Saving...

Transforming Technical Treasury Yield Data into Trader-Ready Market Insights

Saving...

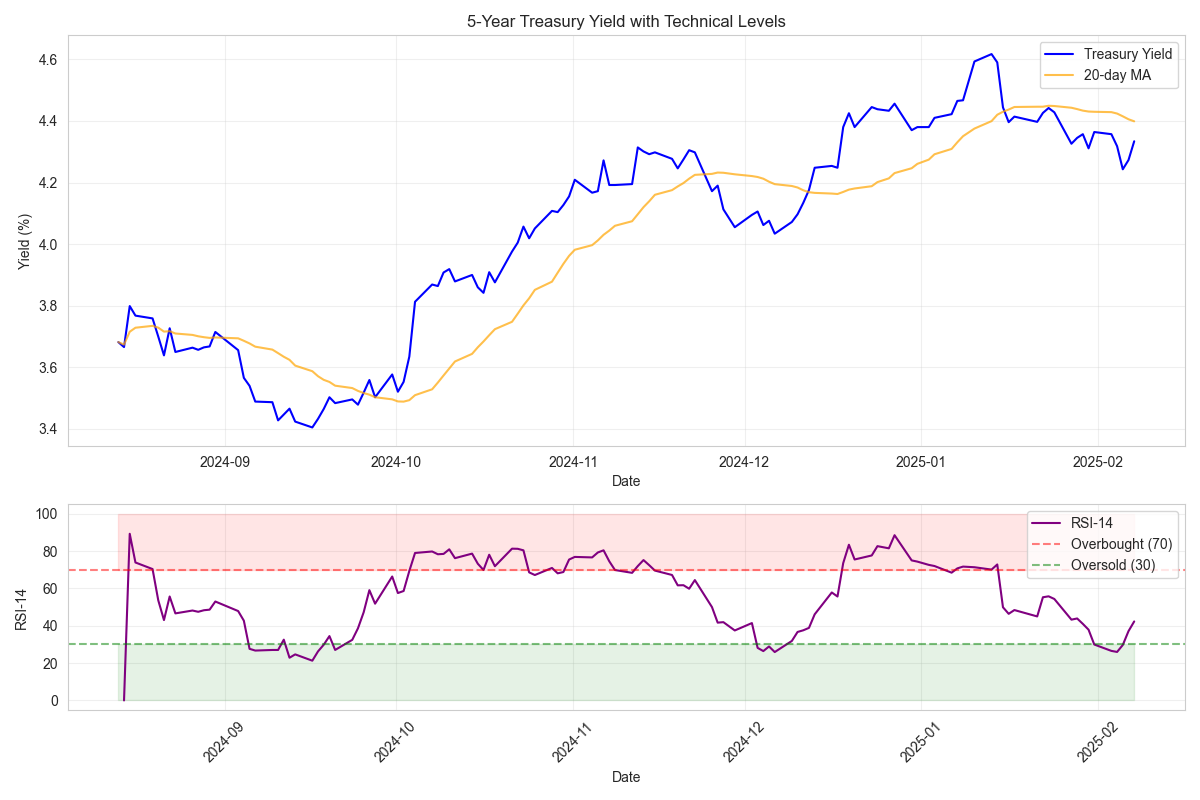

Strong Bearish Setup in Treasury Yields with Clear Trading Levels

Saving...

Strong Bearish Setup in Treasury Yields with Clear Trading Levels

Saving...

Saving...

