Corn Market Decoded: Traders' Quick Guide to Navigating Price Volatility

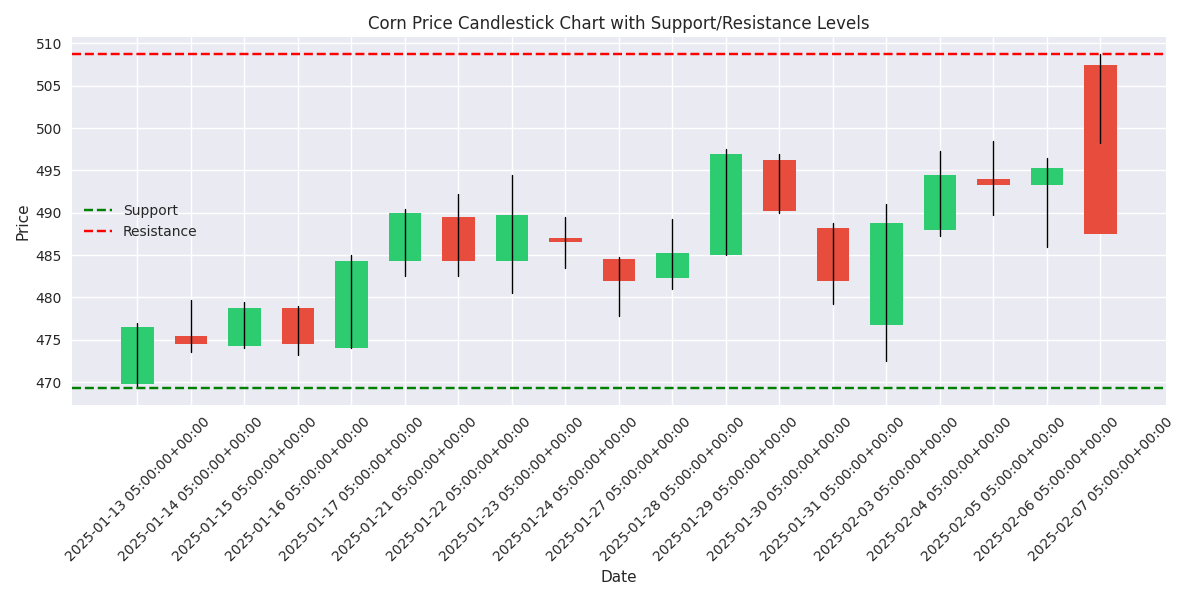

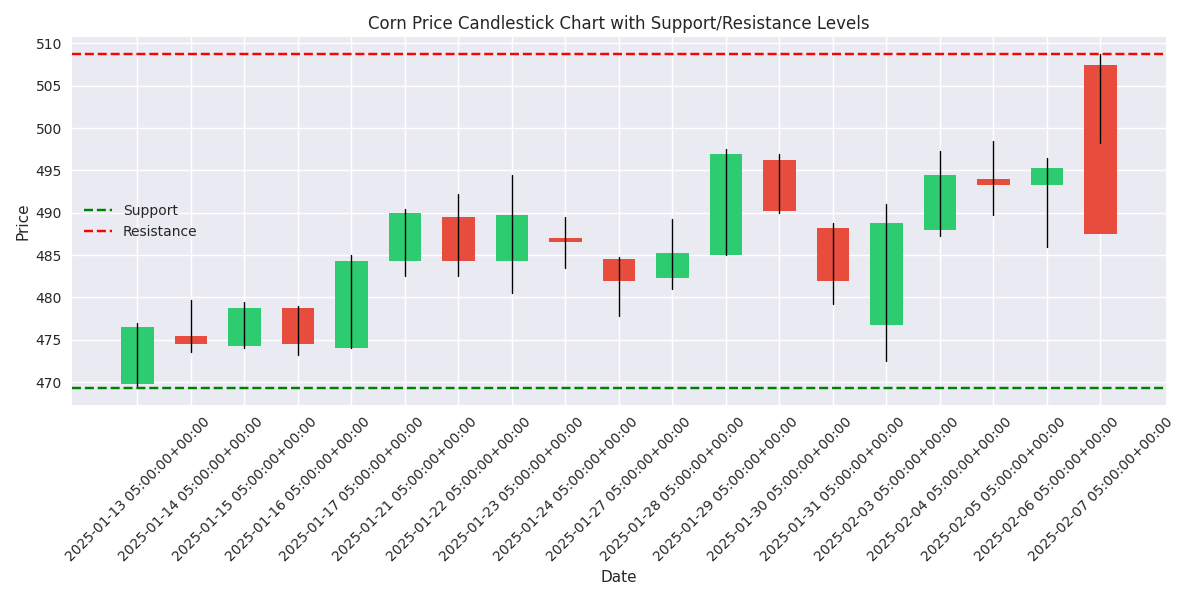

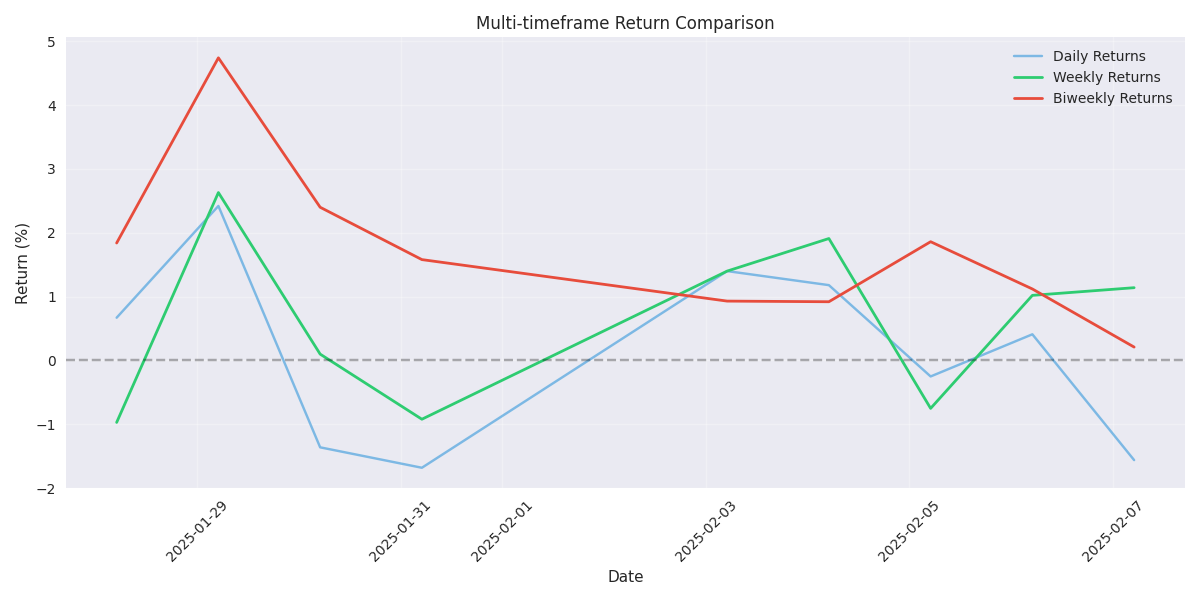

