Natural Gas Market: Volatile Trends and Trader's Quick-Fire Predictions Revealed

Saving...

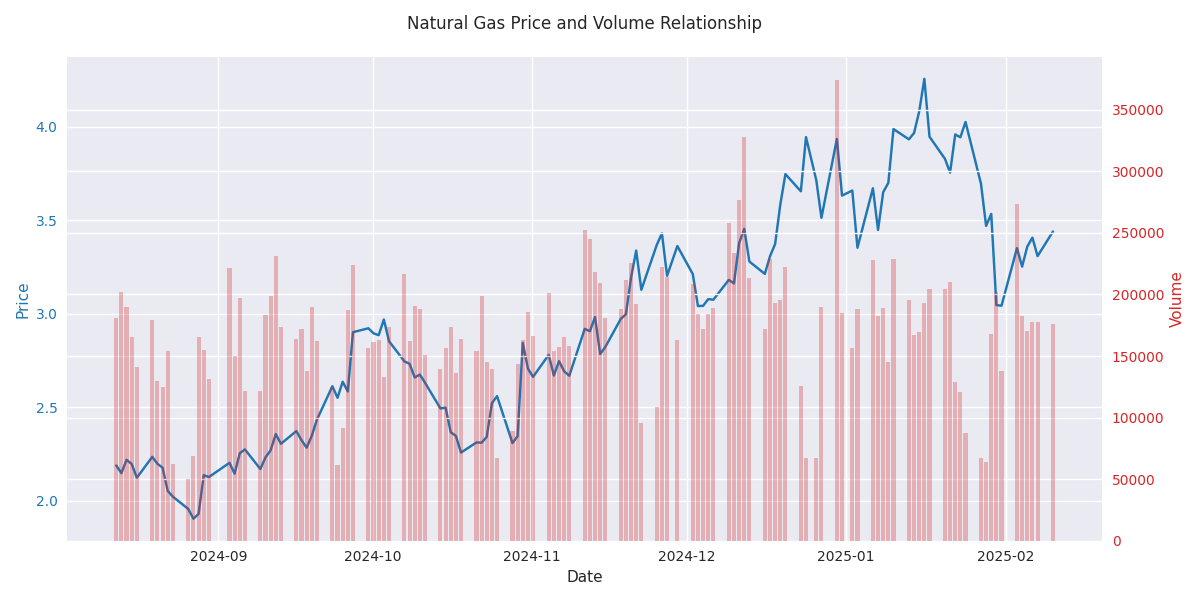

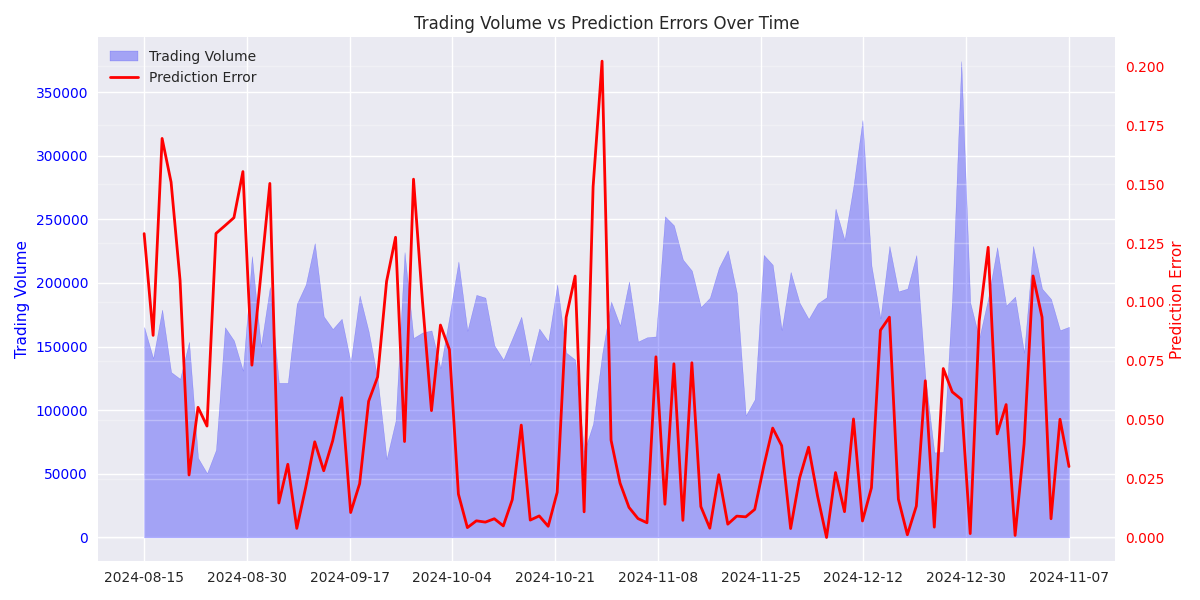

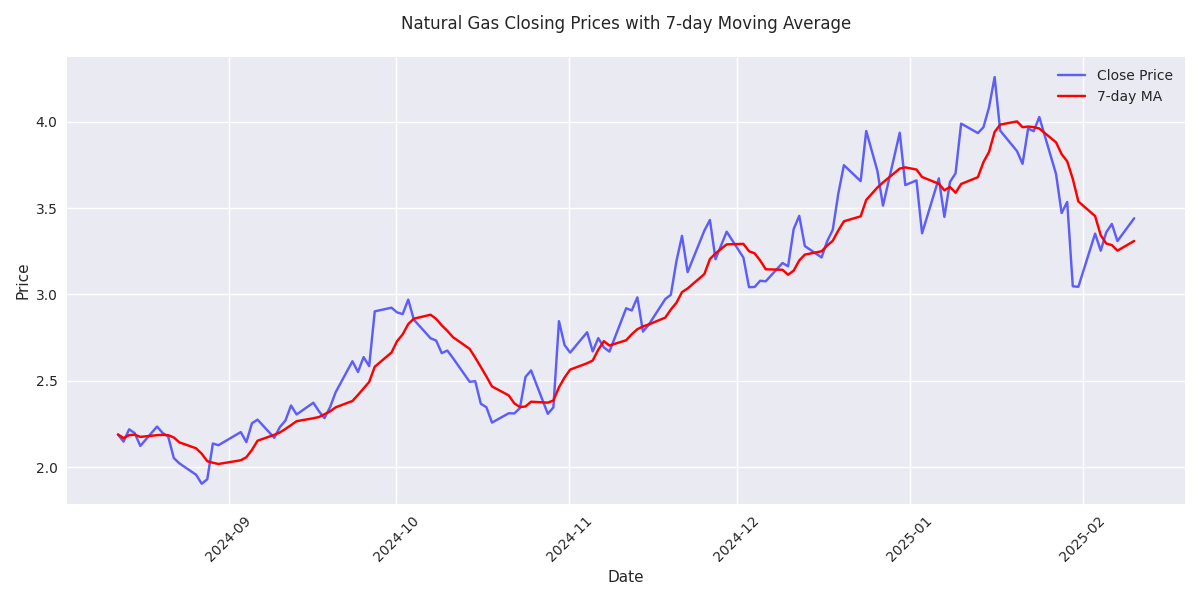

Natural Gas Shows Recovery Signs with Strong Volume Support

Saving...

