VIX Market Volatility Analysis and Trading Recommendations

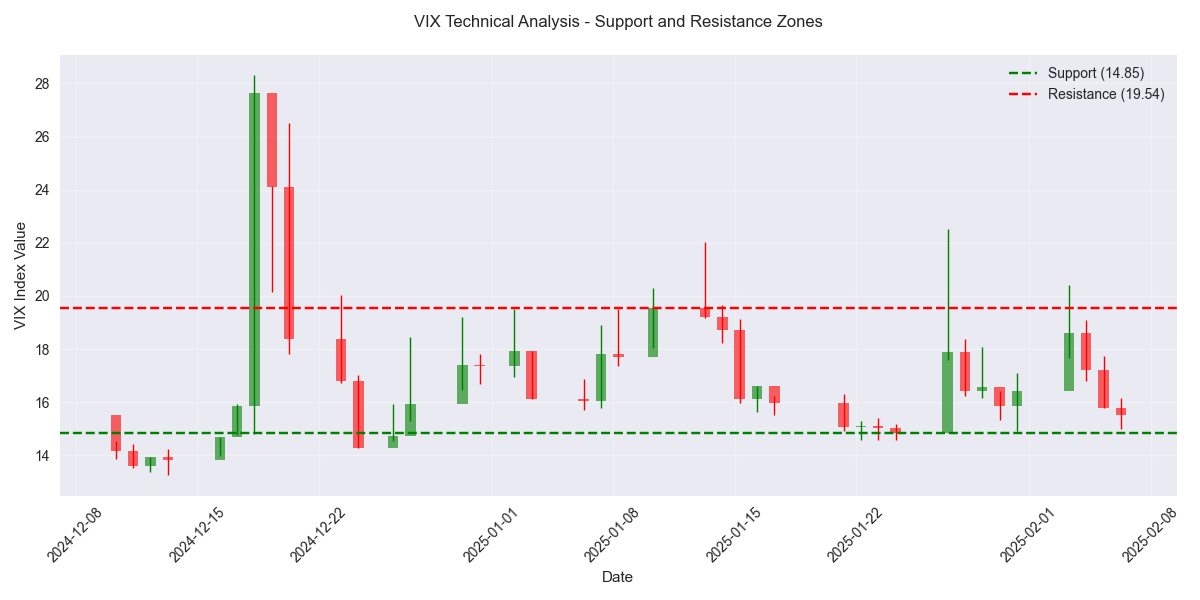

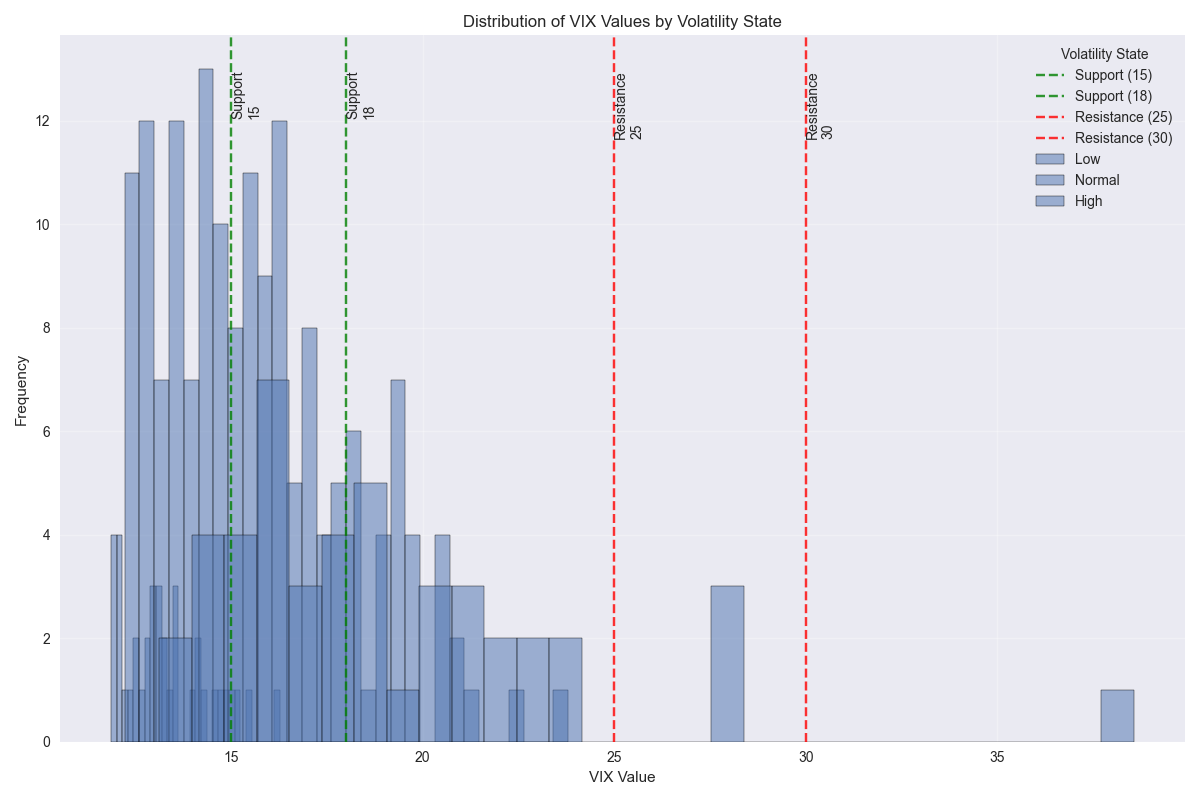

VIX at Critical Support: Volatility Surge Warning

