Saving...

Ethereum Market Pulse: Decoding Critical Price Movements for Savvy Traders

Saving...

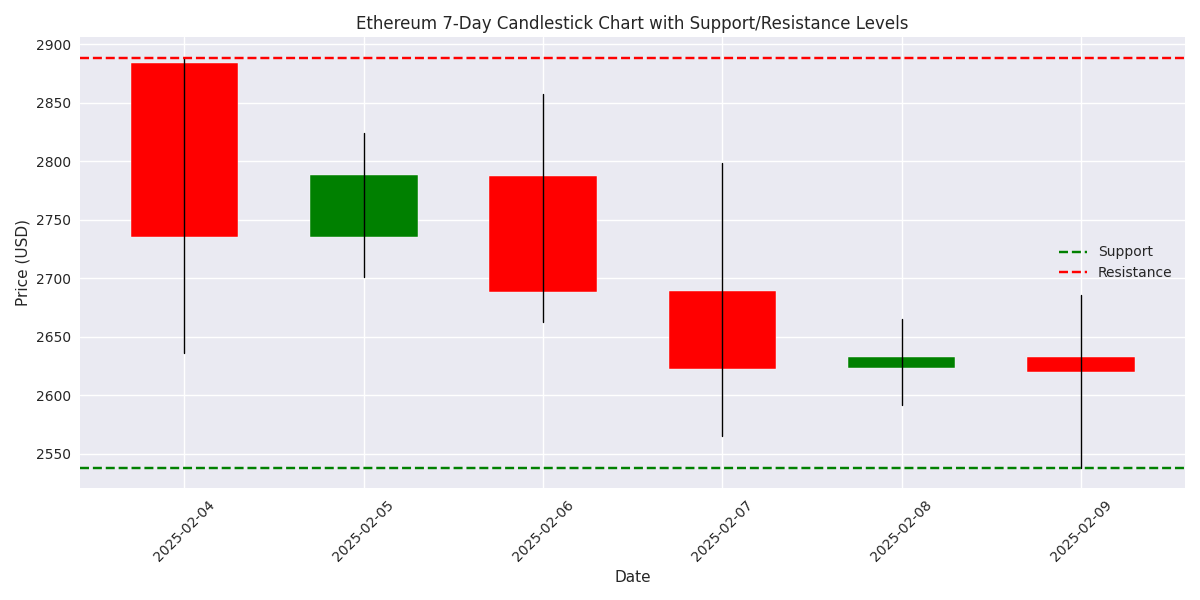

ETH Finds Support After 21% Drop, Shows Signs of Accumulation

Saving...

ETH Finds Support After 21% Drop, Shows Signs of Accumulation

Saving...

Saving...

