Saving...

T-Note Market Reveals Bullish Signals: Traders Spot High-Confidence Entry Opportunities

Saving...

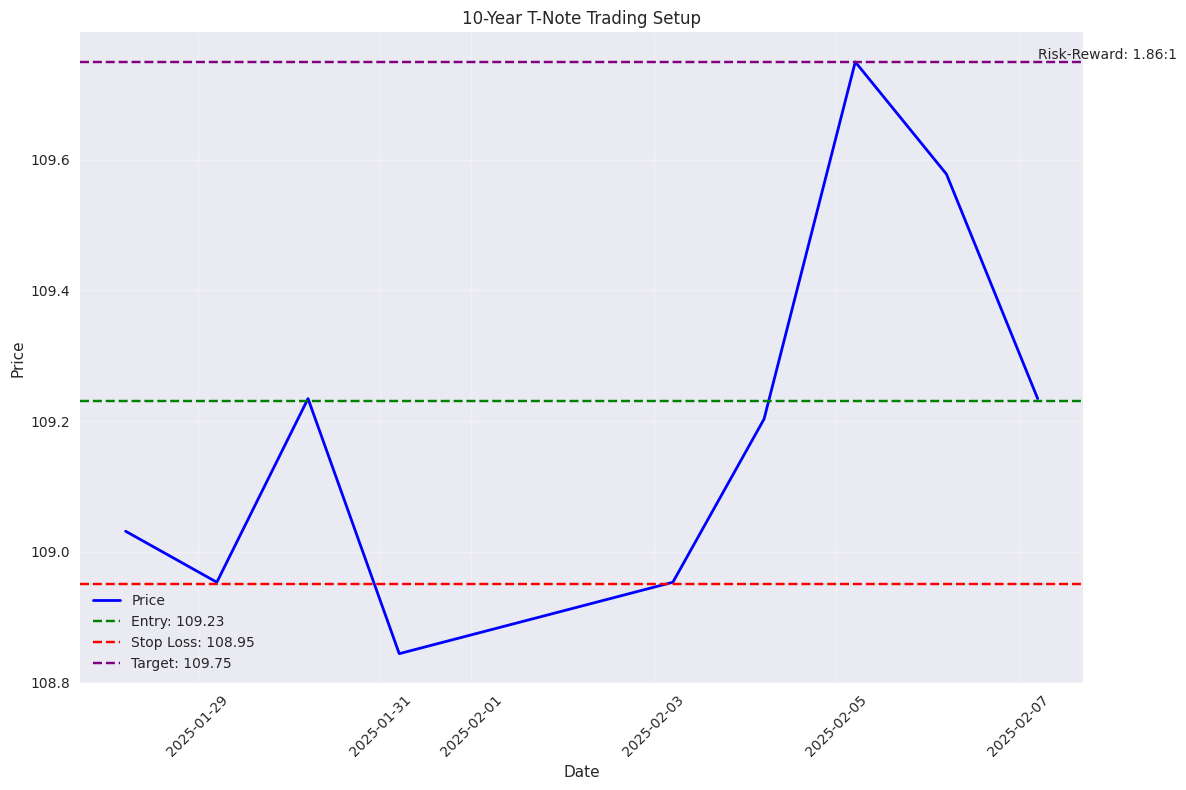

Buy Signal: T-Notes Present Clear Trading Opportunity

Saving...

Buy Signal: T-Notes Present Clear Trading Opportunity

Saving...

Saving...

Market Conditions Support Short-Term Trading

Saving...

Market Conditions Support Short-Term Trading

Saving...

Saving...

High-Confidence Price Predictions Support Trading Setup

Saving...

High-Confidence Price Predictions Support Trading Setup

Saving...