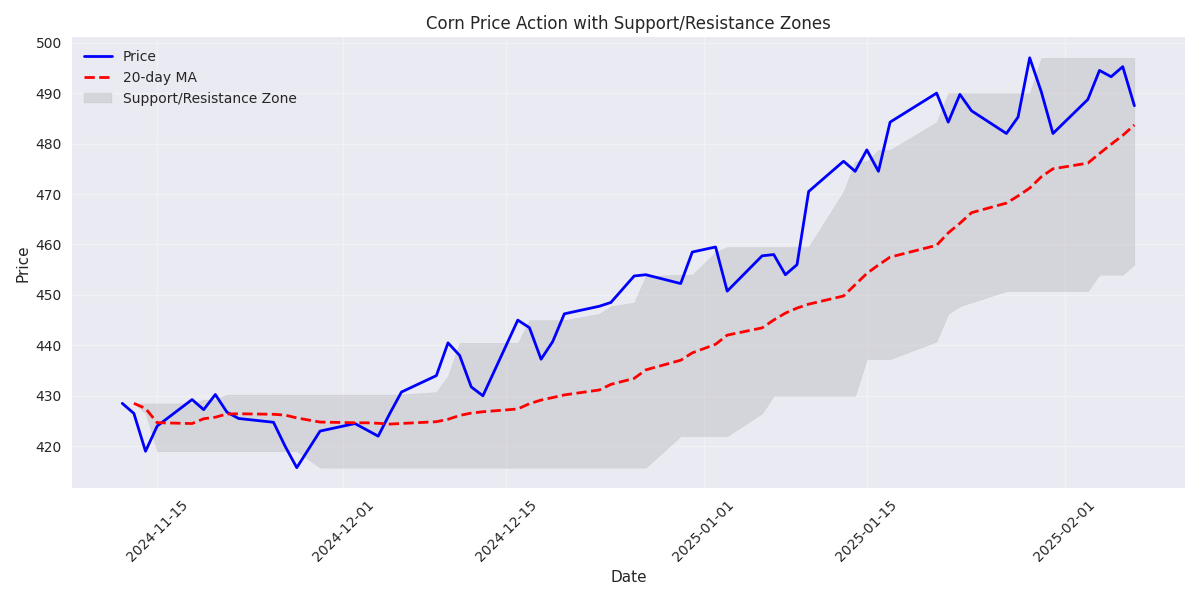

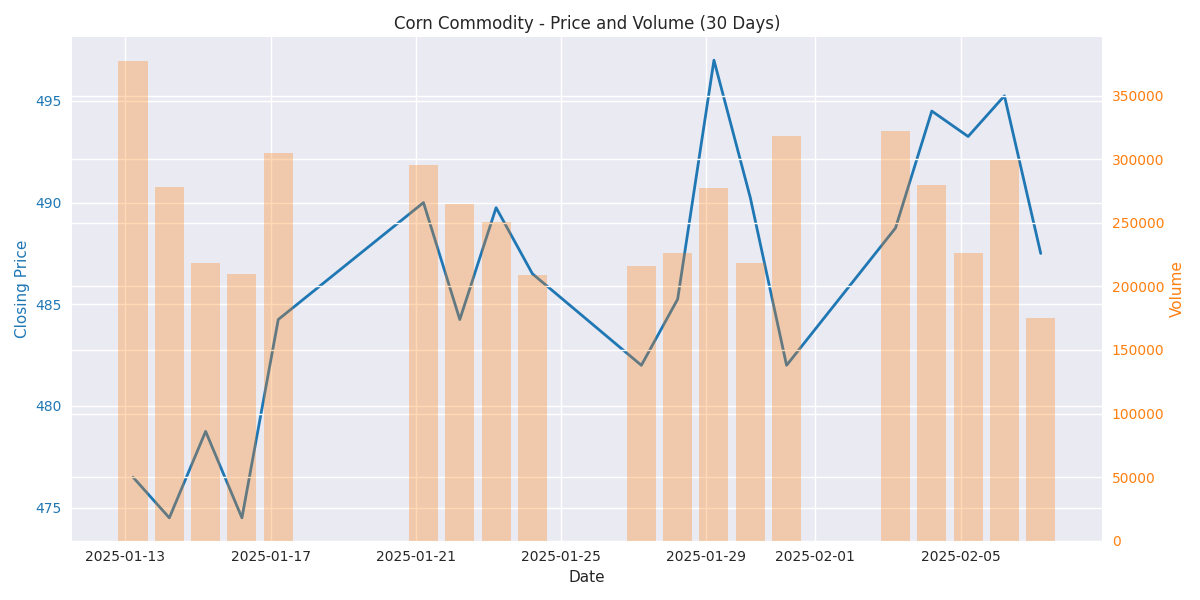

Recent Corn Price Analysis Shows Mixed Market Sentiment with Notable Volatility

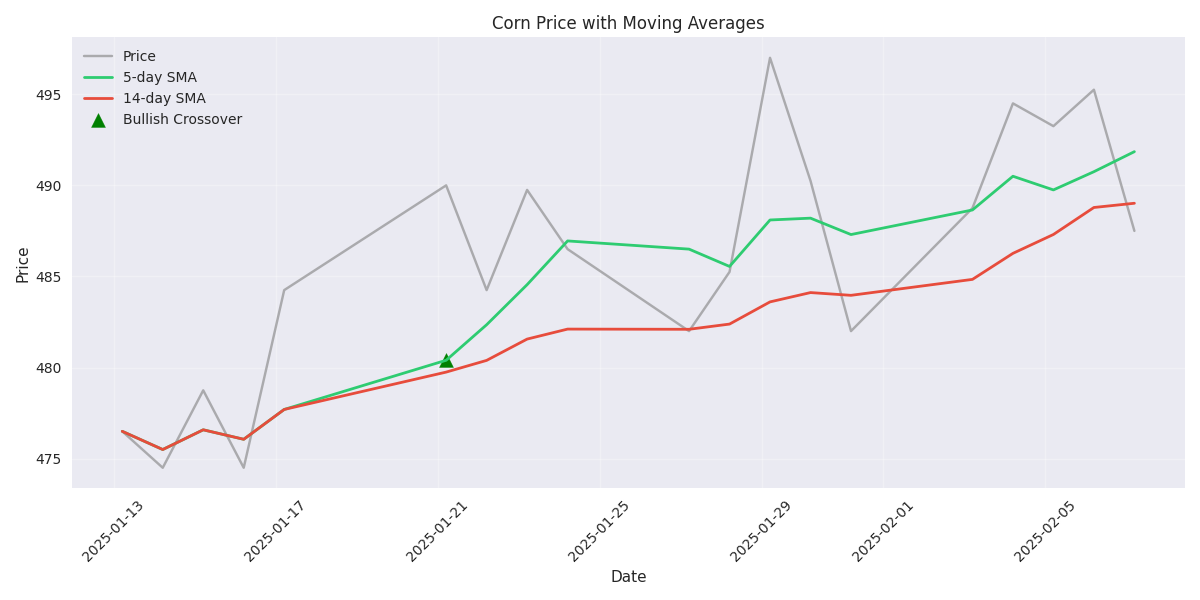

