BIGWIG Archive

See all past analysis

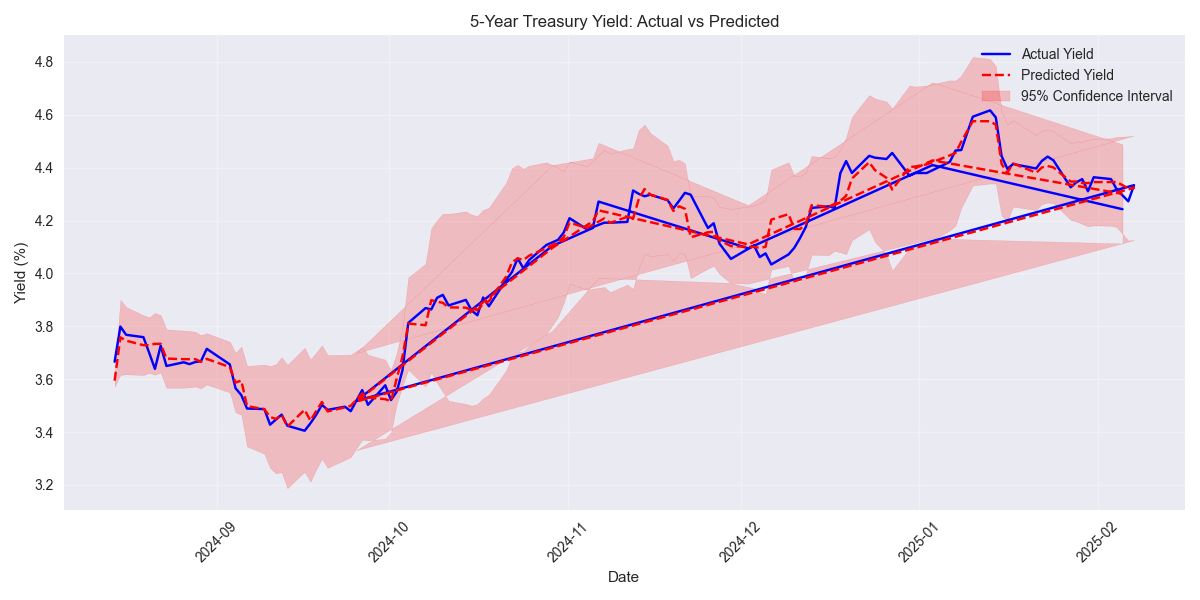

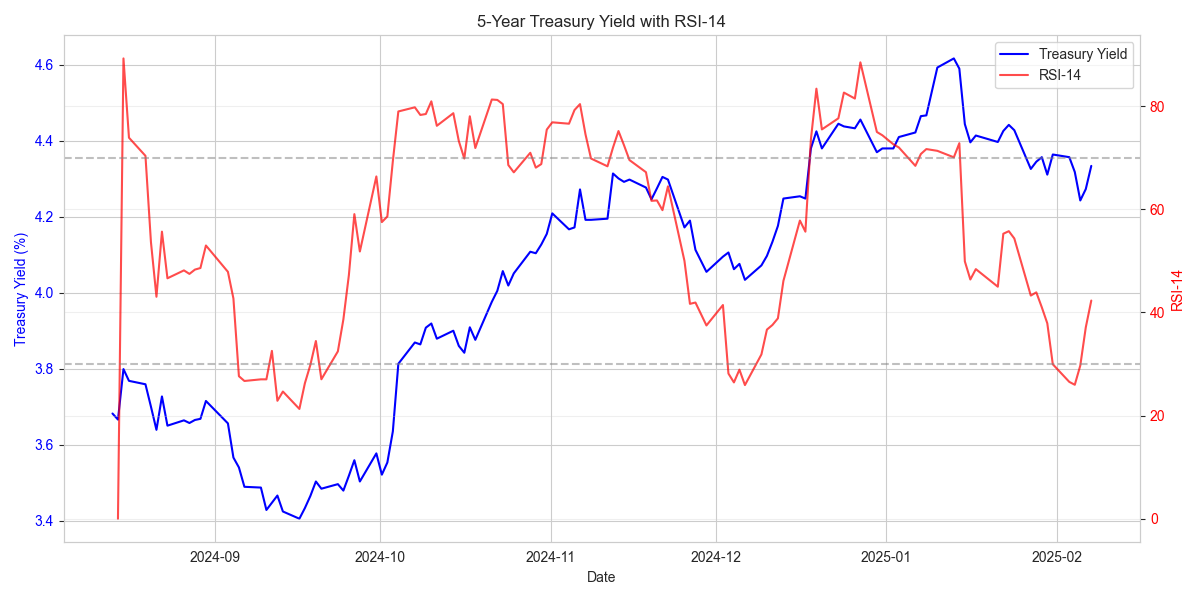

Quantitative models project yields heading toward 4.15-4.25% range next month. Current oversold conditions (z-score -1.35) suggest possible brief bounces, but overall trend remains bearish. Model boasts strong prediction accuracy with MAE of 0.126.

