Saving...

FTSE 100 Market Analysis and Trading Insights

Saving...

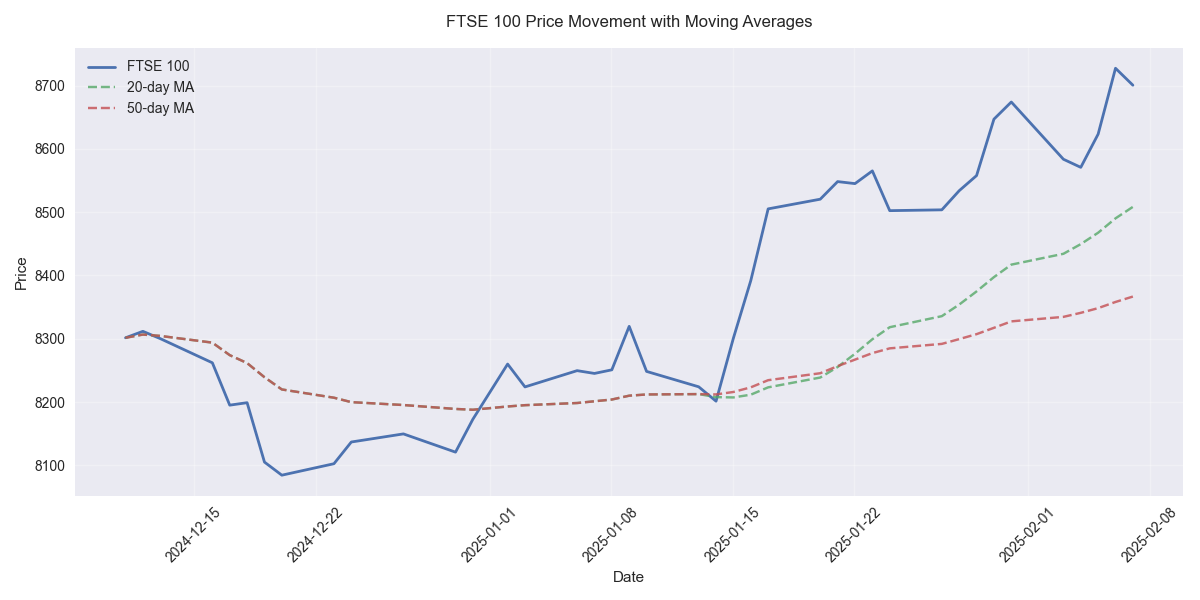

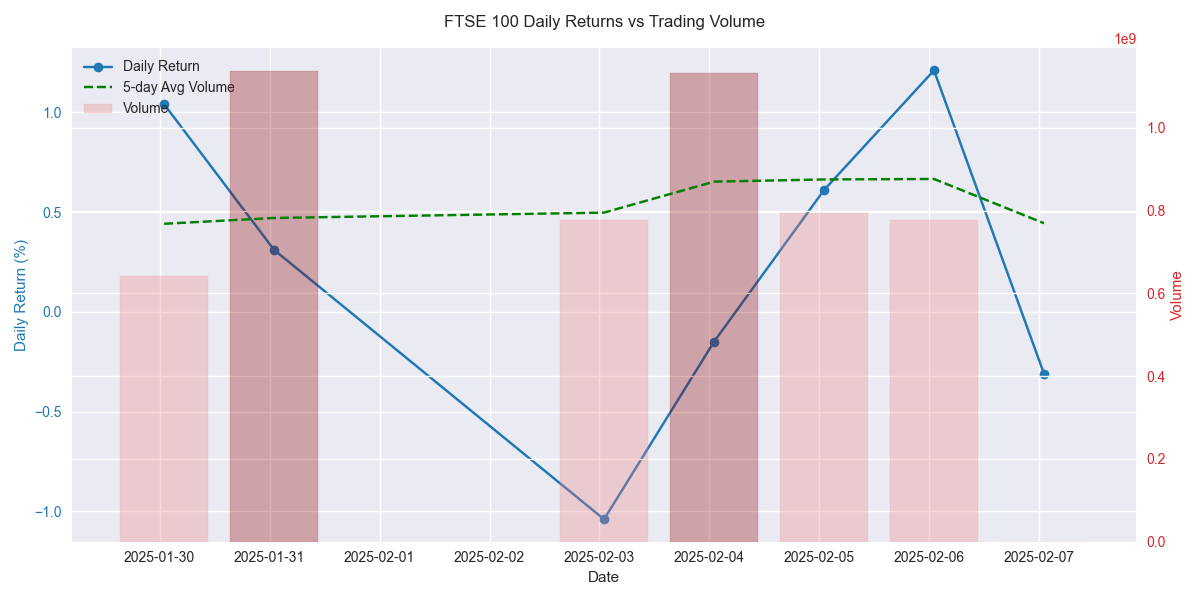

FTSE 100 Shows Bullish Momentum but Volume Warning Signs

Saving...

FTSE 100 Shows Bullish Momentum but Volume Warning Signs

Saving...

Saving...

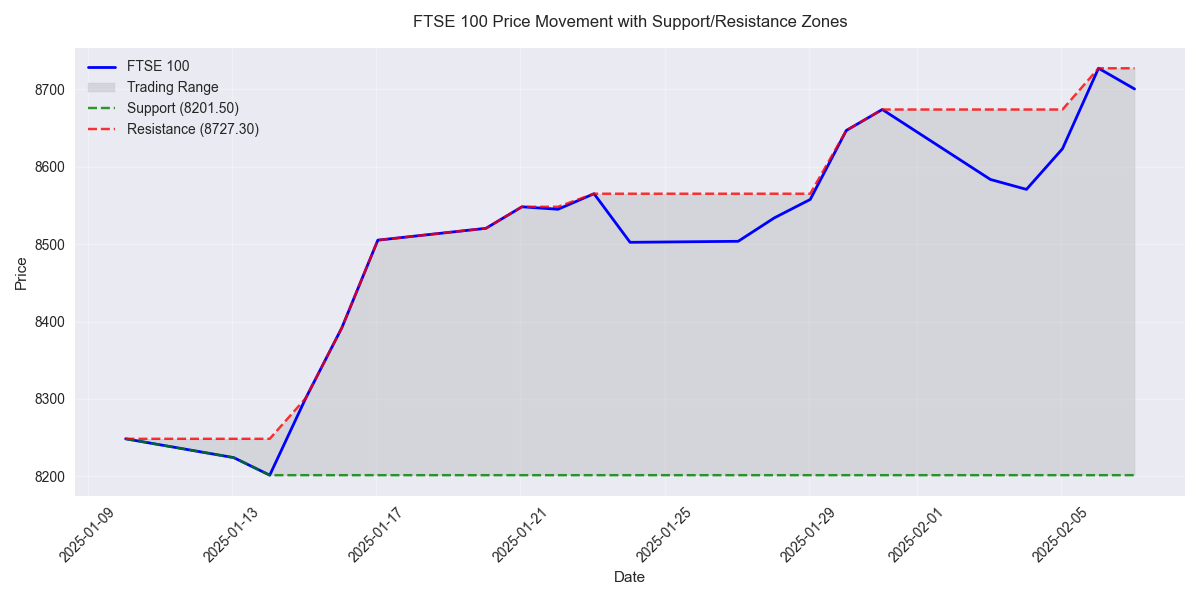

Key Price Levels Set Clear Trading Parameters

Saving...

Key Price Levels Set Clear Trading Parameters

Saving...

Saving...

