S&P 500 Market Insights: Quick Trader Briefing

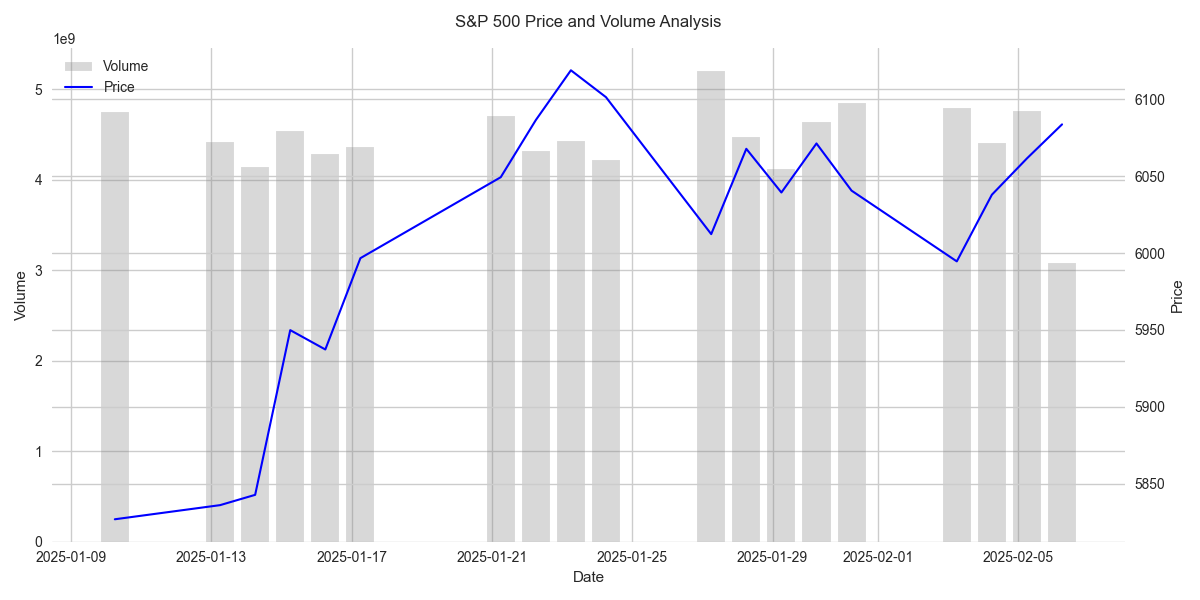

S&P 500 Shows Strong Bullish Momentum Despite Volume Concerns

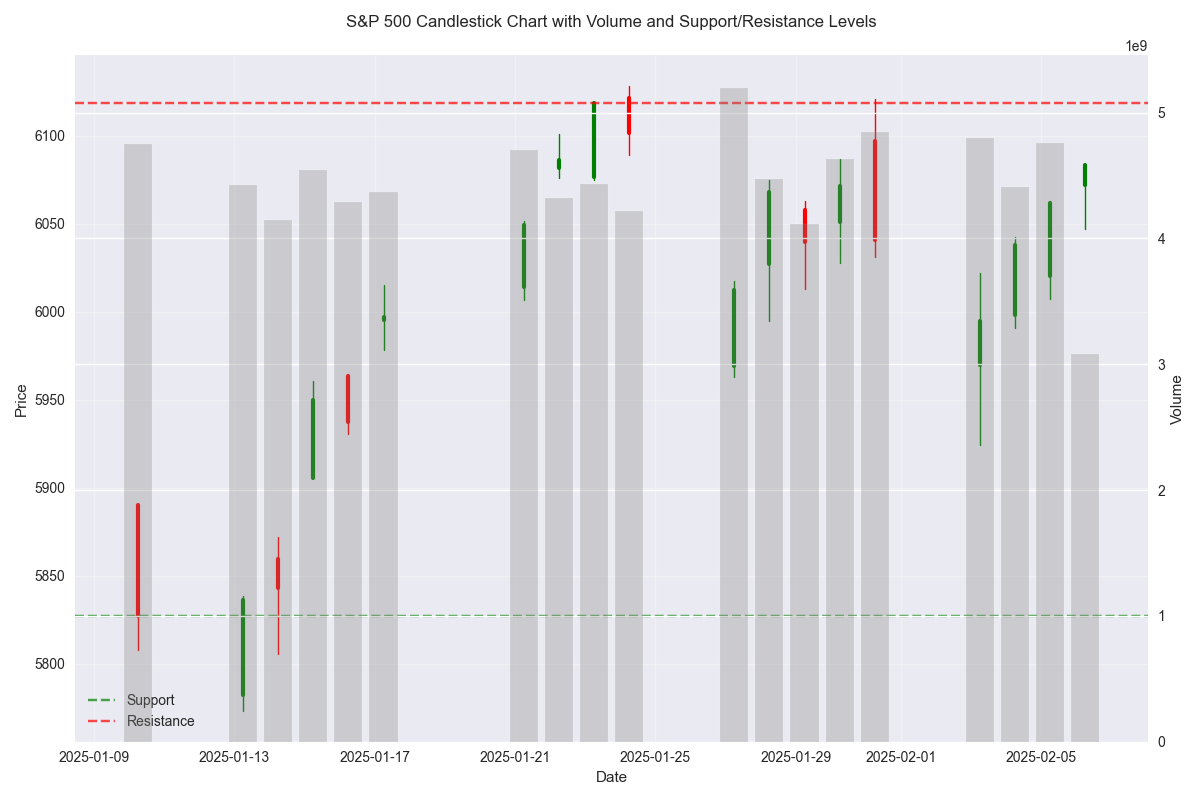

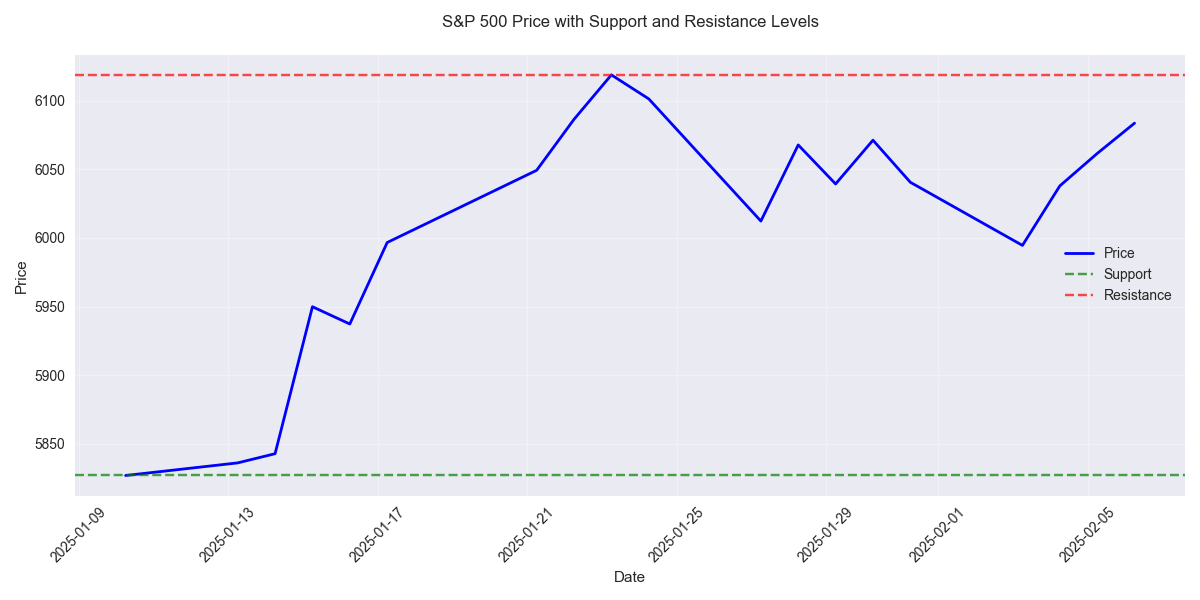

