Streamline Natural Gas Market Analysis for Rapid Trader Consumption

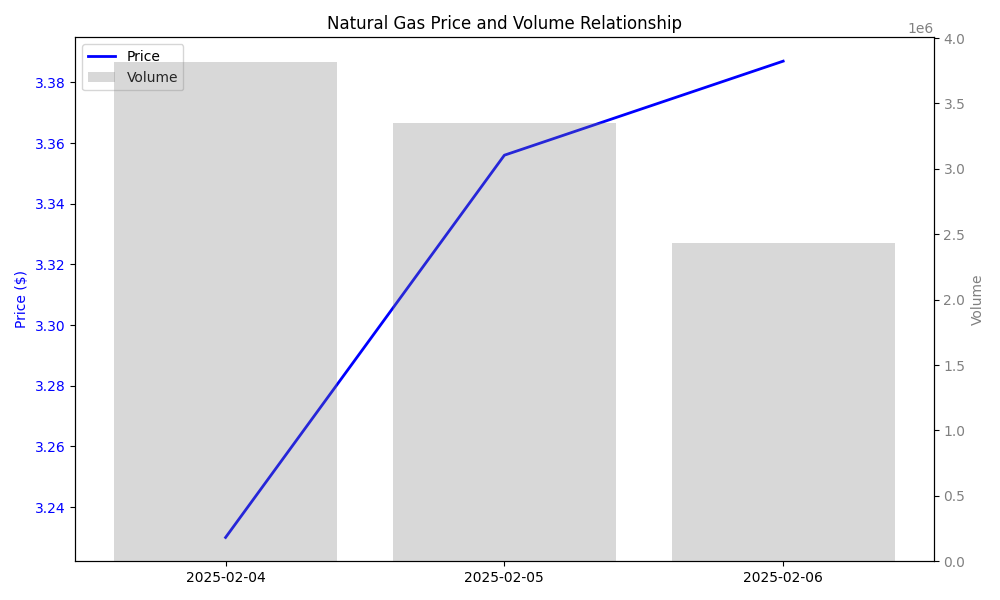

Natural Gas Shows Mixed Signals with Upward Price