Saving...

Breaking Down Live Cattle Market: Urgent Trading Signals for Savvy Investors

Saving...

Saving...

Saving...

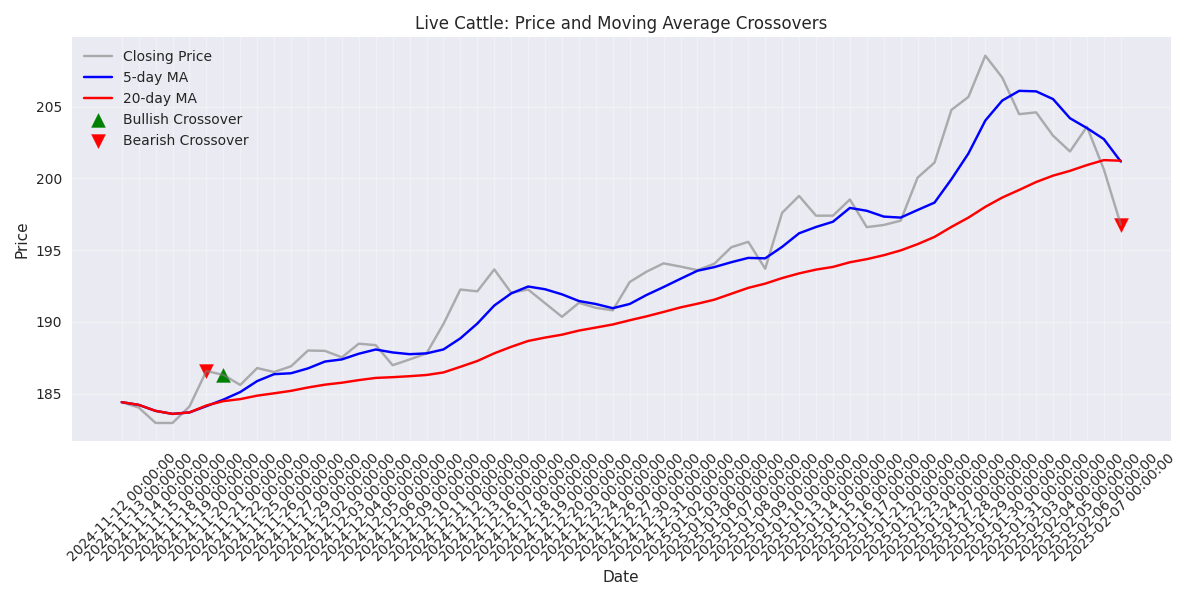

Short-term Bounce Expected Despite Bearish Trend

Saving...

Short-term Bounce Expected Despite Bearish Trend

Saving...

Saving...

