Breaking Down XRP: Urgent Trading Signals and Market Volatility Revealed

Saving...

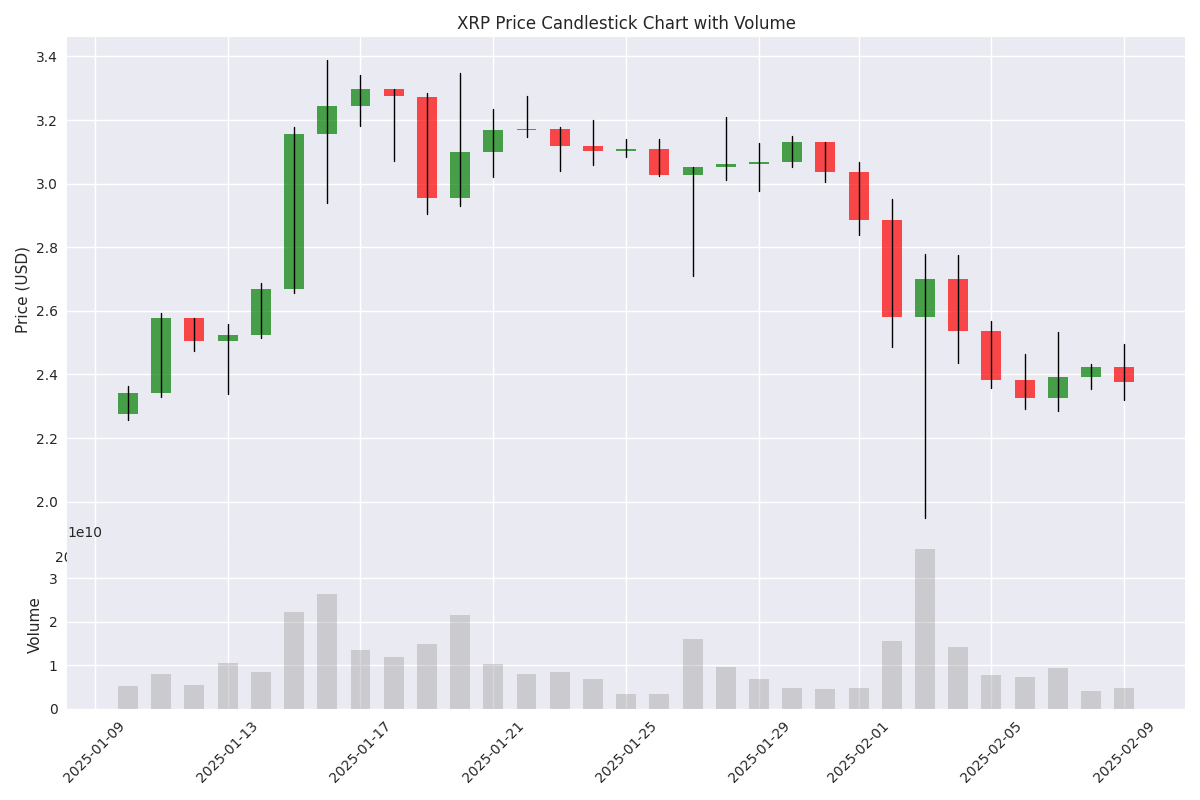

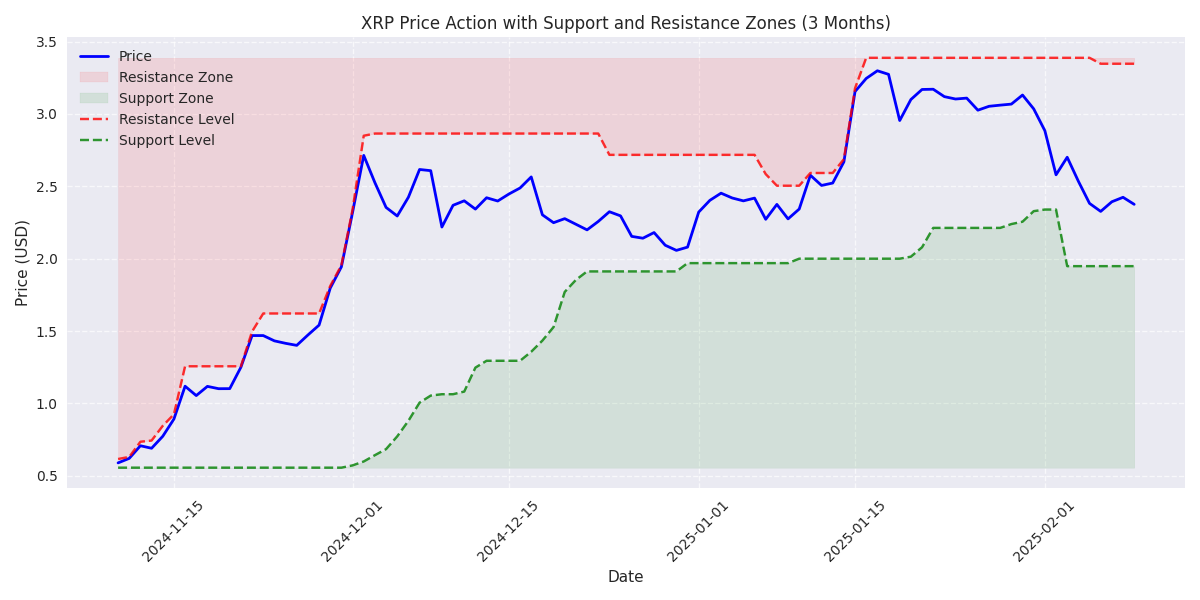

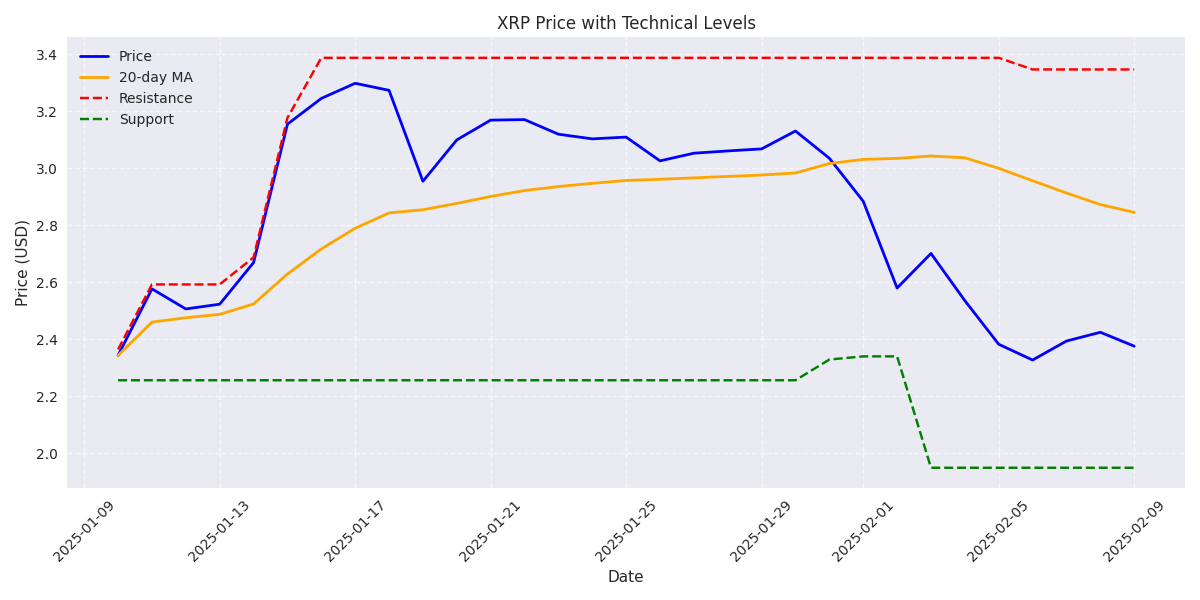

XRP in Bearish Trend with Critical Support Level at $1.94

Saving...

