Saving...

JetBlue Stock: Traders' Quick Guide to Navigating Turbulent Market Conditions

Saving...

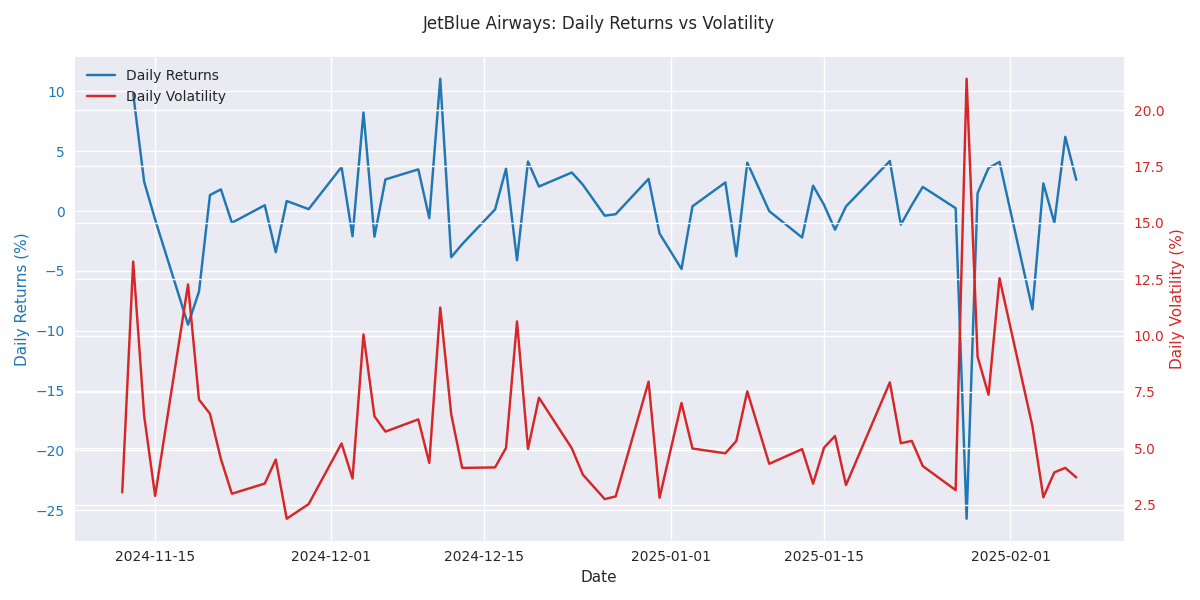

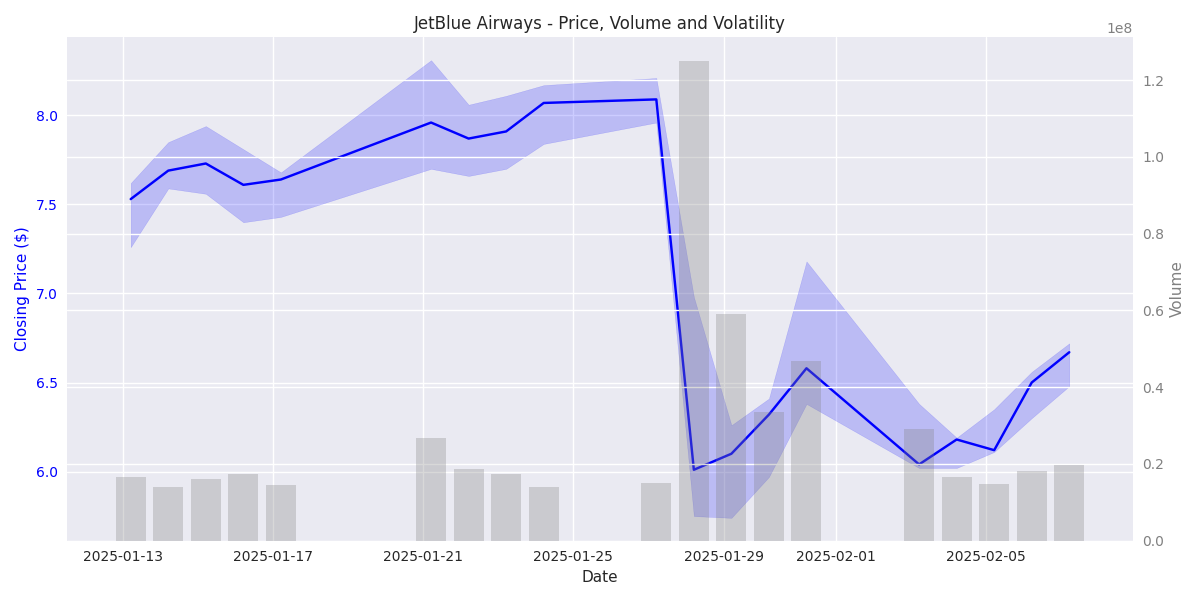

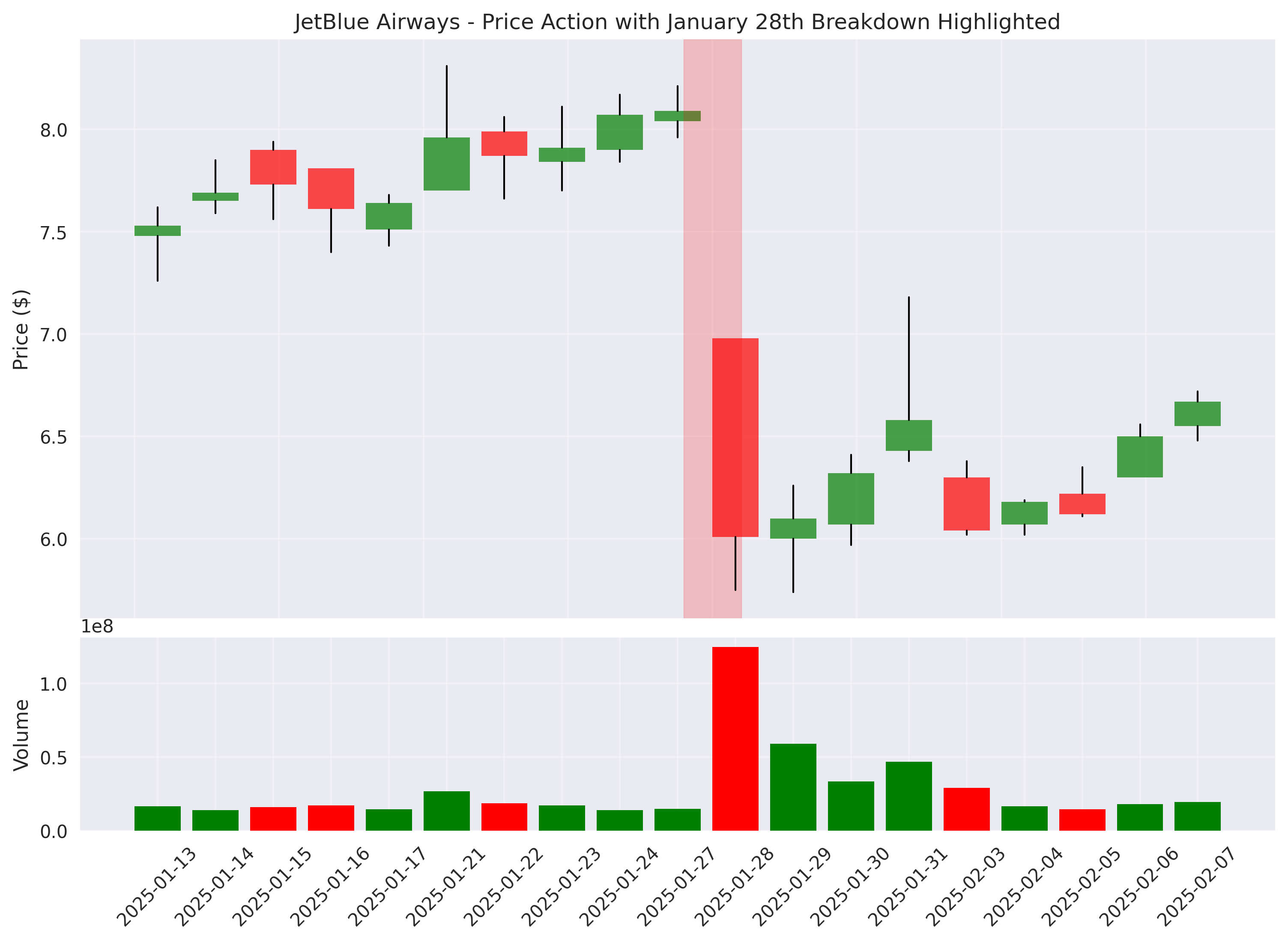

JetBlue's 25.7% Plunge Creates Trading Opportunity

Saving...

JetBlue's 25.7% Plunge Creates Trading Opportunity

Saving...

Saving...

