Crude Oil Market Insights: Rapid Trader Briefing

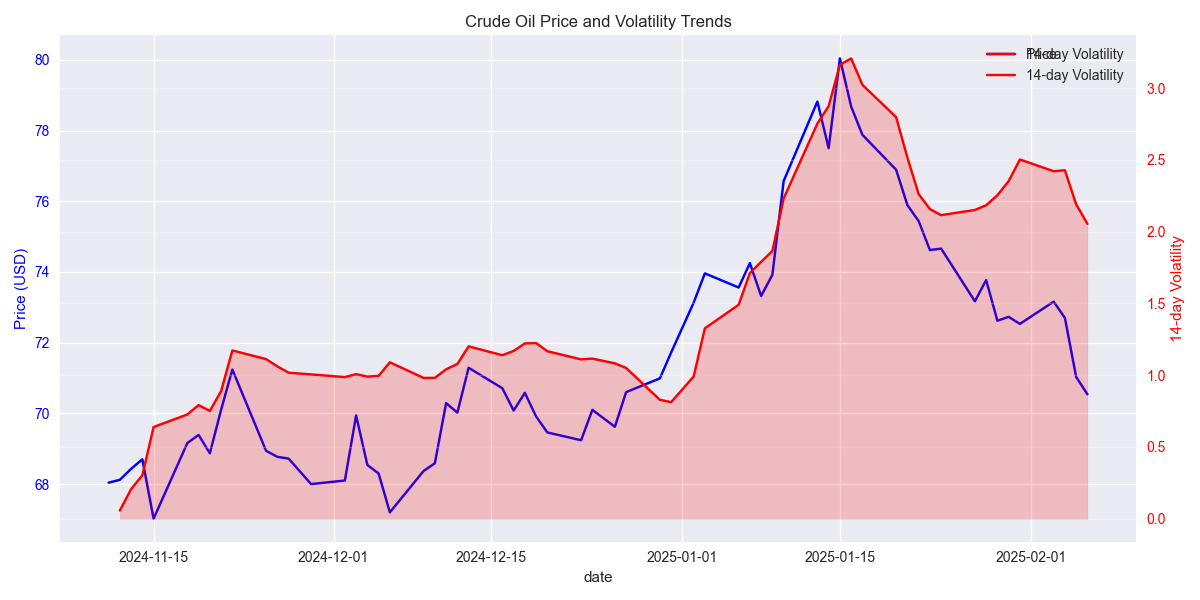

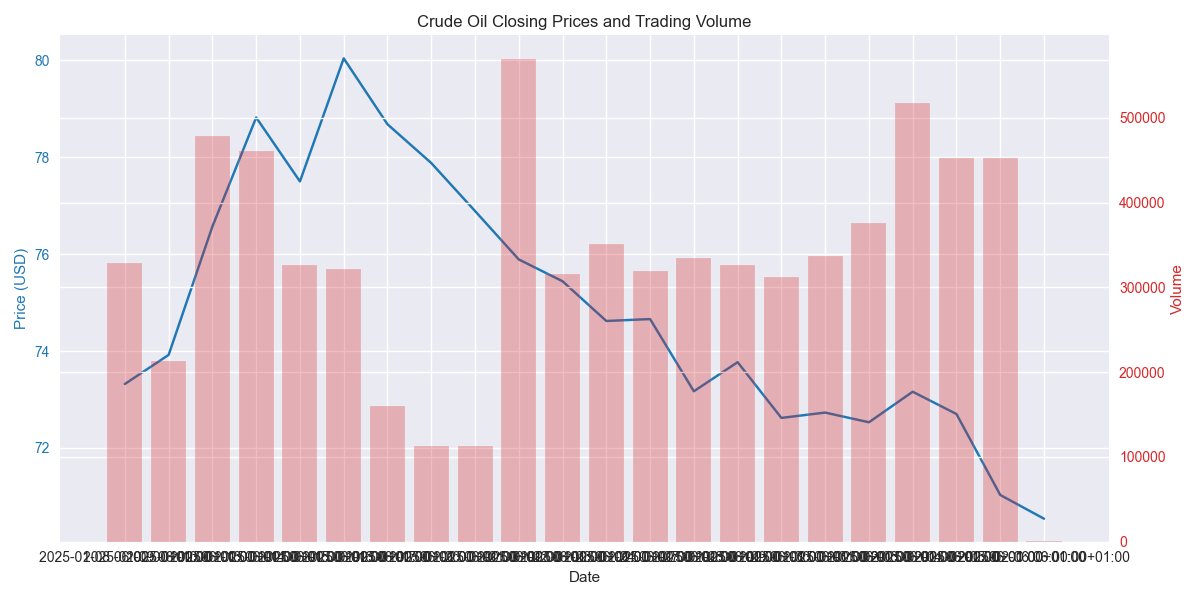