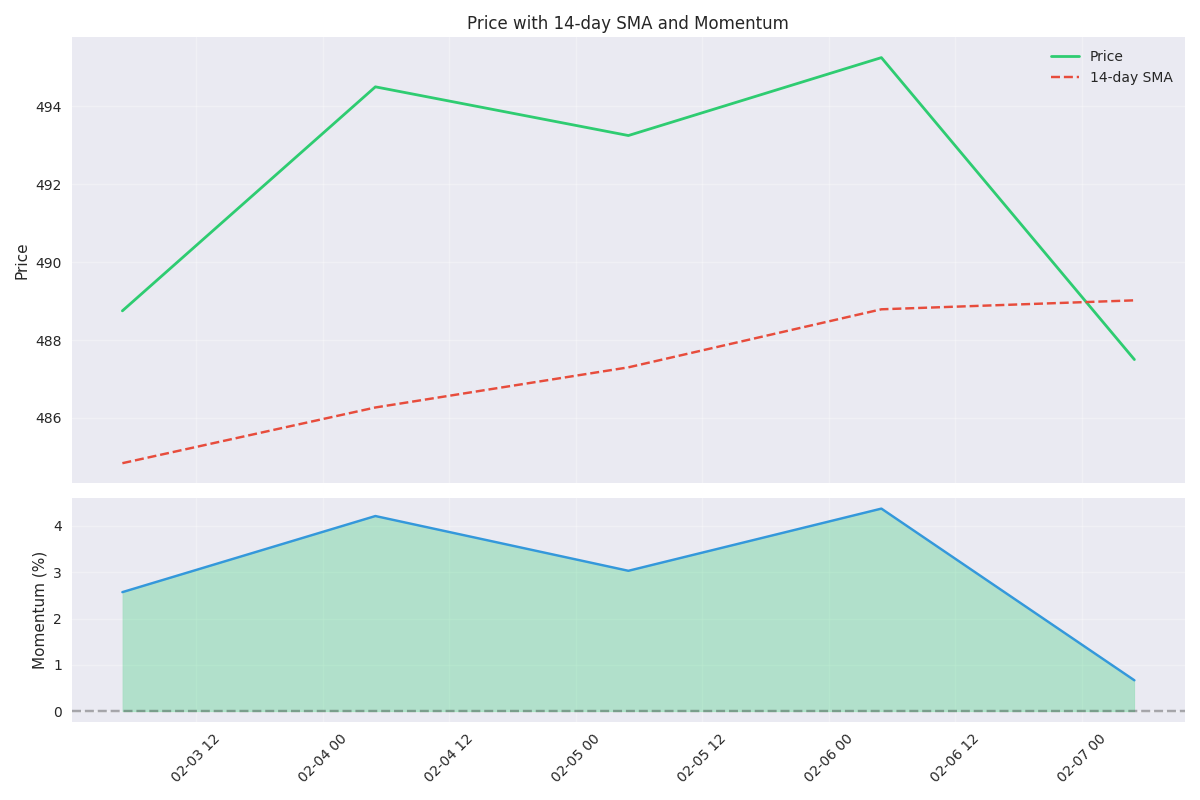

Technical Analysis Reveals Bullish Momentum Despite Recent Price Decline

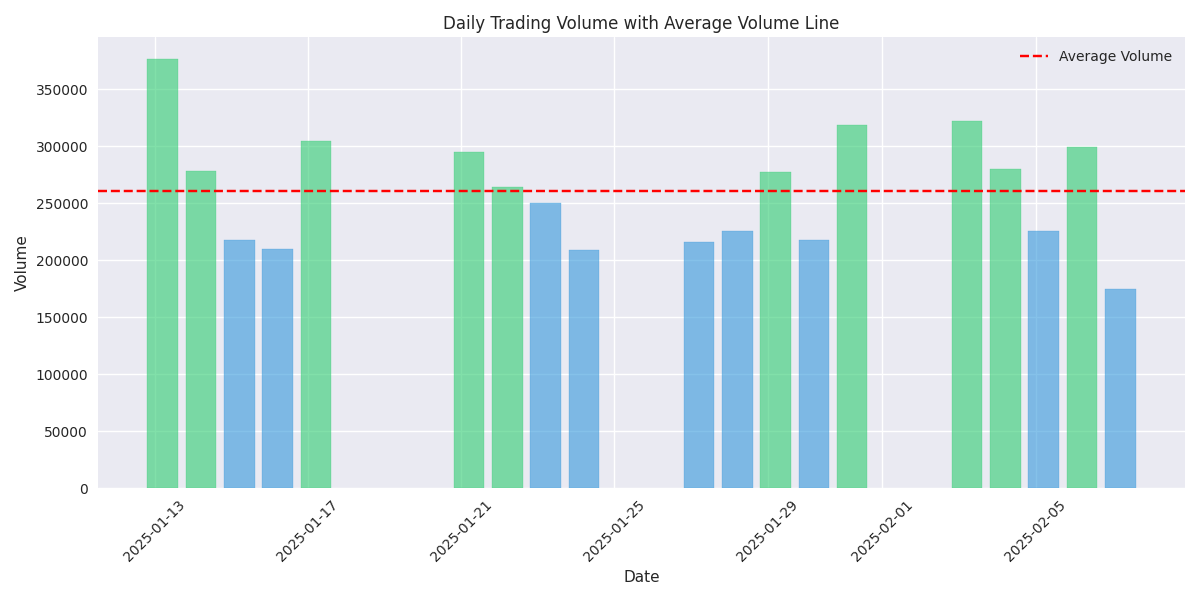

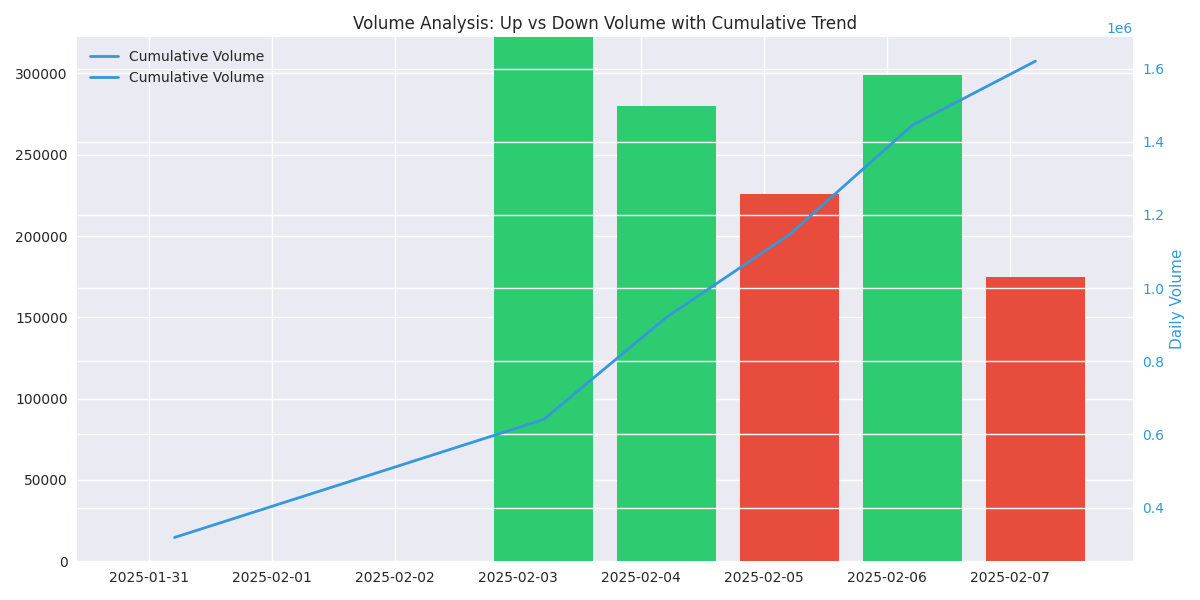

