Breaking Down the USD/BRL: Urgent Trading Signals for Savvy Investors

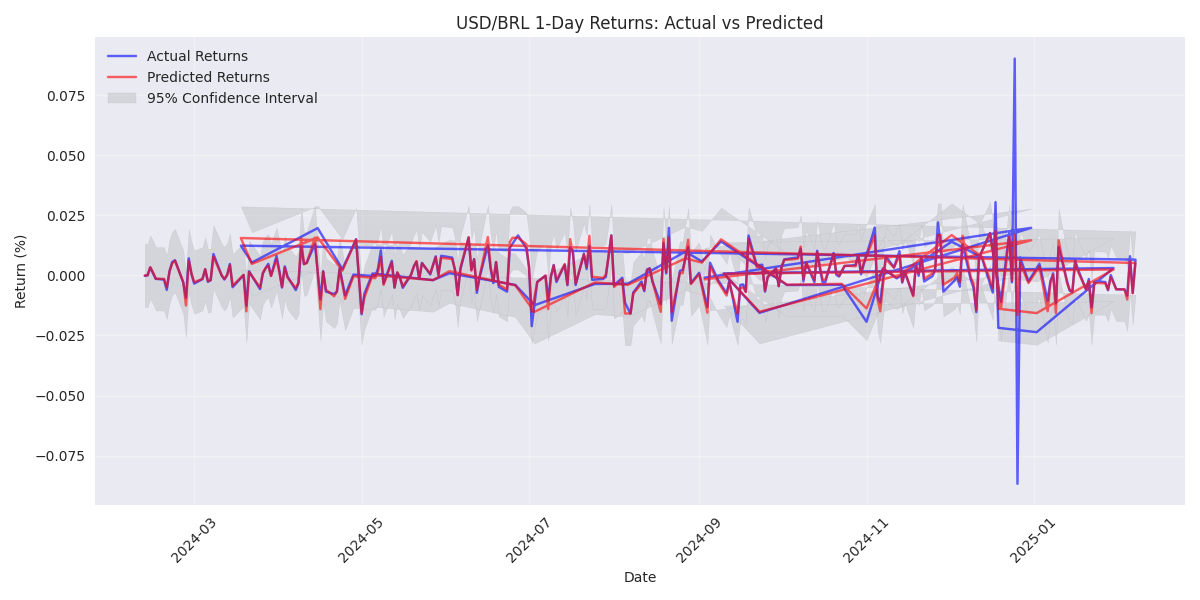