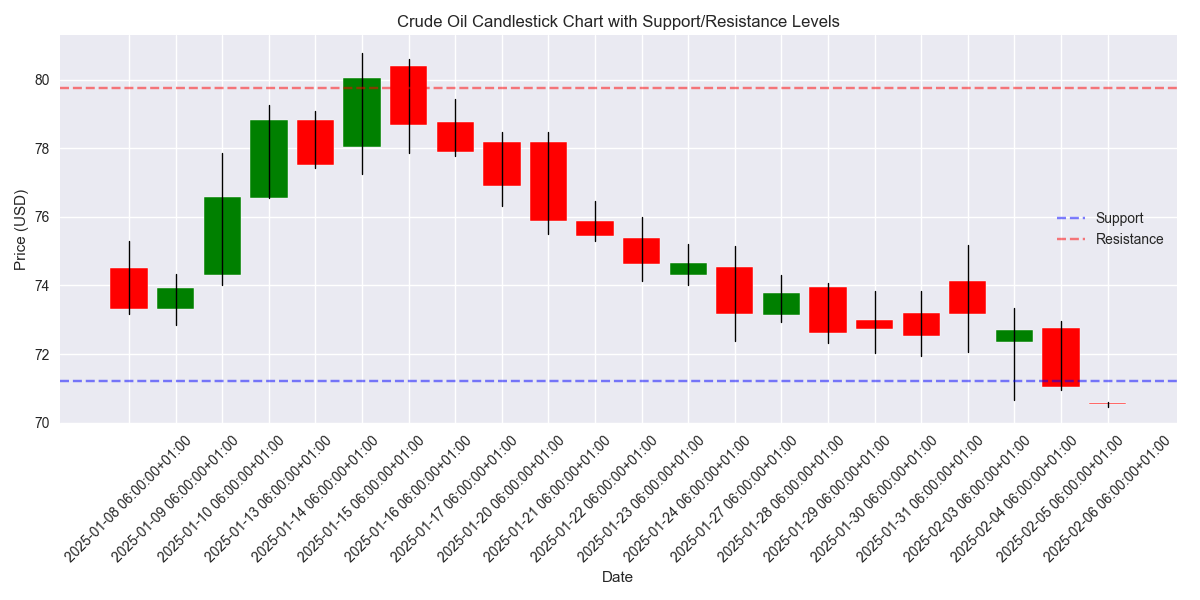

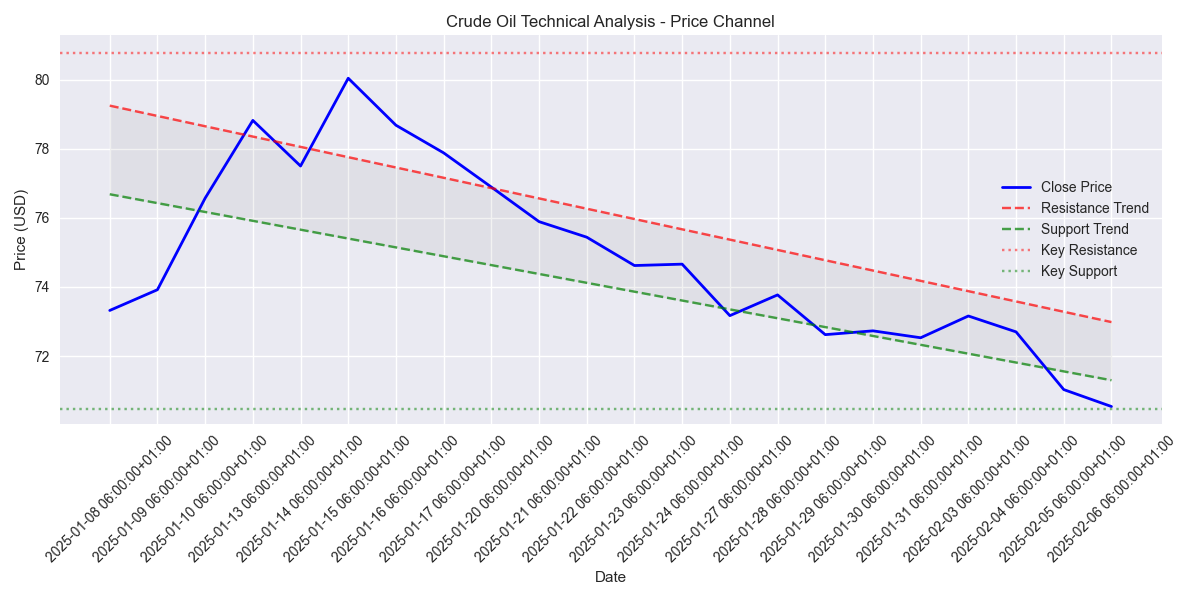