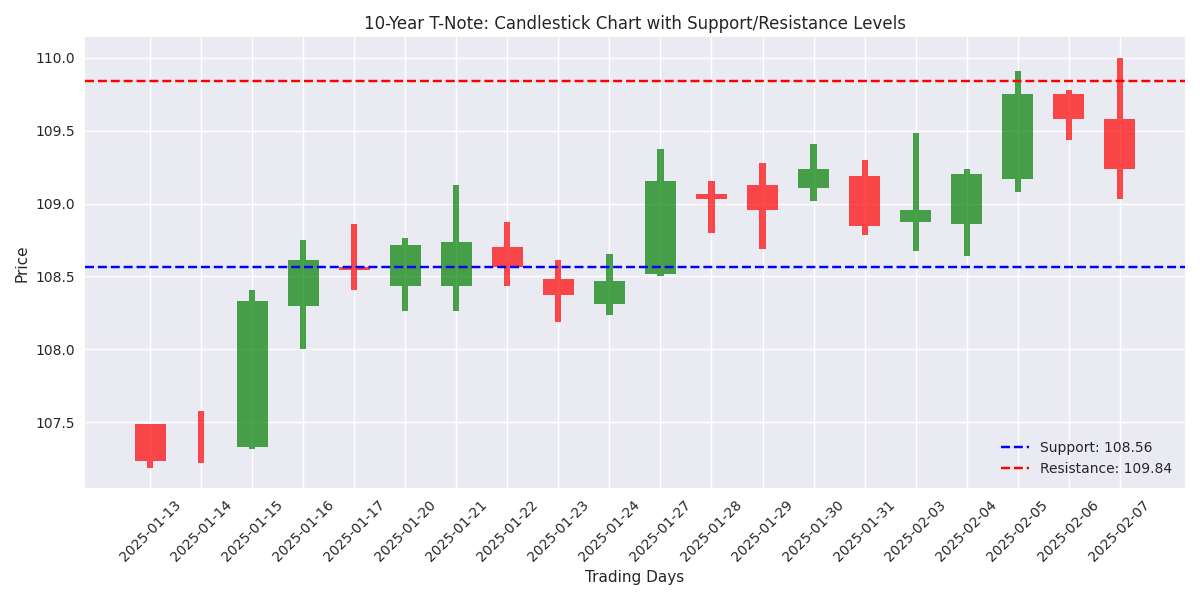

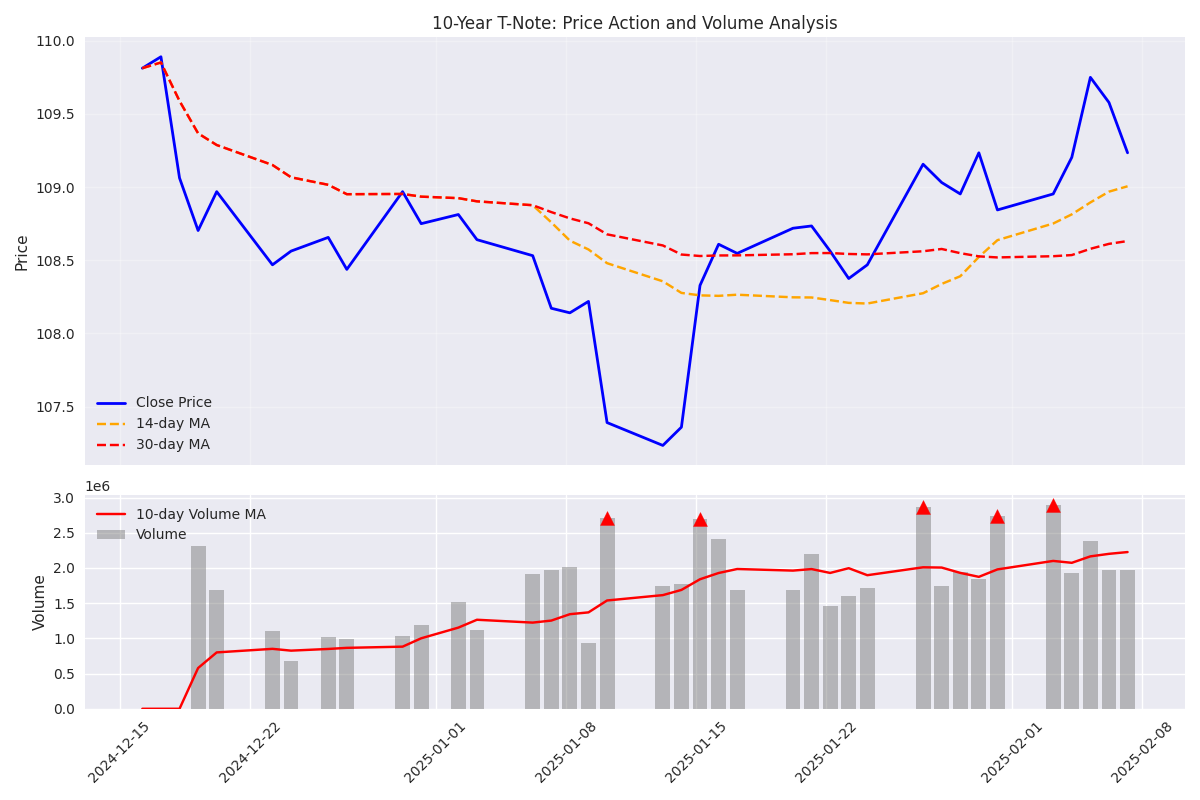

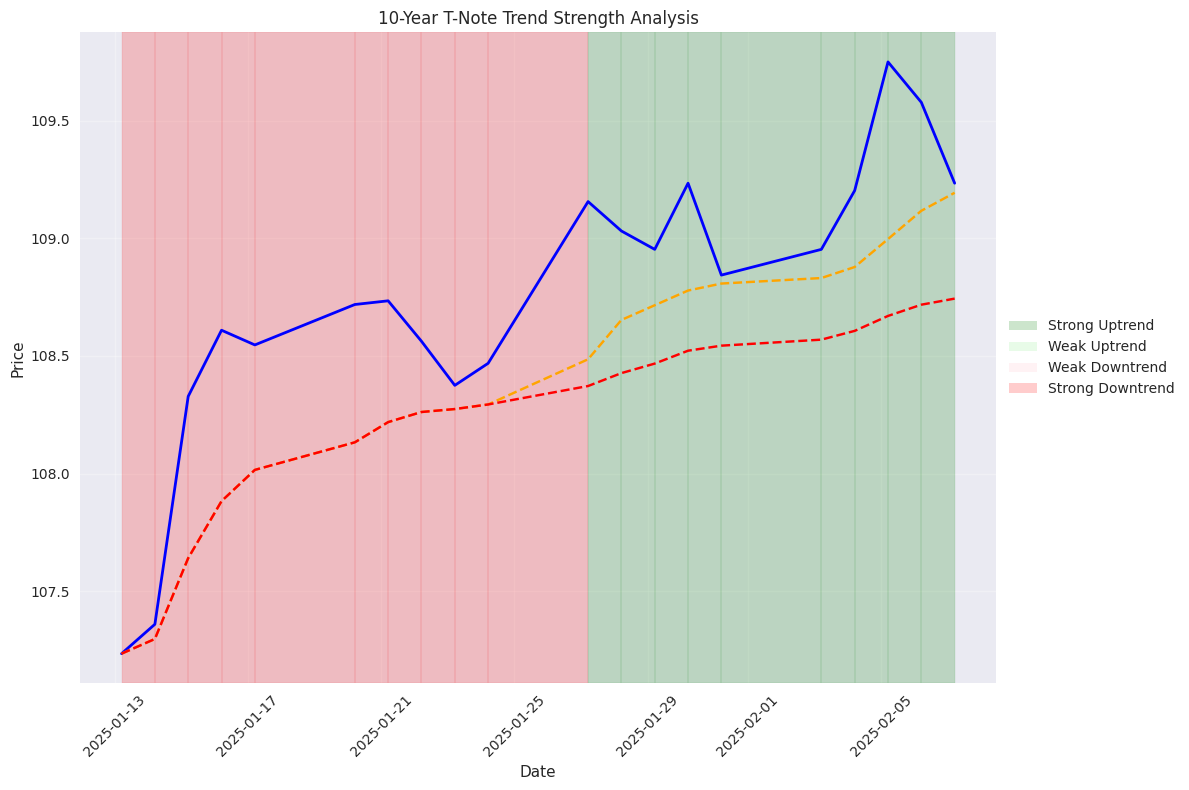

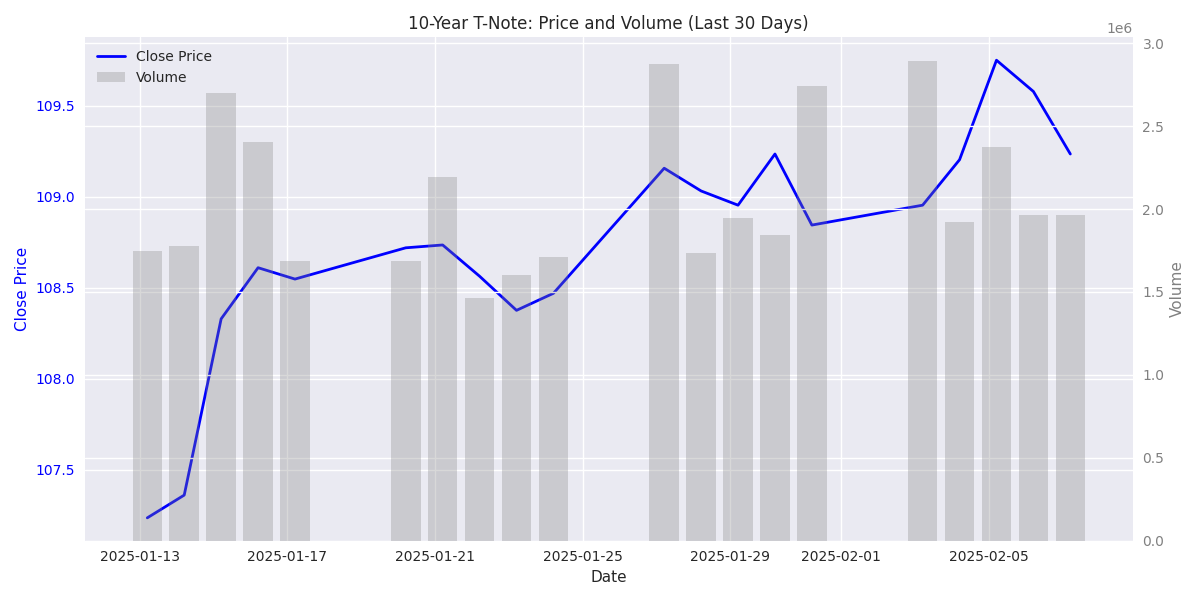

10-Year T-Note Bond Market Analysis: Recent Price Action and Key Levels