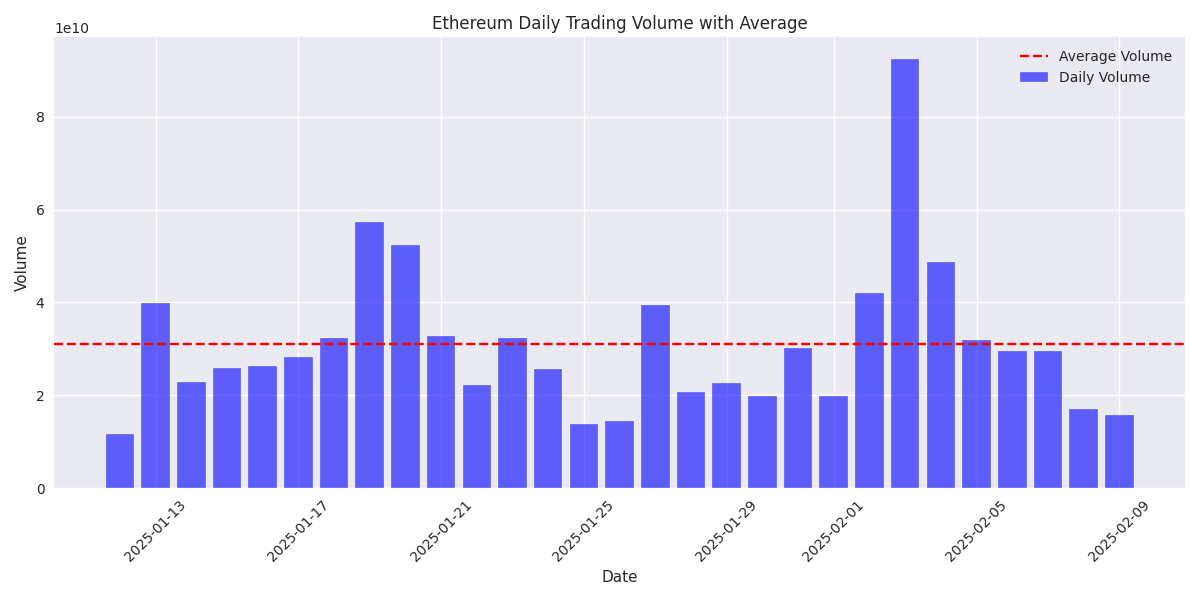

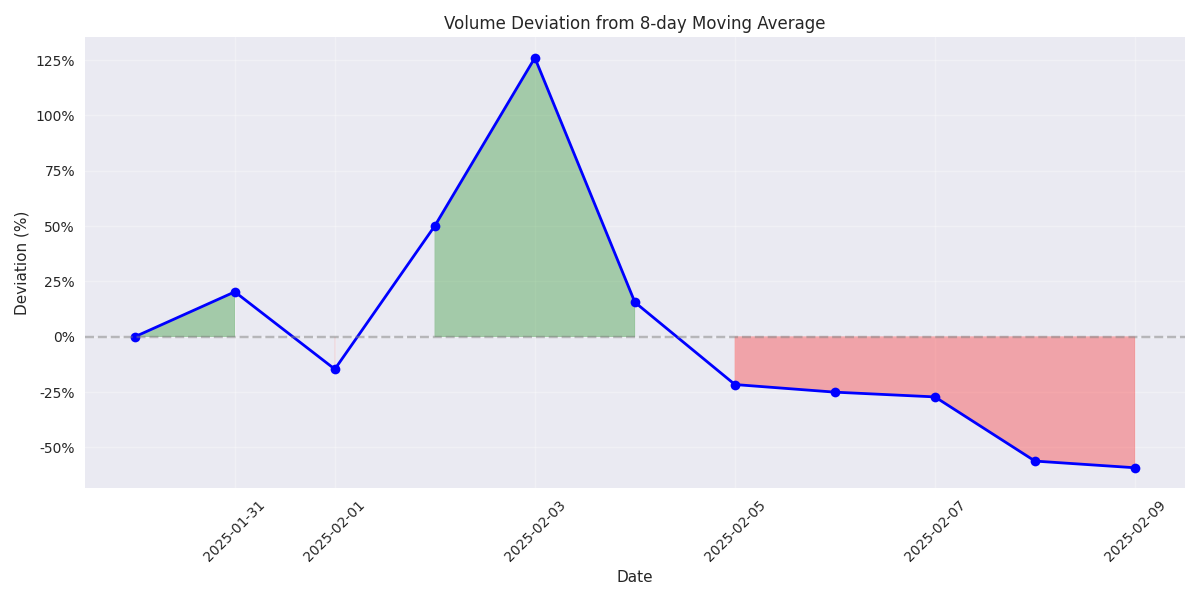

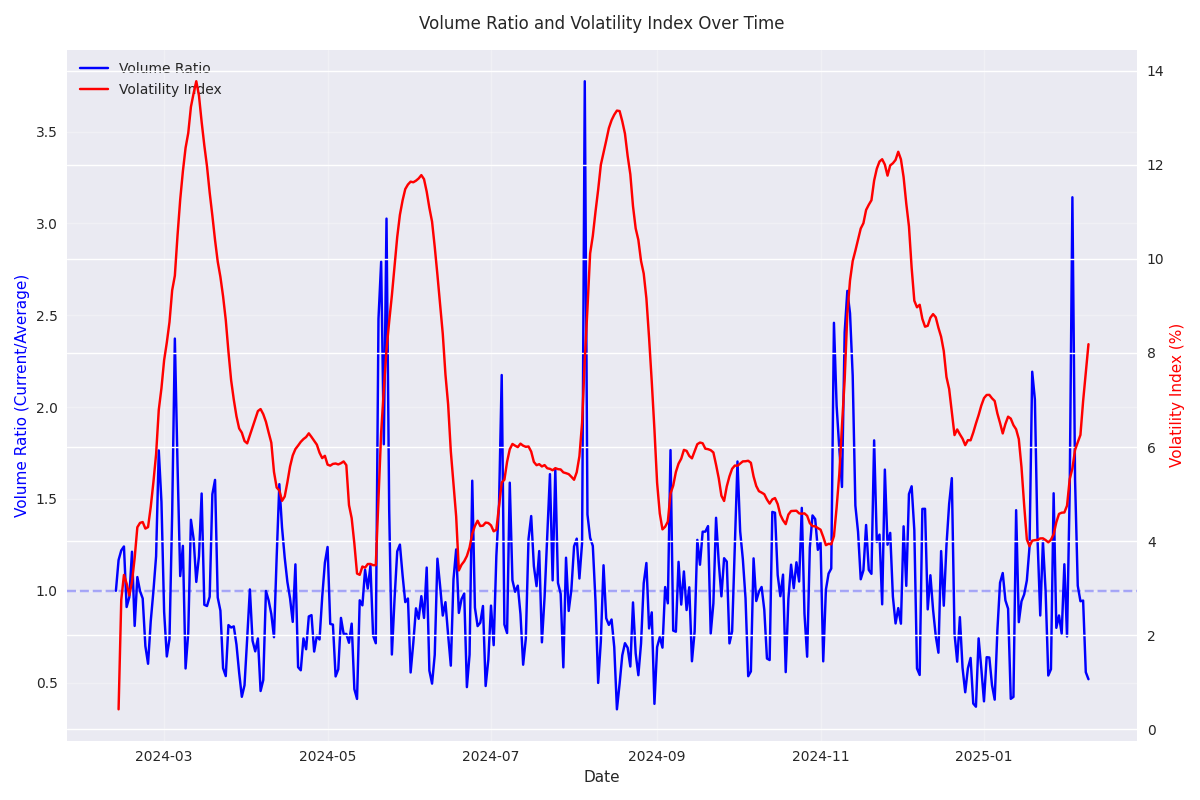