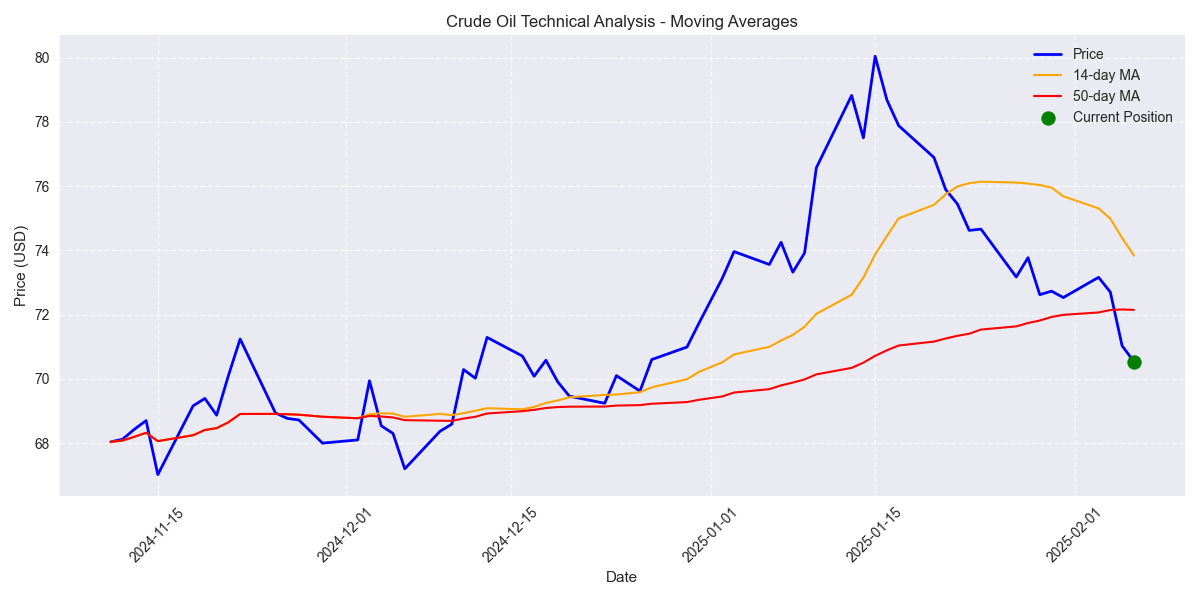

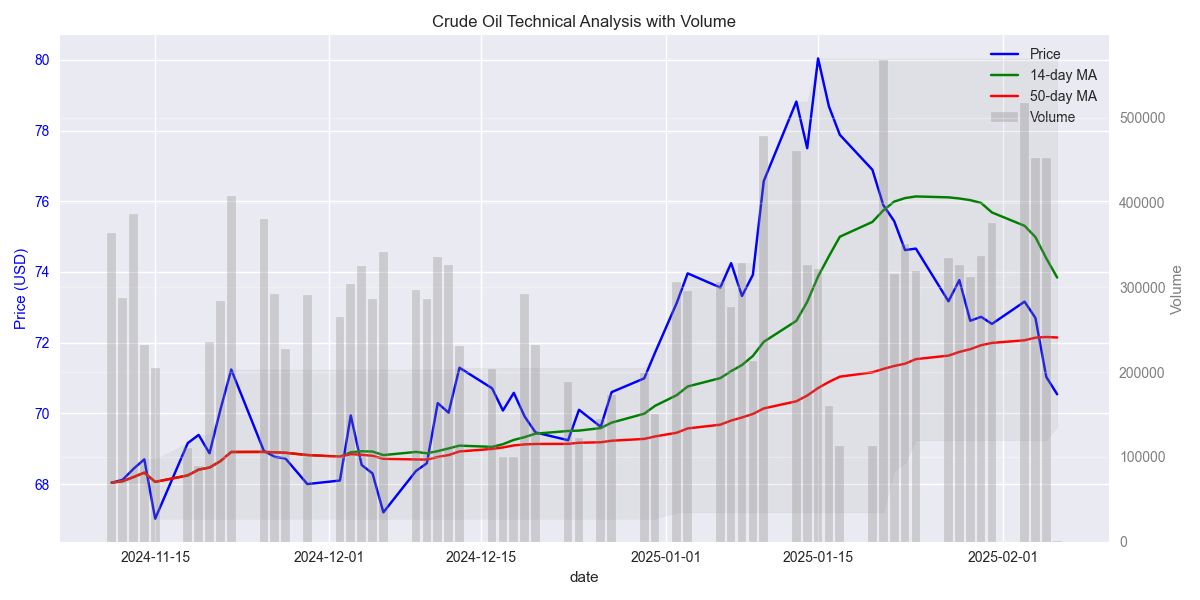

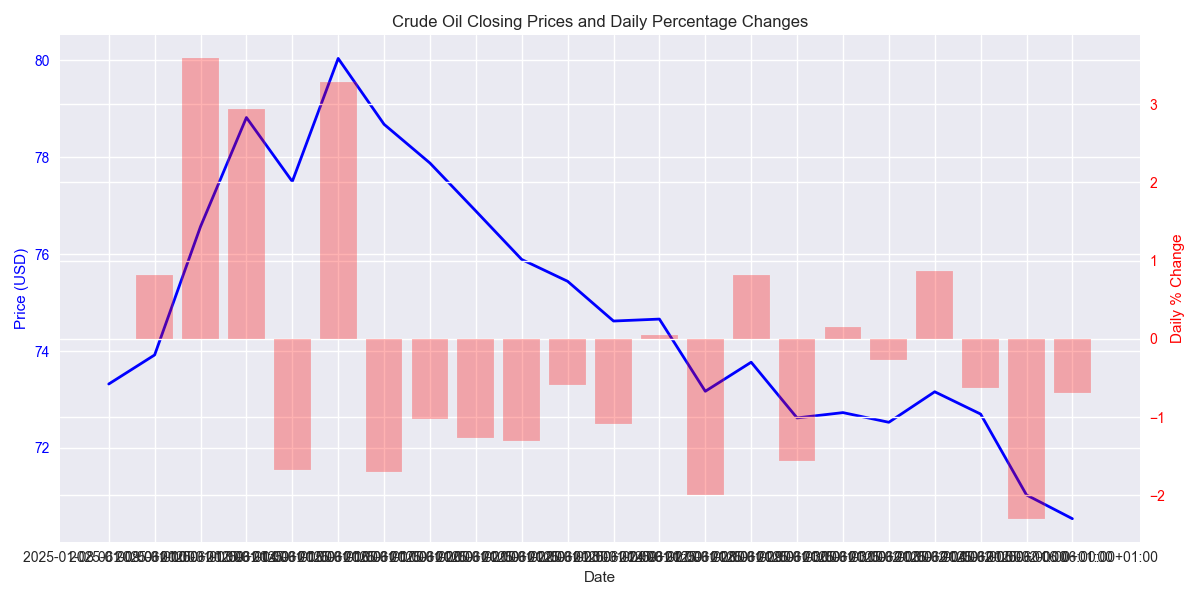