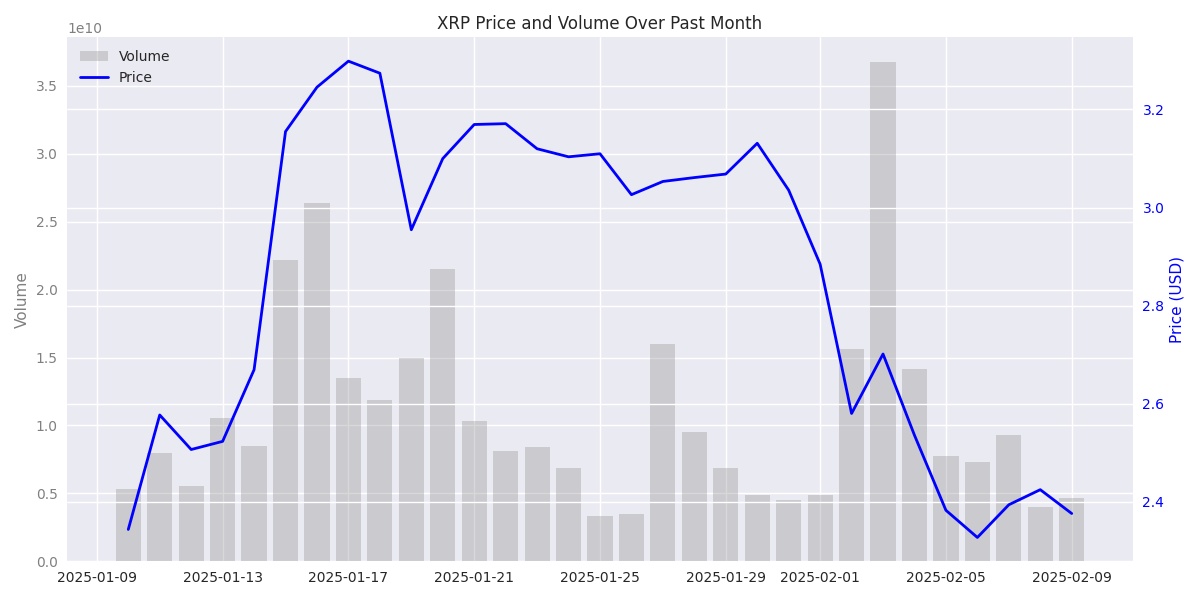

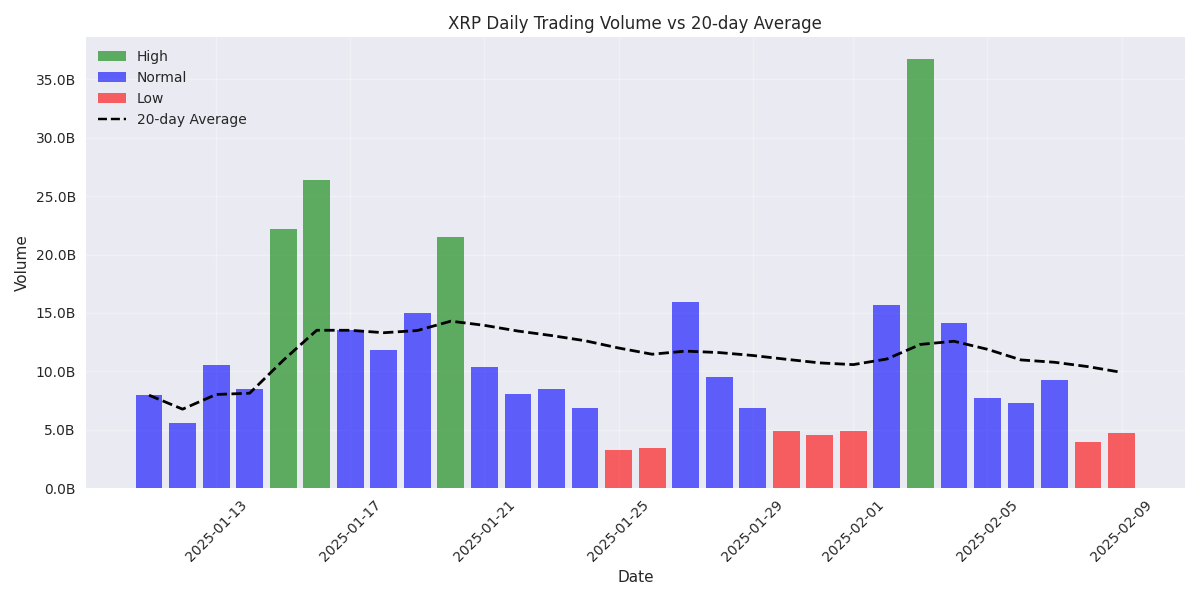

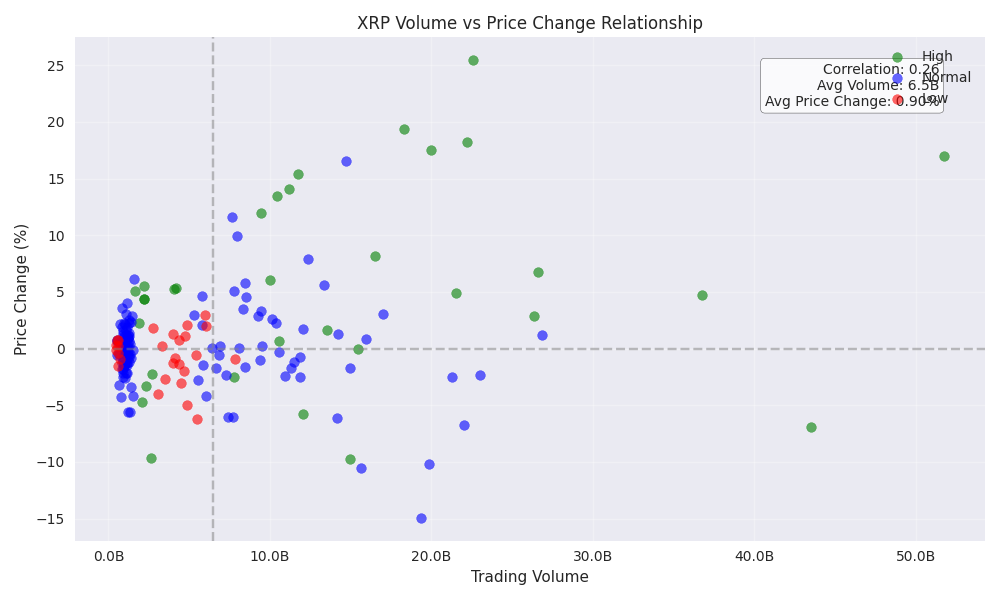