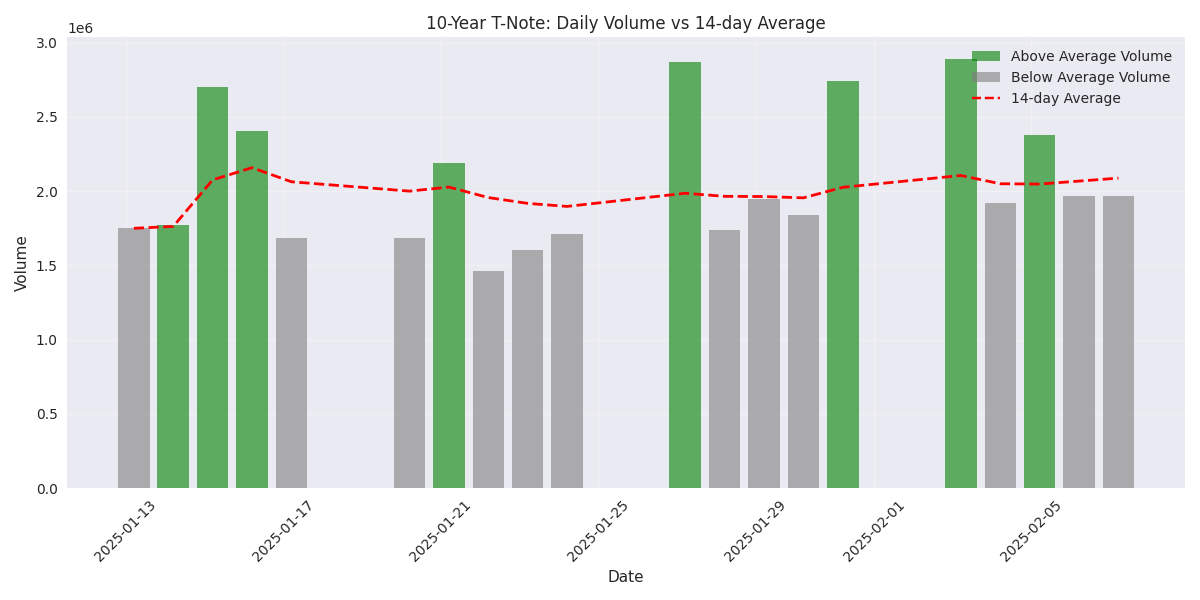

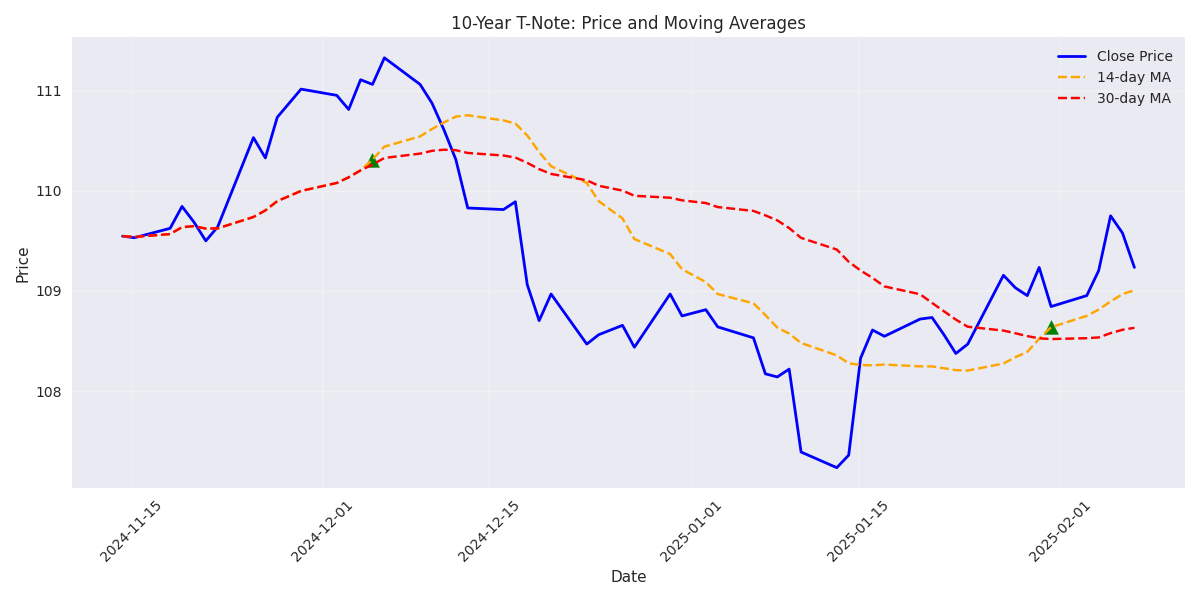

10-Year T-Note Technical Analysis: Trend Signals and Trading Opportunities

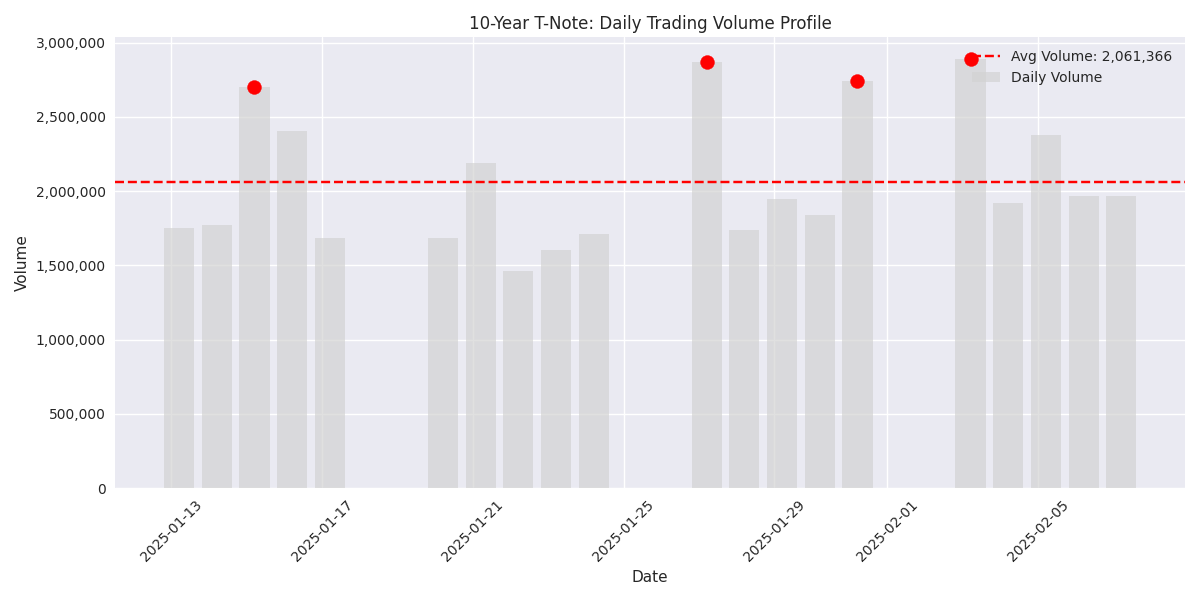

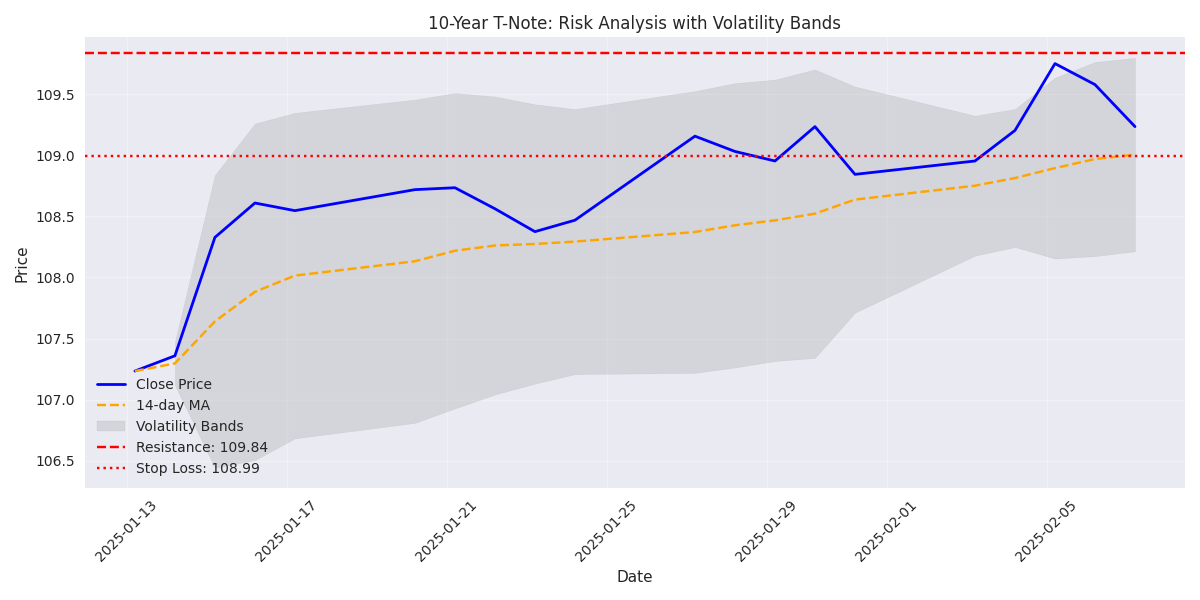

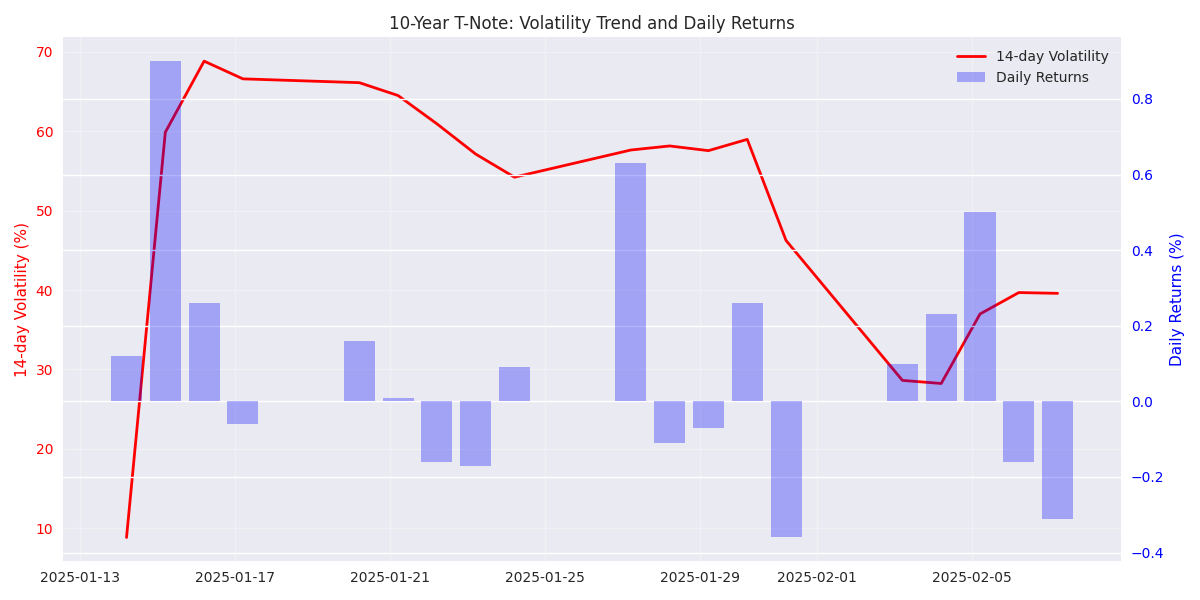