Momentum but Declining Volume

Chinese Tariffs Create Near-Term Market Risk

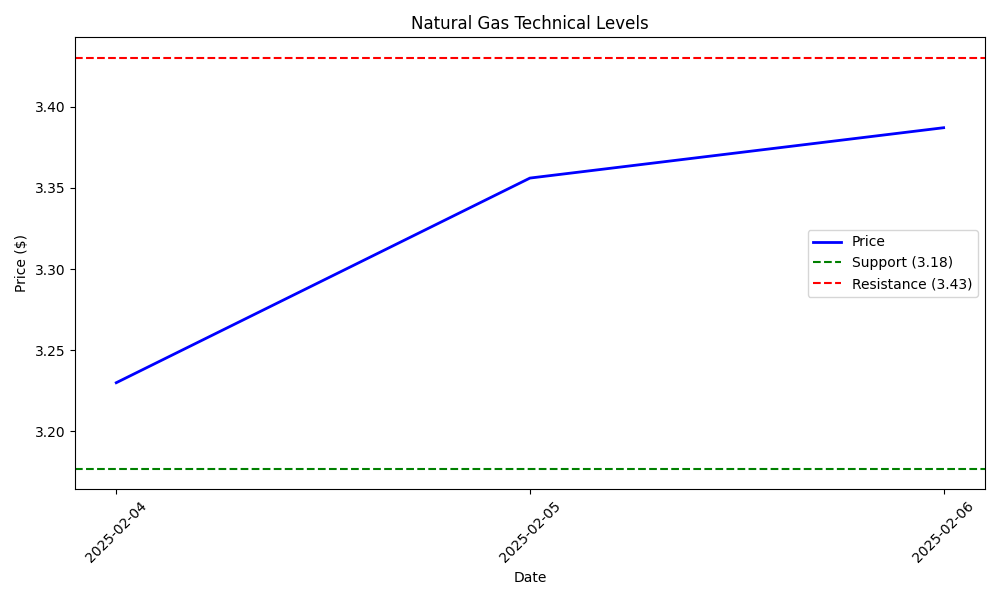

High-Probability Range-Bound Trading Expected

