Crude Oil Market Insights: Trader's Quick Guide

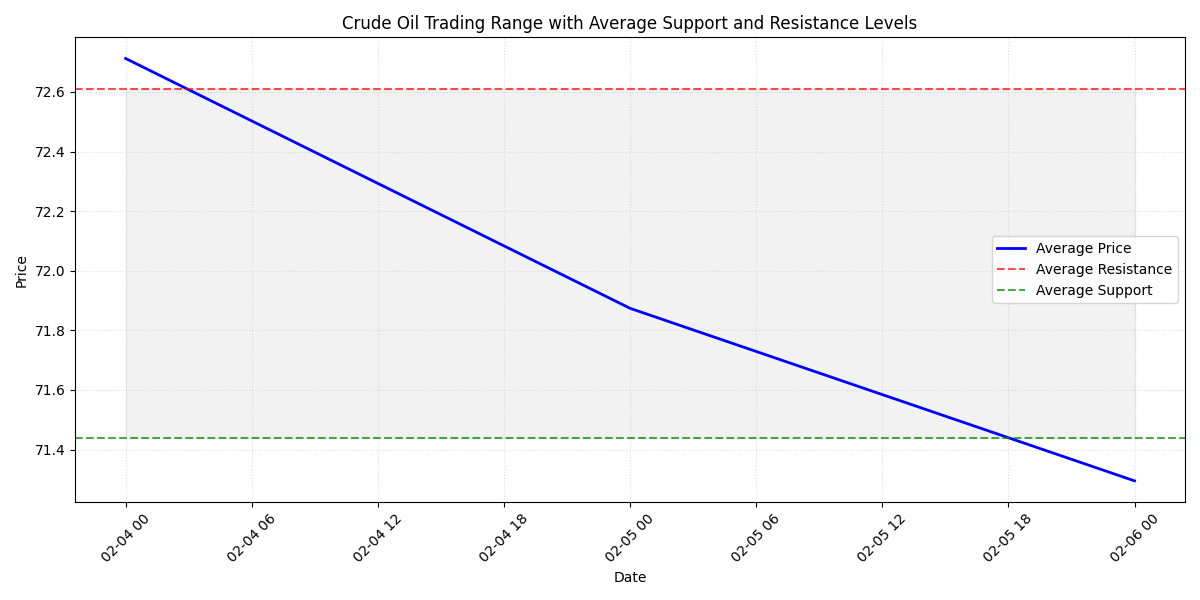

Crude Oil in Bearish Territory with Clear Trading Boundaries