Critical Price Levels Set Stage for Potential Breakout

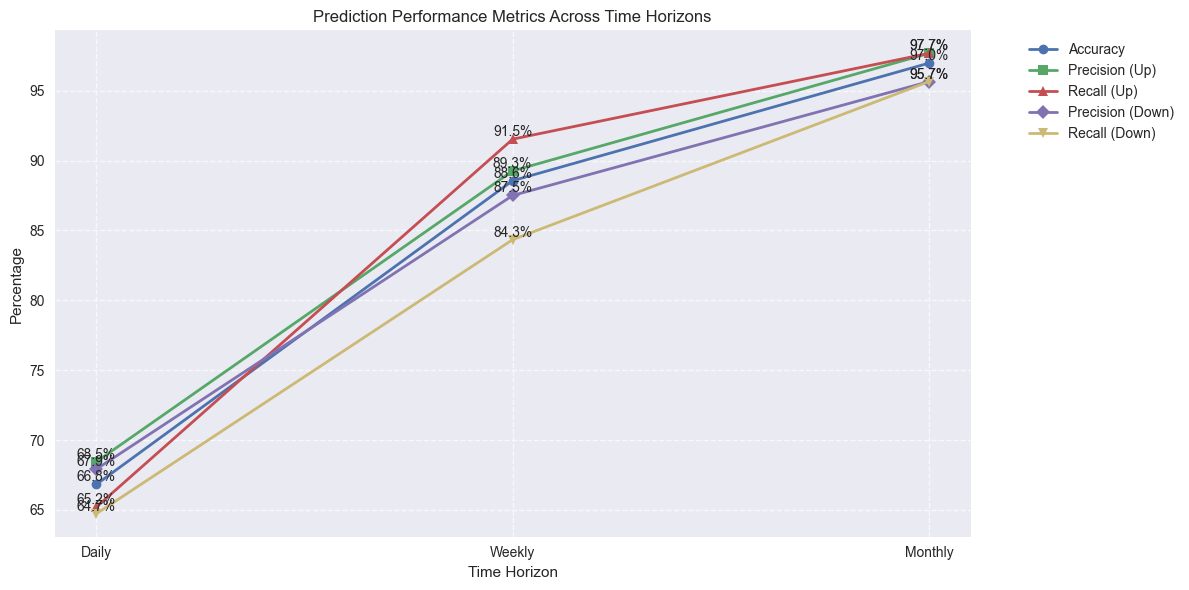

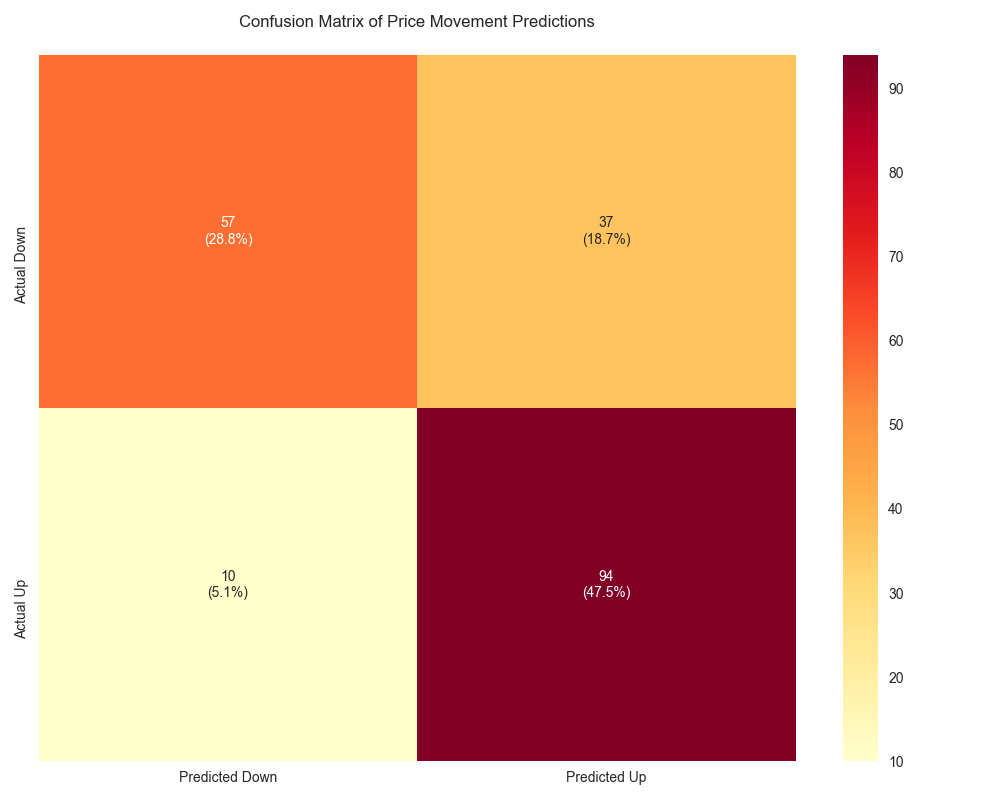

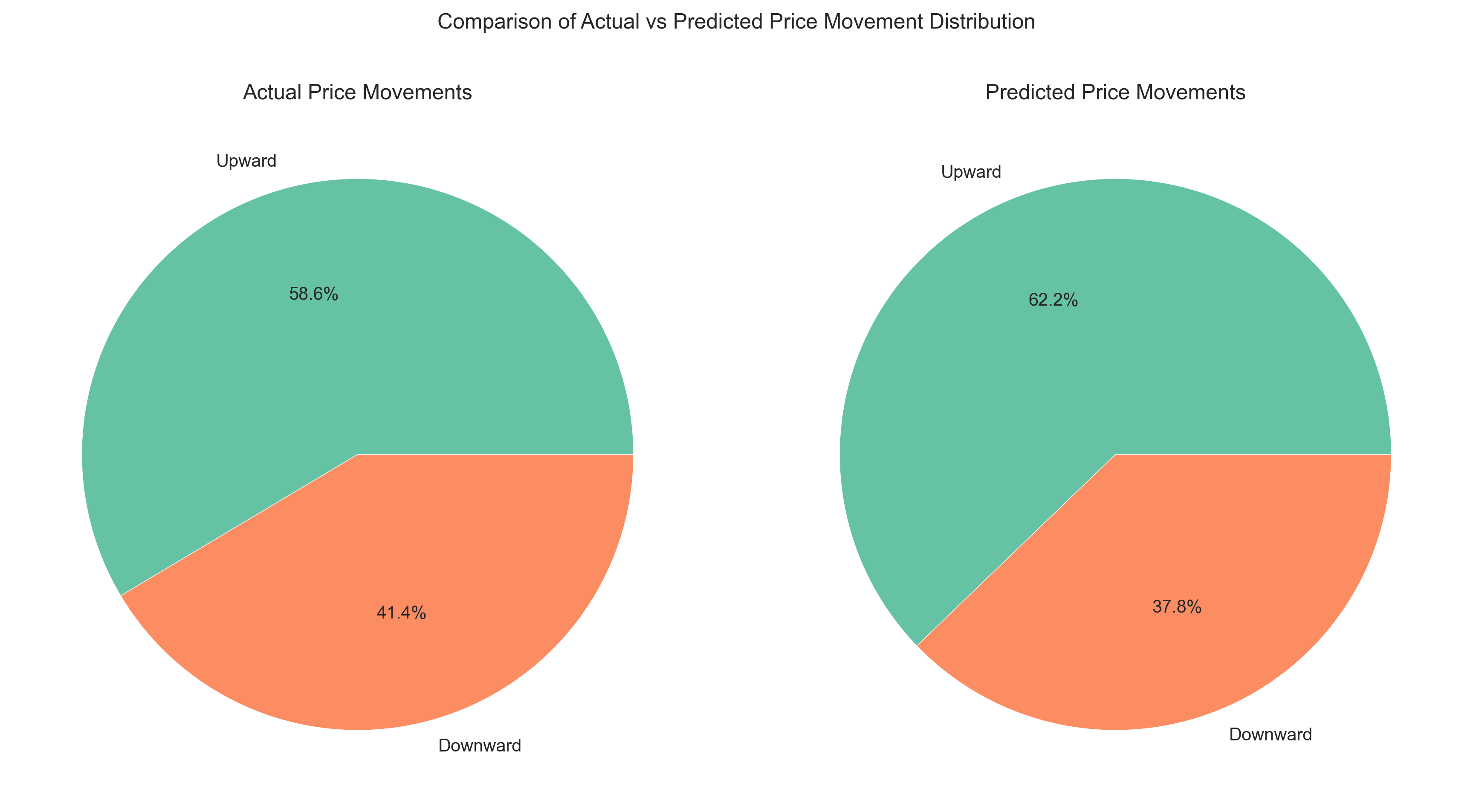

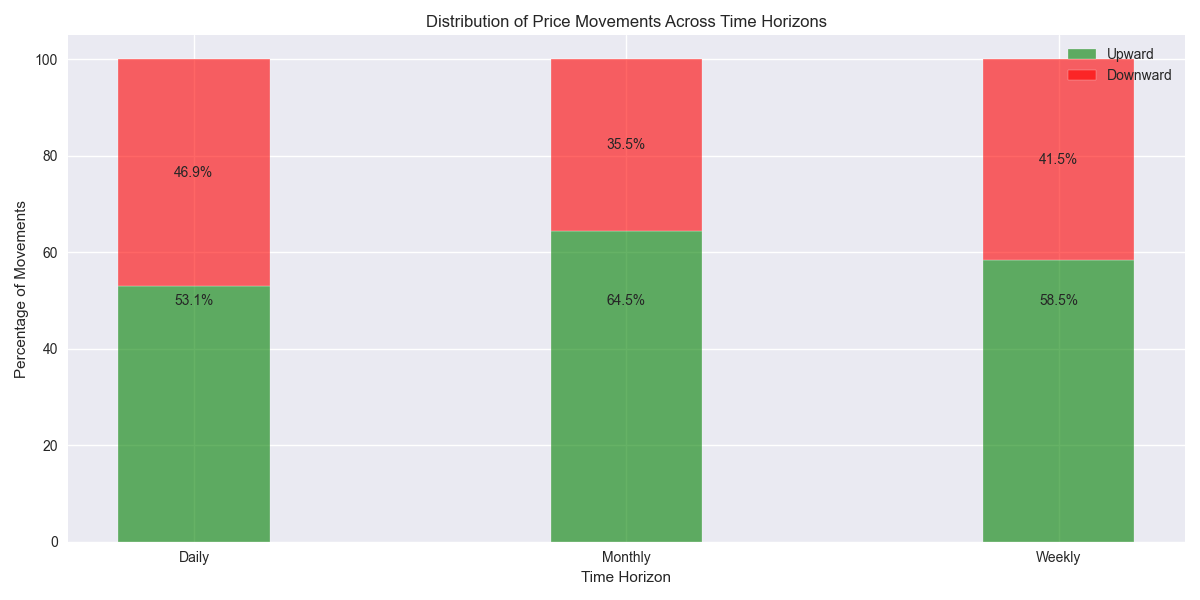

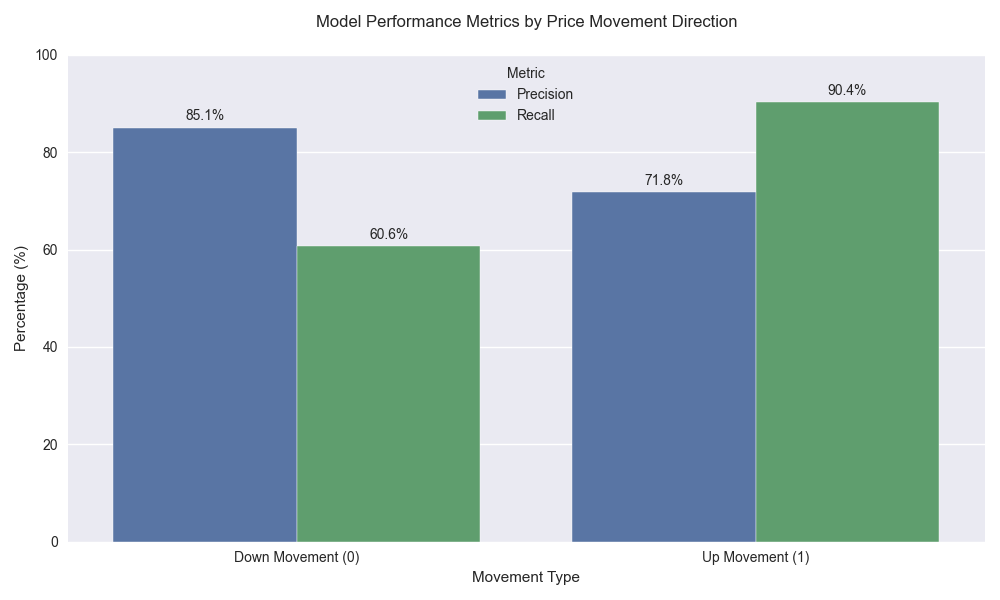