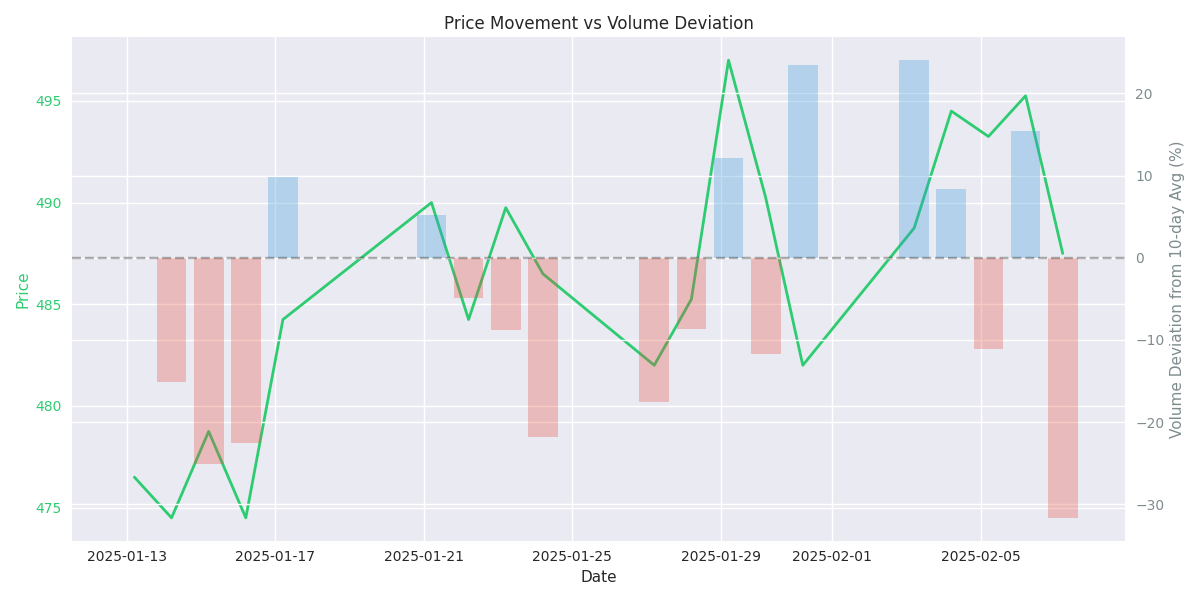

Volume Analysis Reveals Shifting Market Dynamics and Potential Price Support

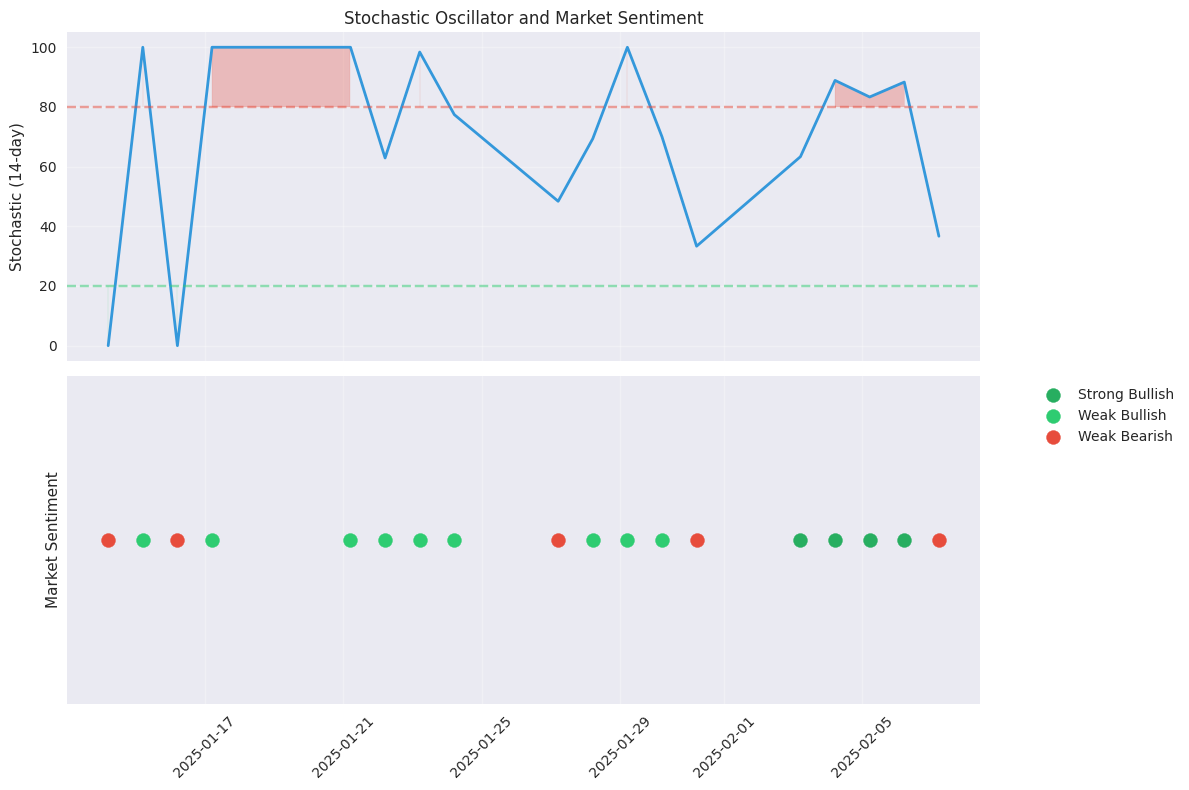

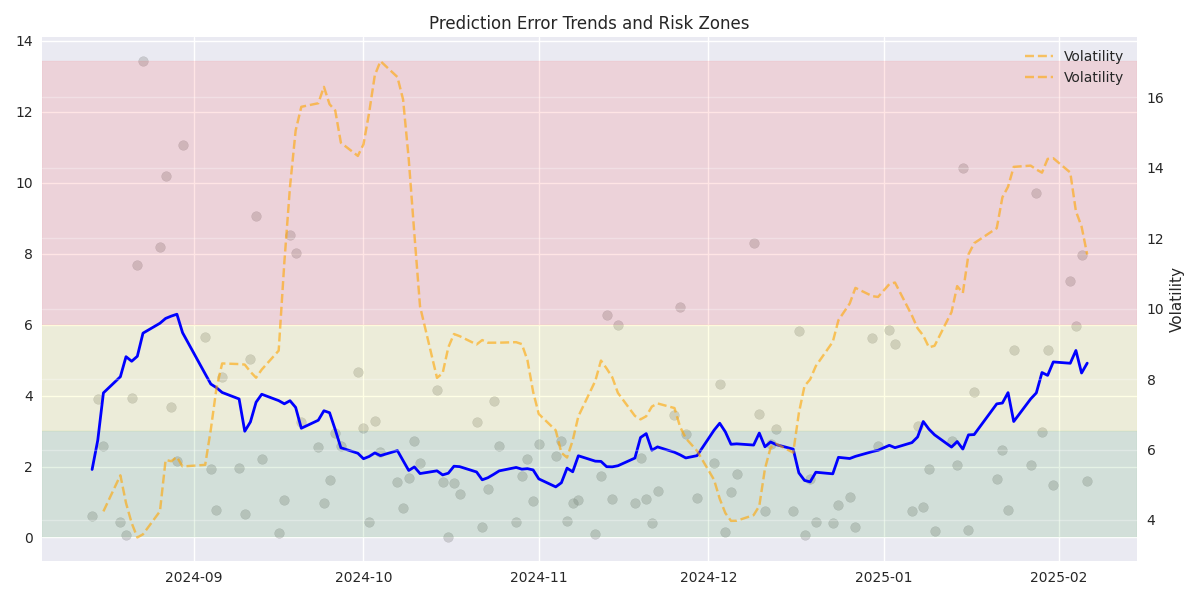