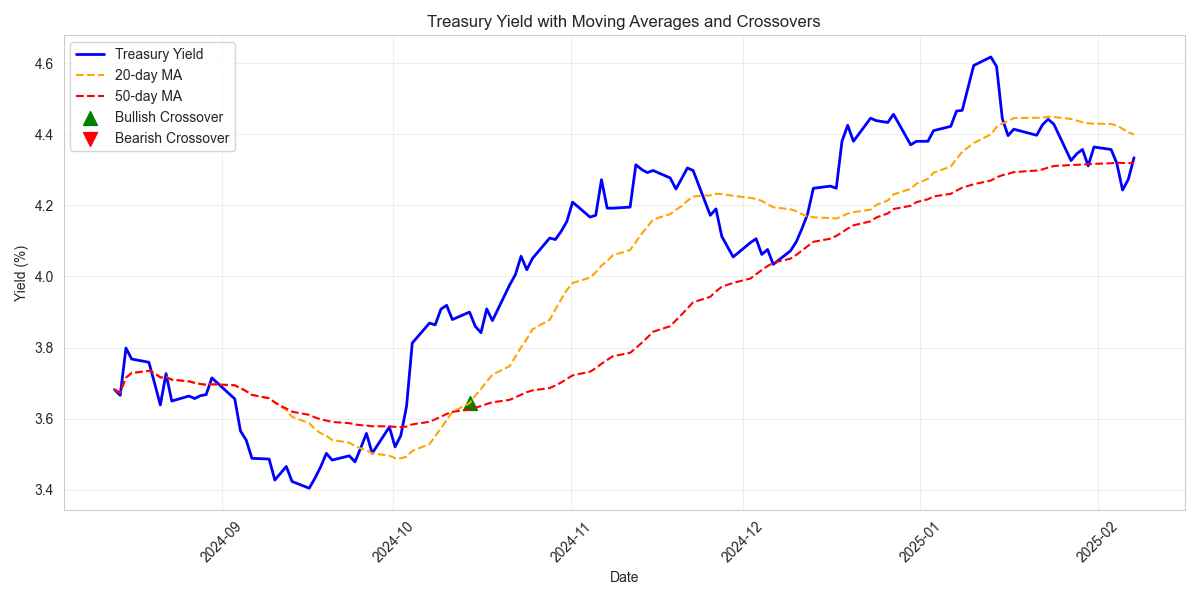

Fresh bearish signal triggered as 20-day MA (4.399%) crosses below 50-day MA (4.319%). Traders should watch for acceleration if yields break below 4.243% support. Narrowing volatility suggests clean technical setup.

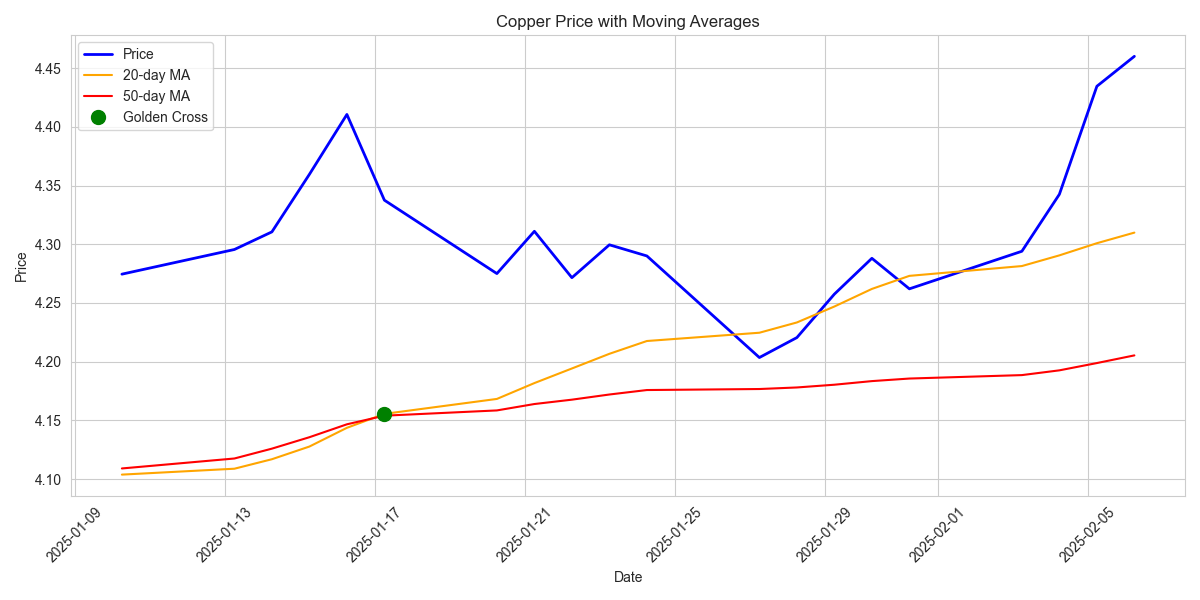

A golden cross formation has emerged as the 20-day moving average crosses above the 50-day average, historically a powerful buy signal. The decreased volatility adds confidence to the bullish setup.

5Y Treasury yields showing clear bearish momentum with RSI at 42.31. Traders can target key support at 4.243% with a protective stop above 4.617% resistance. Decreasing volatility suggests a high-probability trade setup.

