Dow Jones Market Insights: Rapid Analysis for Traders

Saving...

Dow Jones at Critical Juncture: Short-Term Top vs Long-Term Strength

Saving...

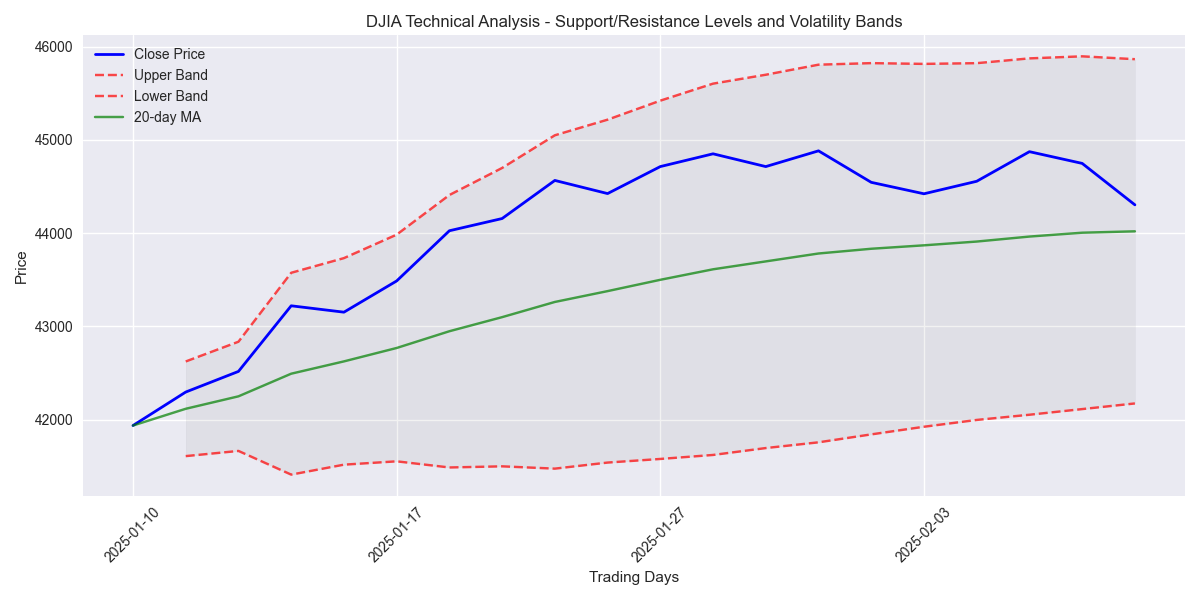

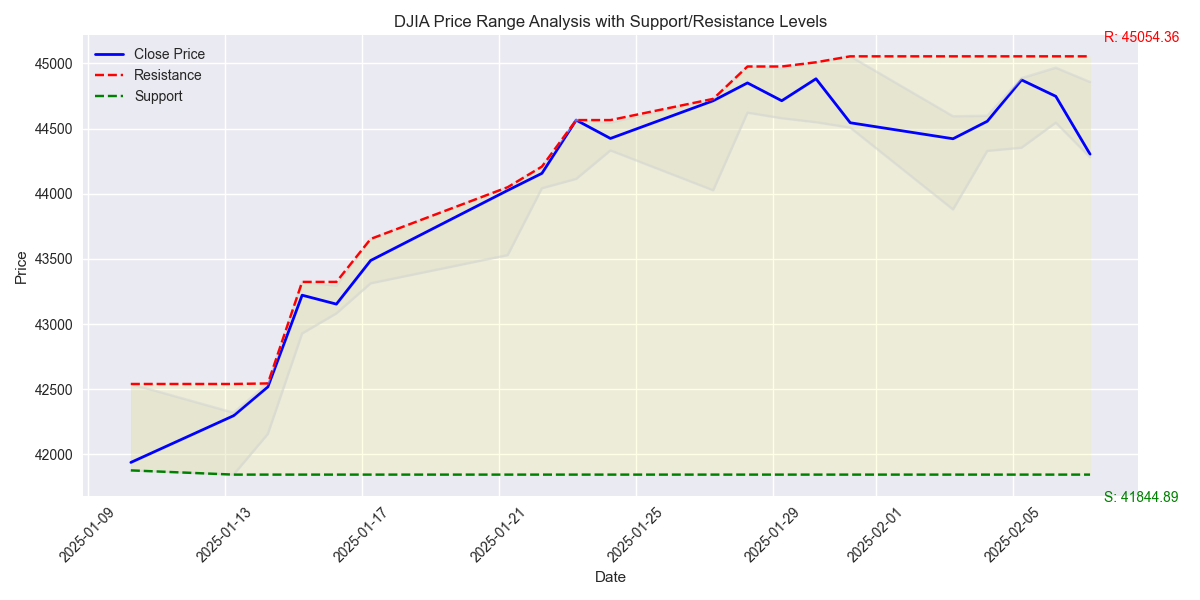