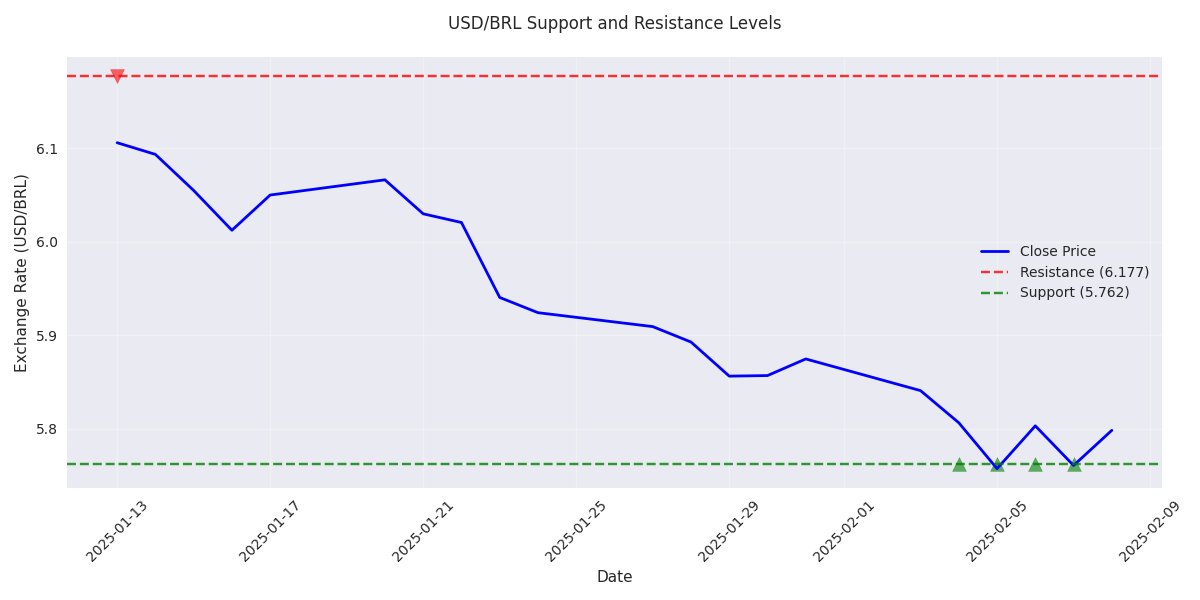

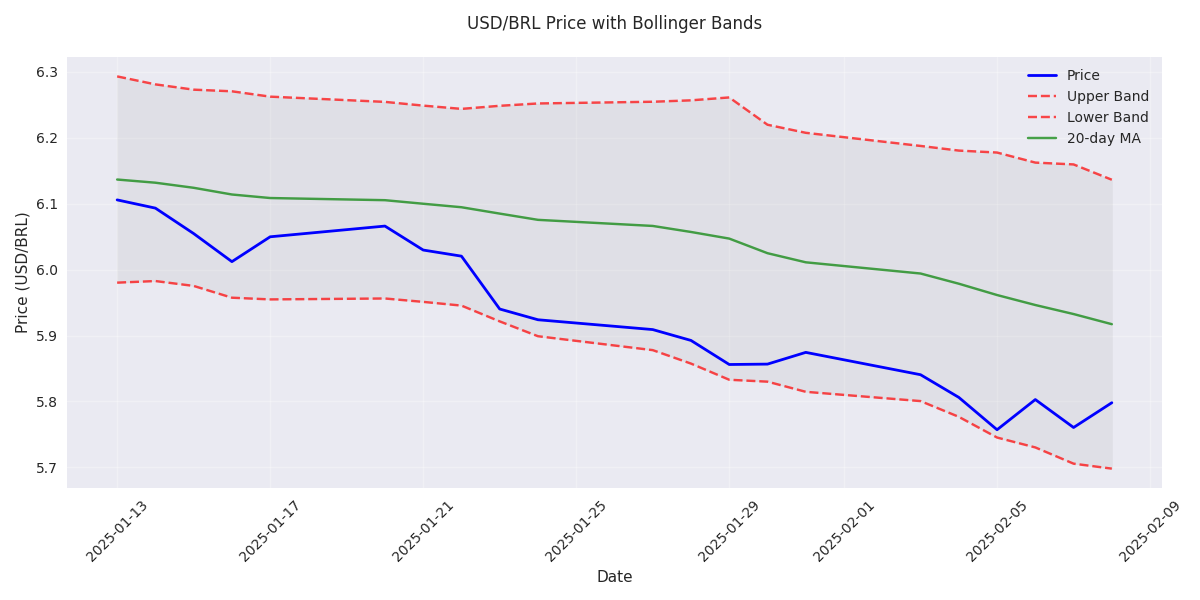

