Corn Market Heats Up: Traders Decode Key Price Signals and Momentum Trends

Saving...

Corn Futures Near Breakout Point with Strong Bullish Signals

Saving...

Technical Indicators Support Further Upside Potential

Saving...

Predictive Models Signal High-Probability Trading Opportunity

Saving...

Long-term Outlook Indicates Stable Growth Trajectory

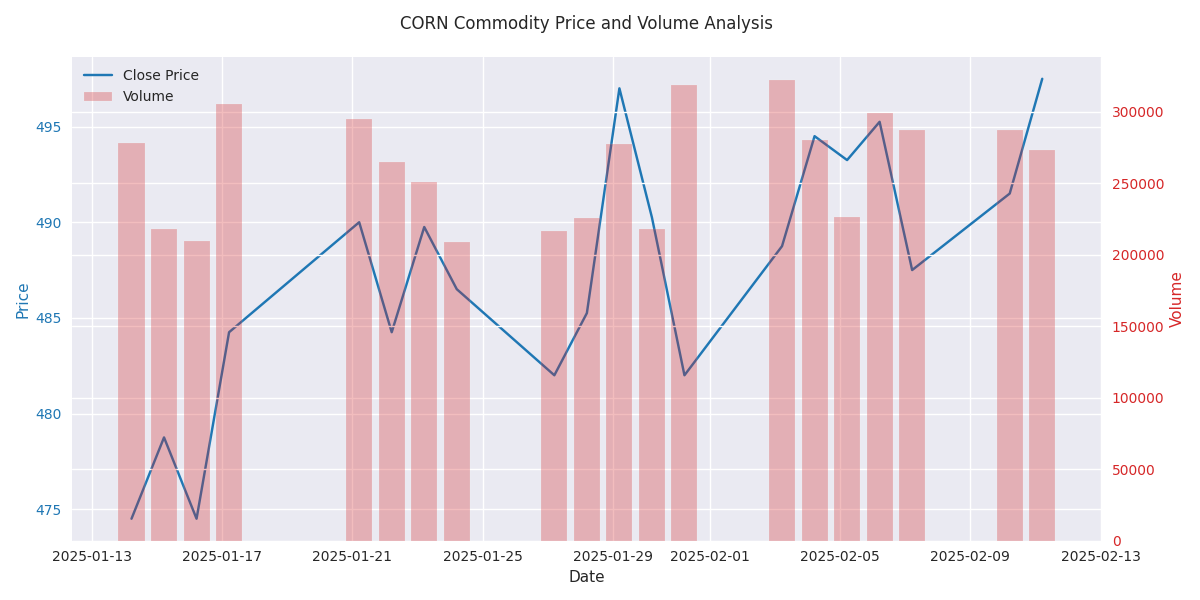

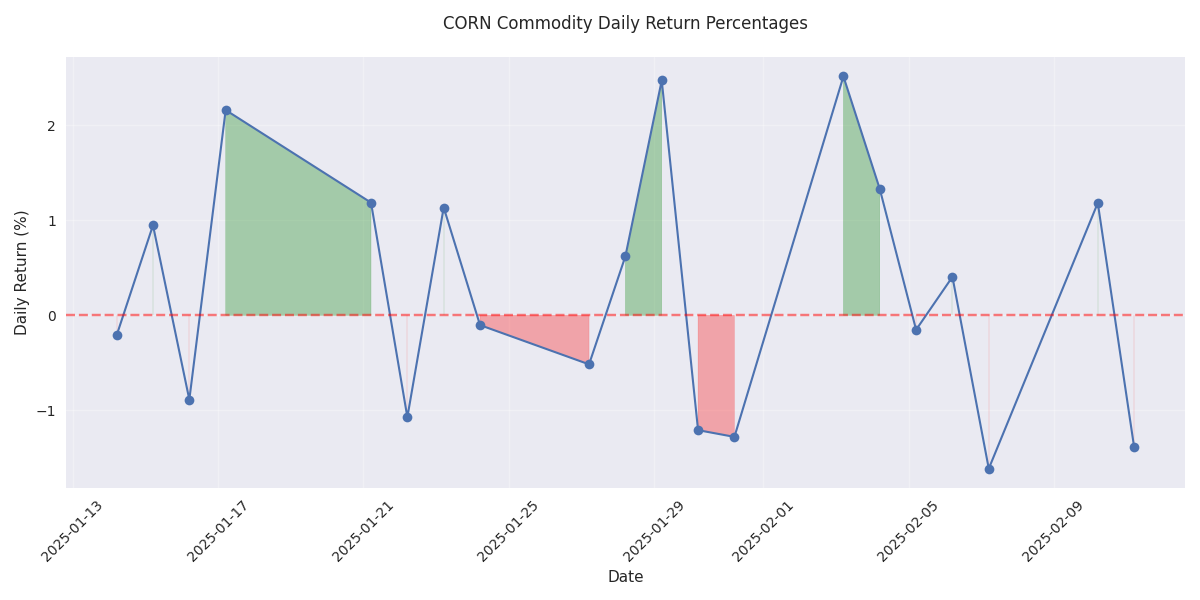