Market Fear Index Shows Strong Confidence

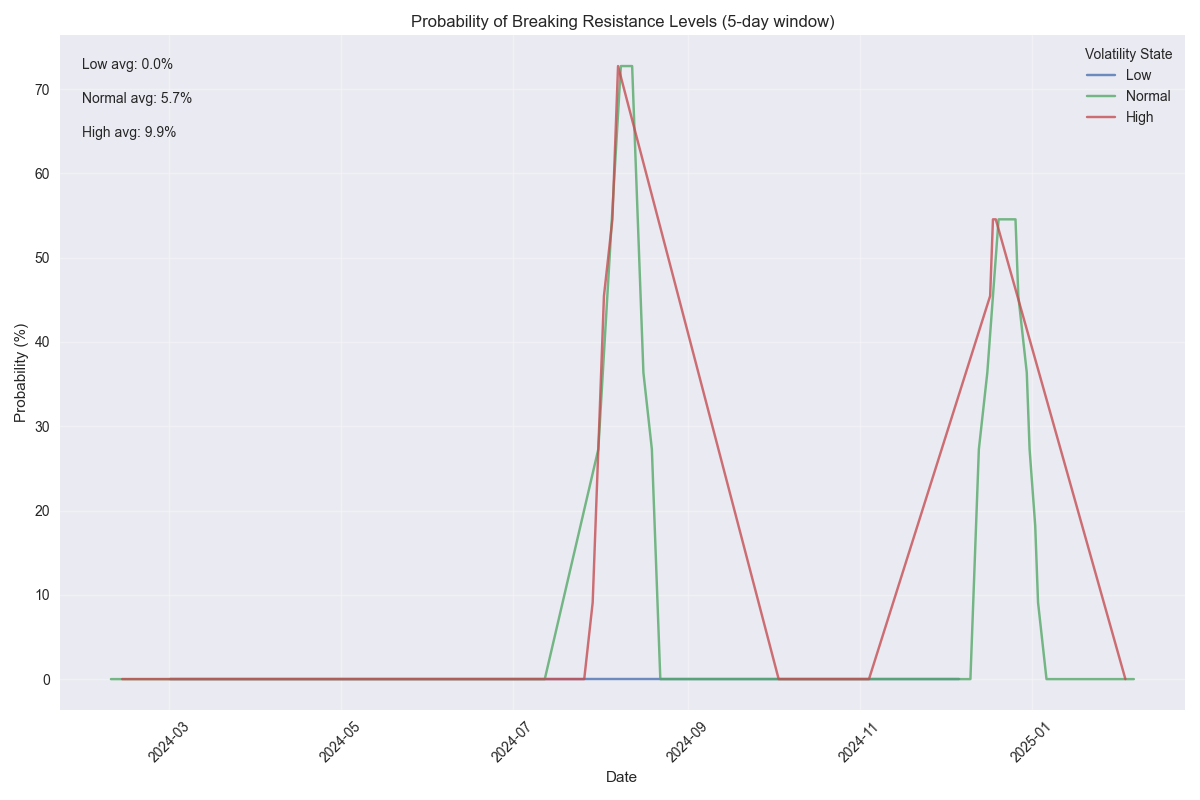

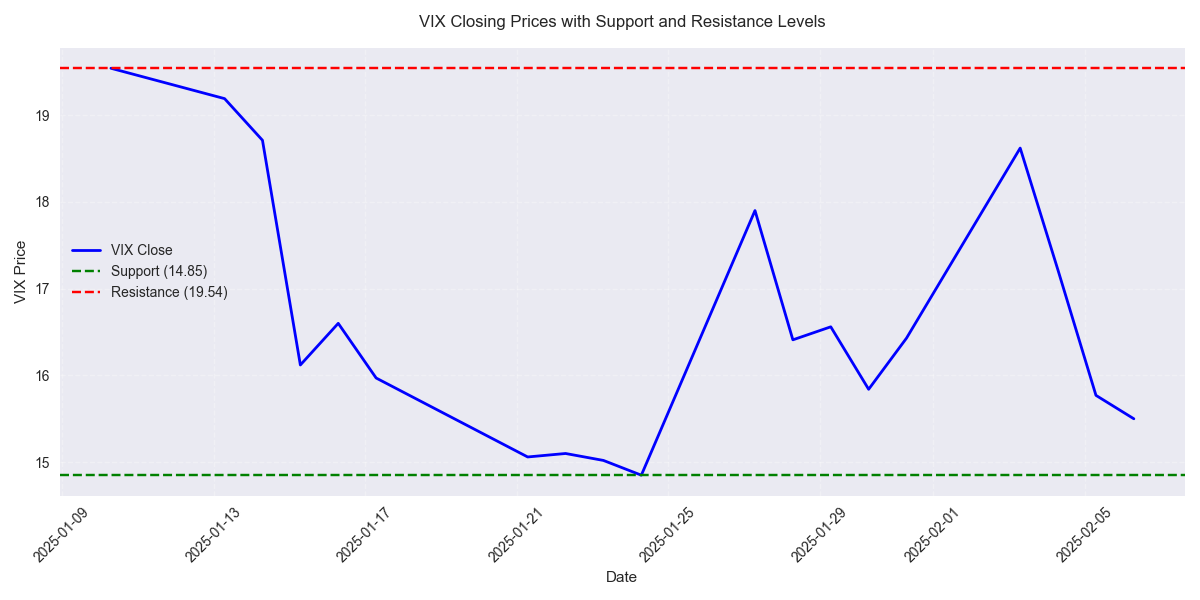

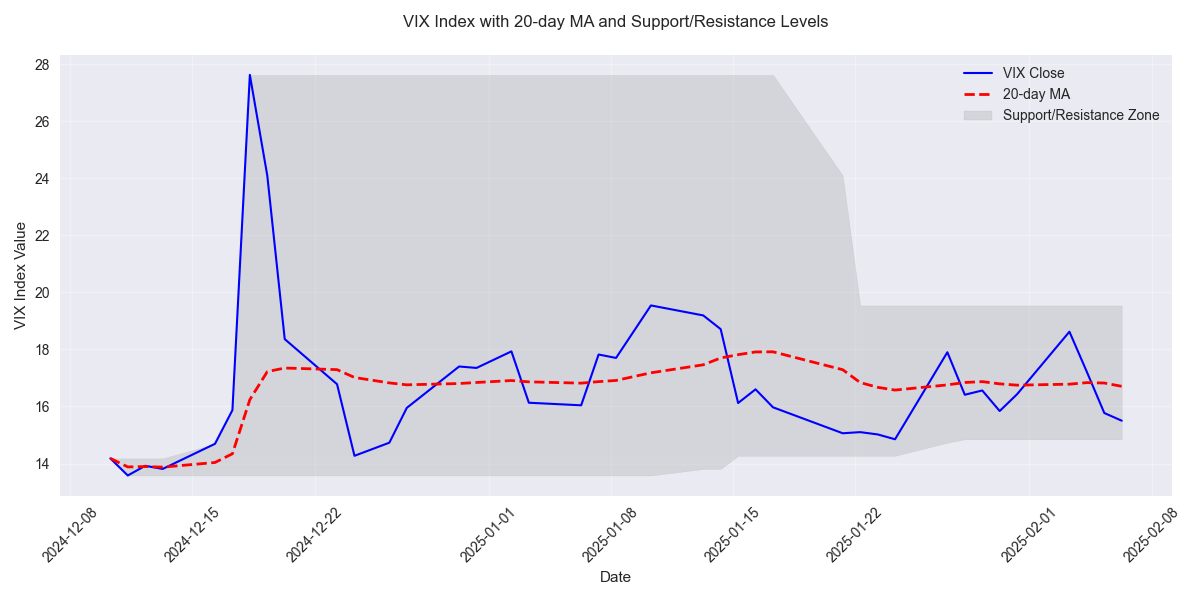