Market Momentum Analysis Shows Potential Shift in Trend

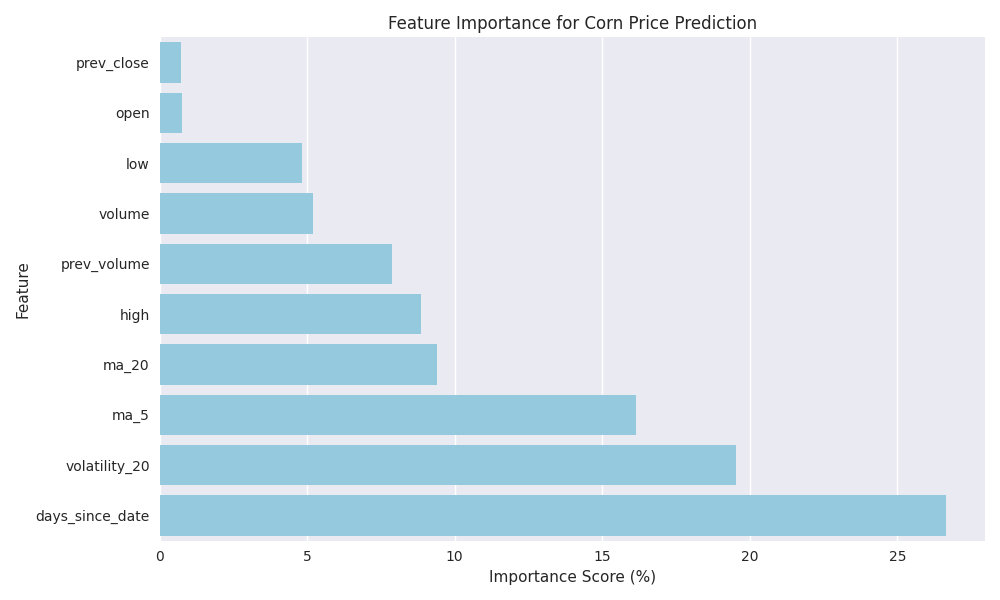

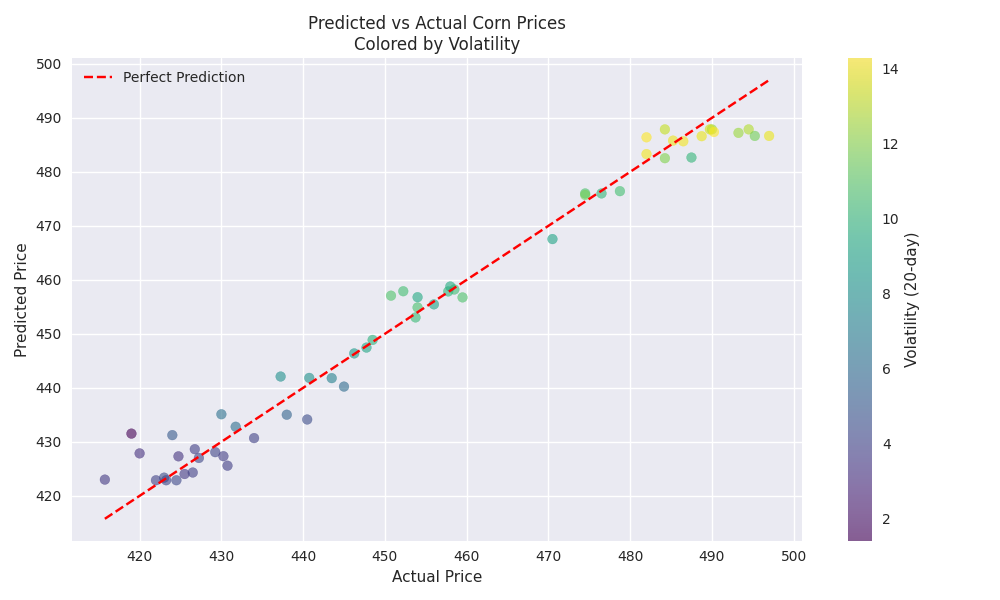

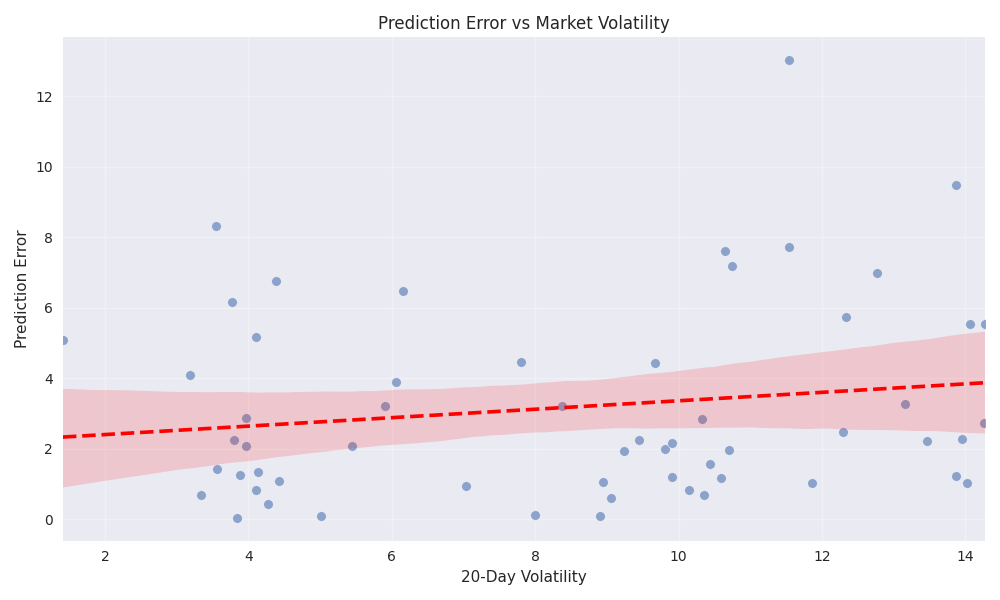