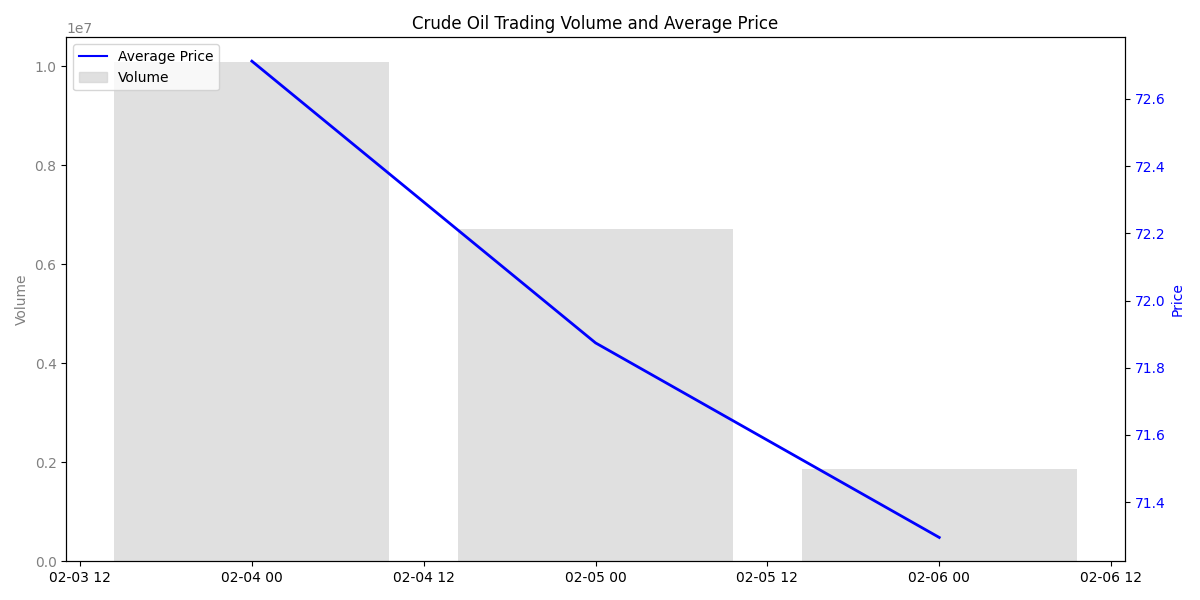

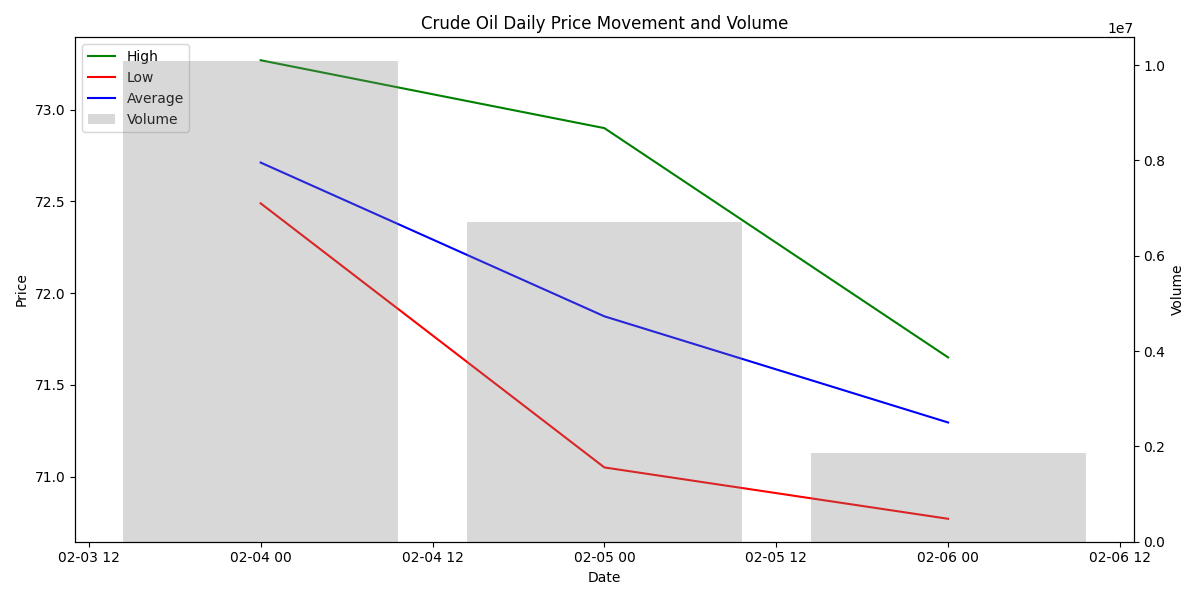

Volume Patterns Signal Major Price Move Ahead

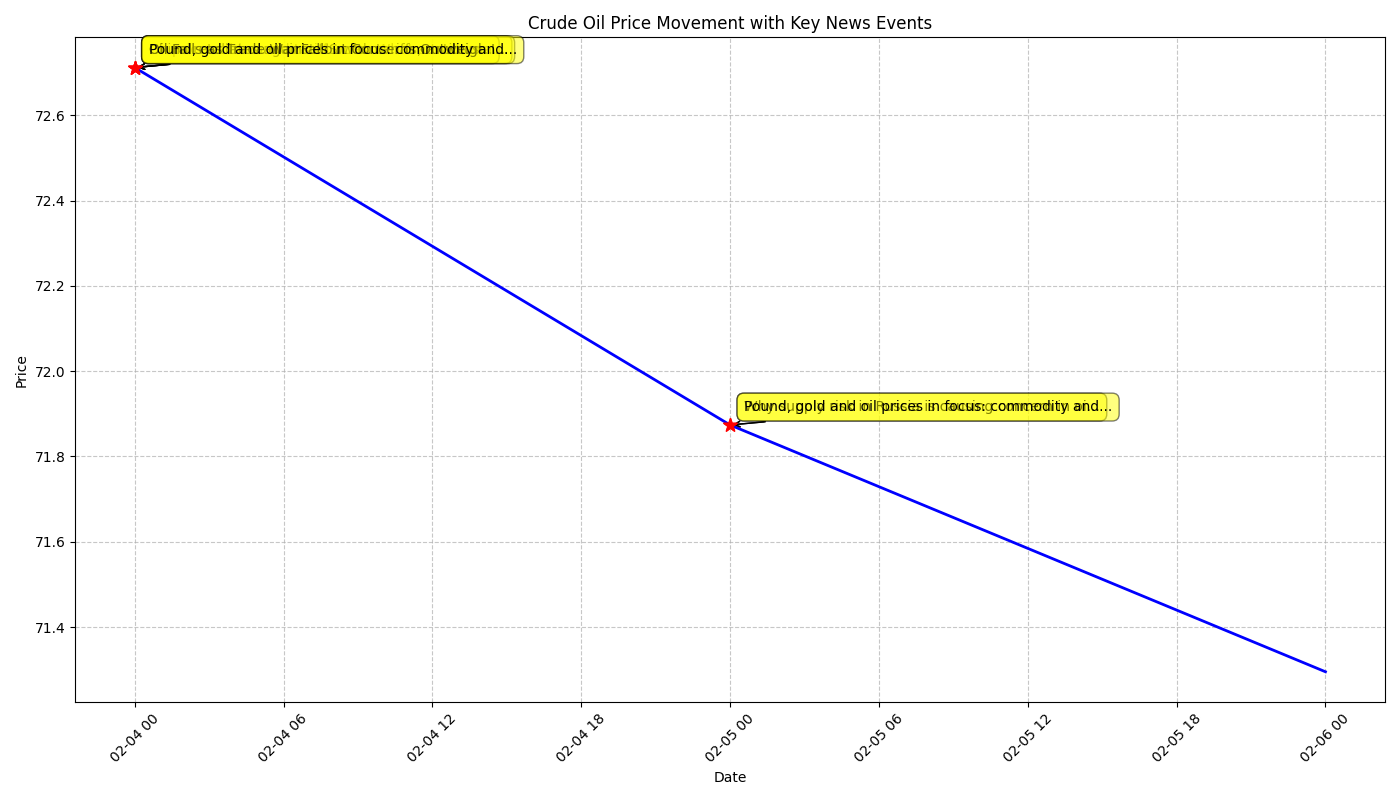