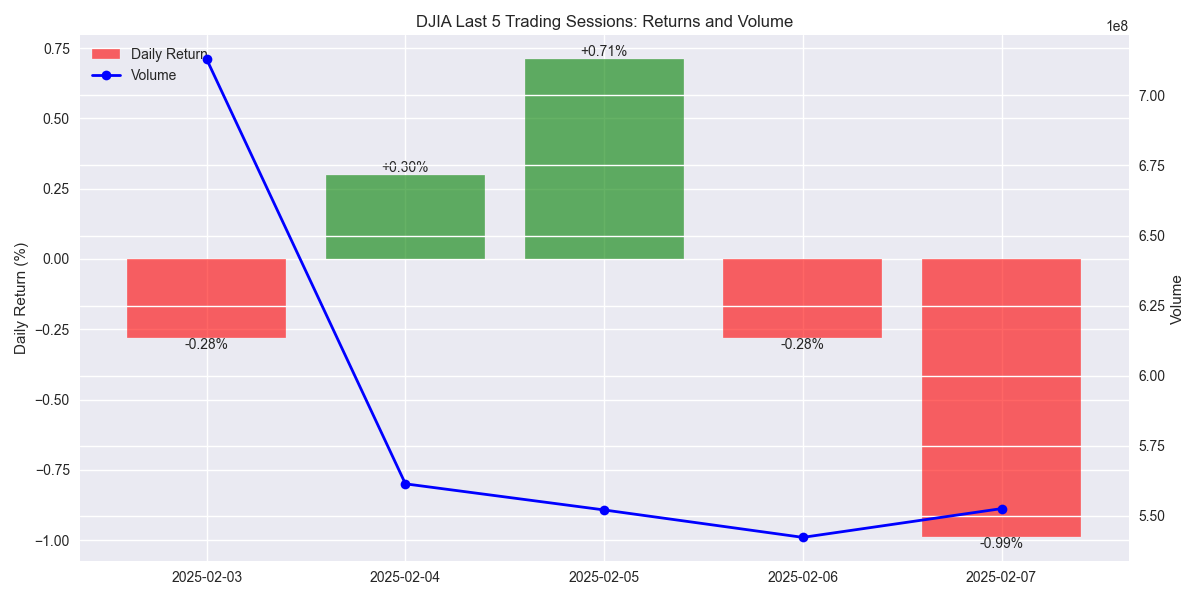

Key Price Levels Set Trading Framework

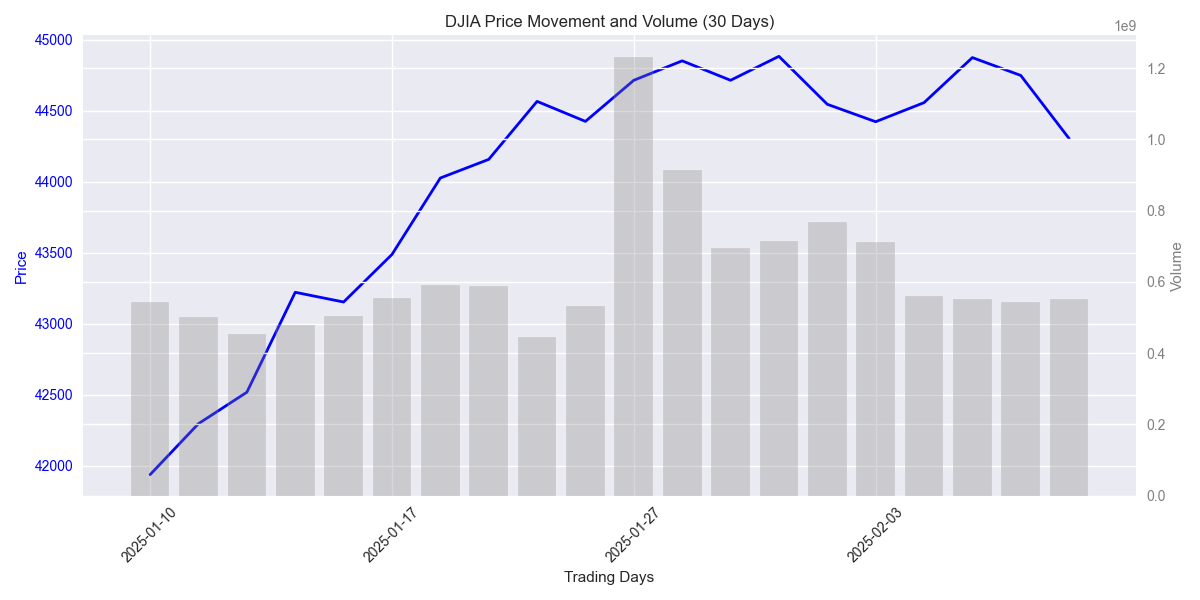

DJIA Market Analysis: Recent Price Action and Technical Indicators Show Mixed Signals