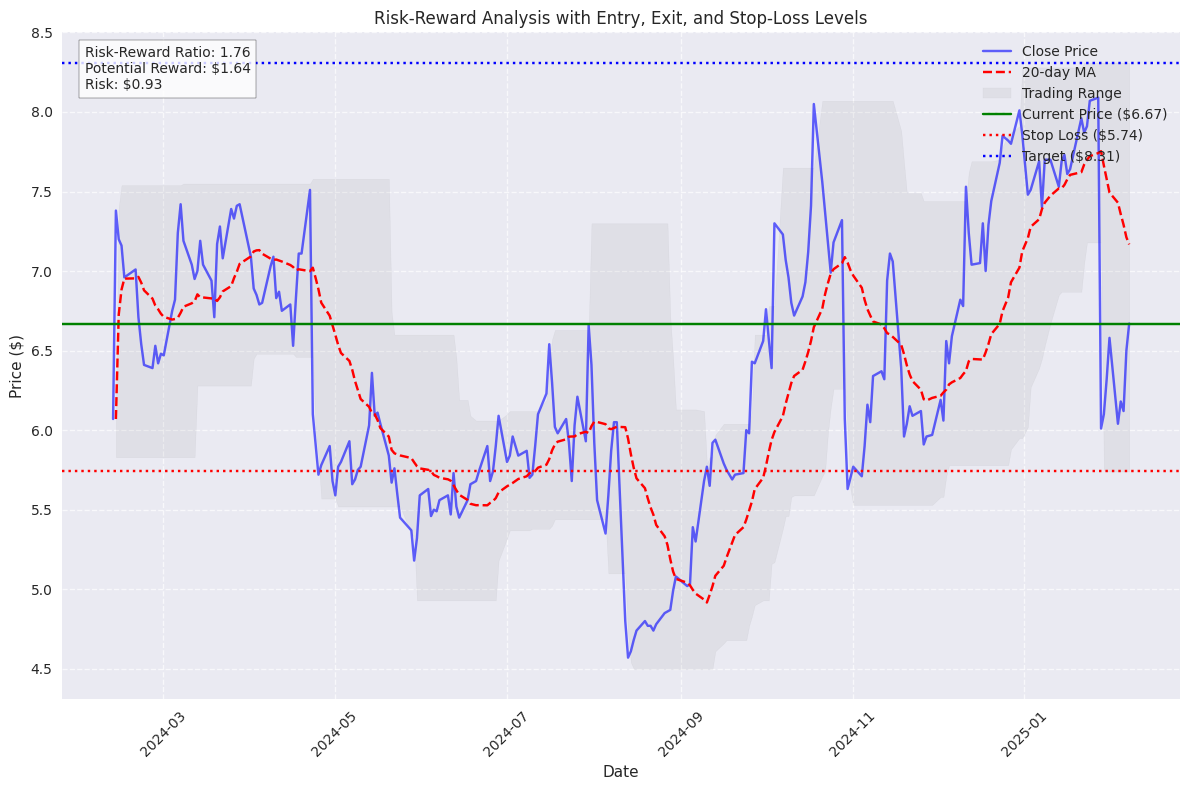

High-Probability Trading Setup with Defined Risk

Saving...

High-Probability Trading Setup with Defined Risk

Saving...

Saving...

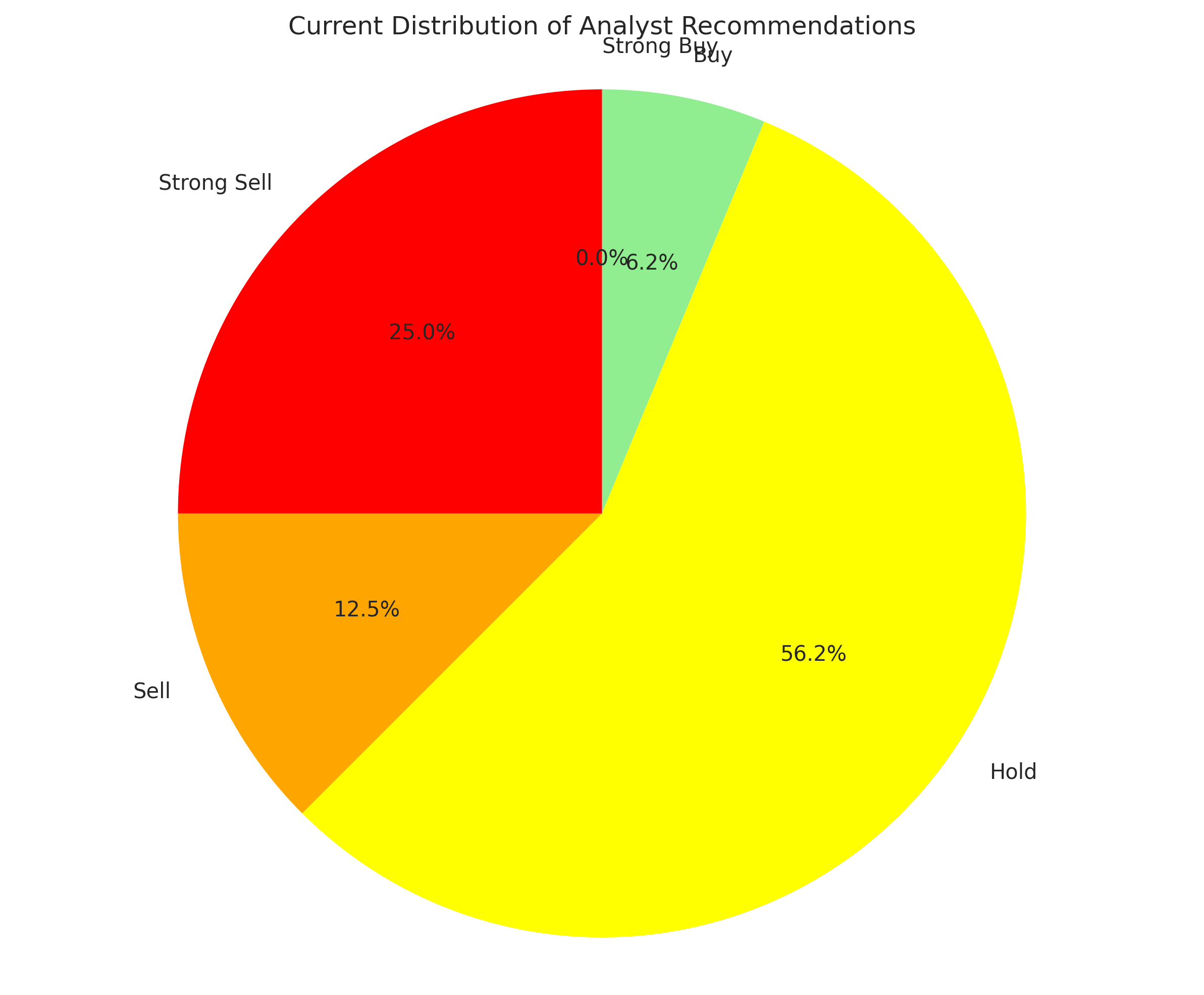

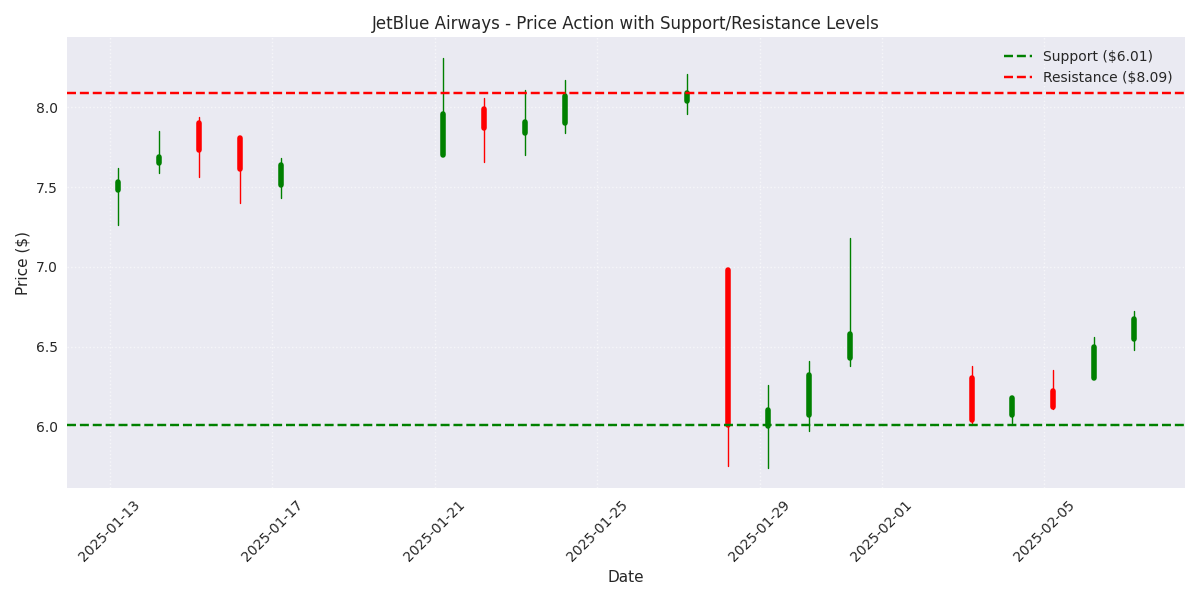

Extreme Bearish Sentiment Creates Contrarian Opportunity

Saving...

Extreme Bearish Sentiment Creates Contrarian Opportunity

Saving...

Saving...