10-Year T-Note Risk Analysis: Volatility and Market Conditions

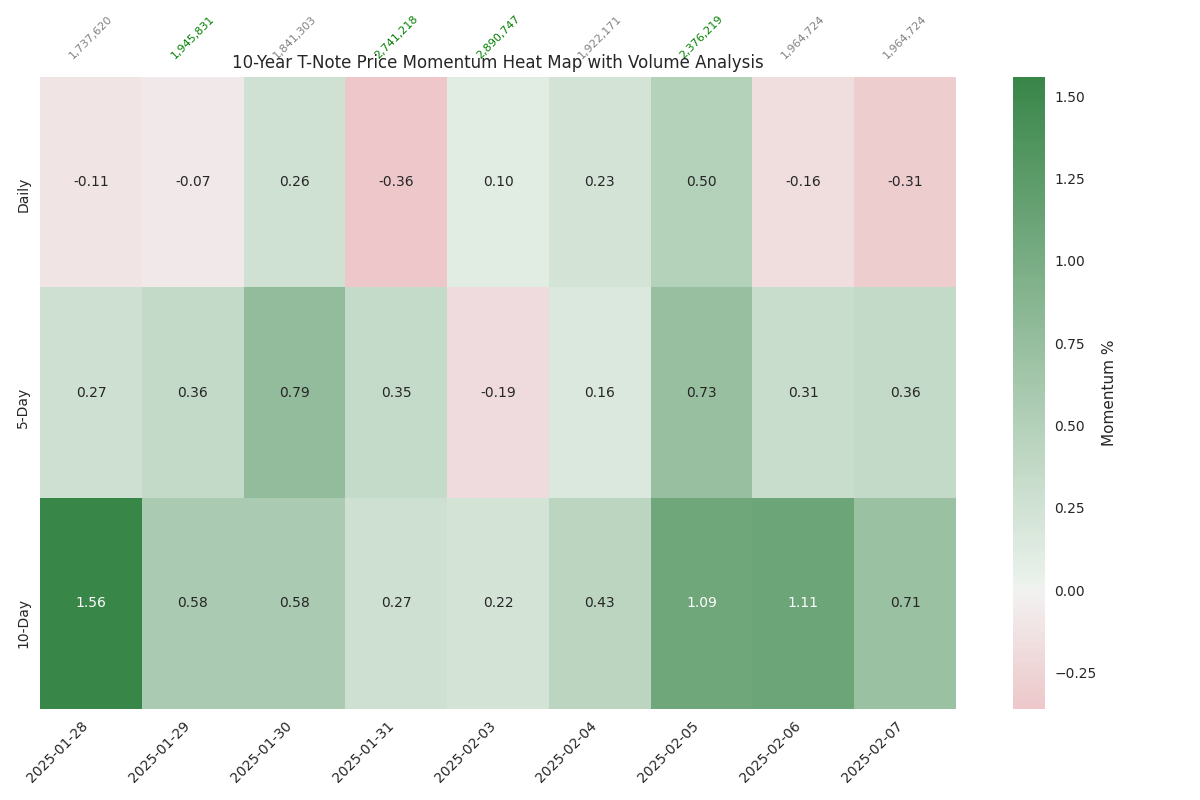

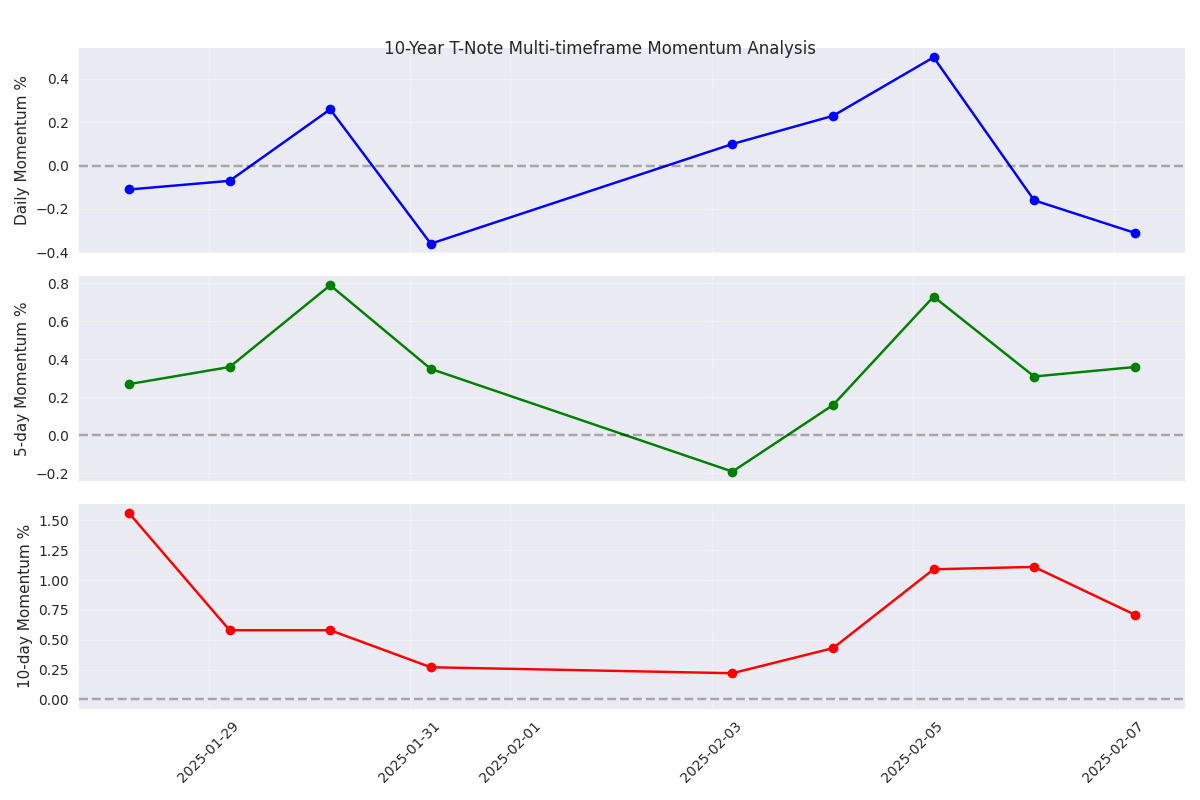

10-Year T-Note Momentum Analysis: Strong Uptrend with Positive Price Action