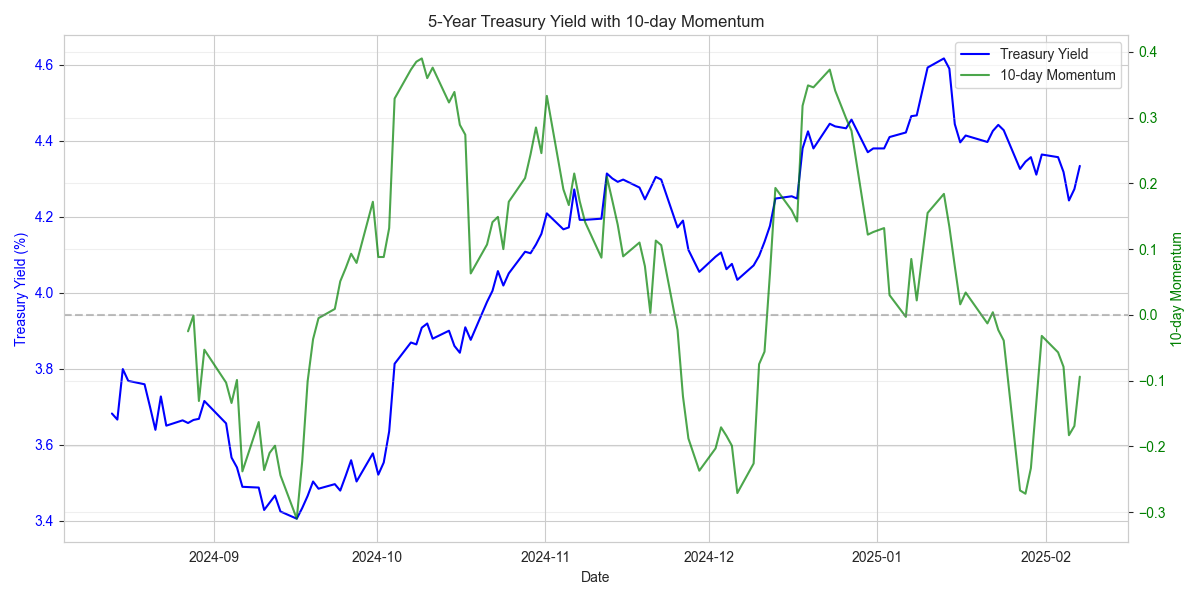

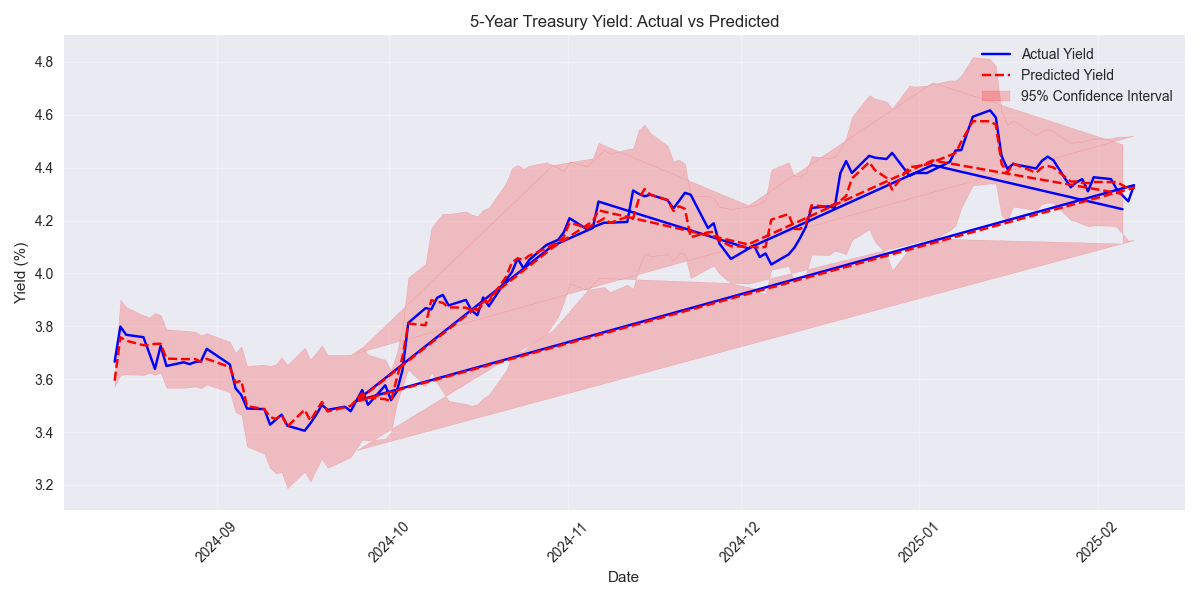

Model Projects Further Yield Decline Despite Oversold Conditions

Saving...

Model Projects Further Yield Decline Despite Oversold Conditions

Saving...

Saving...

