Breaking Down Intel's Market Moves: Urgent Trading Insights for Savvy Investors

Saving...

High-Confidence Bearish Signal for Intel Stock

Saving...

Clear Trading Range Identified with Strong Technical Setup

Saving...

Potential Reversal Signal Despite Bearish Trend

Saving...

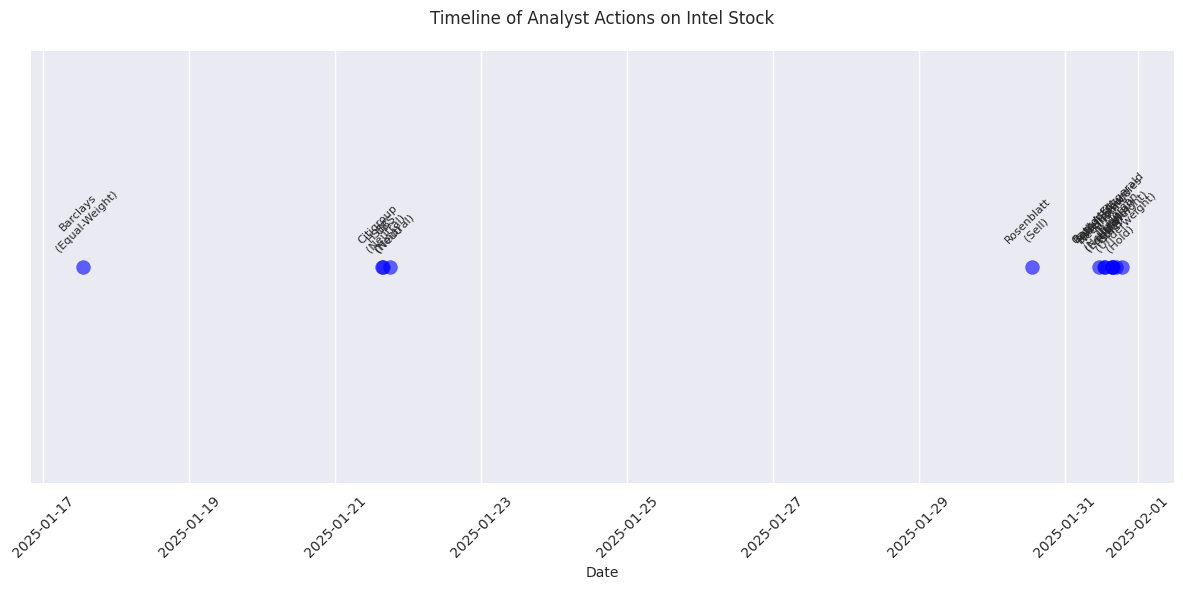

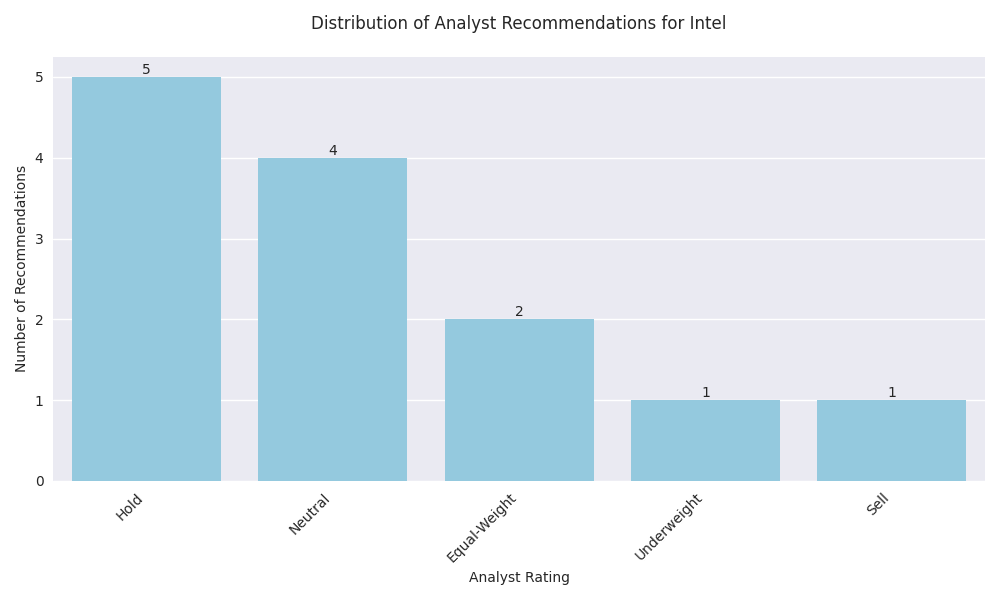