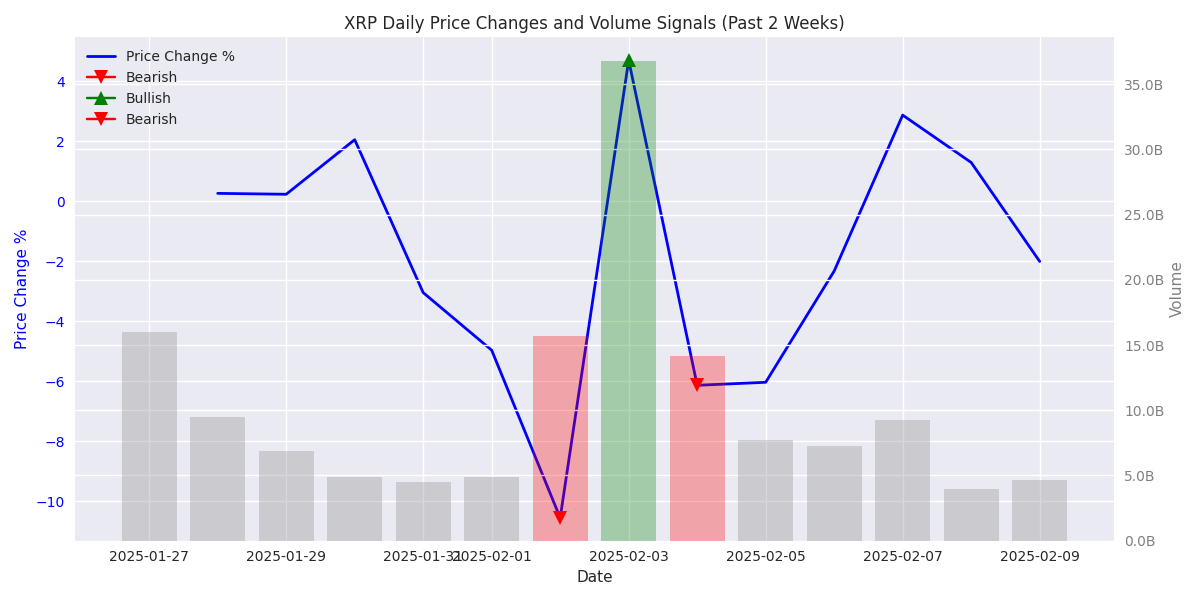

Volume Analysis Shows Market Exhaustion Signs

Saving...