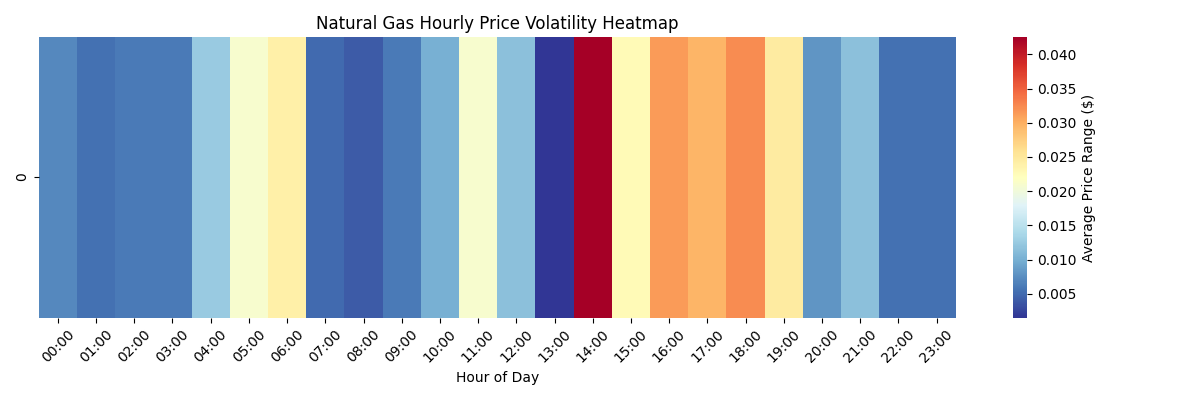

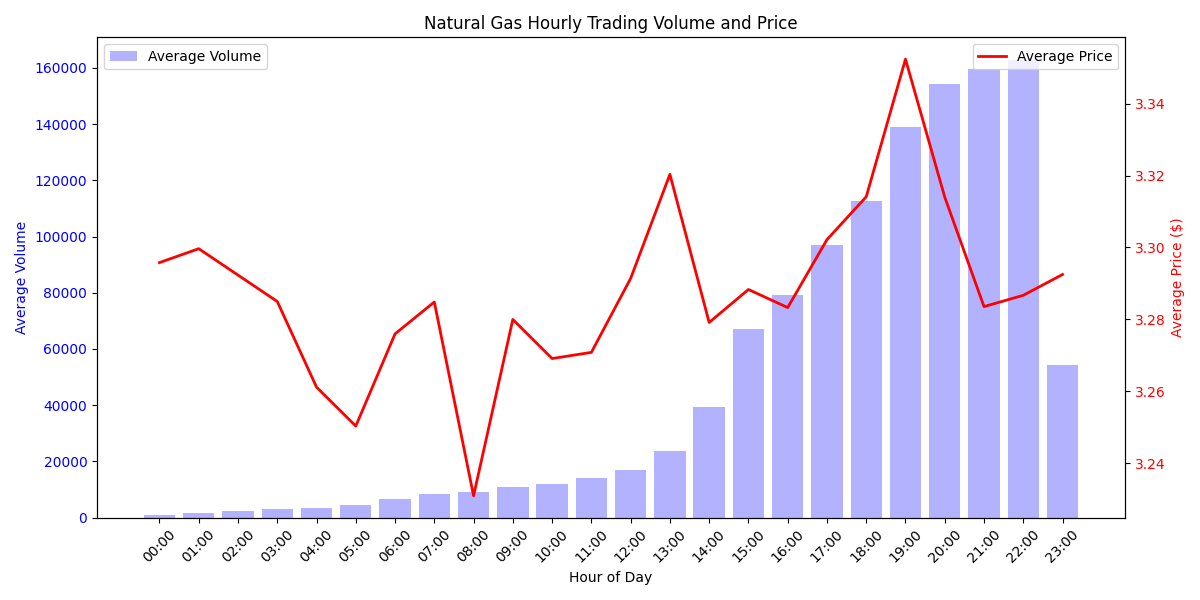

Optimal Trading Windows Identified for Day Traders