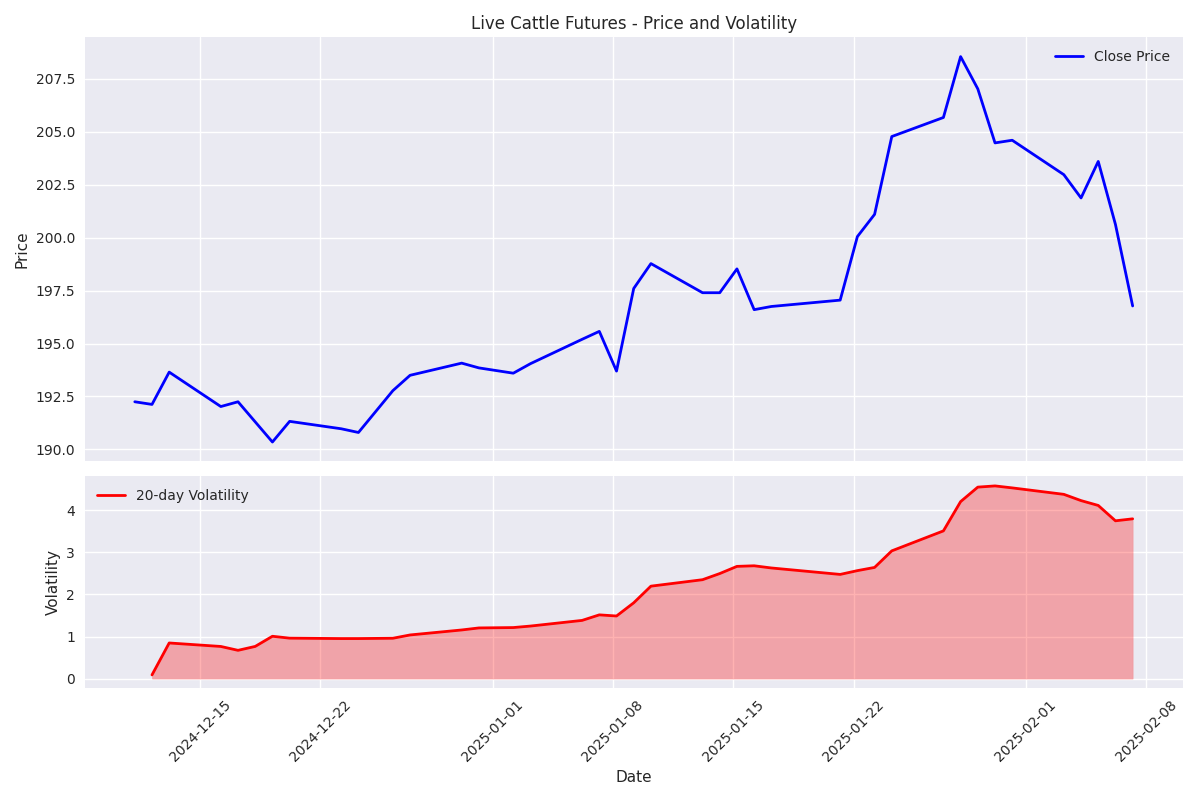

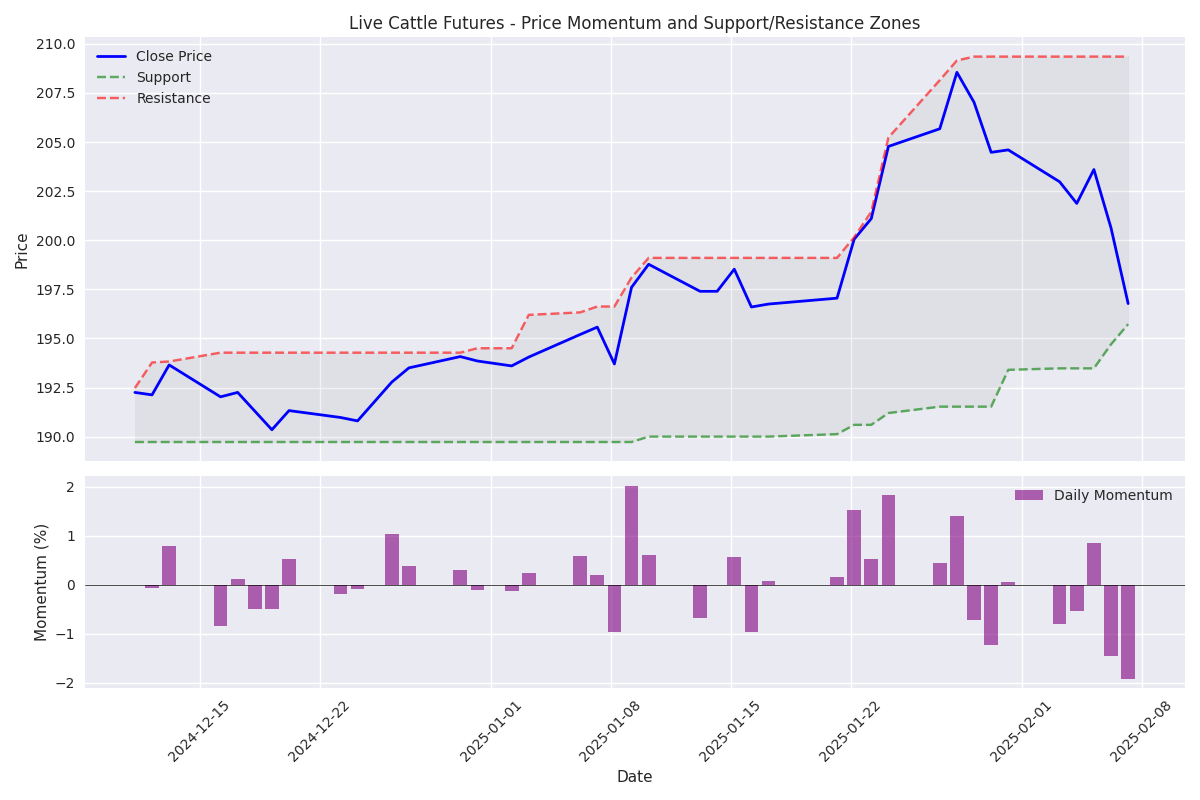

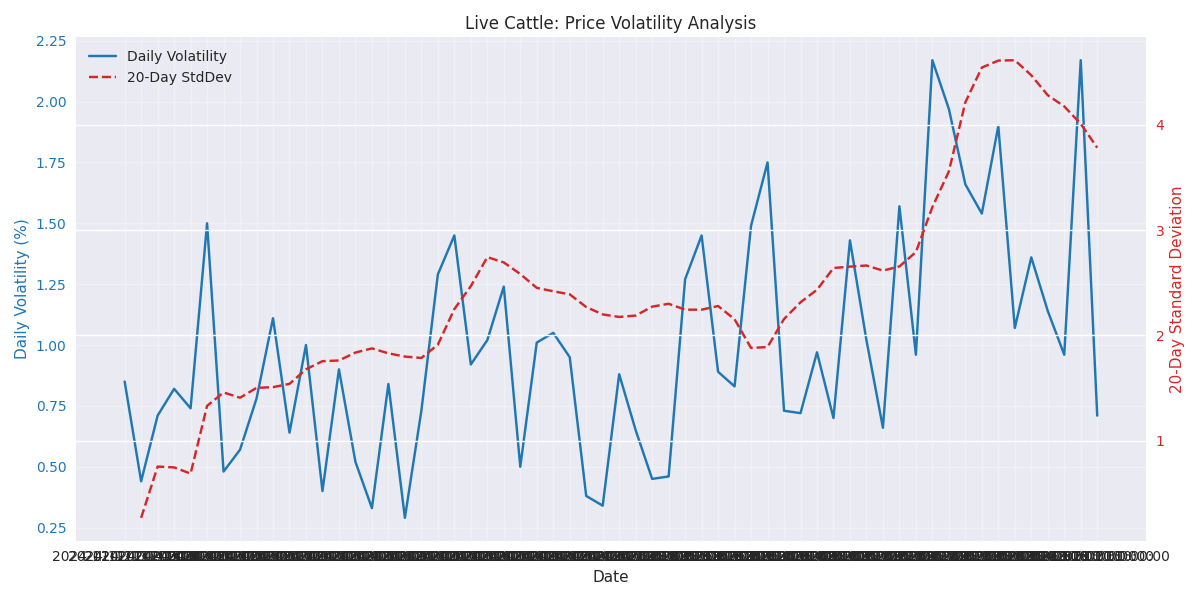

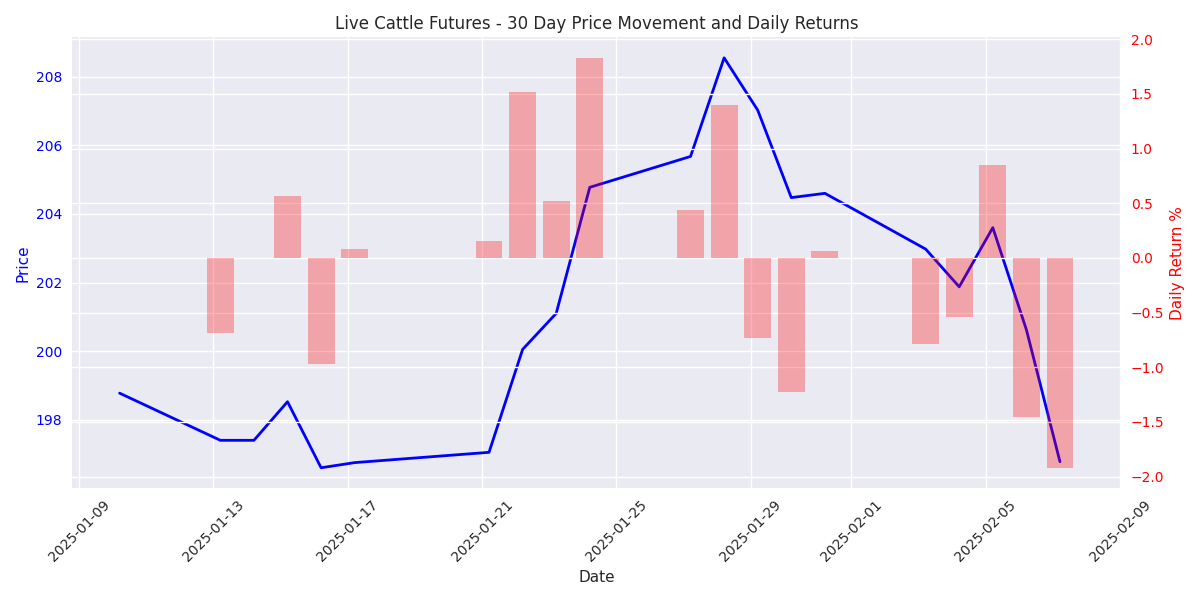