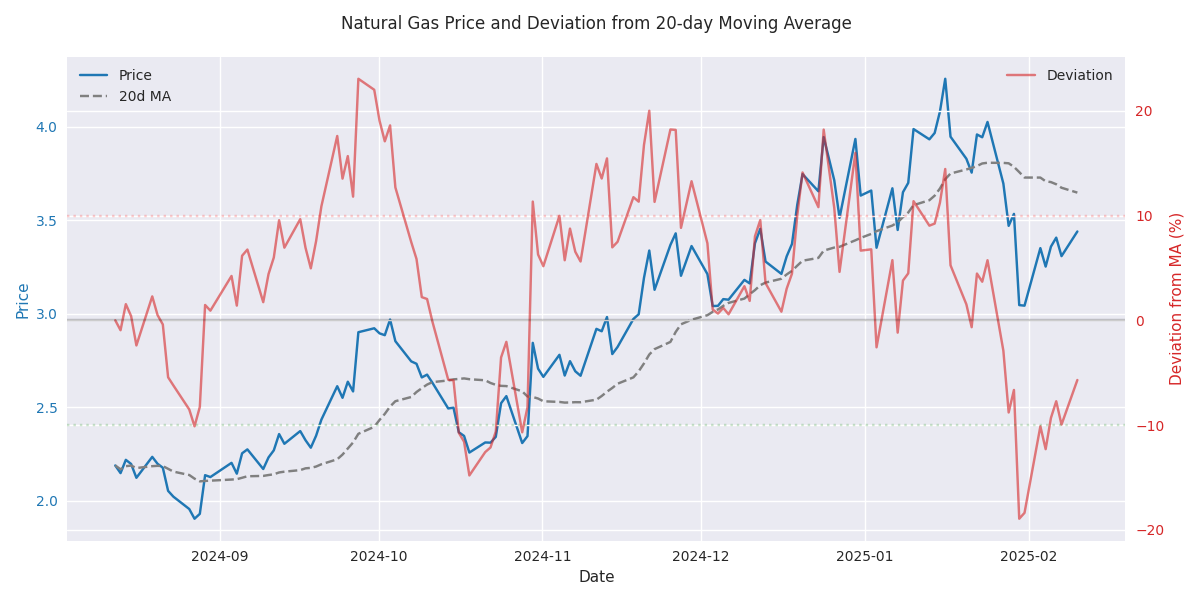

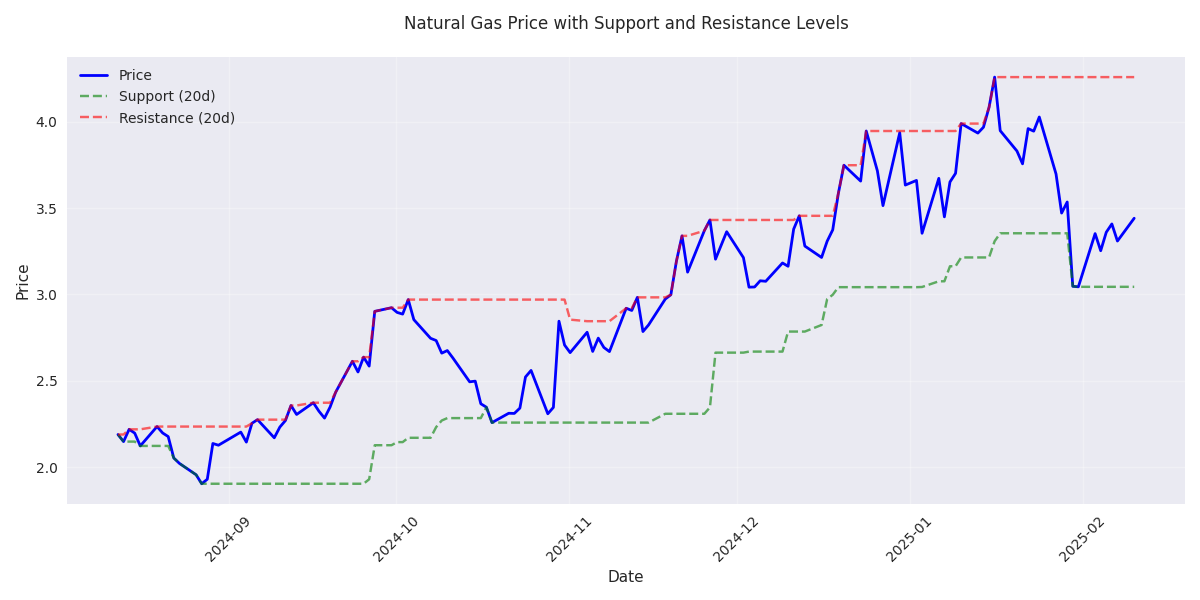

Key Price Levels Set Trading Range for Natural Gas

Saving...

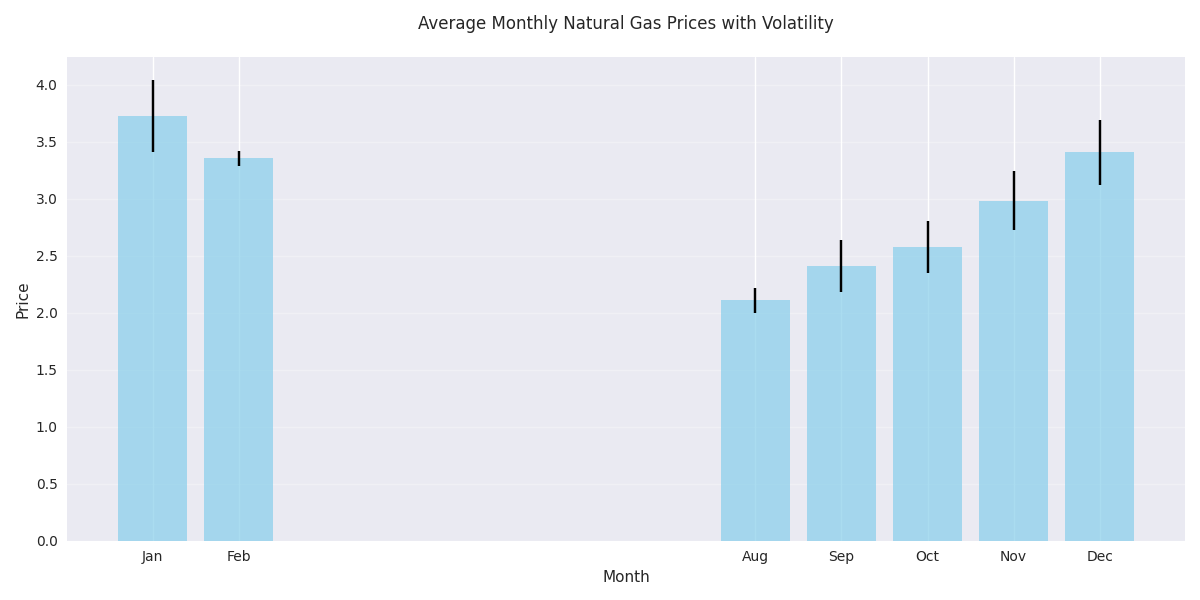

Winter Trading Offers Prime Opportunities in Natural Gas

Saving...