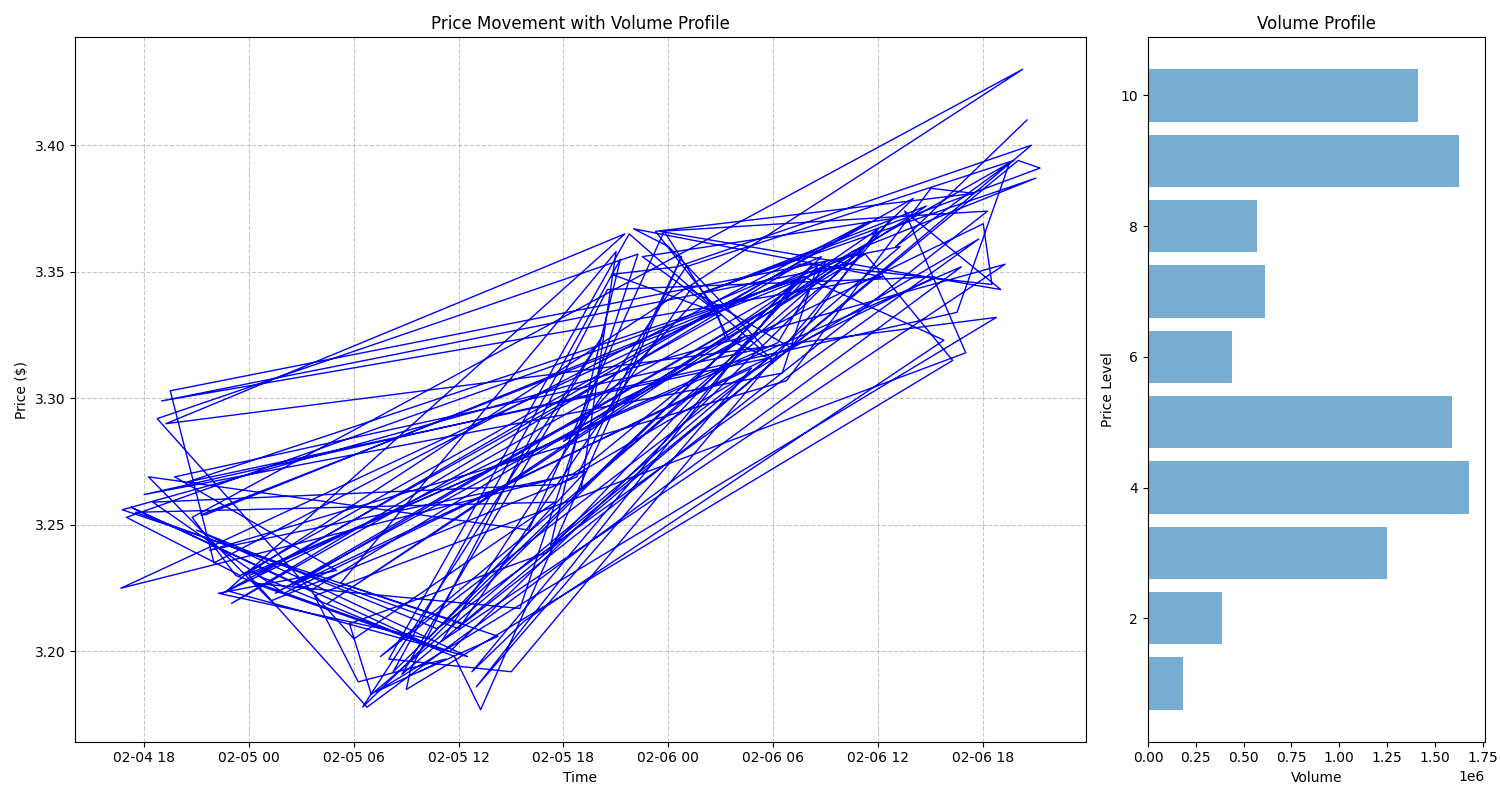

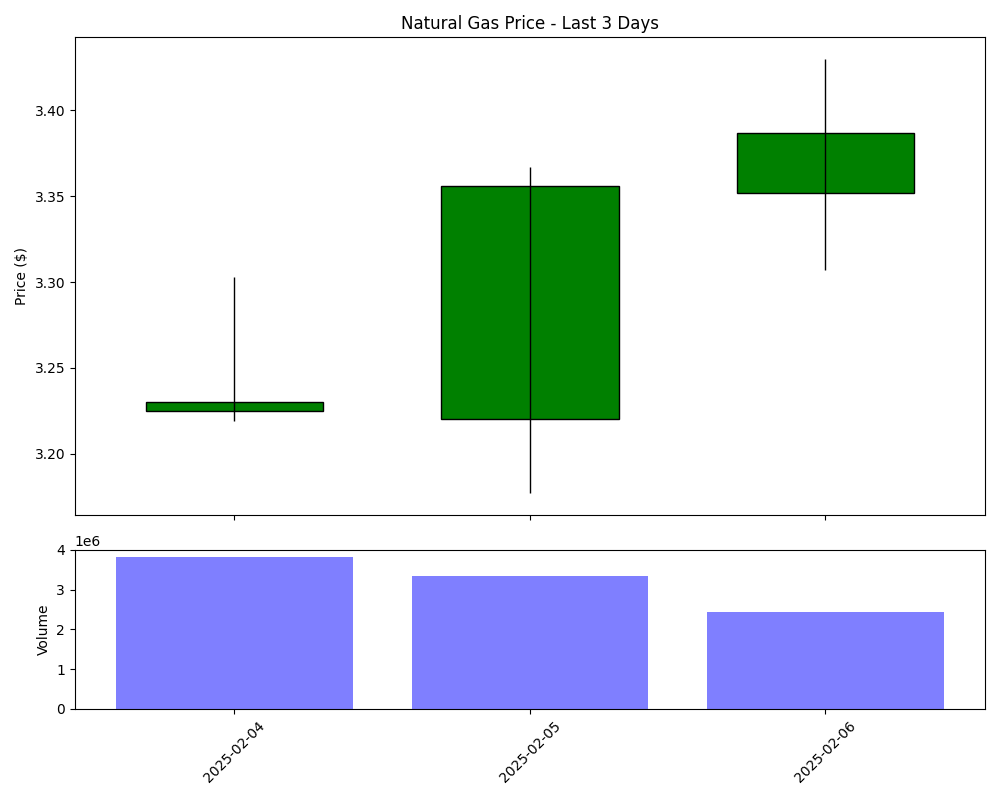

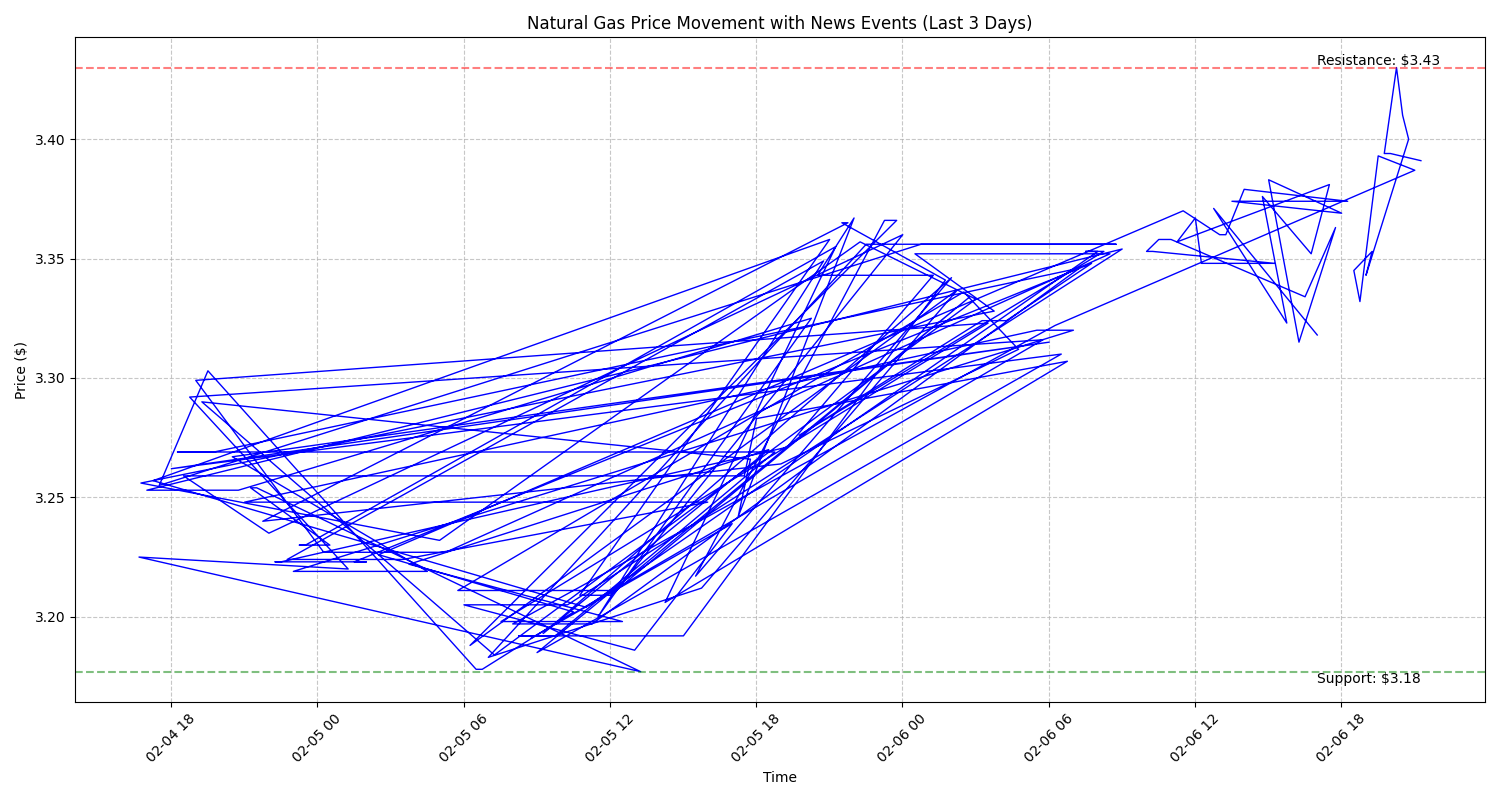

Natural Gas Price Analysis: Recent Price Action Shows Bullish Momentum