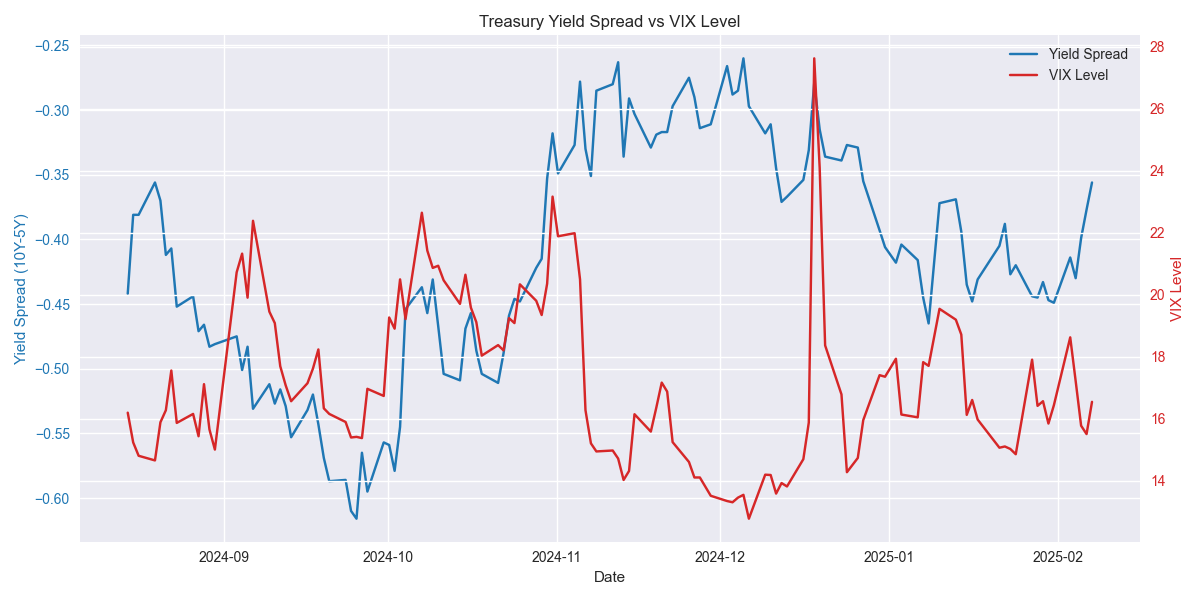

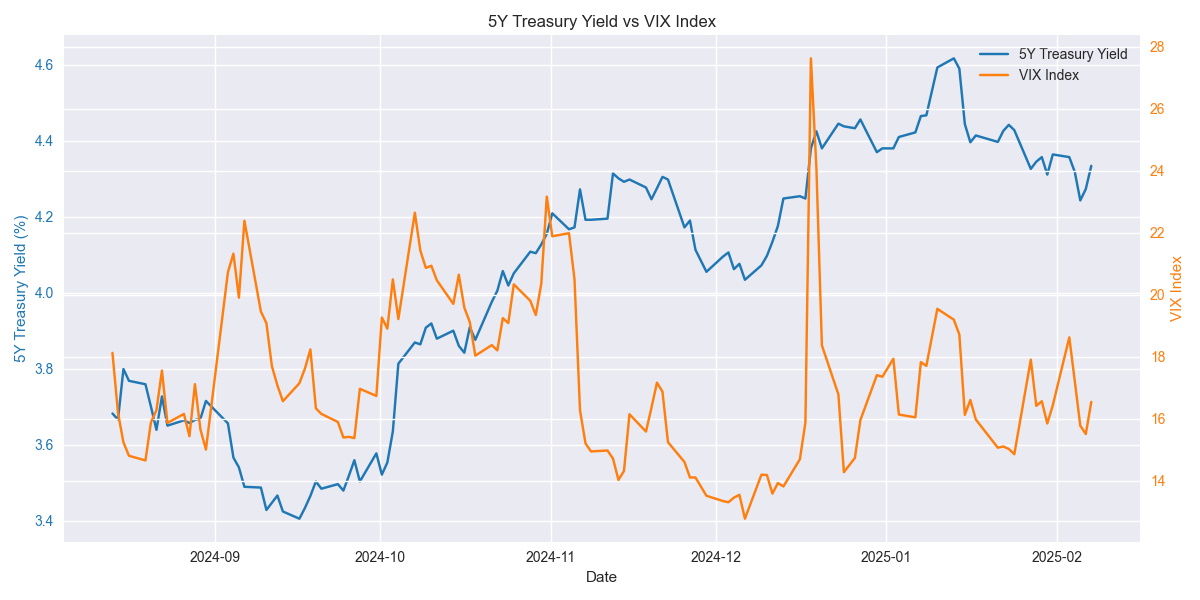

Market Risk Indicators Signal Potential Treasury Rally

Saving...

Market Risk Indicators Signal Potential Treasury Rally