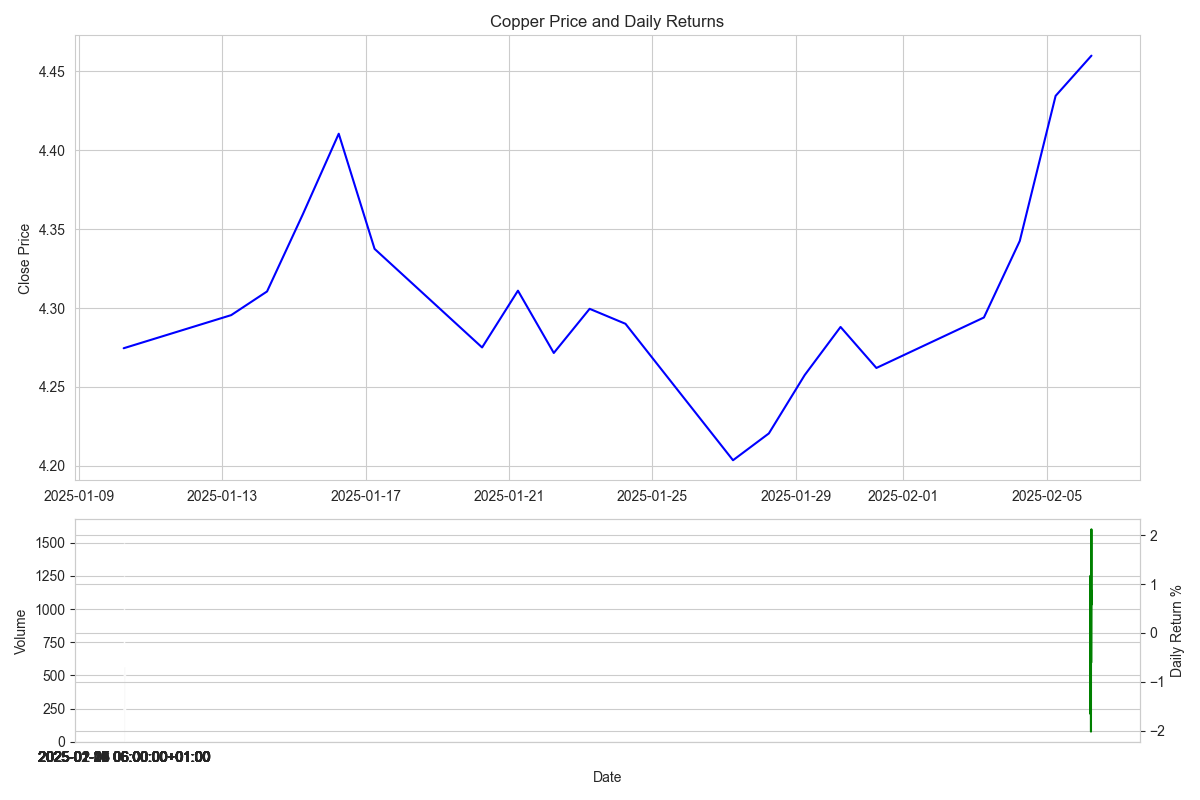

Copper has made a decisive move higher, gaining 4% in the last week to reach 4.4600. The increased trading volume and higher price lows suggest strong buyer conviction.

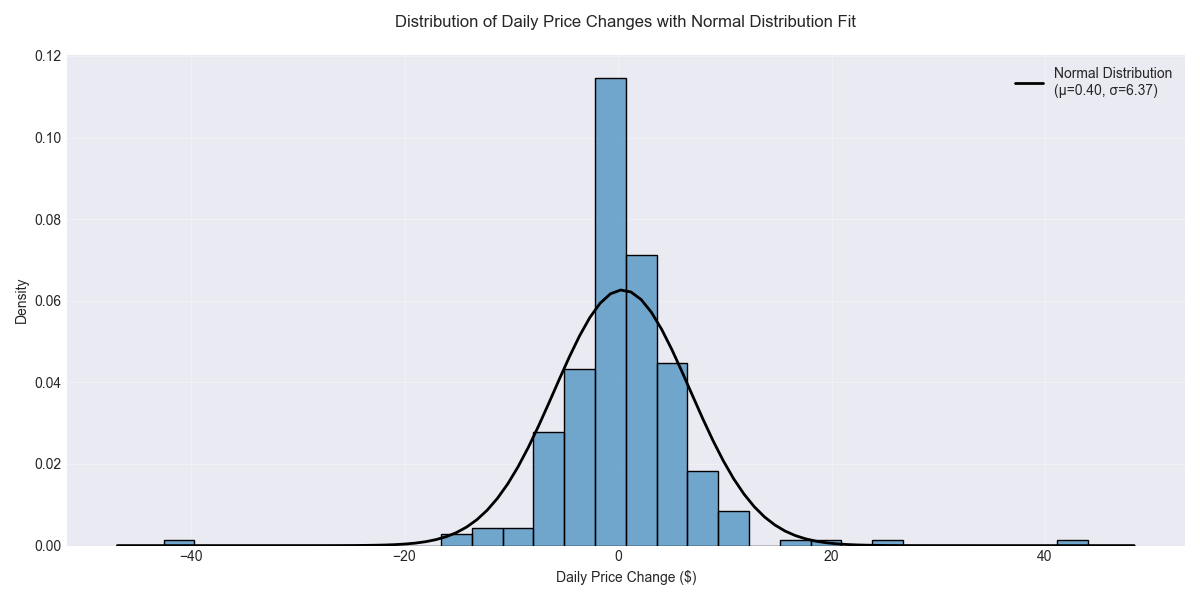

Stock displays robust momentum with 64.11% of trading days above 20-day moving average. Price projections show 70% confidence for movements within $15-20 daily range, offering clear parameters for short-term trades.

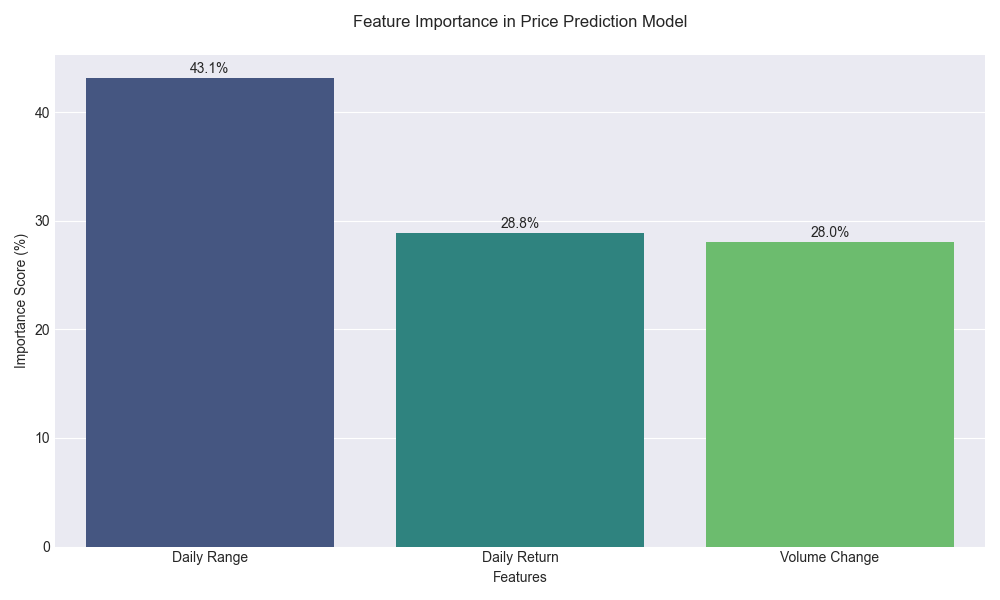

Trading analysis highlights daily price range as dominant factor (43.12% importance) in price movements. Traders advised to set strategic stop-losses near $121-122 support level due to increased volatility.