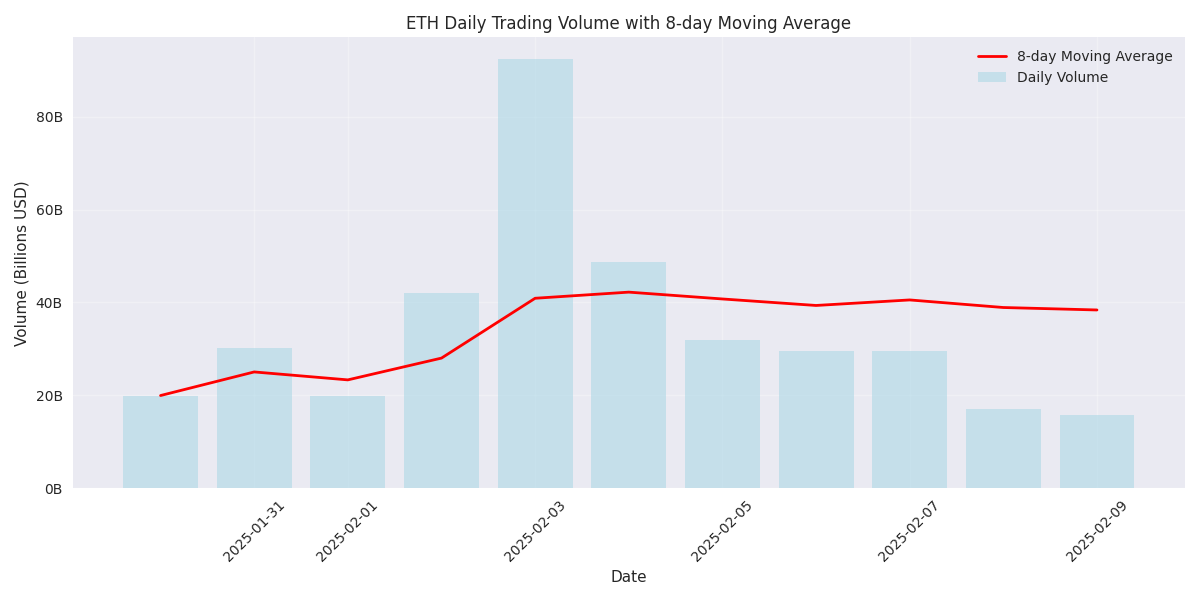

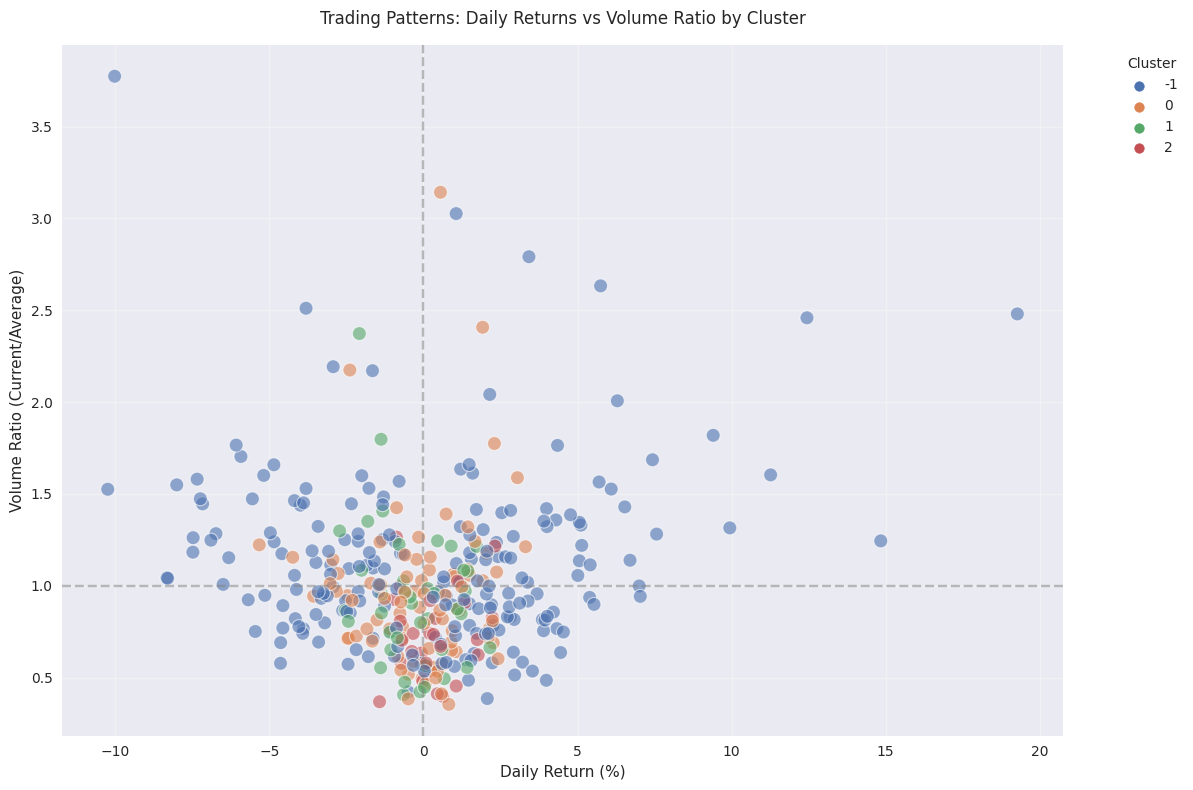

Volume Pattern Suggests Major Move Brewing

Saving...