Saving...

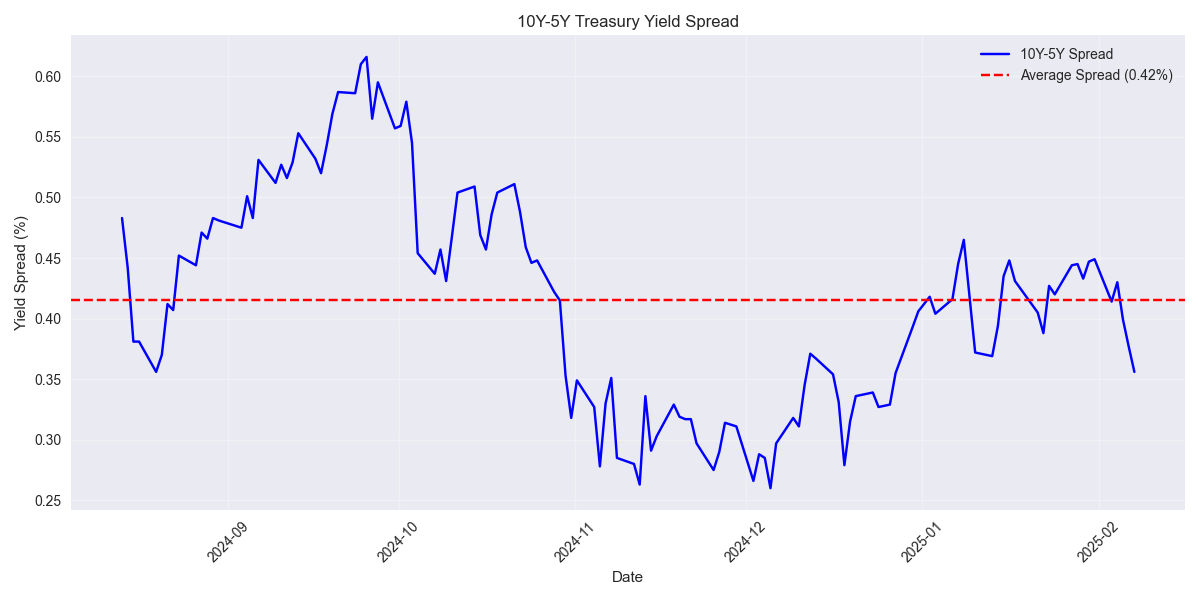

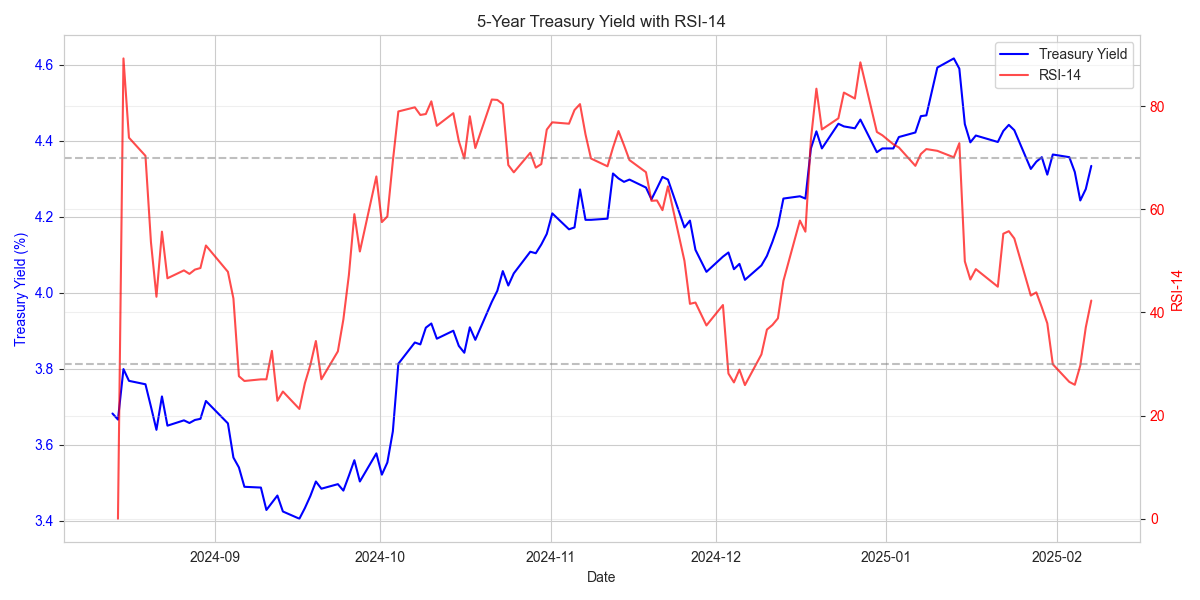

Treasury Yield Technical Analysis Shows Bearish Momentum with Oversold Conditions