Limited Institutional Support Adds Pressure

Intel Stock Analysis: Price Movement and Analyst Sentiment

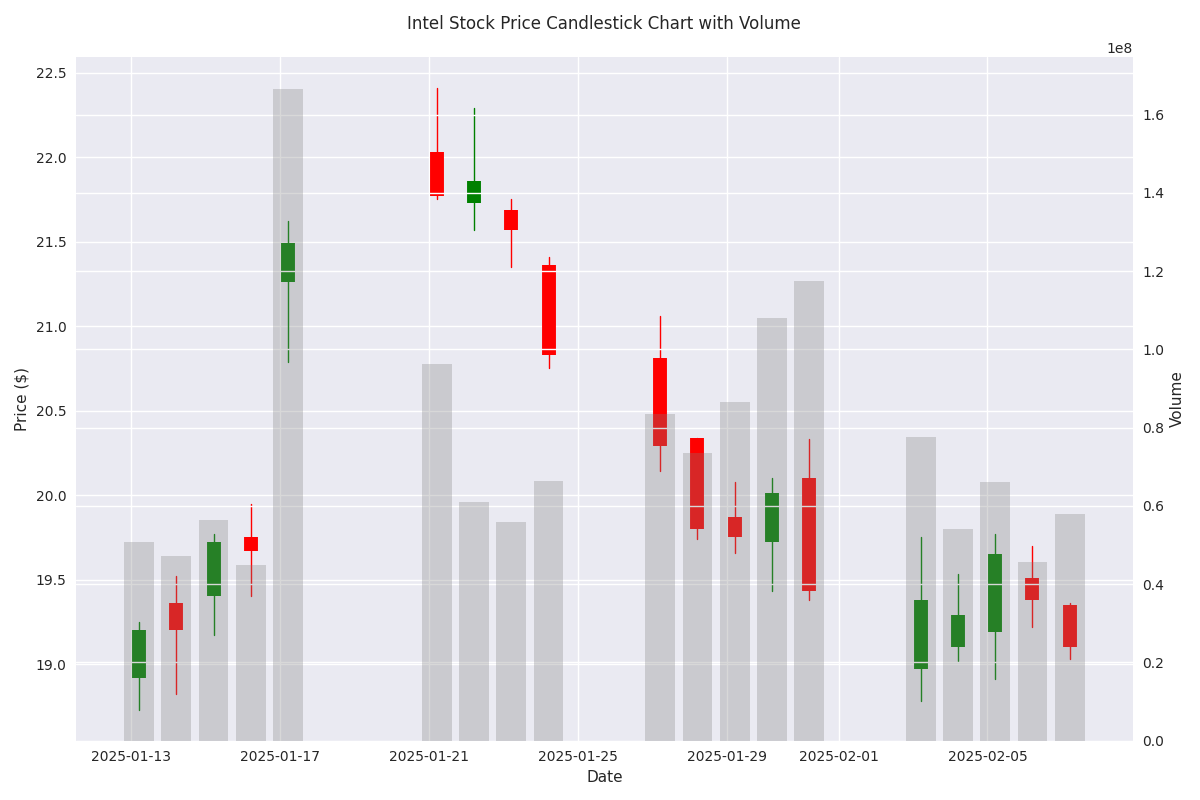

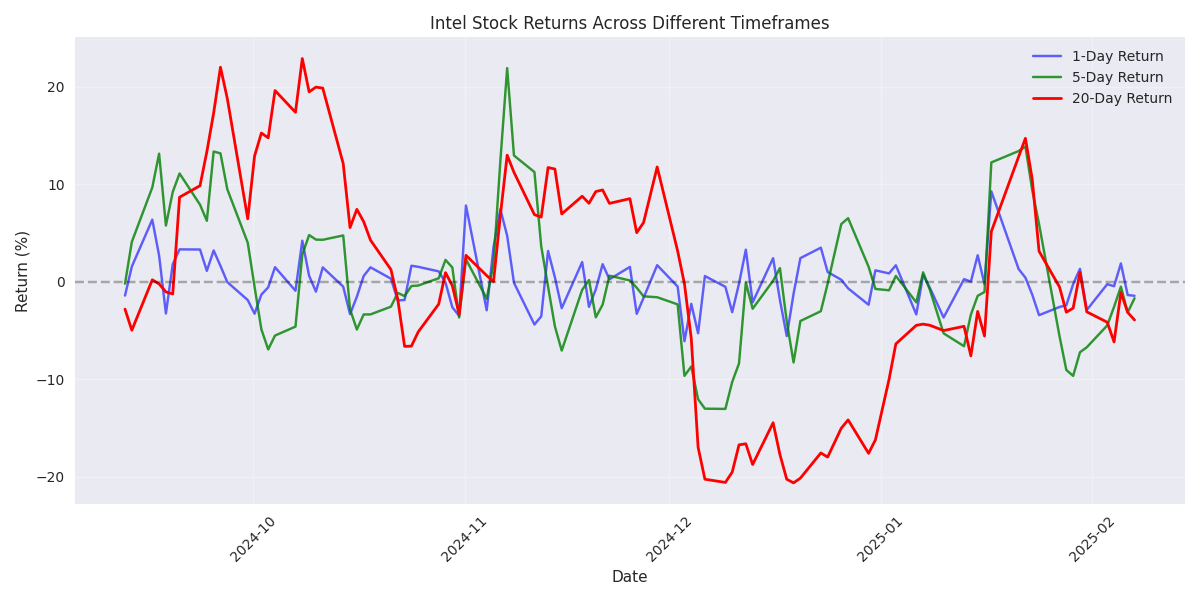