Recent Price Trends Show Bearish Momentum in Live Cattle Futures

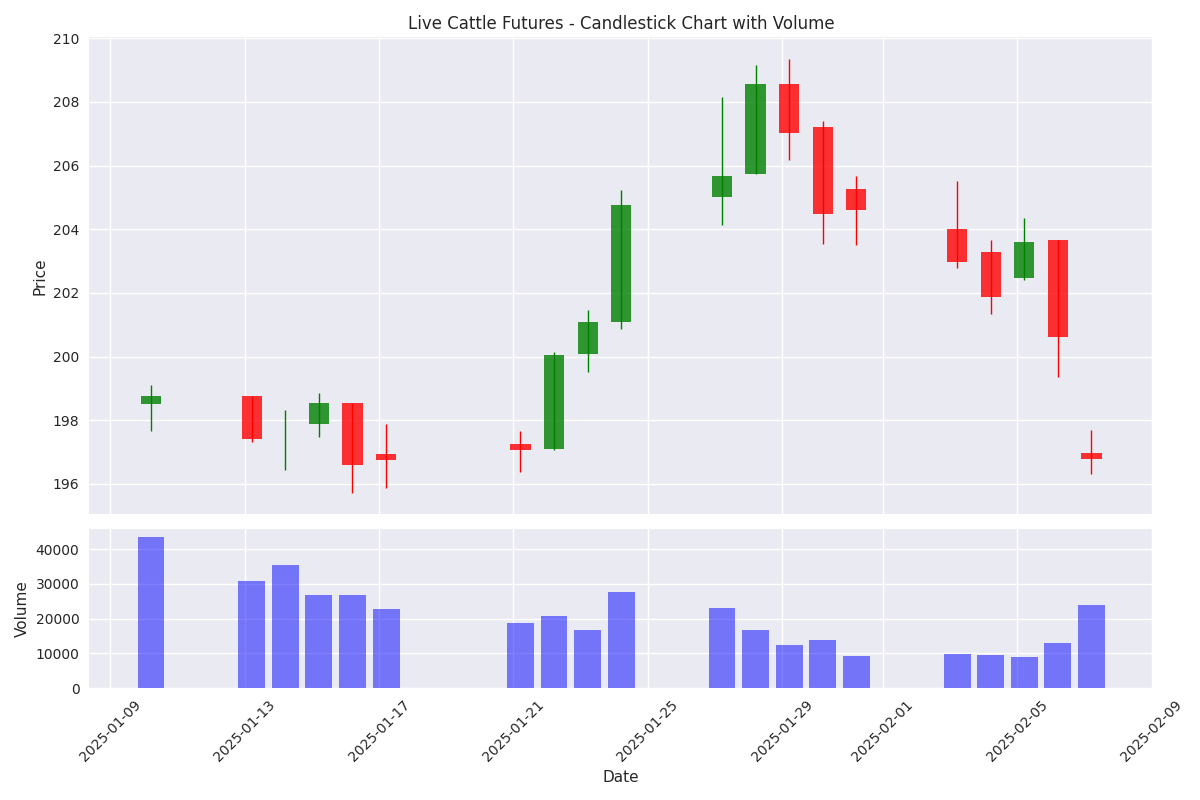

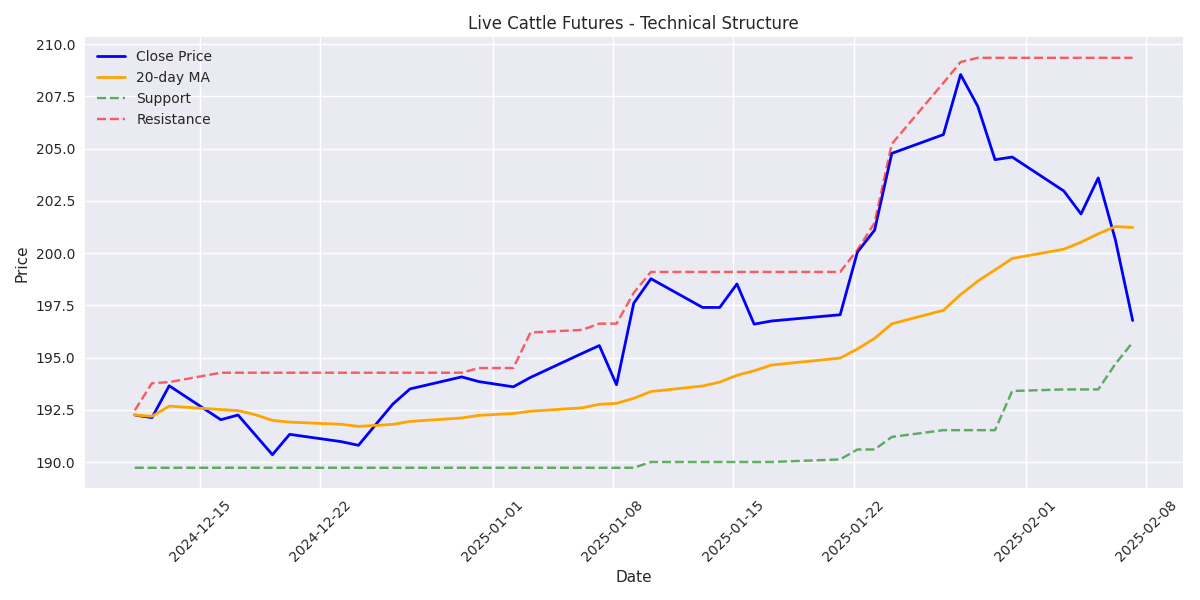

Technical Analysis Reveals Key Support and Resistance Levels