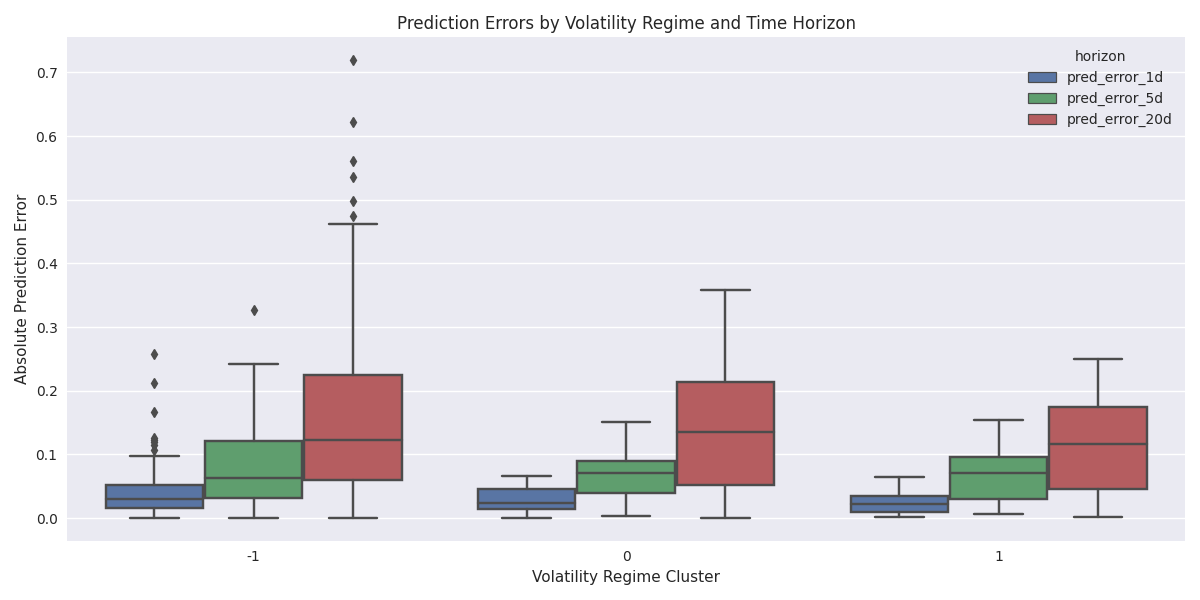

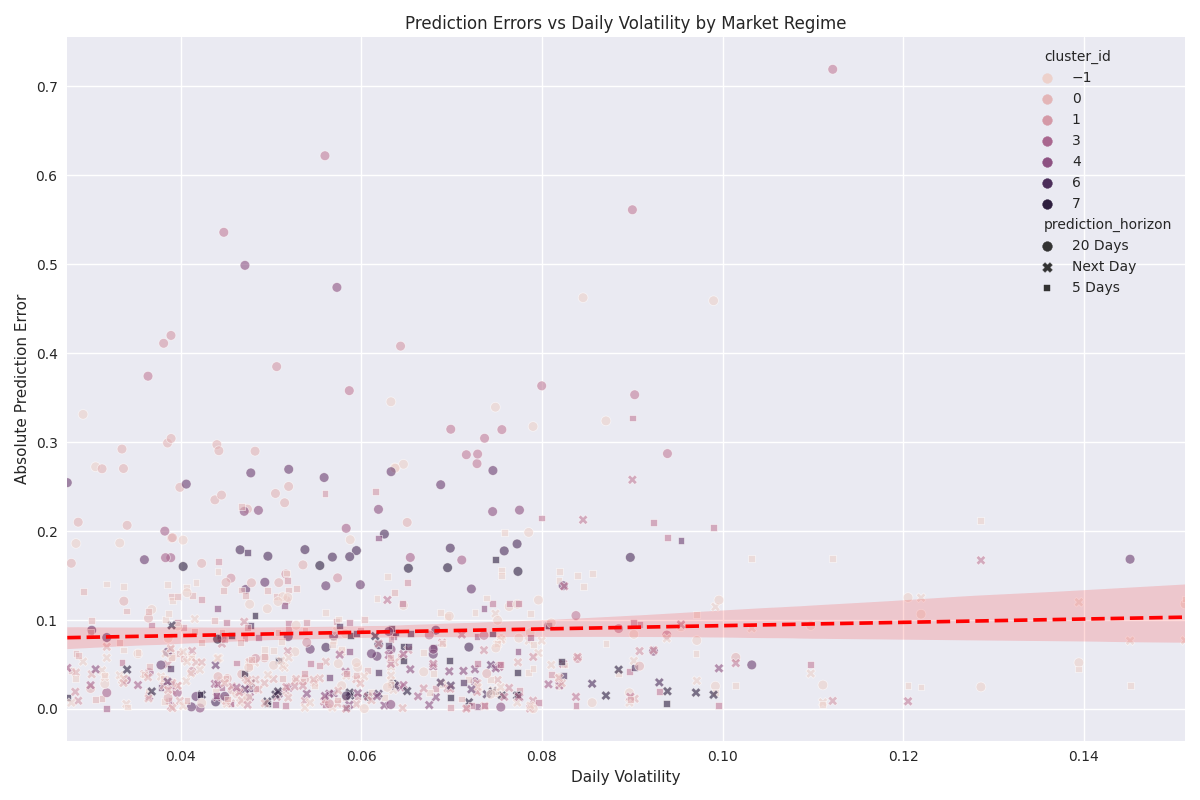

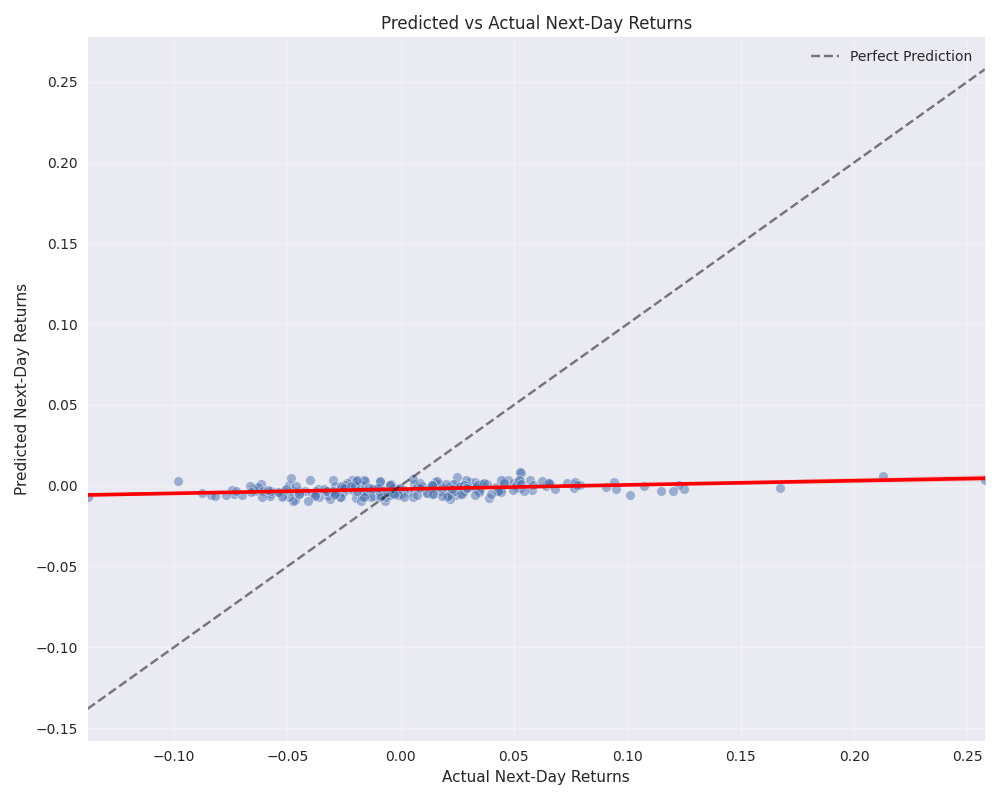

Trading Success Rates Highest in Stable Market Conditions

Saving...