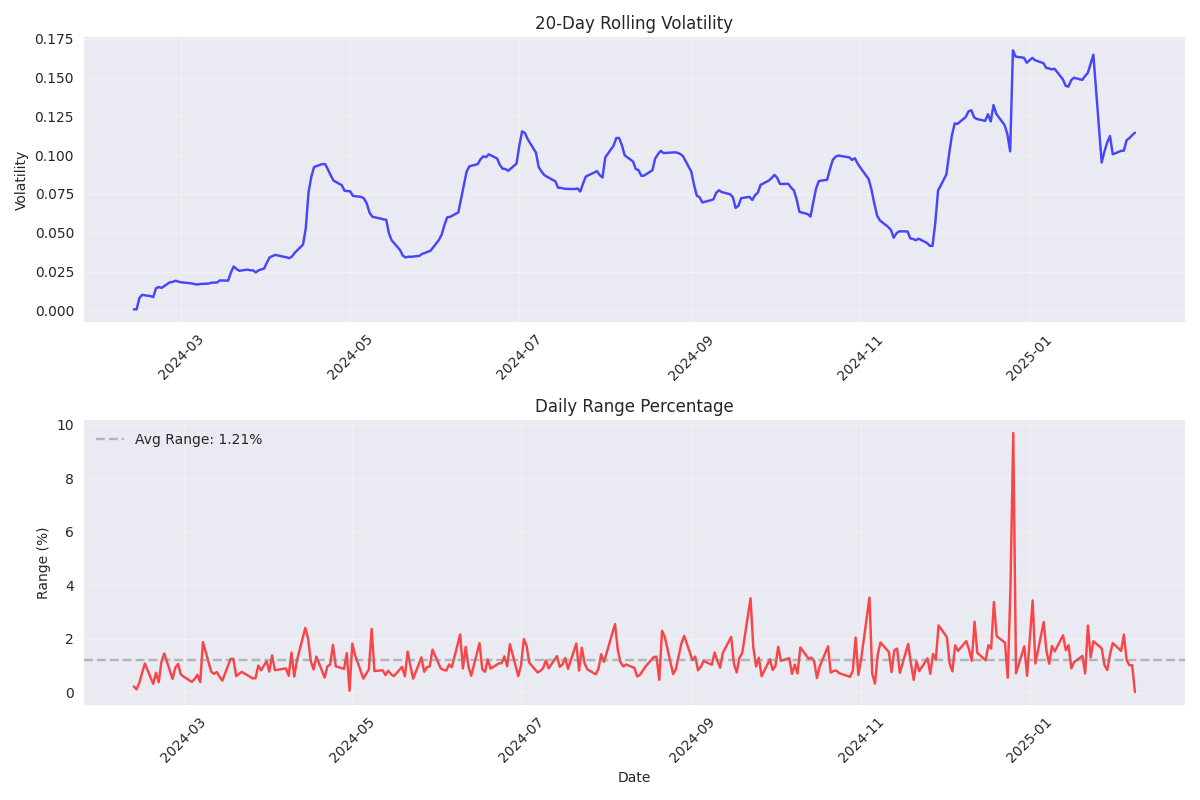

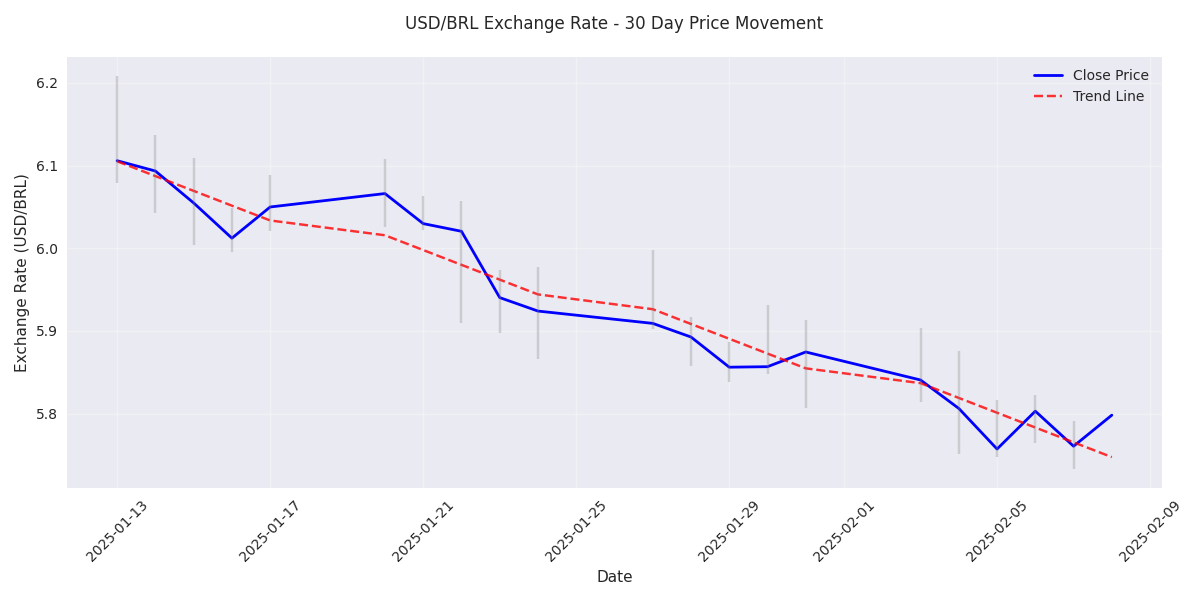

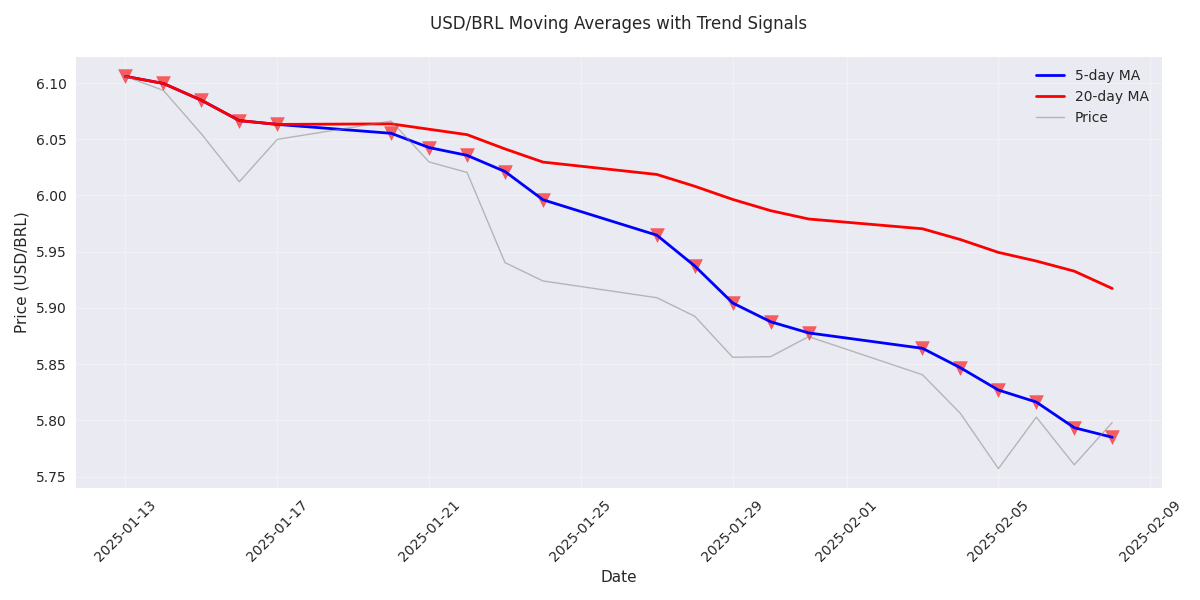