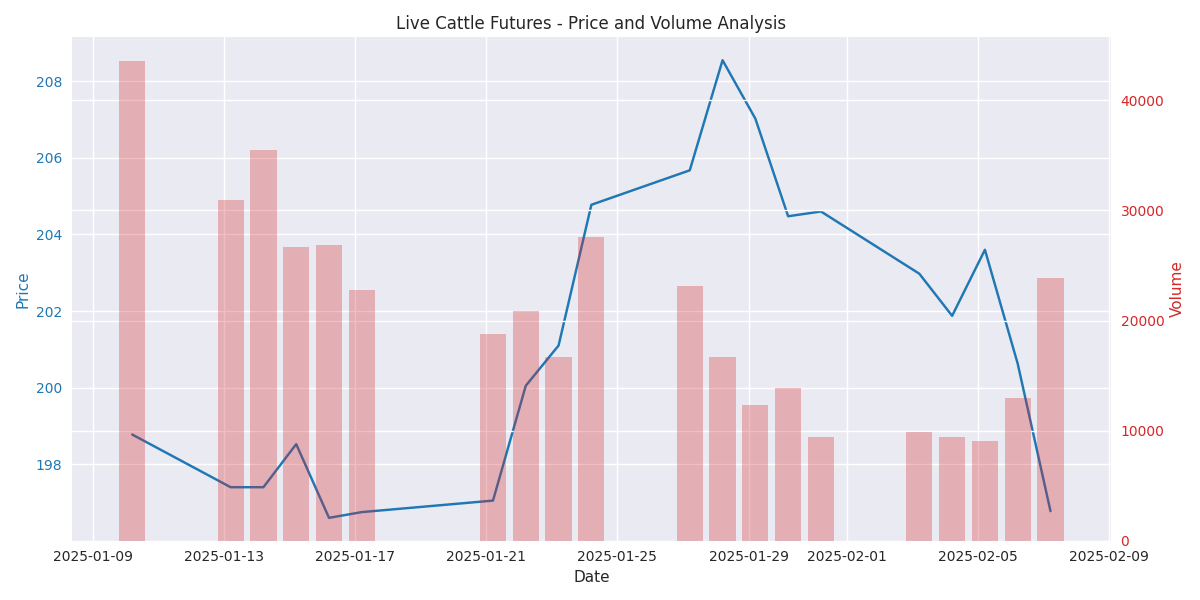

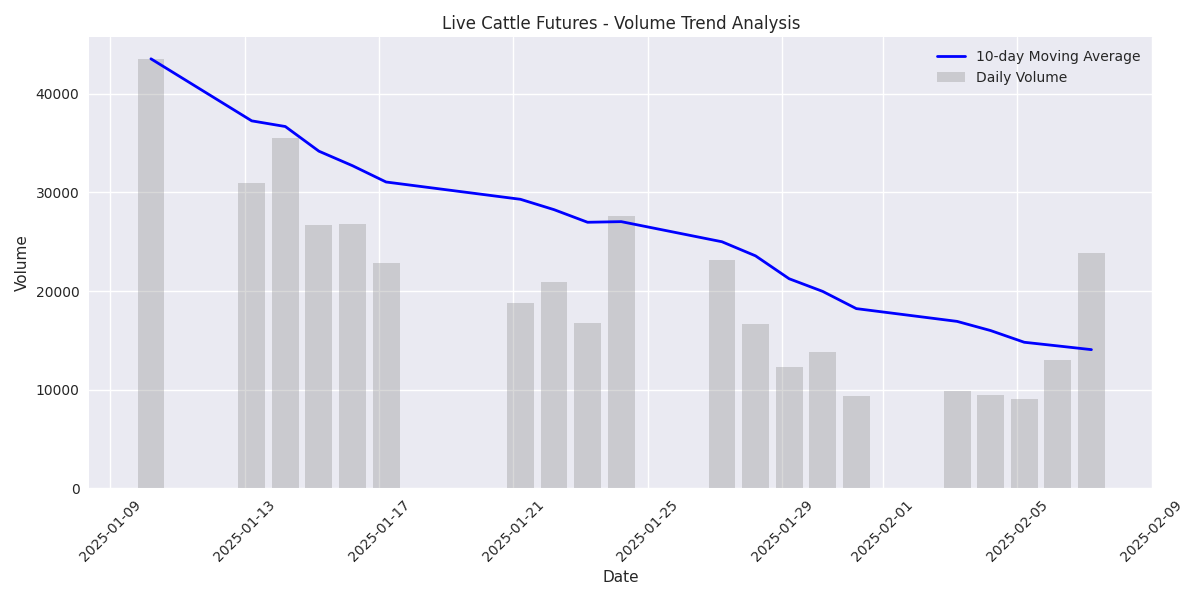

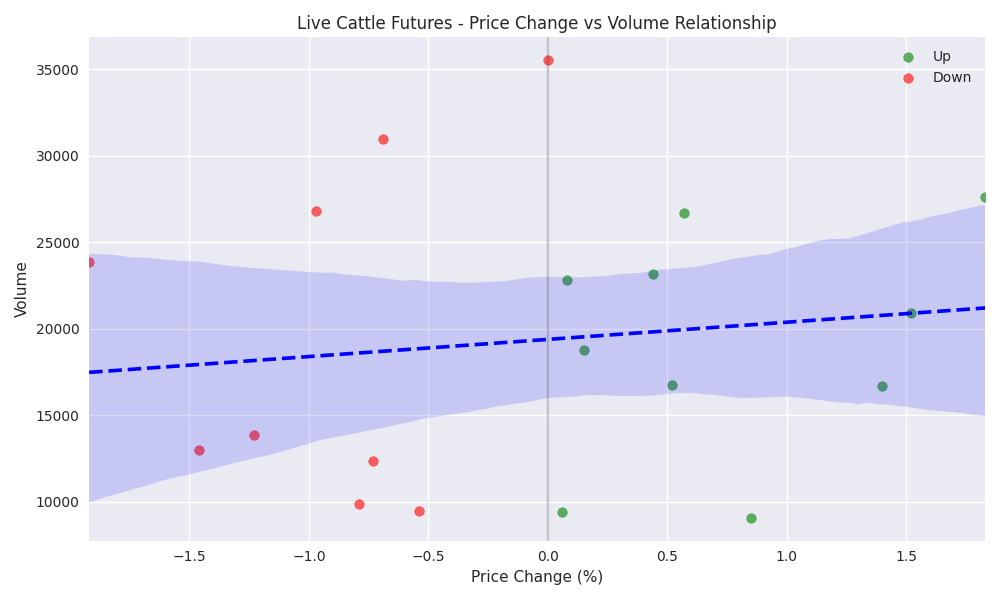

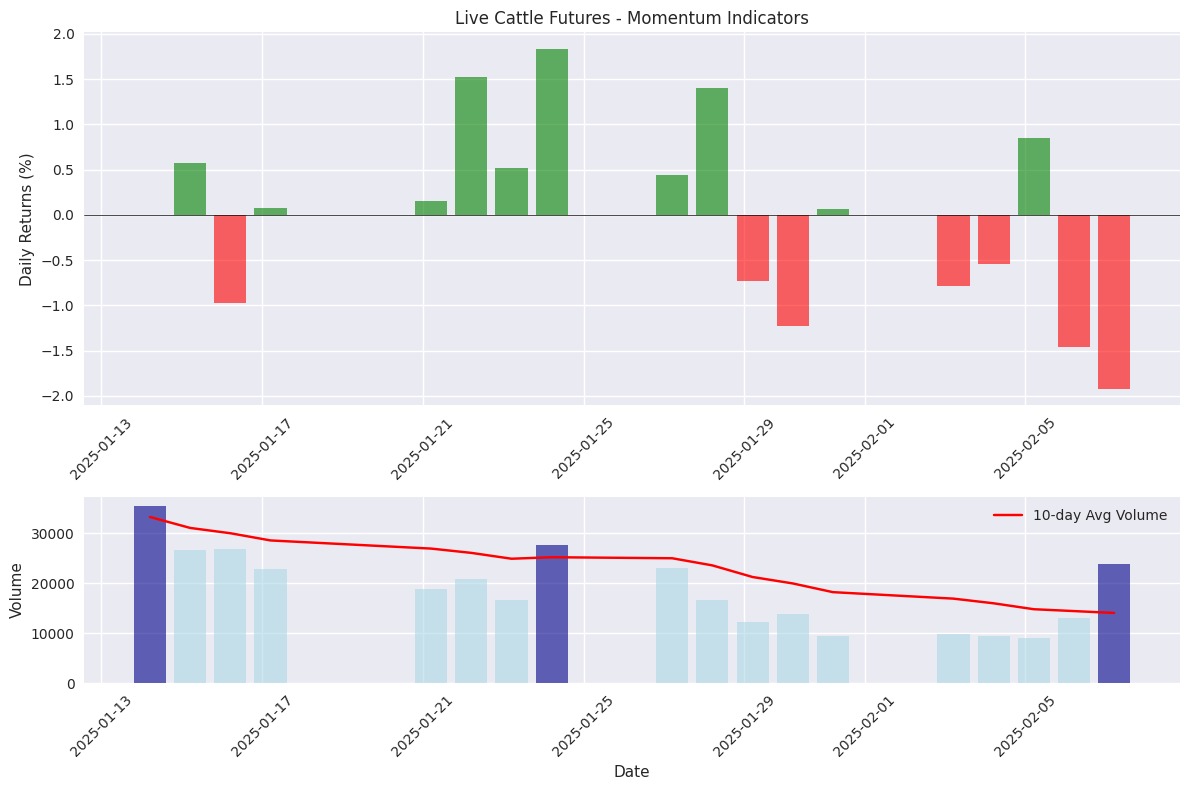