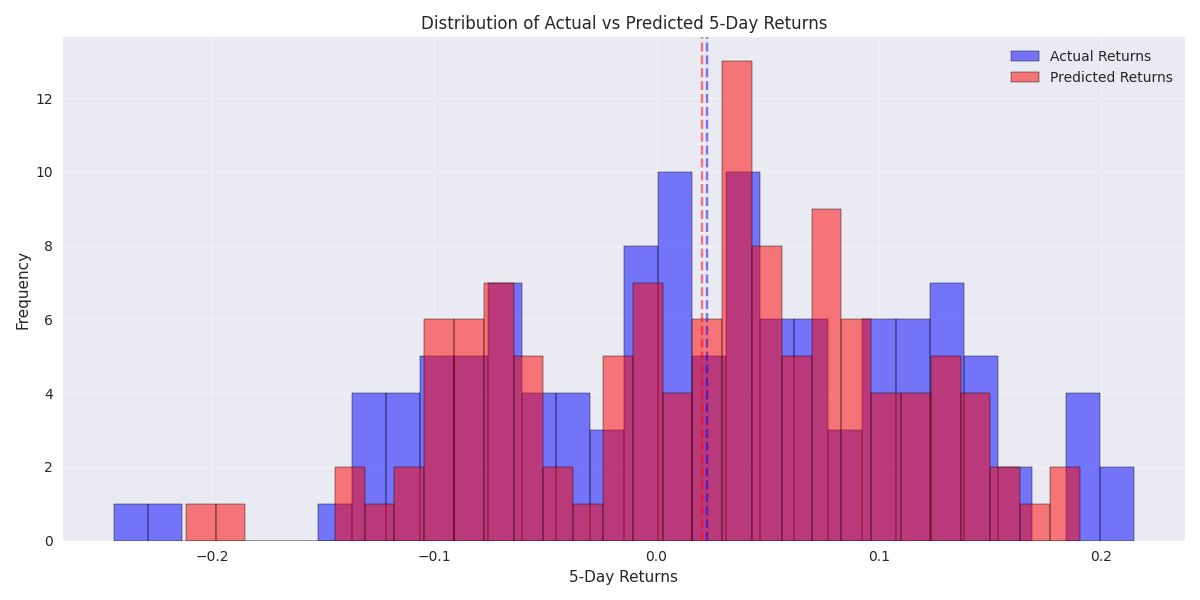

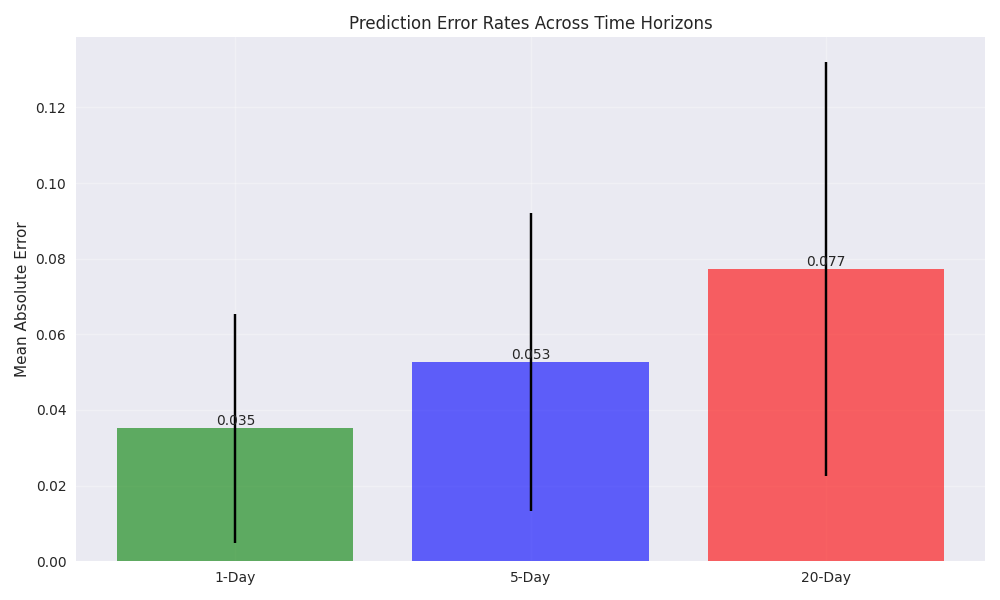

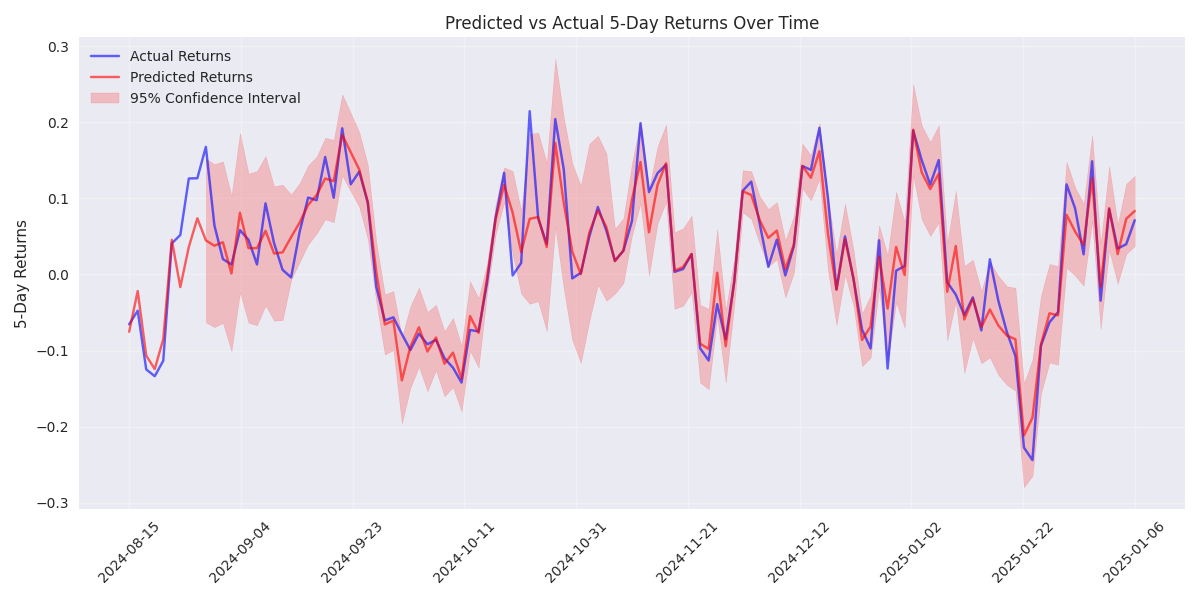

Medium-Term Trading Shows Superior Prediction Accuracy

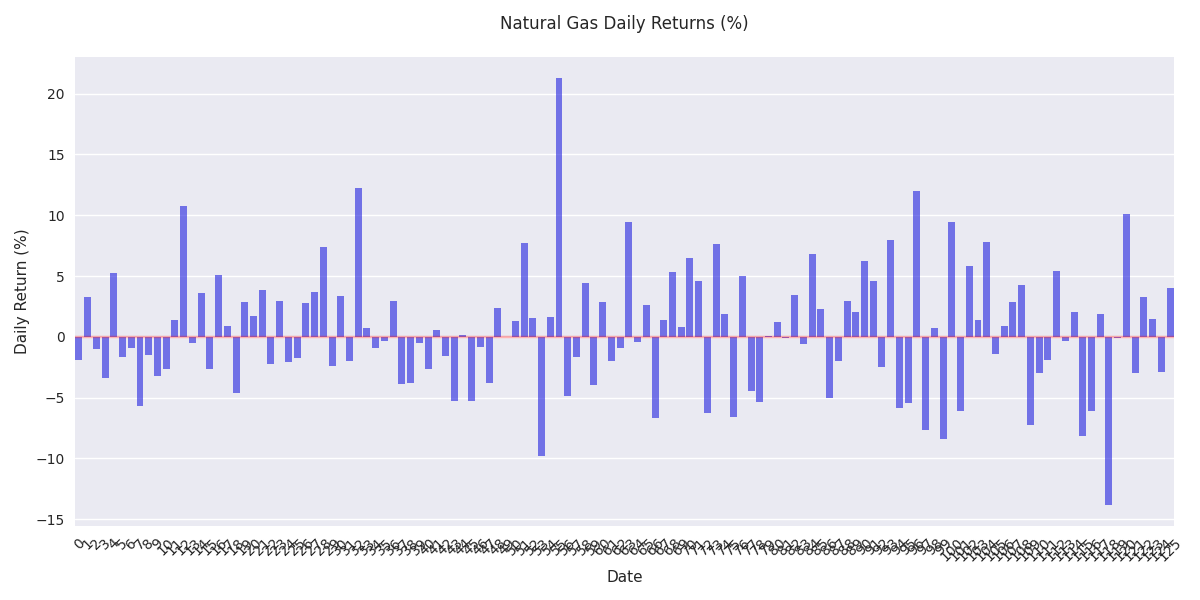

Natural Gas Price Analysis: Recent Price Trends and Volatility

Natural Gas Support and Resistance Analysis: Key Price Levels and Trading Opportunities