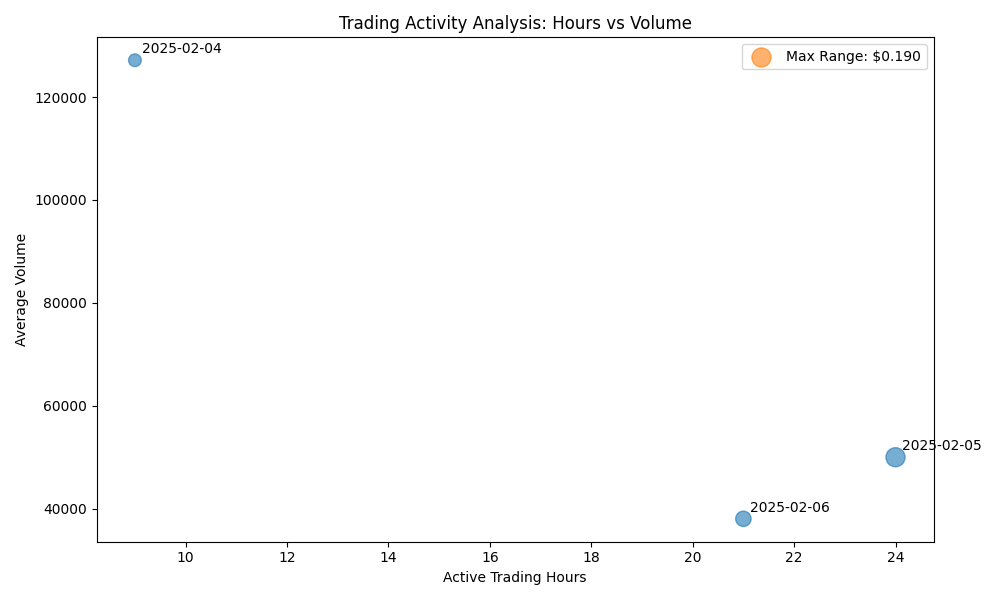

Intraday Trading Analysis: Optimal Trading Hours and Volume Patterns

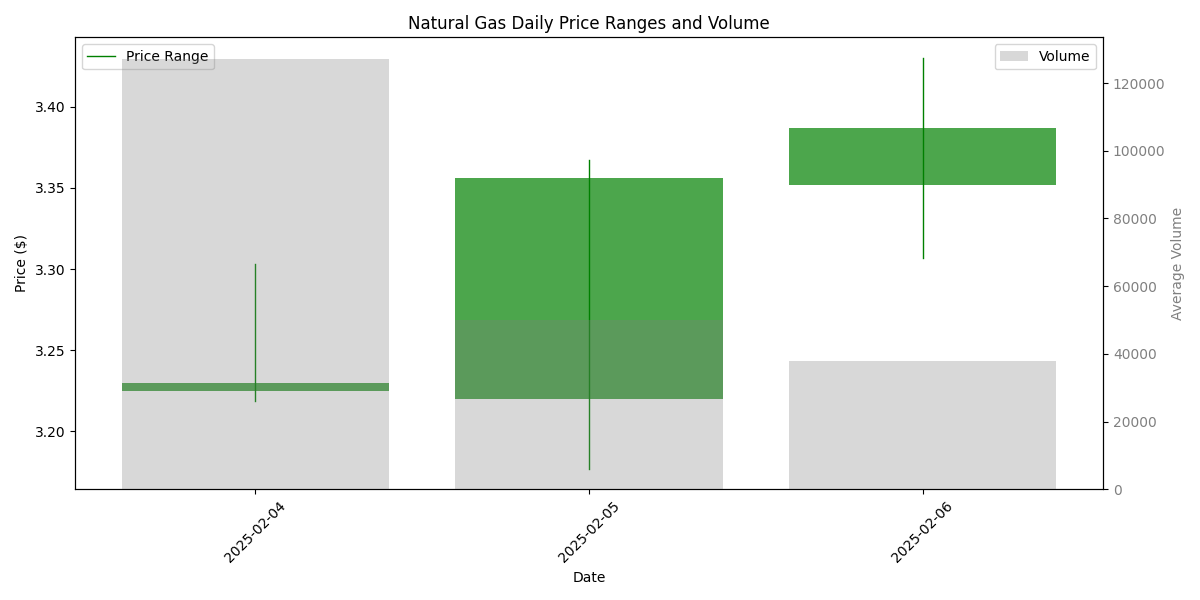