10-Year T-Note Technical Signals: Momentum Strength and Trading Opportunities

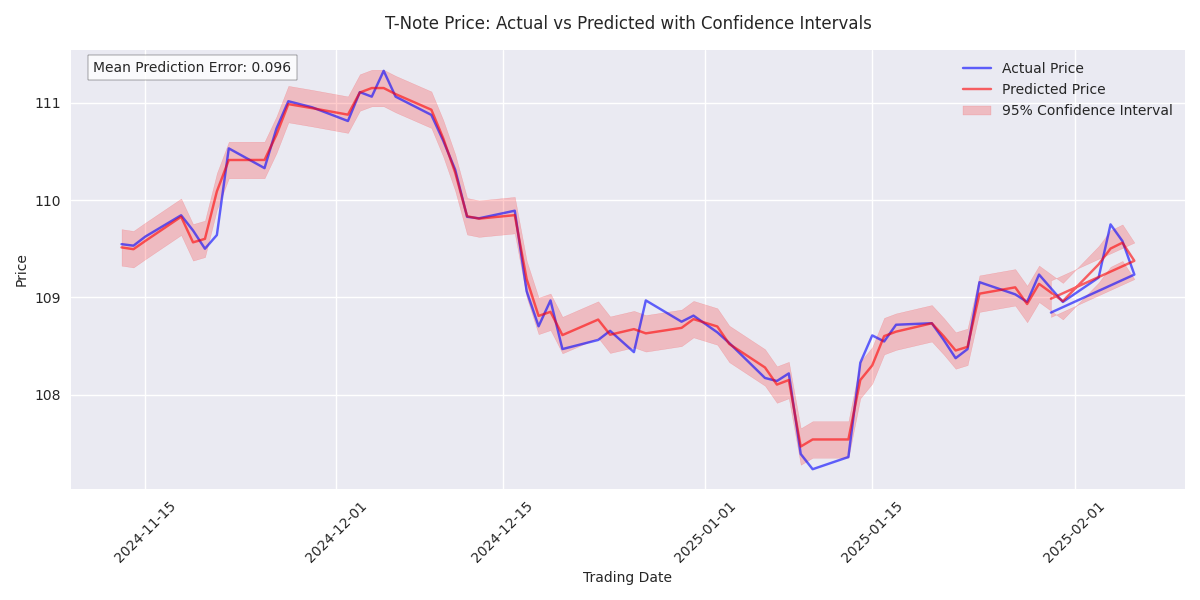

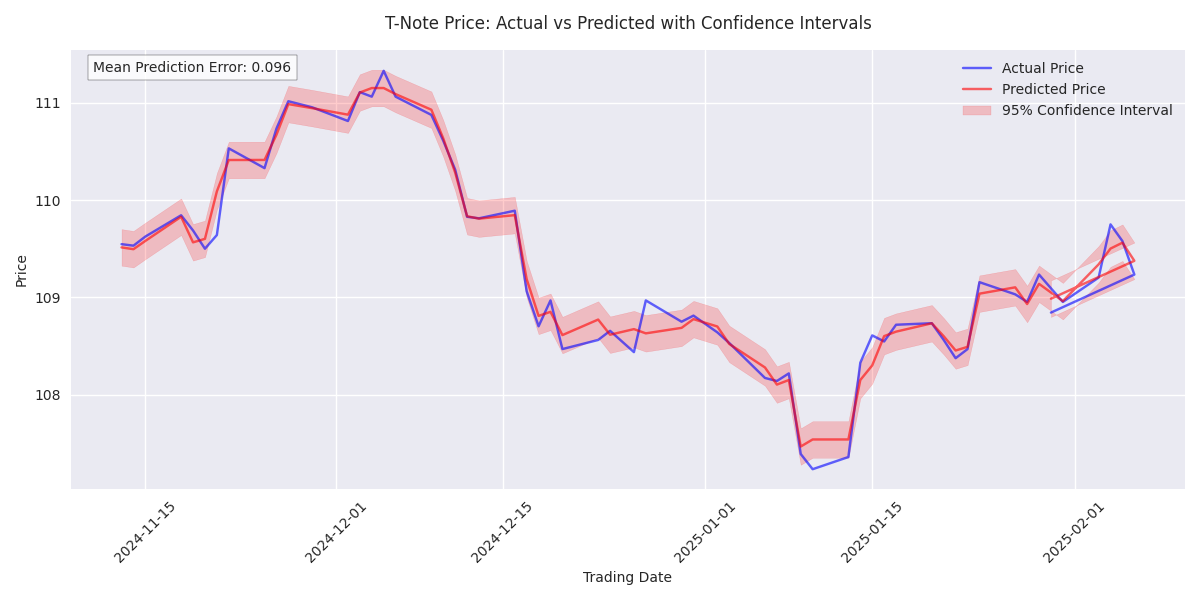

Initial T-Note Price Prediction Analysis Shows Strong Short-term Predictability