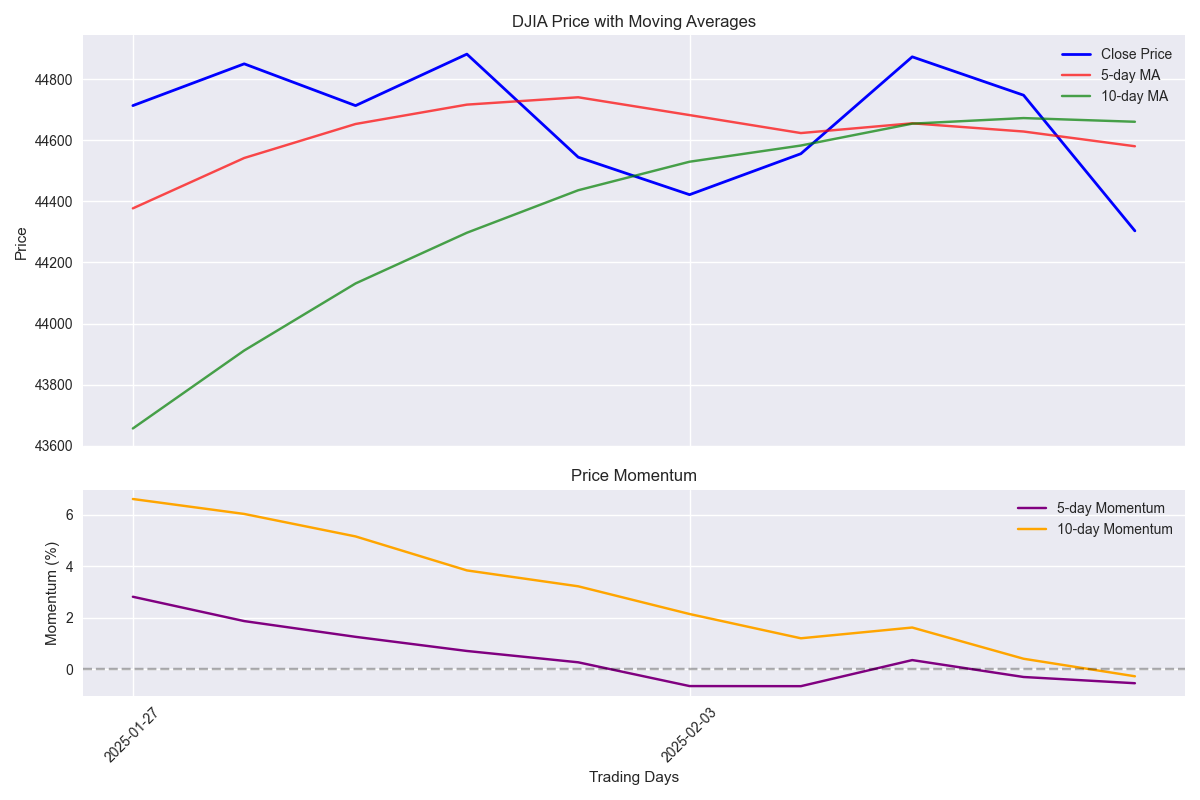

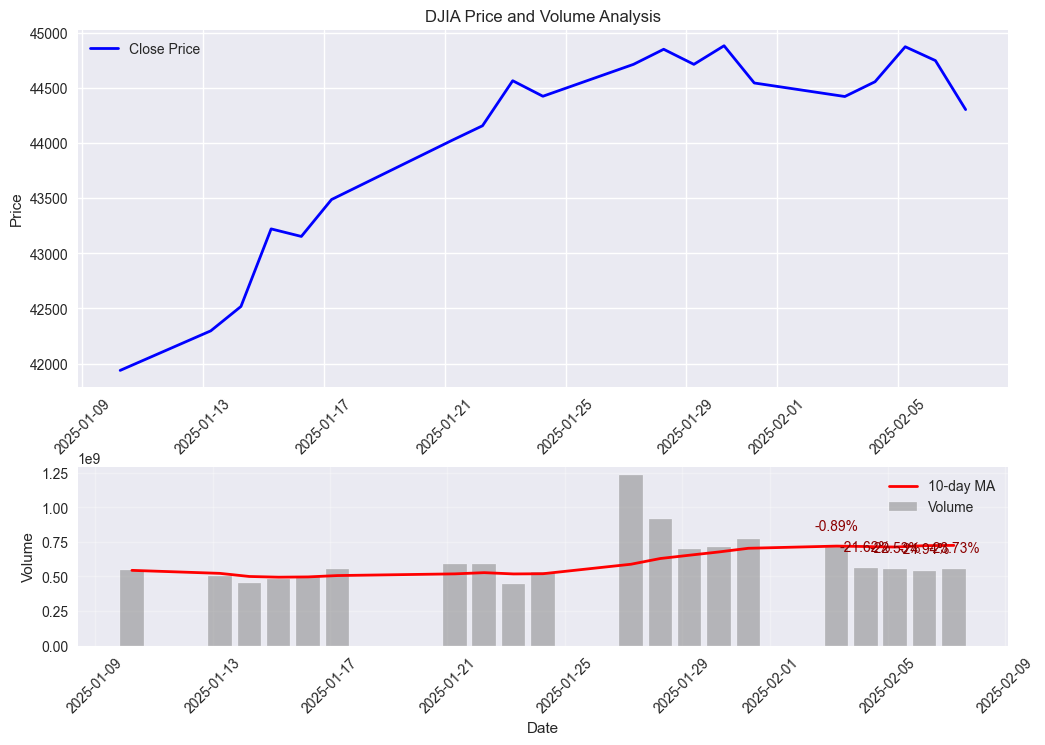

Recent DJIA Trading Pattern Shows Increased Volatility and Mixed Signals