Trading Algorithm Shows Exceptional Accuracy for Buy Signals

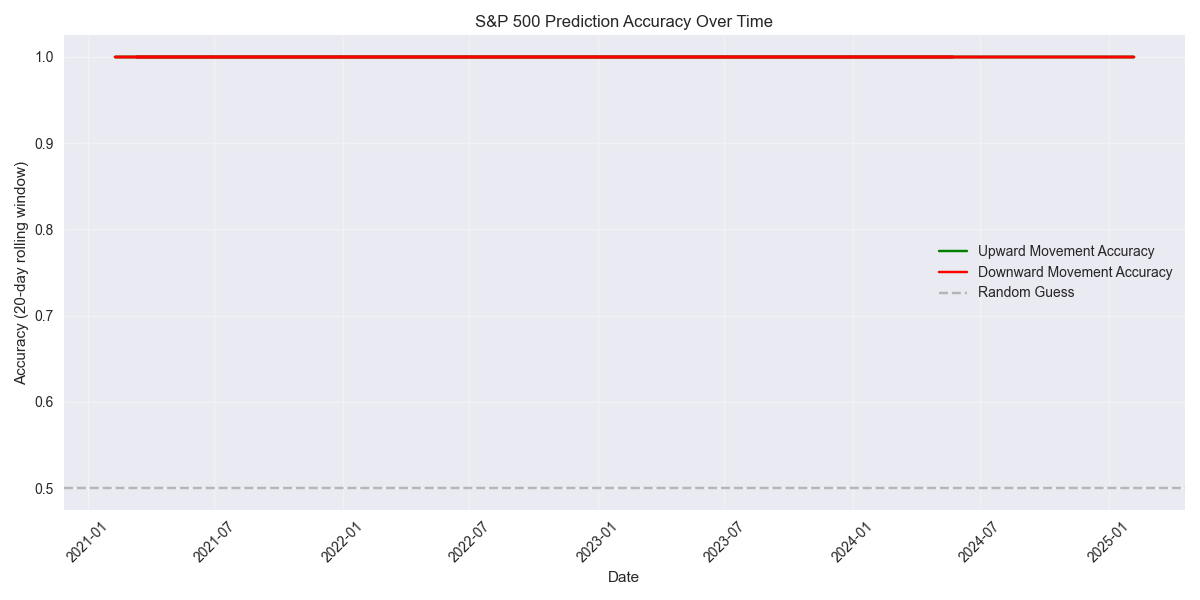

Monthly Analysis Points to Strong Upward Bias

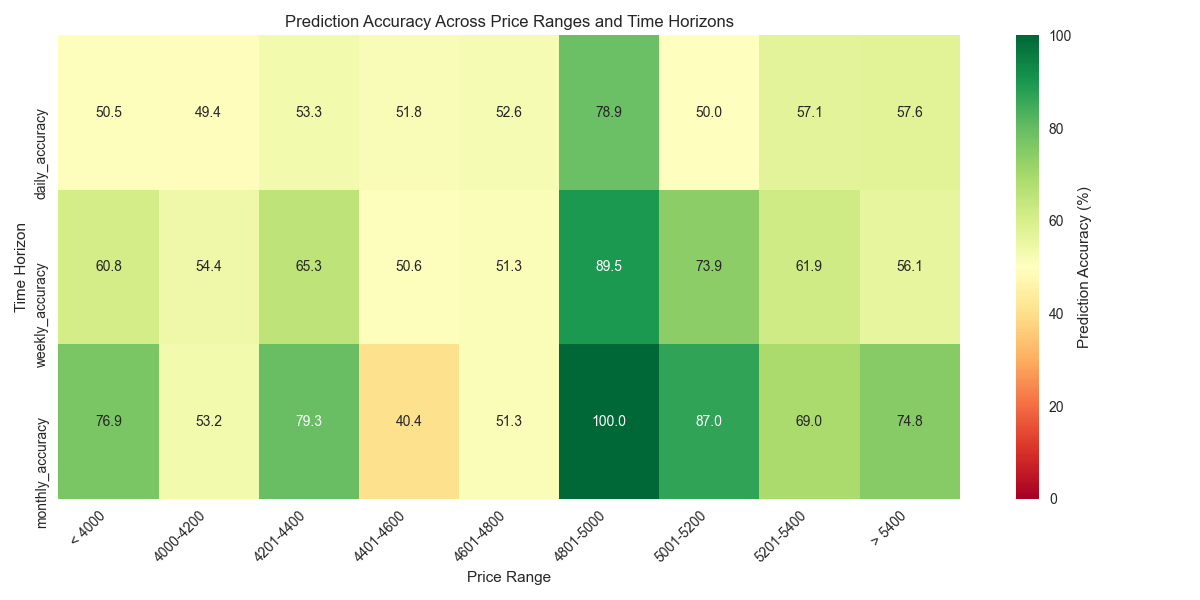

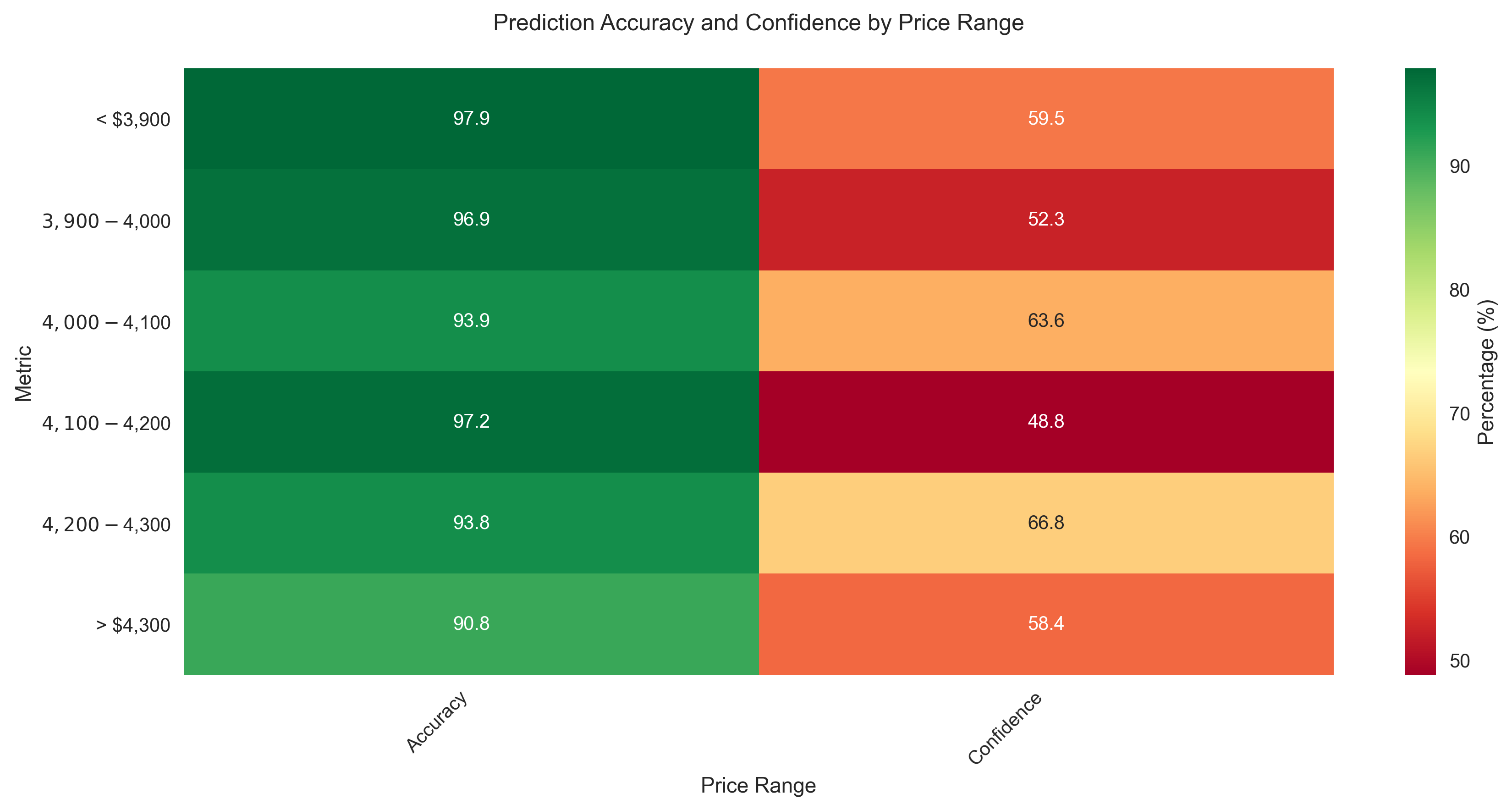

Optimal Trading Zones Identified with High Confidence