Key Trading Levels and Break Probabilities

VIX Support/Resistance Level Analysis and Break Probabilities

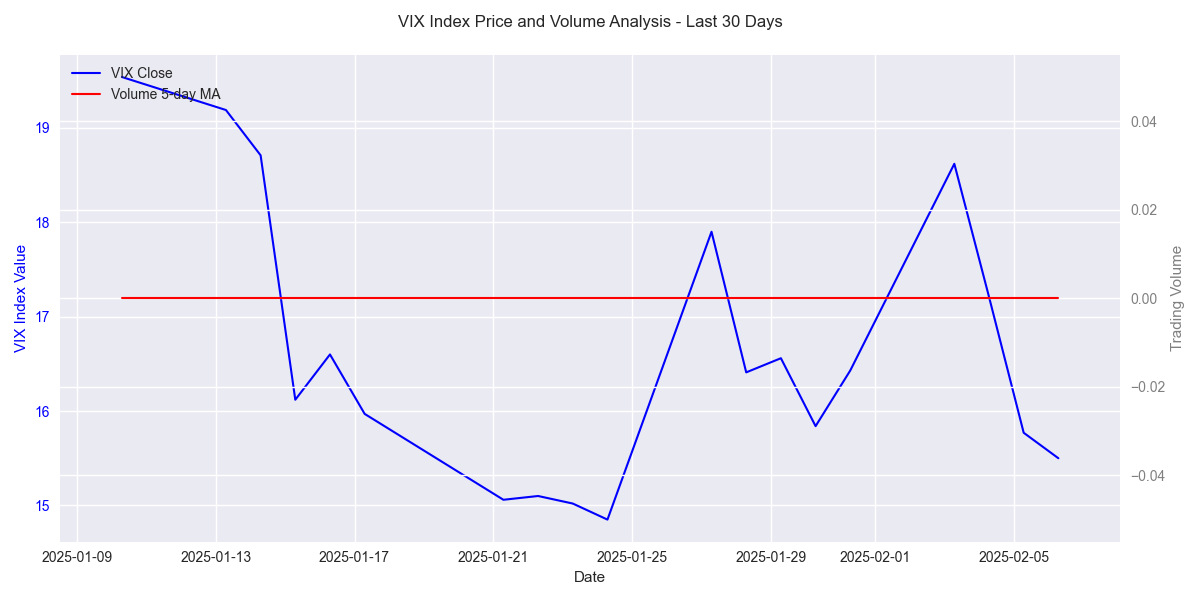

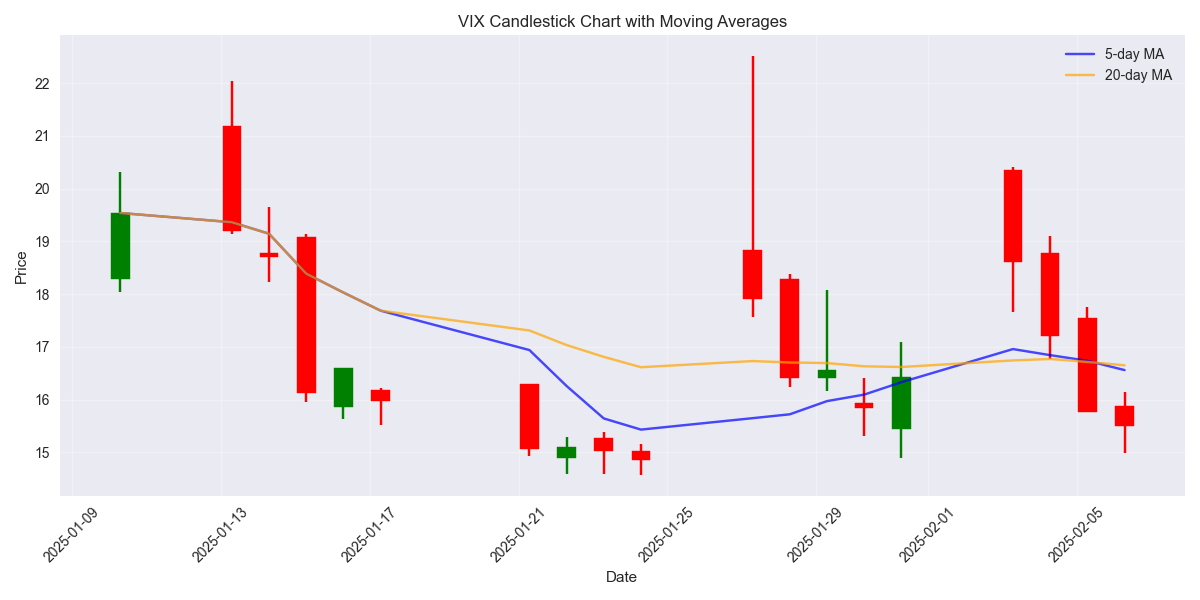