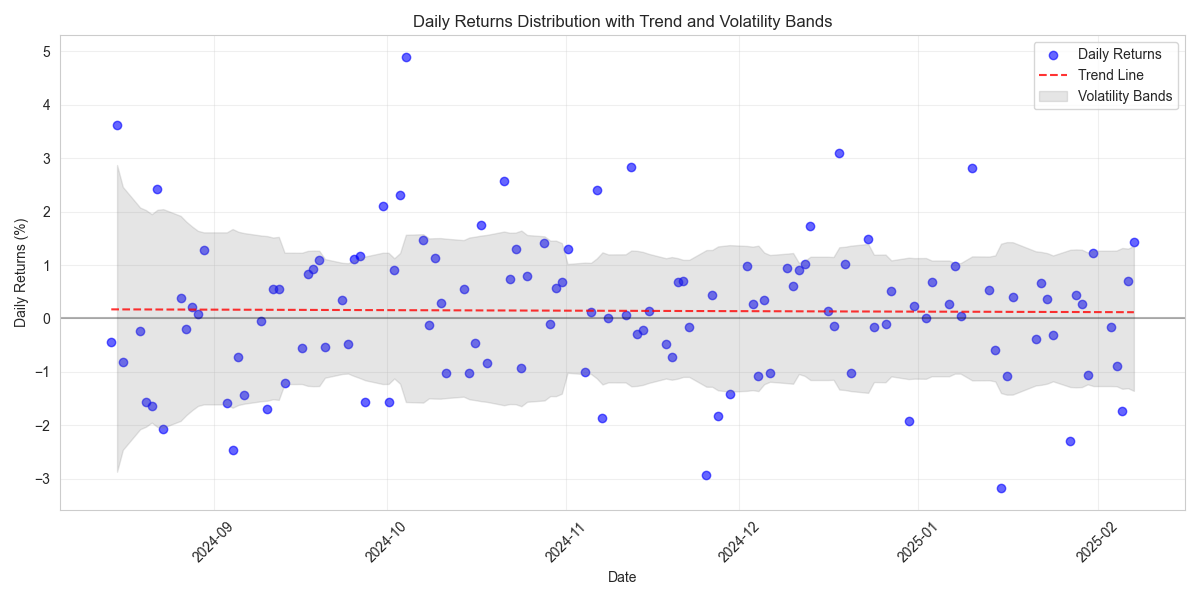

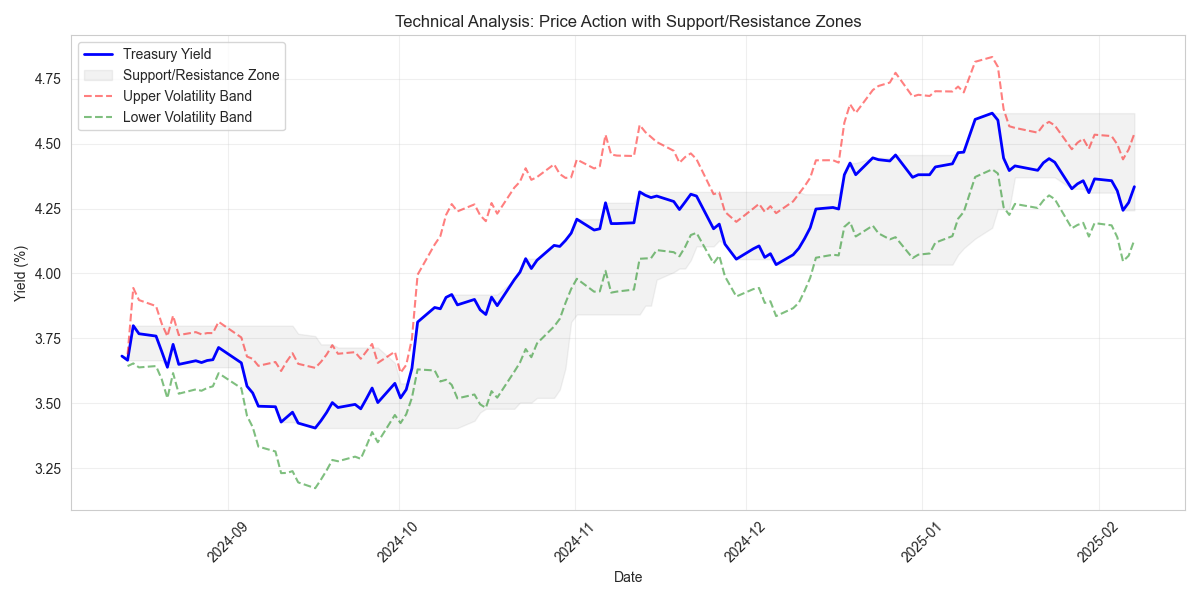

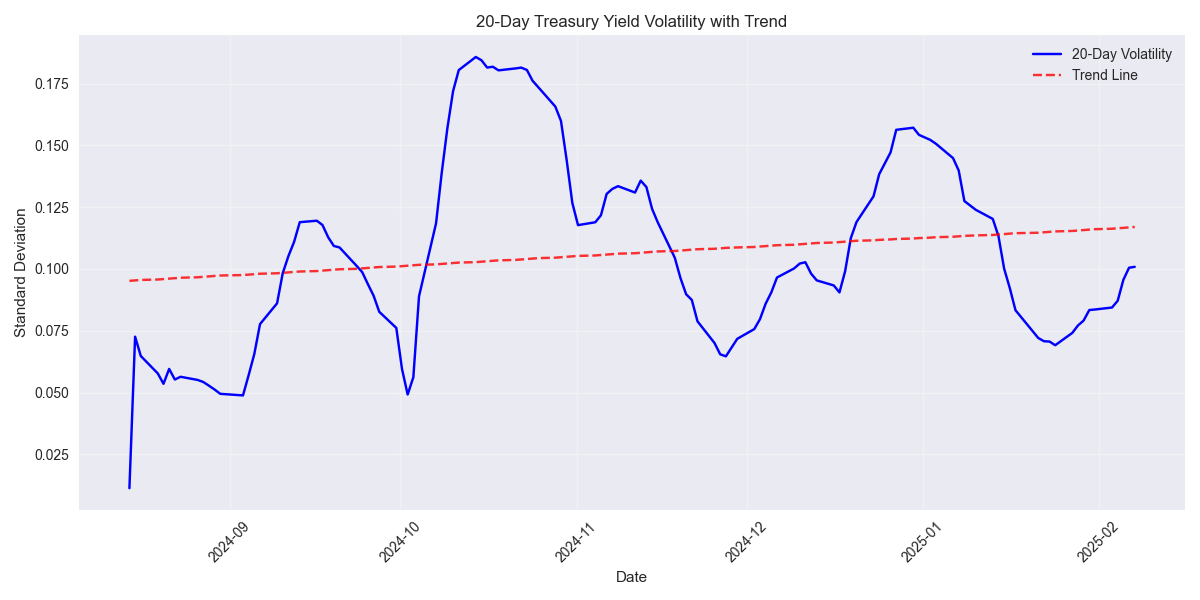

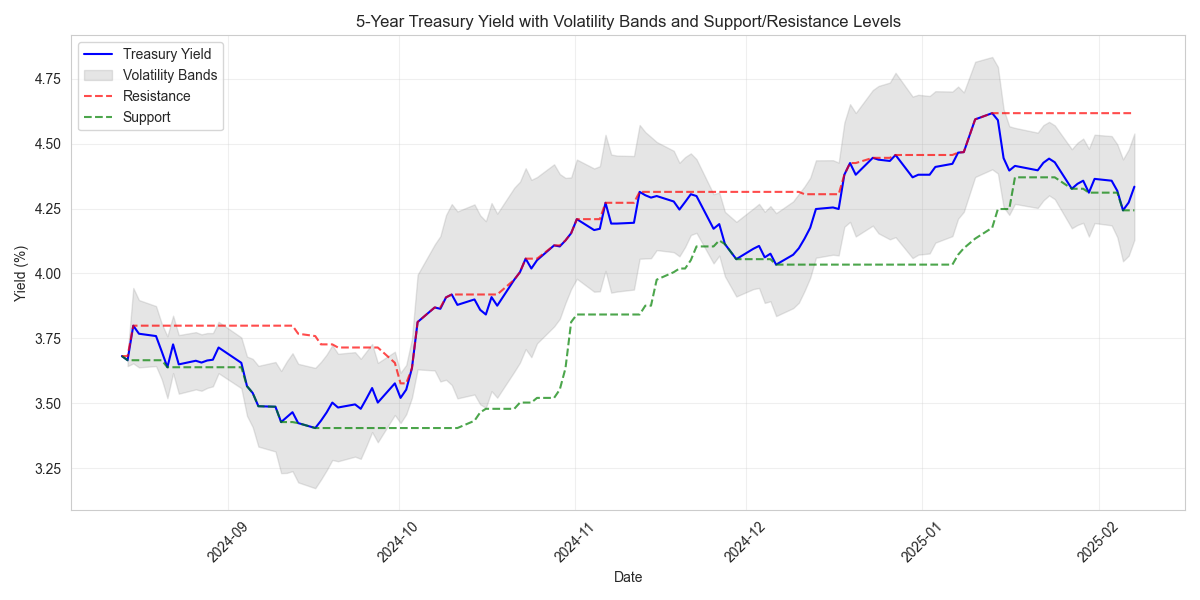

Volatility Analysis Reveals Increasing Market Stability with Key Support/Resistance Levels