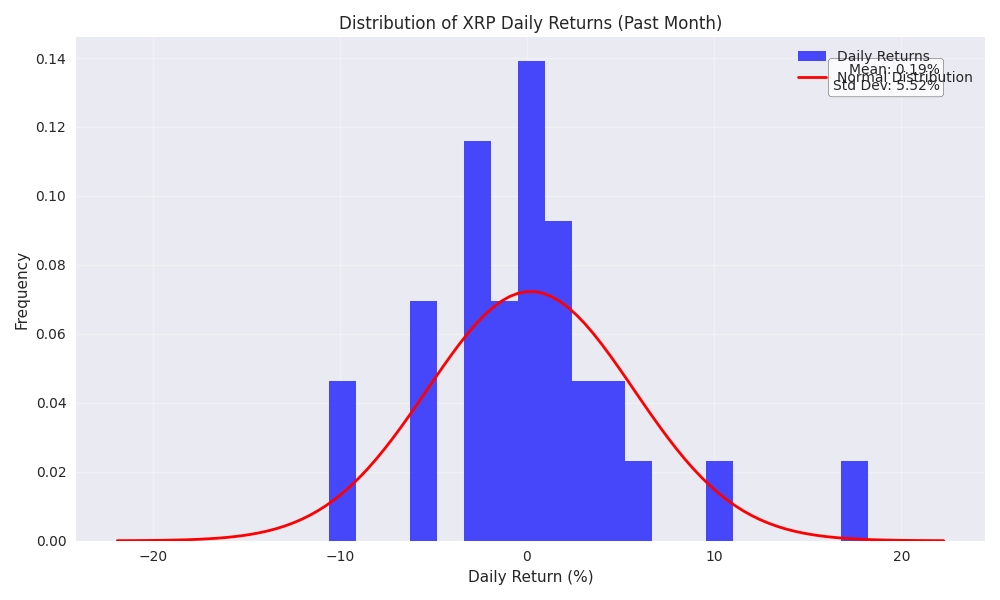

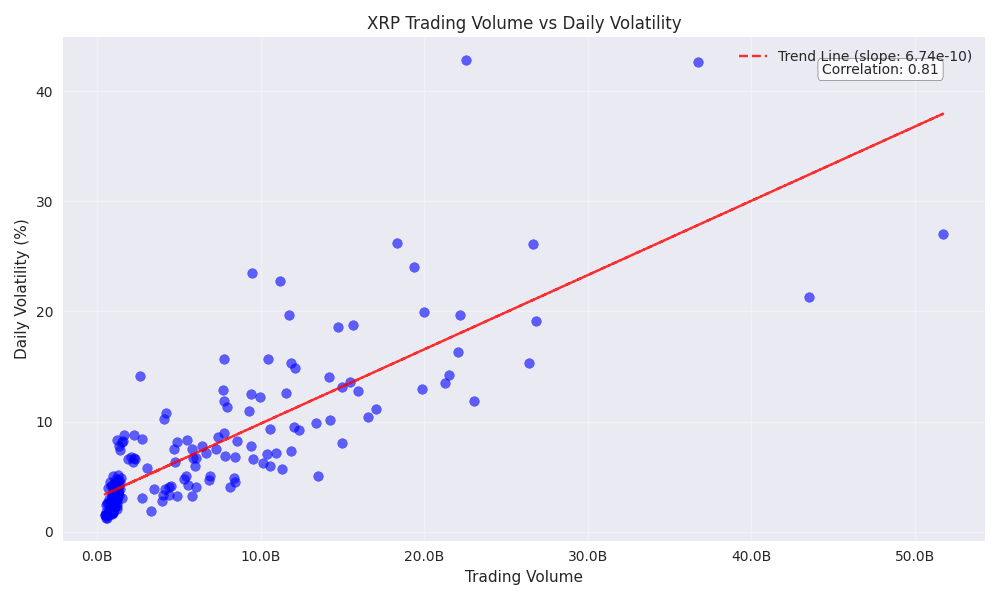

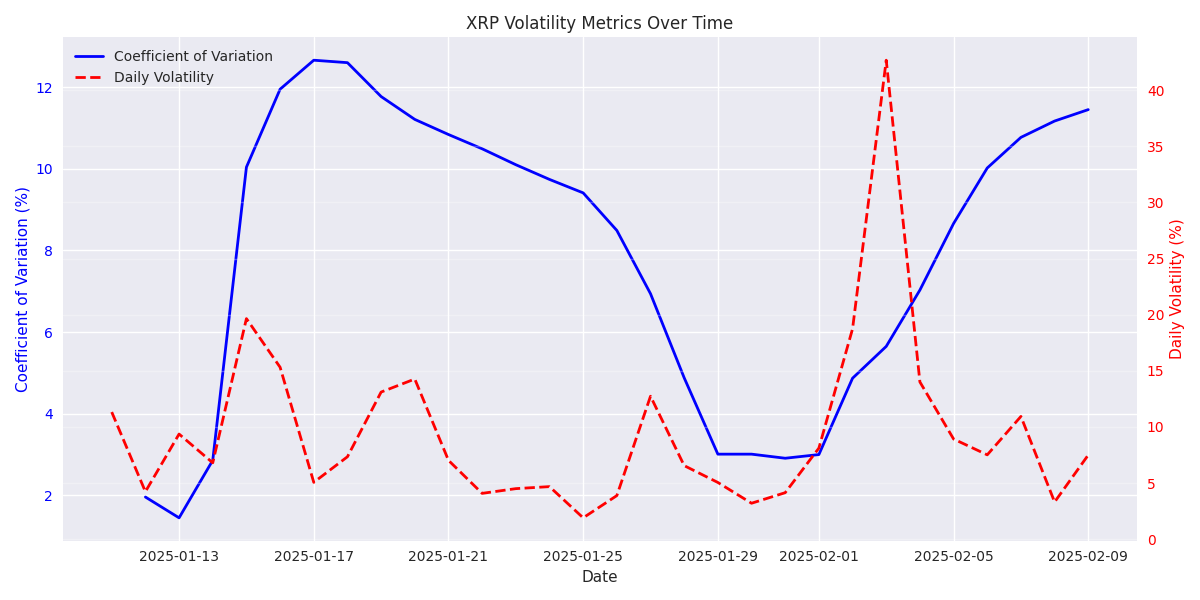

Risk Metrics Indicate Heightened Trading Volatility

Saving...