Crude Oil Price Analysis: Recent Bearish Trend with High Volatility

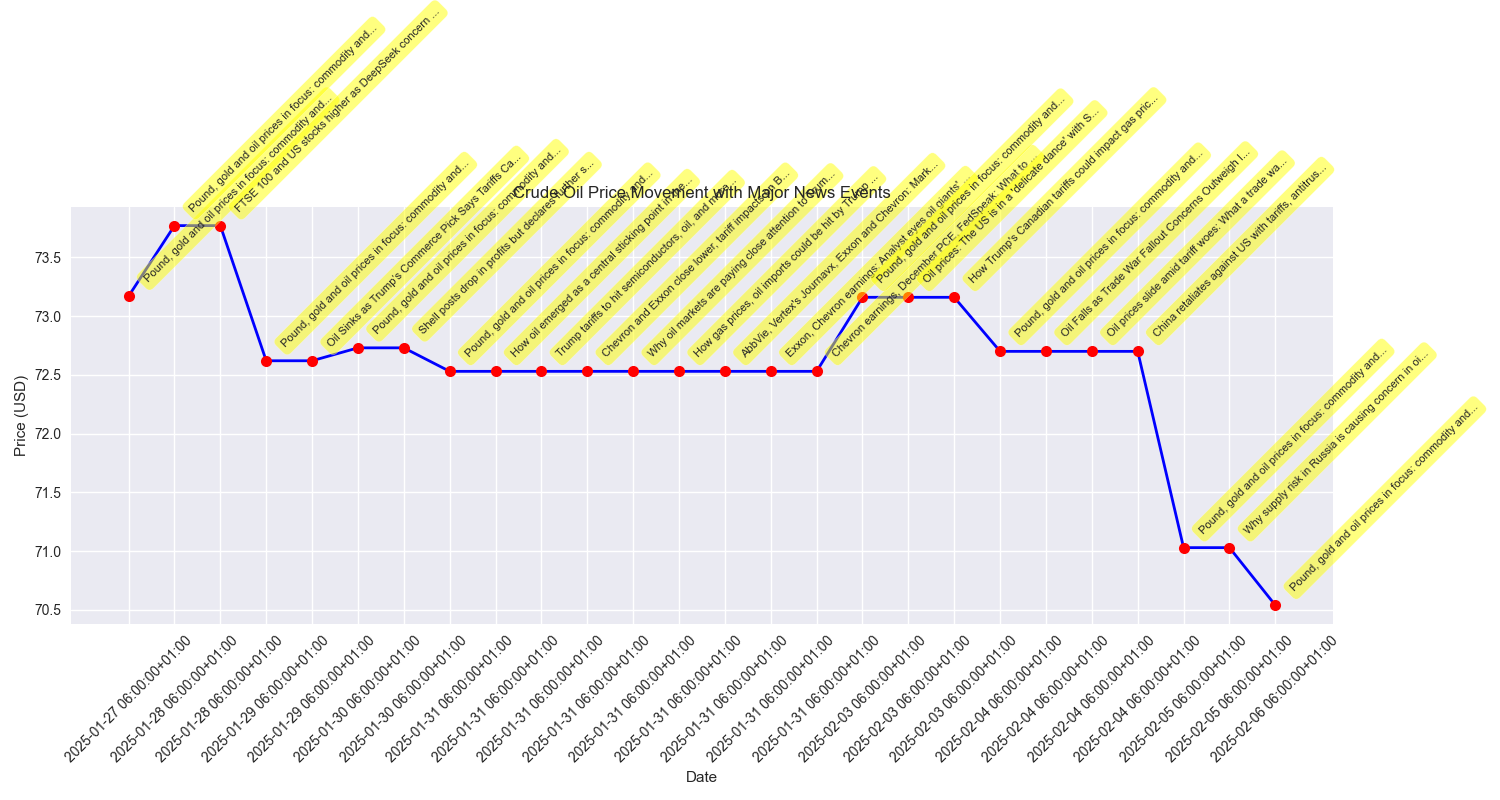