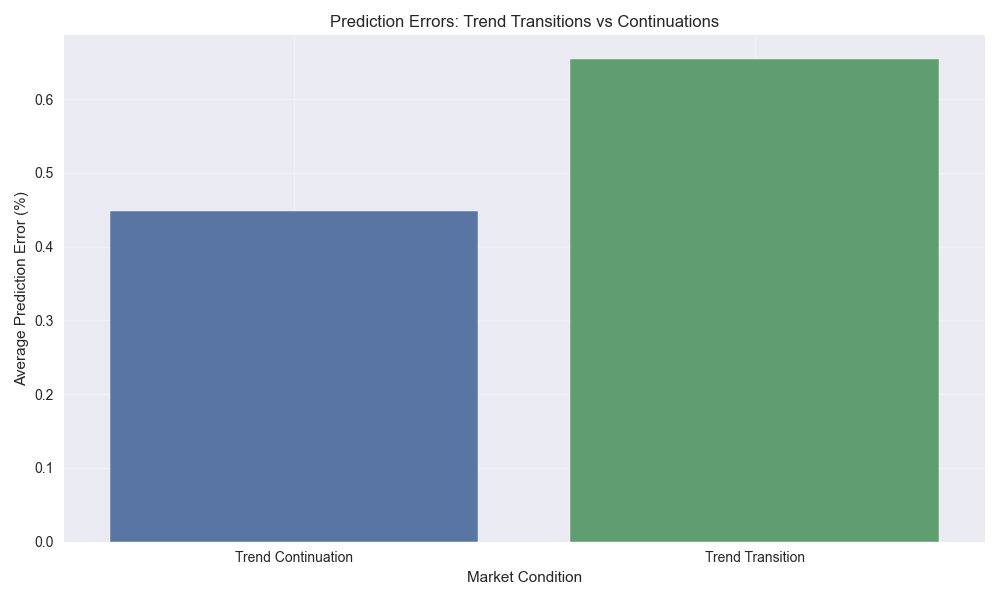

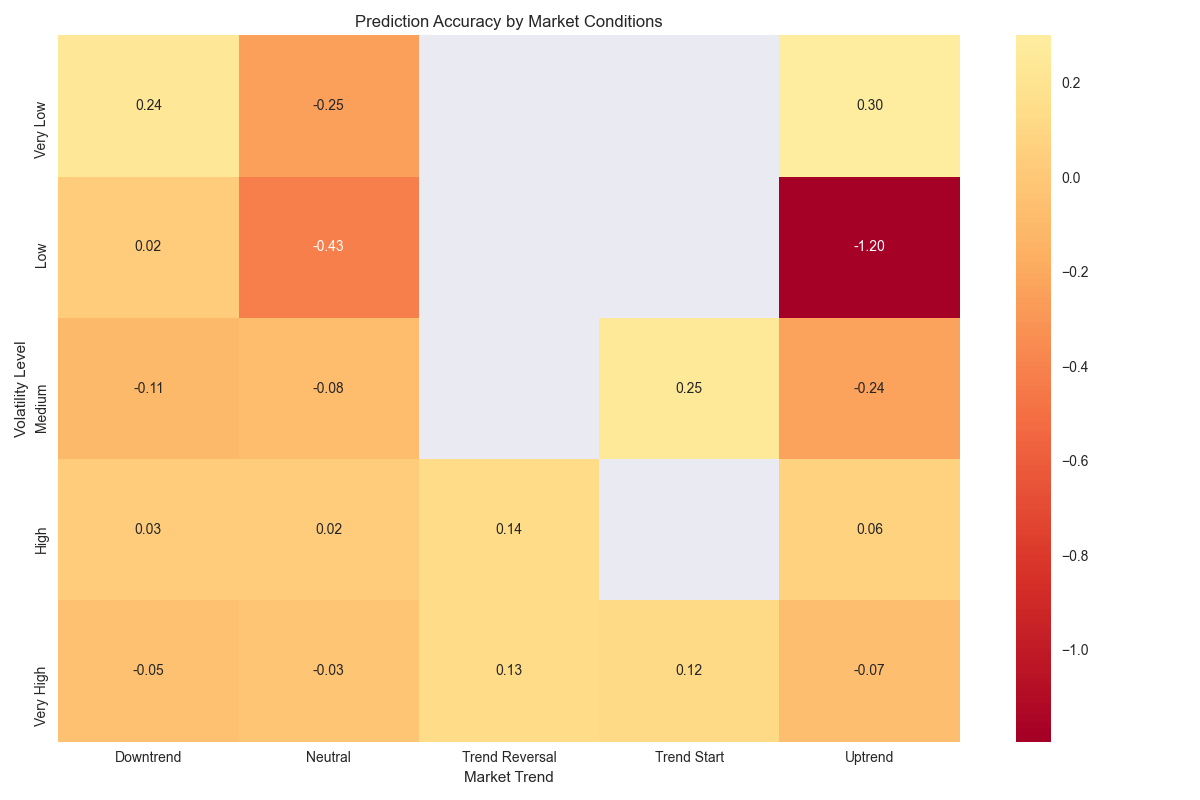

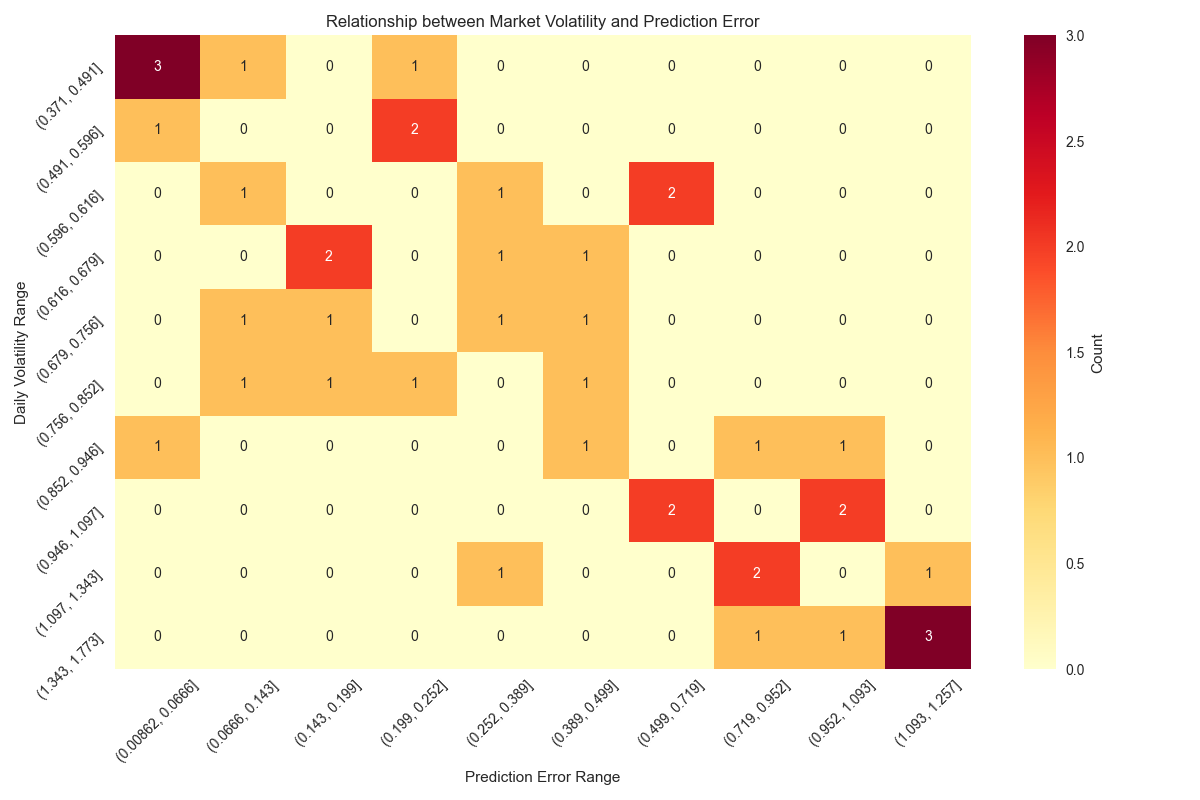

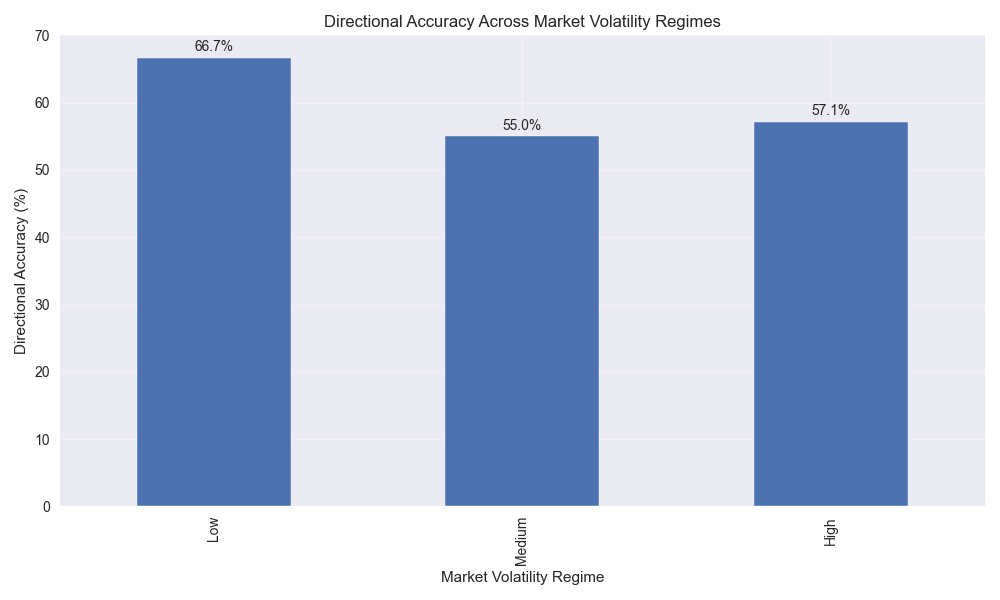

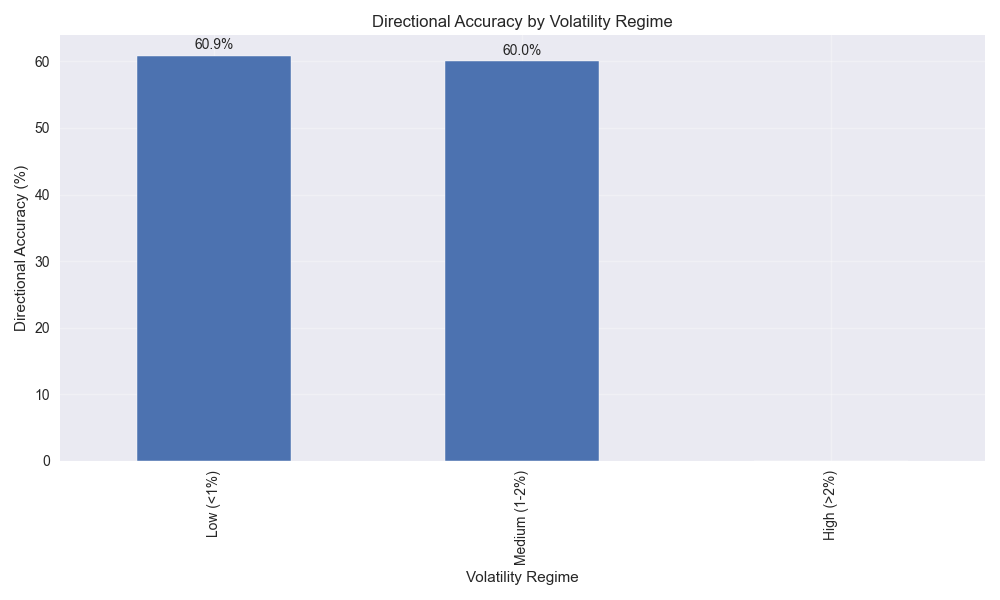

Trading Strategy Most Effective in Low Volatility Conditions

Saving...

Trading Strategy Most Effective in Low Volatility Conditions

Saving...

Saving...

Optimal Entry Points Identified Through Moving Averages

Saving...

Optimal Entry Points Identified Through Moving Averages

Saving...