Trading Strategy: Focus on Short-Term Opportunities

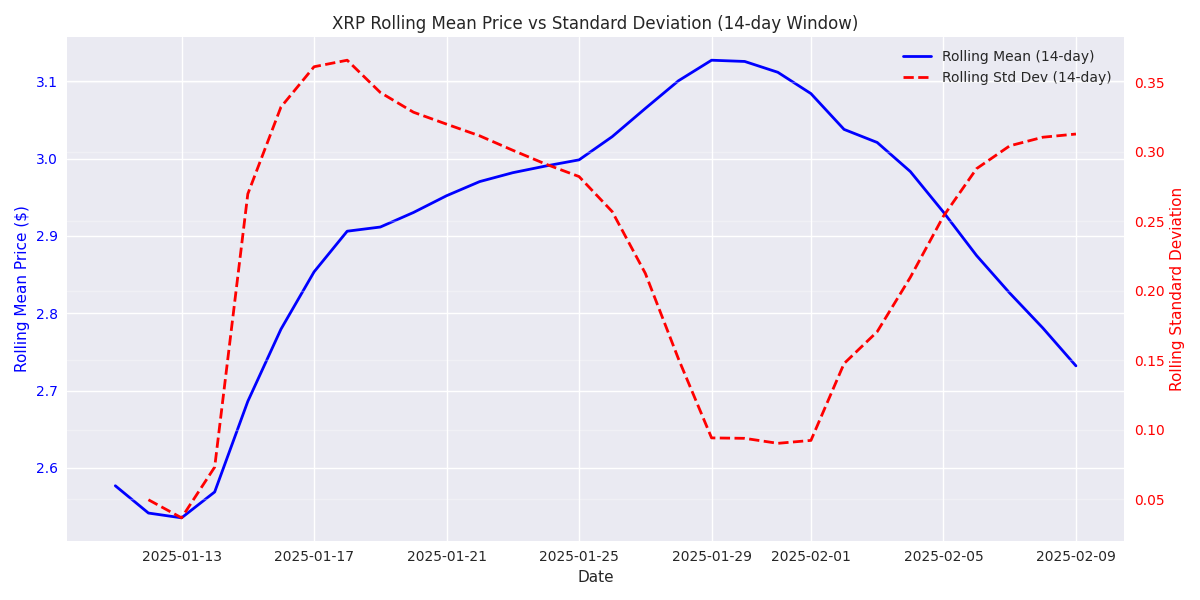

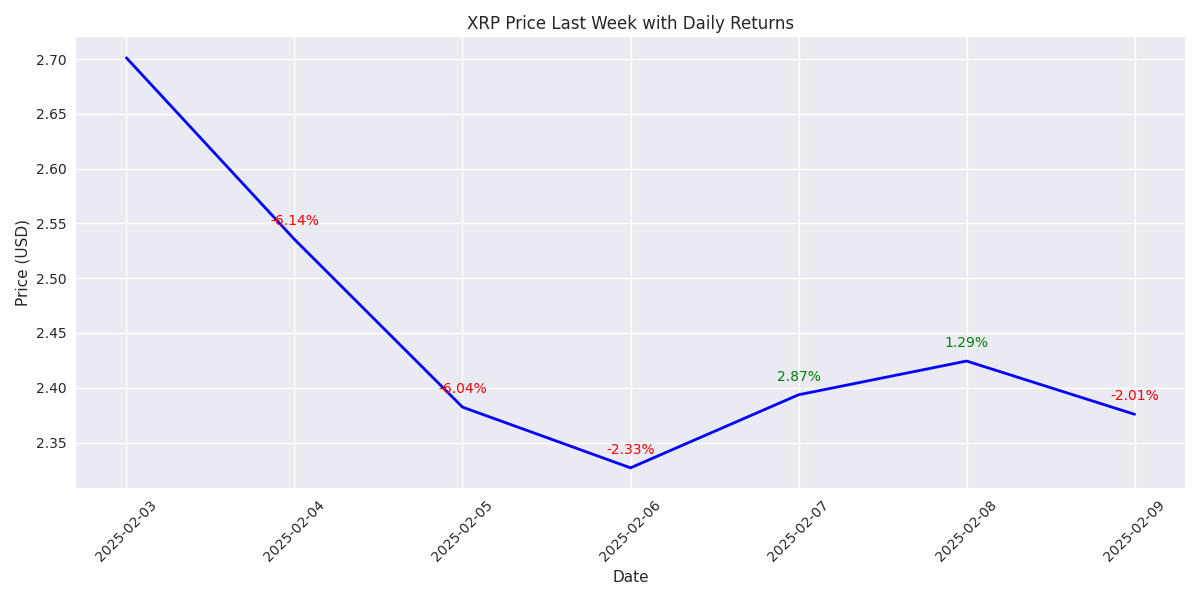

XRP Price Shows Significant Volatility with Recent Downward Trend

XRP Technical Analysis Reveals Key Support and Resistance Levels