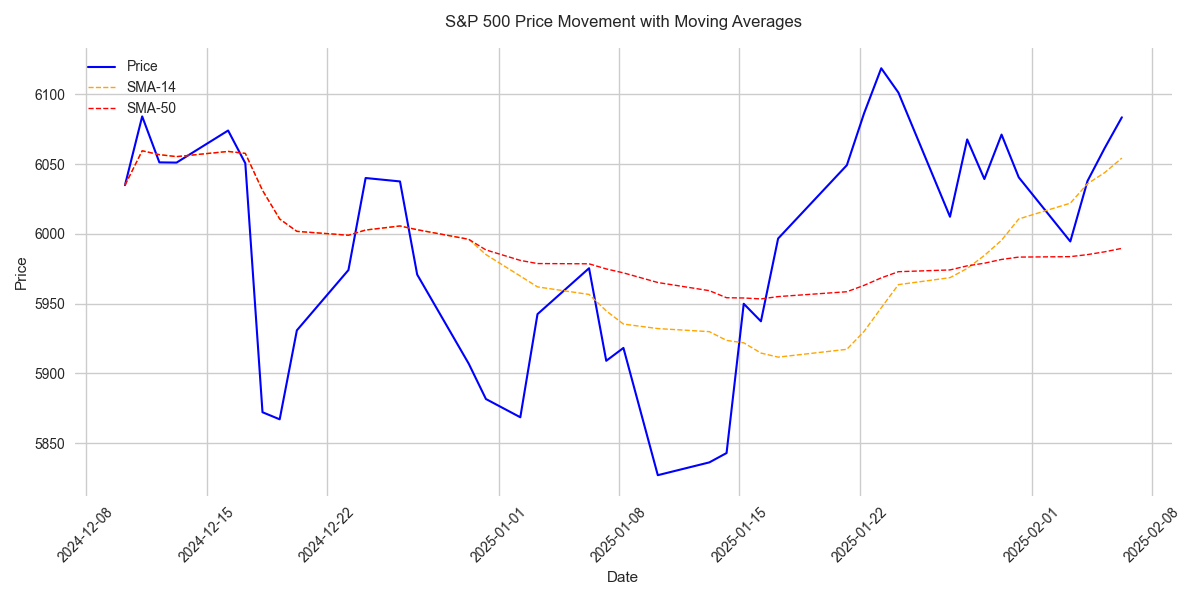

Comprehensive SP 500 Price Movement Analysis Across Multiple Time Horizons

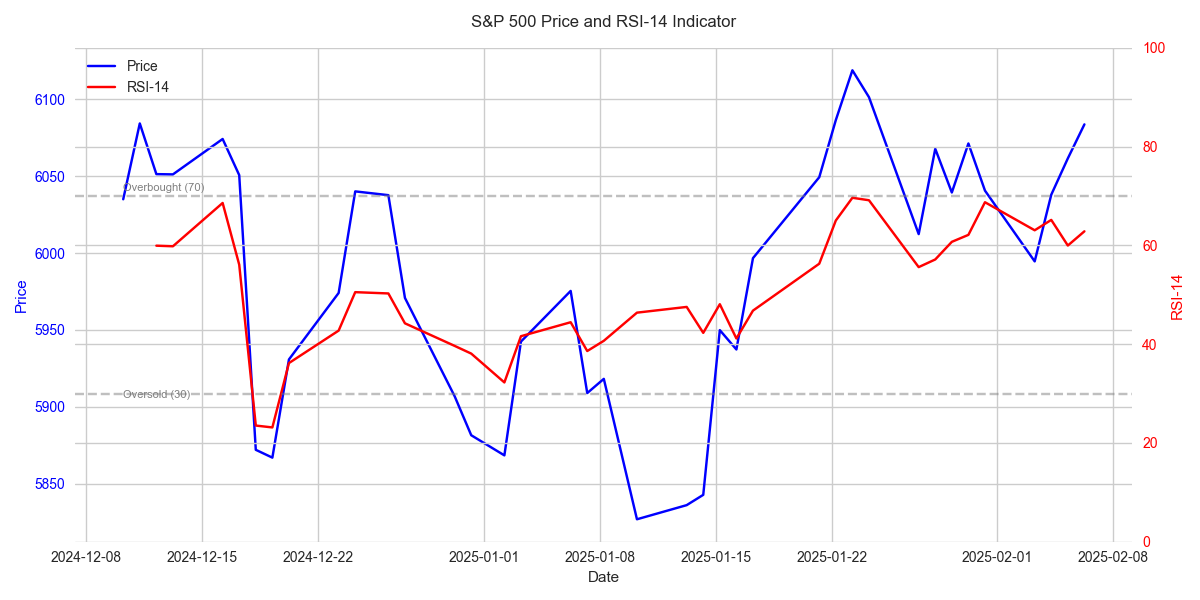

S&P 500 Technical Support and Resistance Analysis Reveals Strong Bullish Position