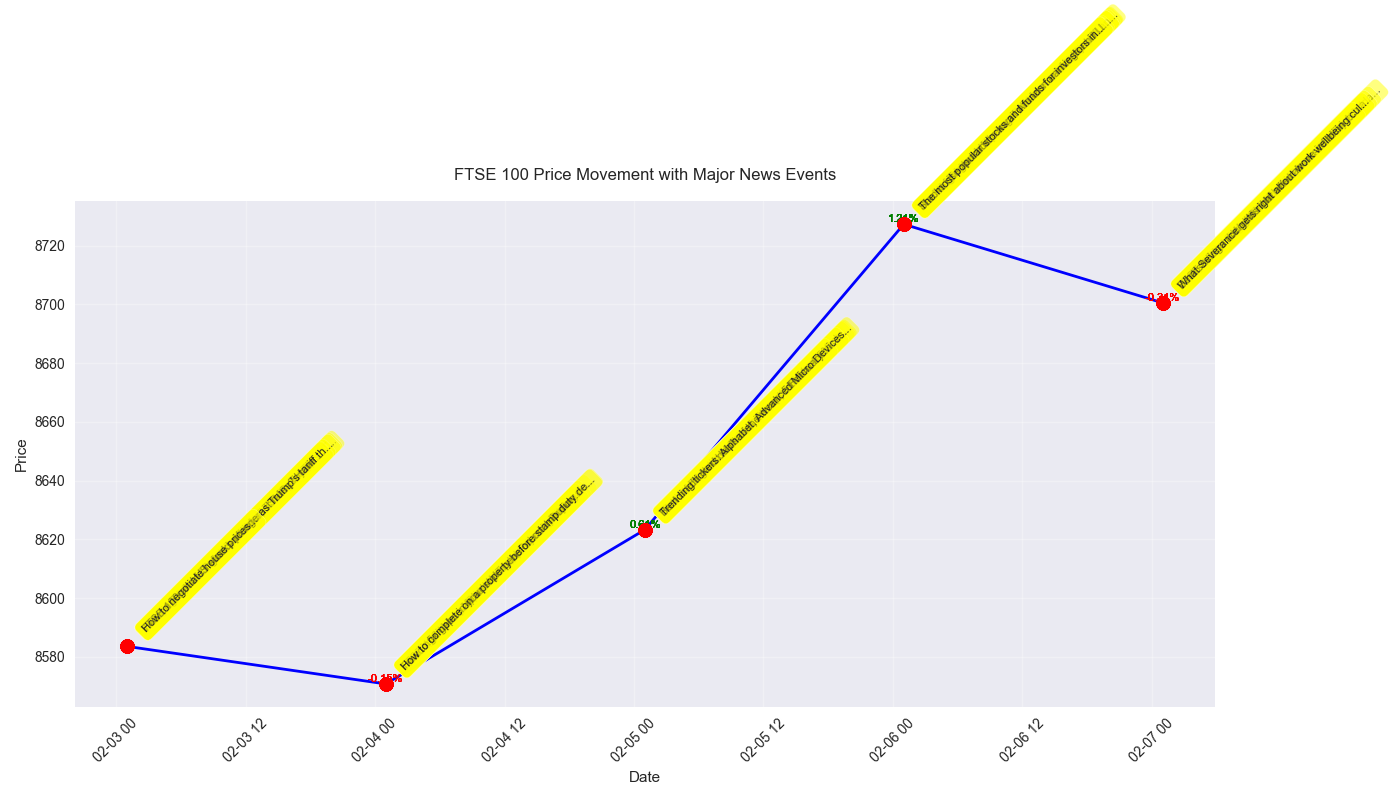

FTSE 100 Technical Analysis and Market Trend Impact on Predictions

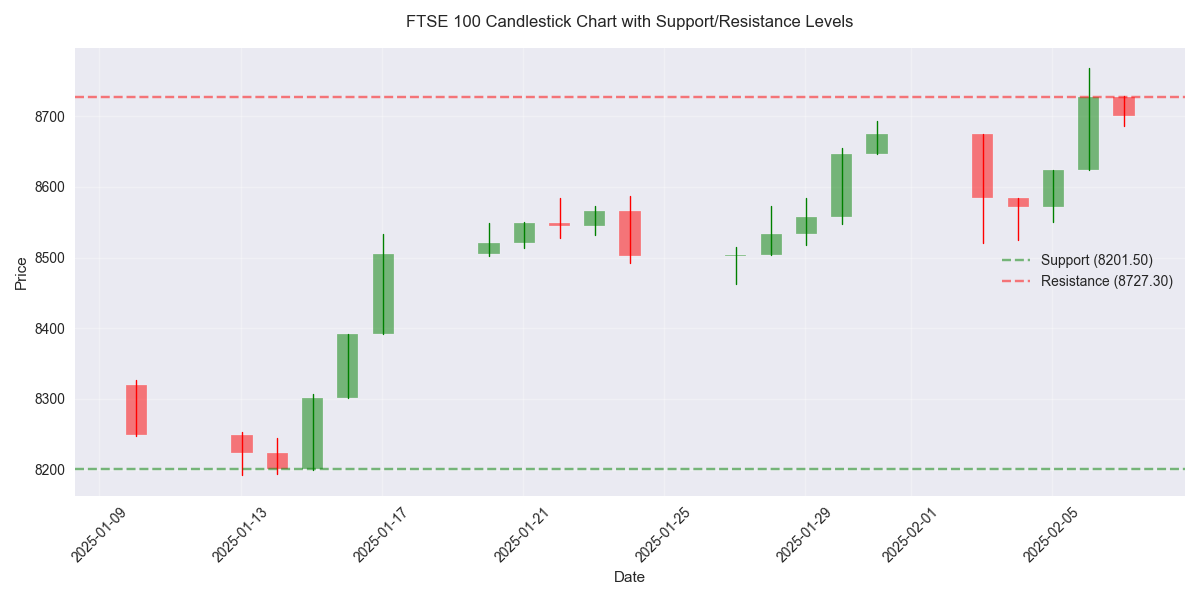

Key Support and Resistance Levels Signal Strong Technical Framework

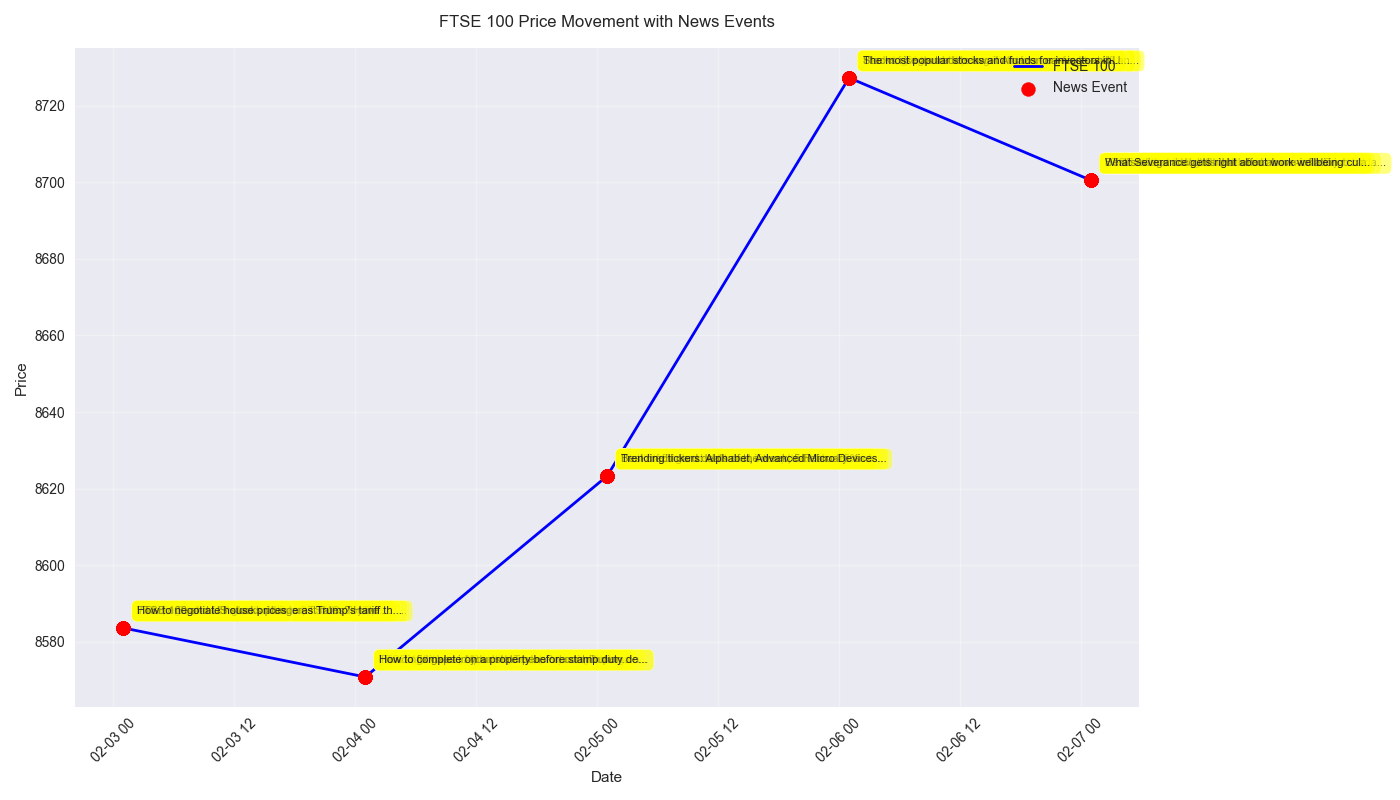