USD/BRL Shows Downward Trend with Decreasing Volatility

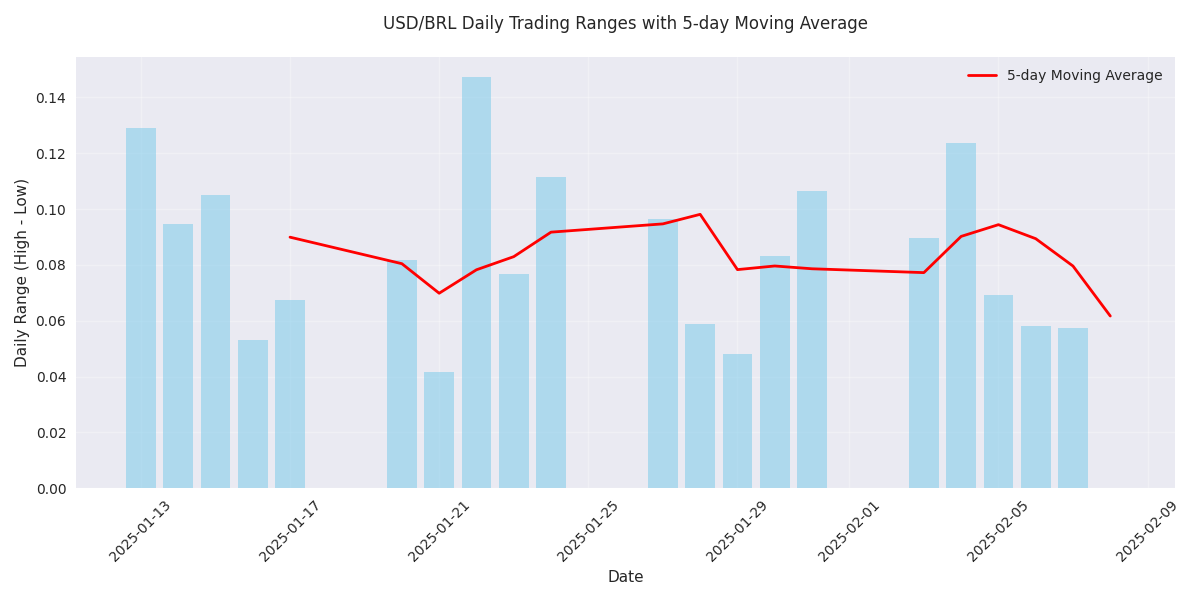