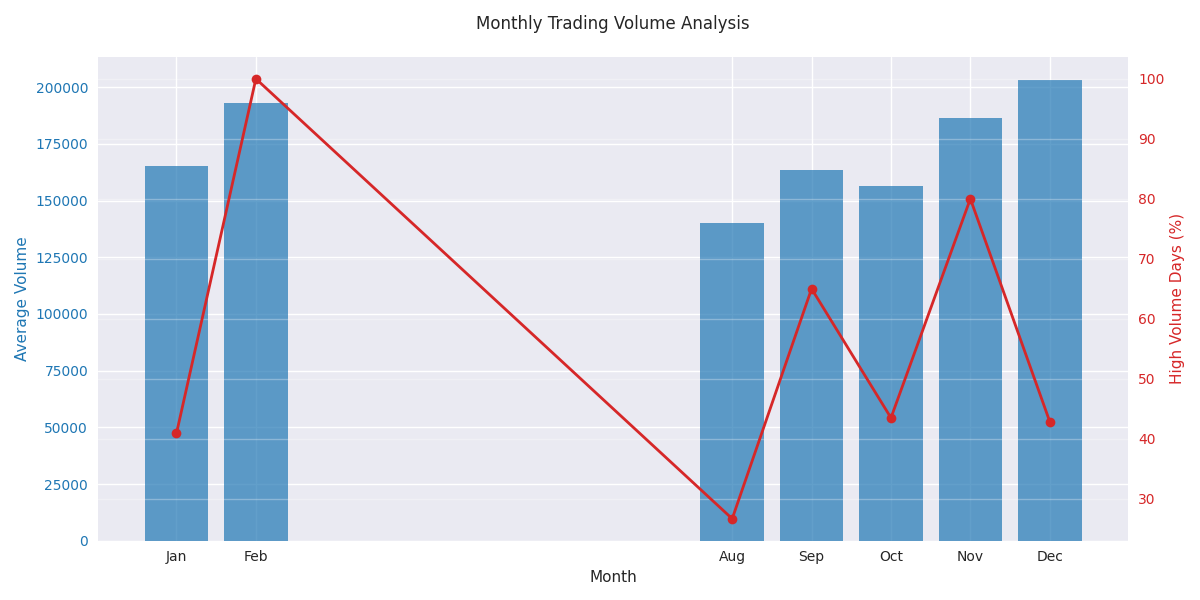

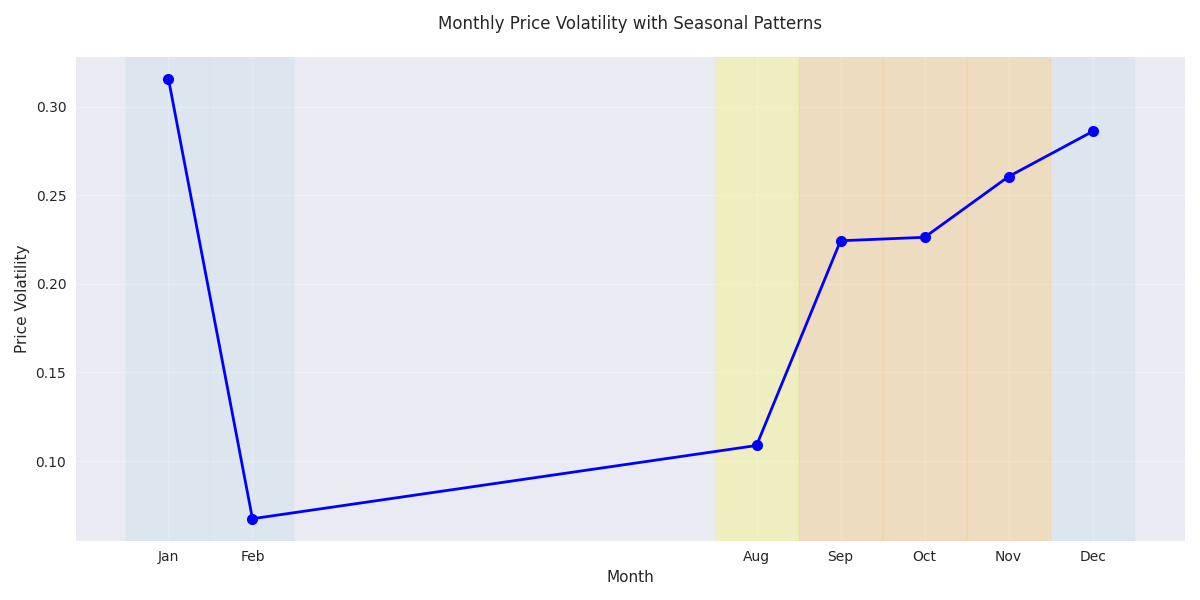

Natural Gas Seasonal Analysis: Monthly Price and Volume Patterns

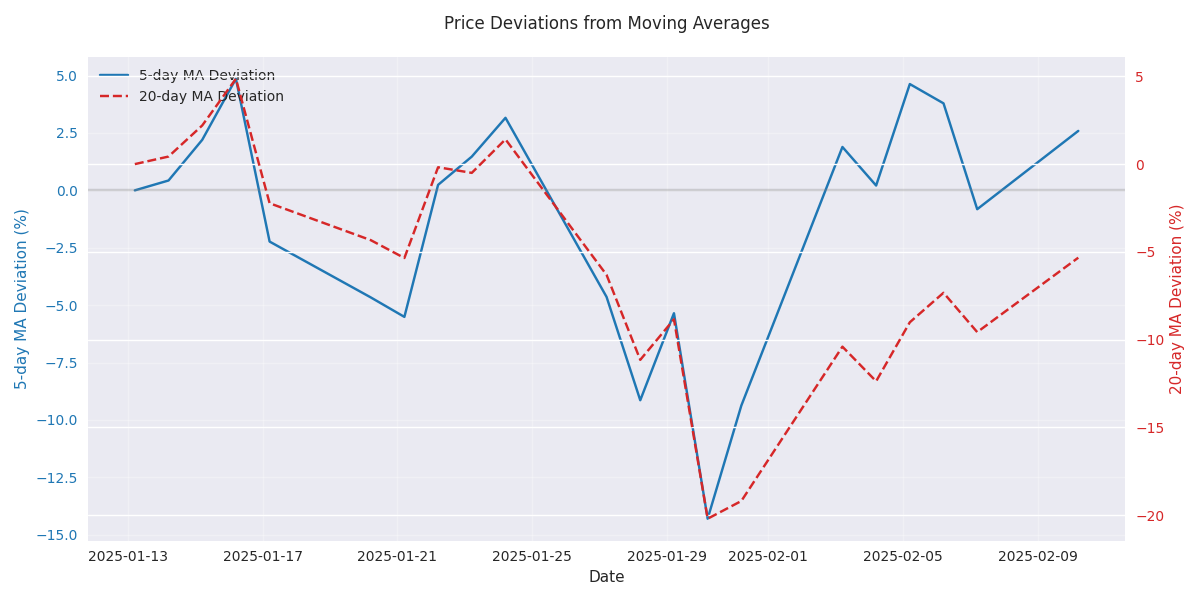