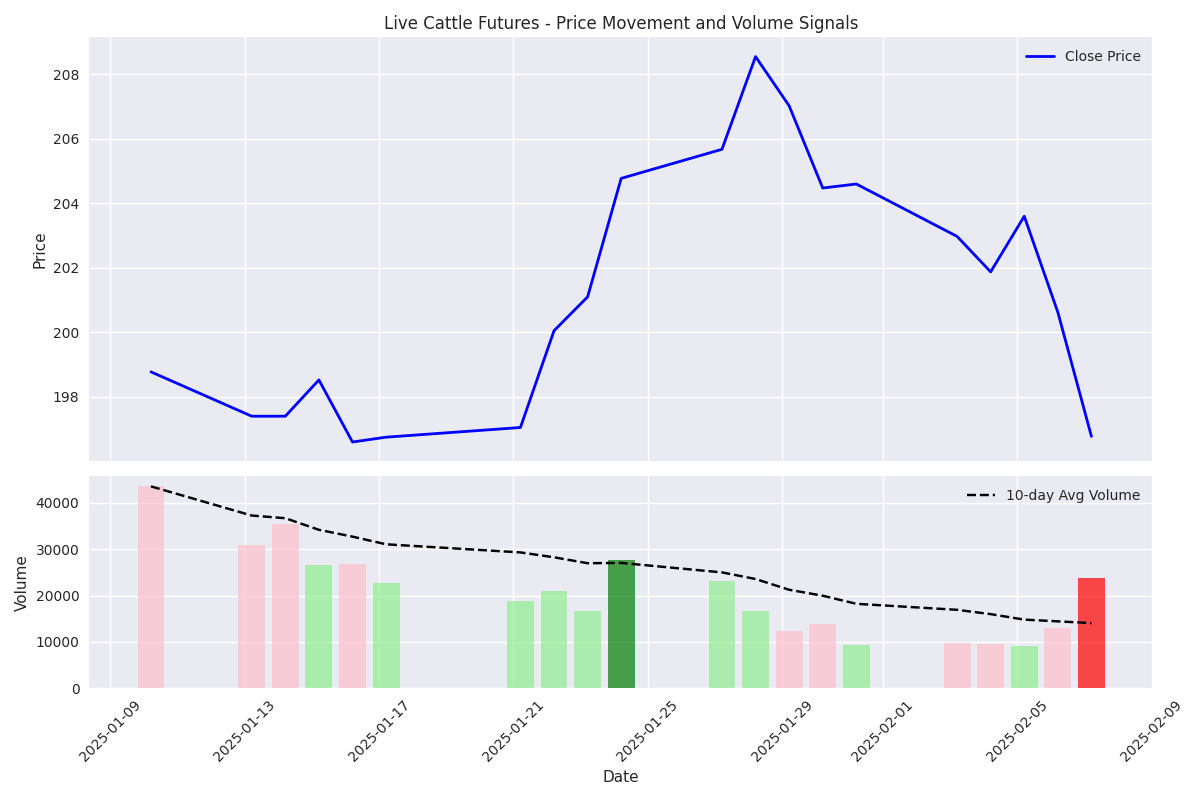

Volume Analysis Reveals Strong Selling Pressure and Market Signals

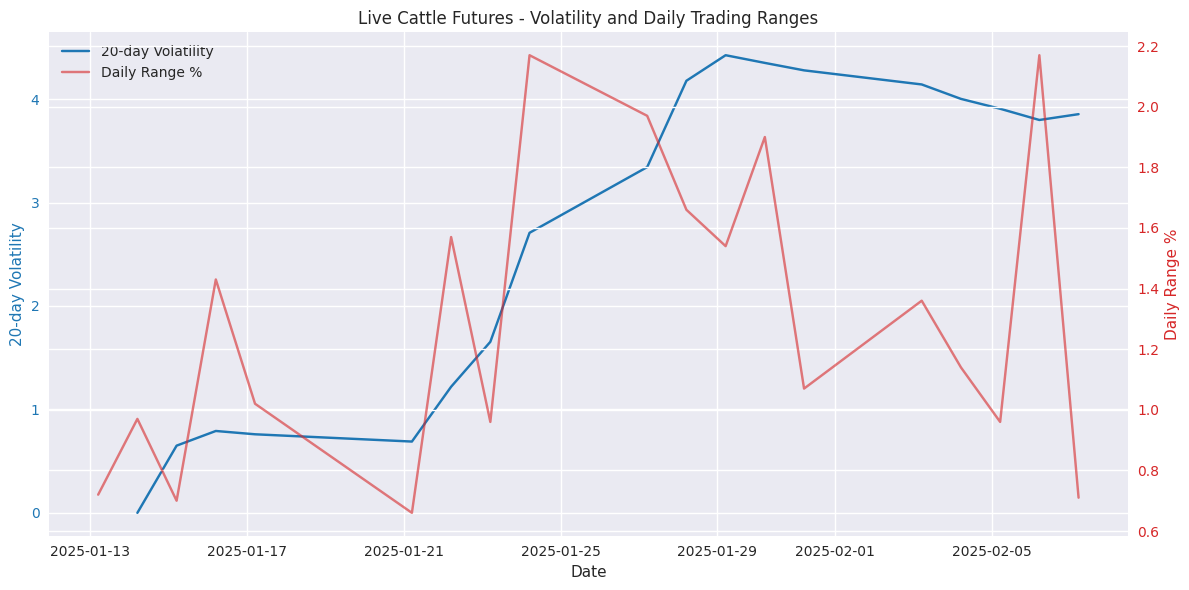

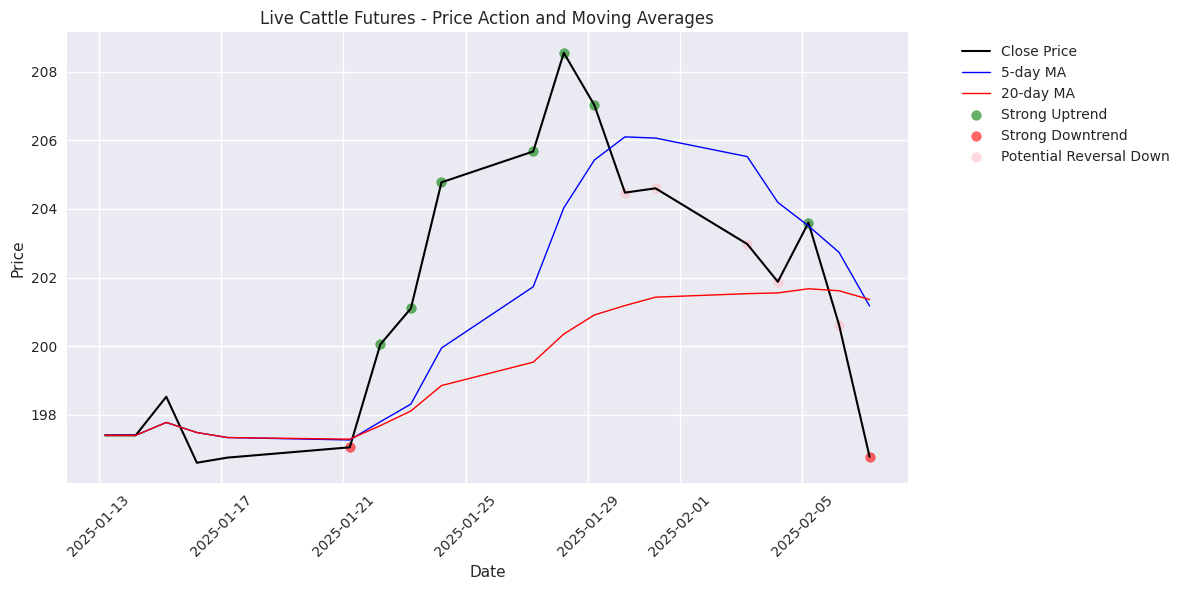