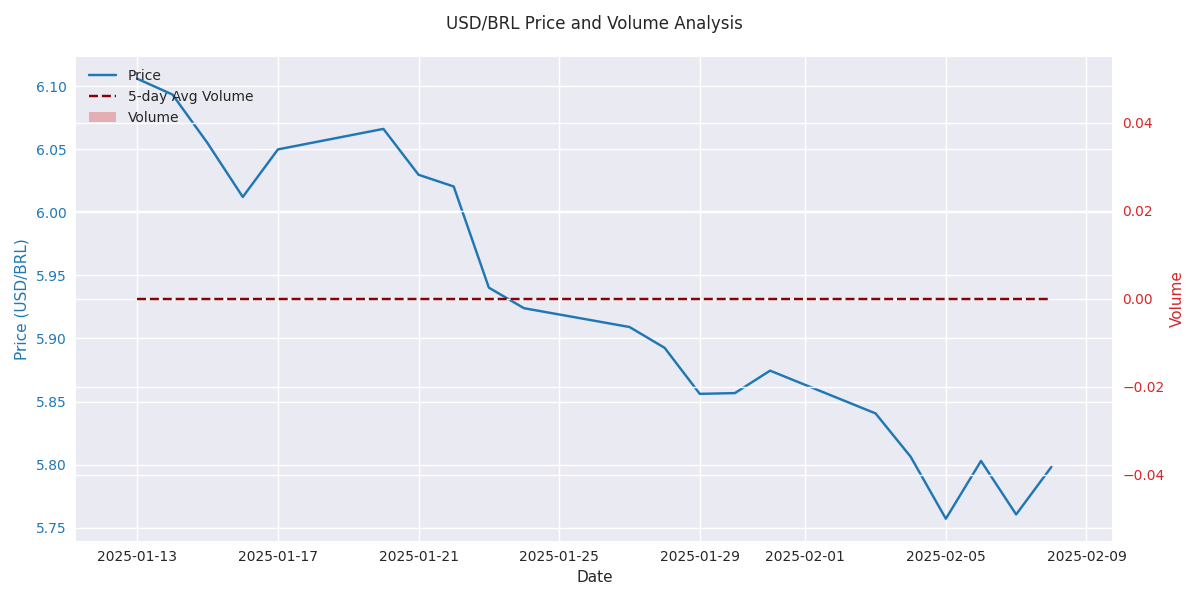

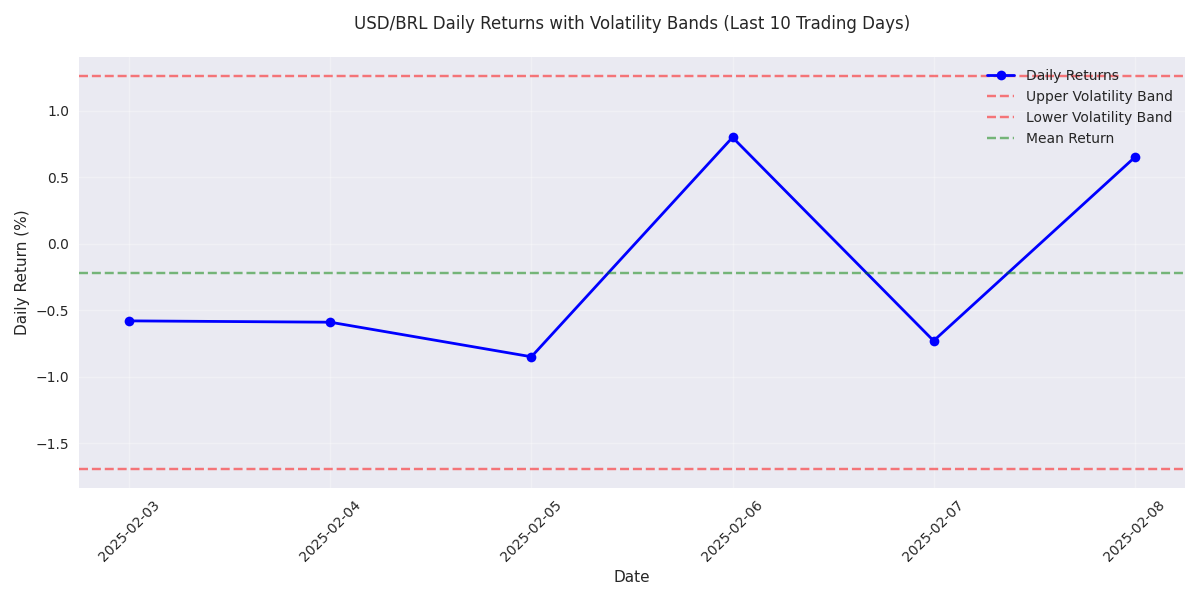

Recent Market Activity Shows