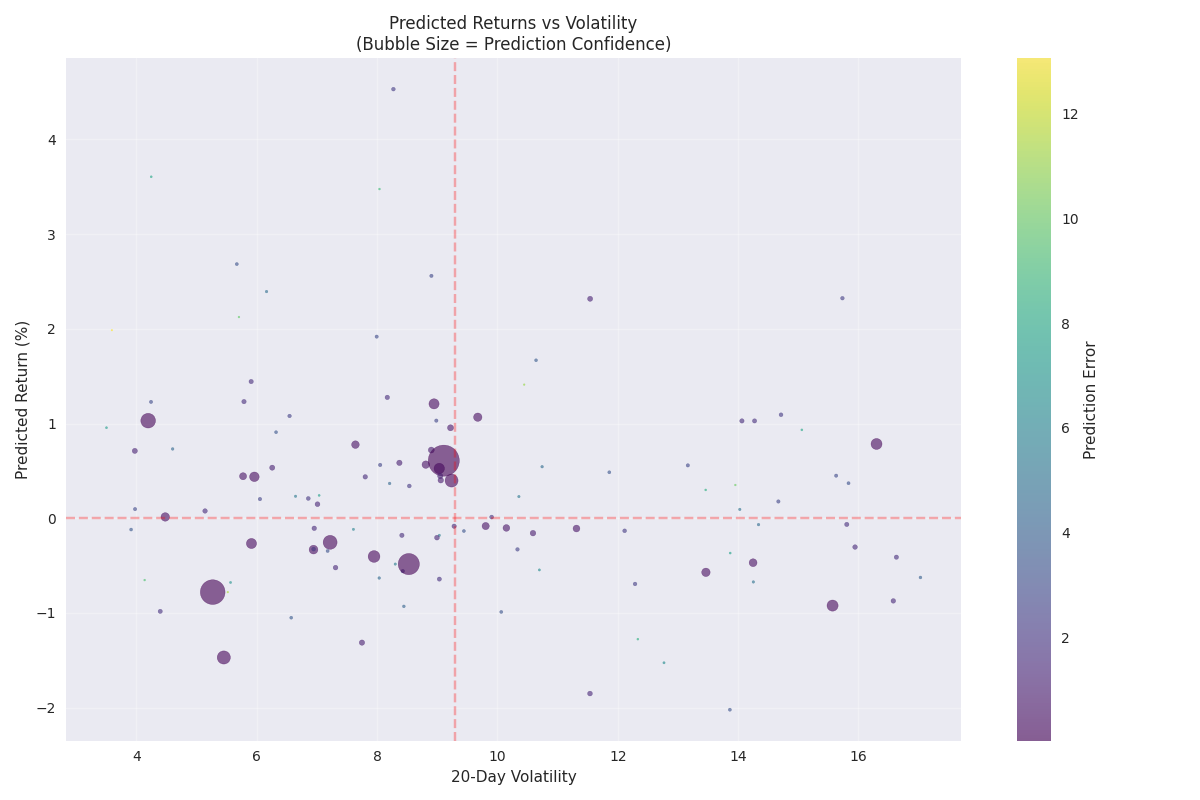

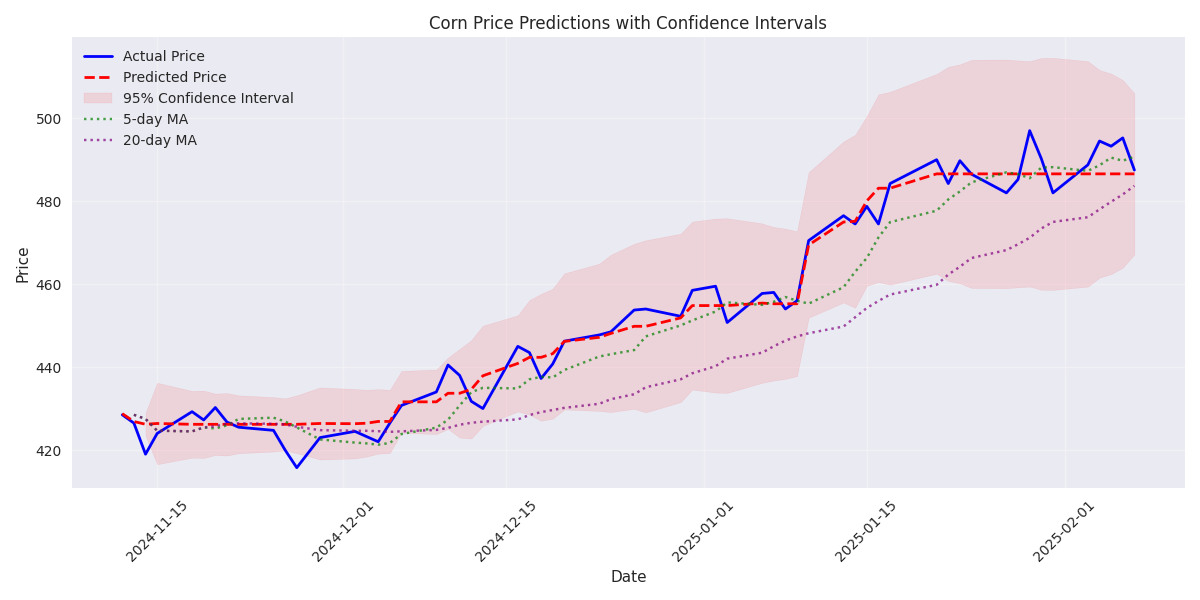

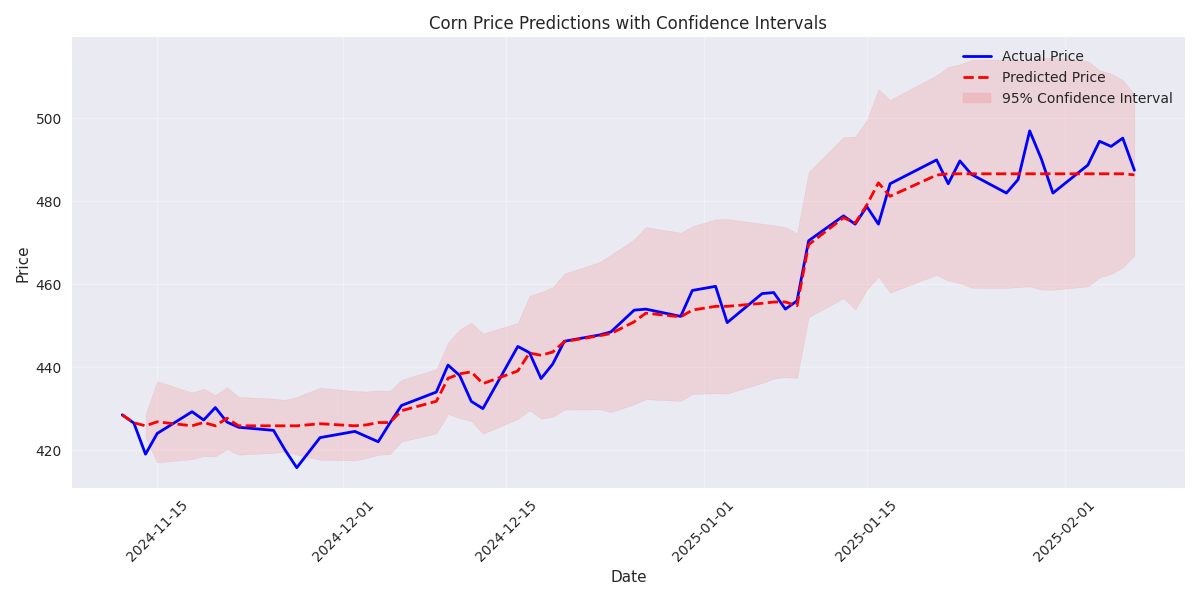

Initial Corn Price Prediction Model Shows Strong Performance with Key Technical Indicators