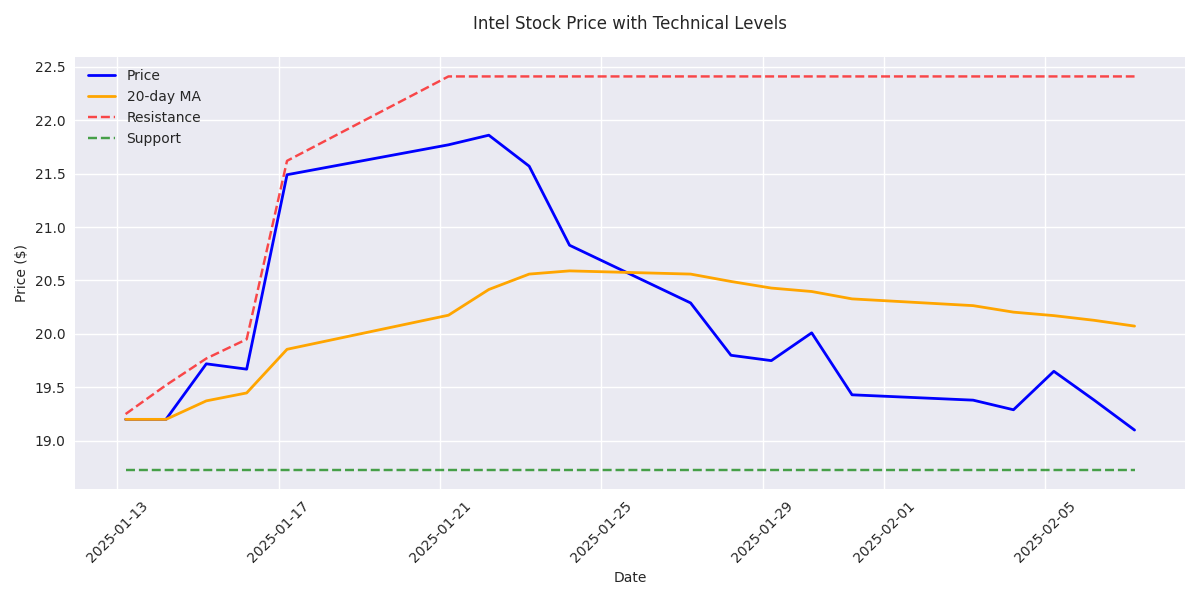

Intel's Technical Analysis: Support, Resistance, and Price Action

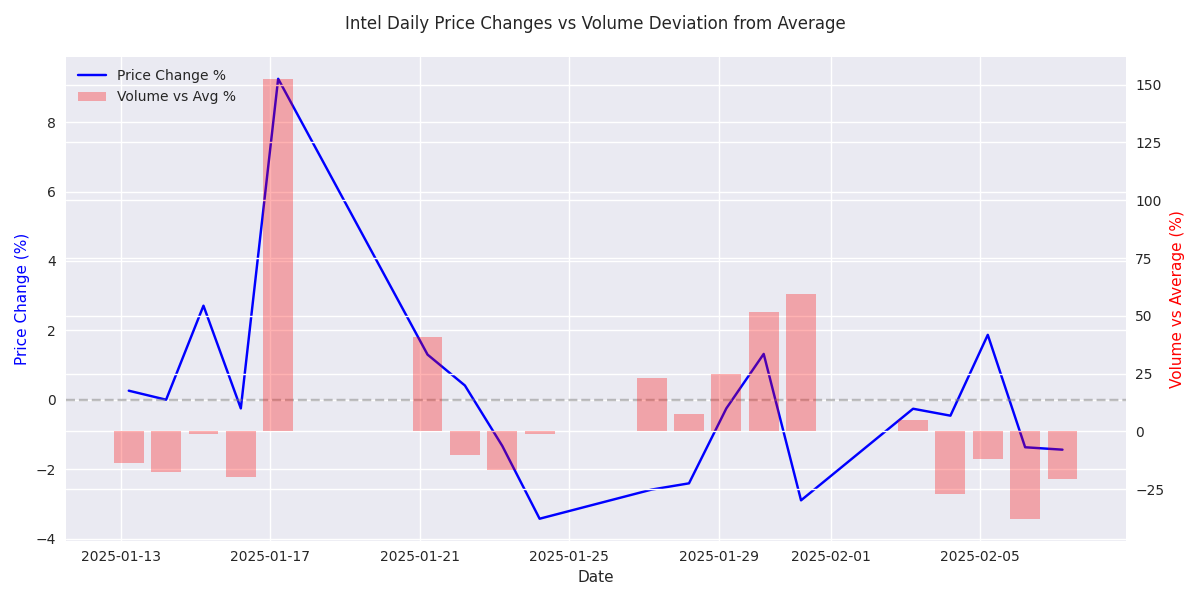

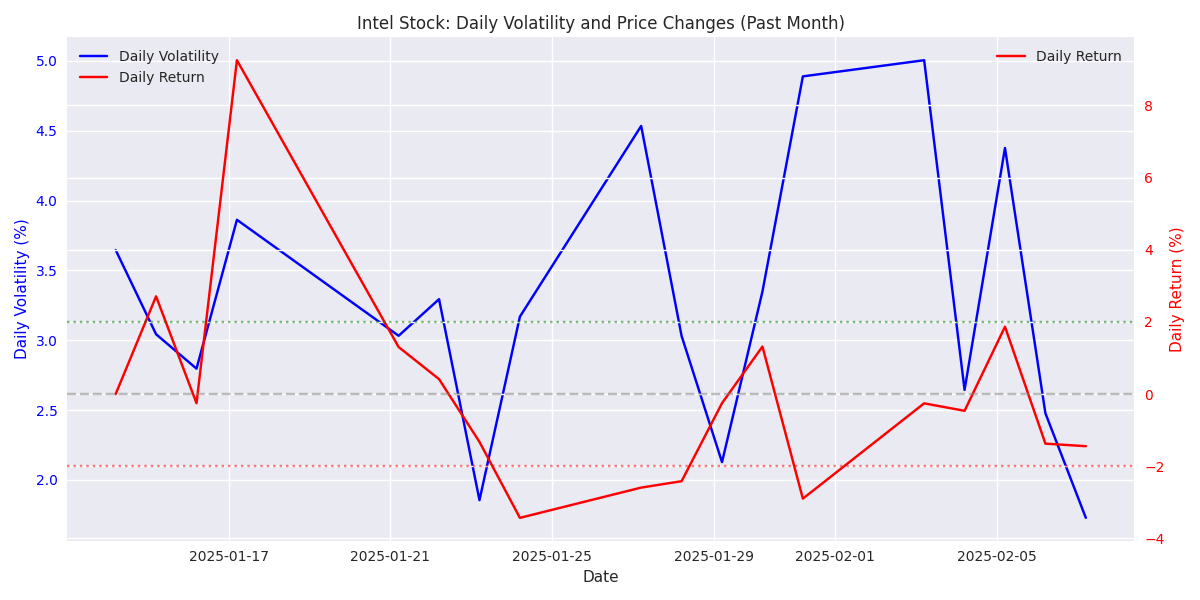