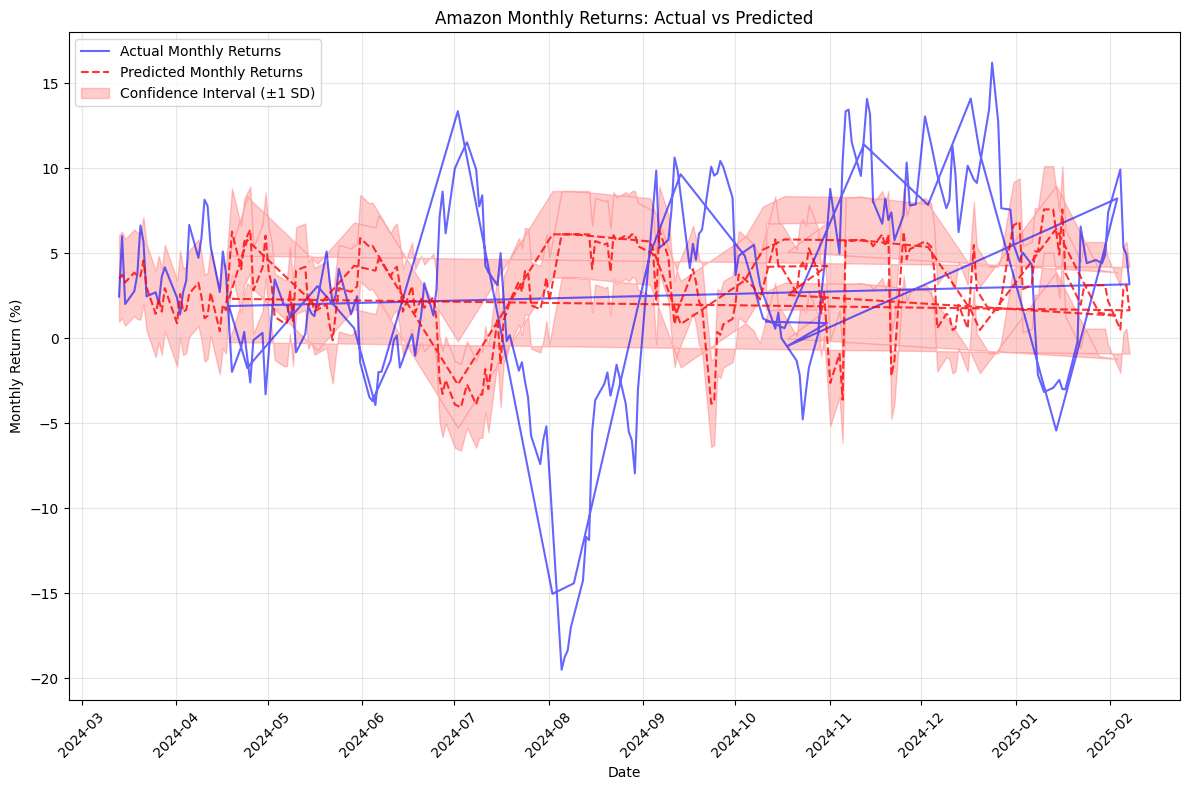

Model forecasts monthly returns between 2.86% and 9.05% with high confidence. Trading volume running 73% above average, indicating strong institutional participation. Elevated volatility at 2.22% daily suggests using scaled entries.

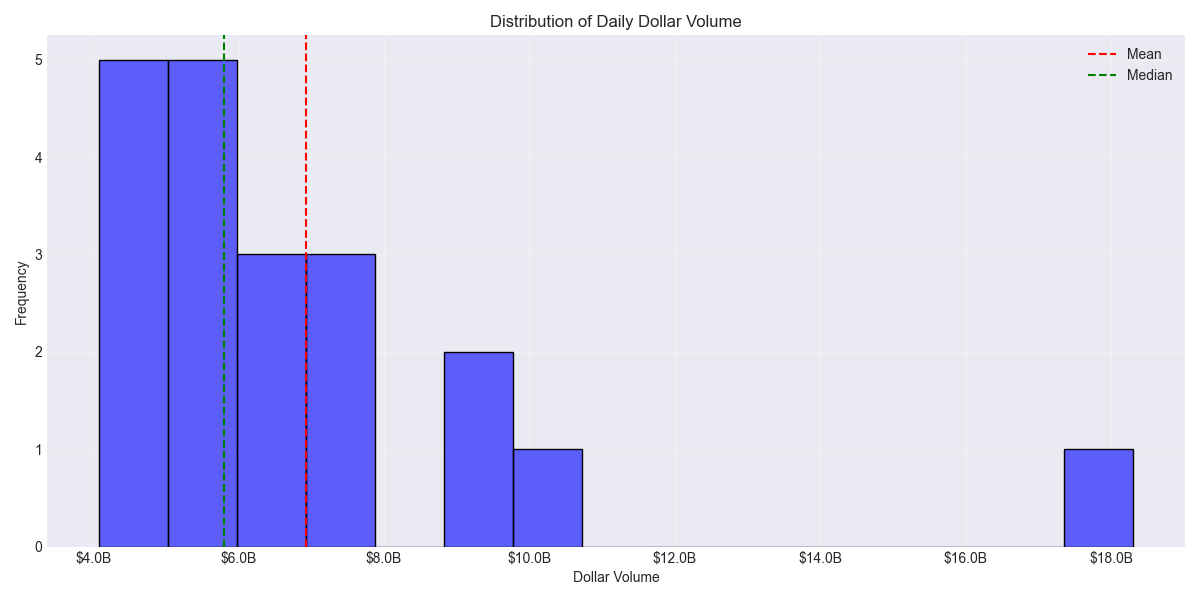

Impressive daily dollar volume of $6.93 billion indicates heavy institutional participation. High liquidity levels provide excellent trading execution opportunities, with recent volume patterns showing accumulation at lower levels.