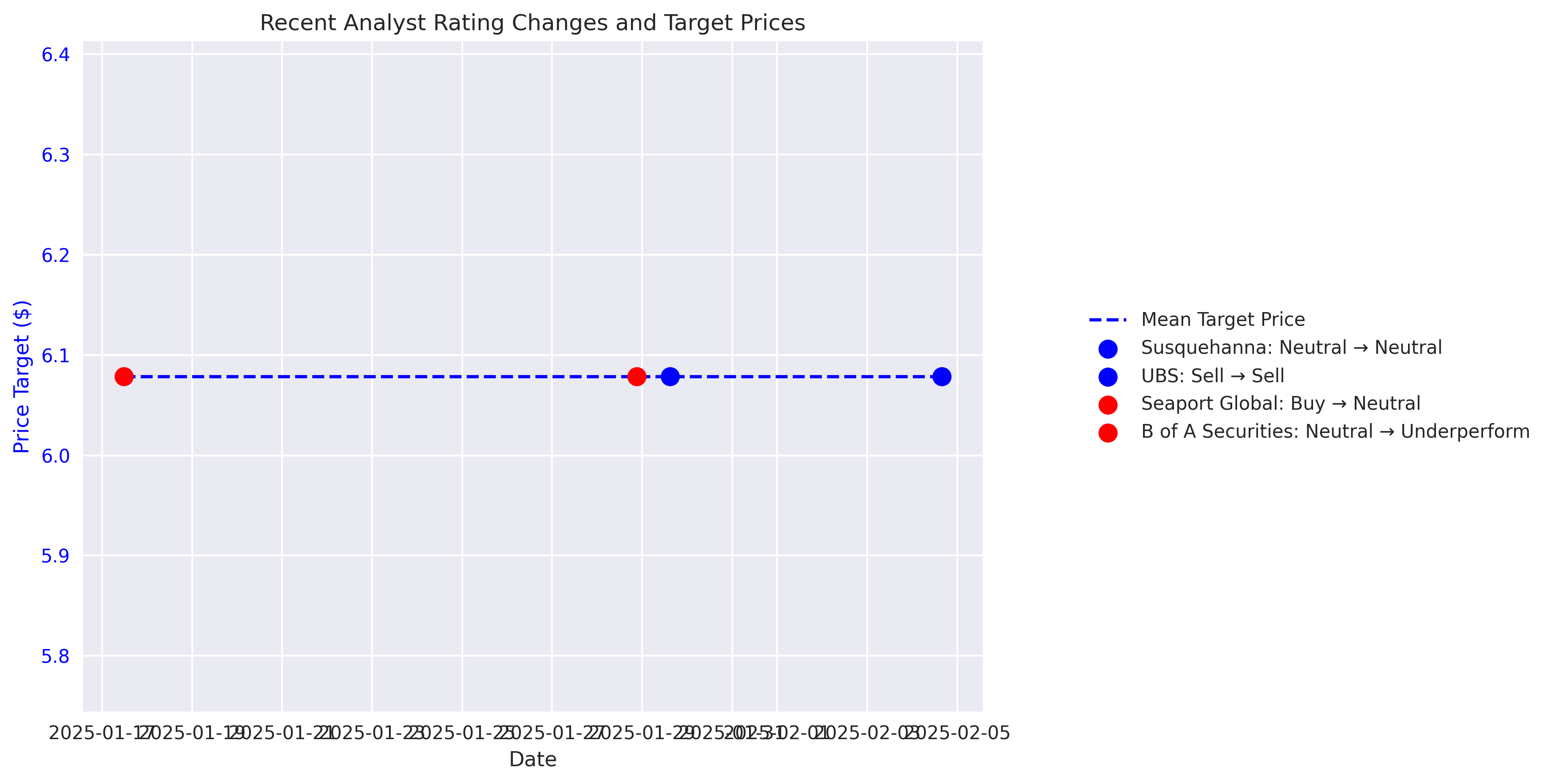

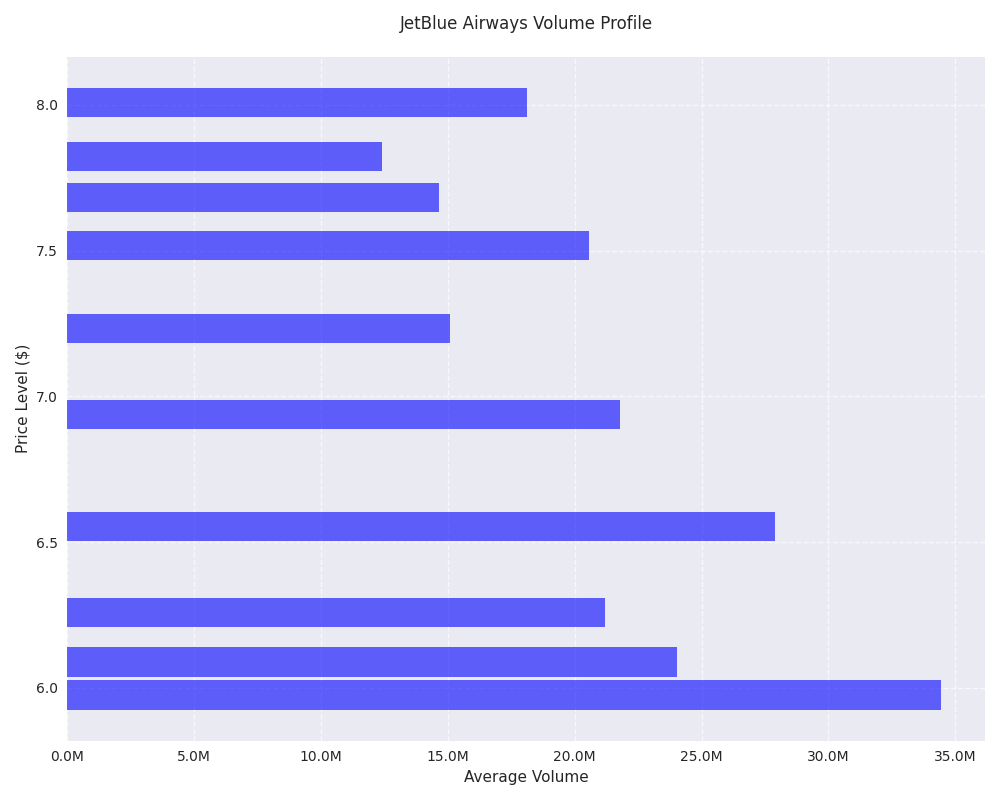

Institutional Buying Patterns Emerge

Saving...

Institutional Buying Patterns Emerge

Saving...