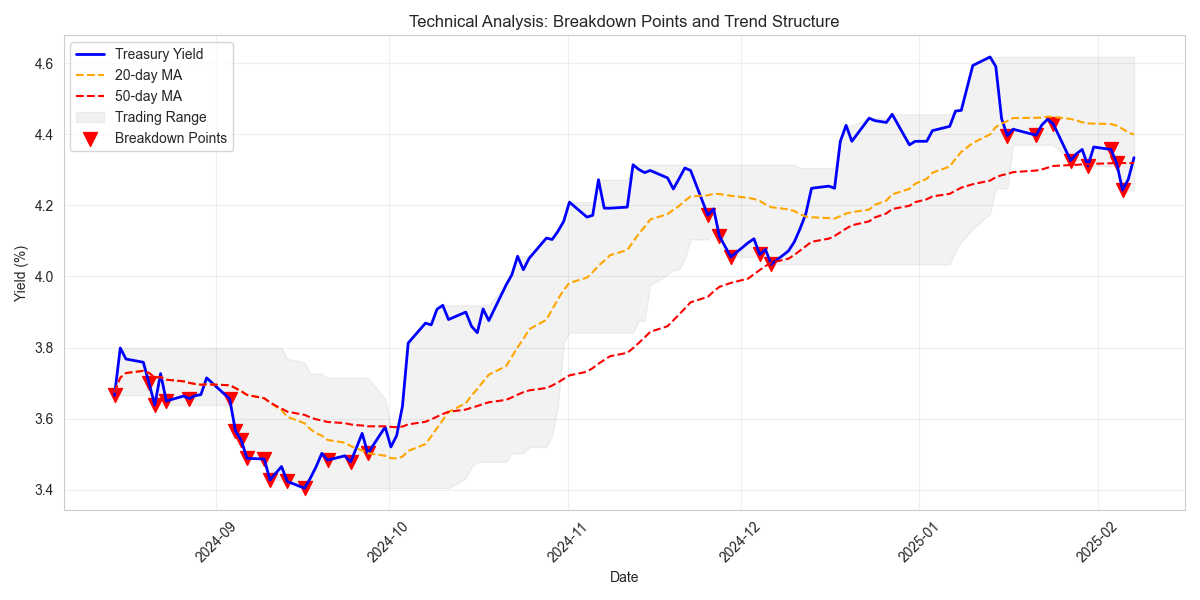

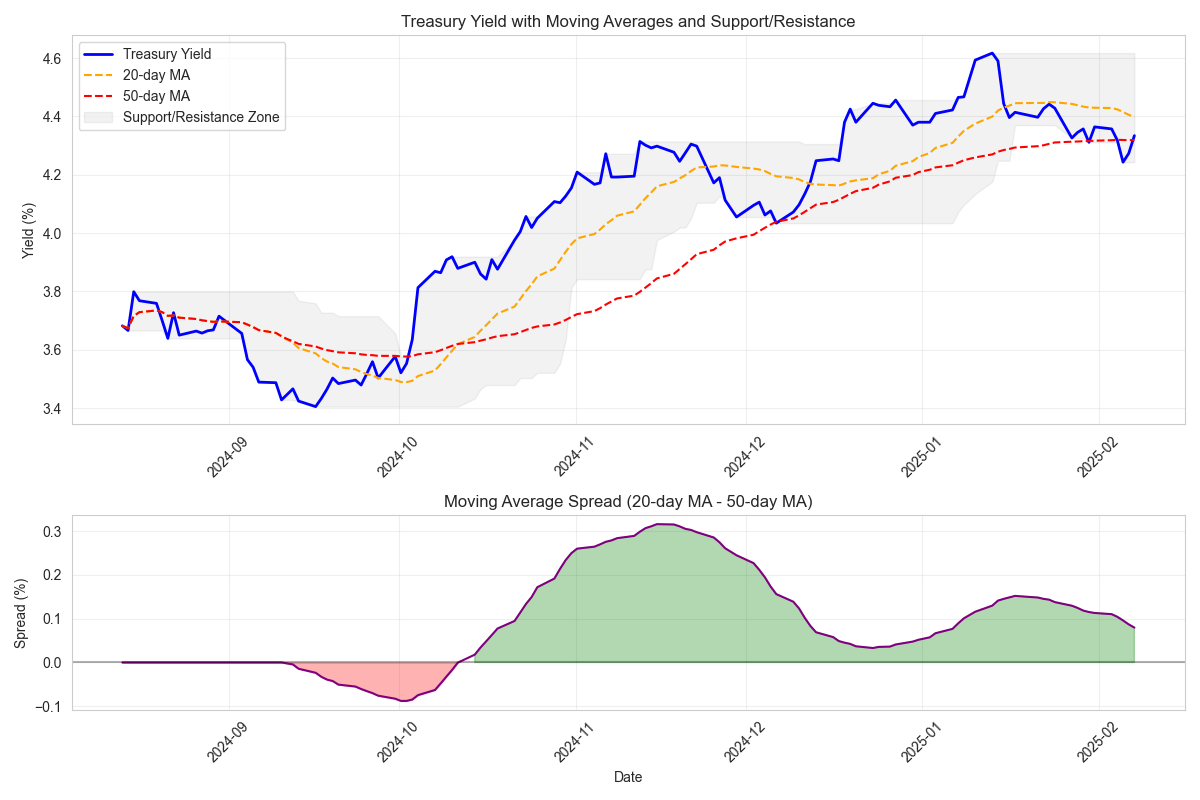

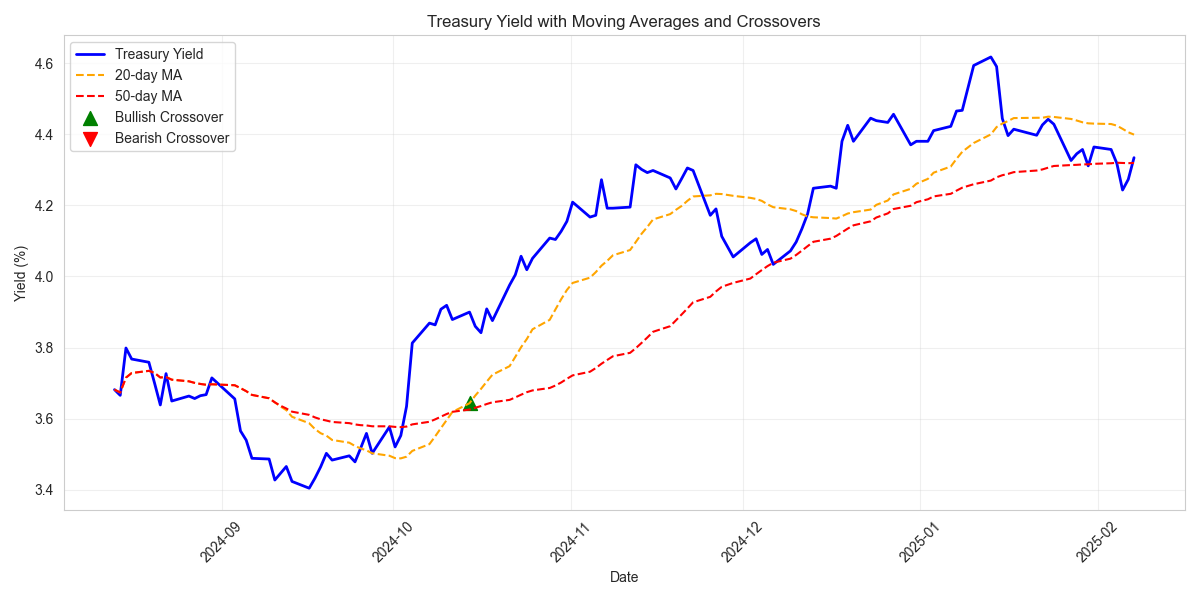

Moving Average Analysis Reveals Critical Price Action and Breakout Points

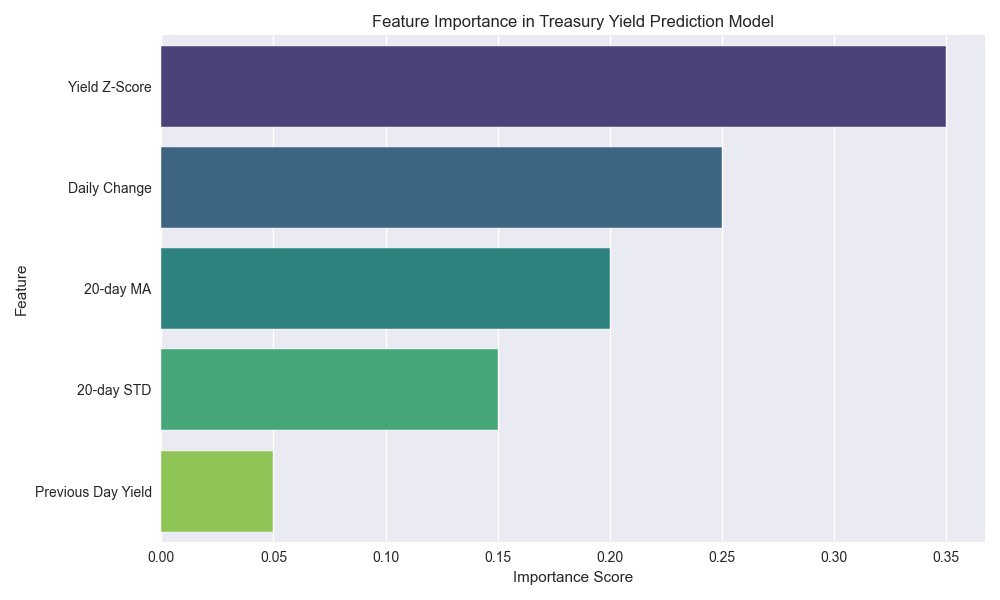