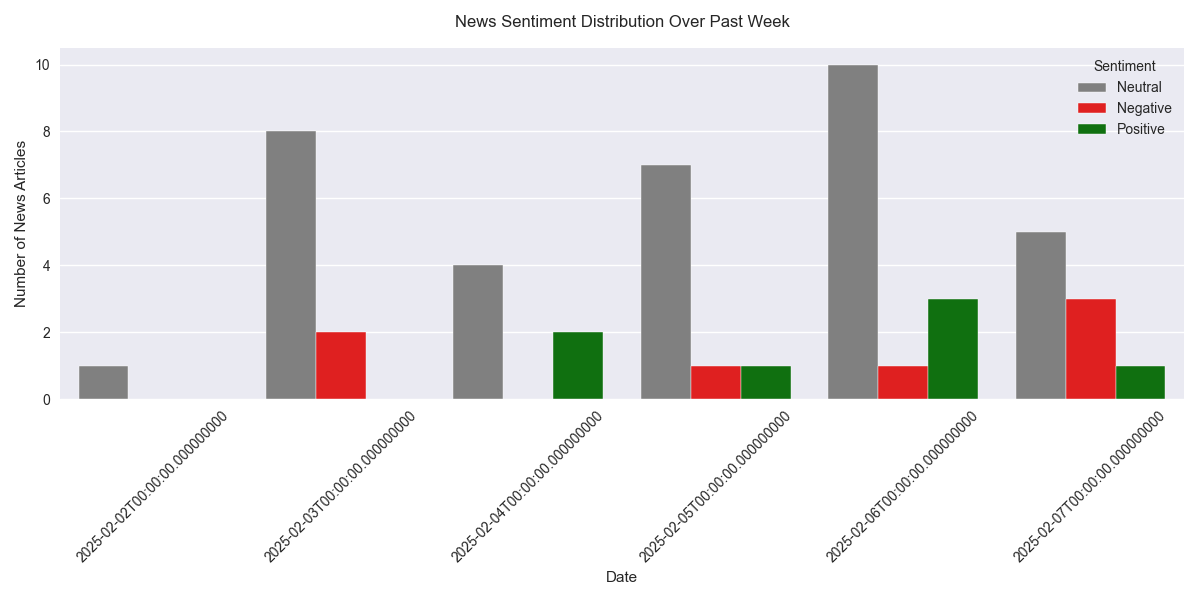

Market Sentiment Analysis Reveals Mixed Signals Amid Trade Tensions

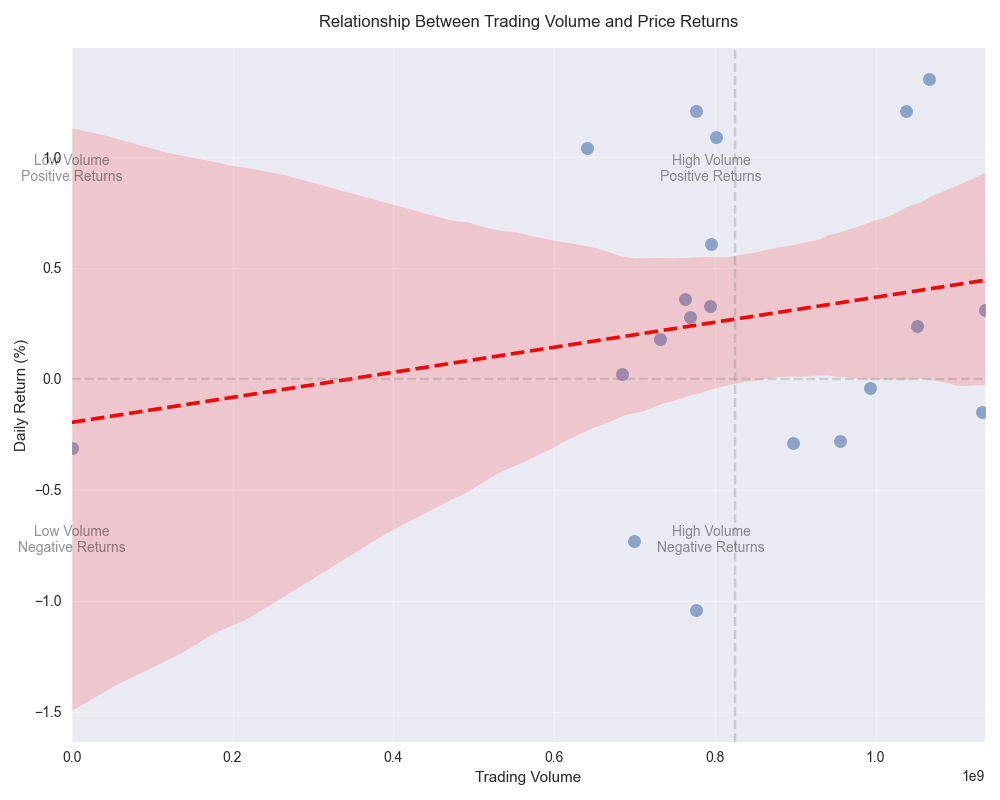

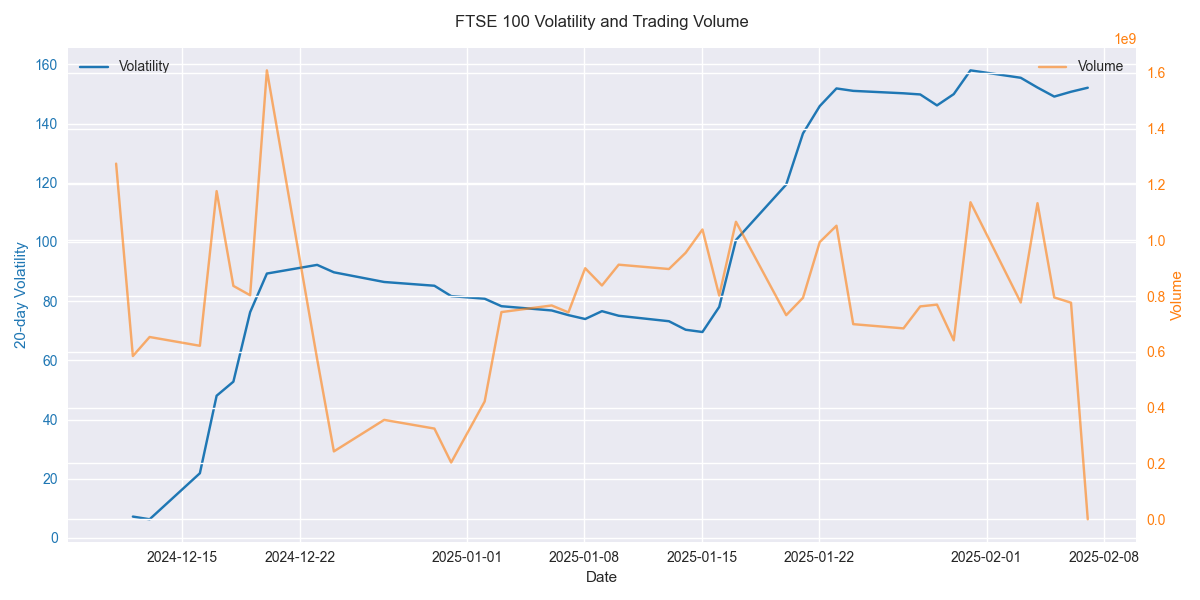