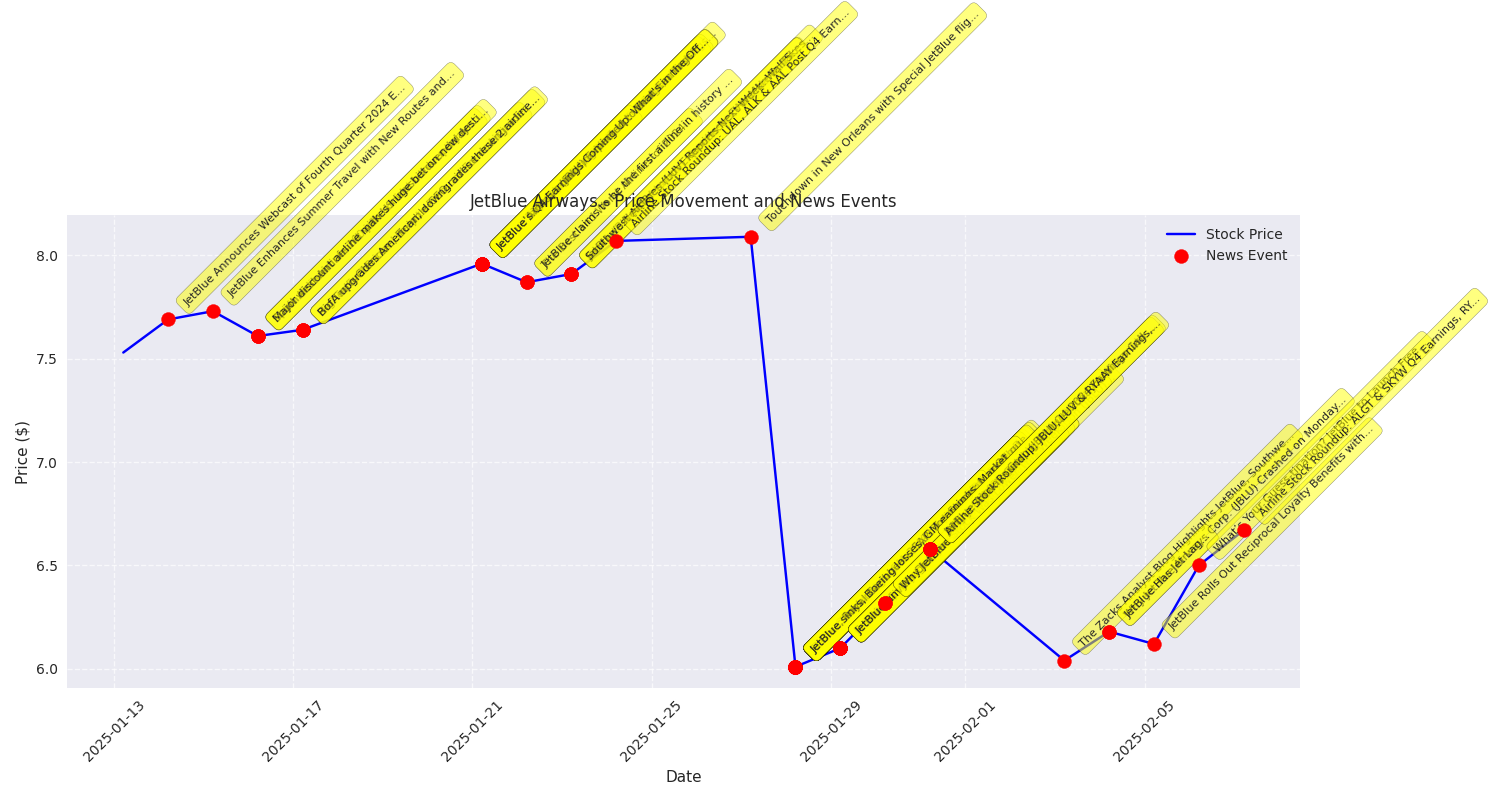

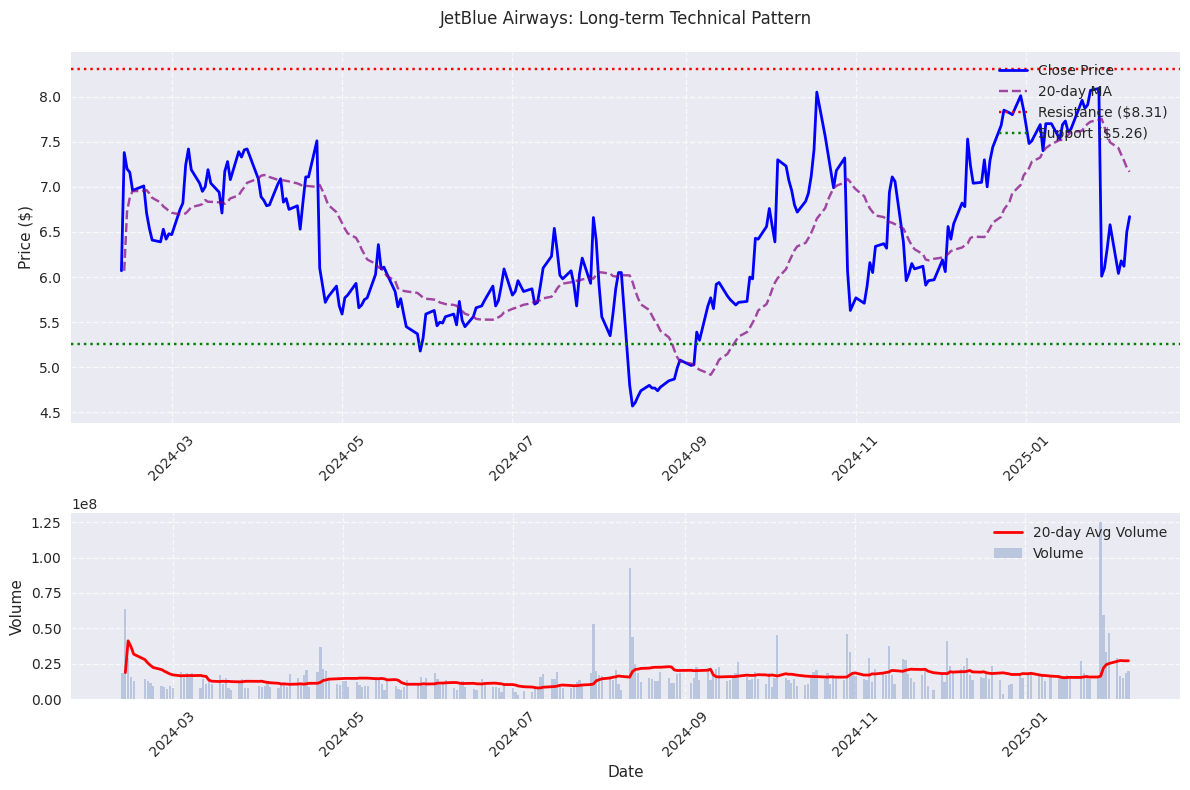

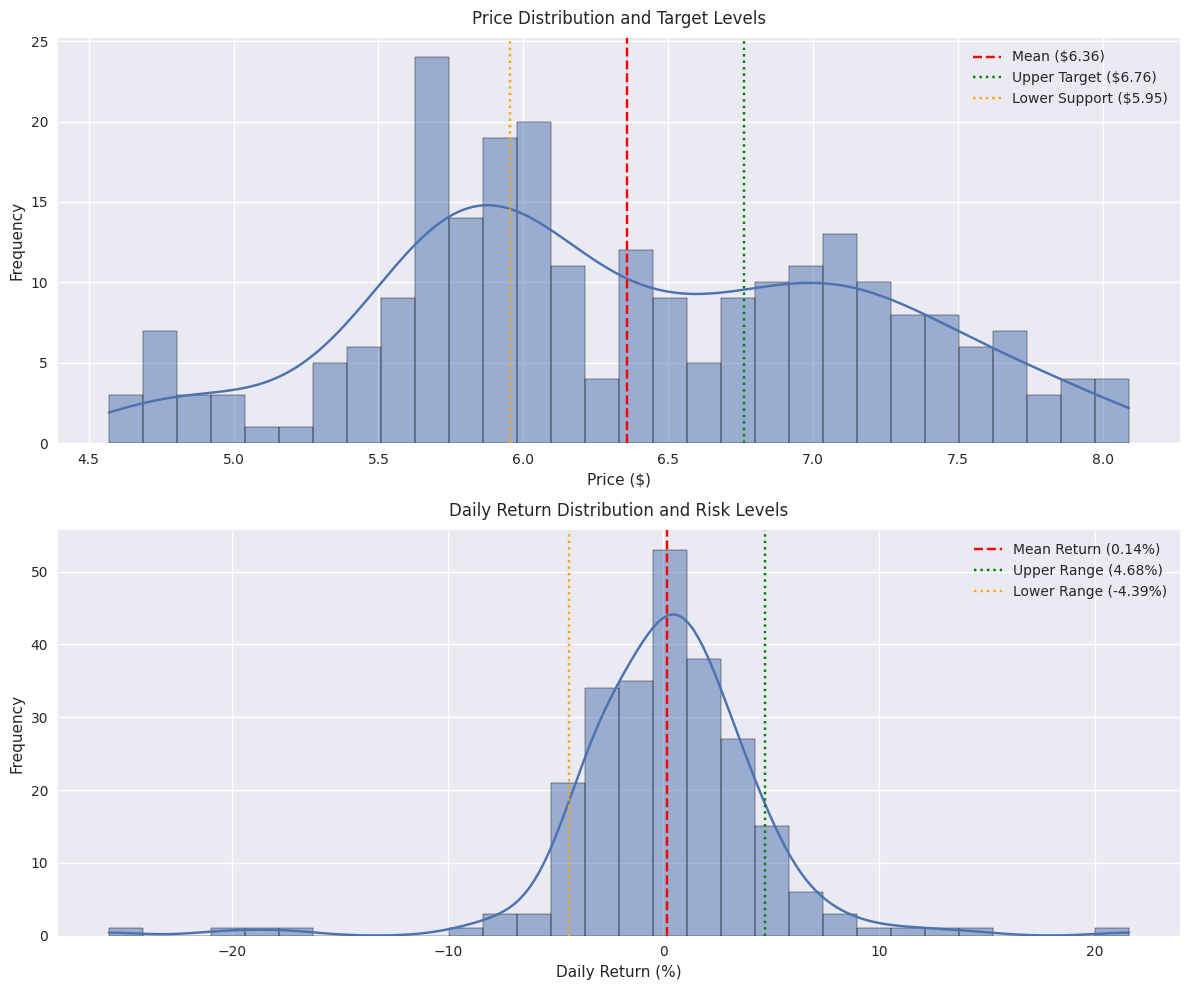

JetBlue Airways Stock Analysis: Price Movement and Market Sentiment

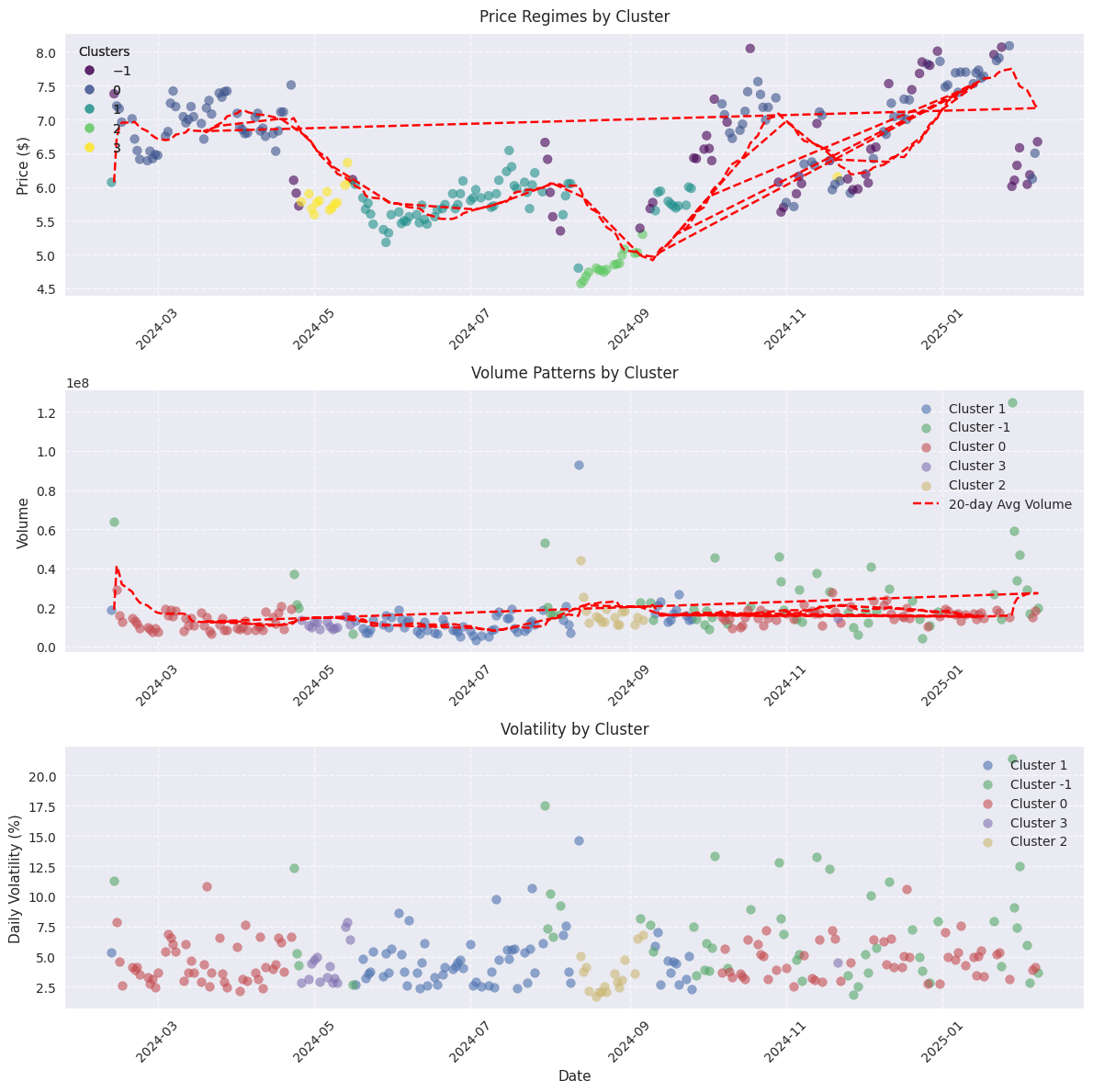

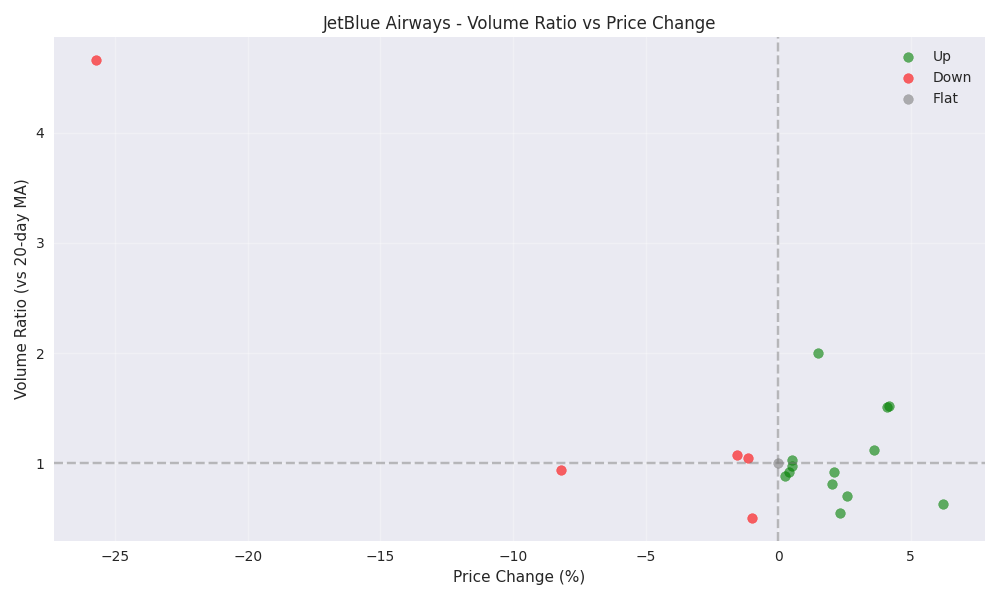