Volume Analysis Reveals Key Market Signals and Trading Patterns

XRP Shows Increasing Market Volatility and Risk Metrics

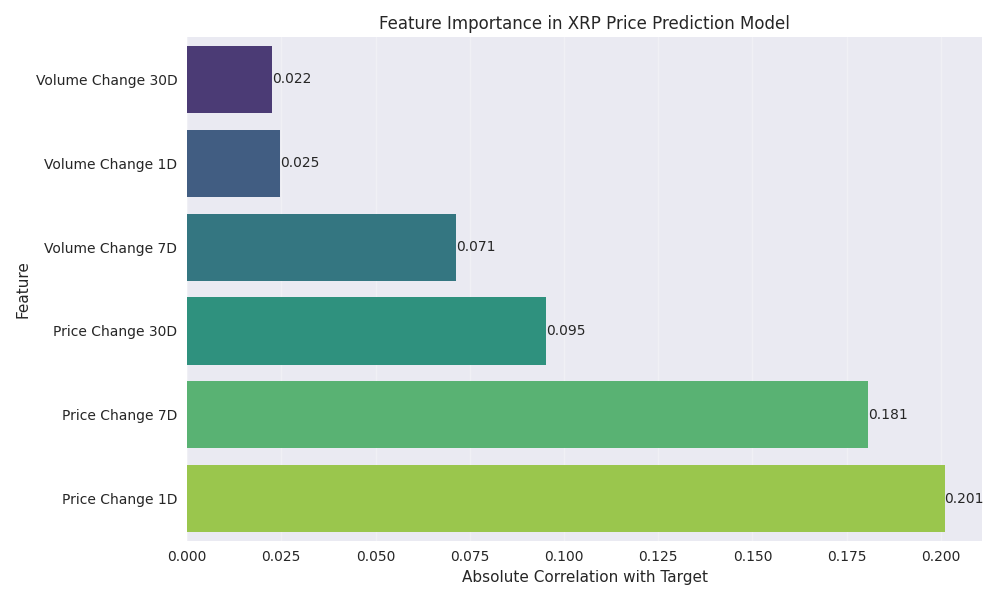

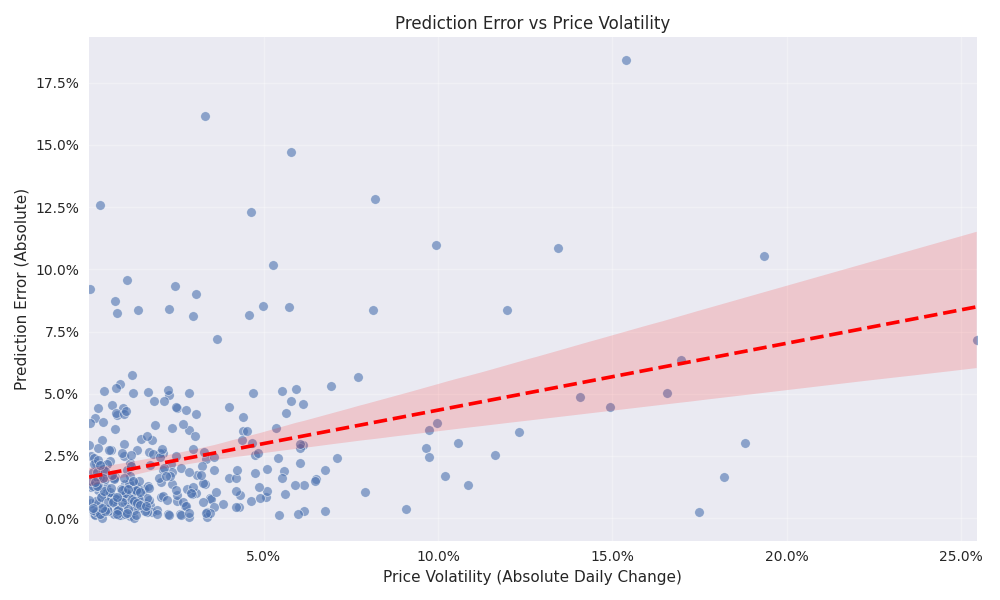

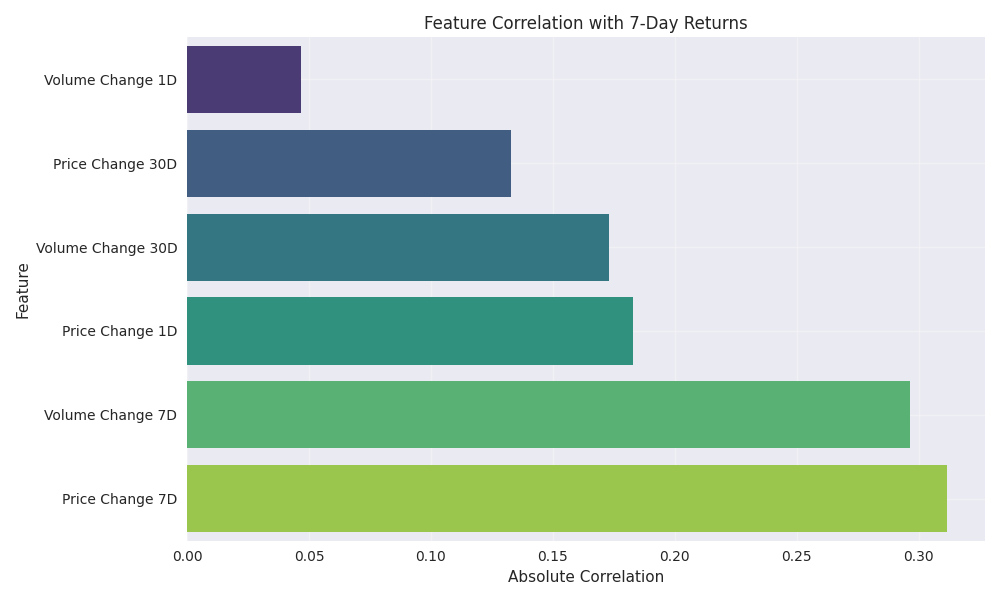