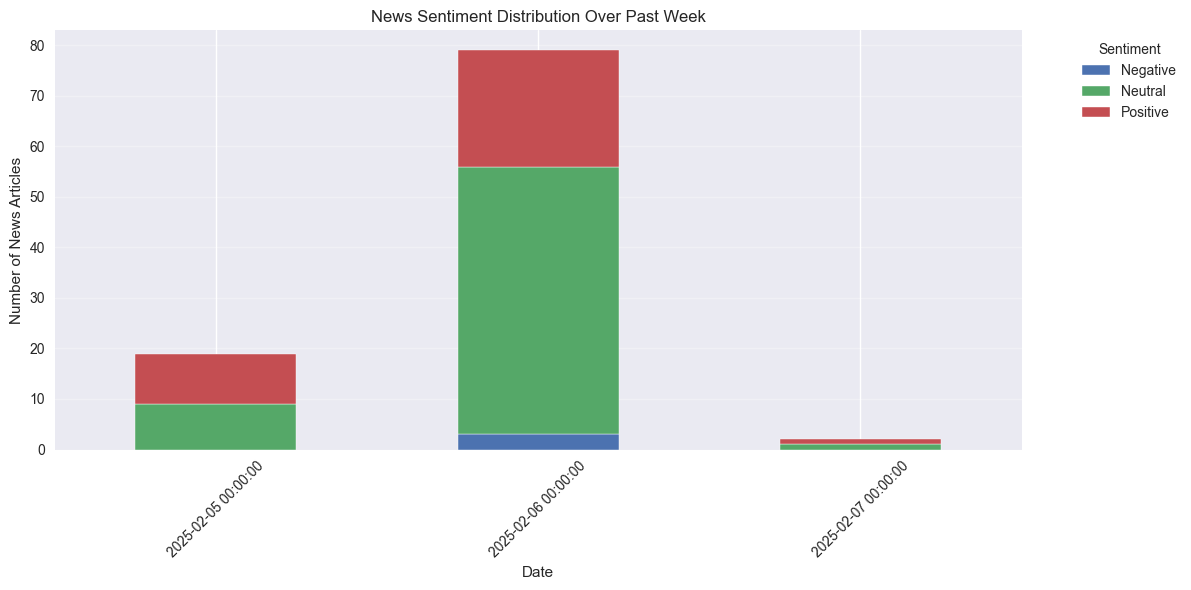

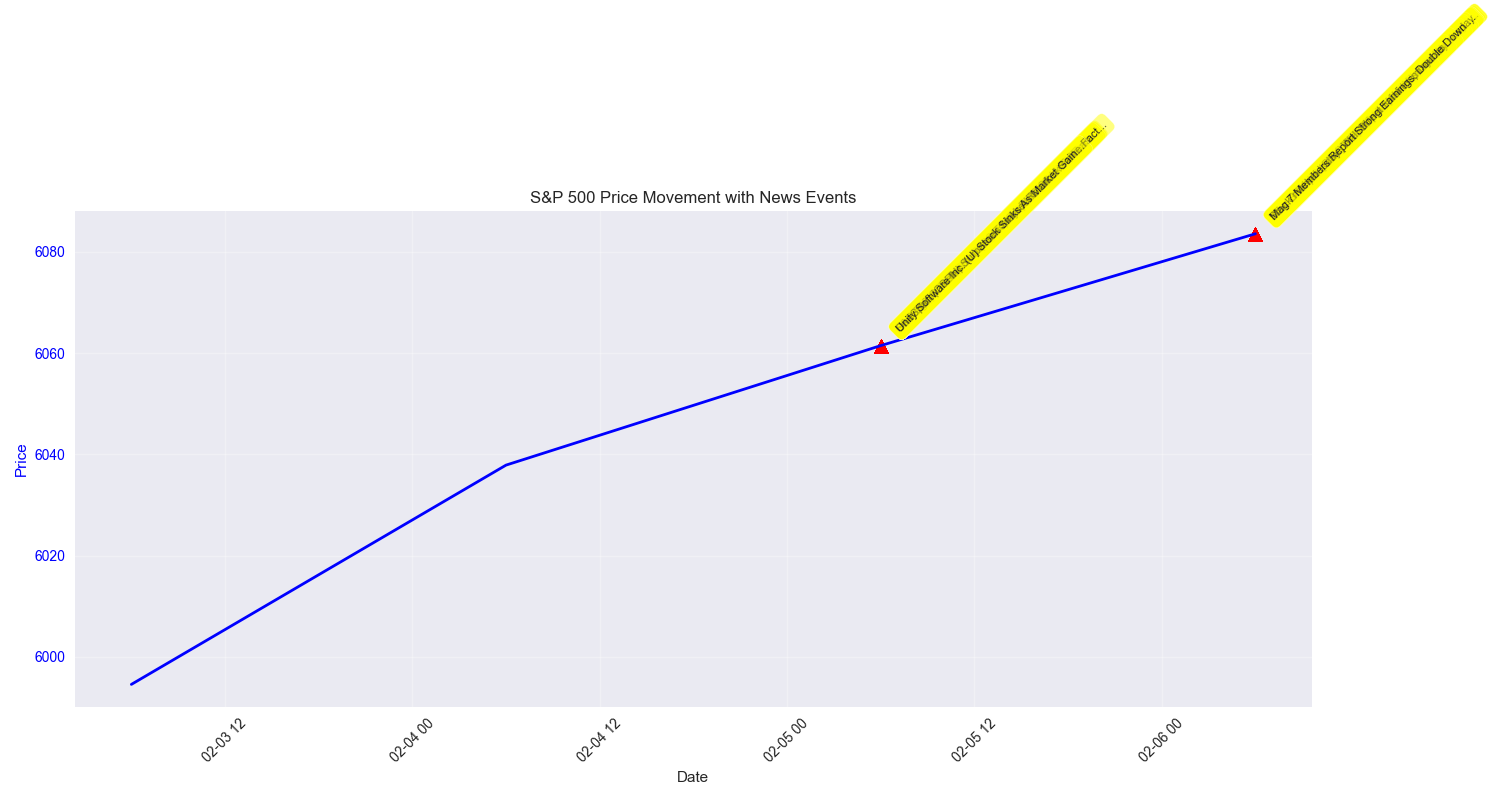

Market Sentiment Analysis Shows Mixed Signals Ahead of Key Economic Data

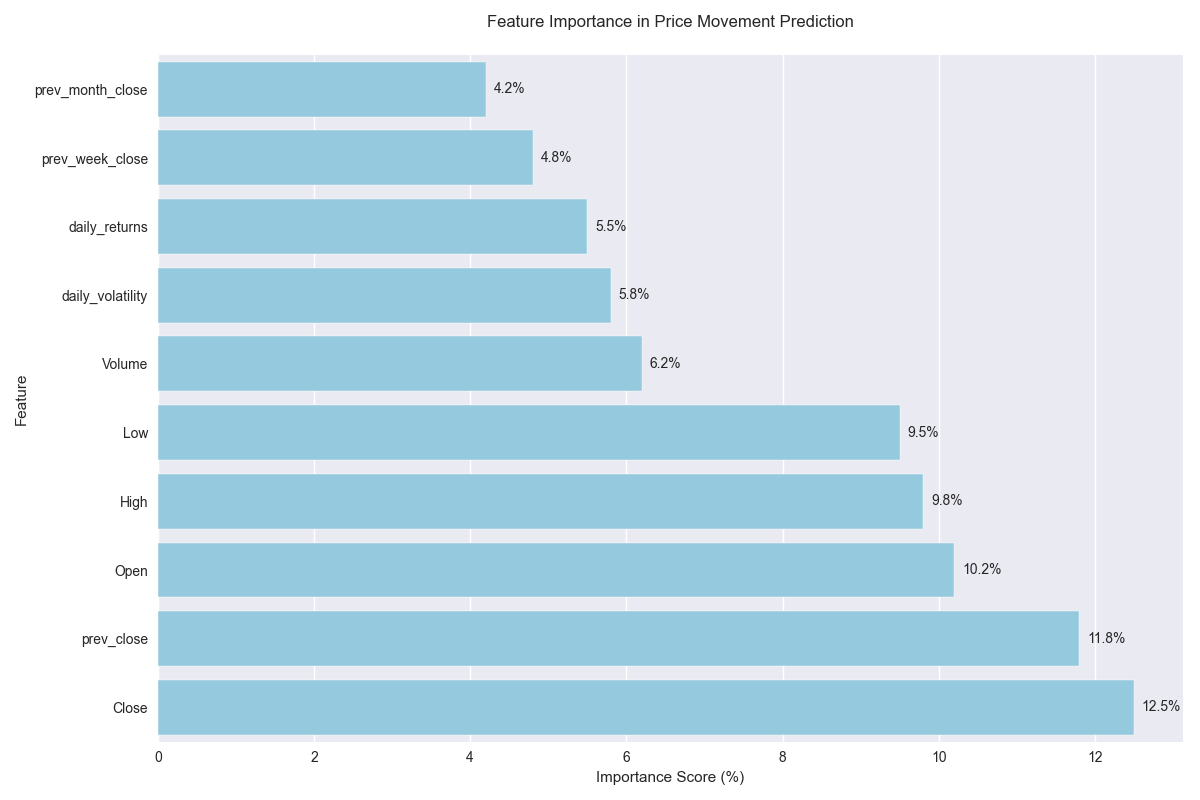