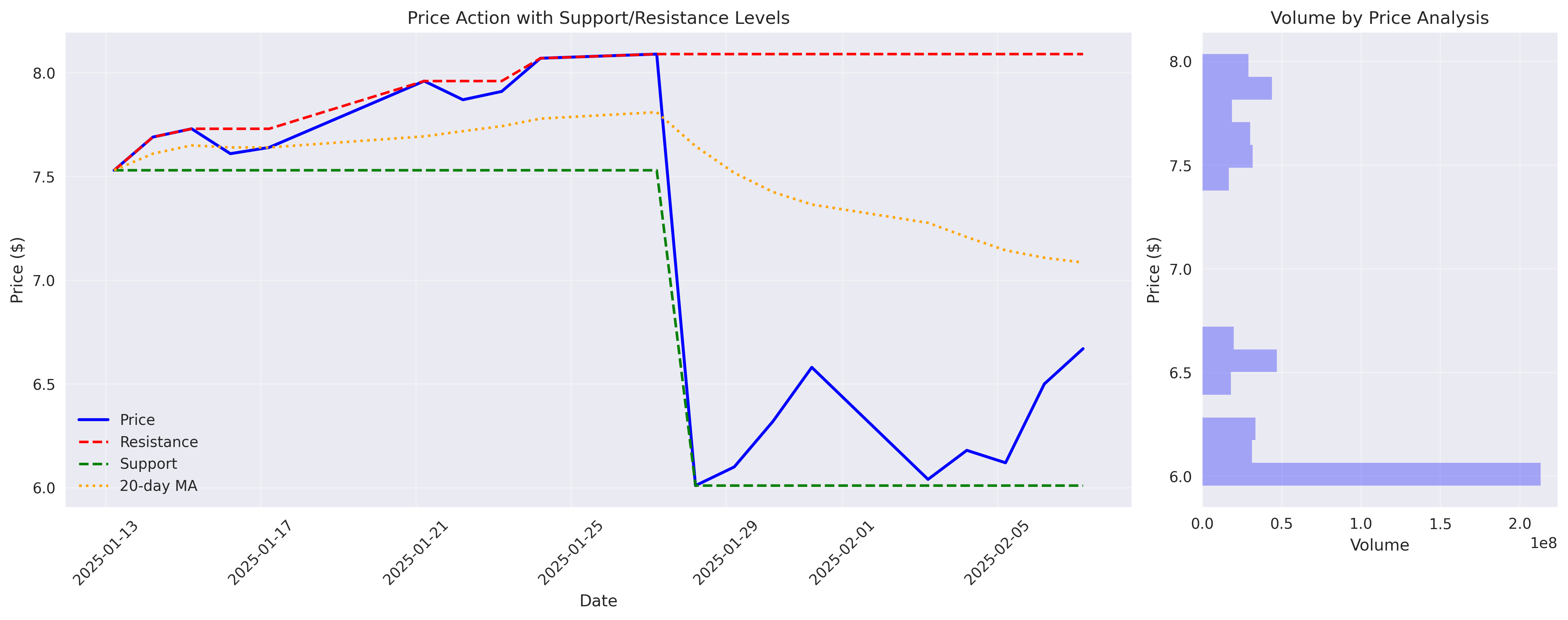

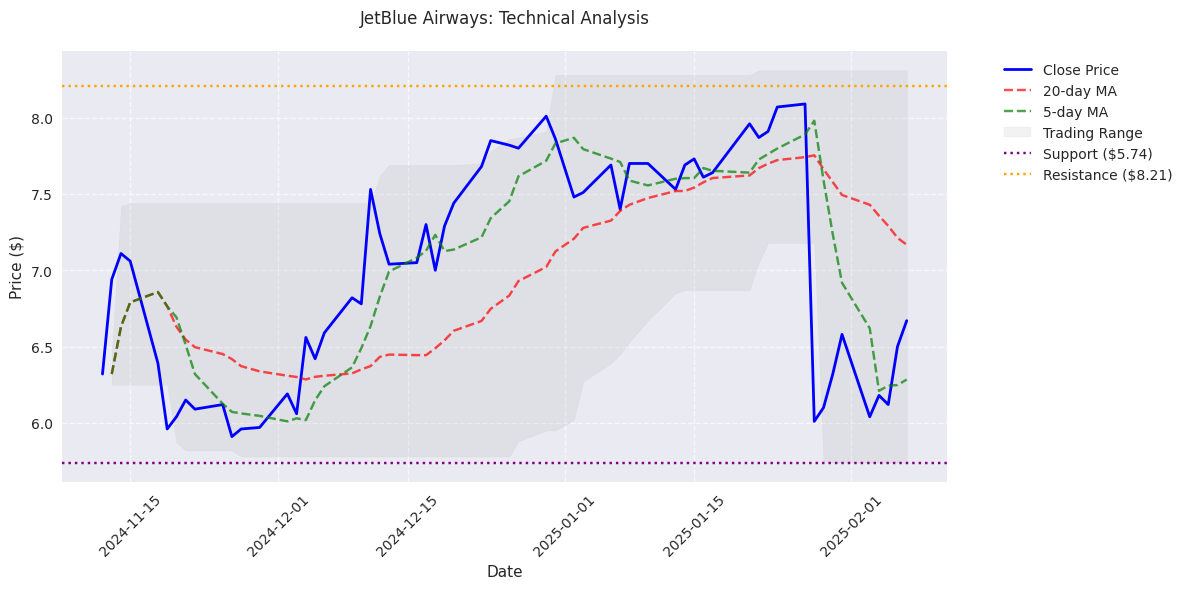

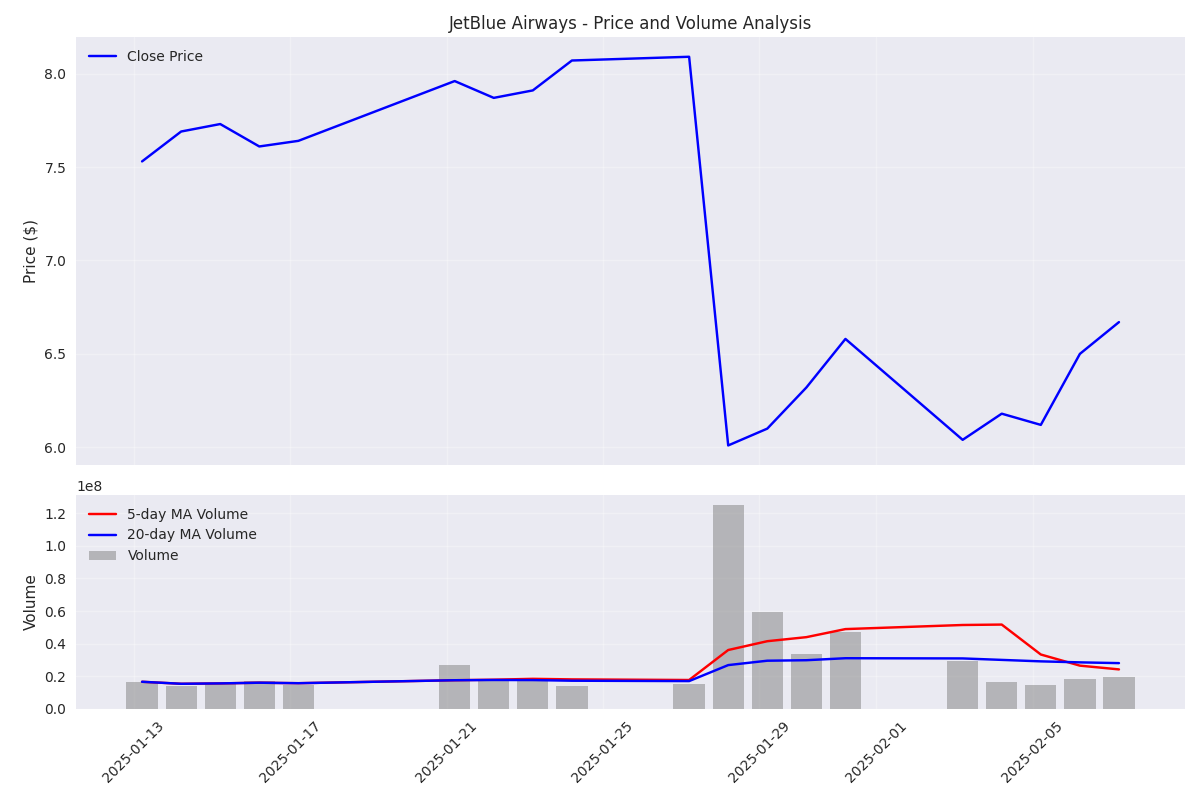

Technical Analysis and Trading Patterns

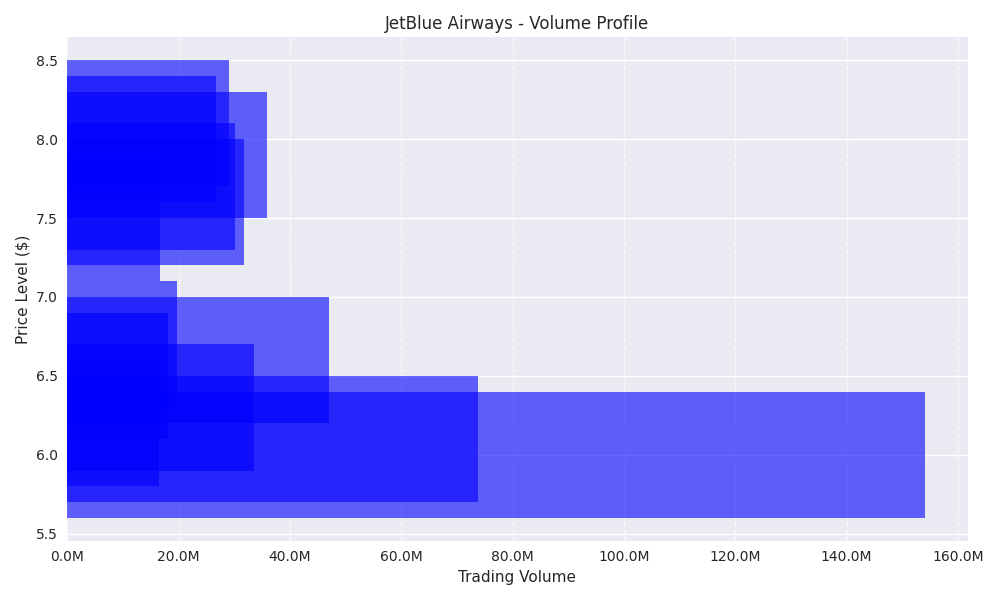

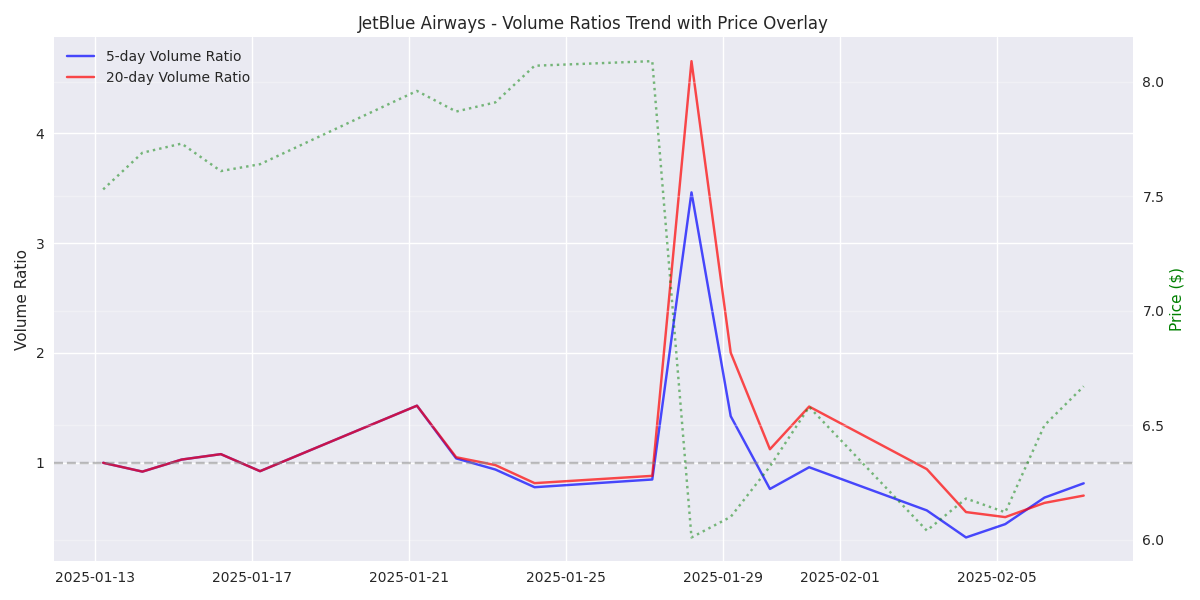