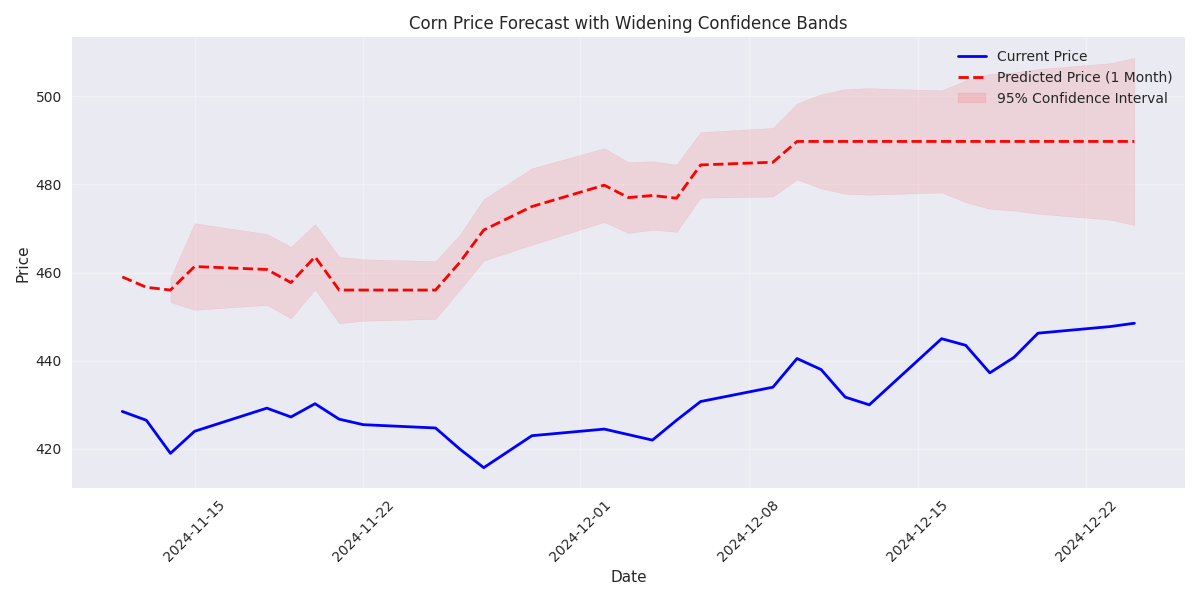

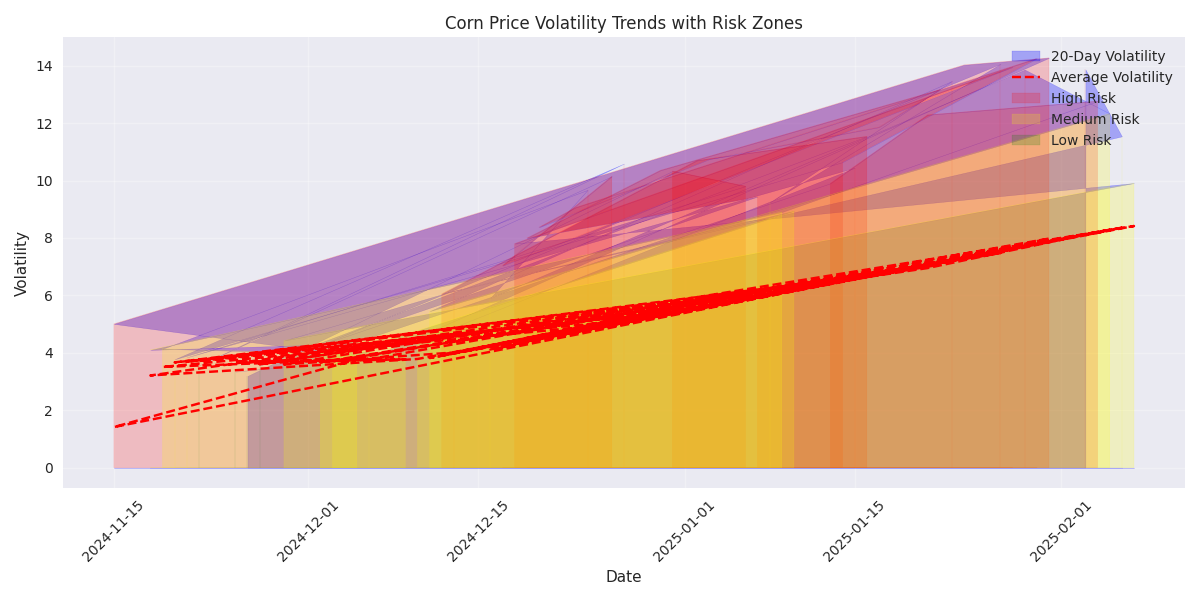

Multi-Horizon Corn Price Predictions Show Increasing Uncertainty

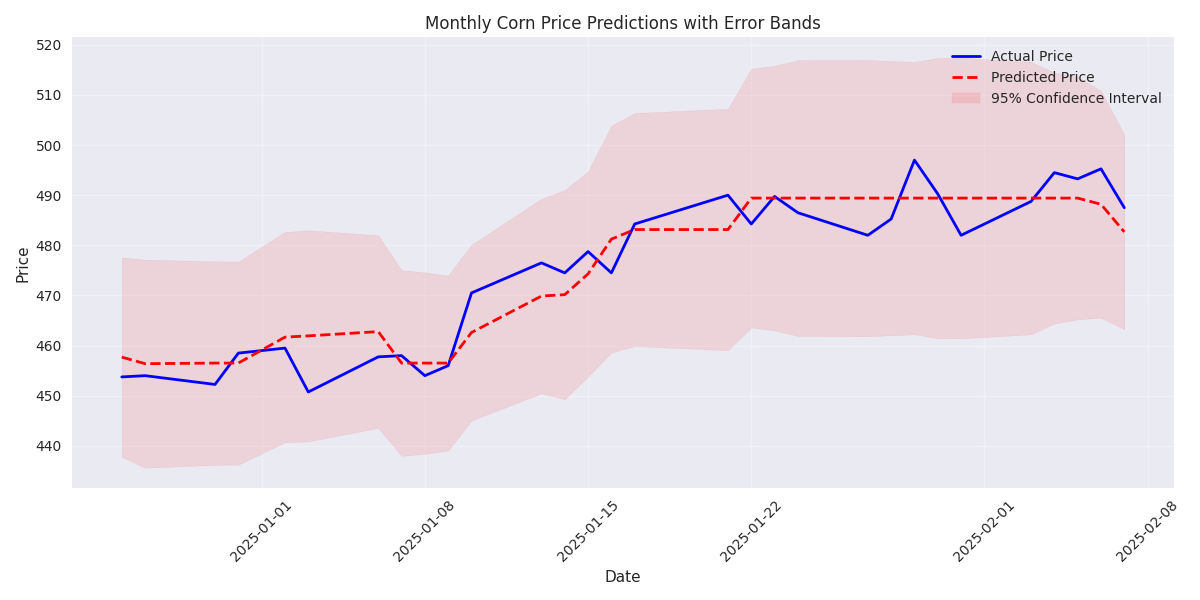

Monthly Corn Price Forecasts Show Stable Trend with Moderate Volatility