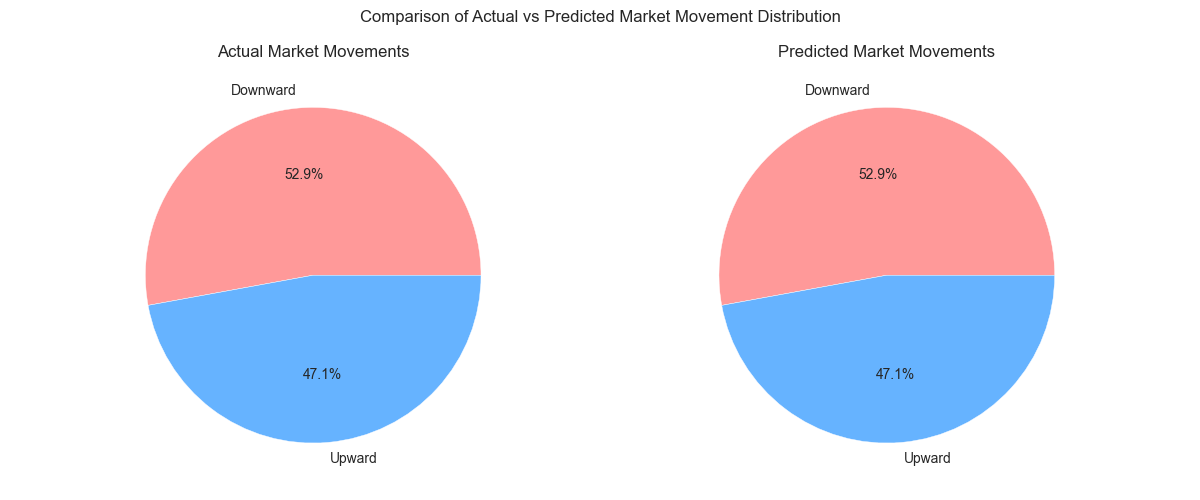

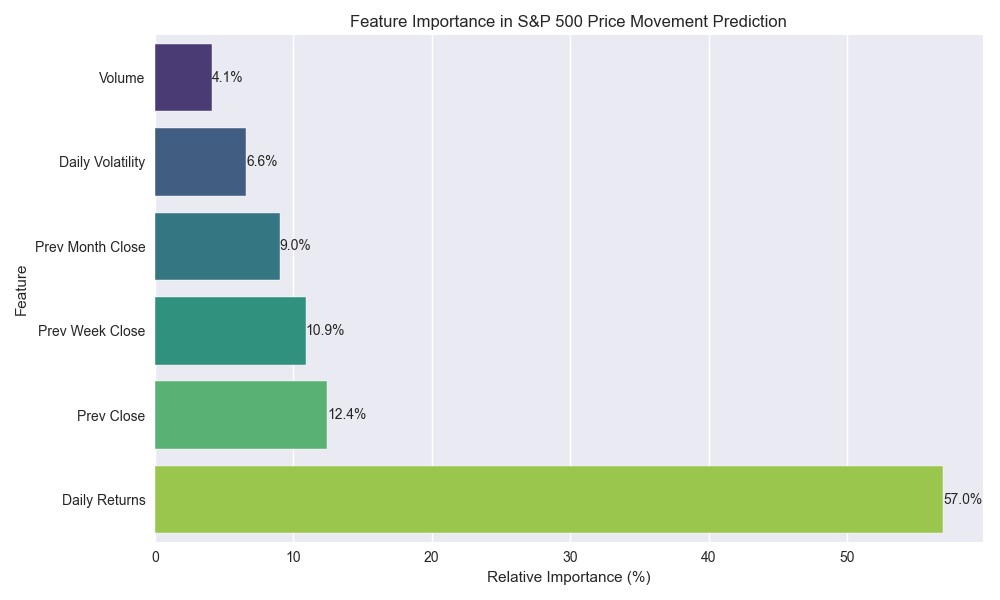

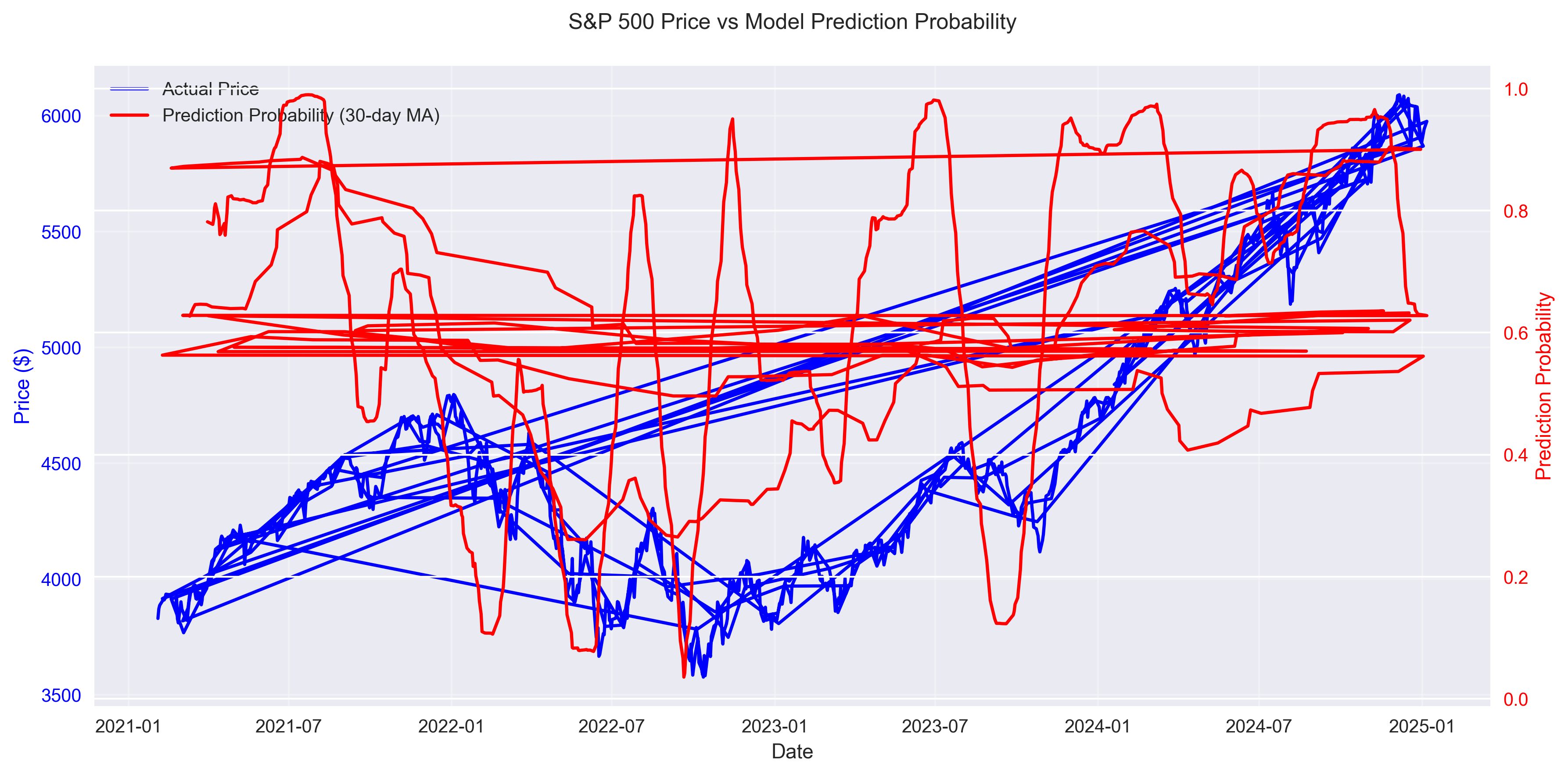

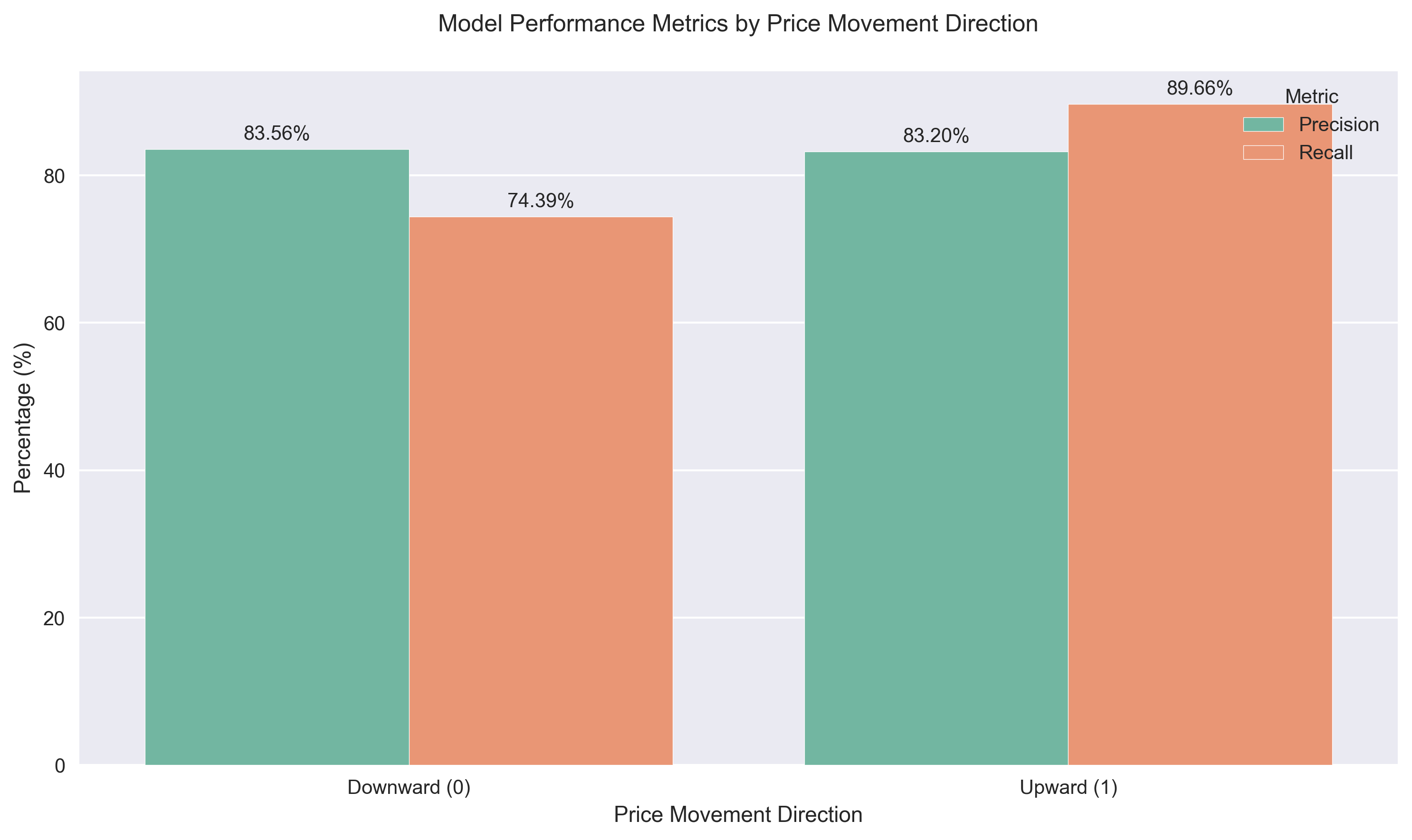