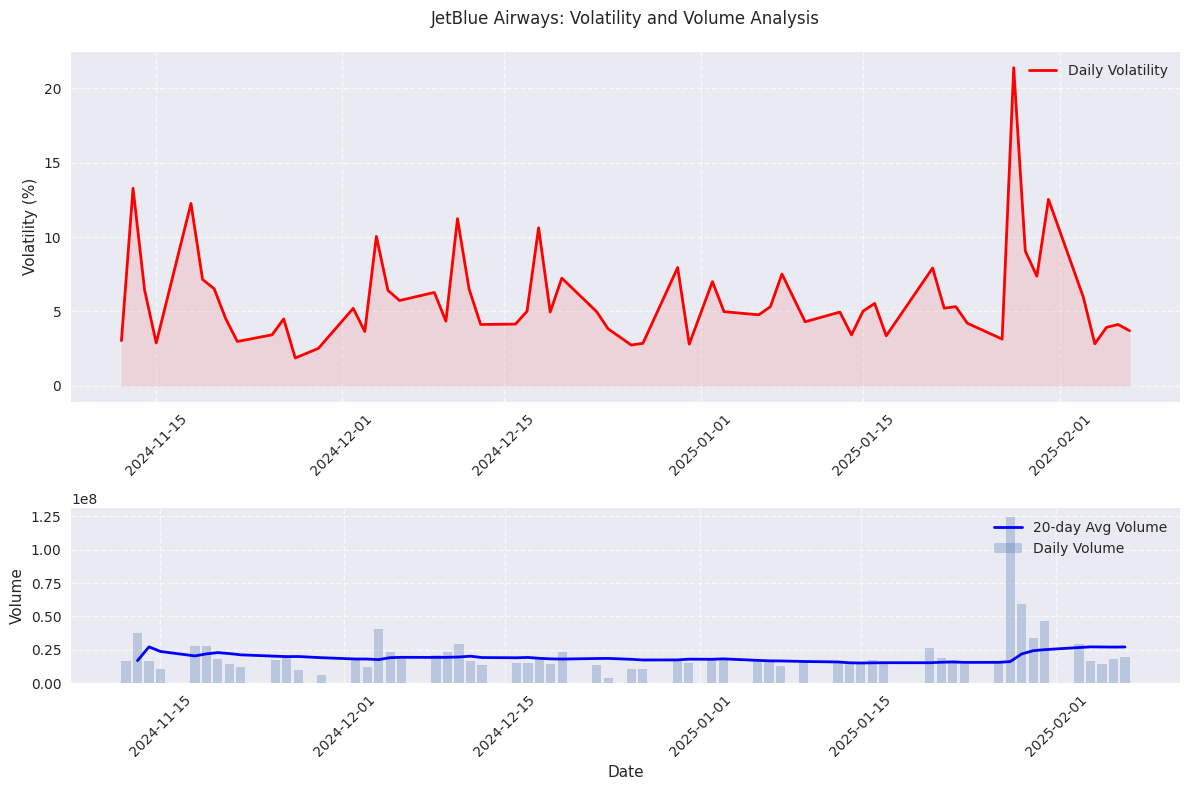

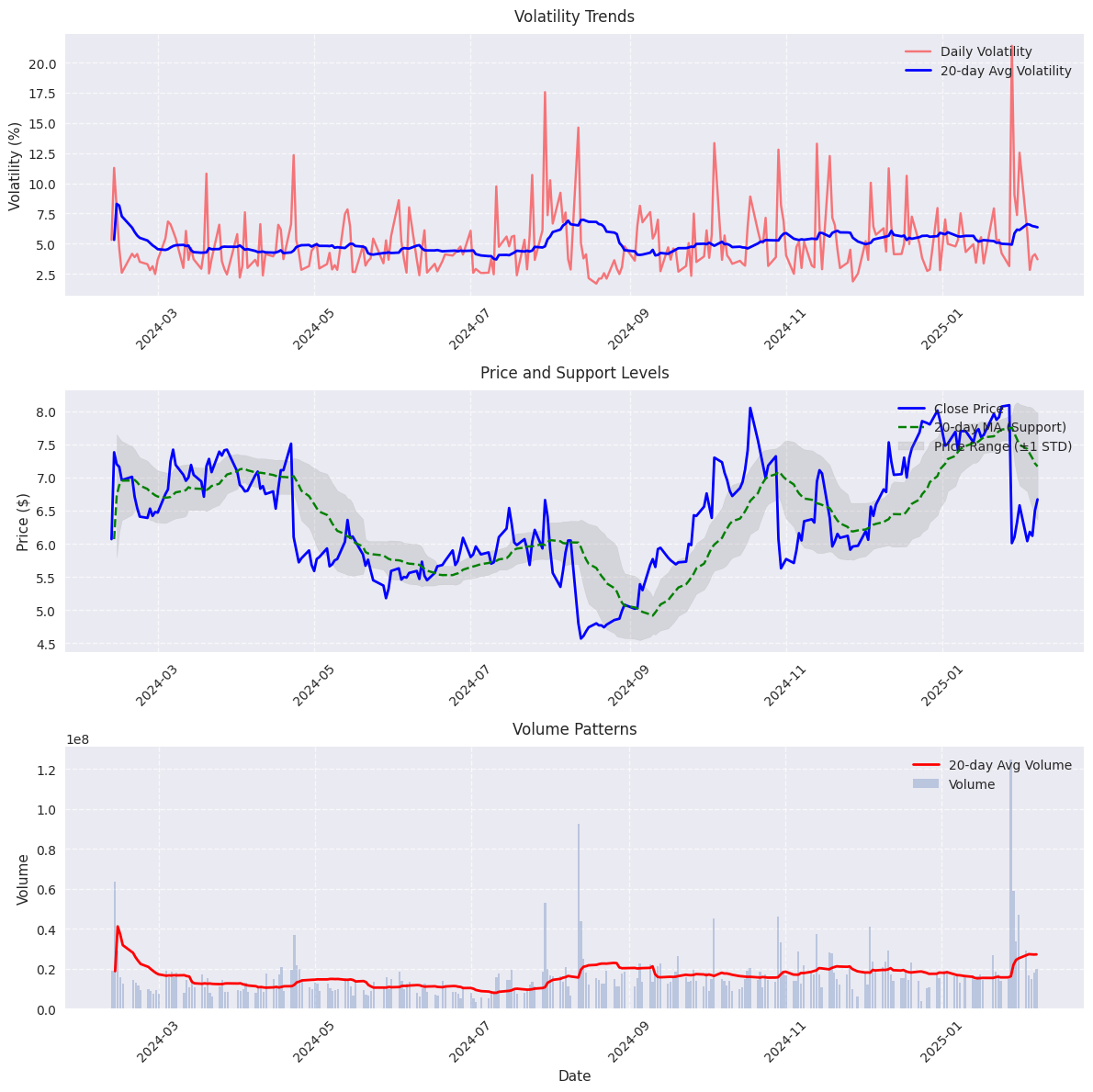

Volume Analysis Reveals Significant Trading Activity Patterns

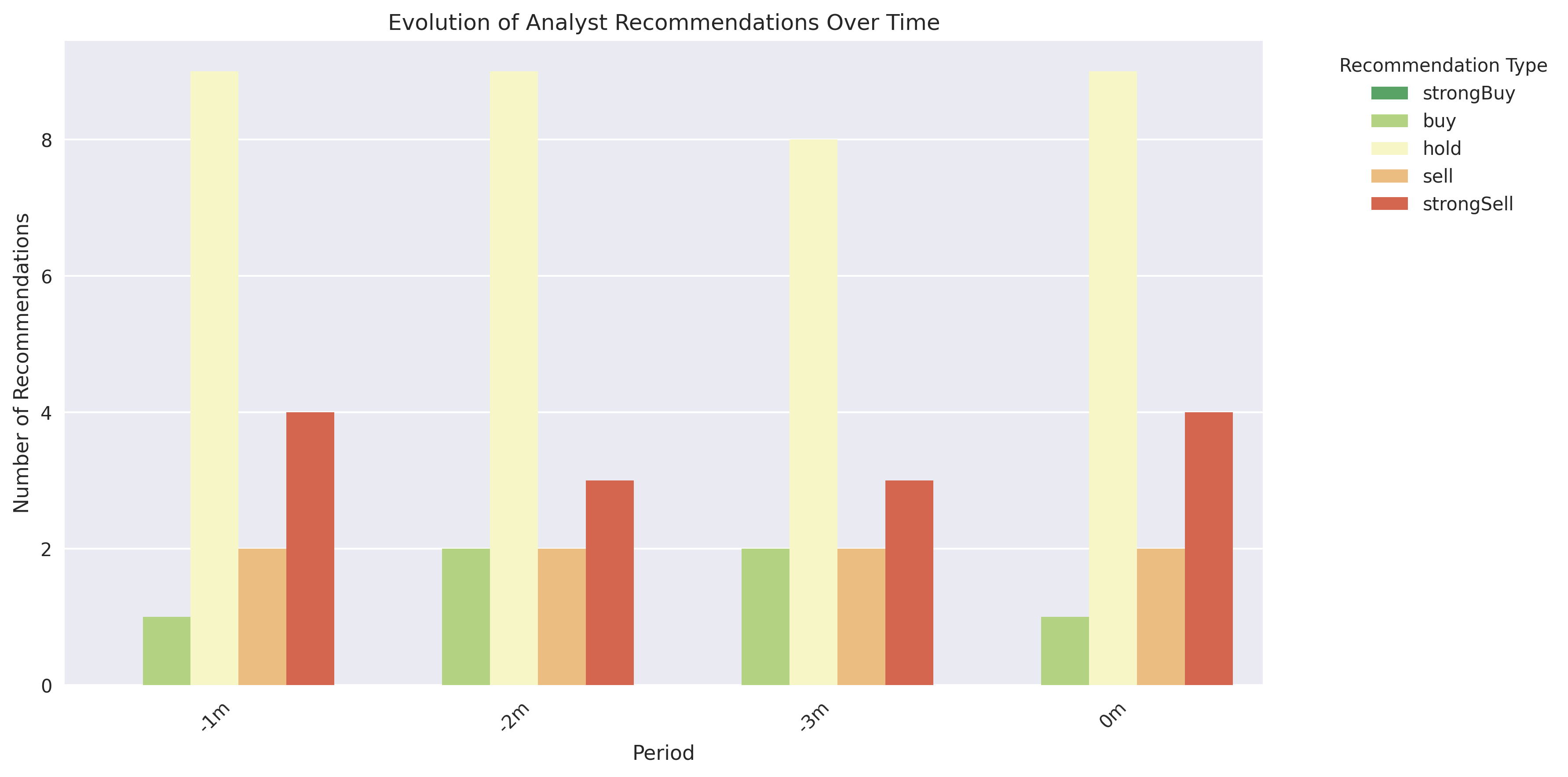

Analyst Sentiment Shows Increasing Bearish Bias

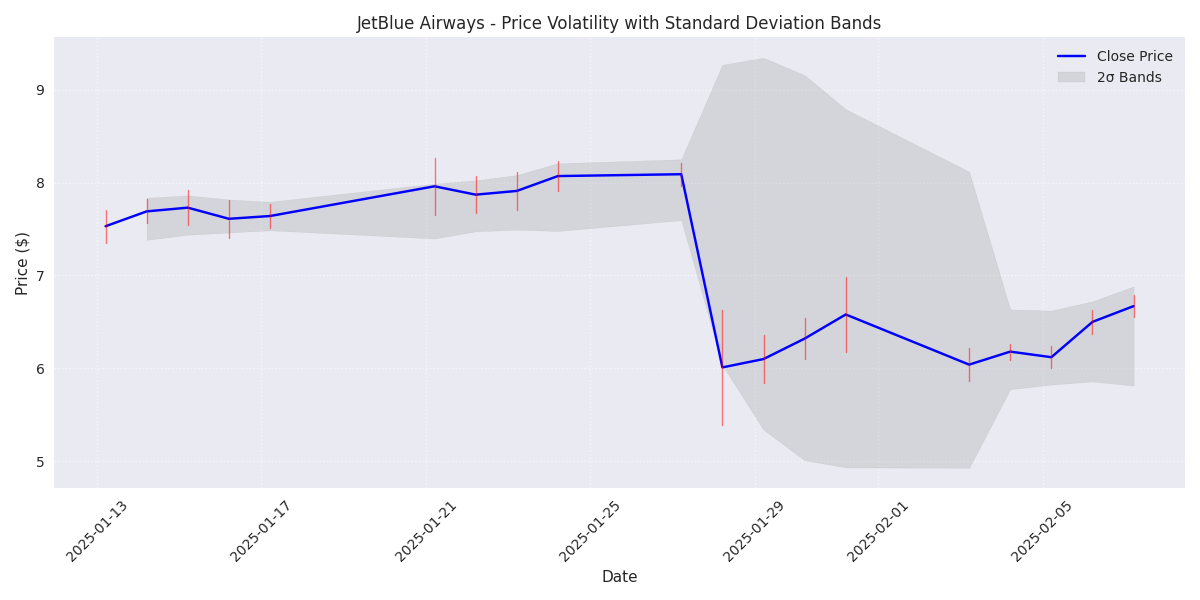