Volume Analysis Reveals Declining Trading Activity Despite Price Gains

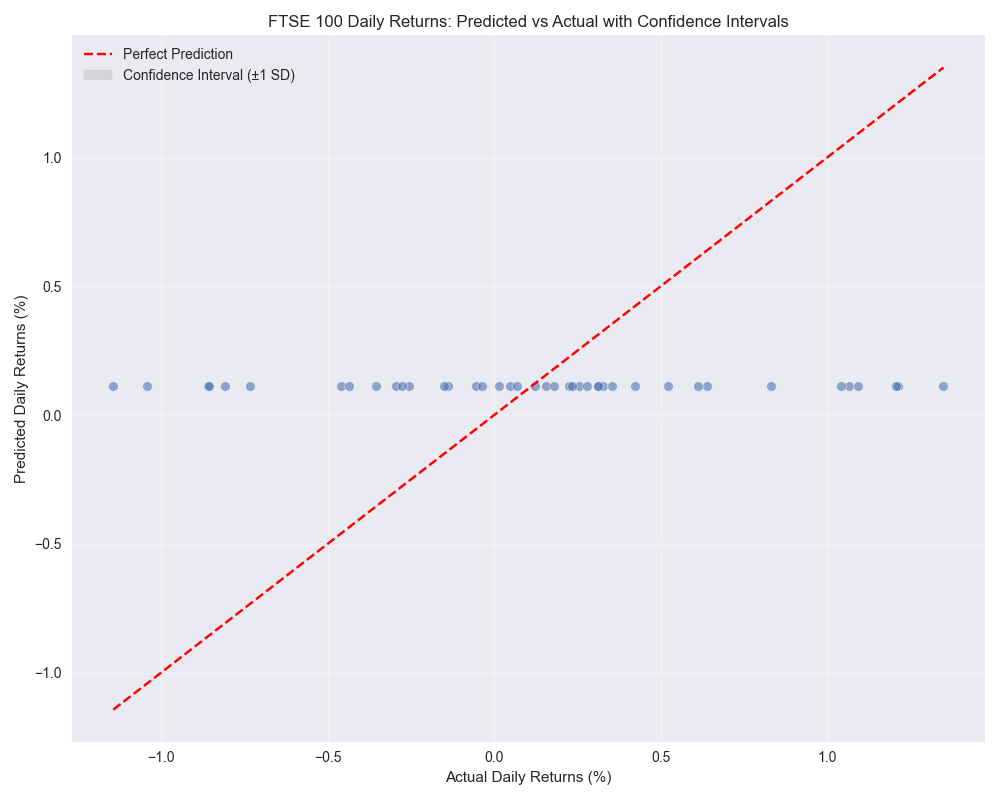

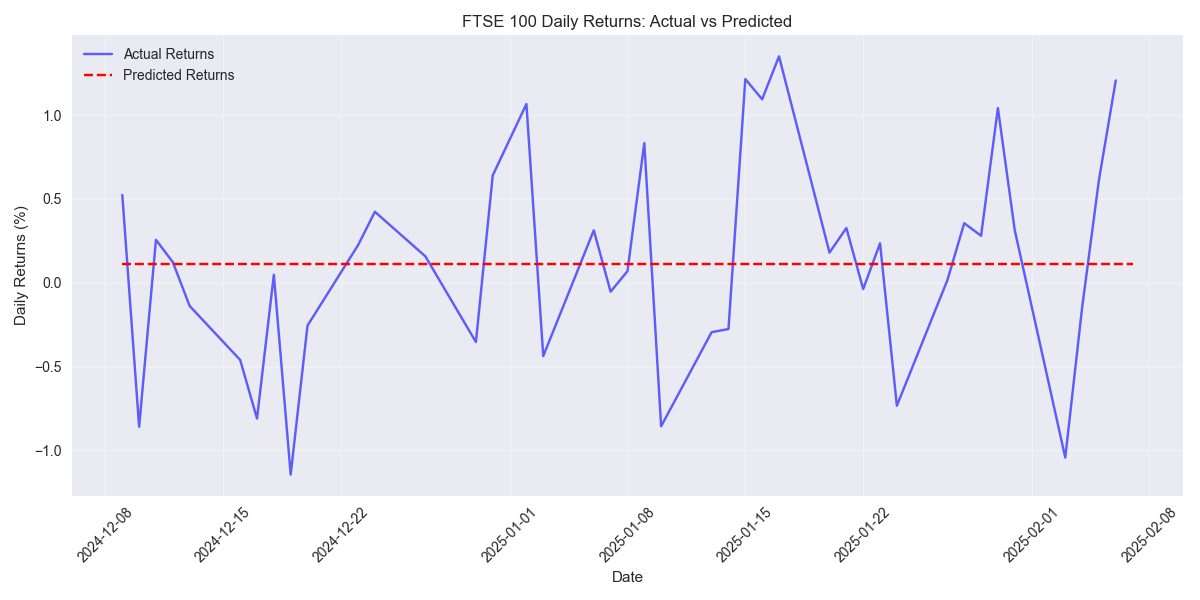

Initial FTSE 100 Daily Returns Prediction Model Performance

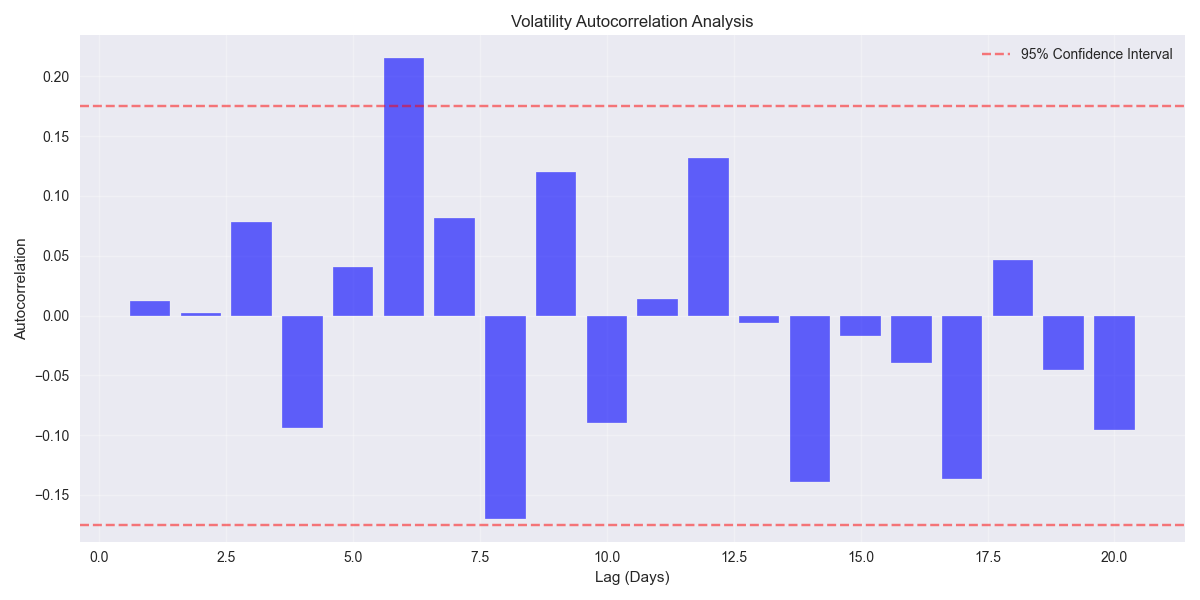