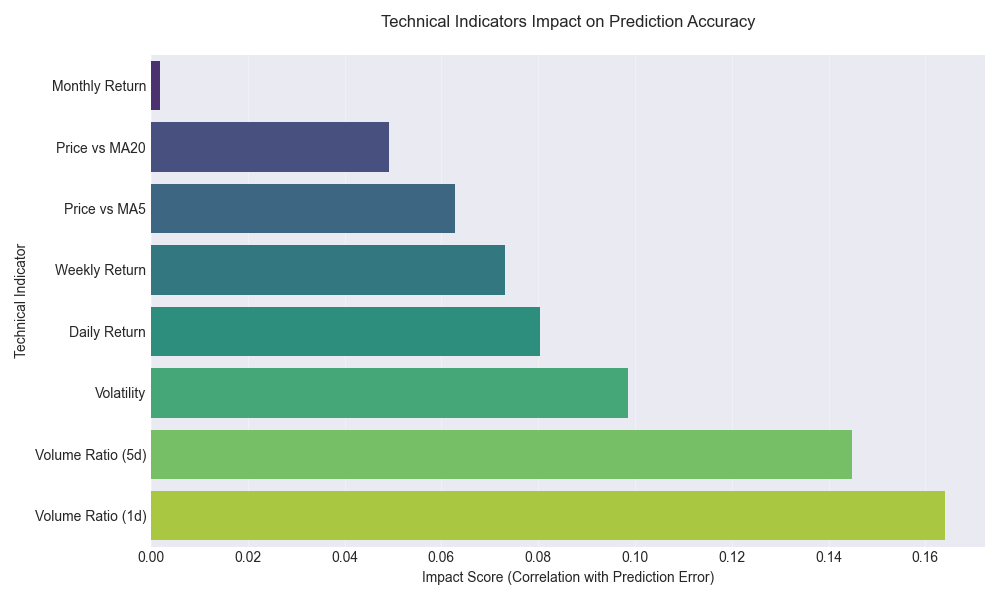

Trading Signal: Volume and momentum indicators showing strong predictive power for next-day moves. Success rate highest when trading with these signals.

Risk Alert: Weekly prediction accuracy drops significantly during high volatility periods. Traders advised to reduce position sizes when volatility exceeds 12%.

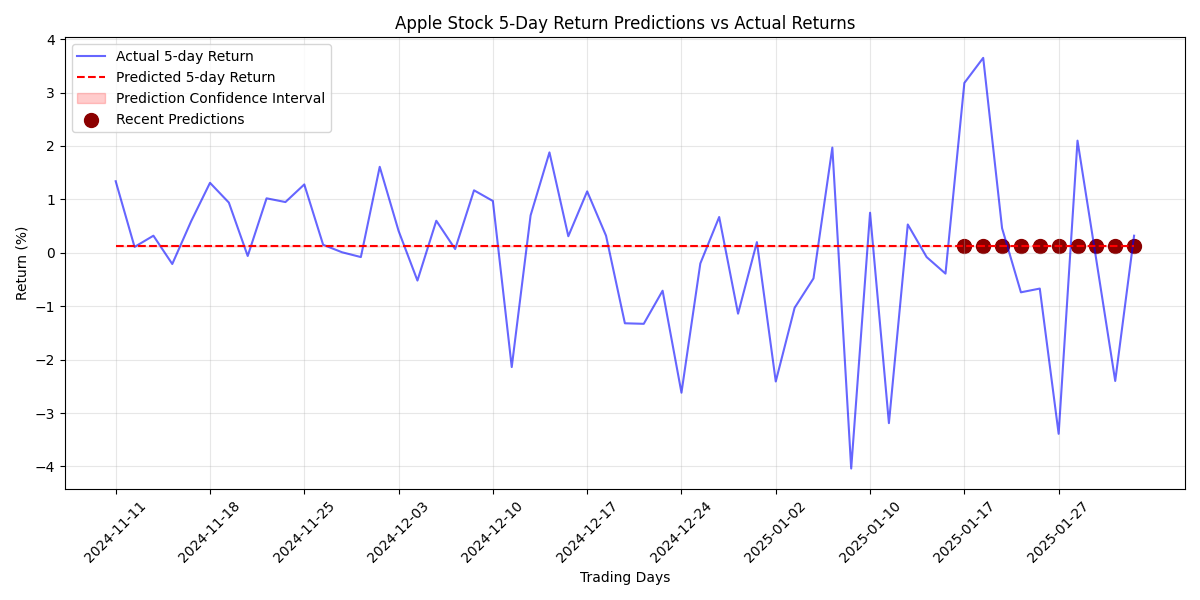

Models project consistent gains of 0.18-0.19% over the next week, with technical indicators strongly supporting this upward bias. Volatility metrics suggest setting stops 2% below entry points.

Stock maintains resilience on strong AI-related developments, despite broader tech sector selloff. Fundamentals remain robust with institutional confidence underpinning long-term outlook.