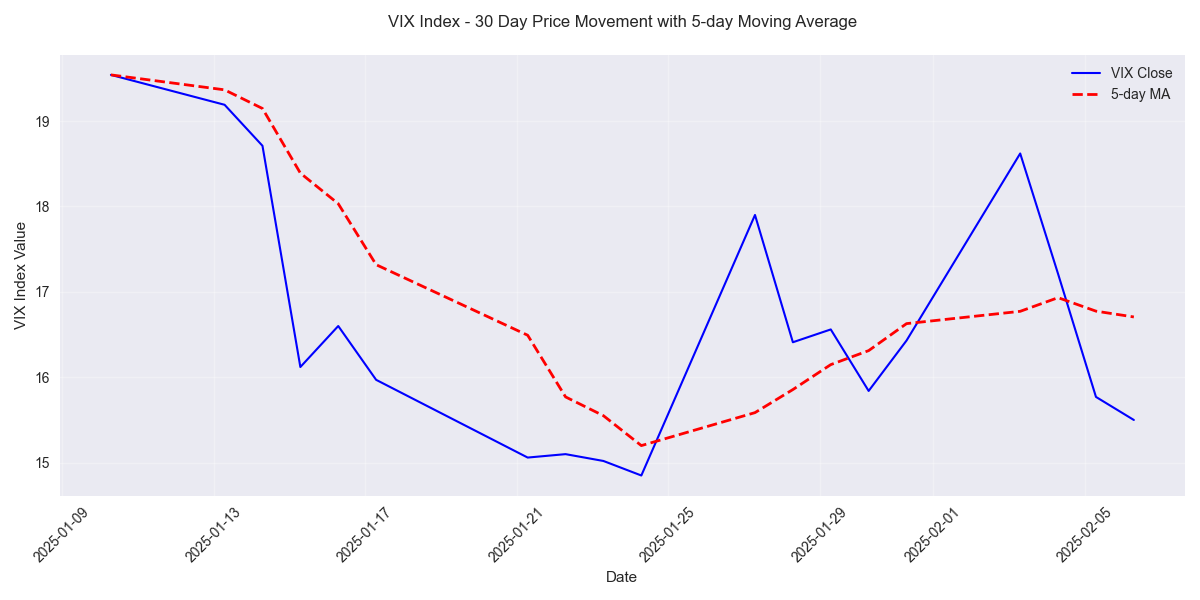

VIX Analysis Reveals Market Stability with Recent Downward Trend

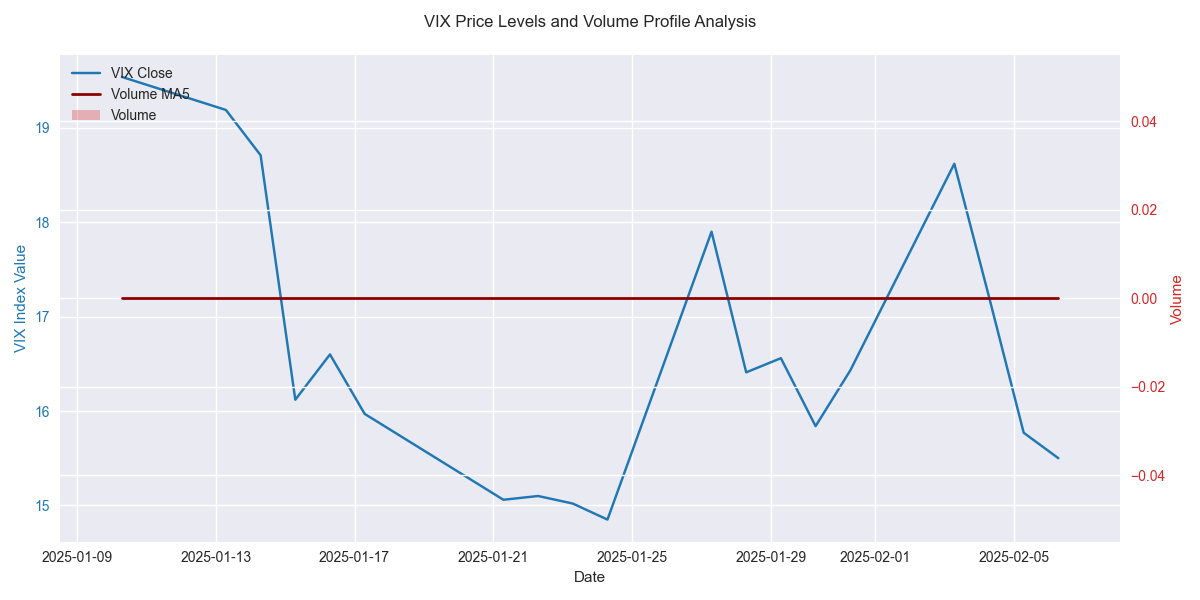

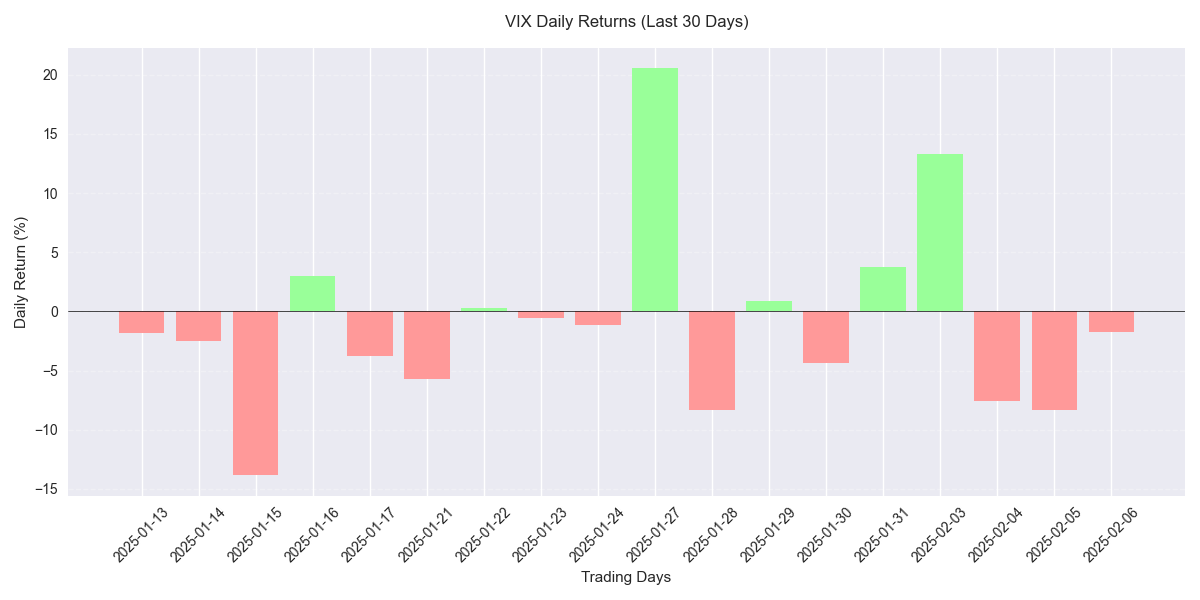