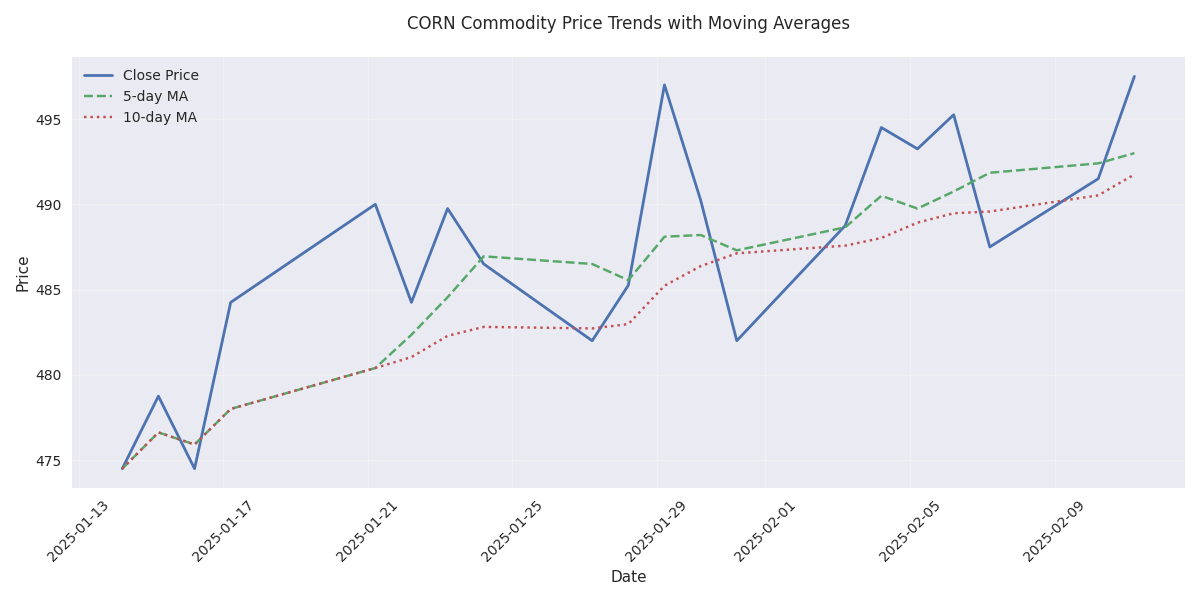

CORN Price Analysis Shows Recent Volatility with Mixed Trading Signals

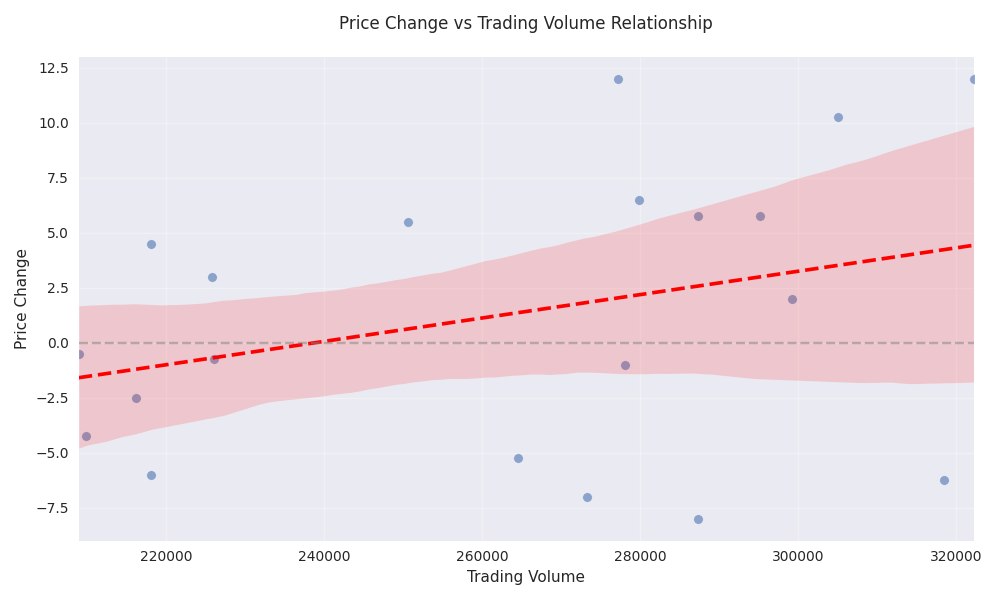

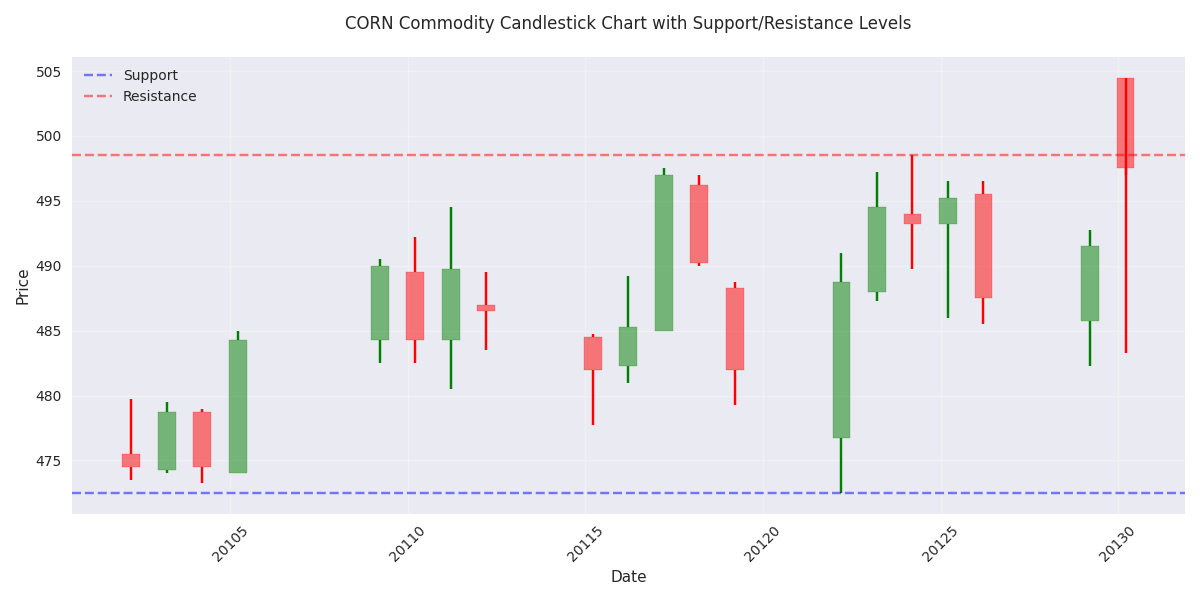

Technical Analysis Reveals Key Support/Resistance