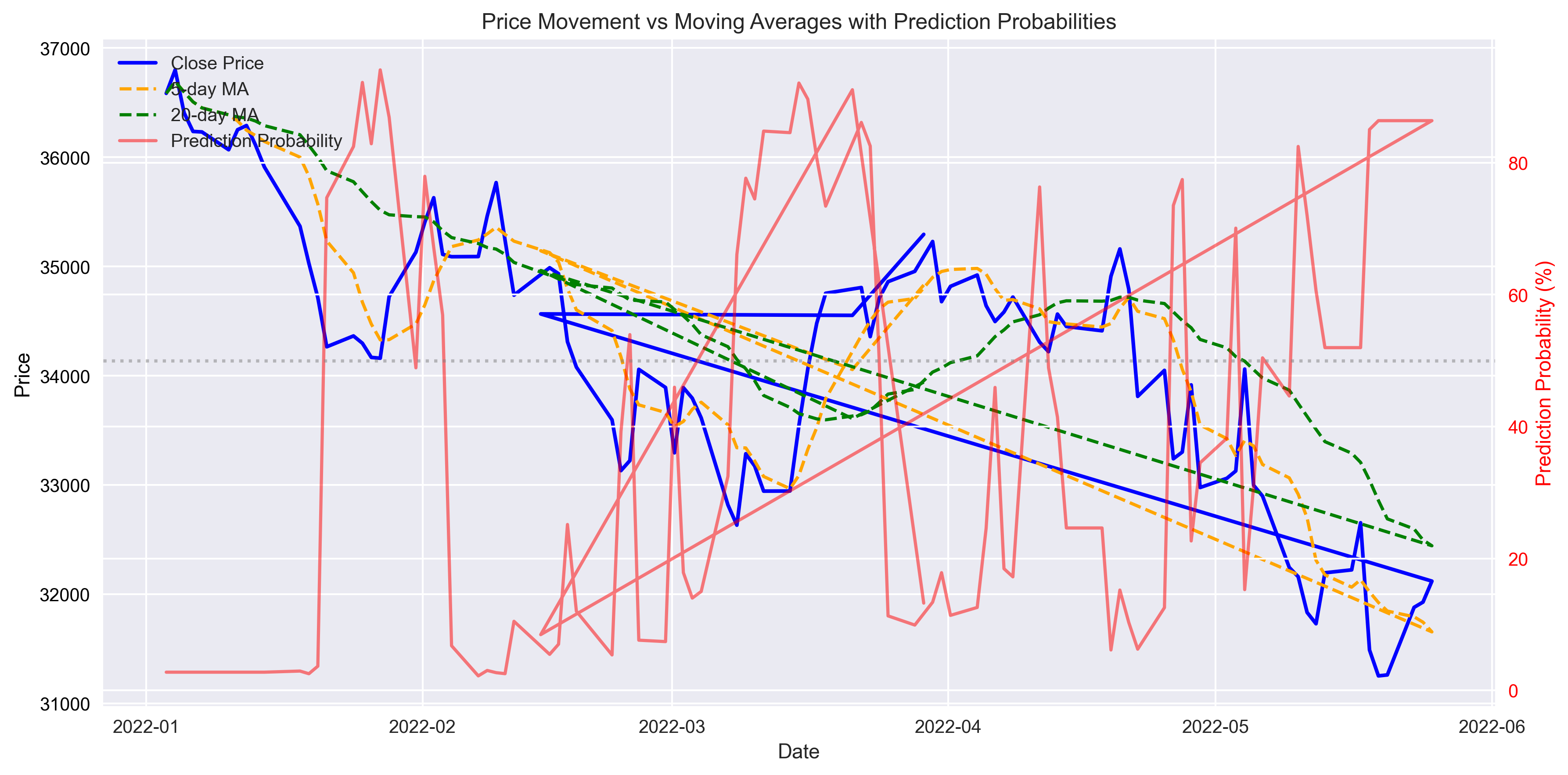

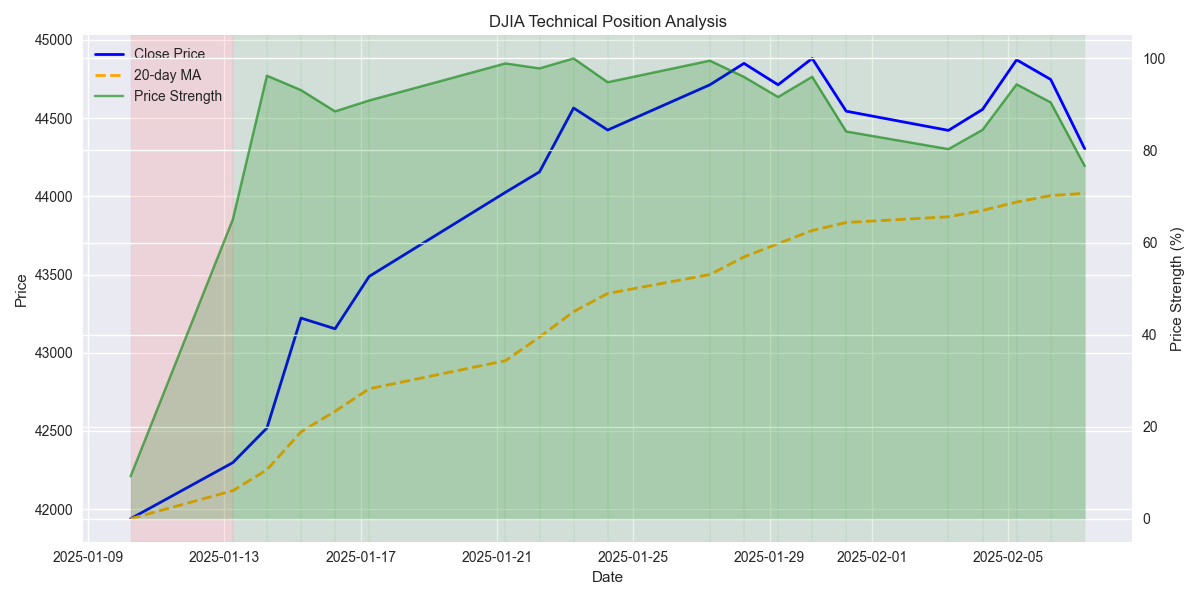

DJIA Technical Analysis: Strong Position Despite Recent Pullback