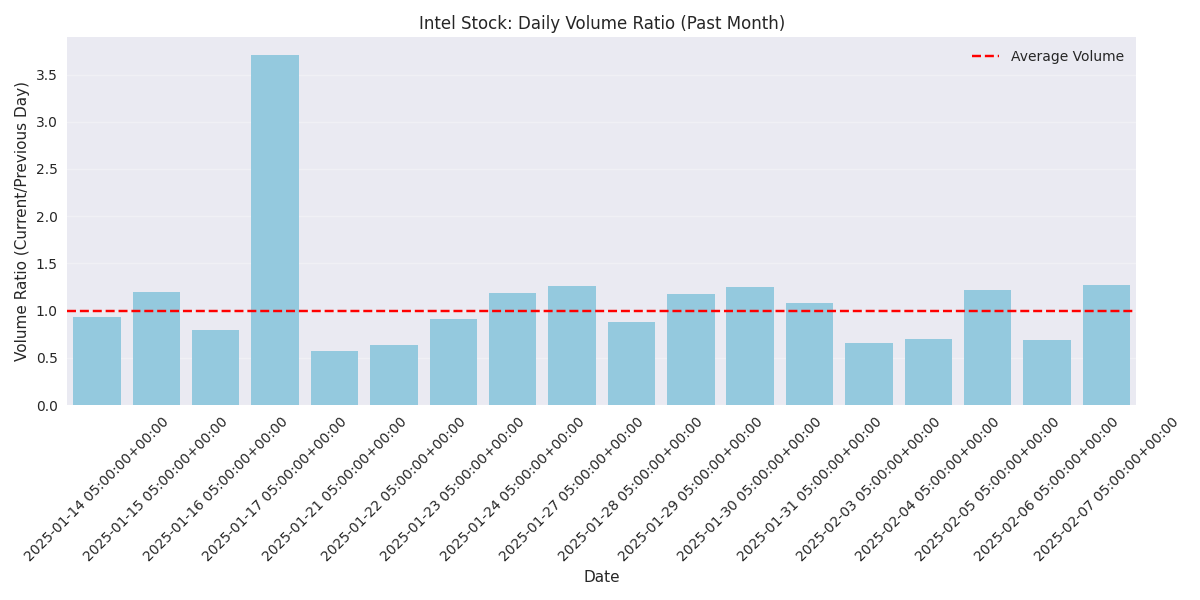

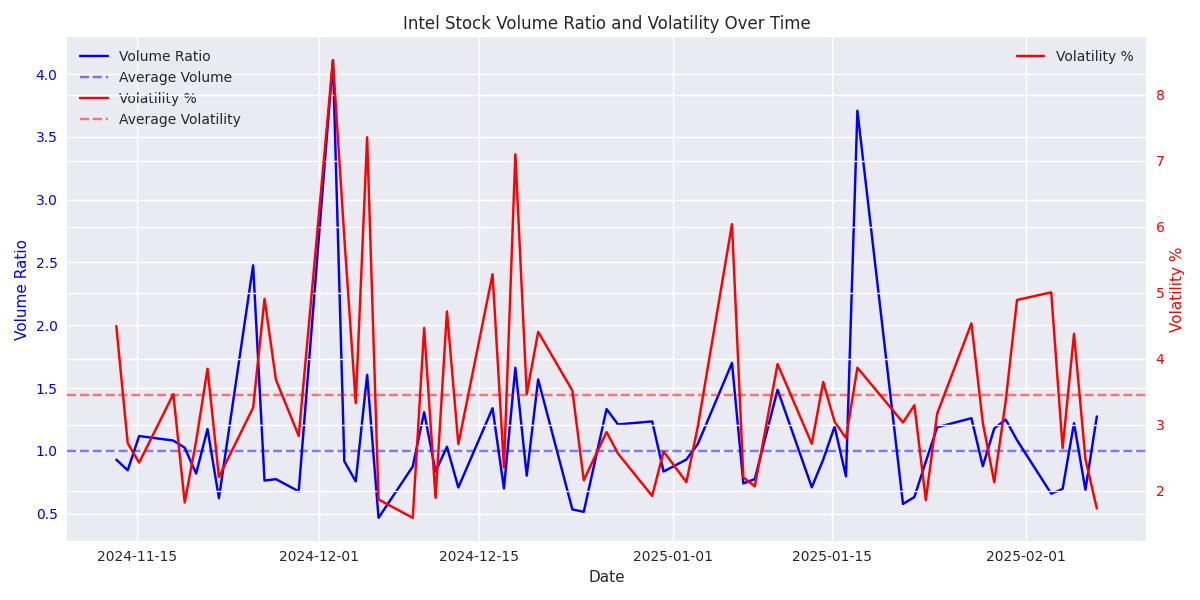

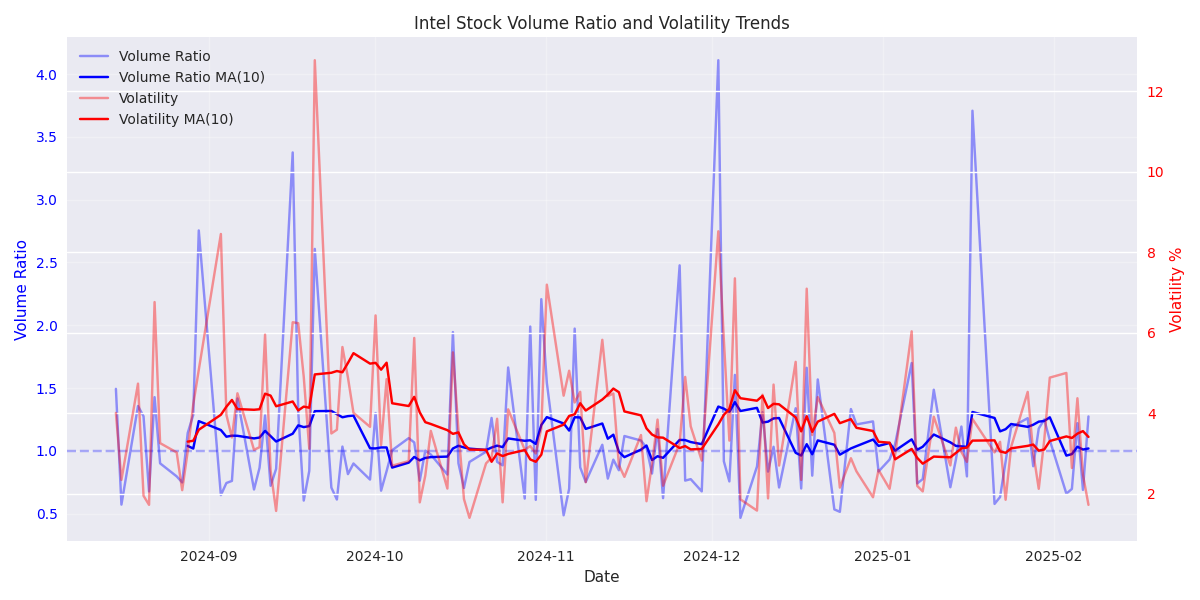

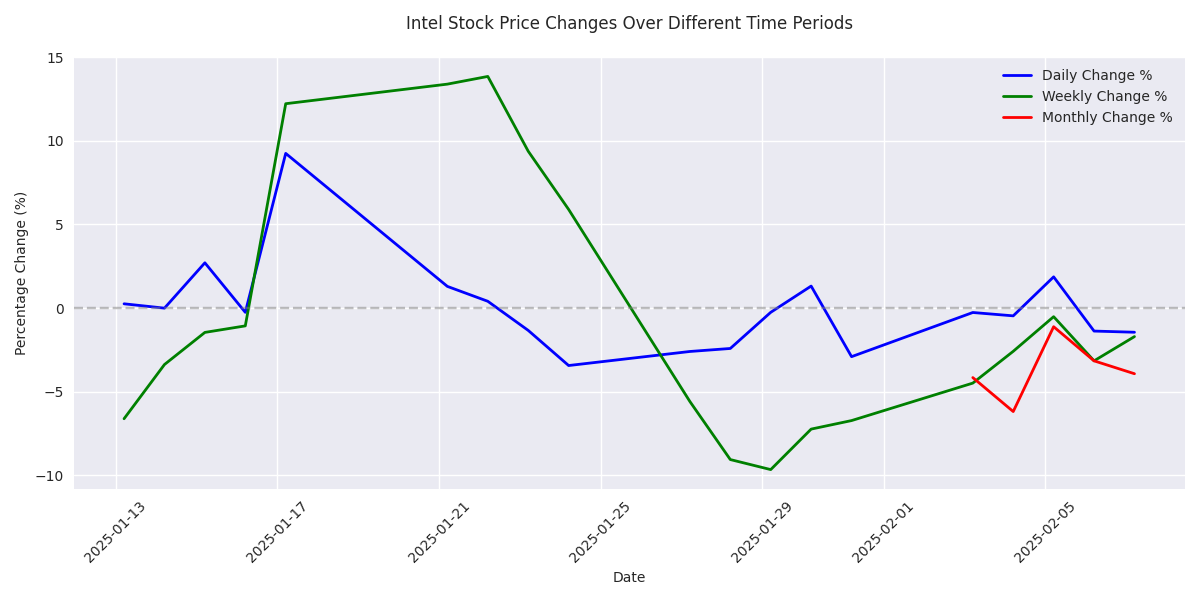

Intel's Recent Price Performance and Volume Analysis