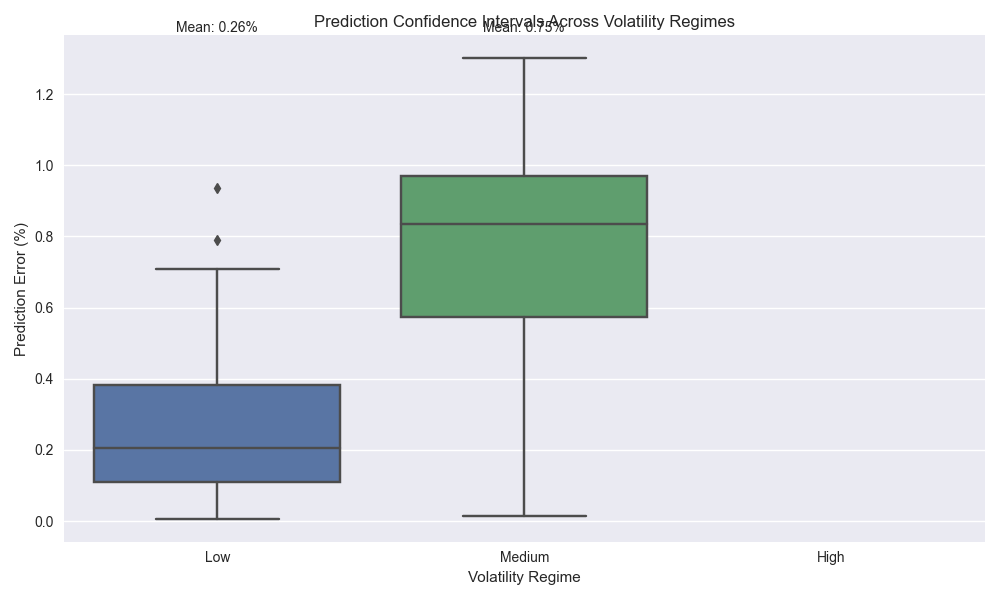

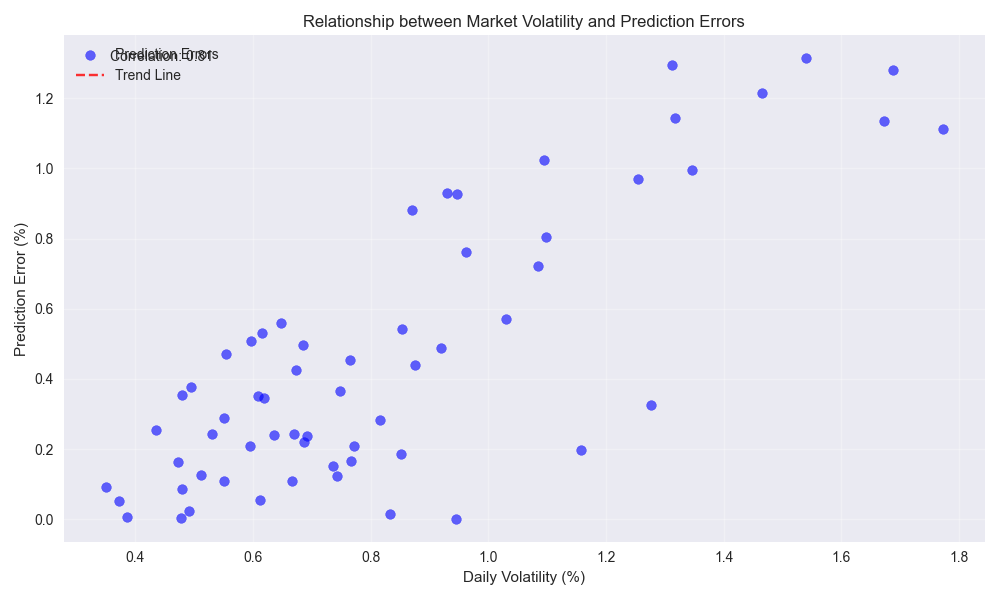

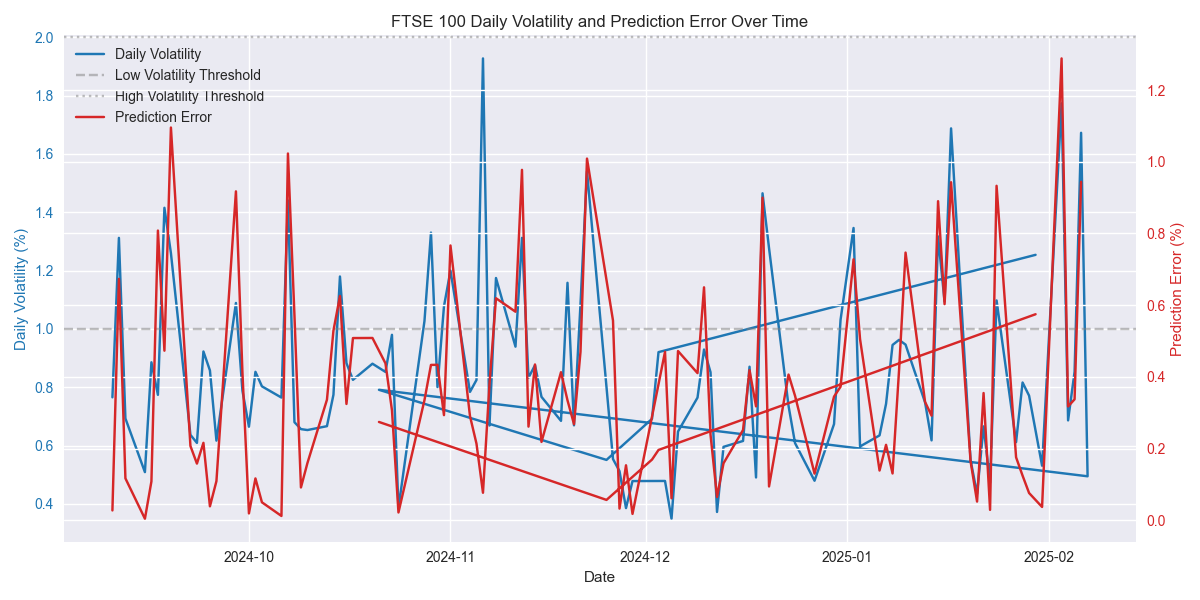

FTSE 100 Volatility and Risk Analysis

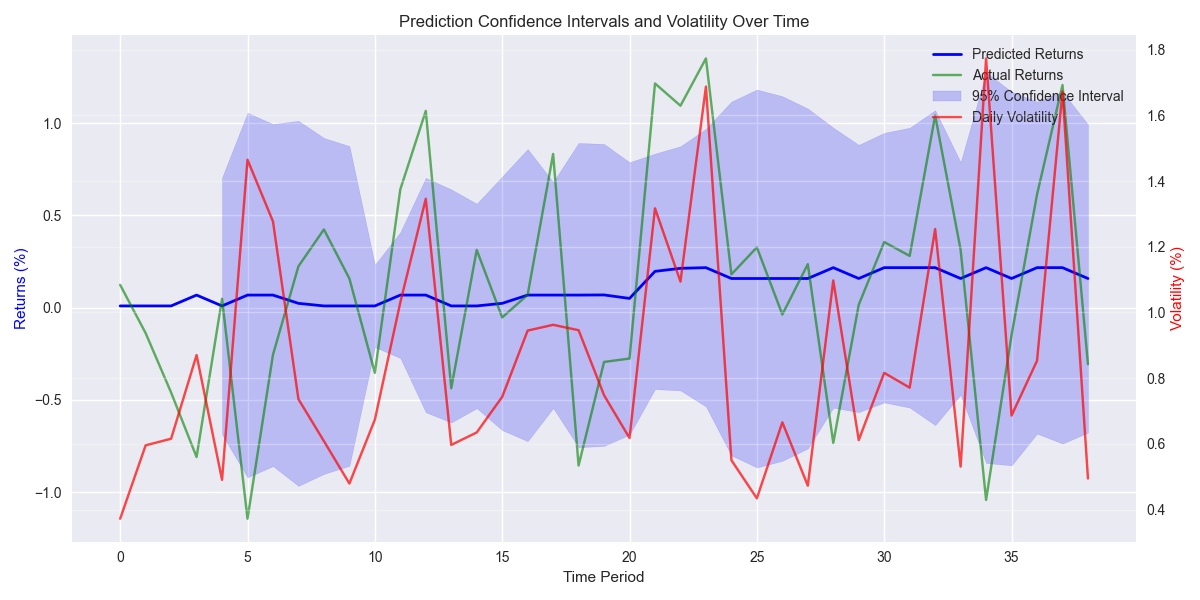

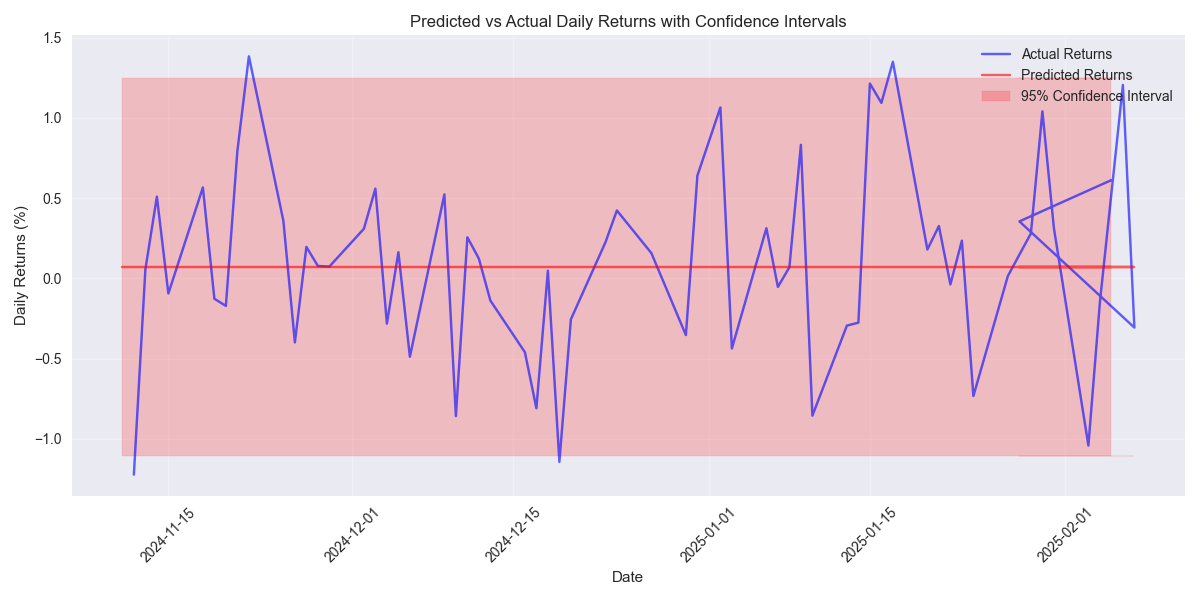