Volume Pattern Suggests Major Move Brewing

Saving...

Saving...

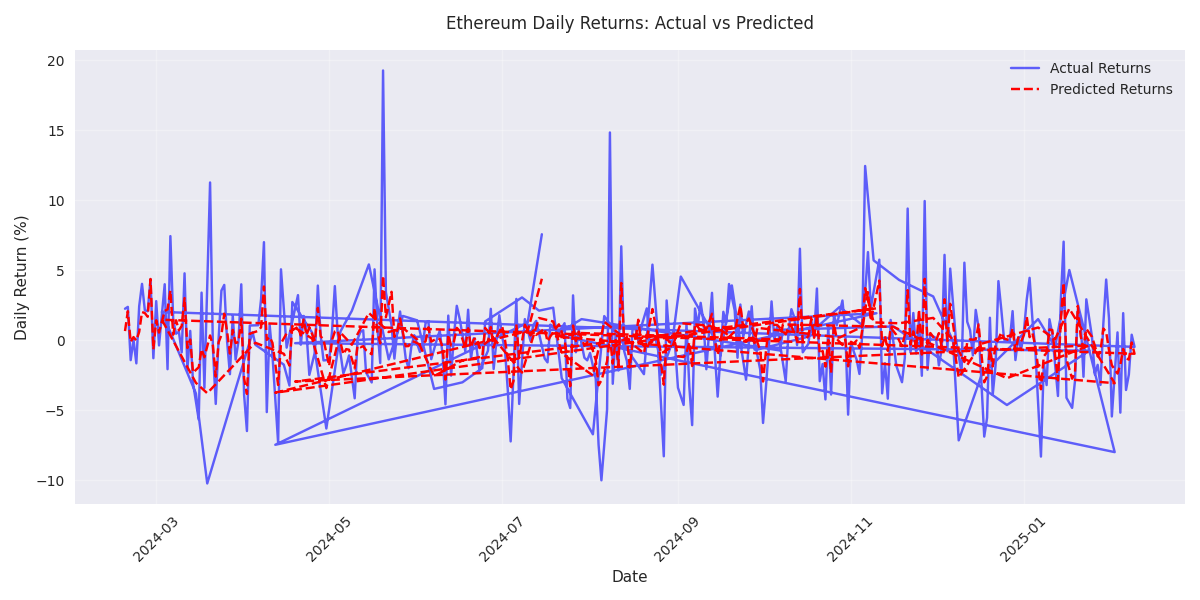

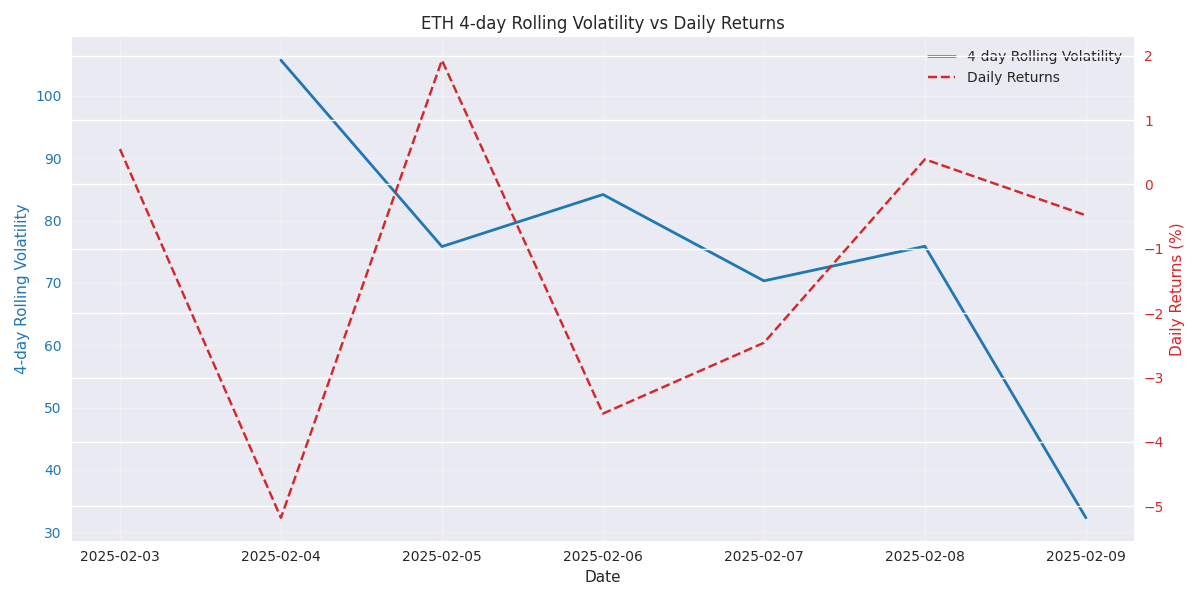

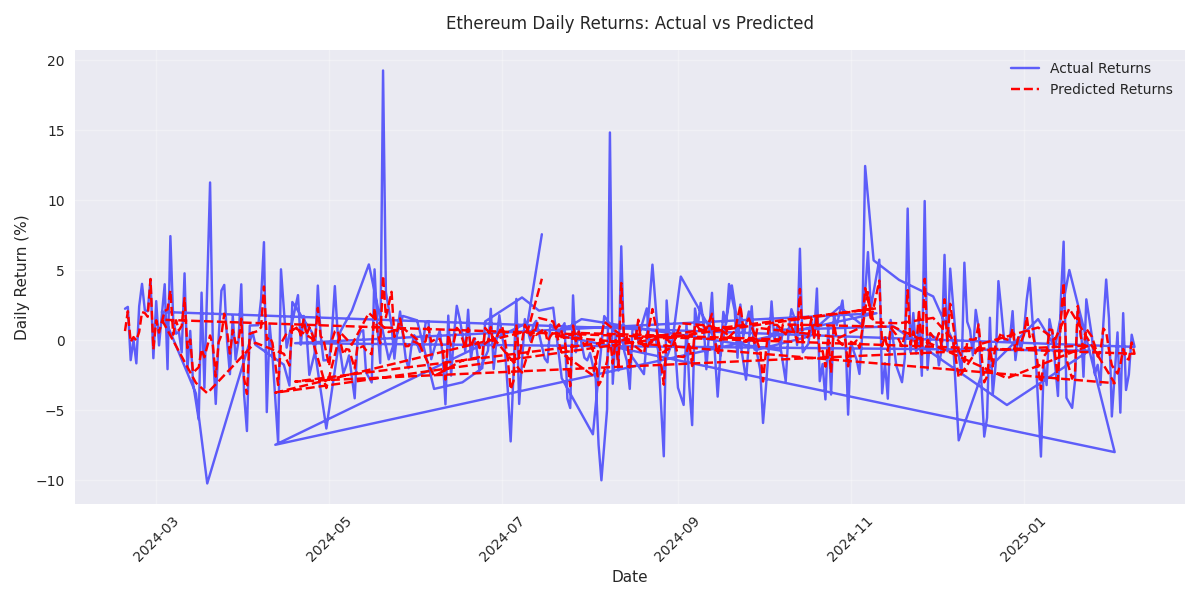

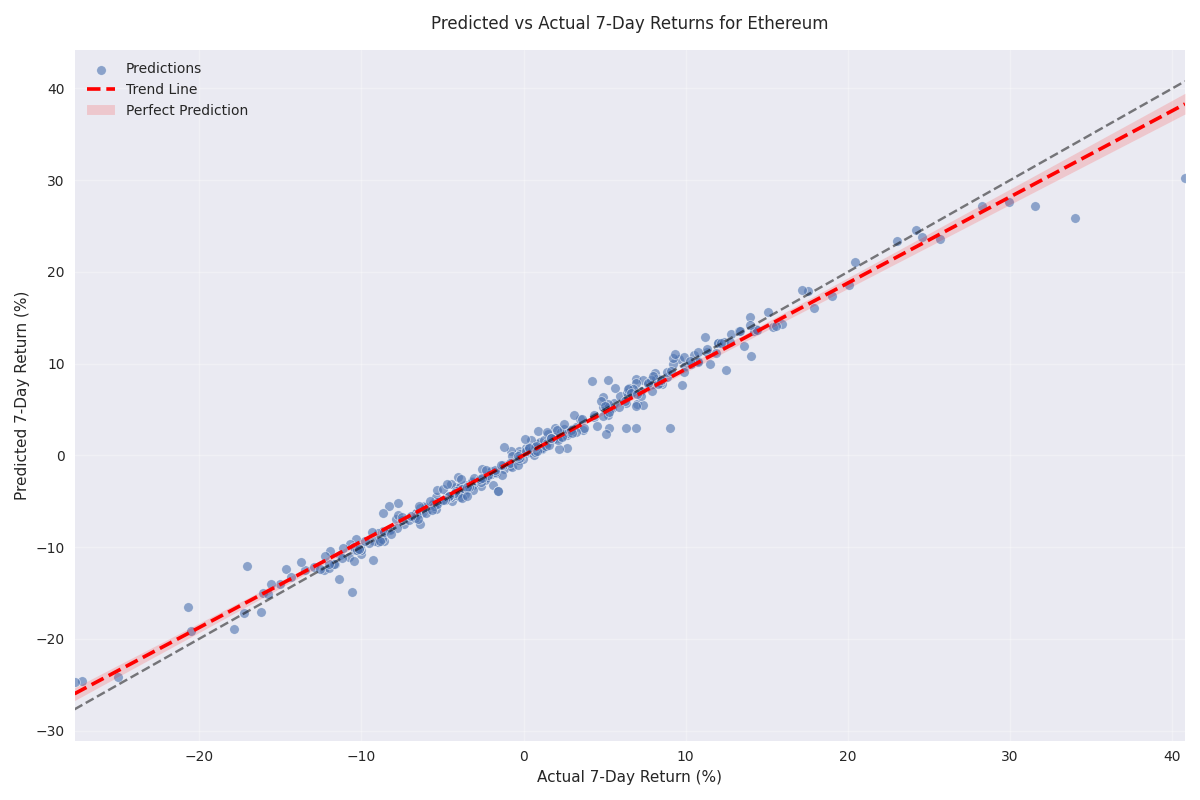

Short-term Models Signal Caution

Saving...

Short-term Models Signal Caution

Saving...

Saving...

Risk-Reward Balanced with Slight Bullish Edge

Saving...

Risk-Reward Balanced with Slight Bullish Edge

Saving...