VIX Technical Analysis Reveals Key Trading Signals

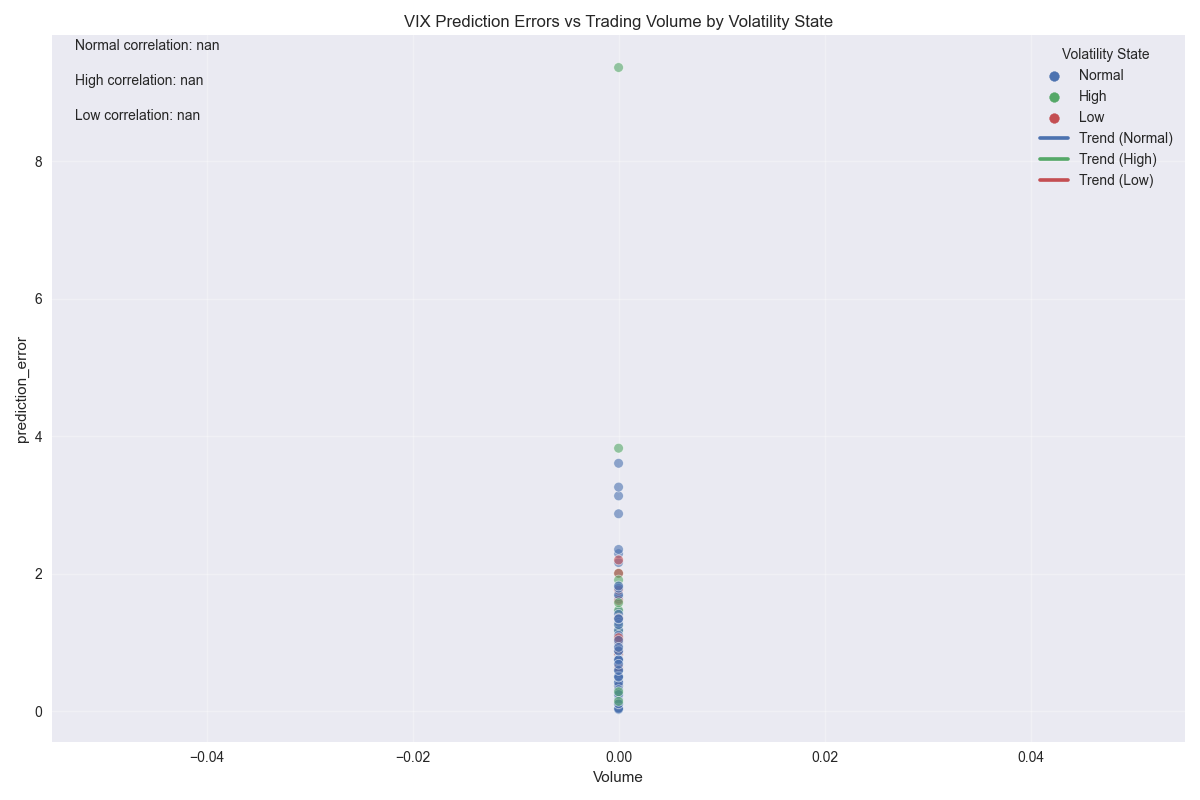

VIX and Market Correlation Analysis Reveals Strong Trading Signals

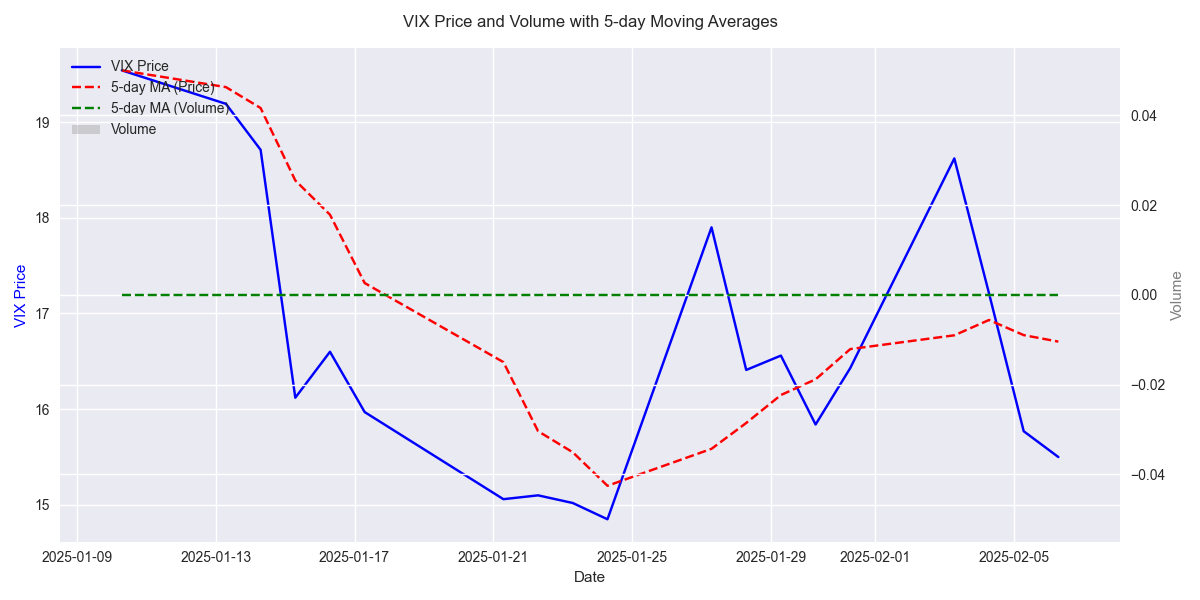