S&P 500 Next-Day Price Movement Prediction Model Performance

S&P 500 Price Direction Prediction and Risk Analysis

S&P 500 Weekly Price Movement Predictions with High Accuracy

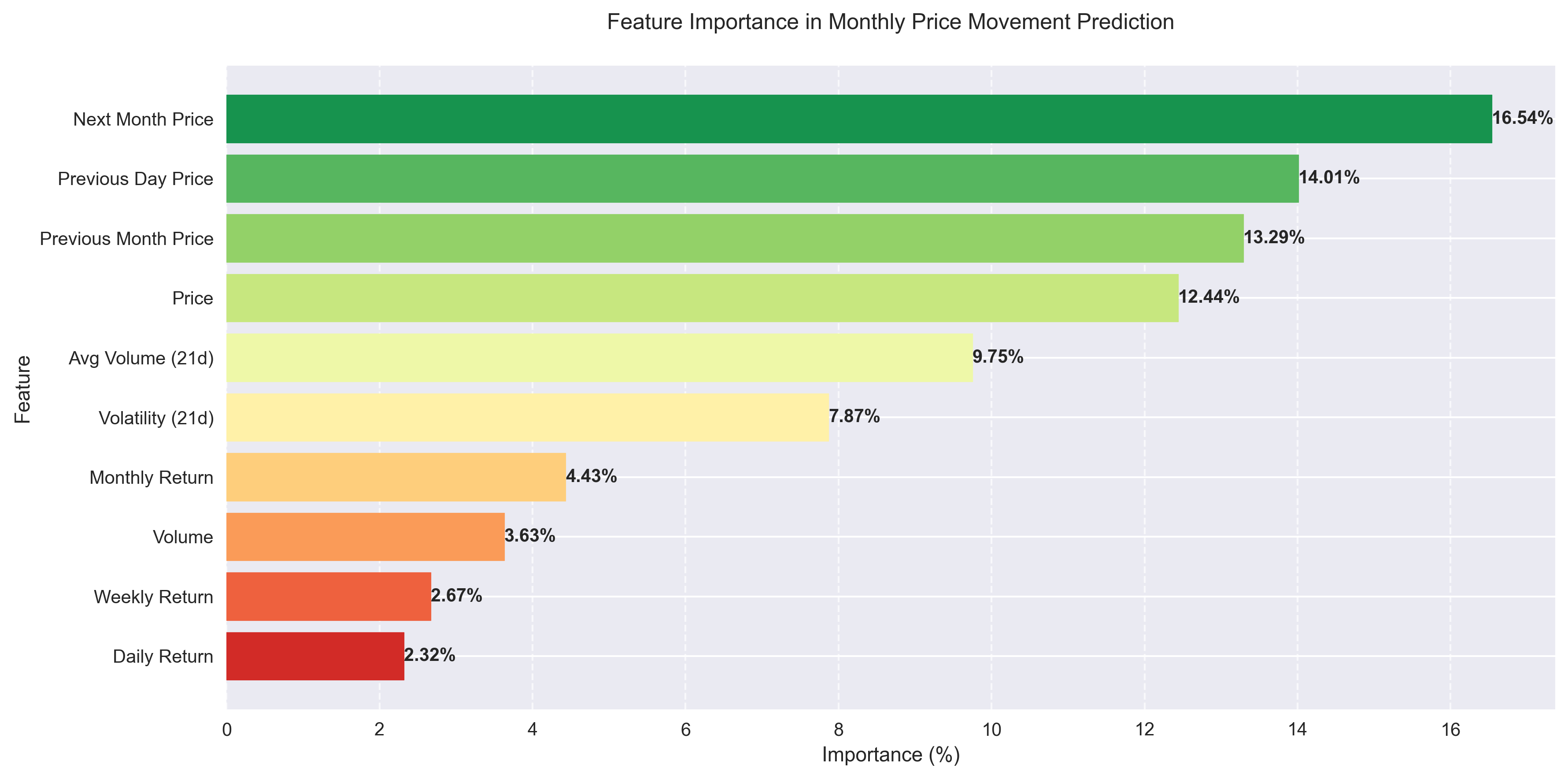