Live Cattle Futures Show Clear Trend Reversal Signals

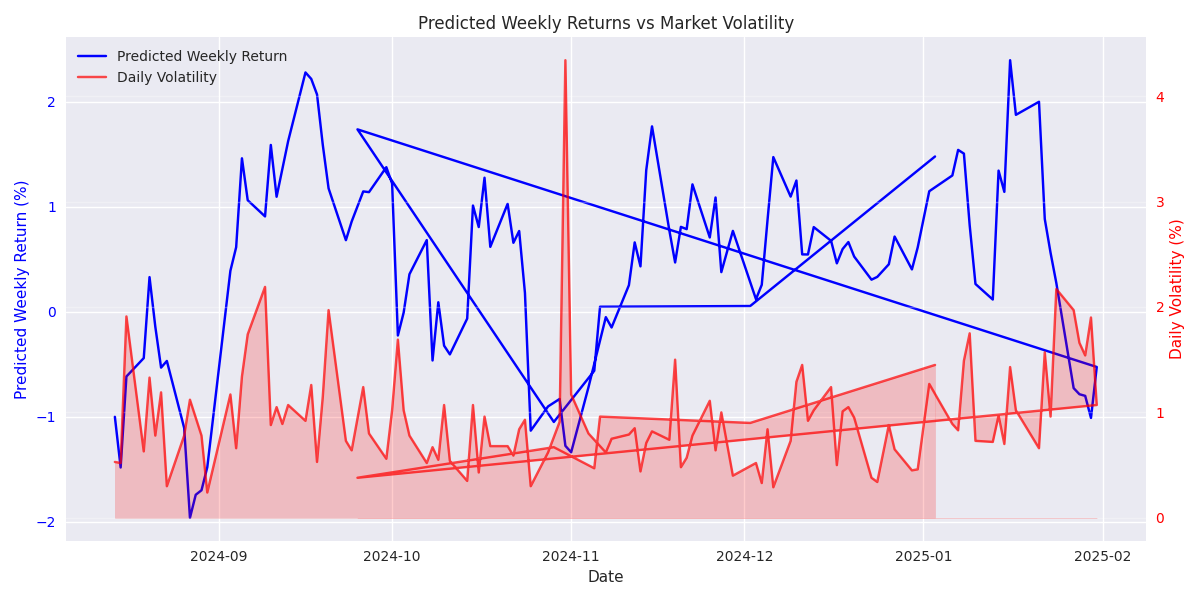

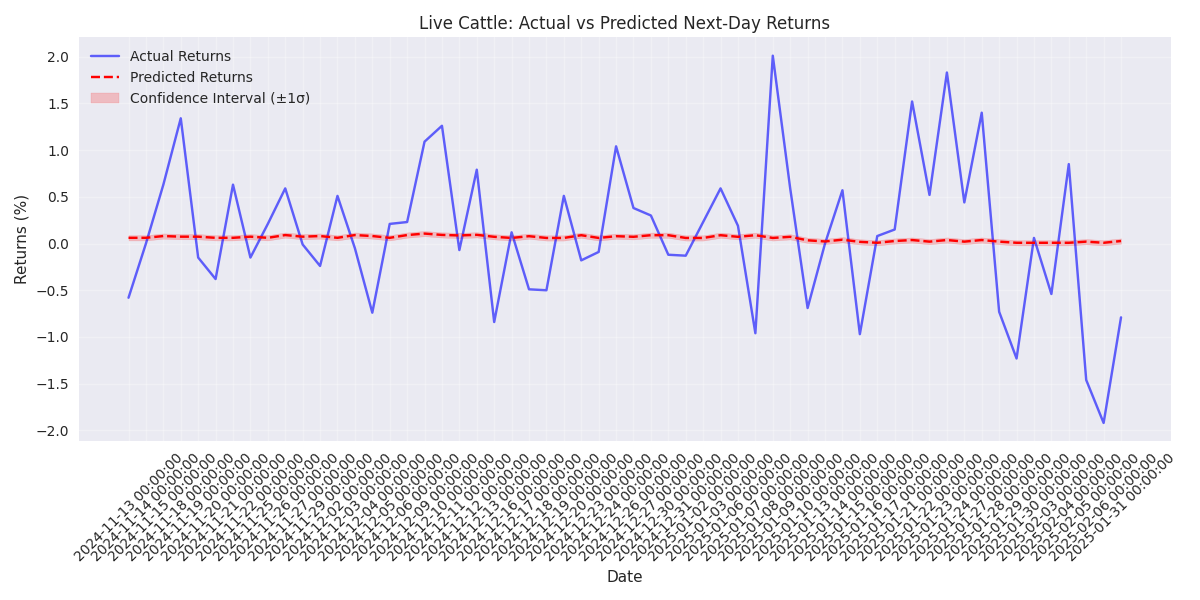

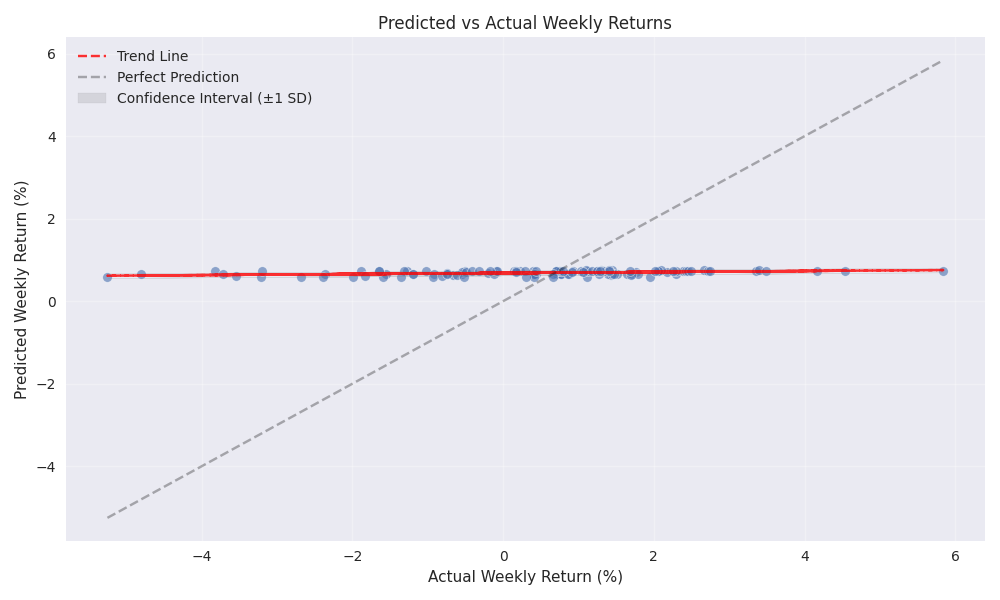