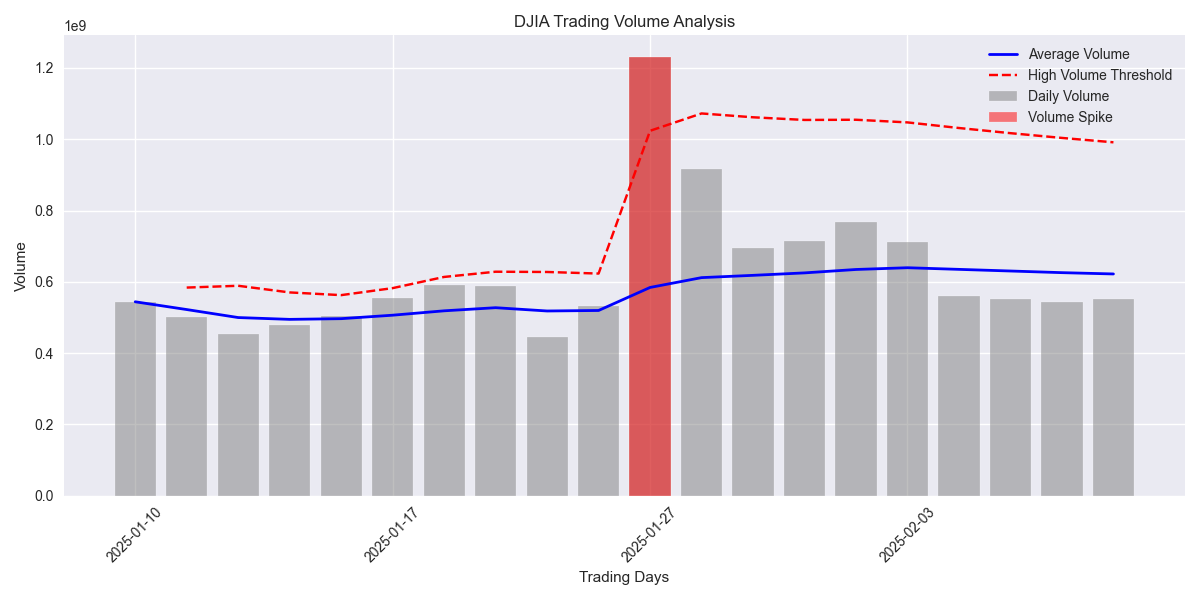

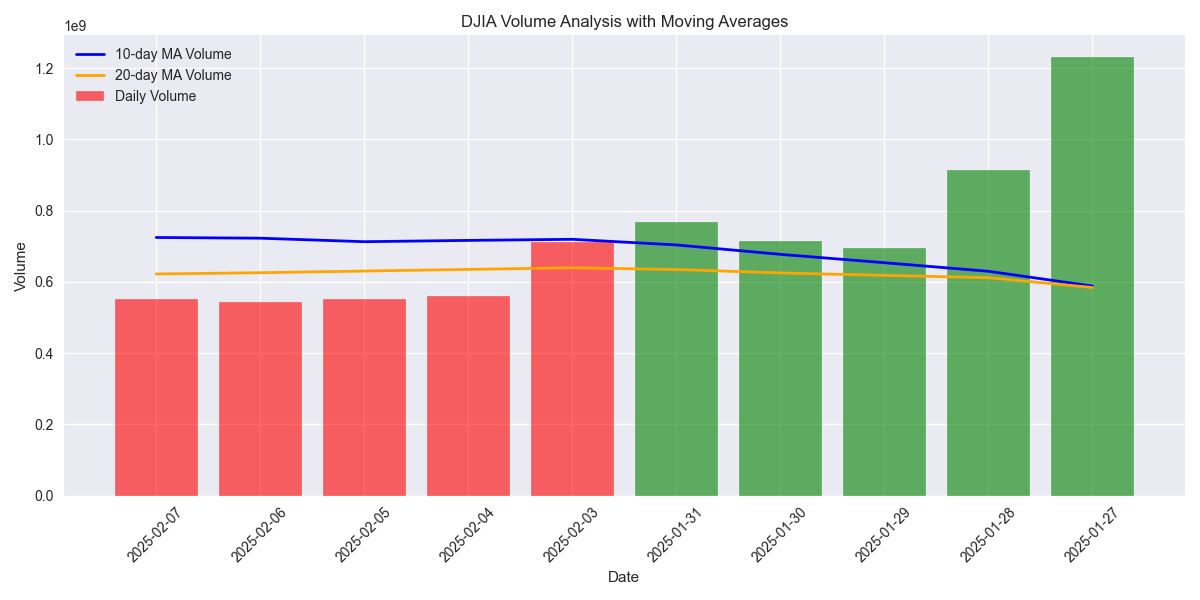

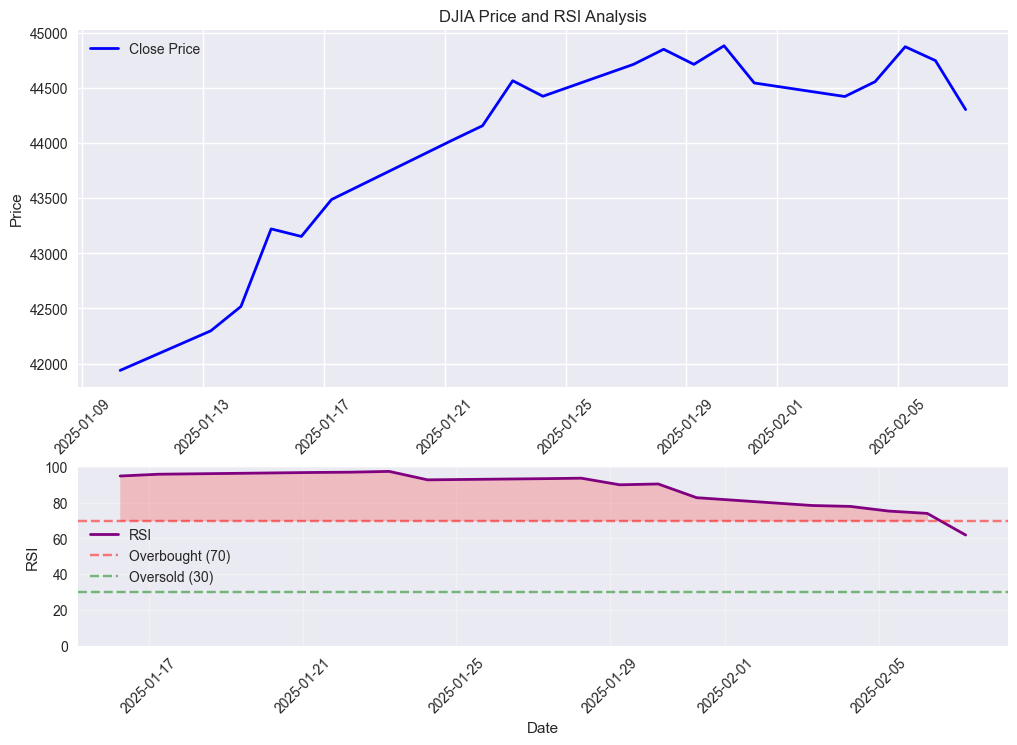