Increased Price Swings with Low Volume

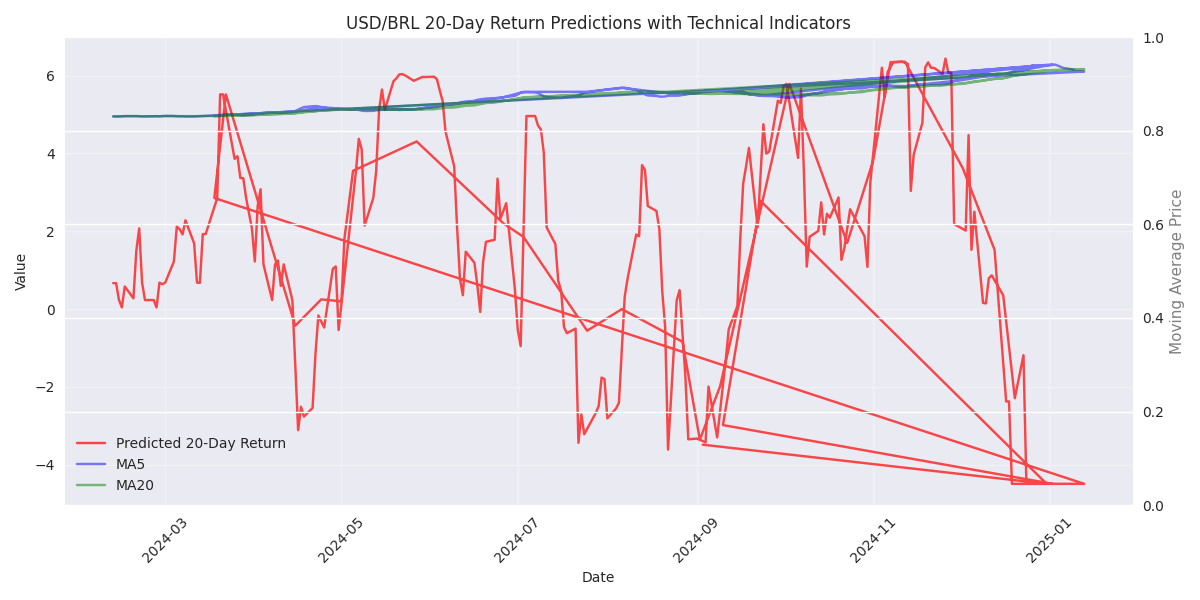

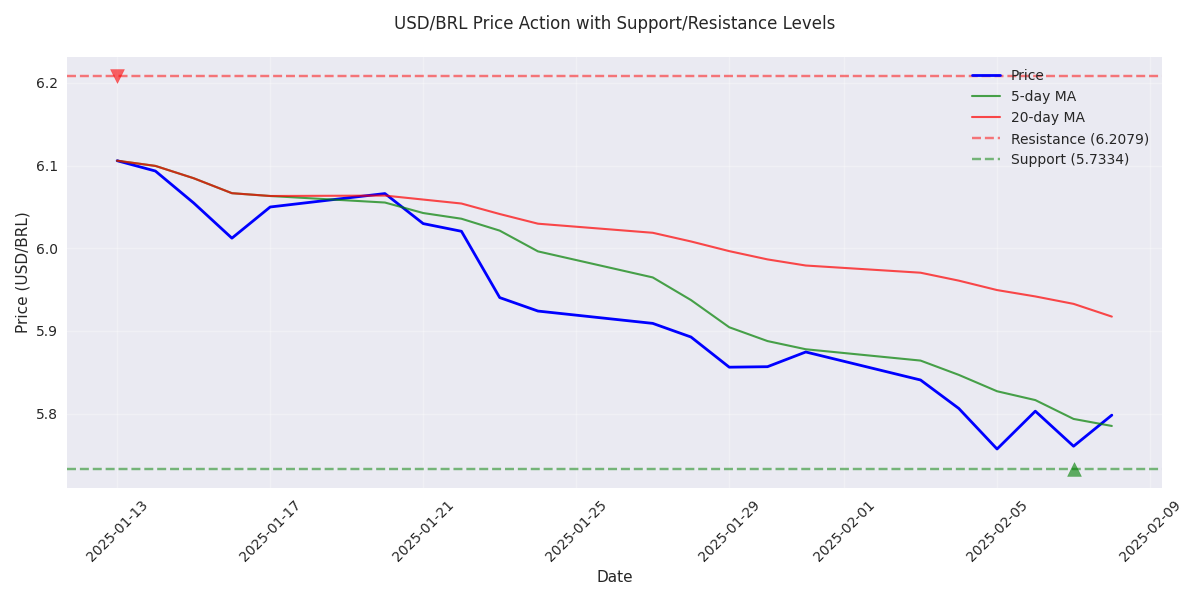