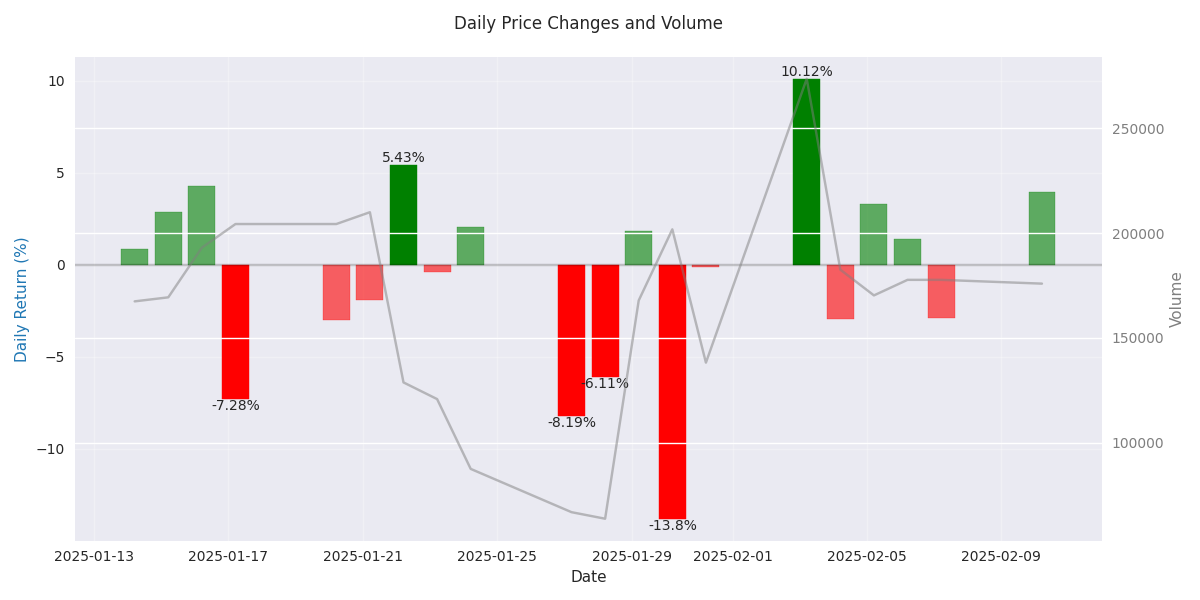

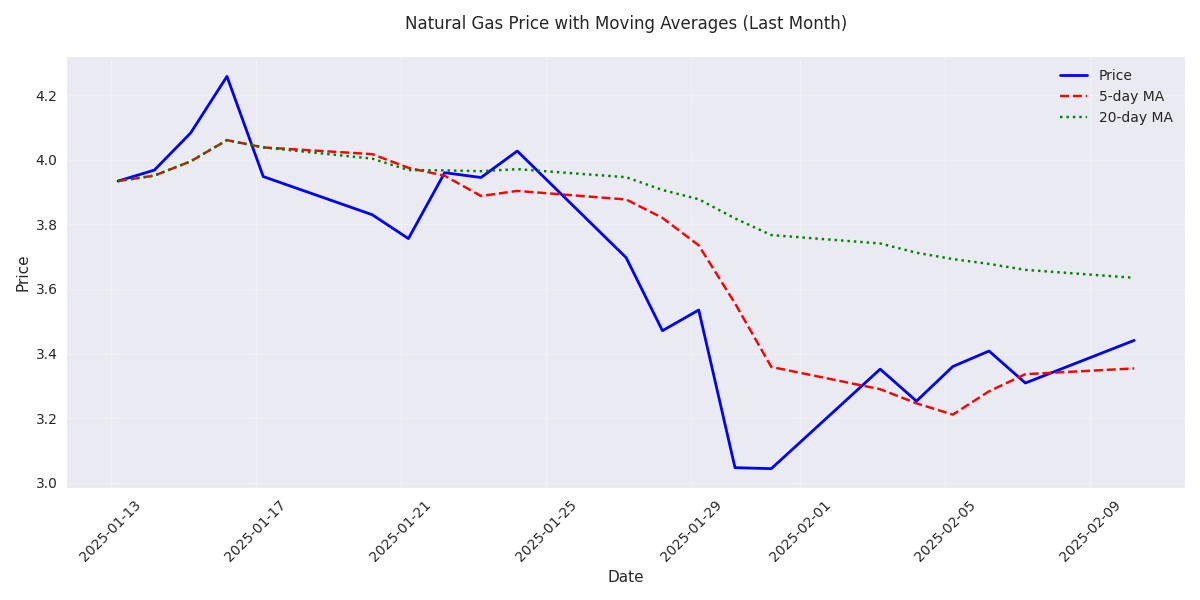

Recent Market Dynamics: Technical Analysis and Trading Signals

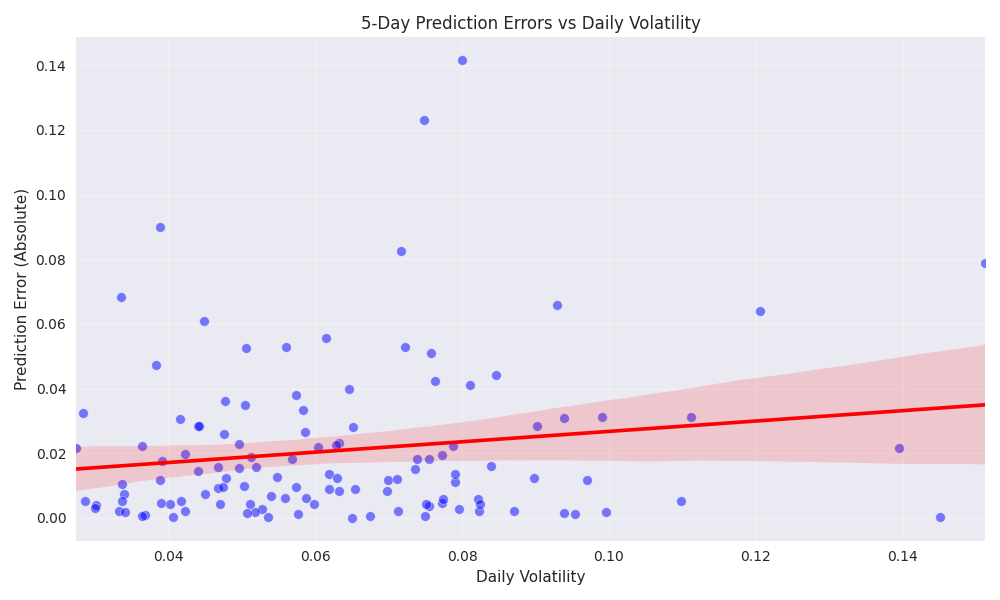