Treasury Yield Prediction Model Shows Strong Technical Patterns

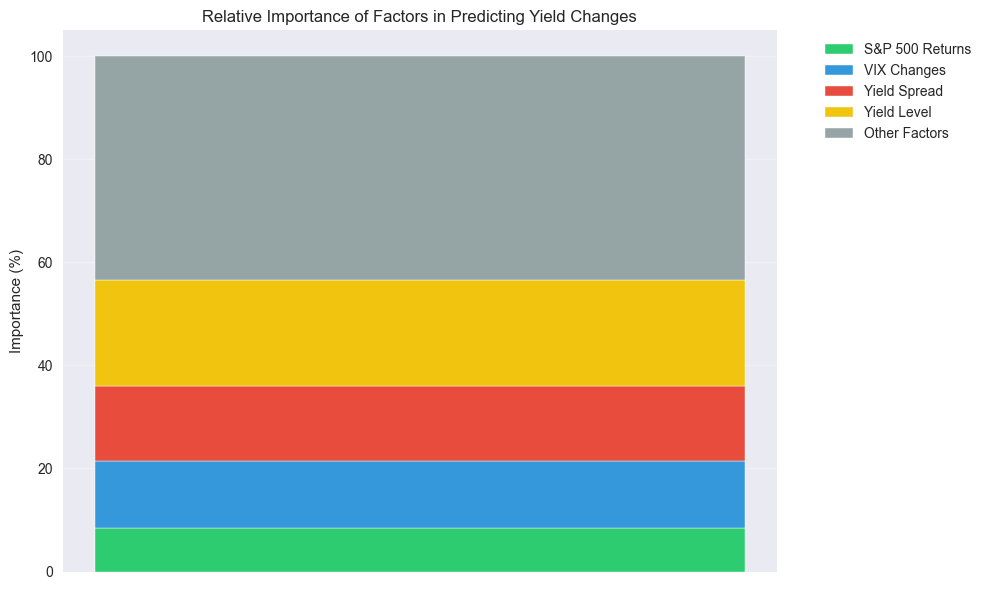

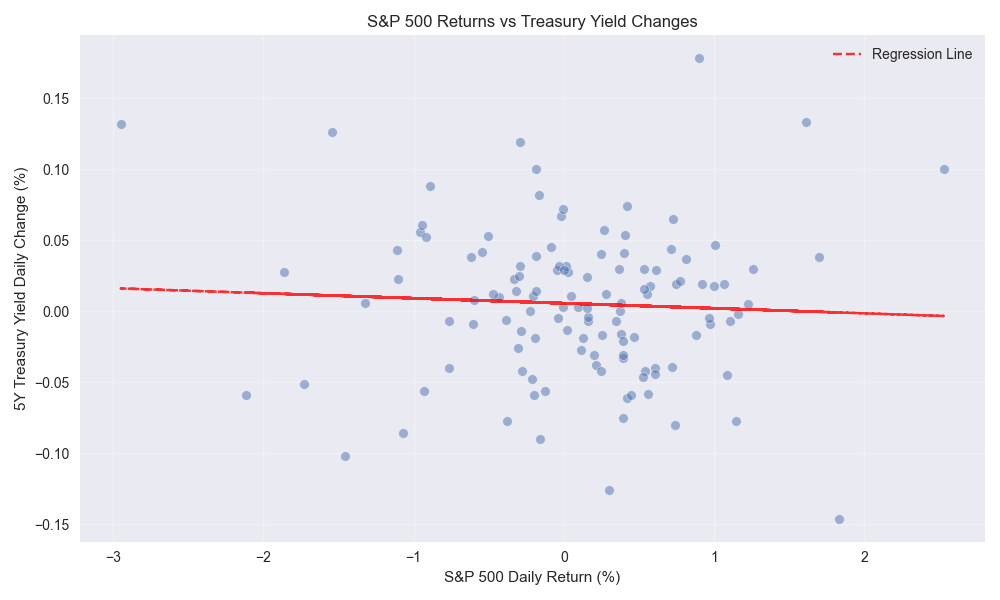

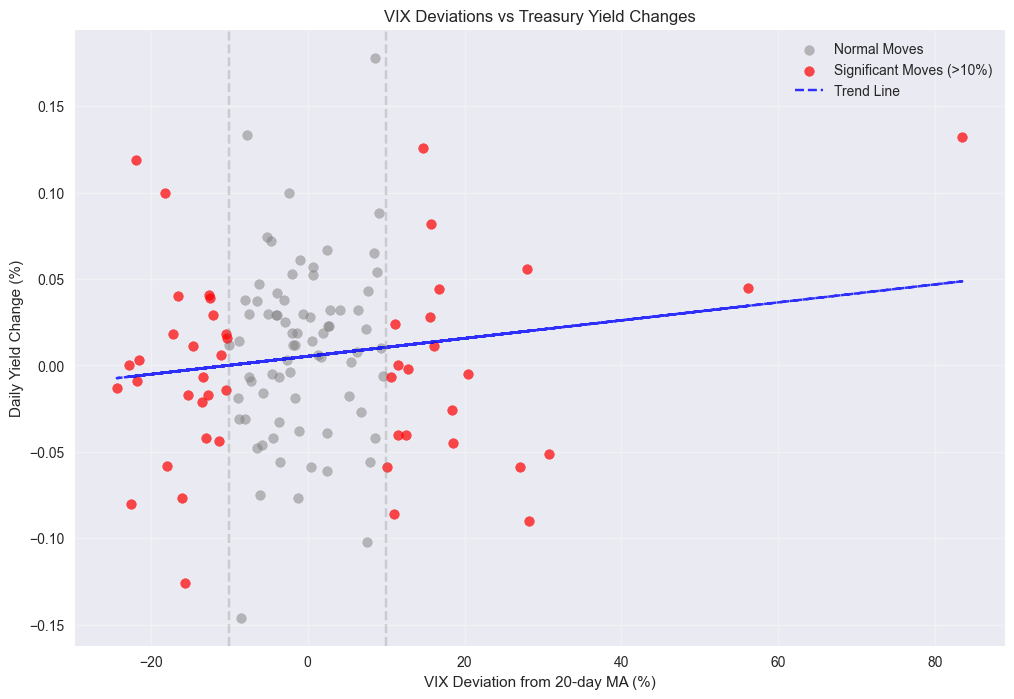

Market Correlations Reveal Strong Links Between Treasury Yields and Risk Sentiment