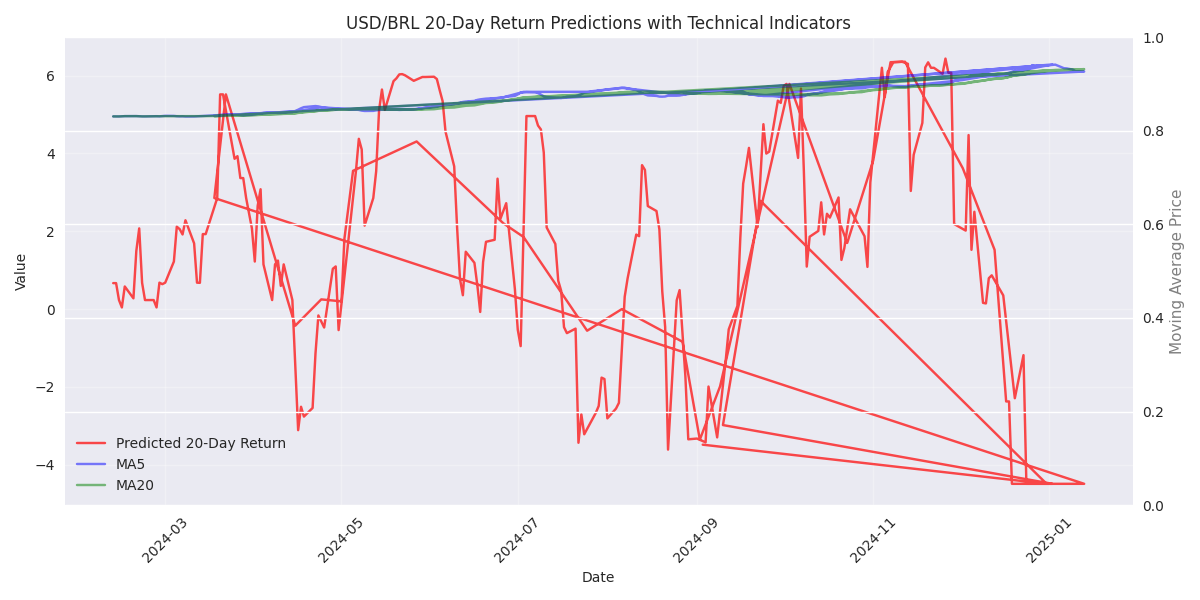

Technical Analysis Signals Point to Continued Bearish Pressure