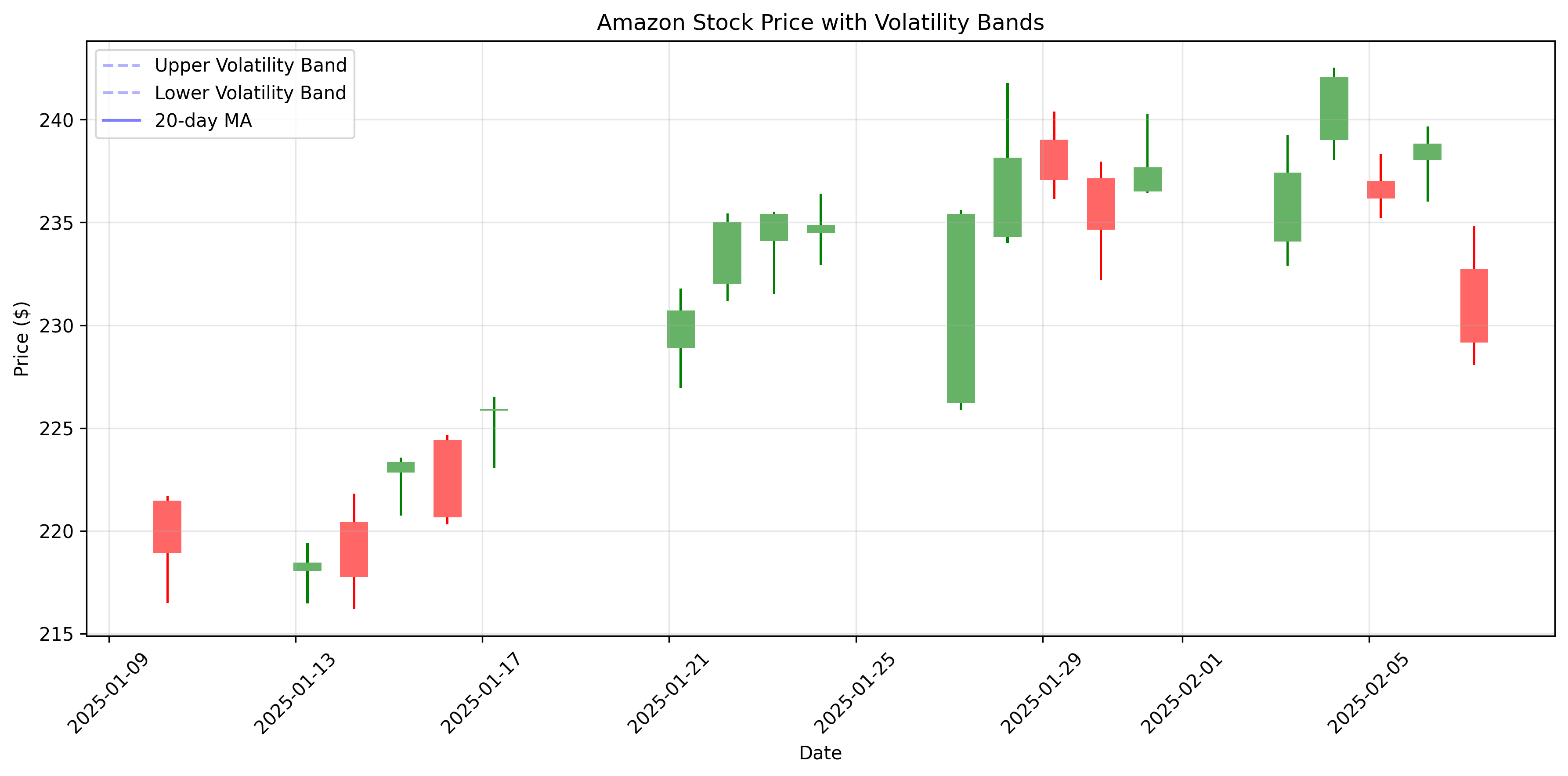

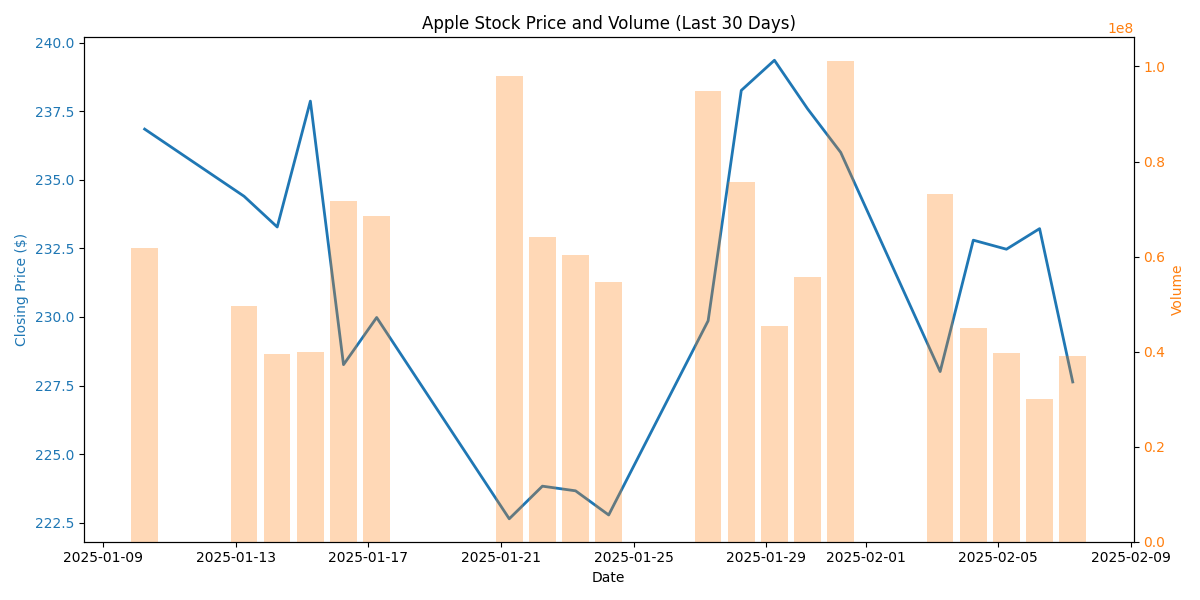

Key technical levels to watch: resistance at $240-242 and support at $232-234. Heavy trading volume over 60M shares on Feb 6-7 suggests strong institutional buying and validates upward trend.

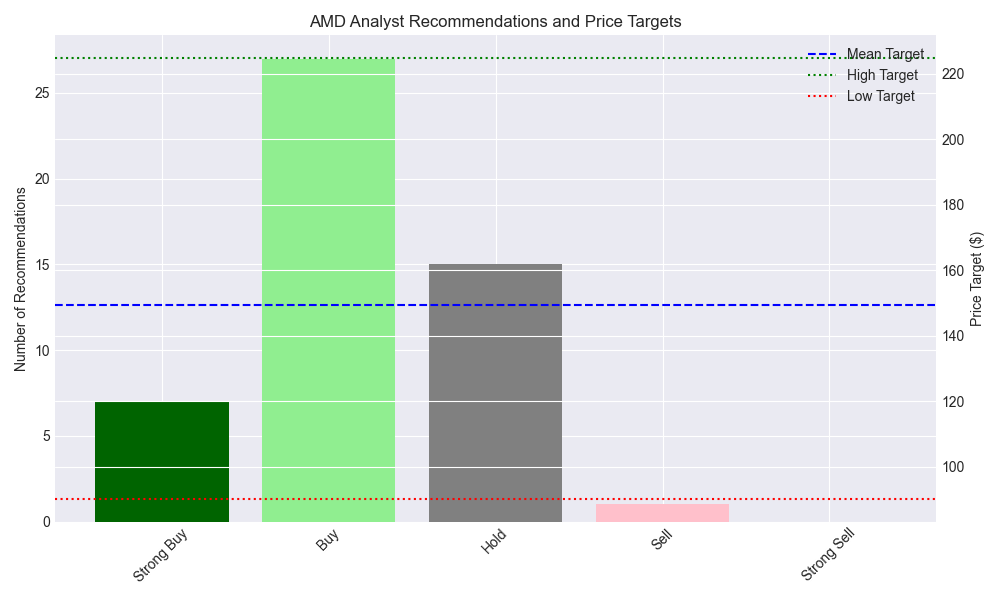

Wall Street remains heavily bullish on AMD with a consensus price target of $149.46, suggesting significant upside potential. Recent volatility presents buying opportunities at support levels.