FTSE 100 Short-term Price Prediction Analysis

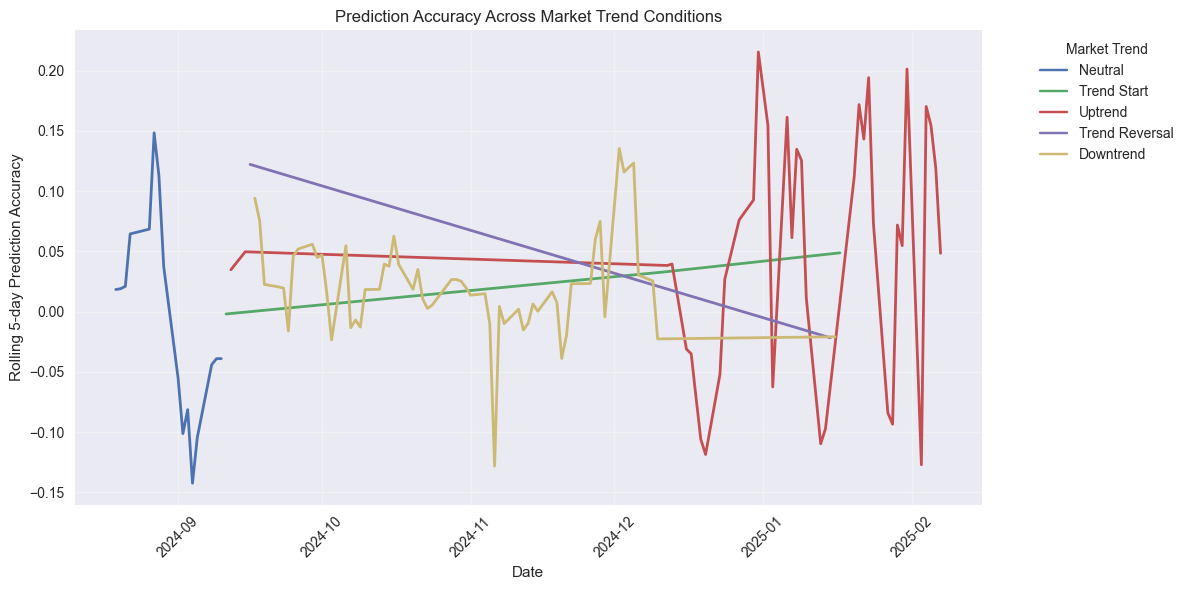

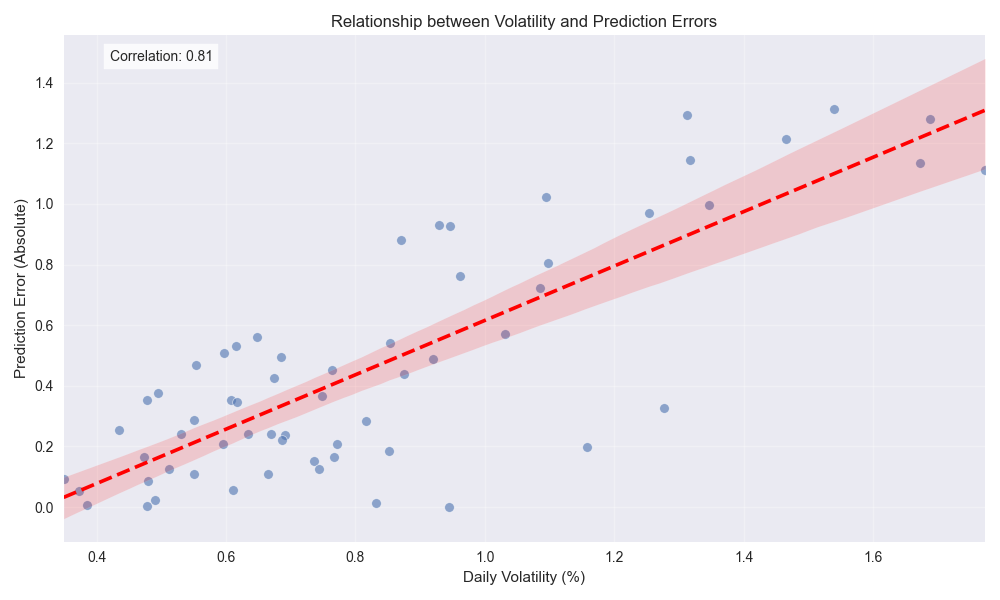

FTSE 100 Volatility Impact on Prediction Confidence

FTSE 100 Shows Strong Bullish Momentum with Key Technical Signals