Recent Market News Impact on Crude Oil Prices

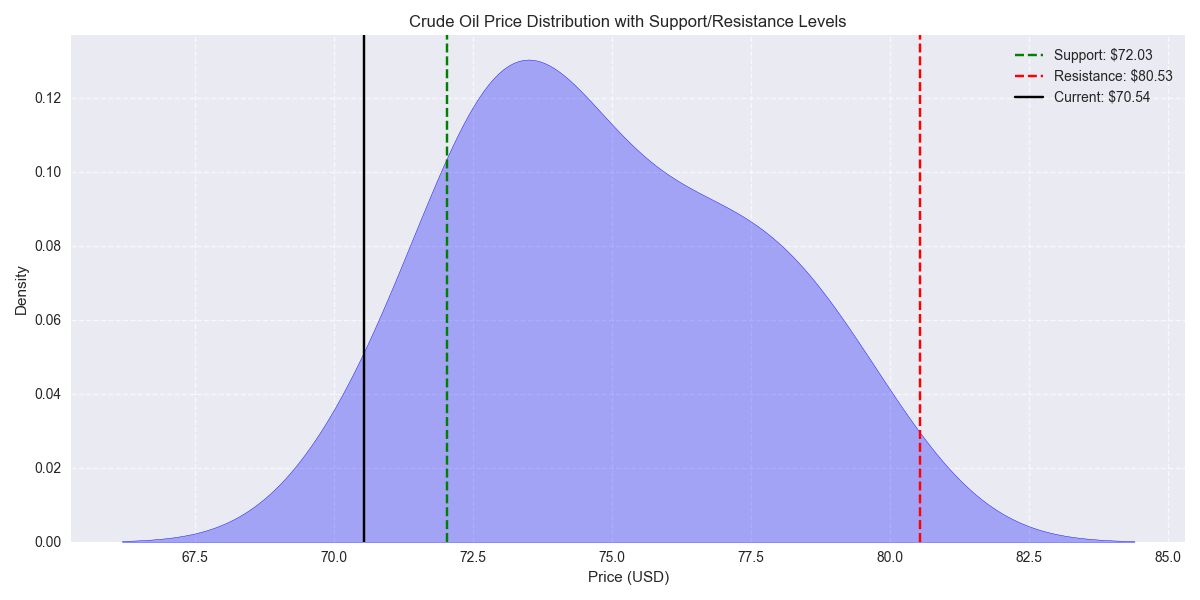

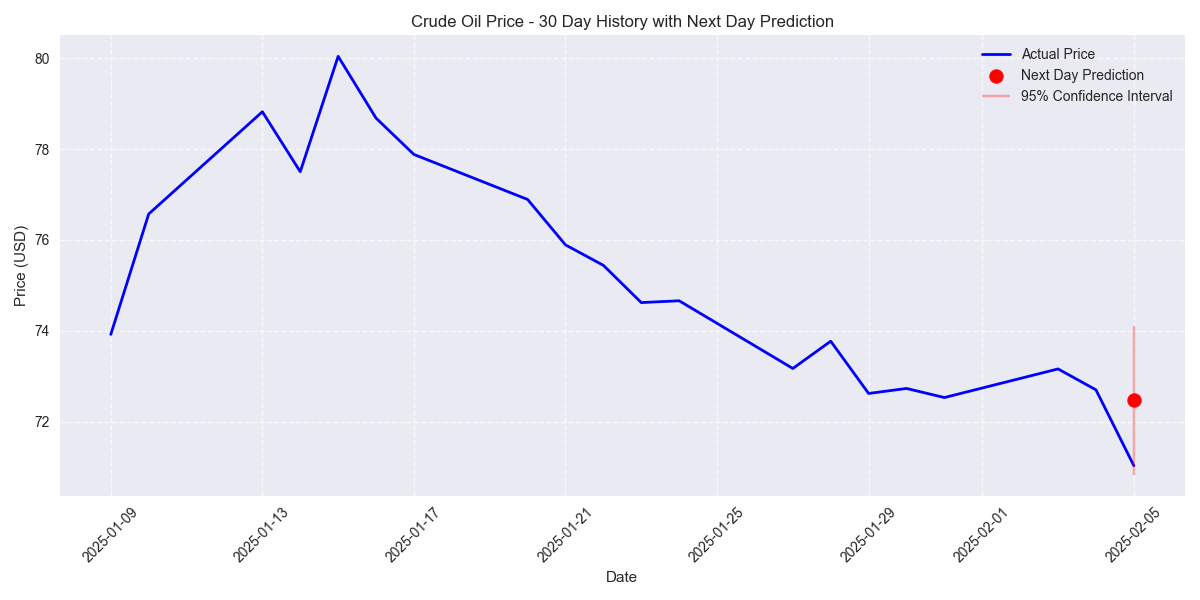