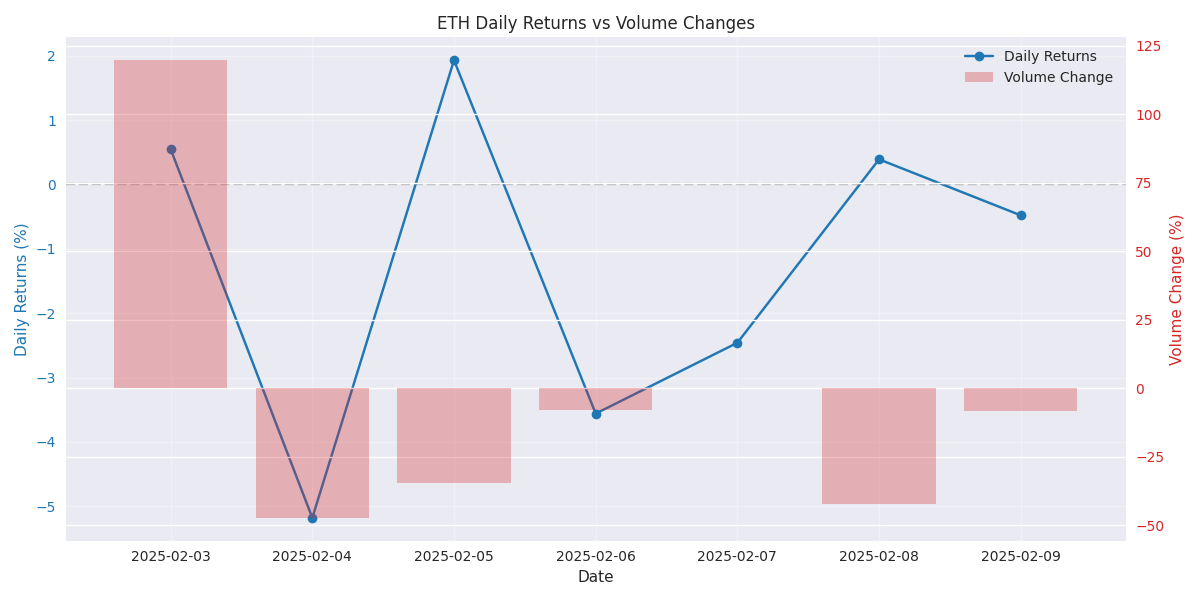

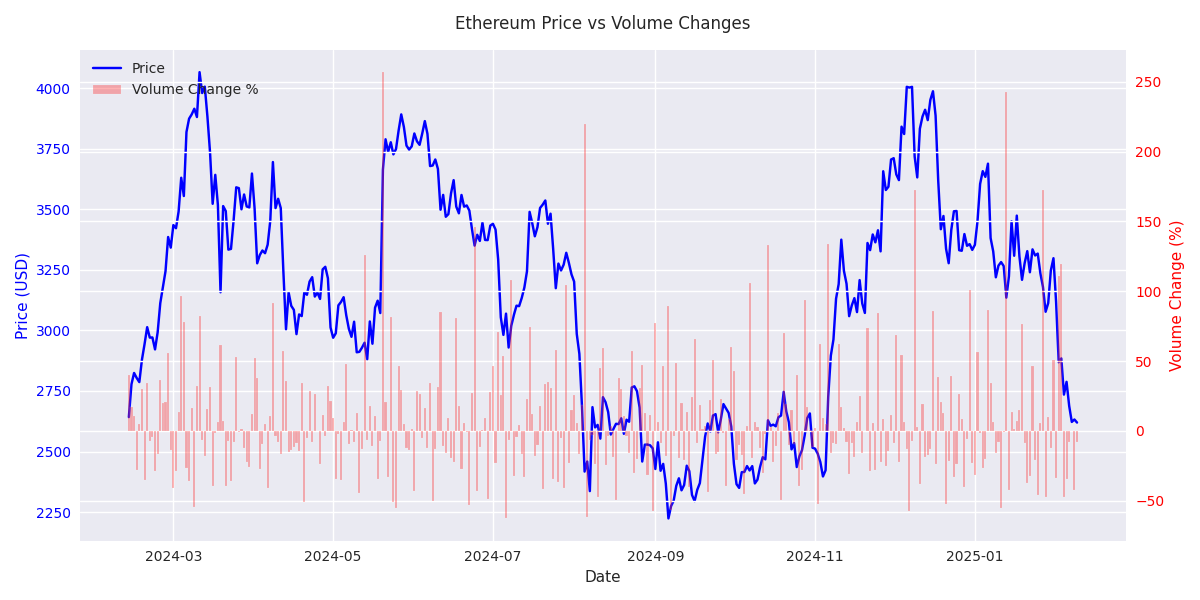

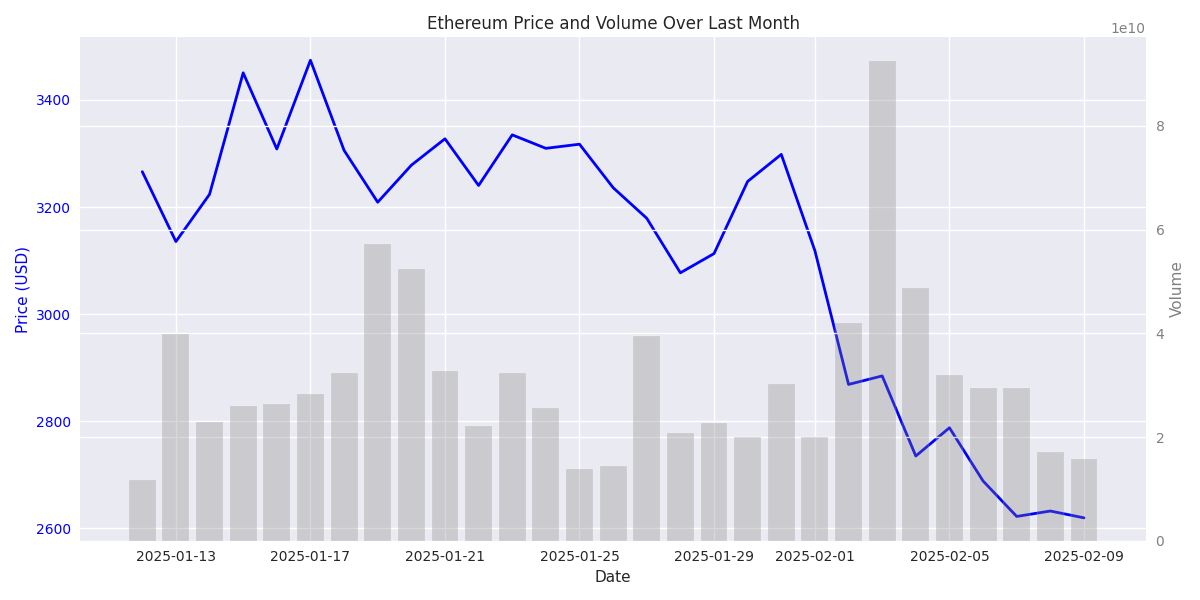

Ethereum's Recent Price Action Shows Significant Volatility and Downward Trend

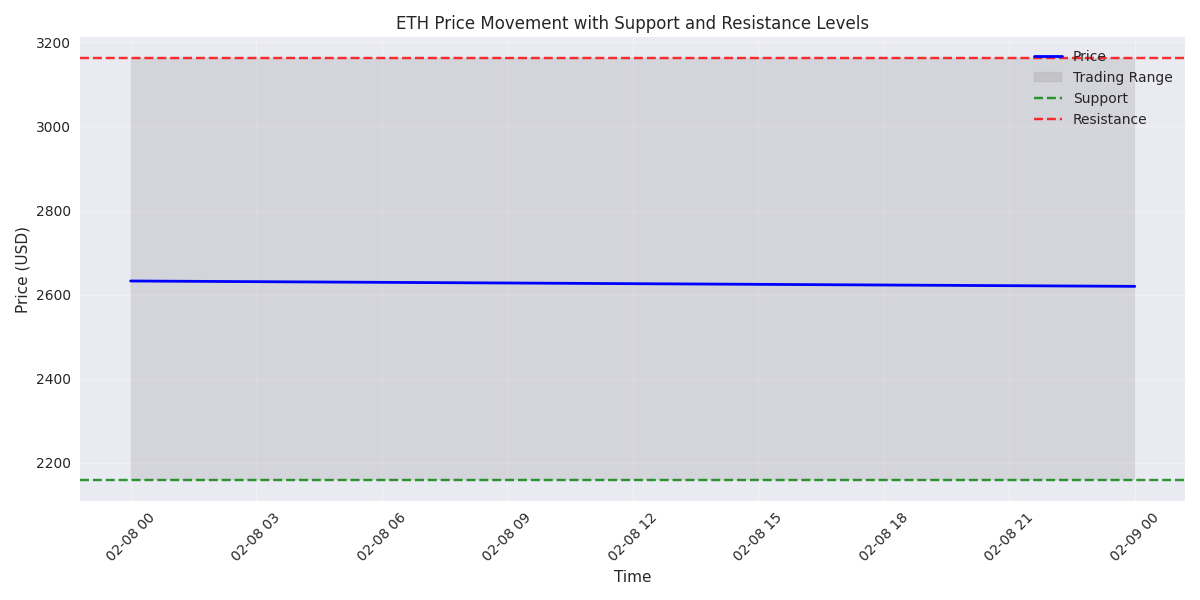