Weekly Trading Analysis: Increasing Price Volatility with Mixed Volume Patterns

Market News Impact: Trade Tensions Affecting Natural Gas Prices

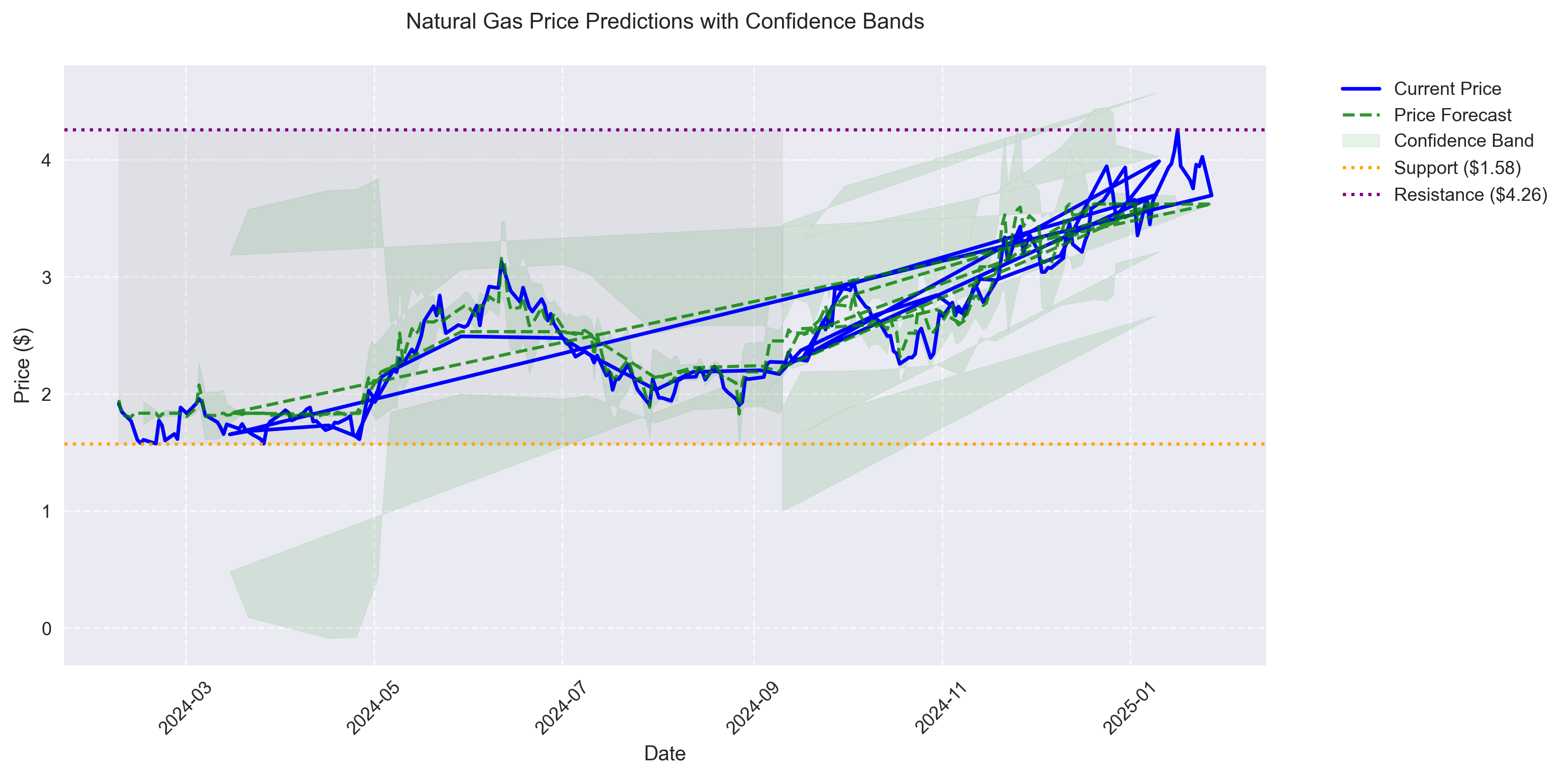

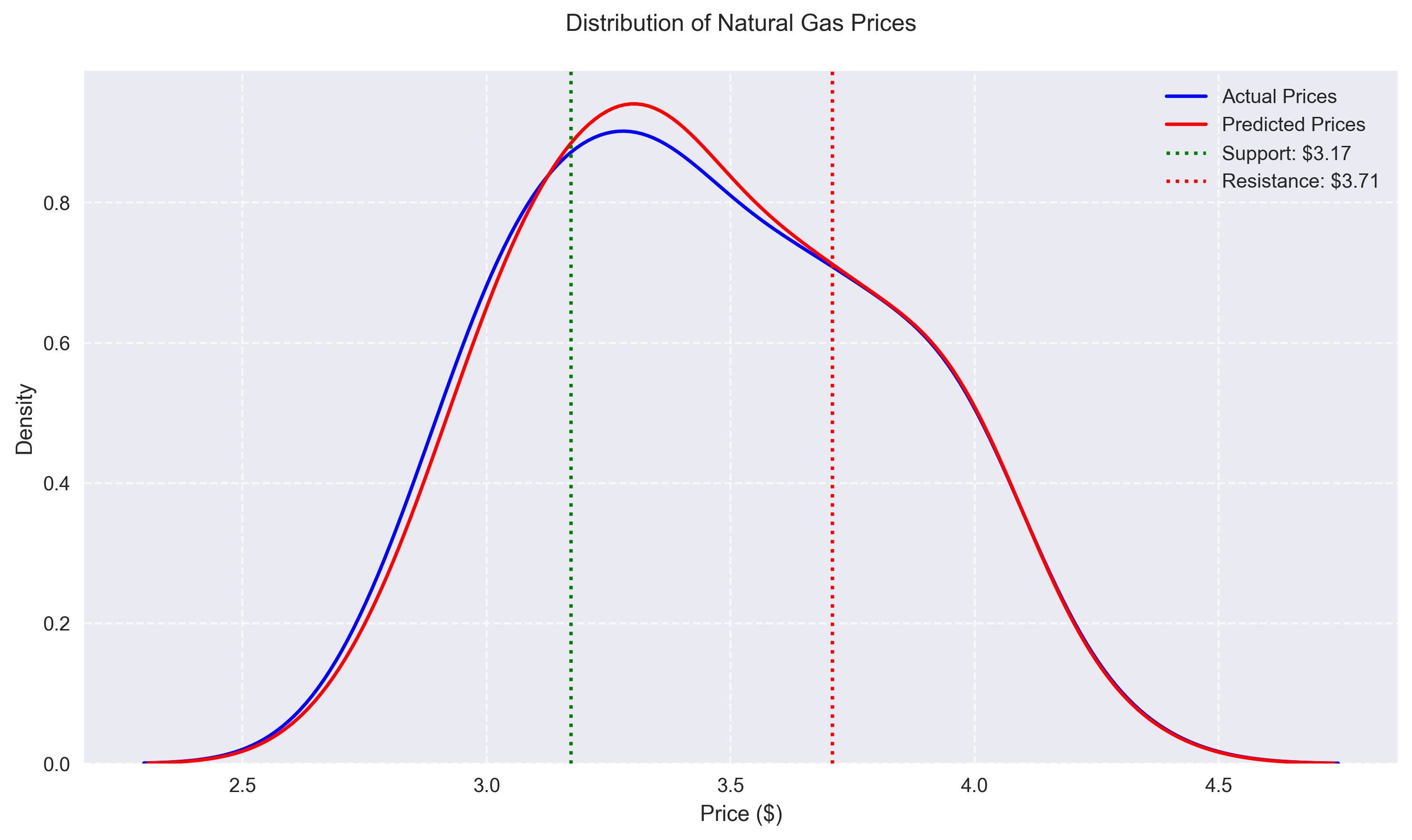

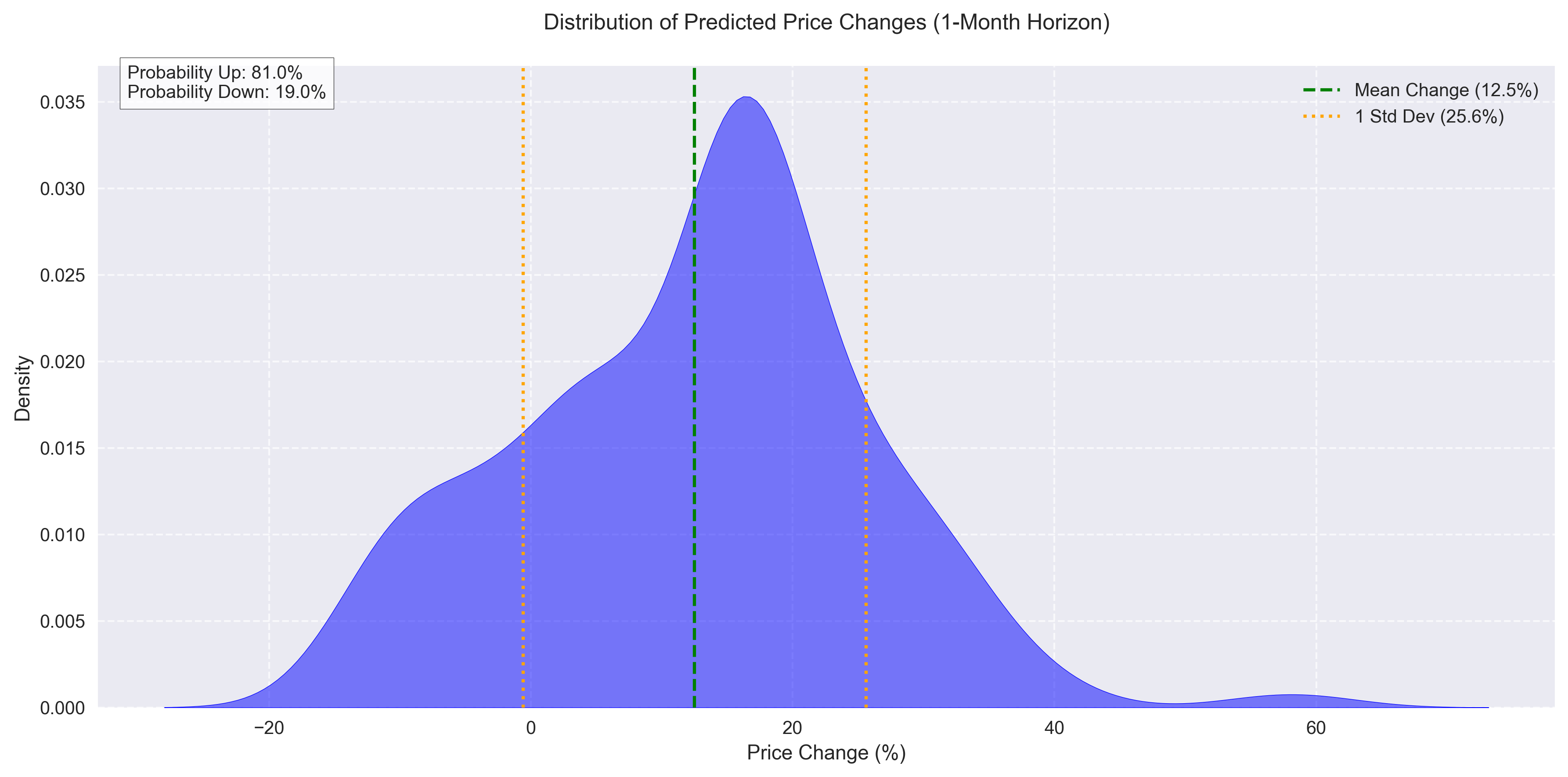

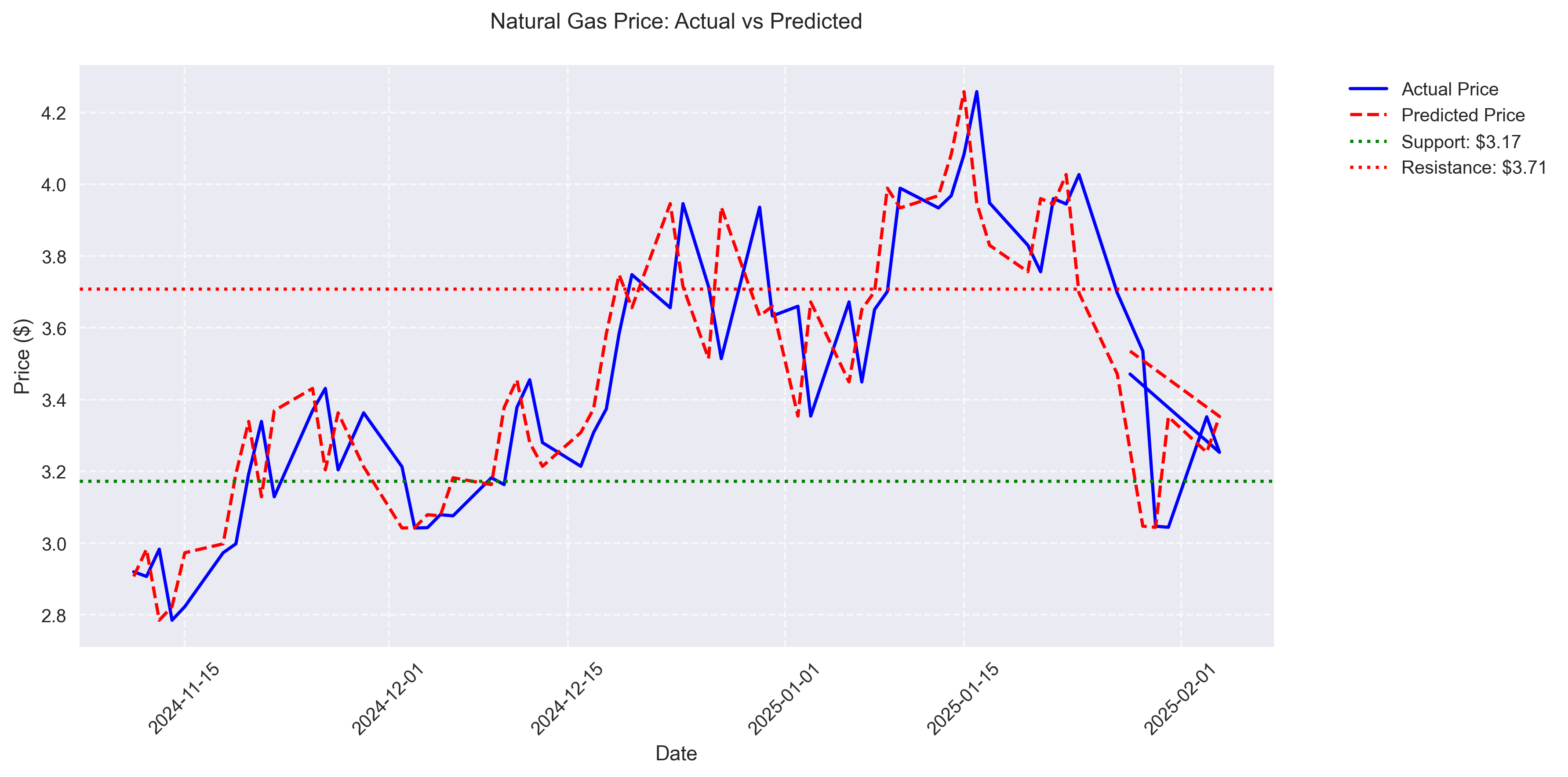

Natural Gas Price Prediction Analysis: Short-term Price Movements and Key Levels

Extended Natural Gas Price Forecasts: Weekly and Monthly Outlook