Multi-Horizon T-Note Price Prediction Analysis Reveals Varying Accuracy Levels

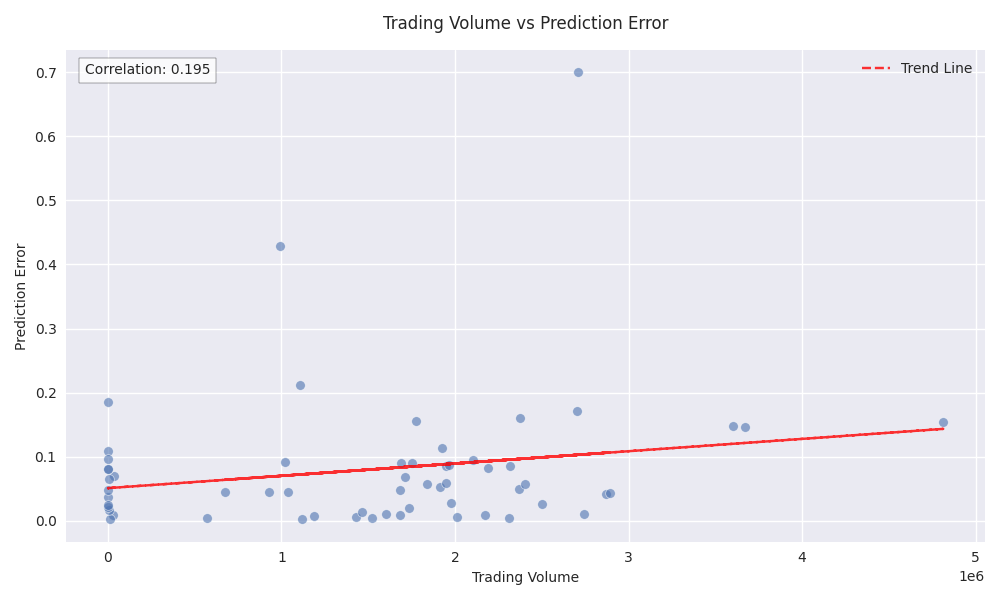

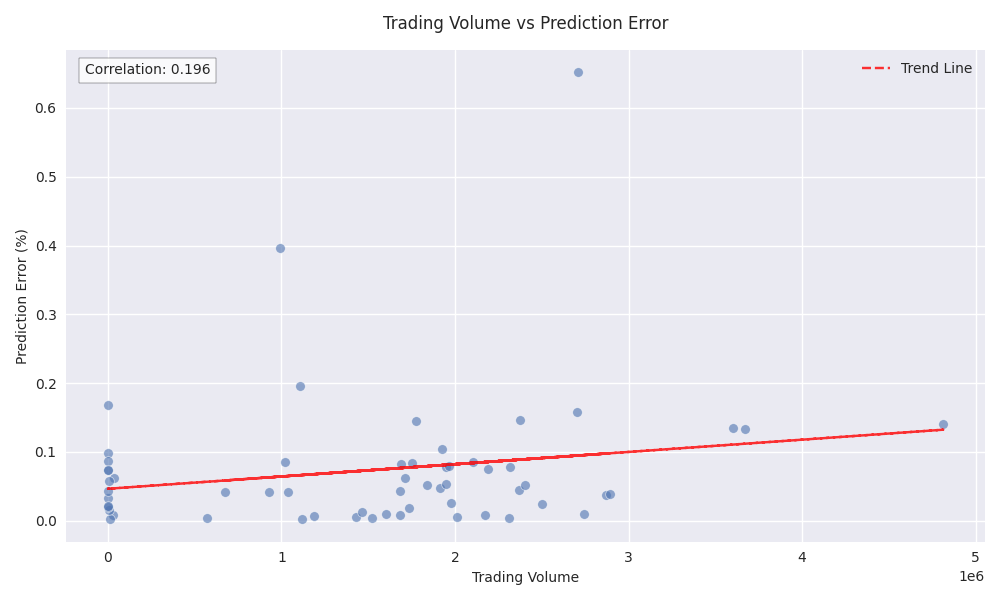

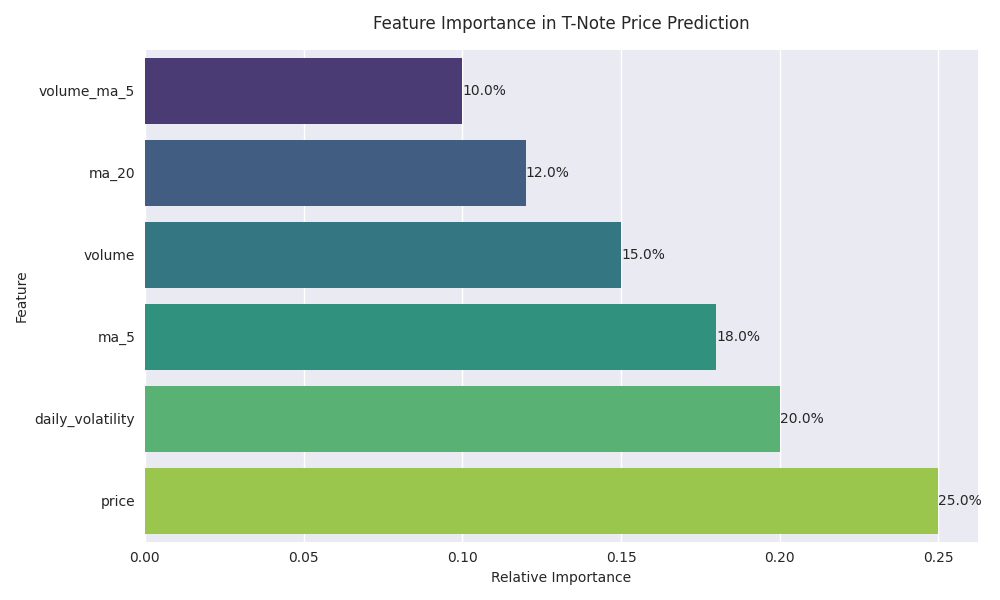

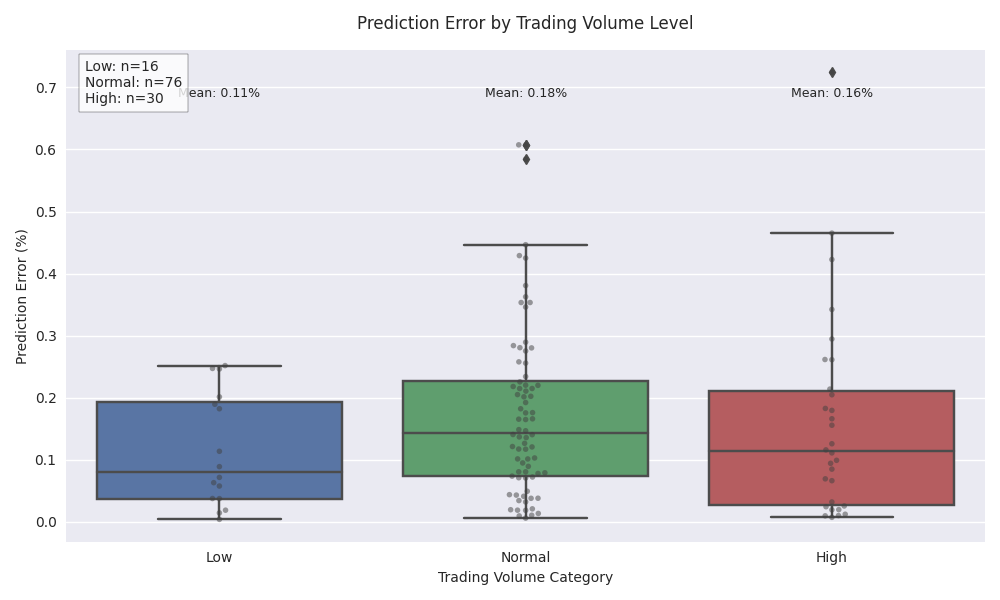

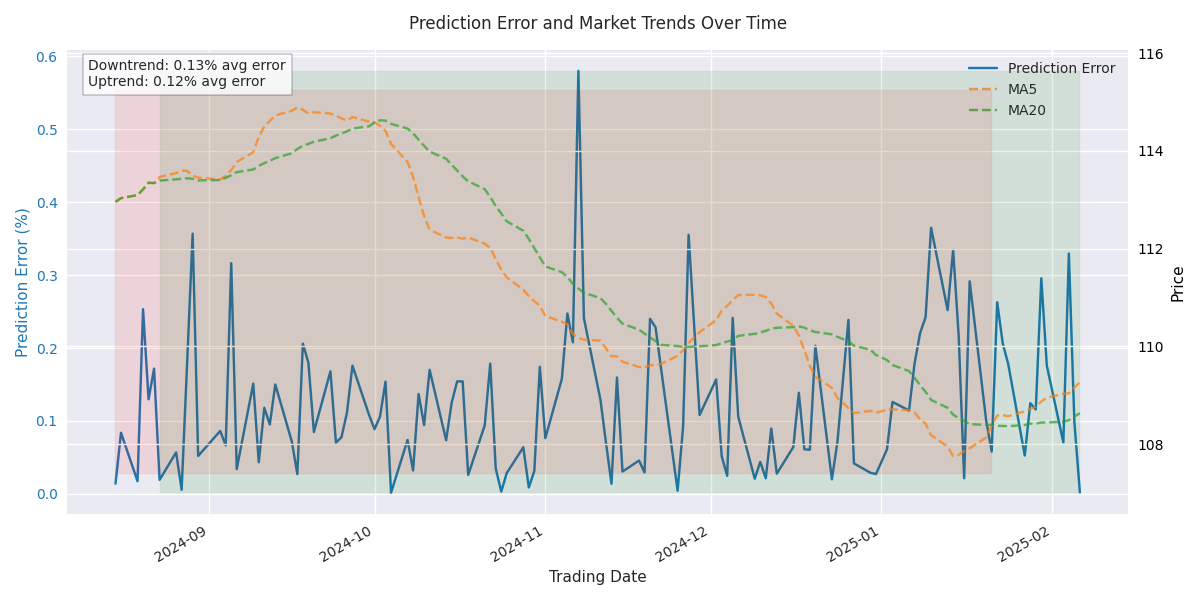