Short-Term Models Predict Further Downside

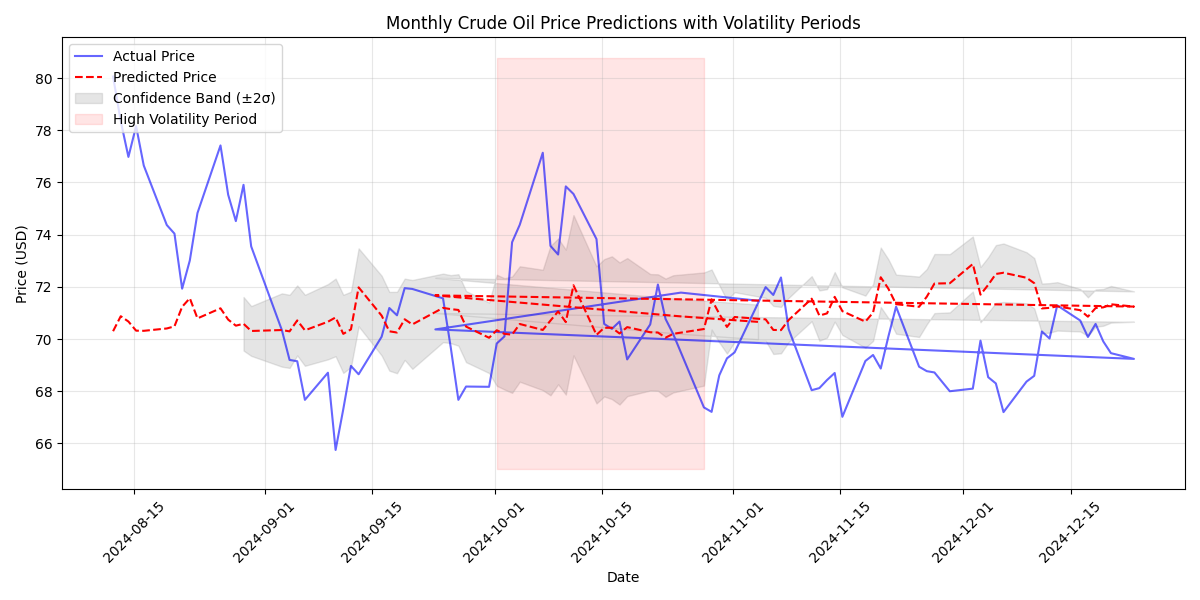

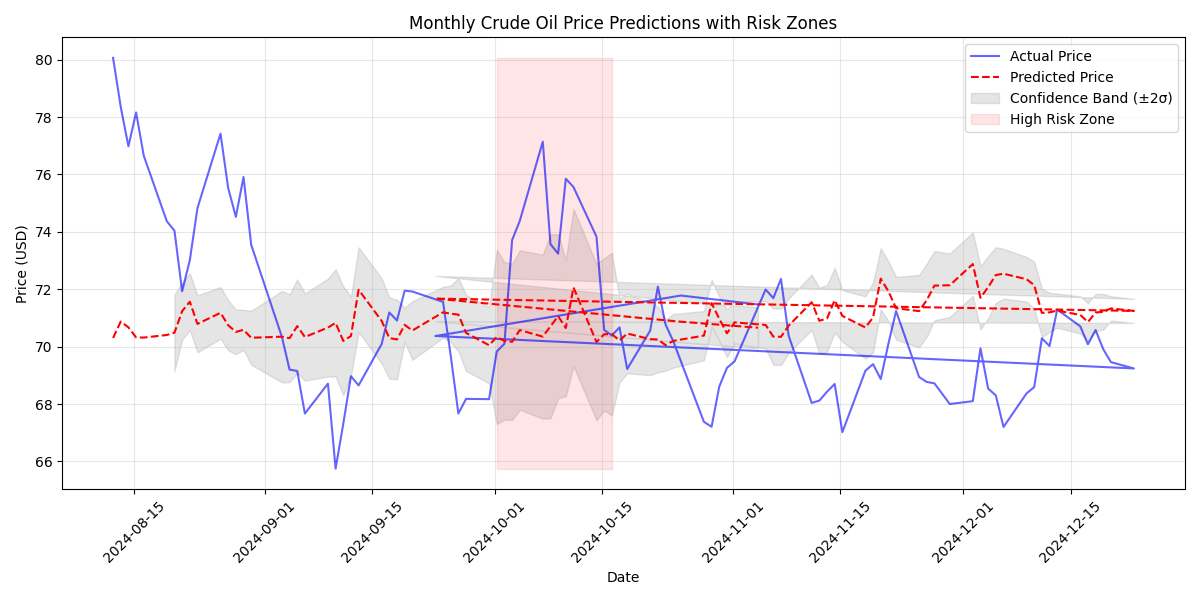

Monthly Price Target: $72-75 Range with Volatility Warning