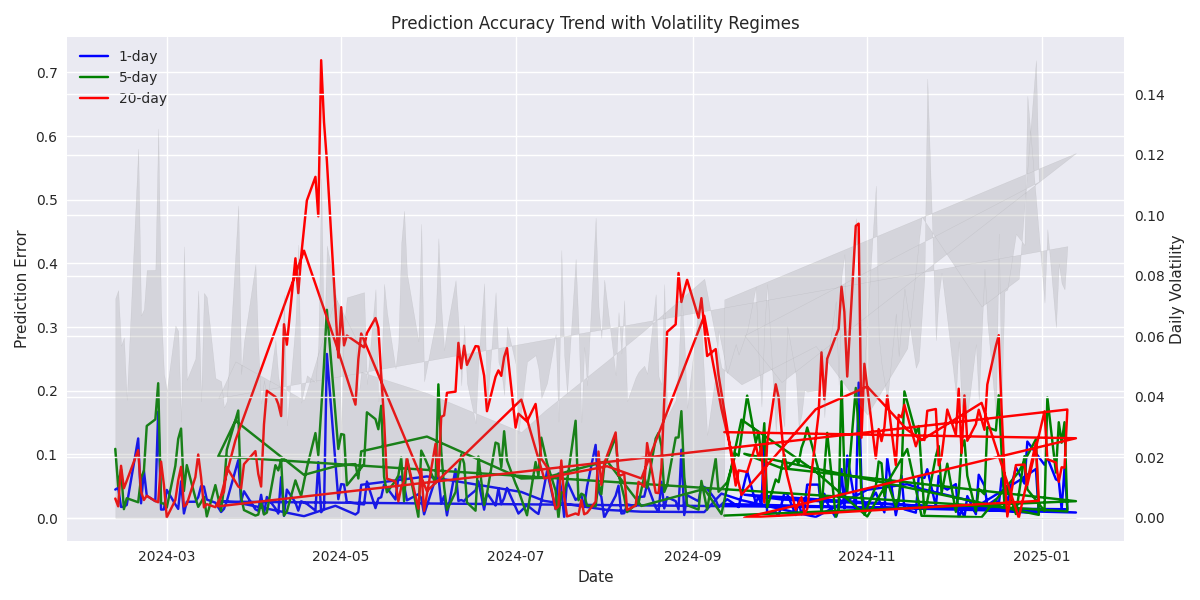

Short-term Natural Gas Price Prediction Analysis

Medium-Term Natural Gas Price Prediction Analysis

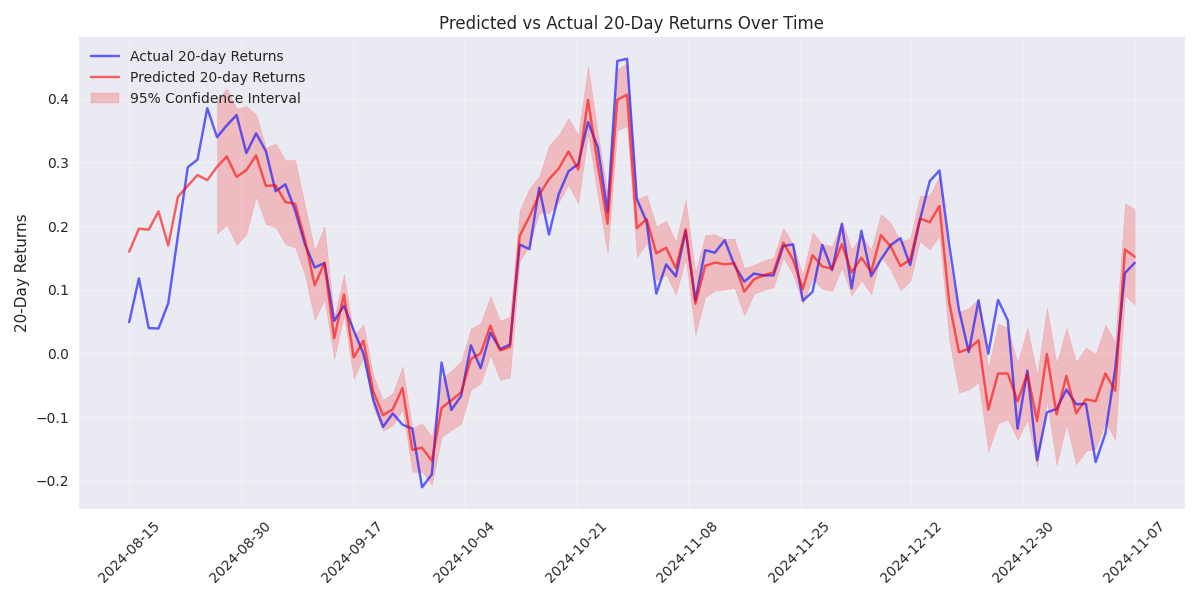