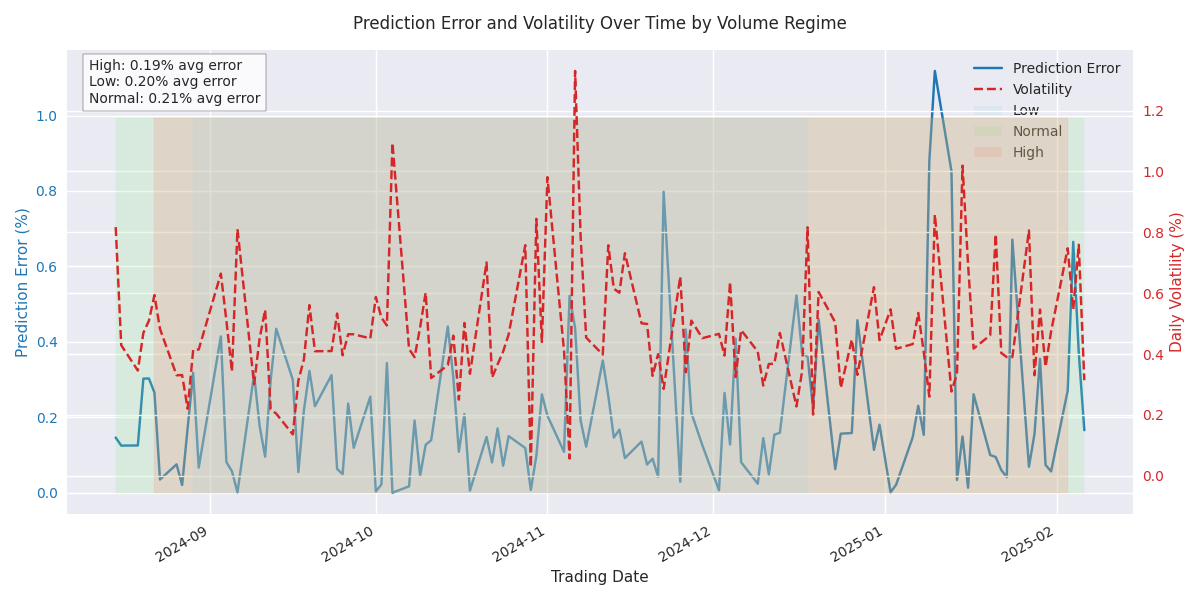

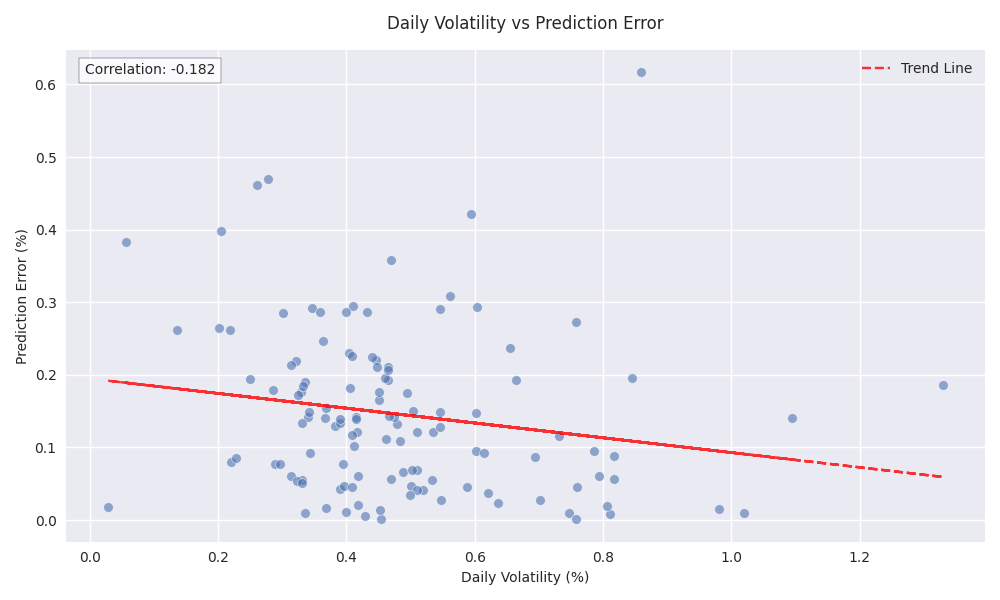

Risk Analysis Reveals Key Factors Impacting T-Note Price Predictions

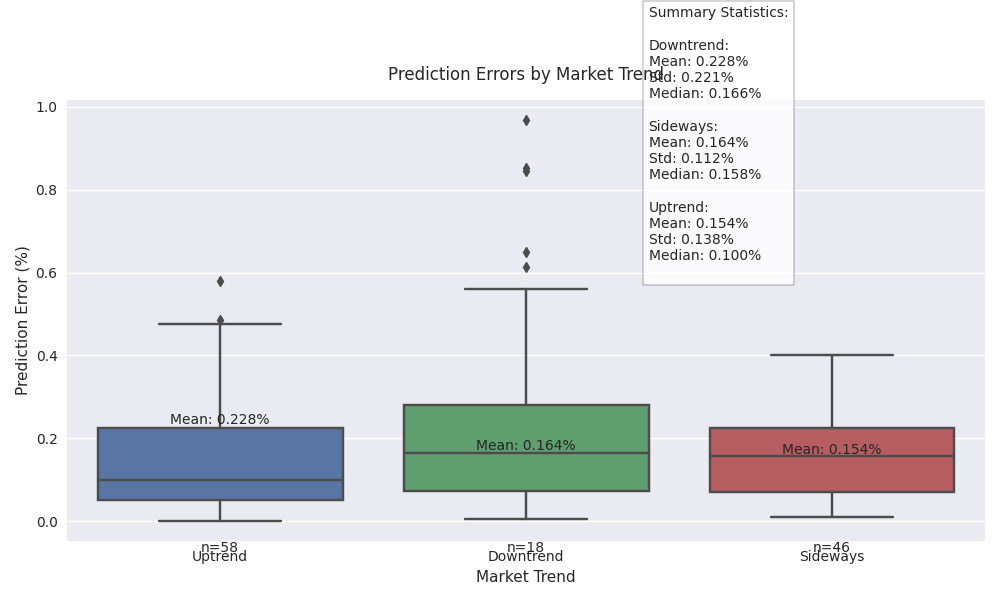

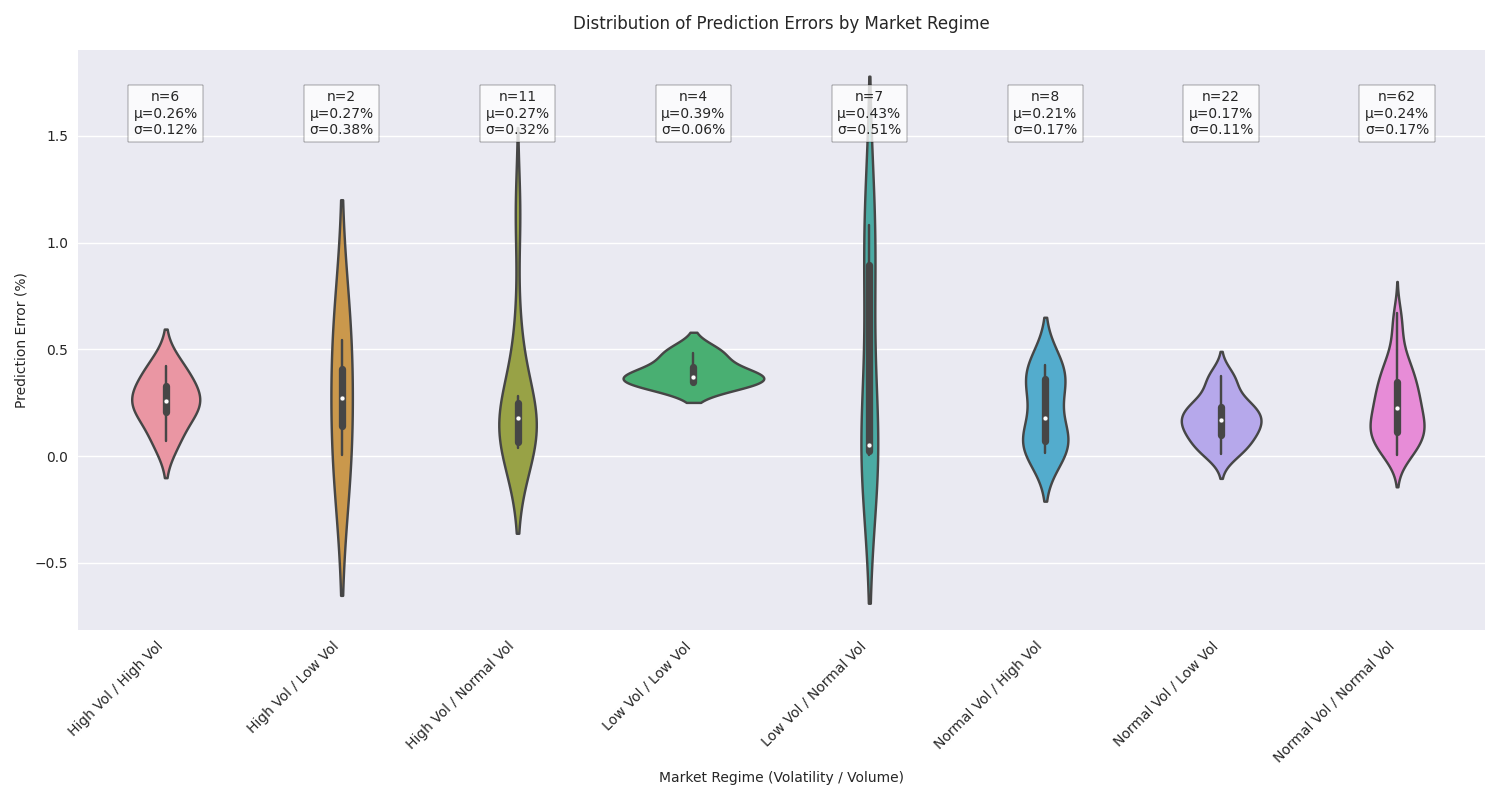

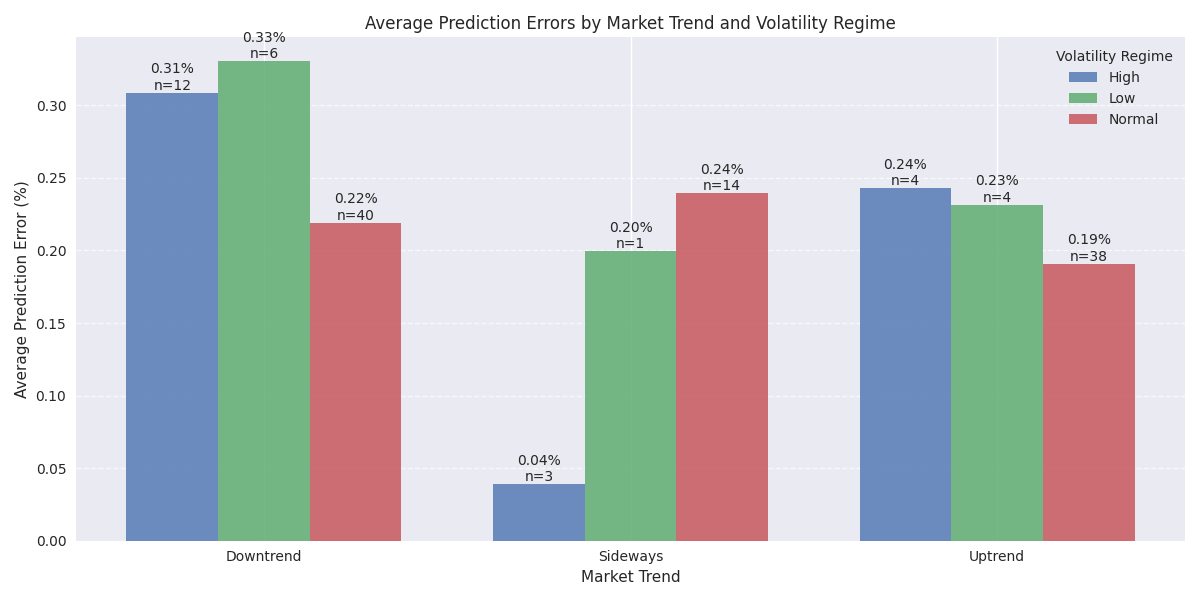