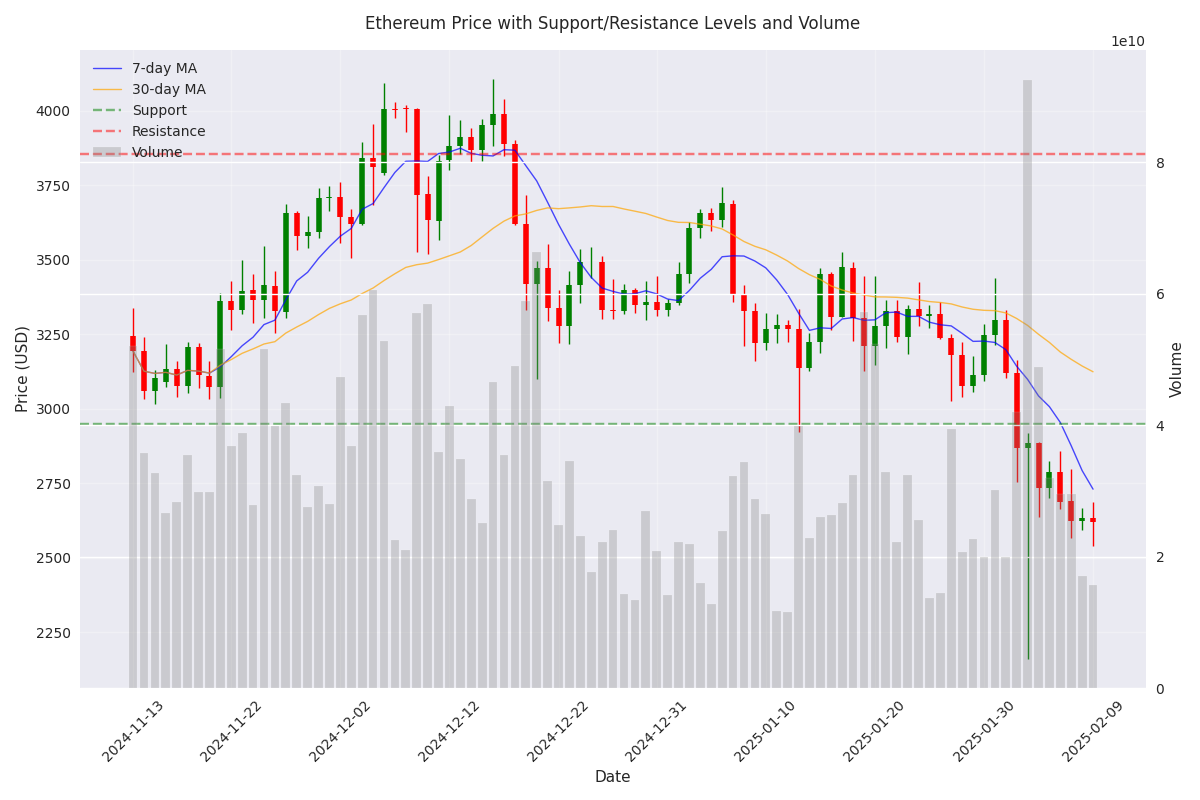

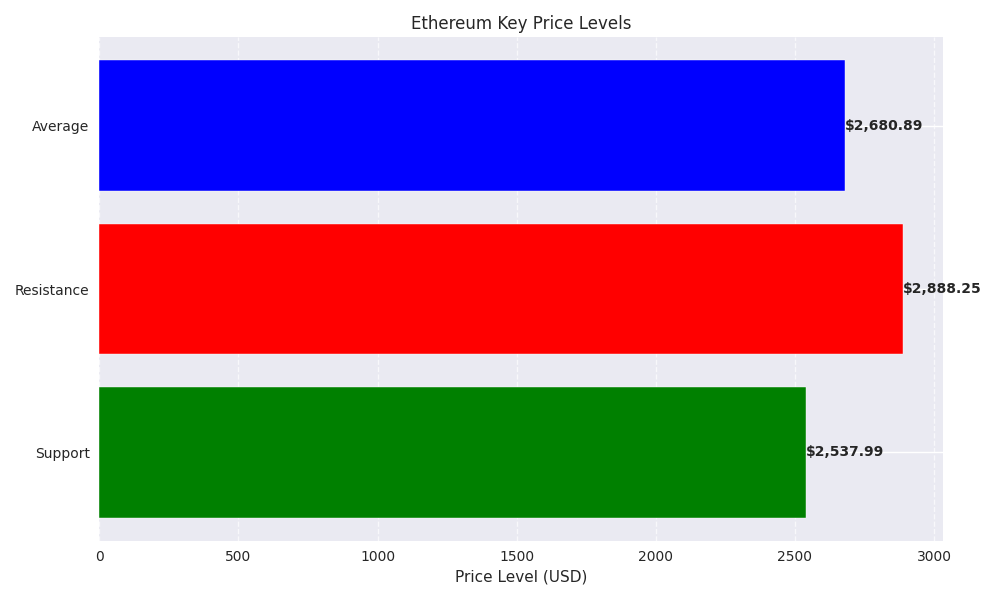

Ethereum's Key Price Levels and Market Statistics Reveal Important Trading Zones

24-Hour Market Analysis Shows Consolidation Phase

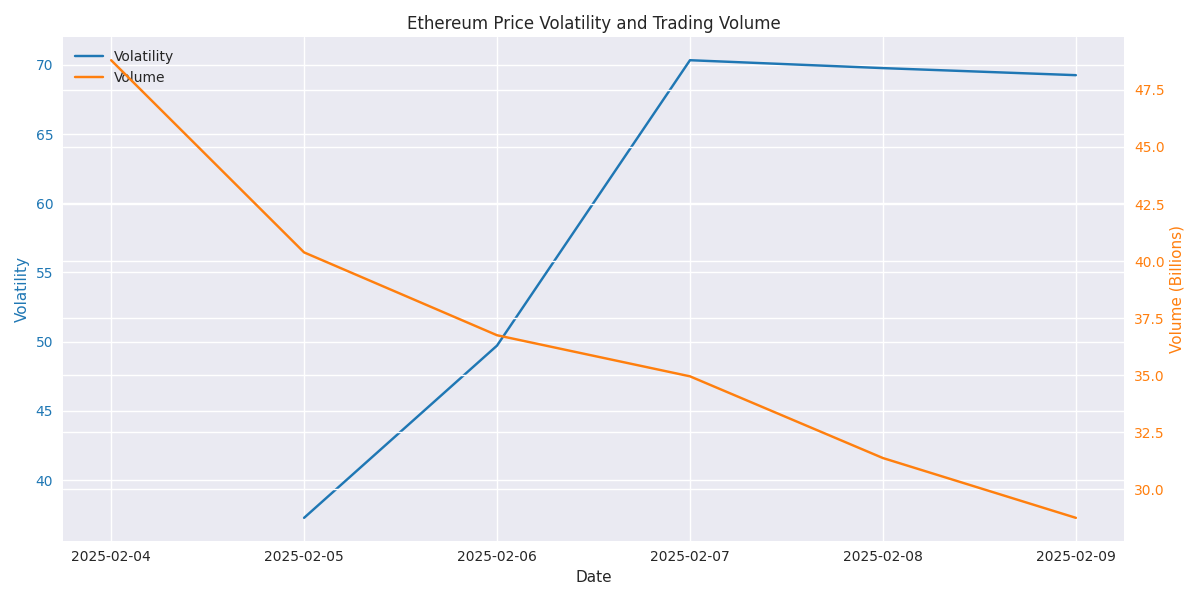

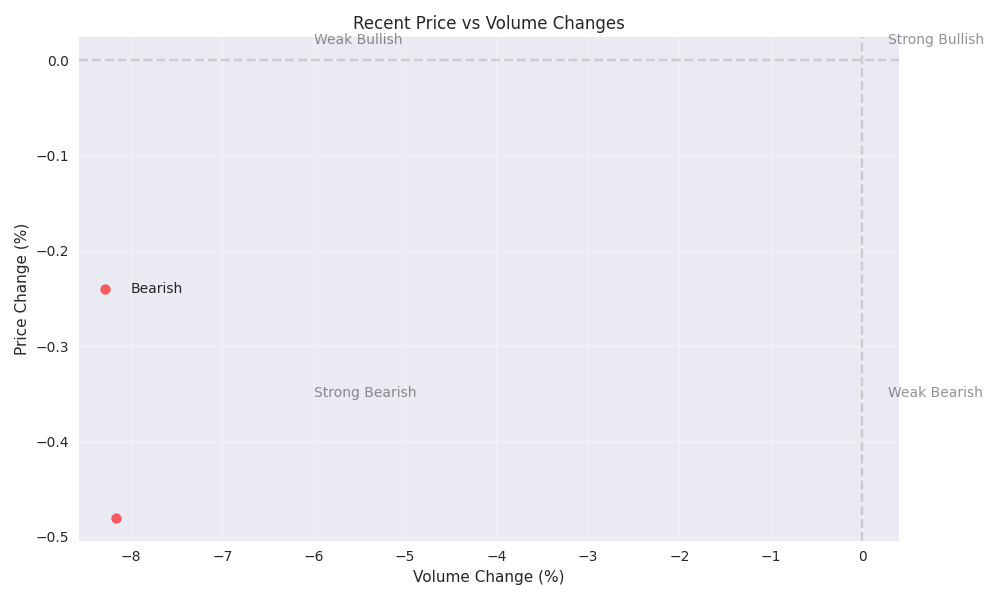