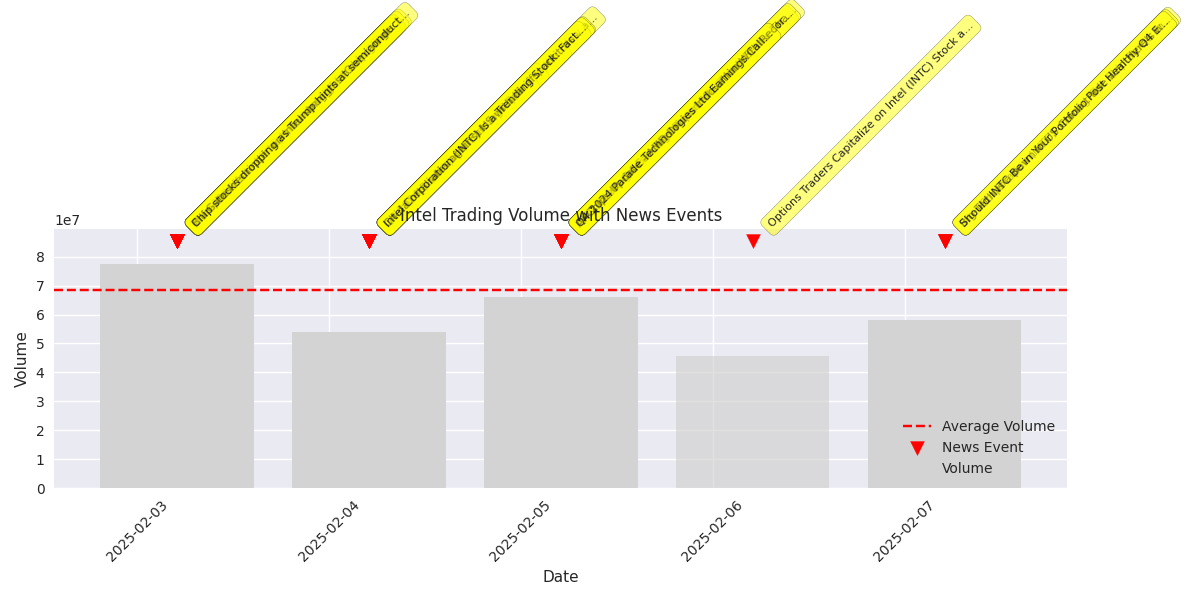

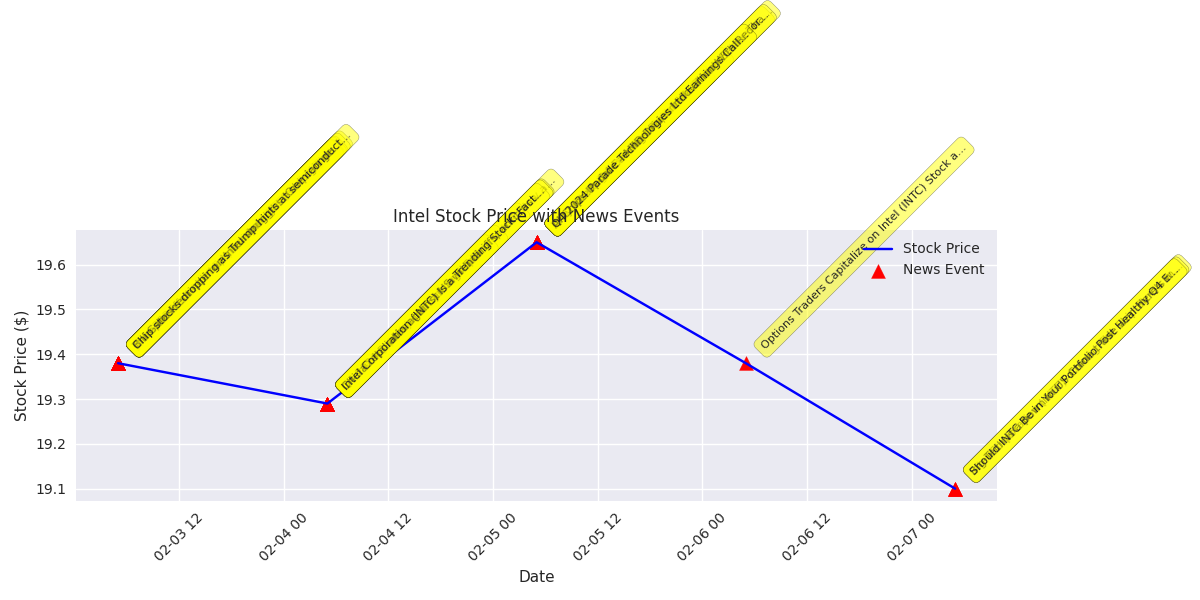

Recent News Impact on Intel's Trading Activity

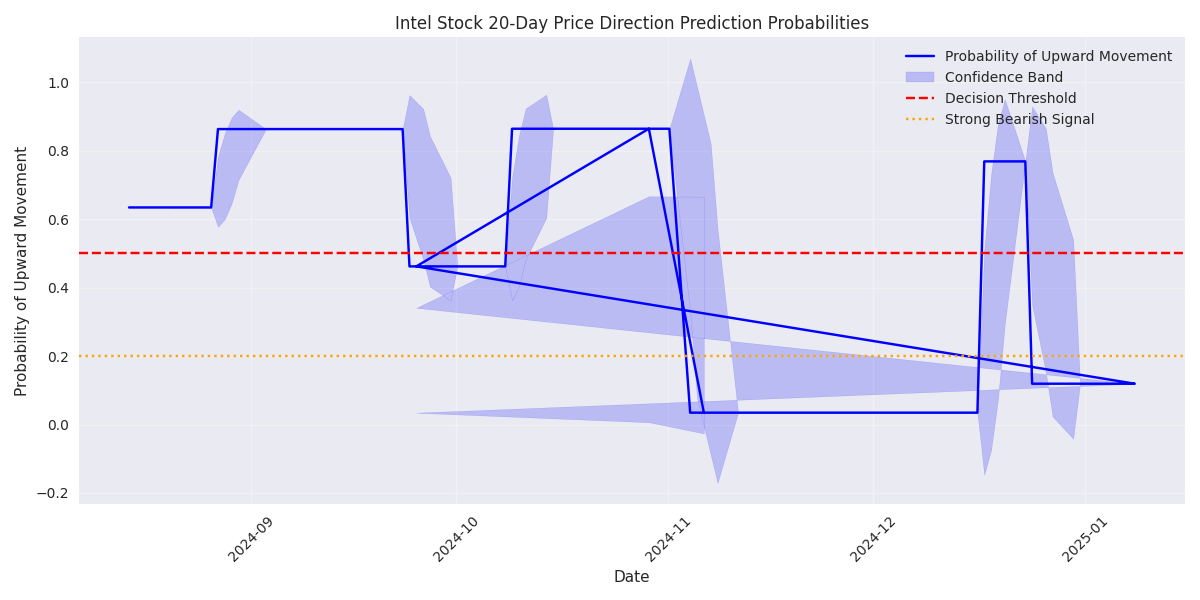