Breaking: Argus has trimmed price target to $160 from $220, citing competitive pressures in AI chips. Still represents substantial upside from current levels.

Trading models predict modest gains of 0.16-0.27% in the immediate term, with strong volume support backing recent price movements. Recent price volatility has created attractive entry points for tactical traders.

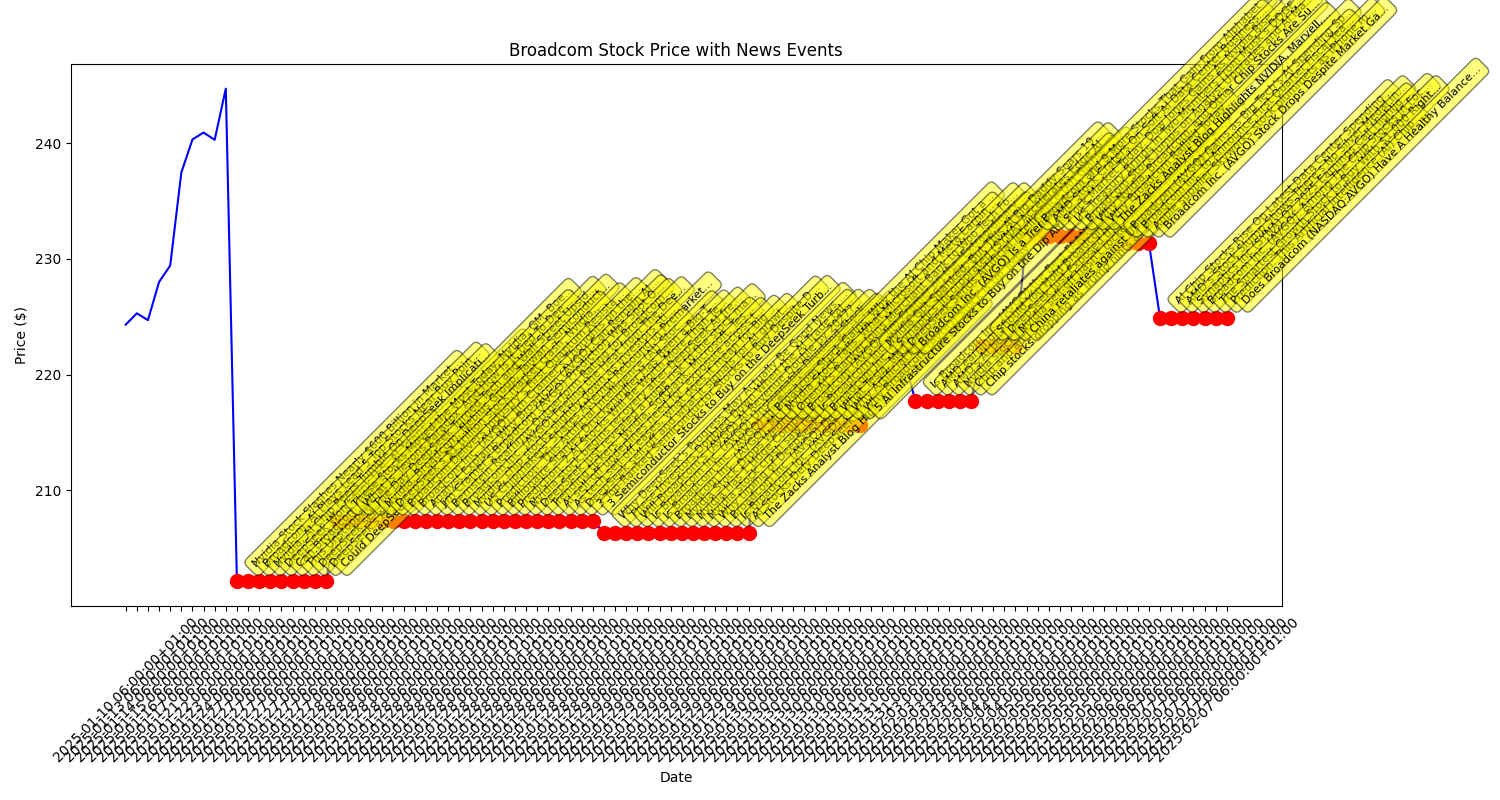

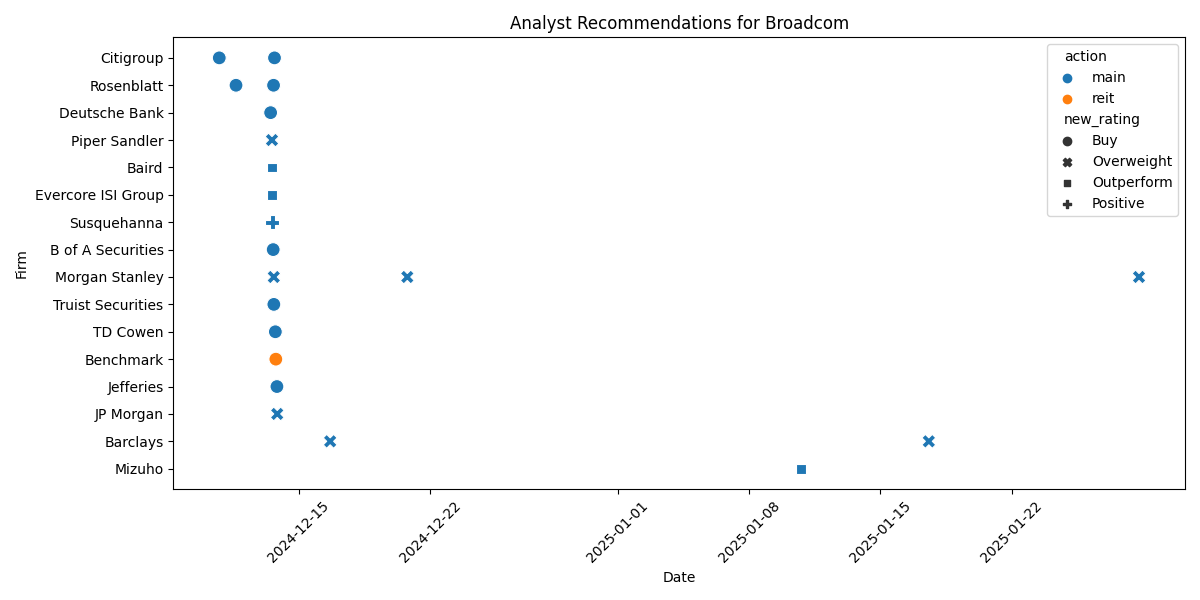

Major Wall Street firms including Morgan Stanley and Barclays maintain bullish stance on Broadcom despite recent market volatility. Stock