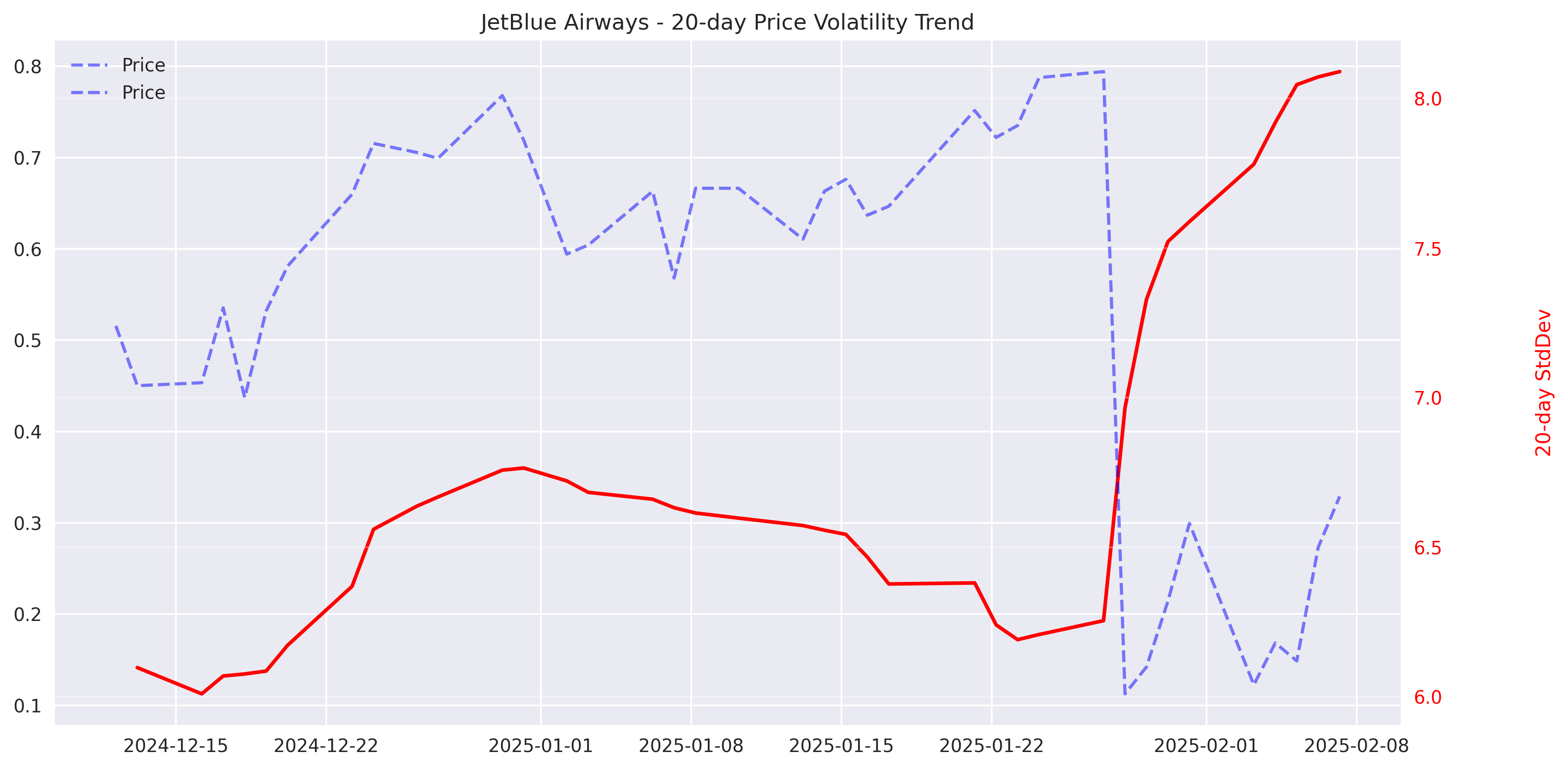

Critical Price Support Break and Heightened Volatility

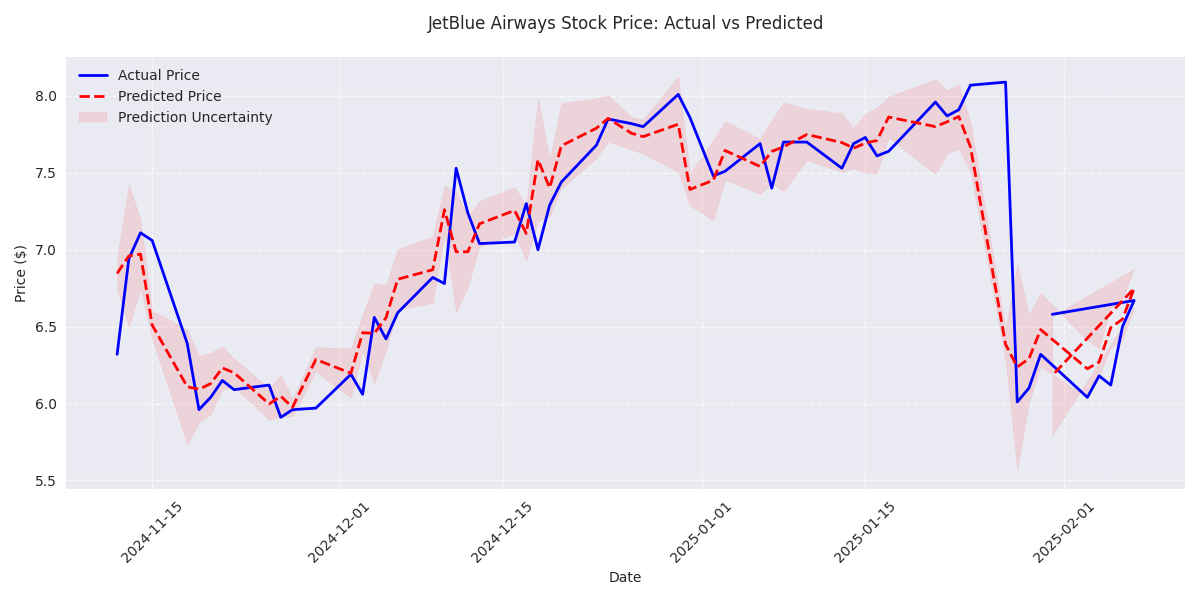

Short-term Price Movement Analysis Shows Mixed Signals with Upward Bias

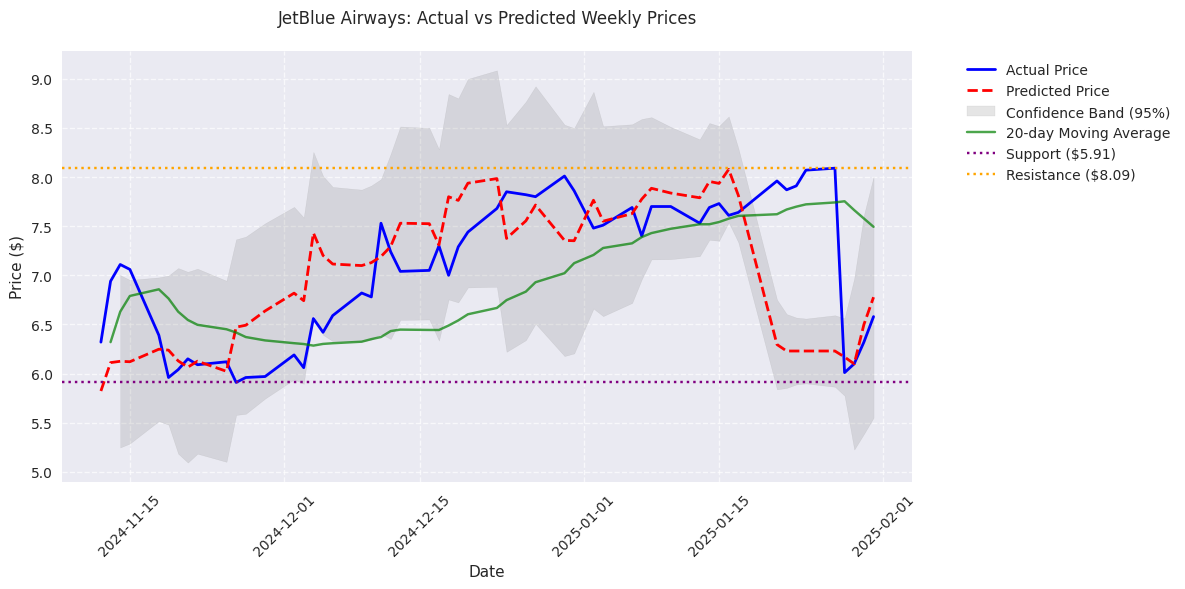