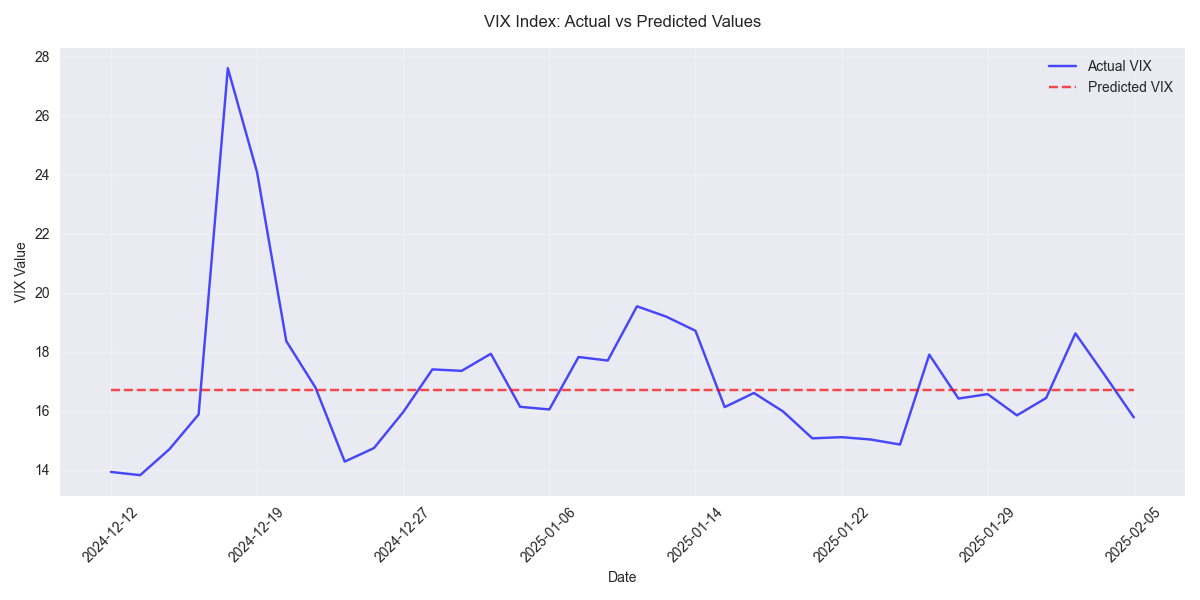

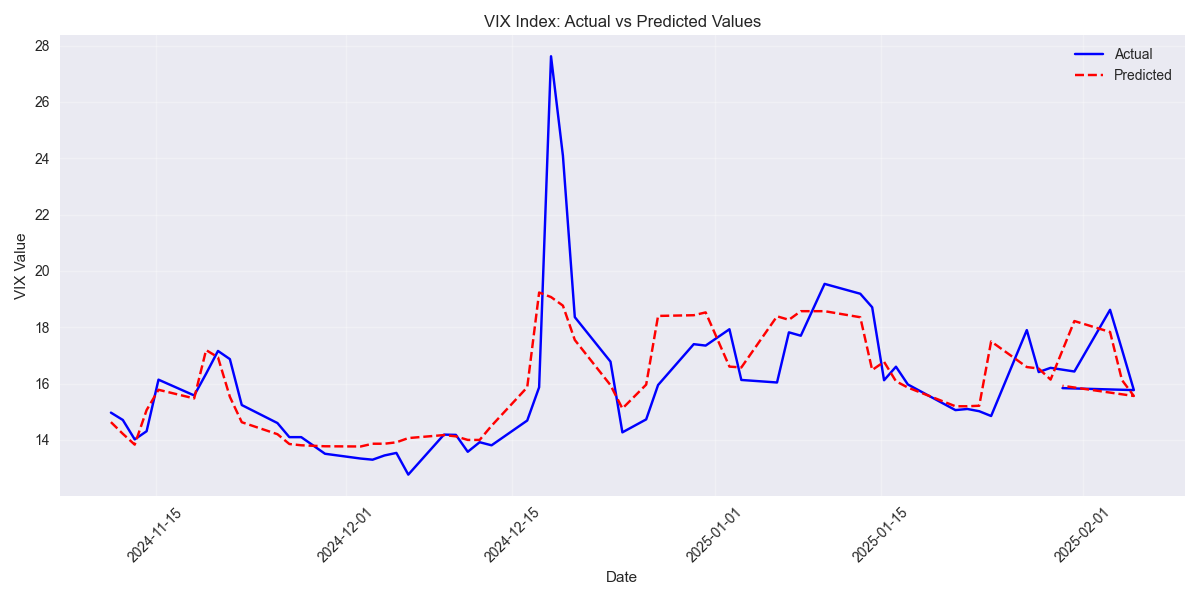

VIX Index Short-Term Price Prediction Analysis

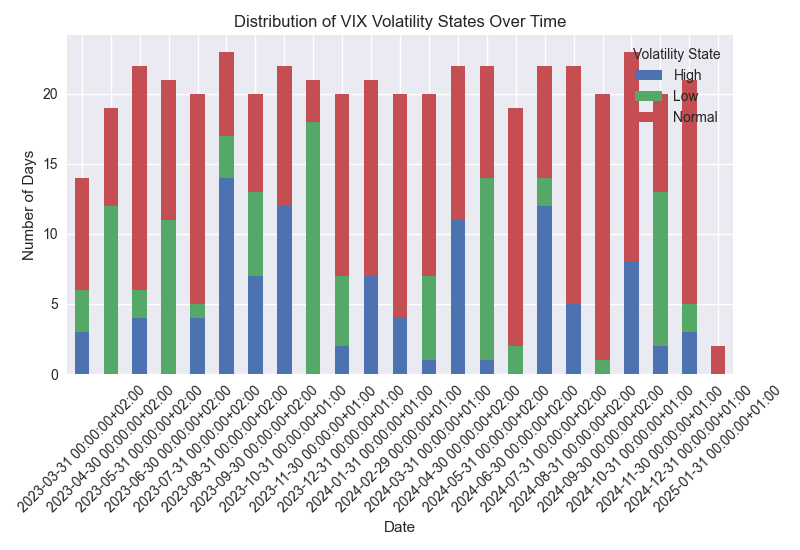