Crude Oil Price Prediction Analysis: Next-Day Forecast and Key Indicators

Crude Oil Price Forecasts: Short to Medium-Term Outlook

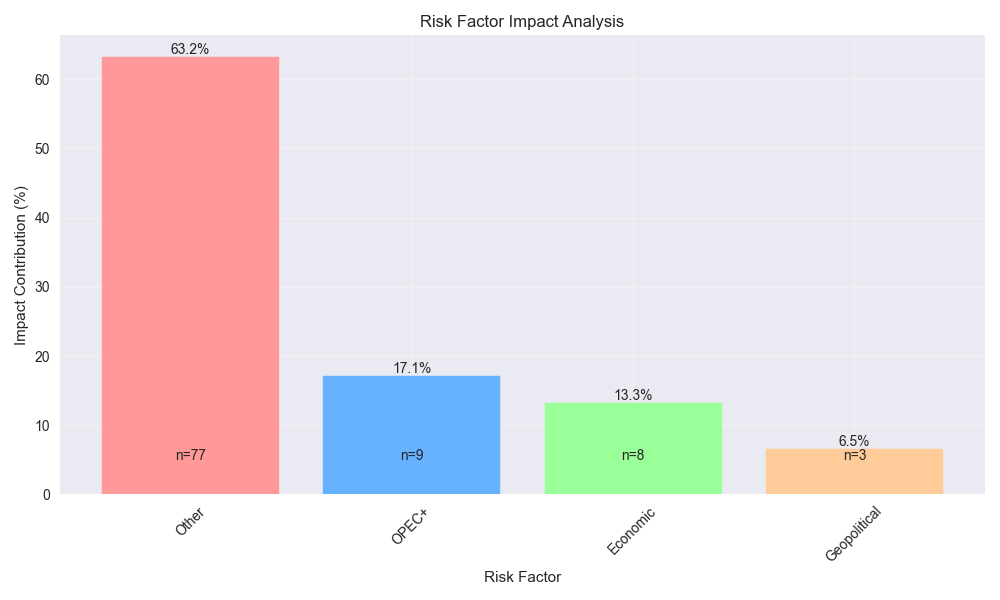

Key Risk Factors Impacting Crude Oil Price Predictions