Long-term Natural Gas Price Prediction Analysis and Risk Assessment

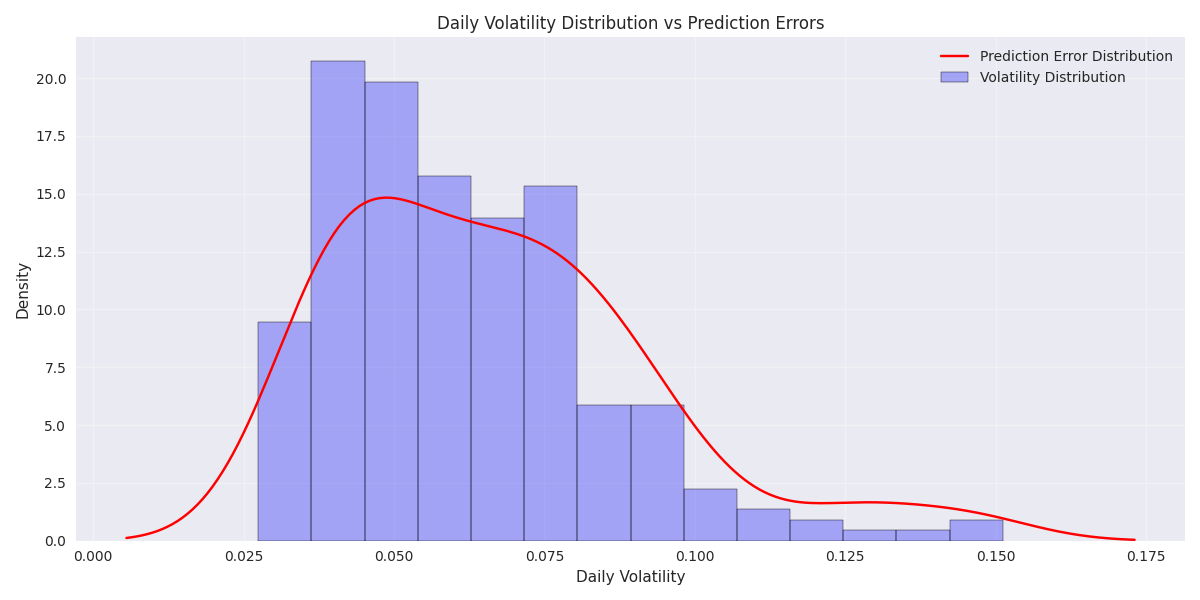

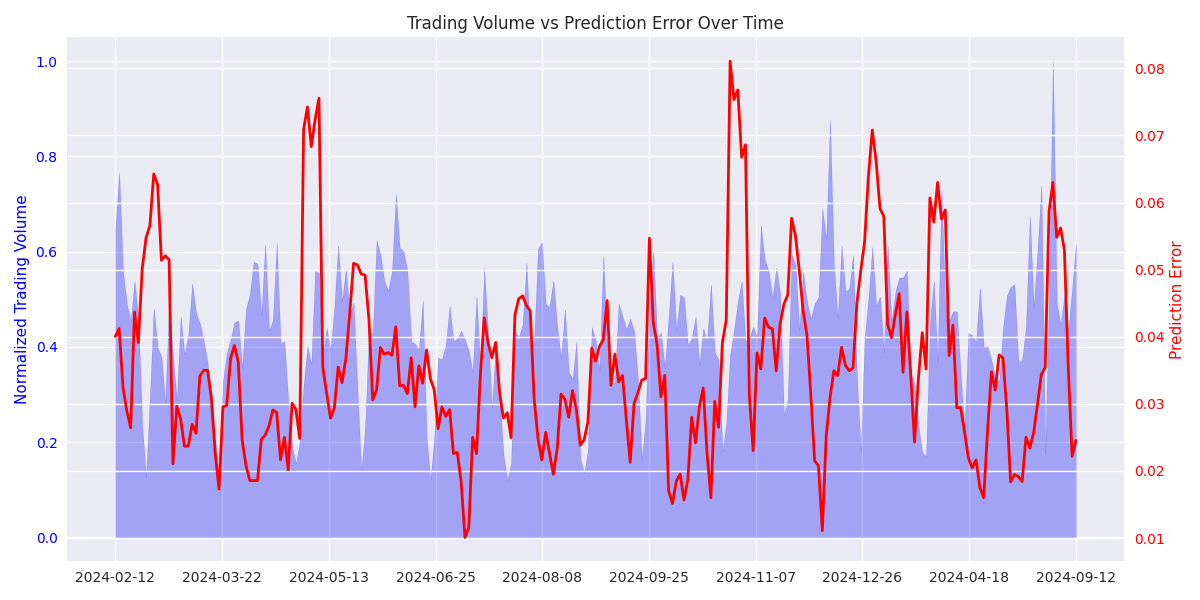

Market Volatility Regimes and Their Impact on Natural Gas Price Predictions