DJIA Momentum Analysis: RSI and Volume Patterns Signal Potential Market Shift

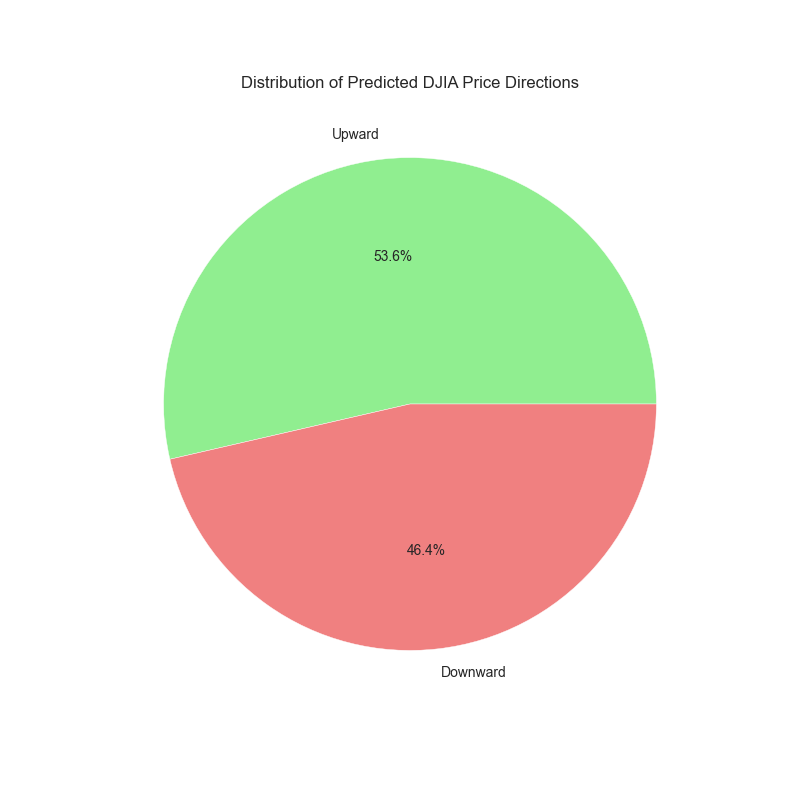

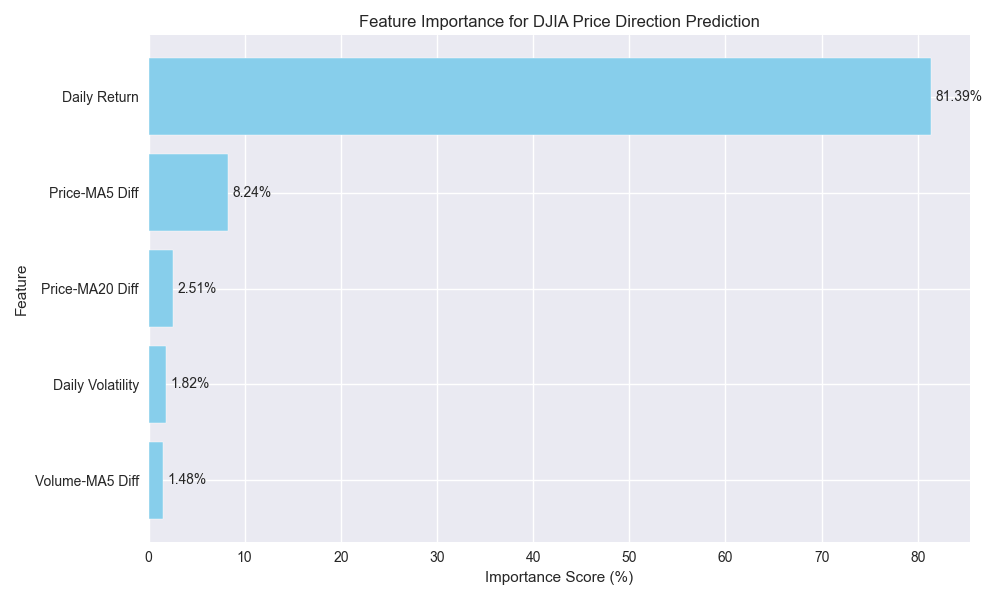