Levels and Market Dynamics

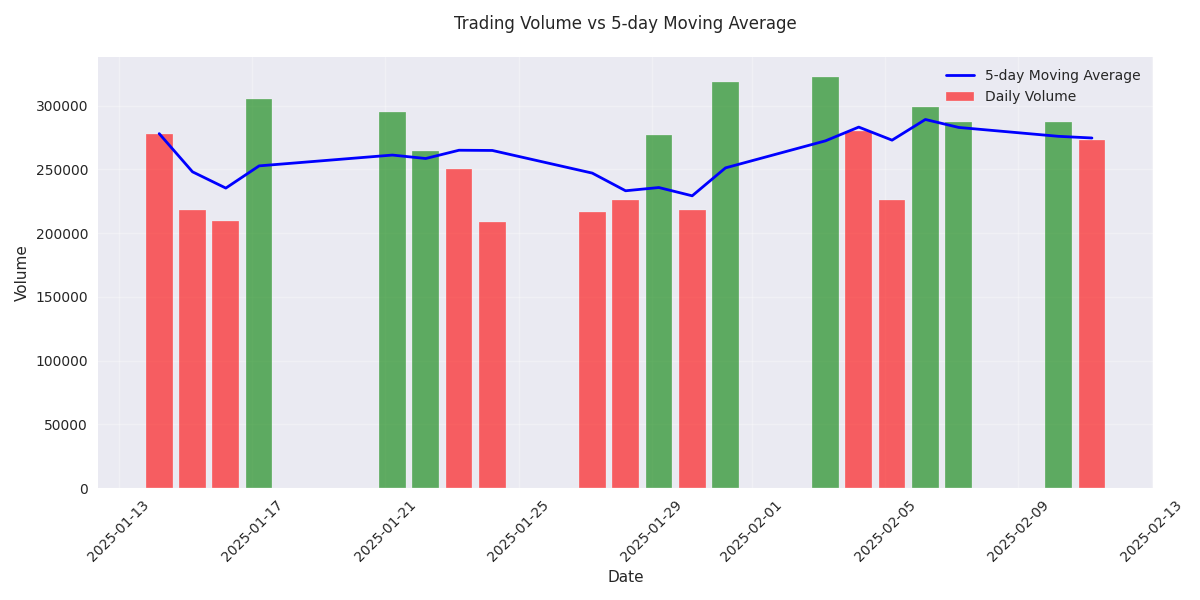

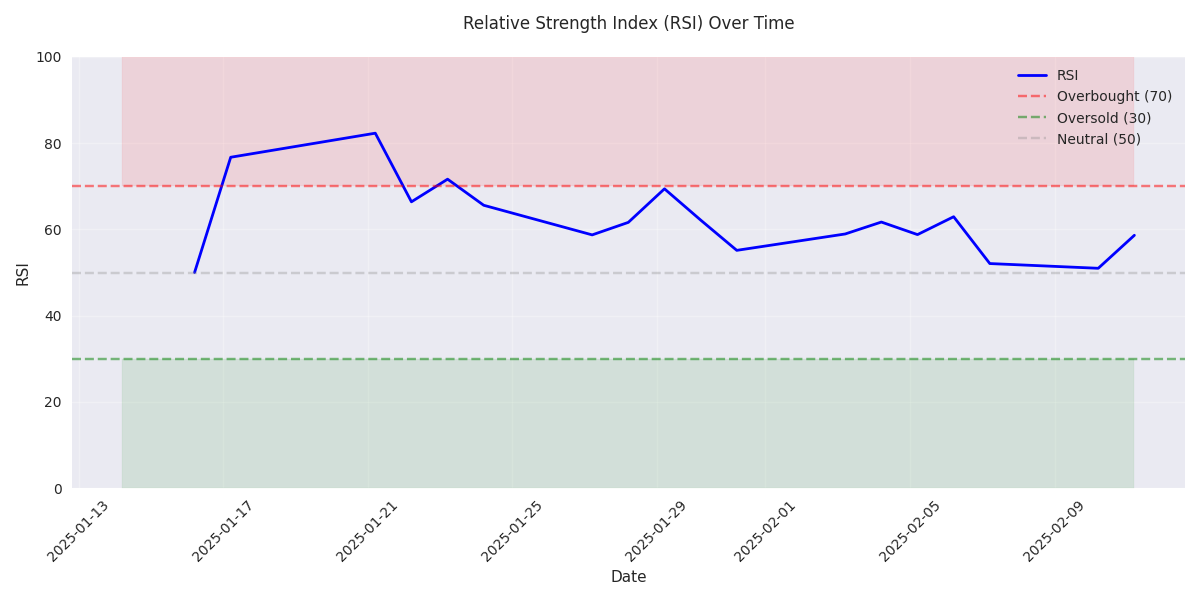

Momentum Analysis Shows Bullish RSI Levels with Mixed Volume Signals

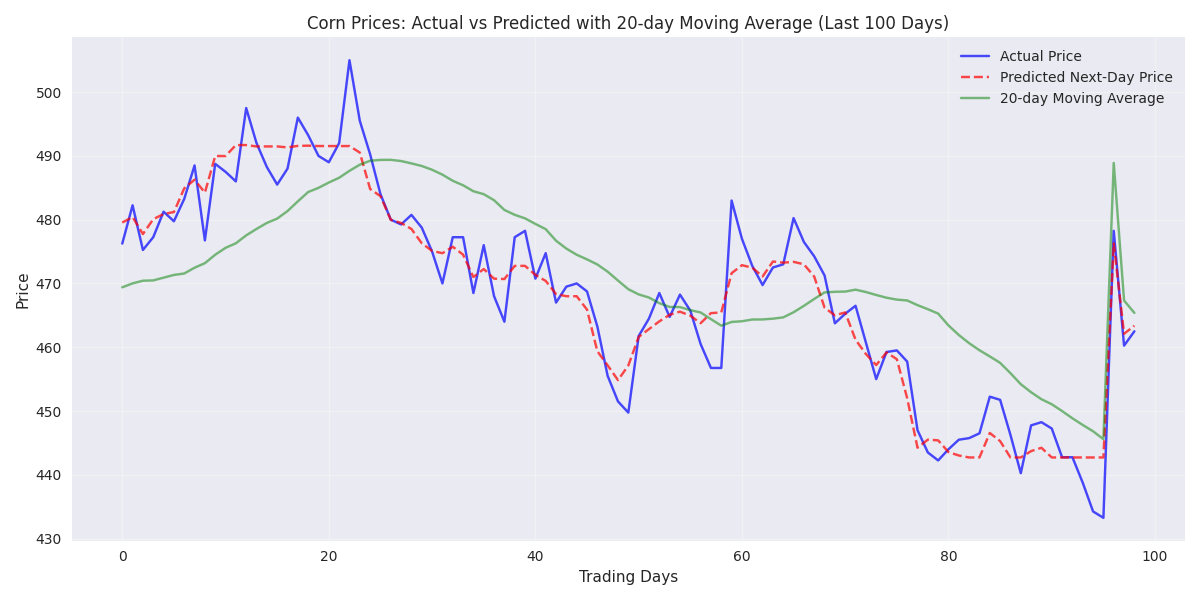