Crude Oil Price Analysis: Recent Trends and Market Dynamics

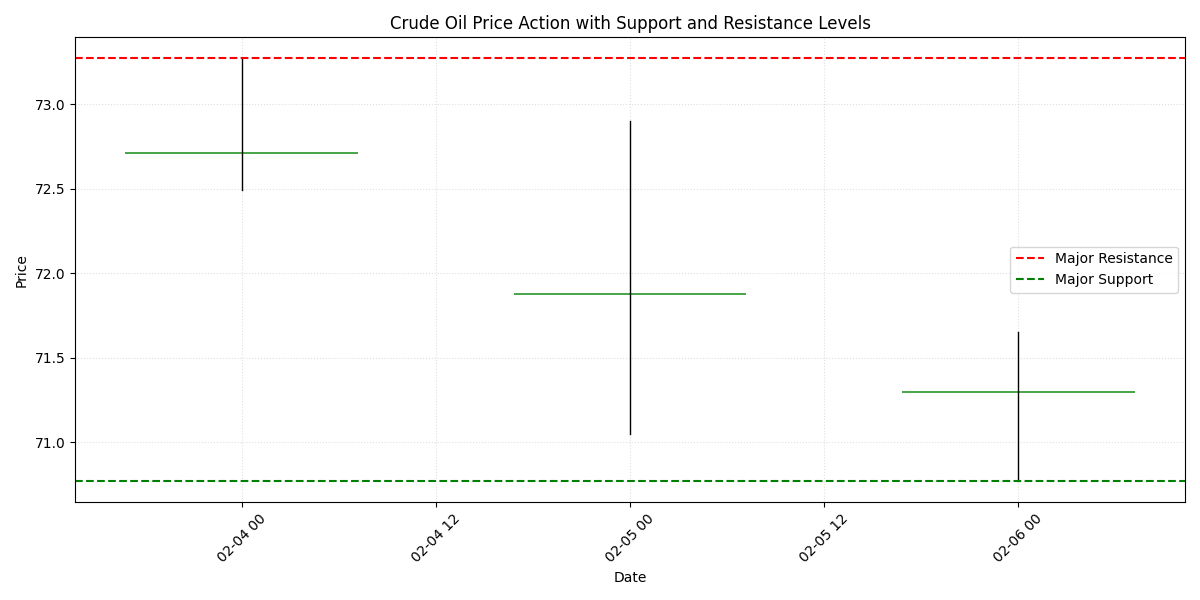

Crude Oil Technical Analysis: Support and Resistance Levels