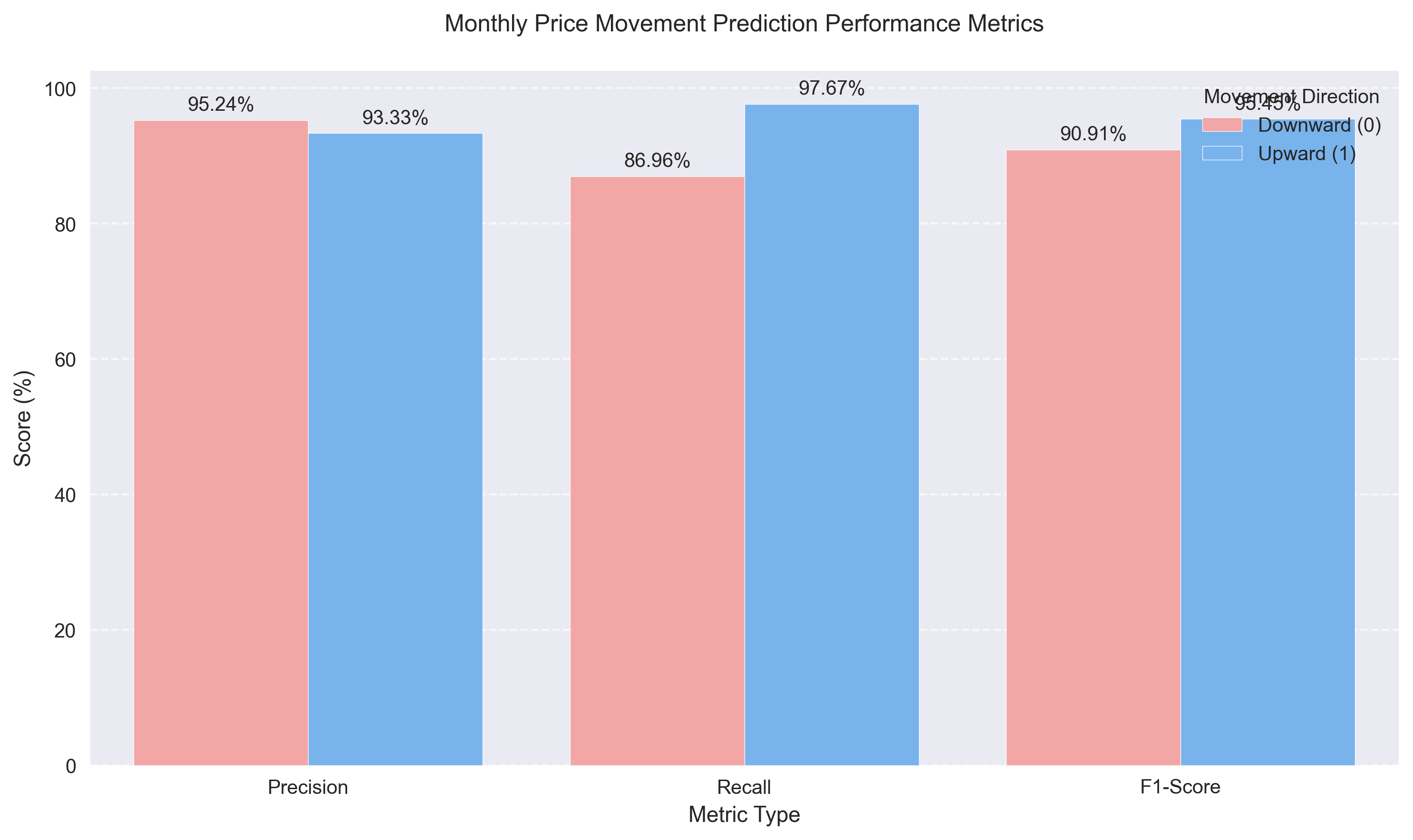

S&P 500 Monthly Price Prediction Model Shows Exceptional Performance

S&P 500 Shows Bullish Momentum with Key Technical Signals