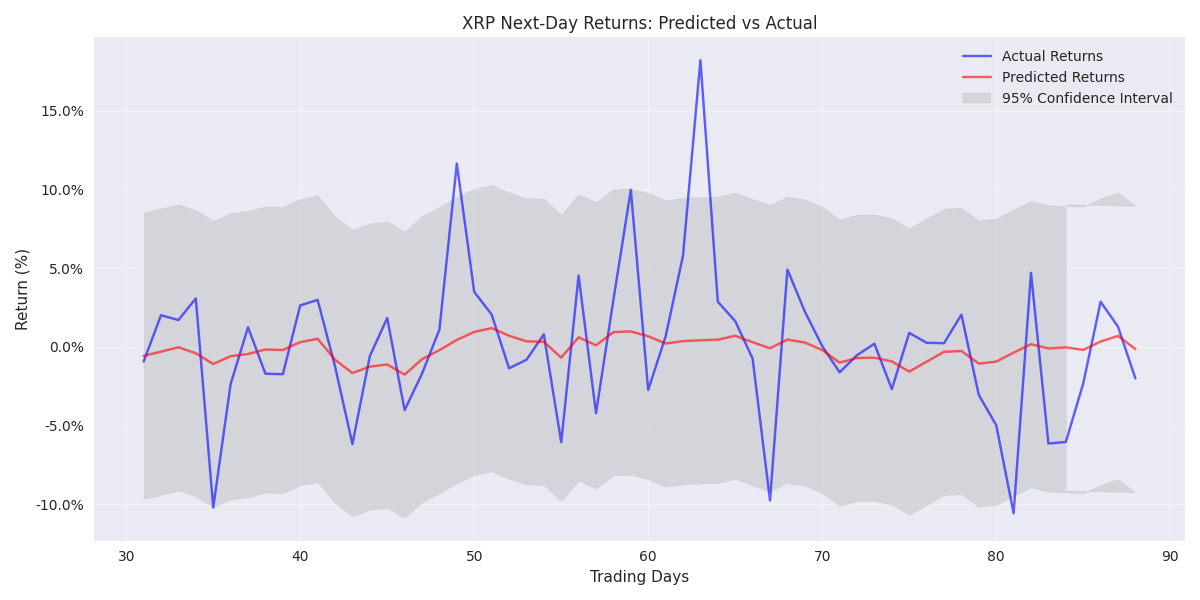

Initial XRP Price Prediction Model Shows Moderate Predictability

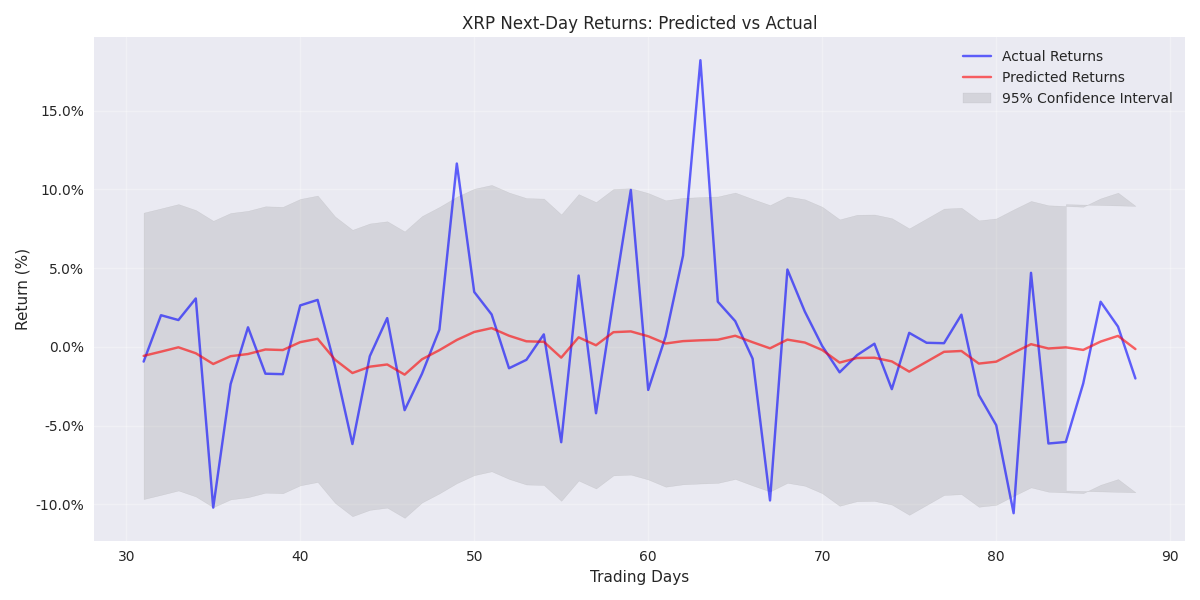

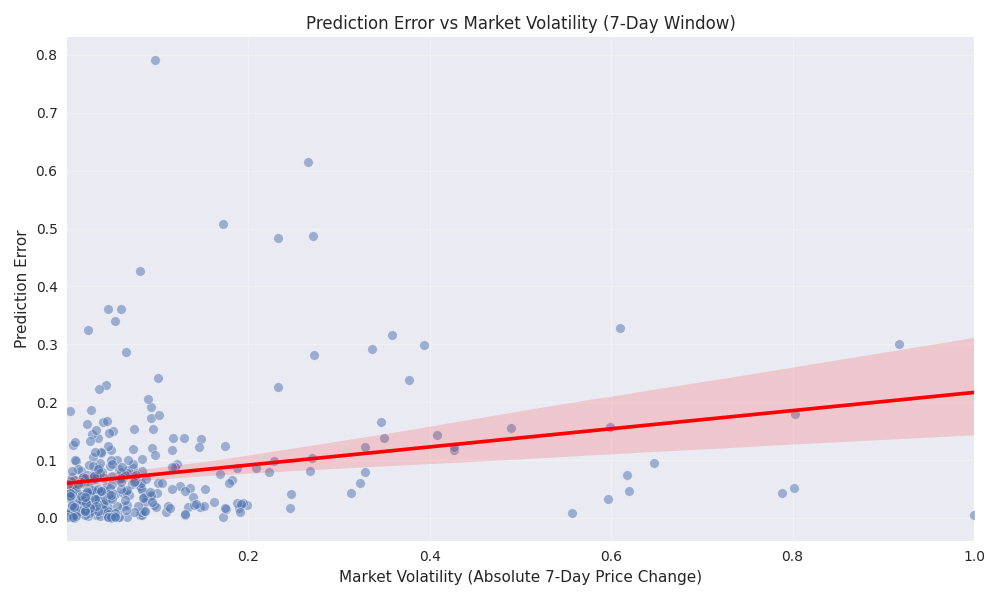

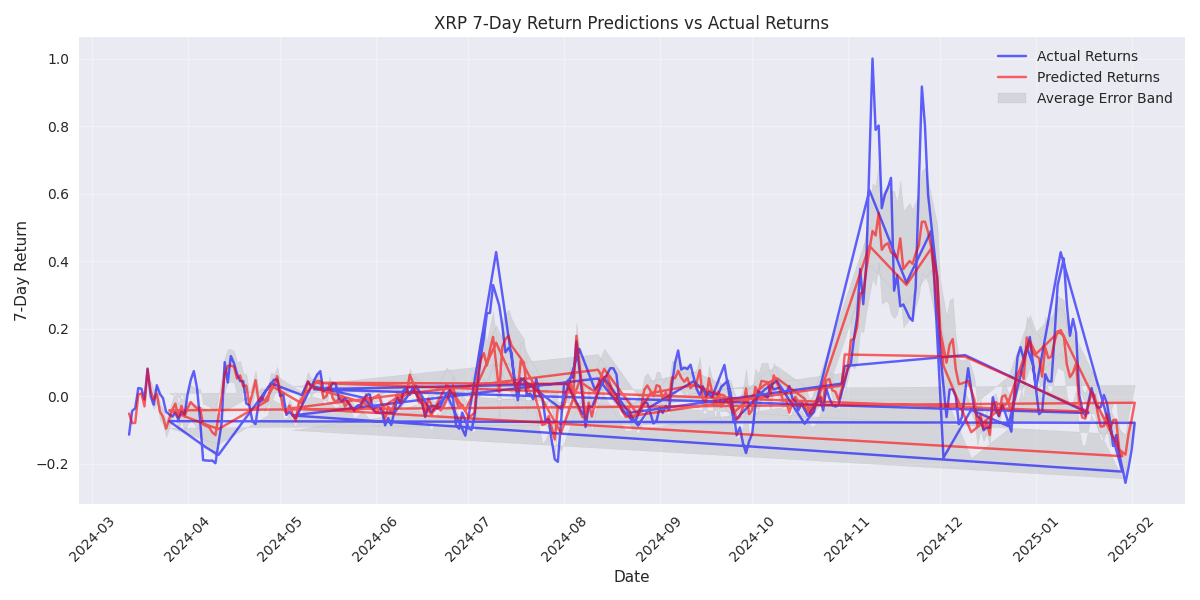