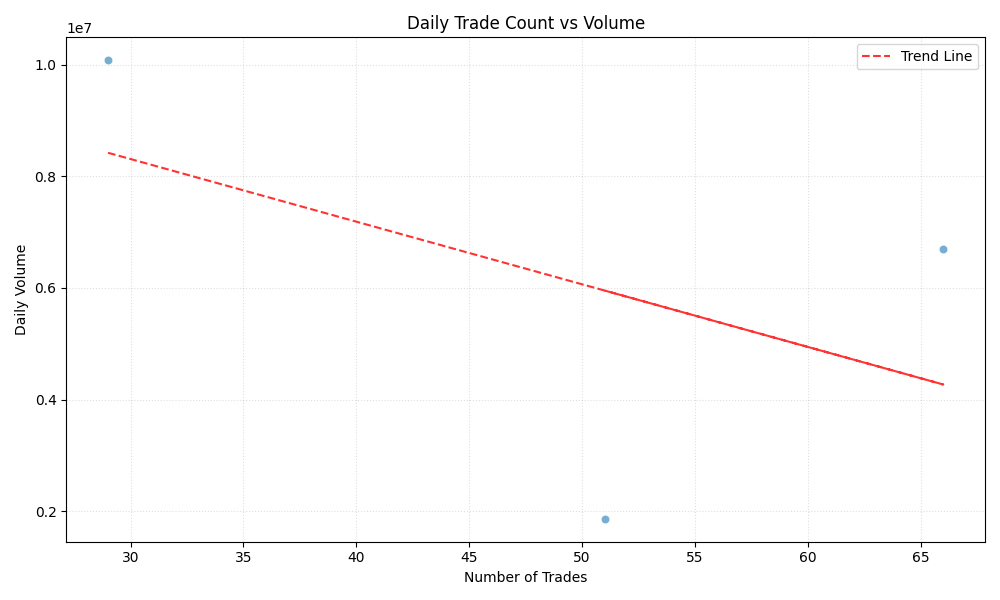

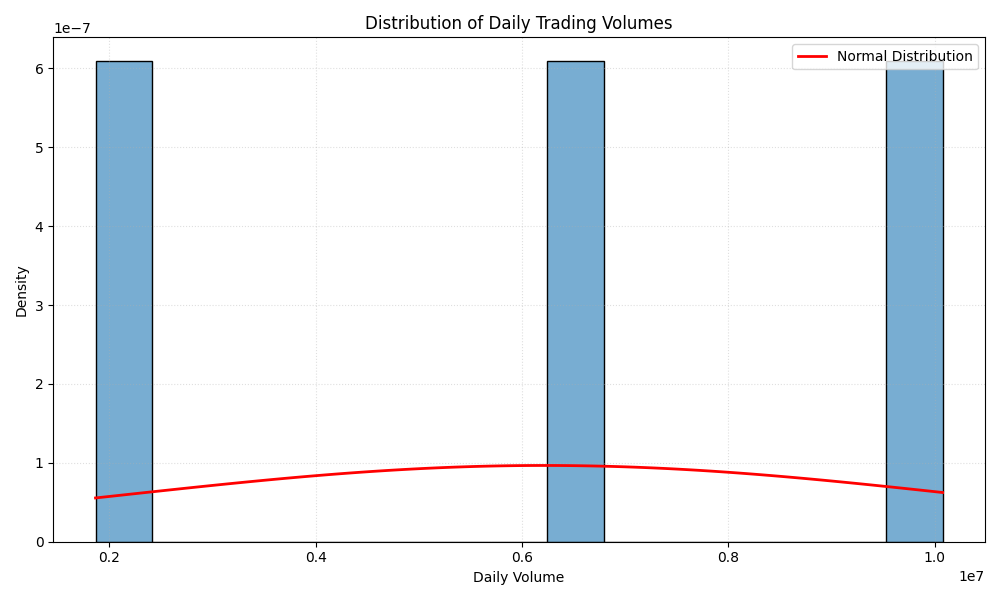

Volume Analysis and Market Participation Patterns