Volume Analysis Reveals Significant Trading Activity Shifts

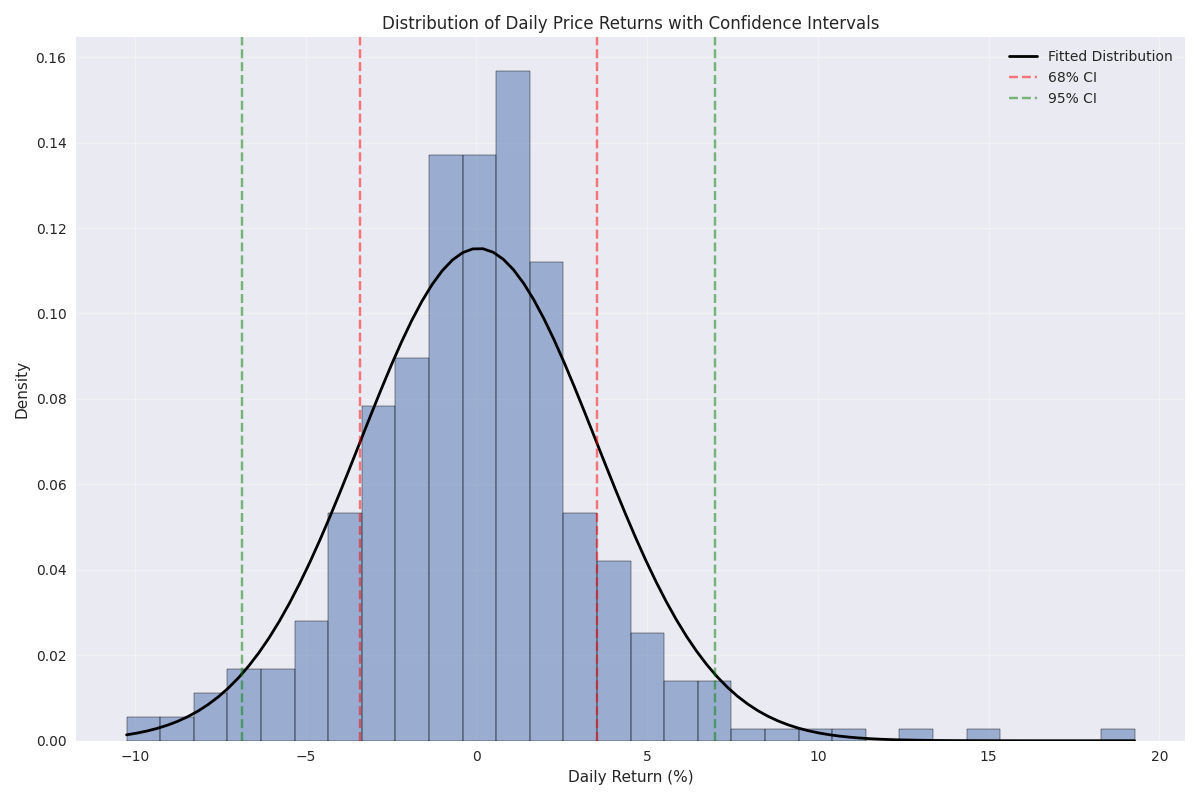

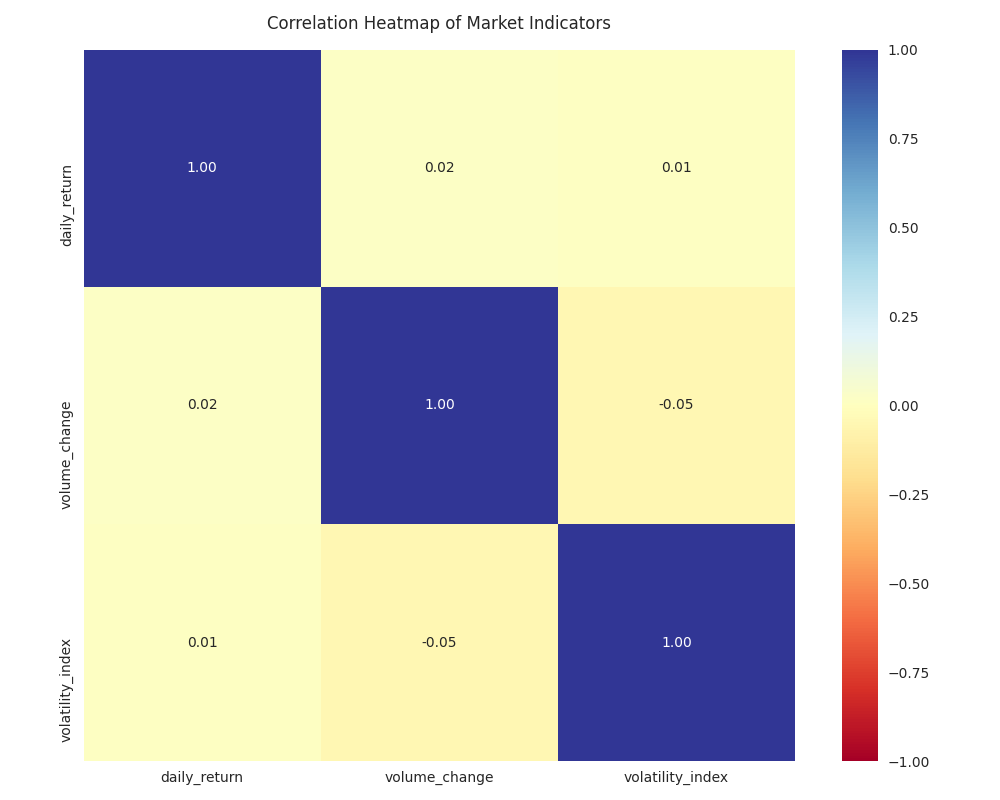

Price Volatility Analysis Shows Market Stabilization Trend

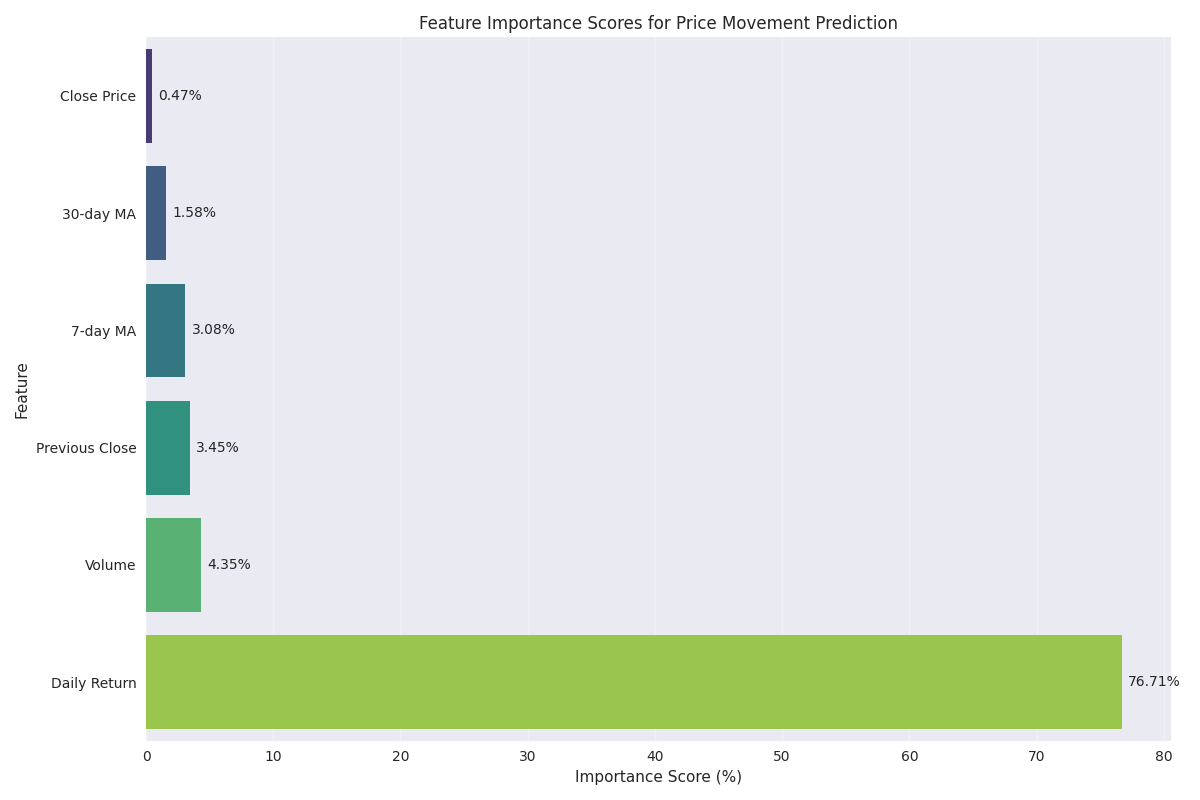