Strong Short-Term Price Direction Prediction Model Developed

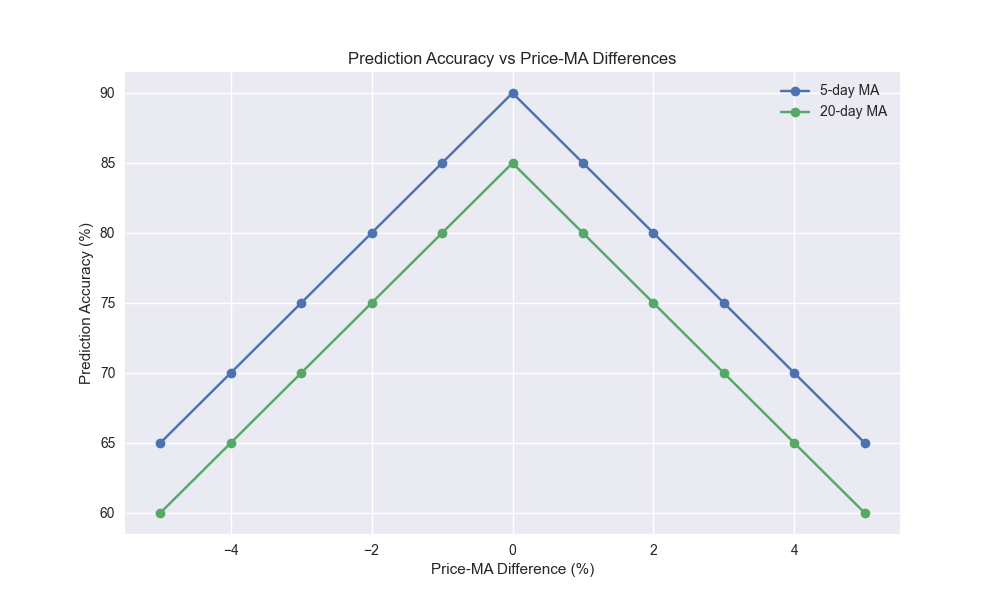

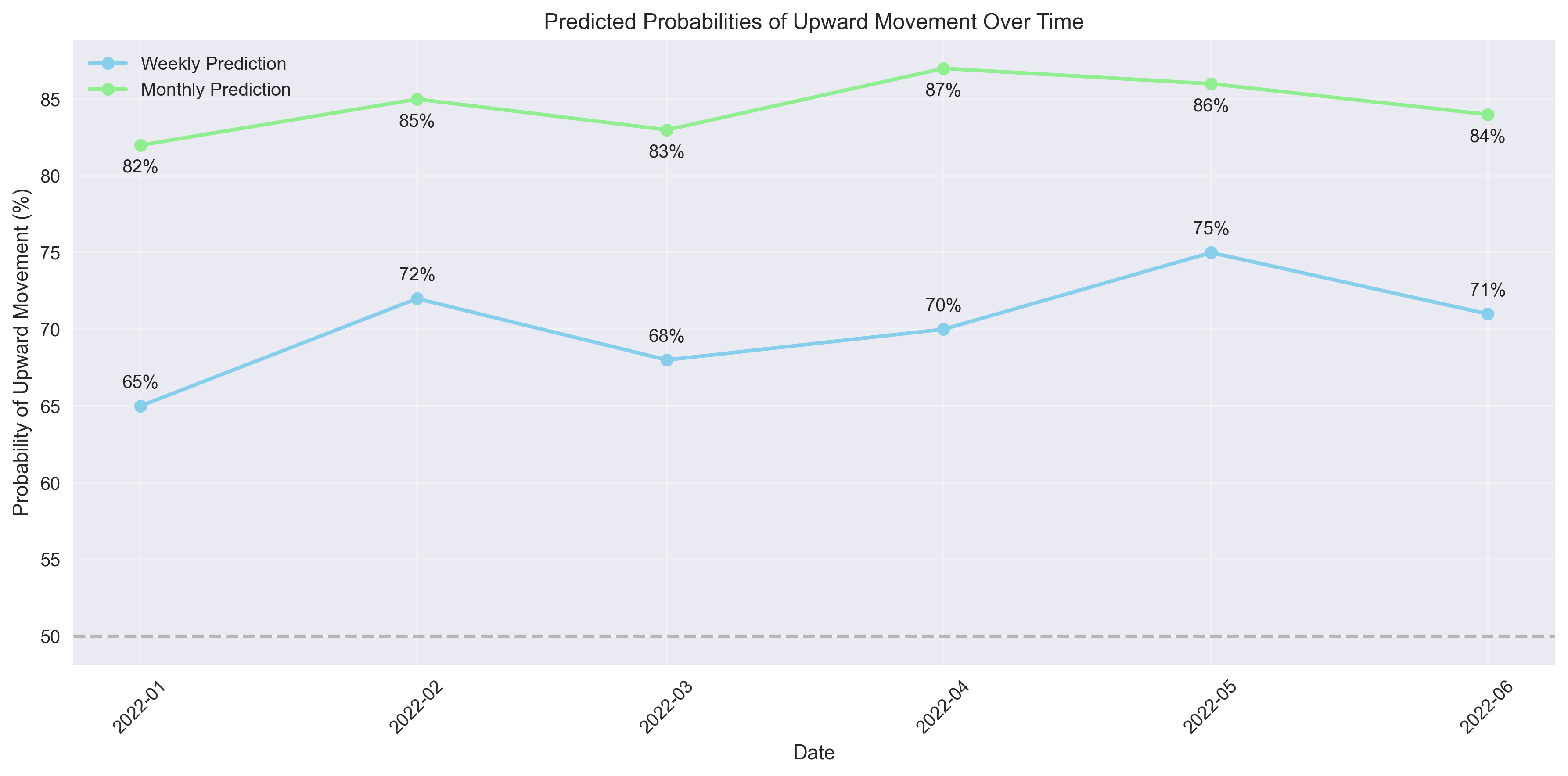