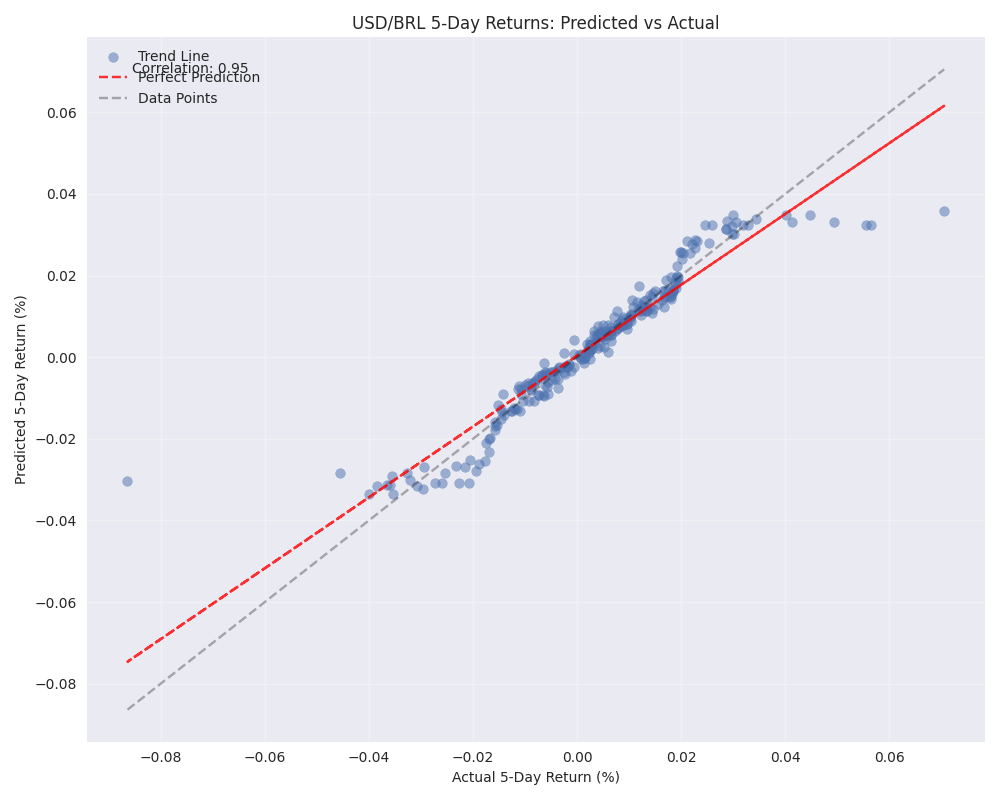

USD/BRL Exchange Rate Predictions and Risk Analysis