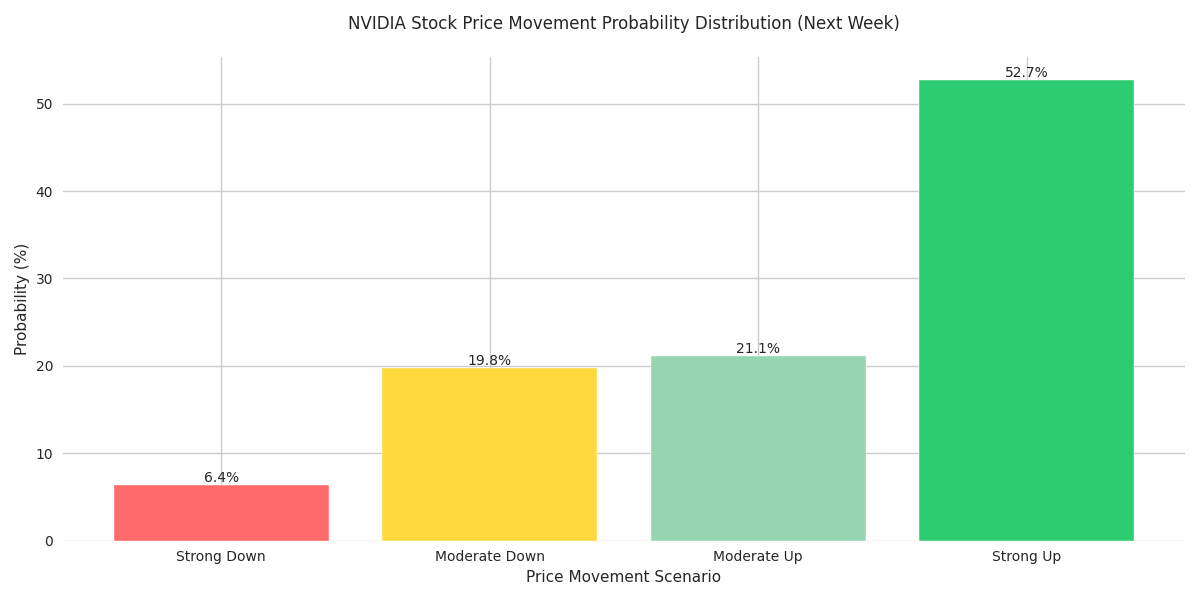

NVIDIA Stock Price Movement Predictions and Risk Analysis

NVIDIA Monthly Price Prediction and Risk Assessment