Live Cattle Price Prediction Analysis: Short-term Market Outlook

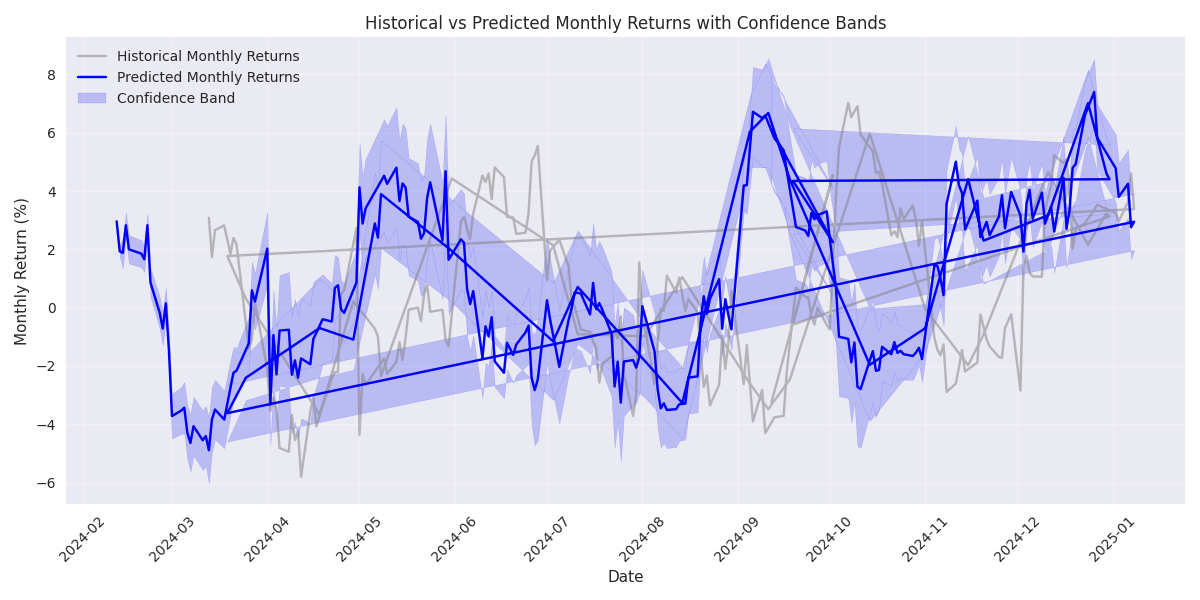

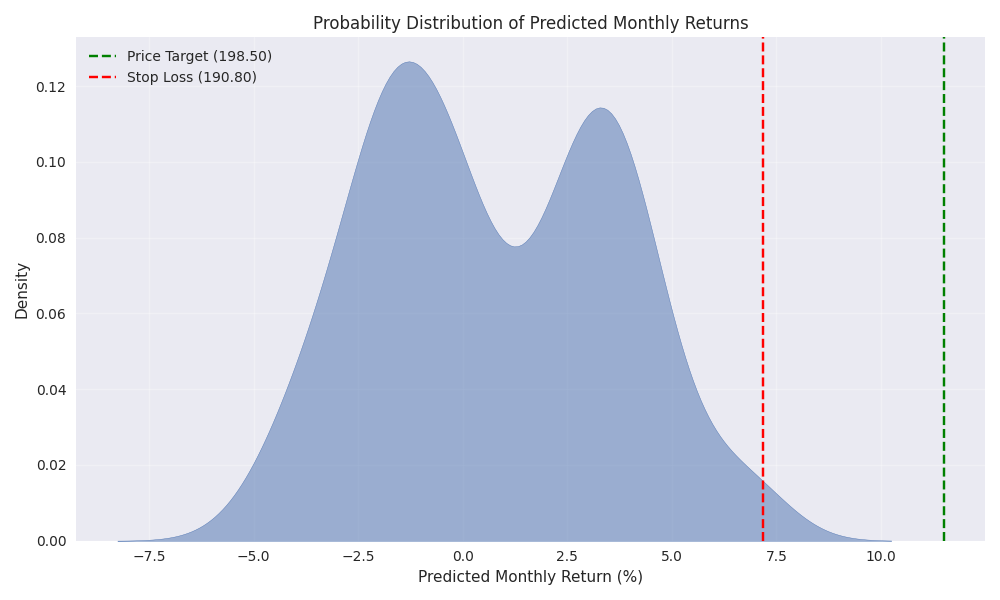