Weekly Price Predictions Show Potential for Moderate Gains with Controlled Risk

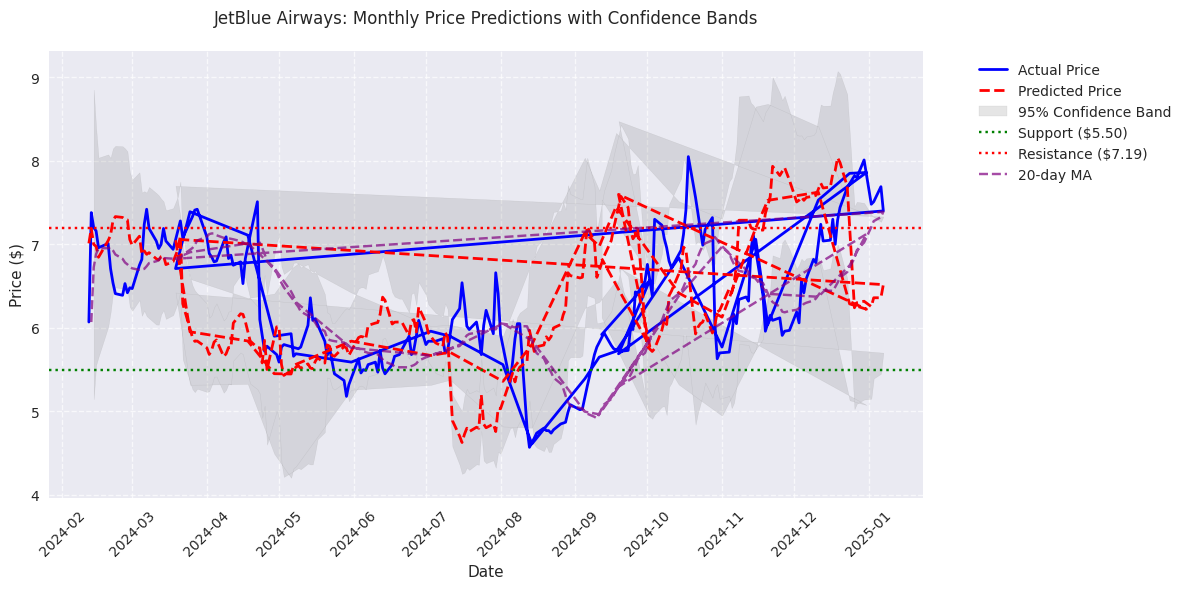

Monthly Analysis Reveals Potential Long-term Value with Managed Risk

Final Trading Recommendations Based on Comprehensive Analysis