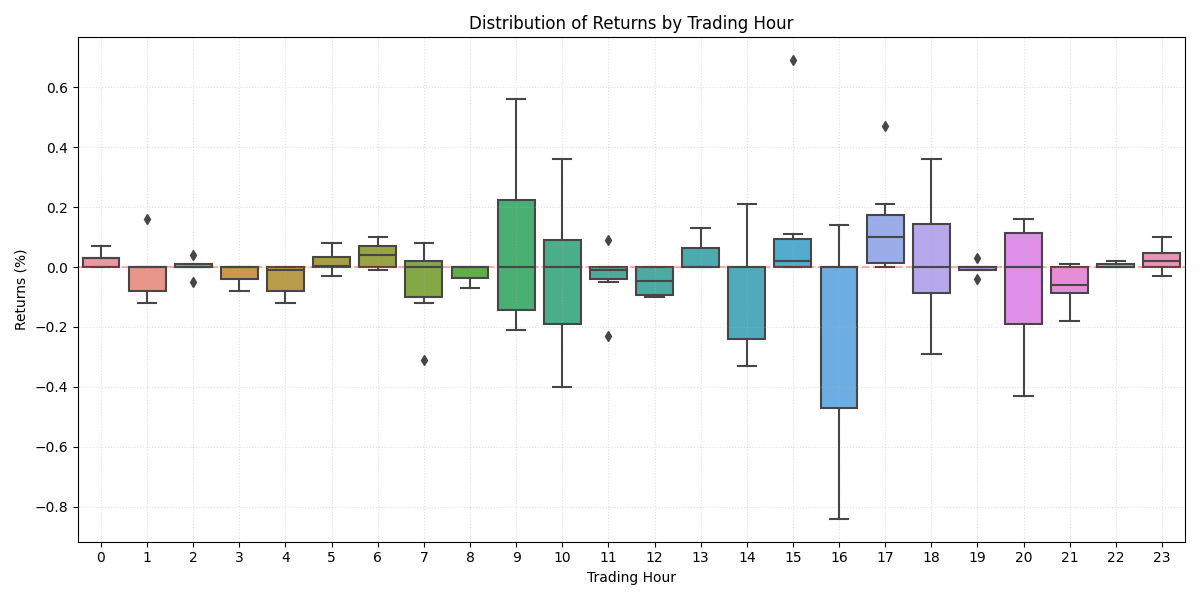

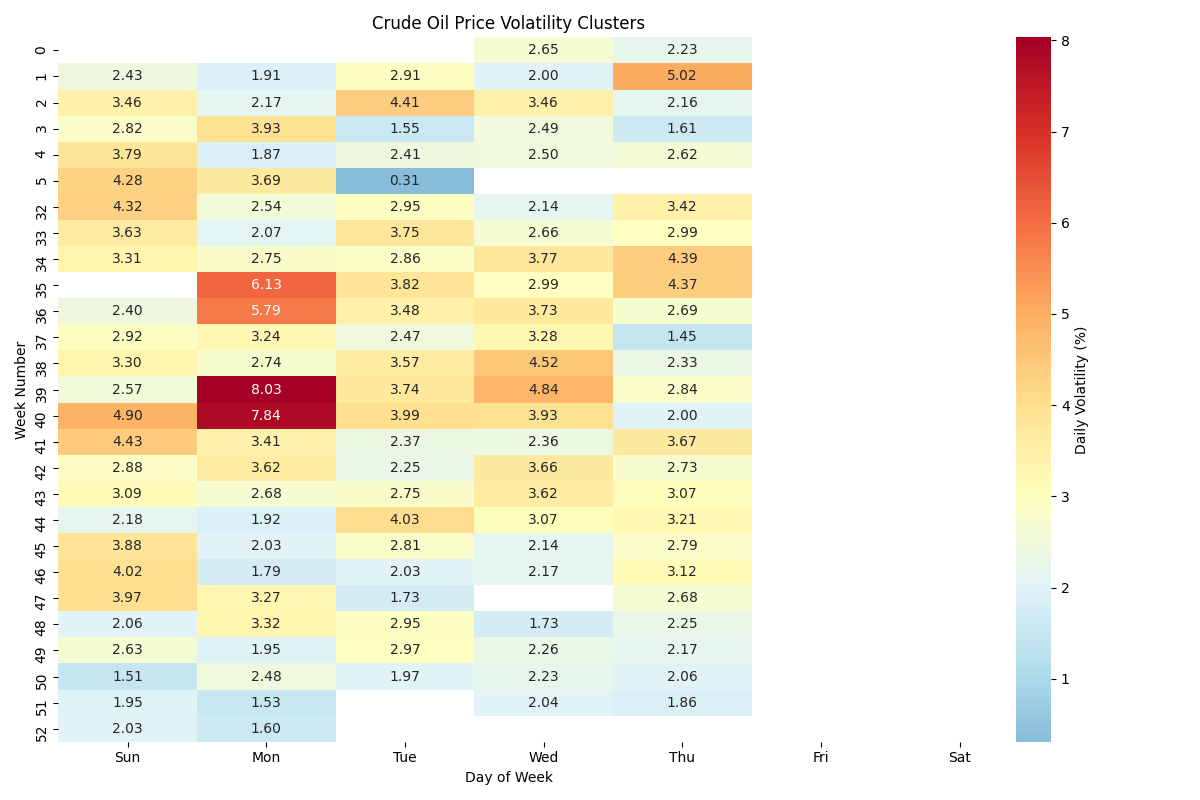

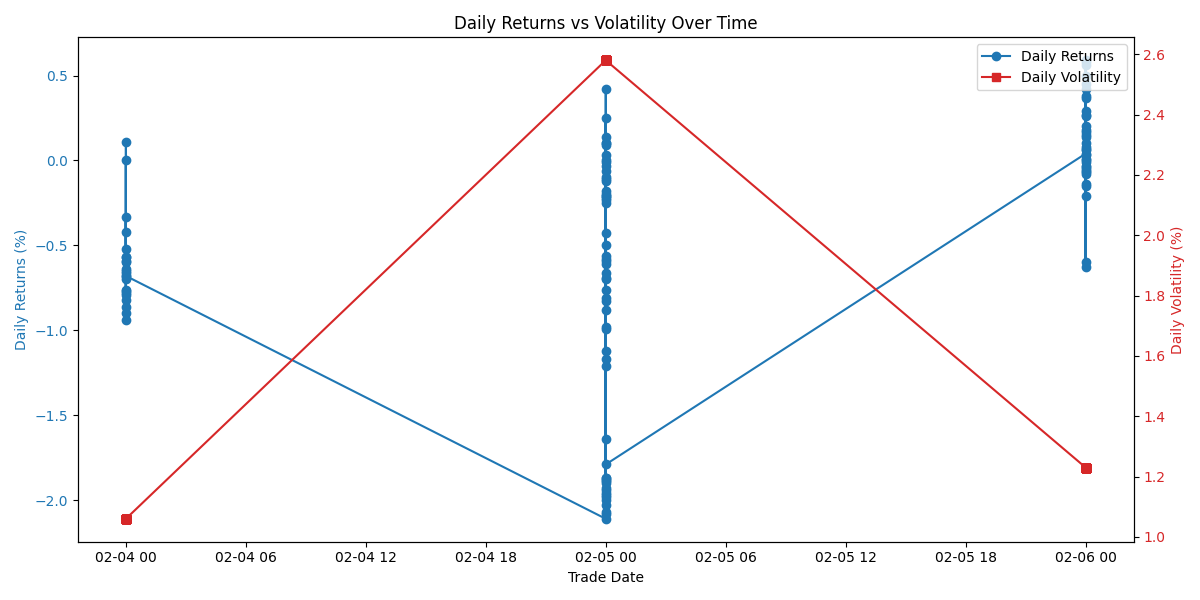

Price Return Analysis and Volatility Patterns