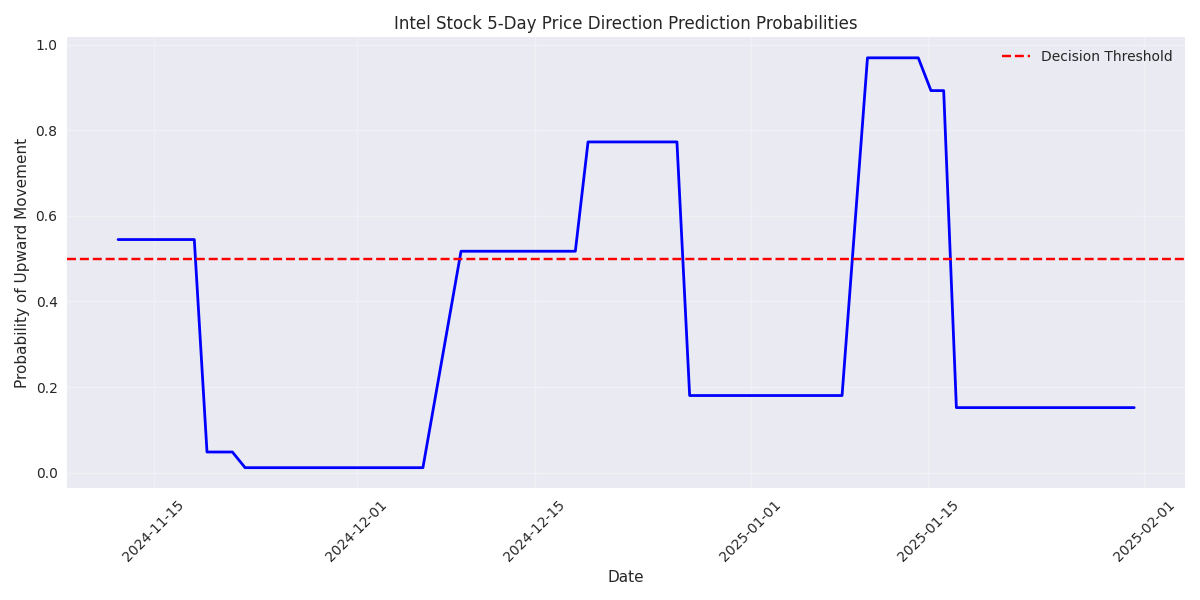

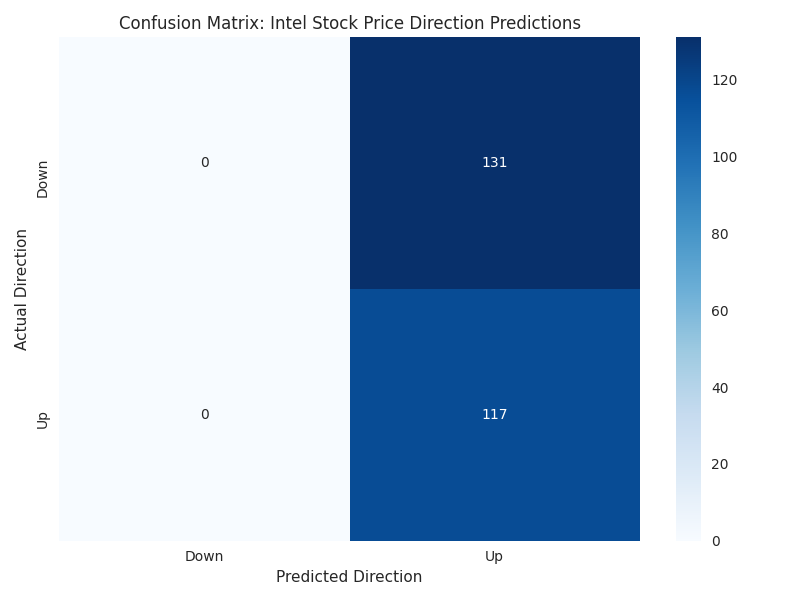

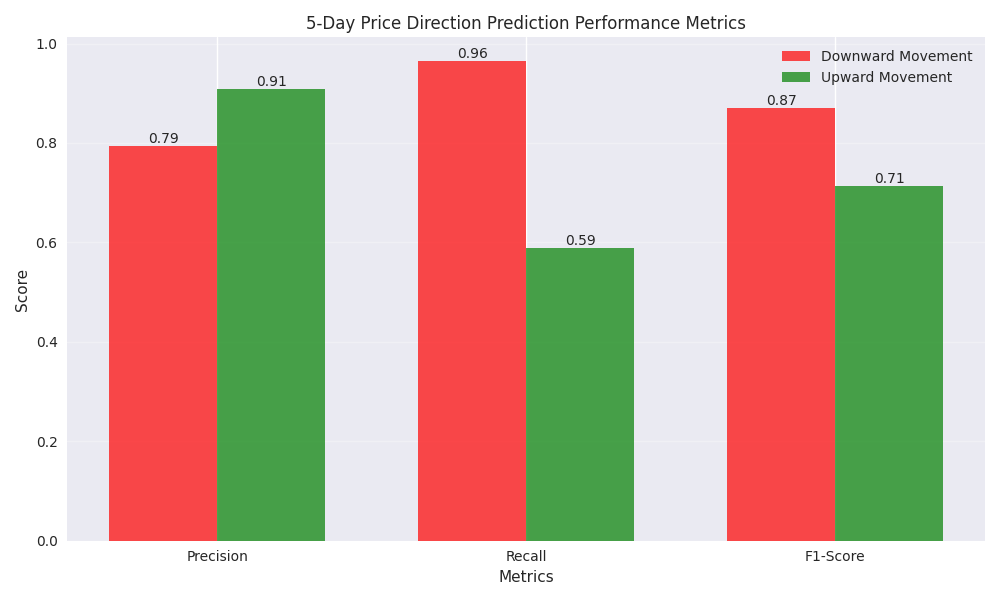

Intel Stock Price Direction Prediction Model Shows Balanced Performance

Intel Stock Shows Strong 5-Day Price Direction Prediction Accuracy with Balanced Risk Profile

Long-Term Analysis Shows Strong Bearish Trend with High Prediction Confidence