Corn Price Prediction Model Performance and Key Drivers

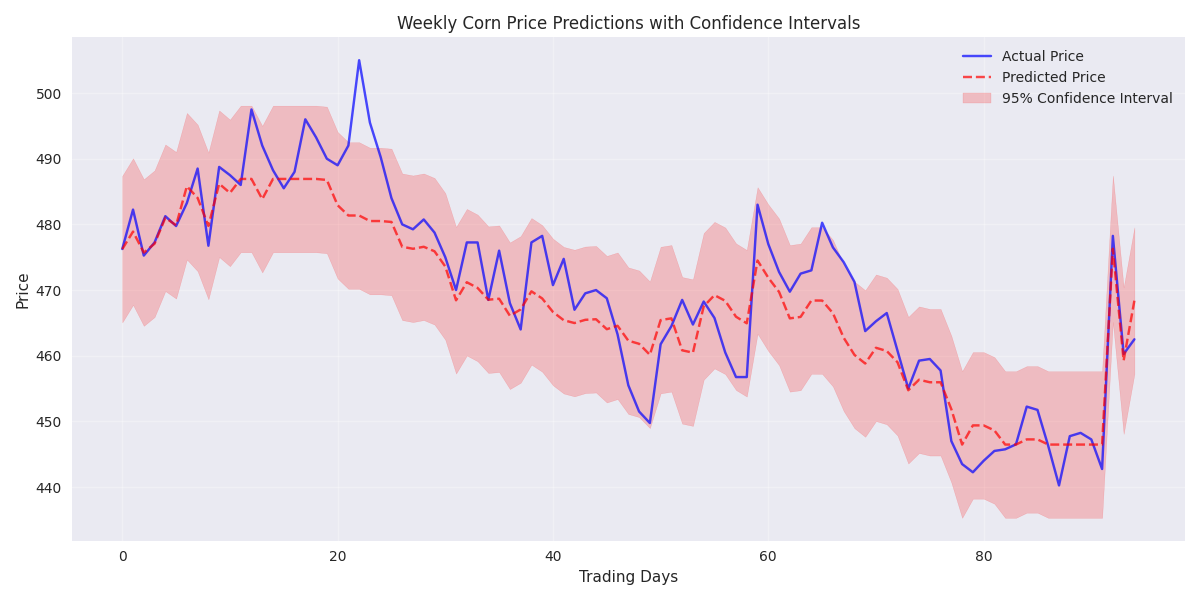

Weekly Corn Price Predictions Show Strong Market Momentum

Monthly Corn Price Analysis Reveals Long-Term Market Stability