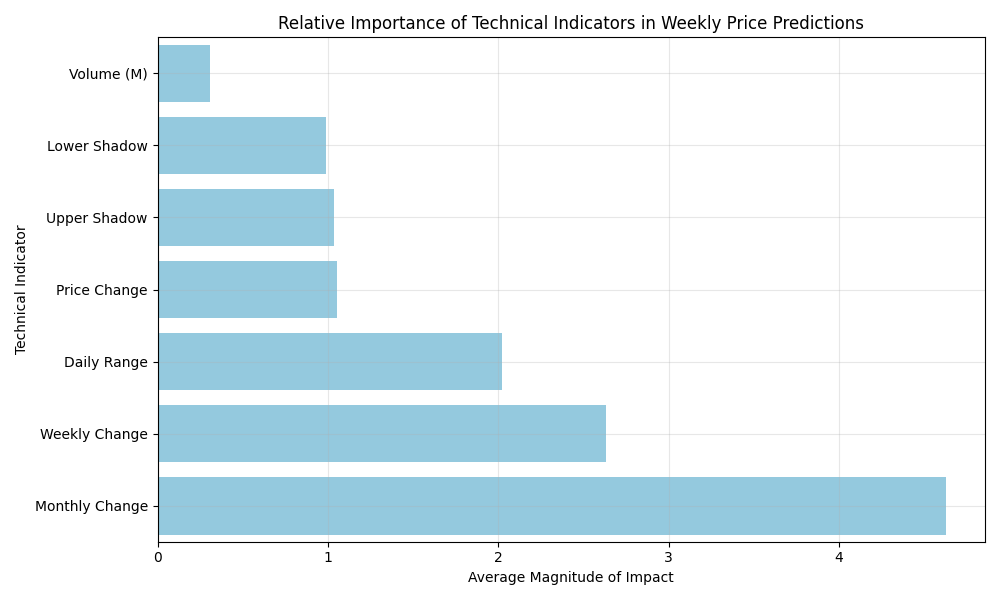

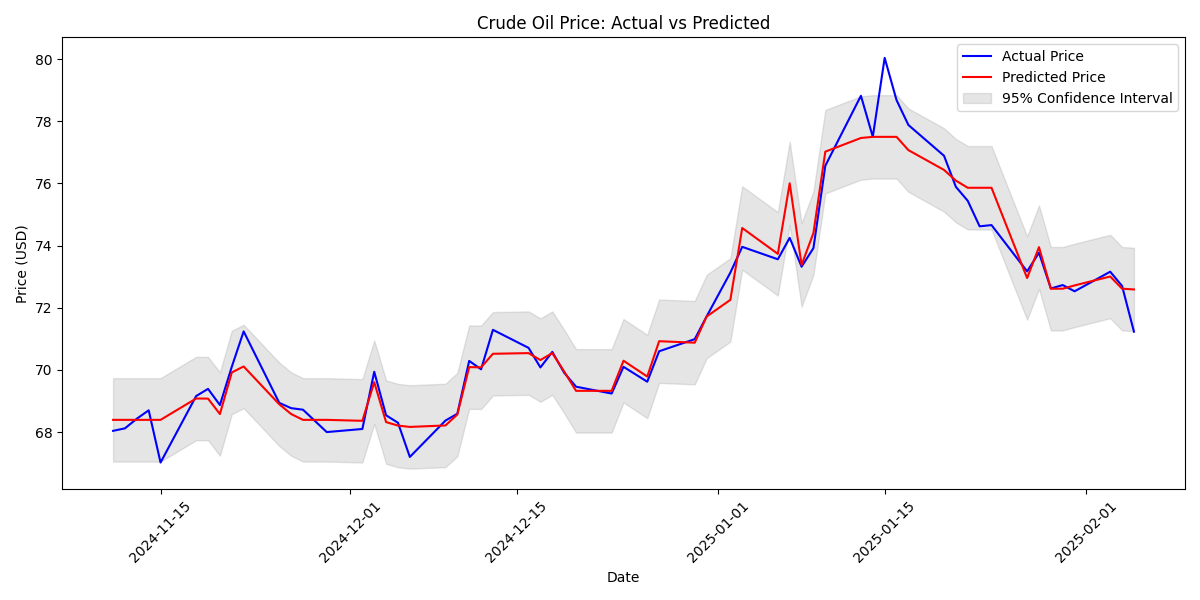

Initial Crude Oil Price Prediction Analysis Shows Strong Short-Term Predictability