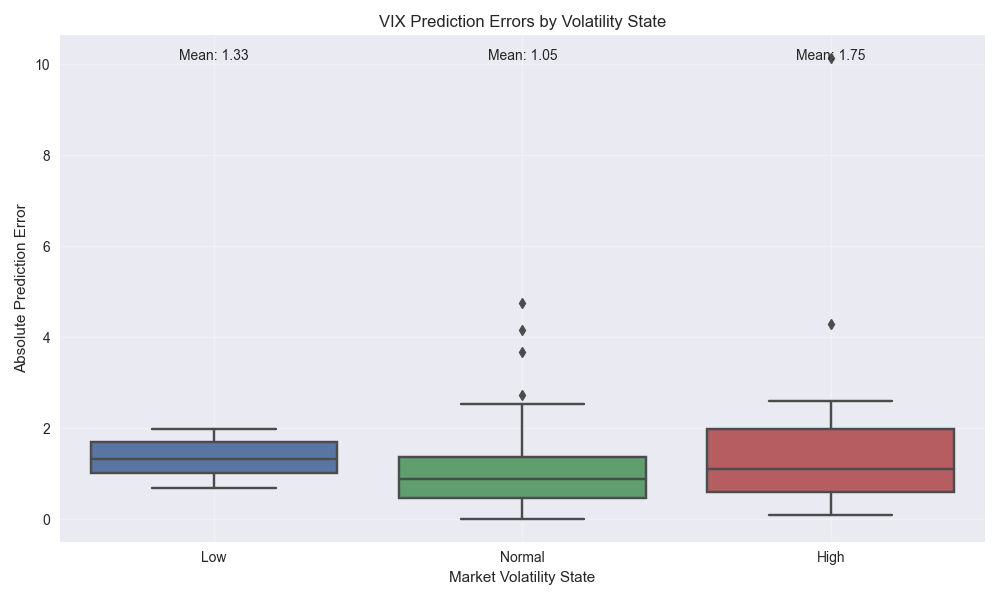

VIX Weekly Predictions and Volatility State Analysis

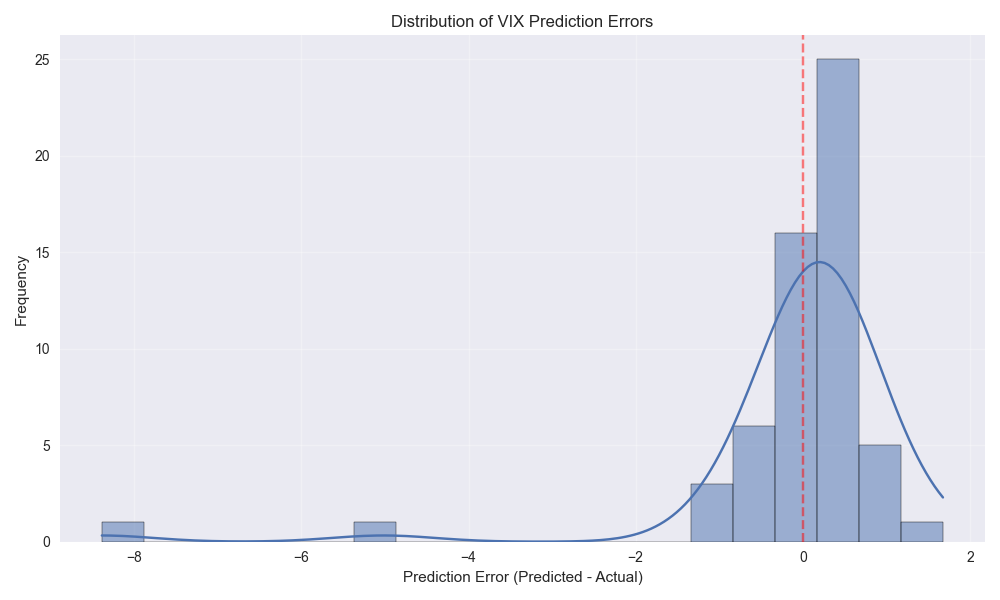

VIX Index Short-Term Prediction Analysis Reveals Strong Accuracy