Live Cattle Price Predictions: Weekly and Monthly Outlook

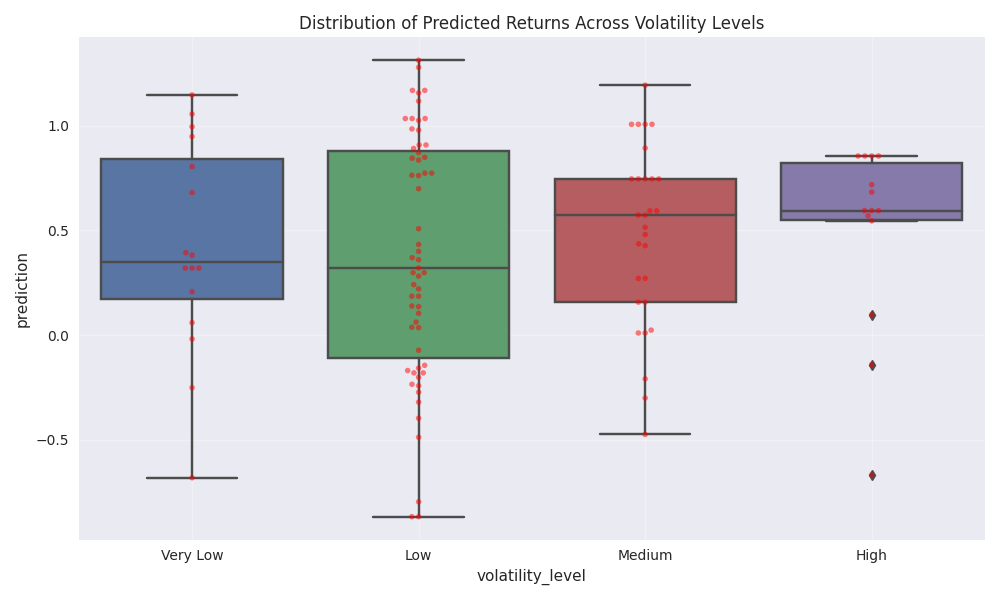

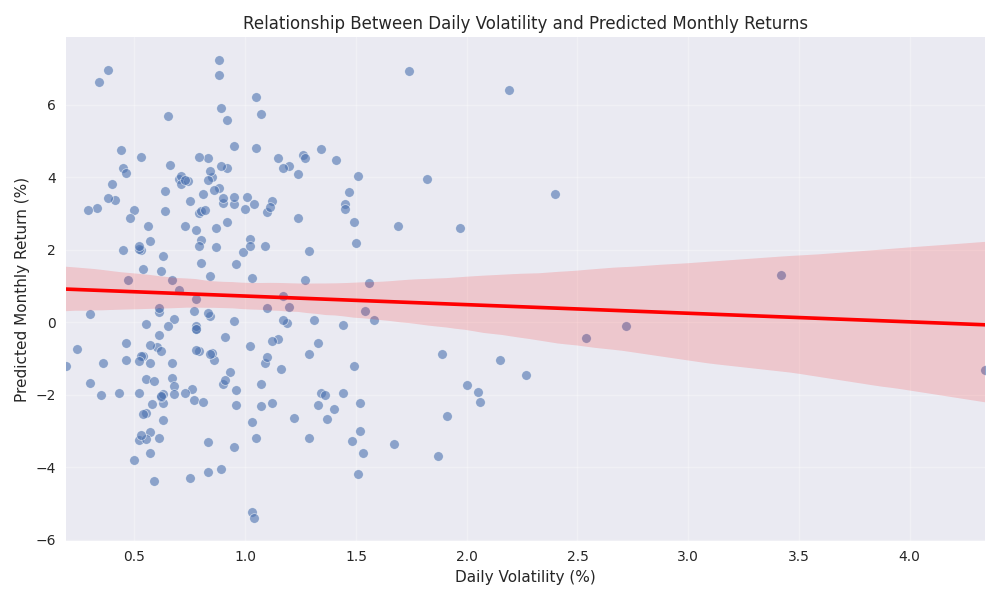

Long-term Price Outlook and Risk Assessment for Live Cattle