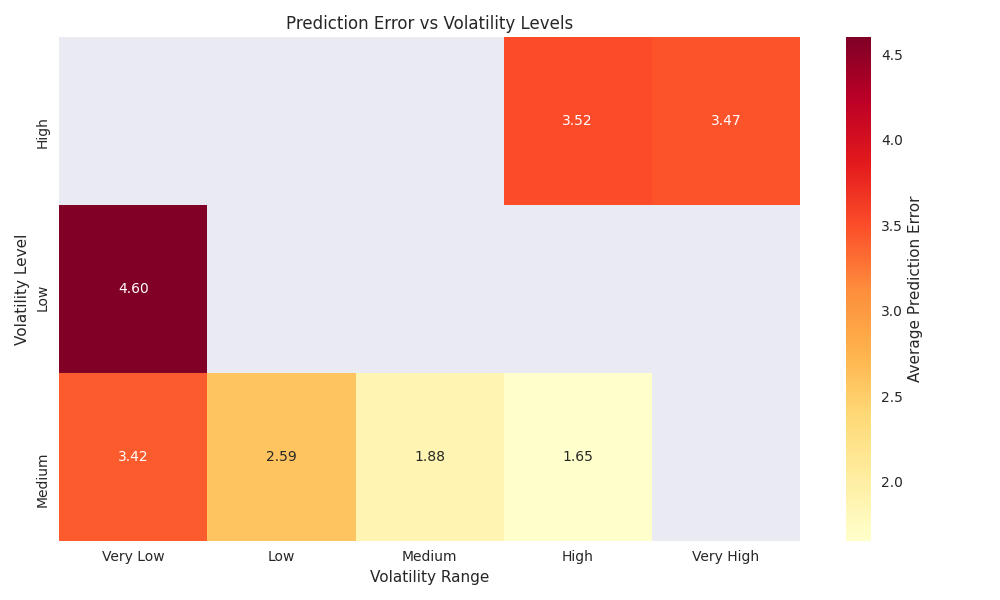

Corn Price Predictions Show High Accuracy with Key Risk Patterns

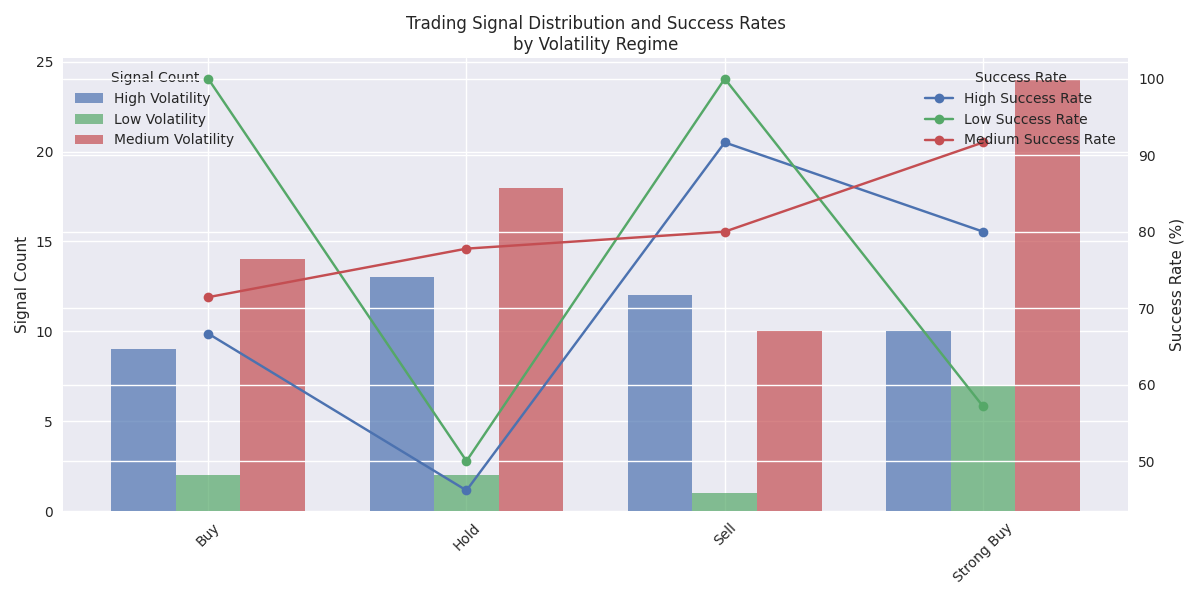

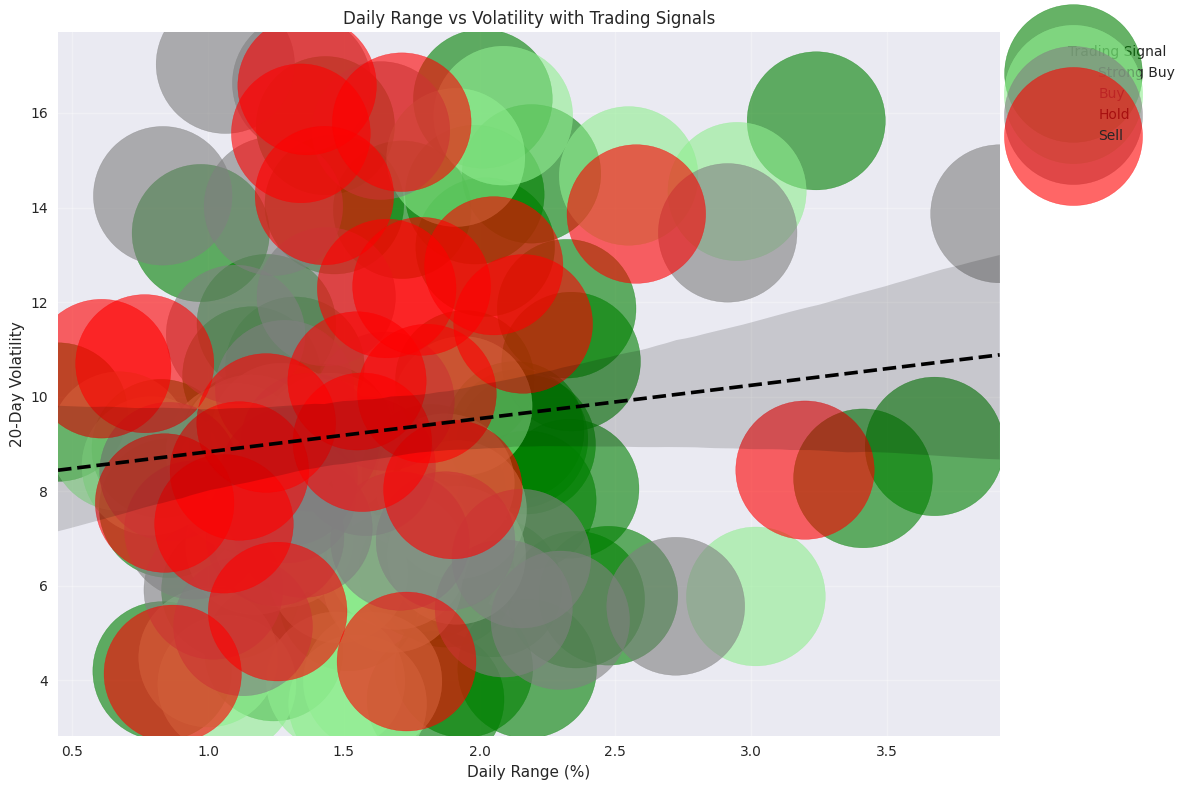

Trading Signals Analysis Reveals Optimal Market Entry Points