VIX Monthly Predictions and Risk Factor Analysis

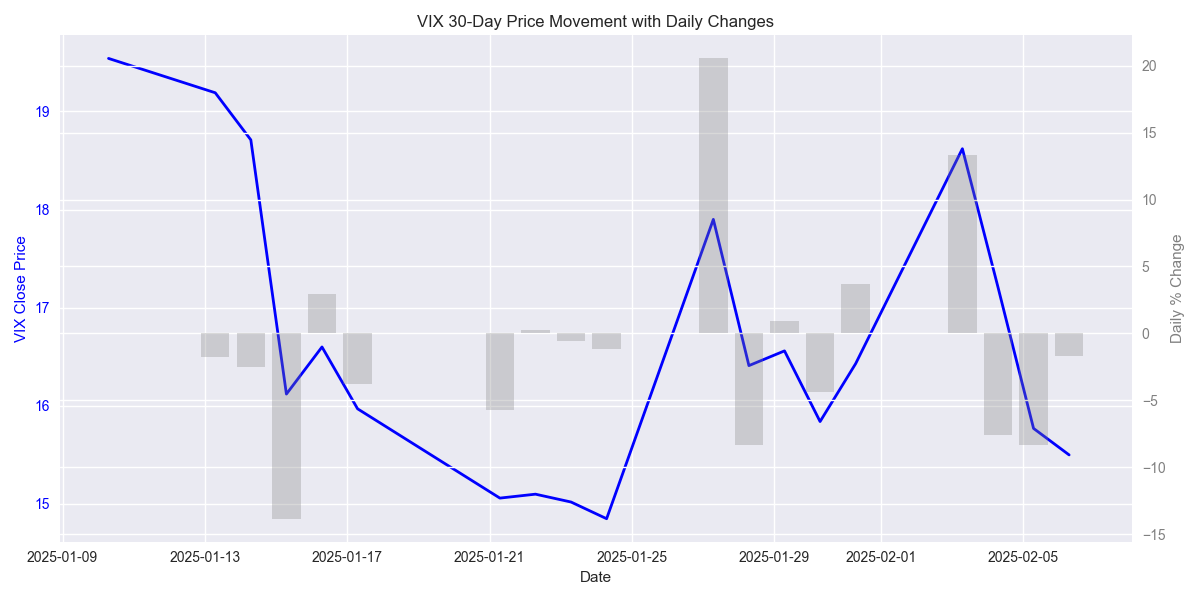

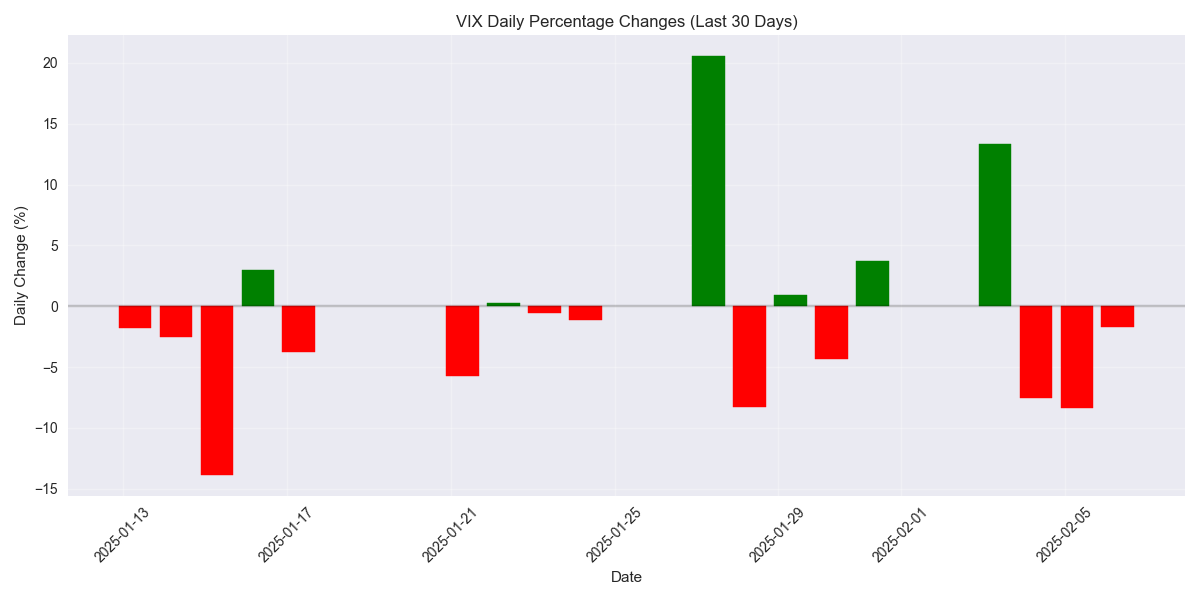

Recent VIX Price Movements Show Declining Volatility Trend