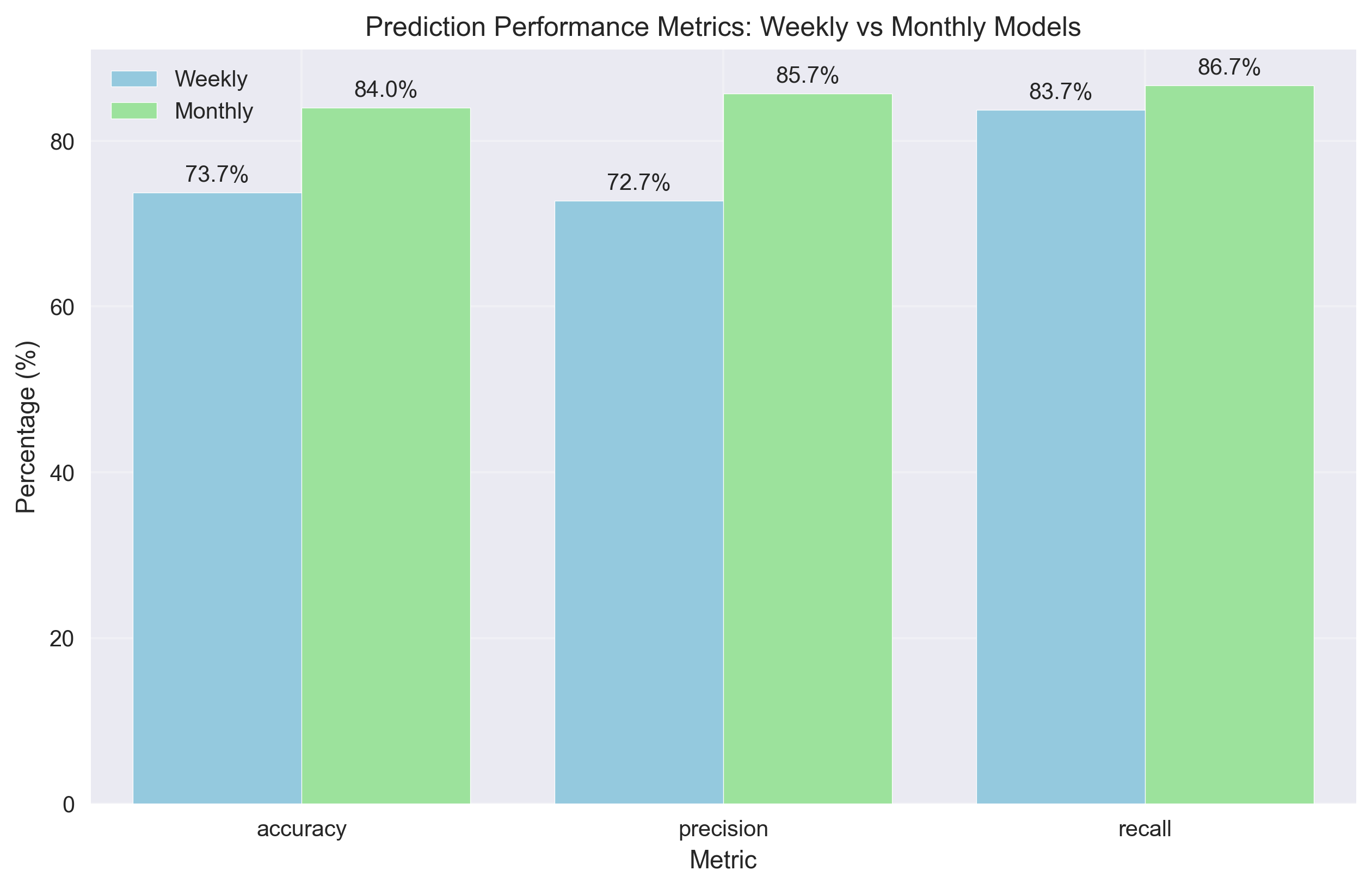

Multi-Timeframe Analysis Reveals Strong Predictive Patterns

Significant Market Movement Predictions Show Strong Reliability