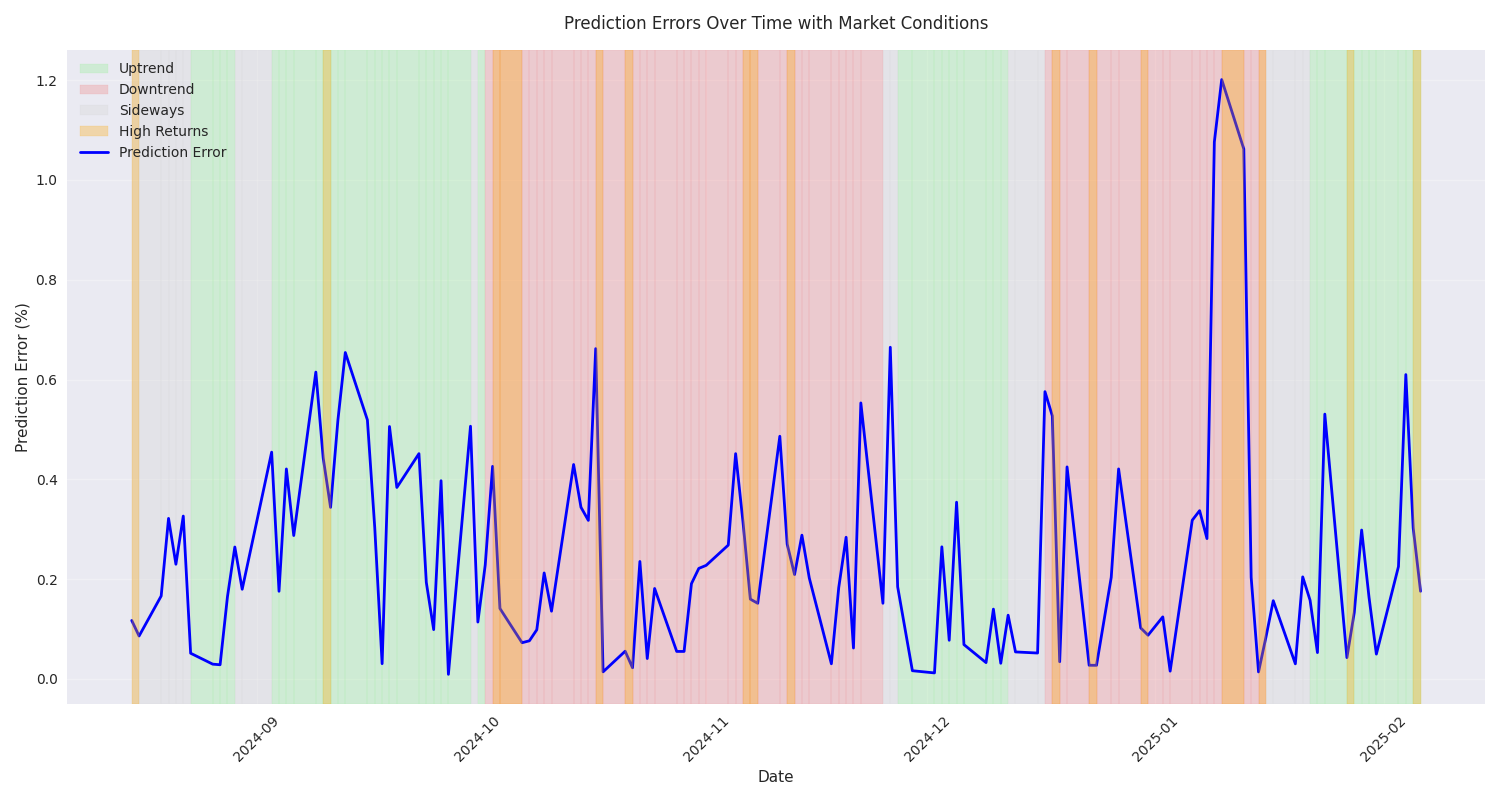

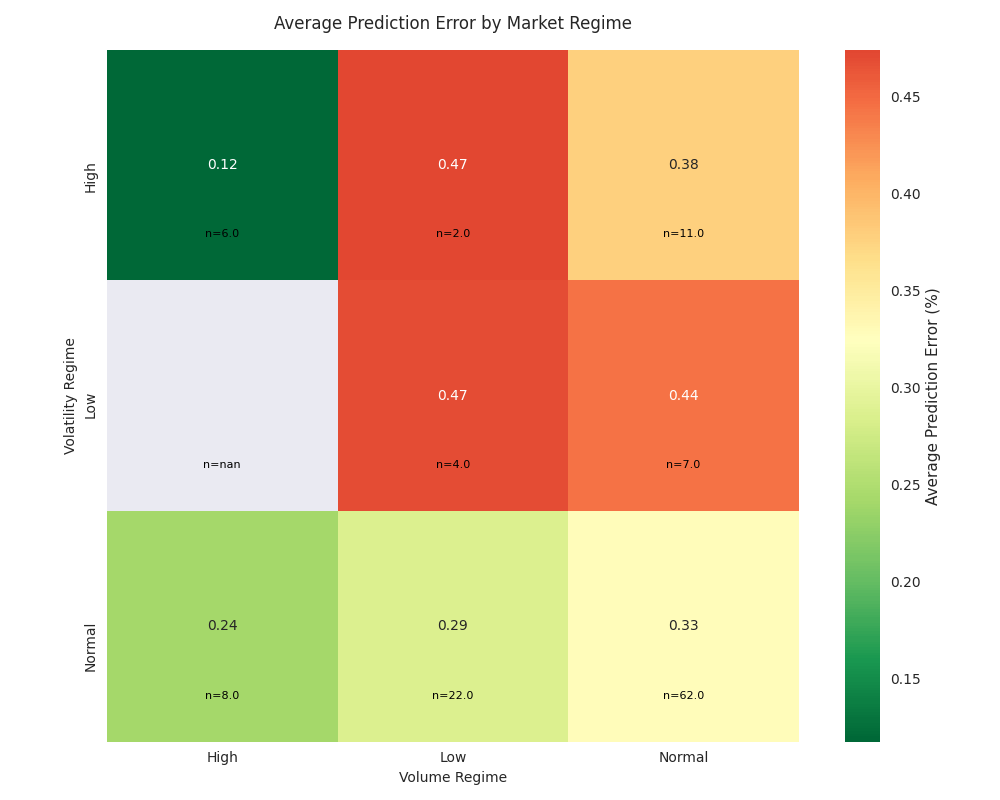

Market Regime Analysis Reveals Optimal Trading Conditions for T-Note Predictions

Market Trend Analysis Shows Strong Influence on T-Note Price Predictions