Short-term Ethereum Price Movement Analysis

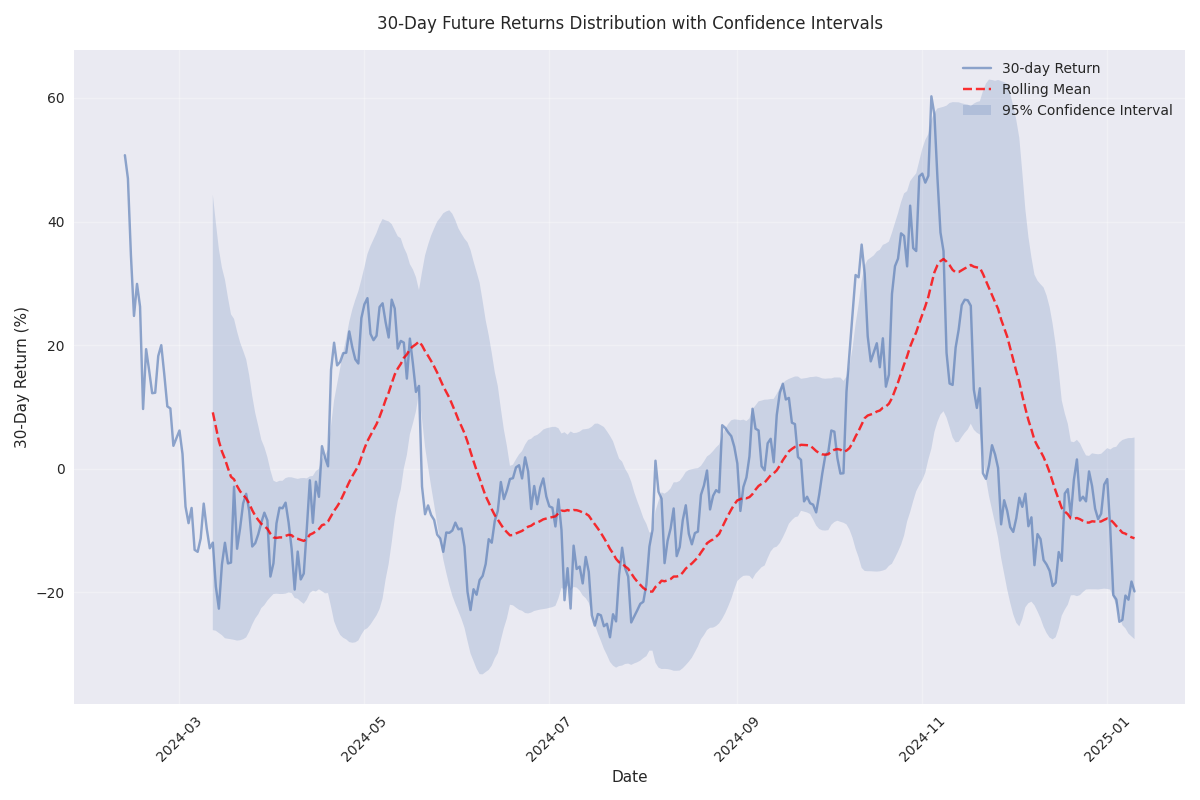

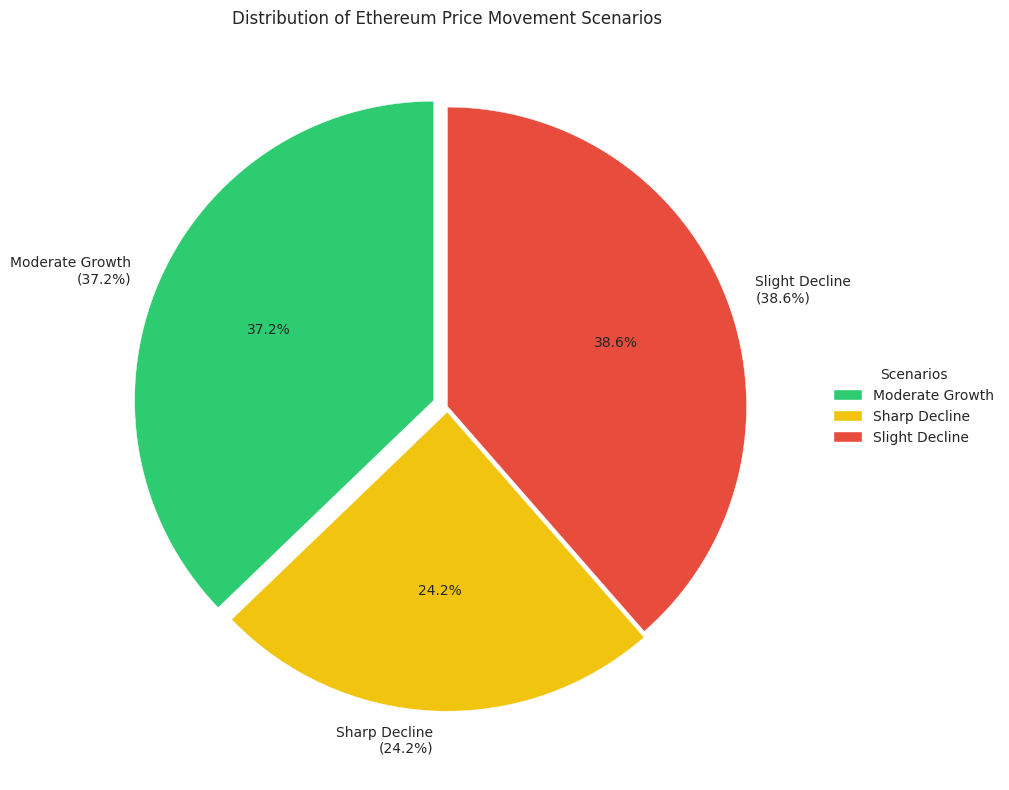

Medium-Term Ethereum Price Outlook and Risk Analysis

Key Factors Driving Ethereum Price Movements

Probability Analysis of Ethereum Price Scenarios