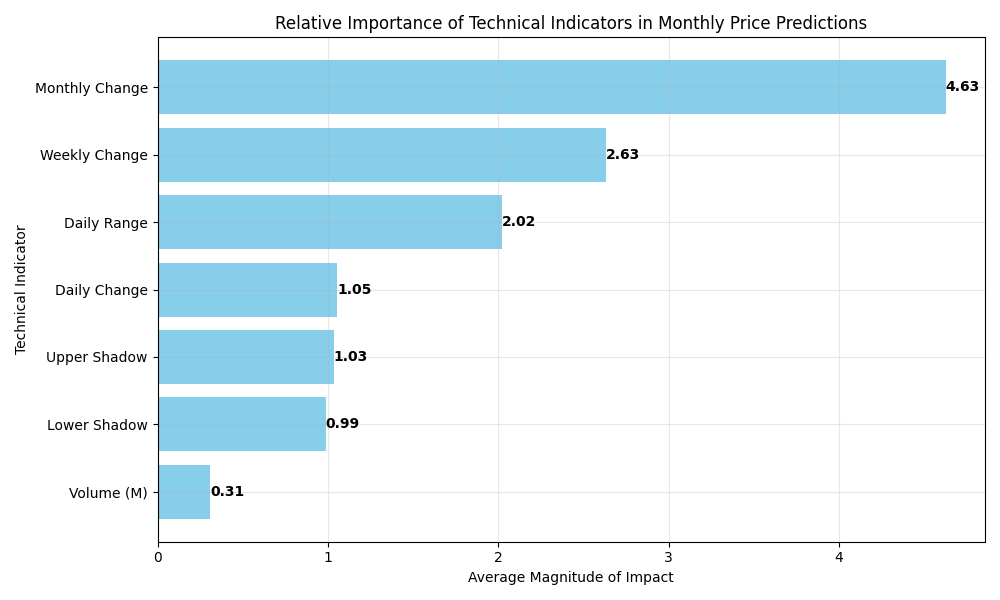

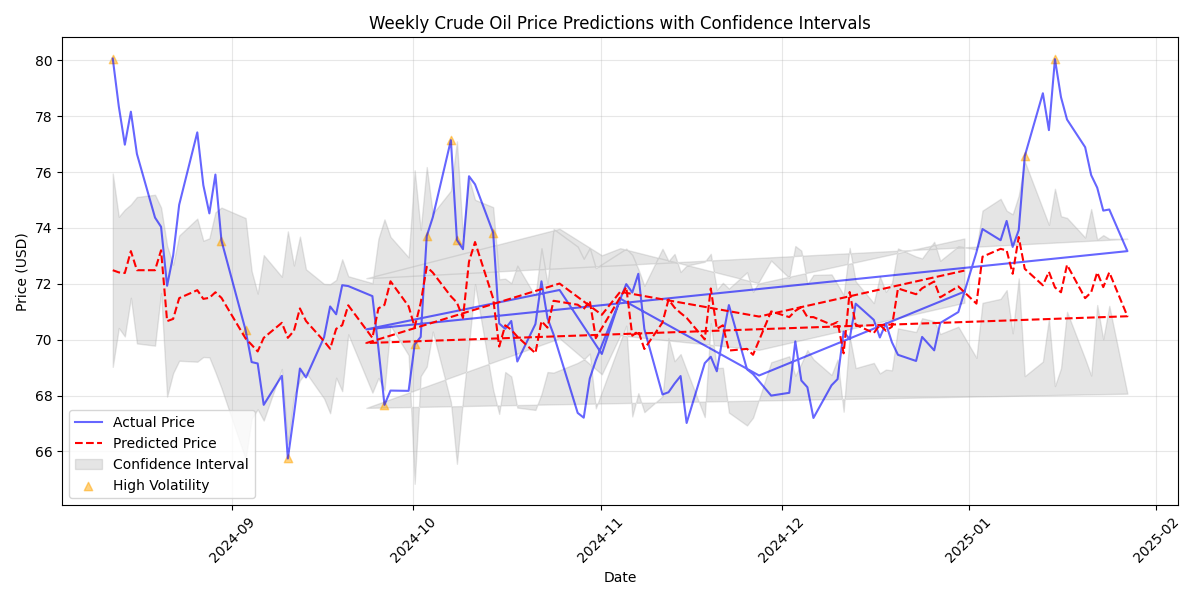

Weekly Crude Oil Price Predictions Show Moderate Volatility with Strong Technical Indicators

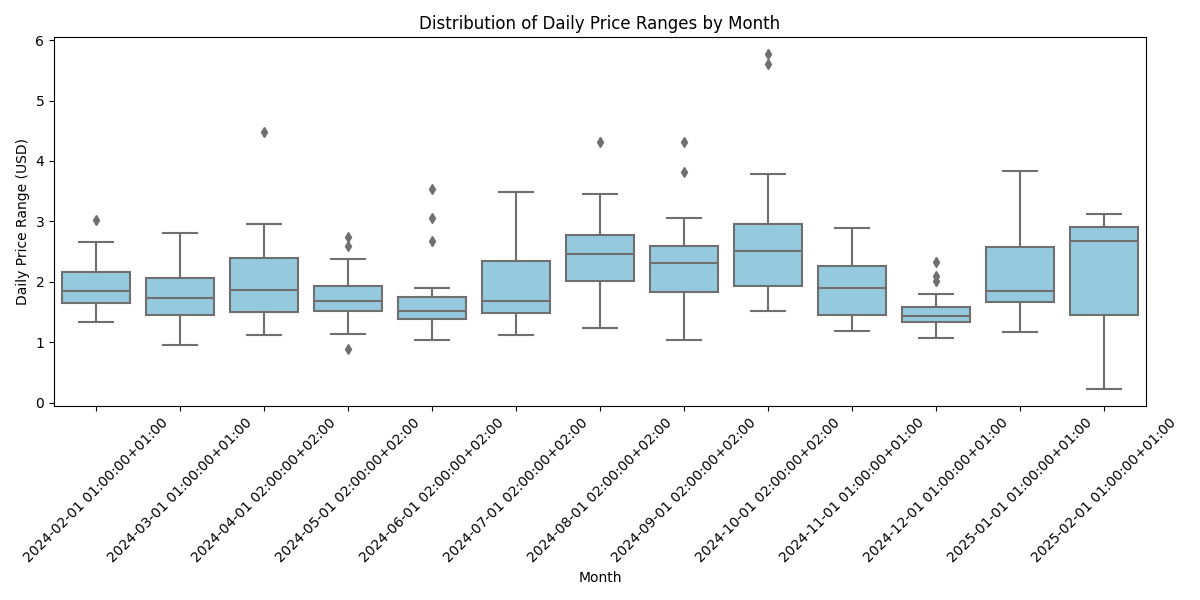

Monthly Crude Oil Price Analysis Reveals Long-term Market Stability with Key Risk Factors