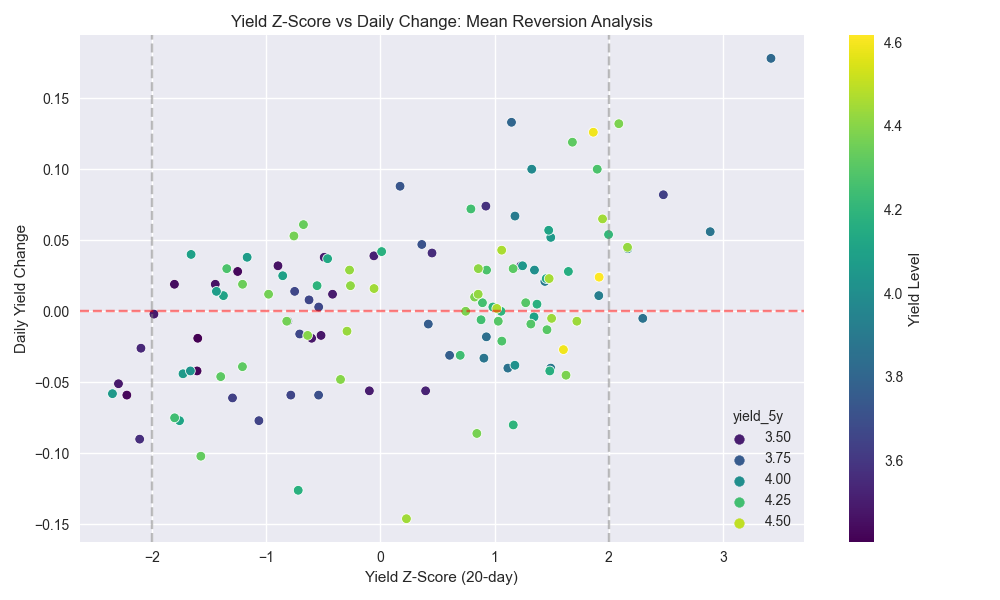

Technical Analysis Reveals Strong Mean Reversion in Treasury Yields

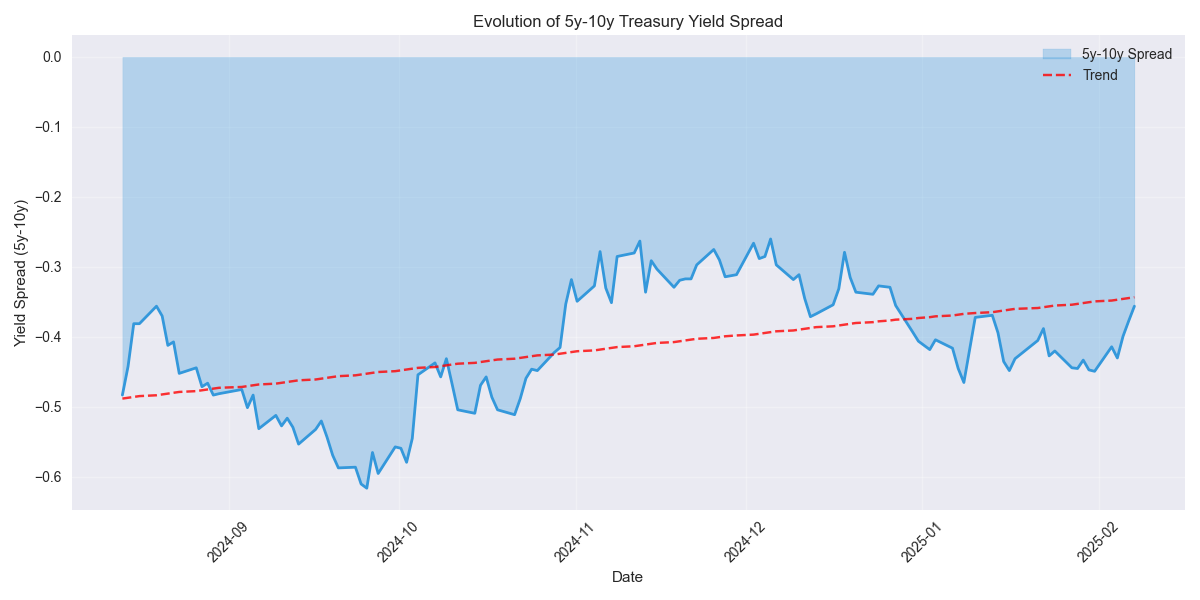

Market Dynamics Show Complex Interplay Between Yields, Equities, and Volatility