7-Day Price Prediction Model Shows Higher Uncertainty but Captures Major Trends

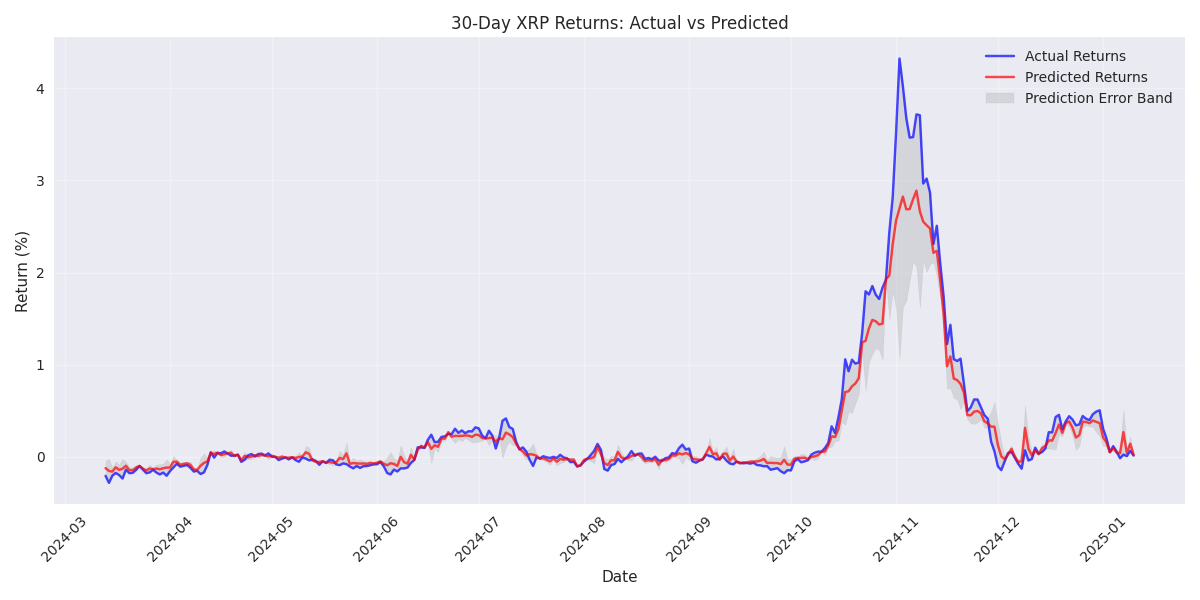

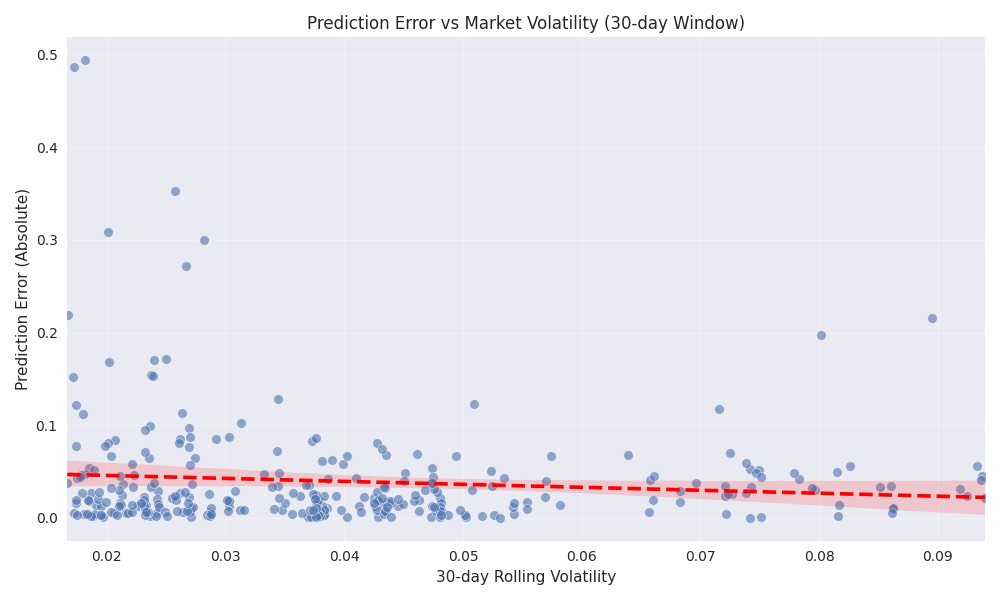

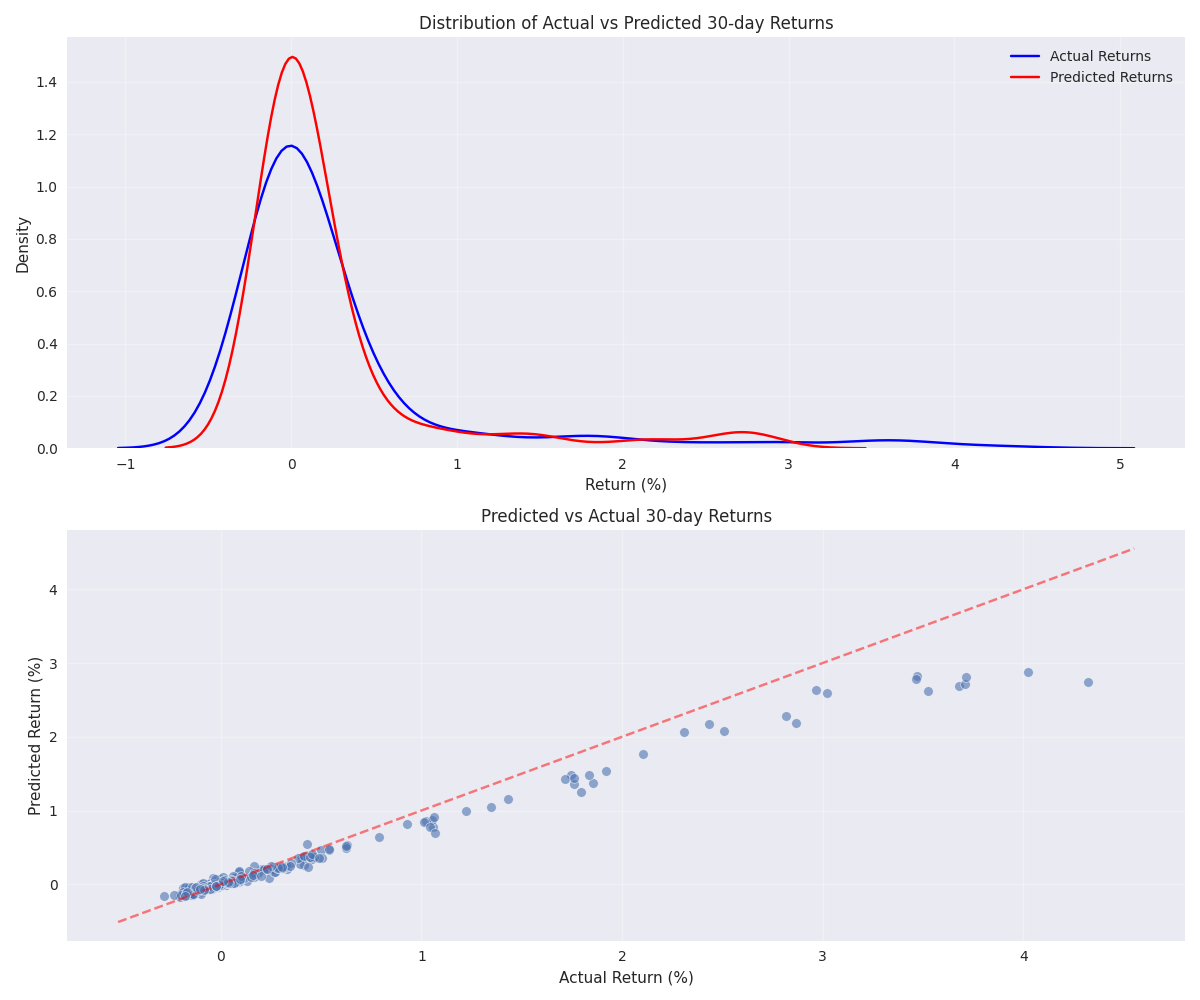

30-Day XRP Price Predictions Show Increased Uncertainty but Capture Major Trends