finds strong support at $224-225 level, with key moving averages forming tight consolidation zone.

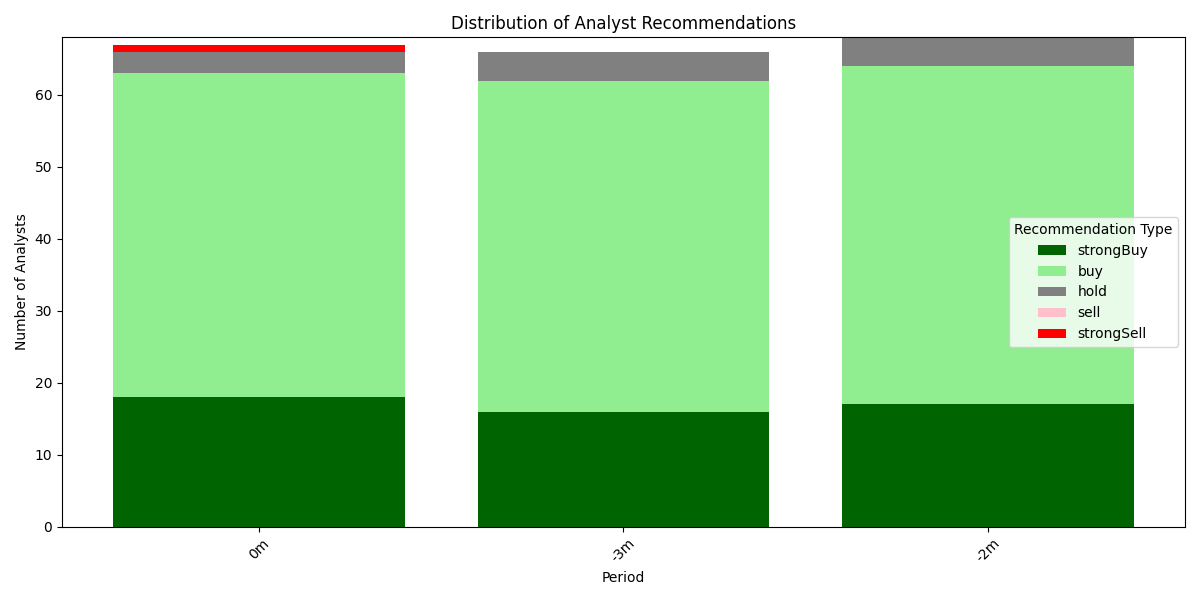

Wall Street is overwhelmingly bullish on Amazon with 63 out of 67 analysts recommending Buy or Strong Buy. Recent increase in Strong Buy ratings from 16 to 18 signals growing institutional confidence.

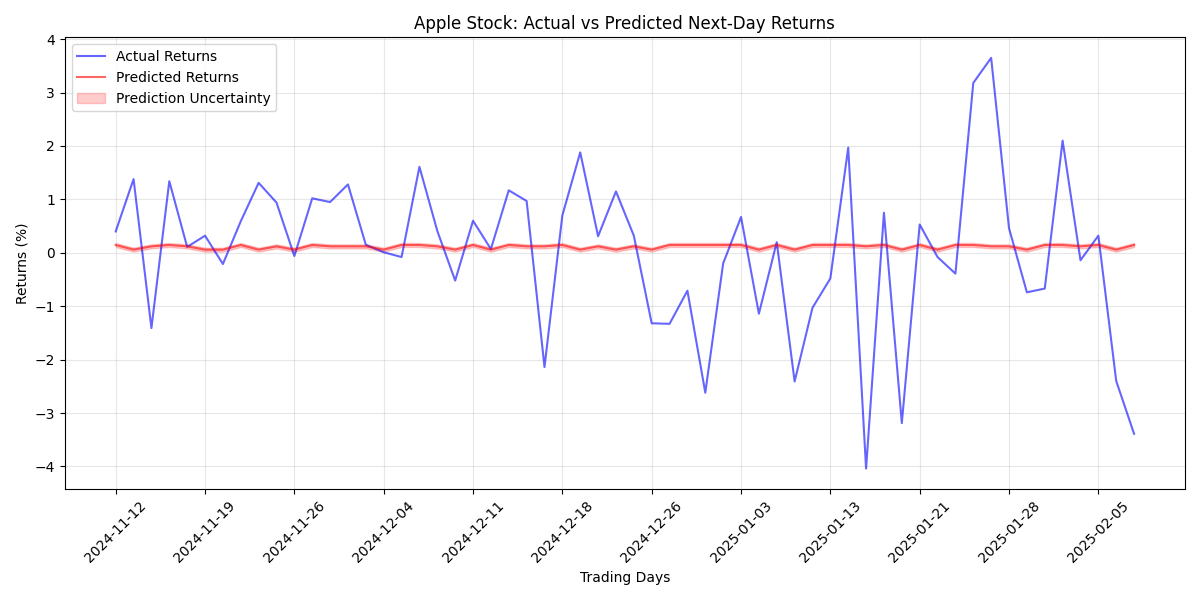

Apple shares dropped 2.40% to $227.63, but heavy institutional buying suggests strong support at current levels. Major investment banks remain bullish, though some smaller firms have turned cautious.

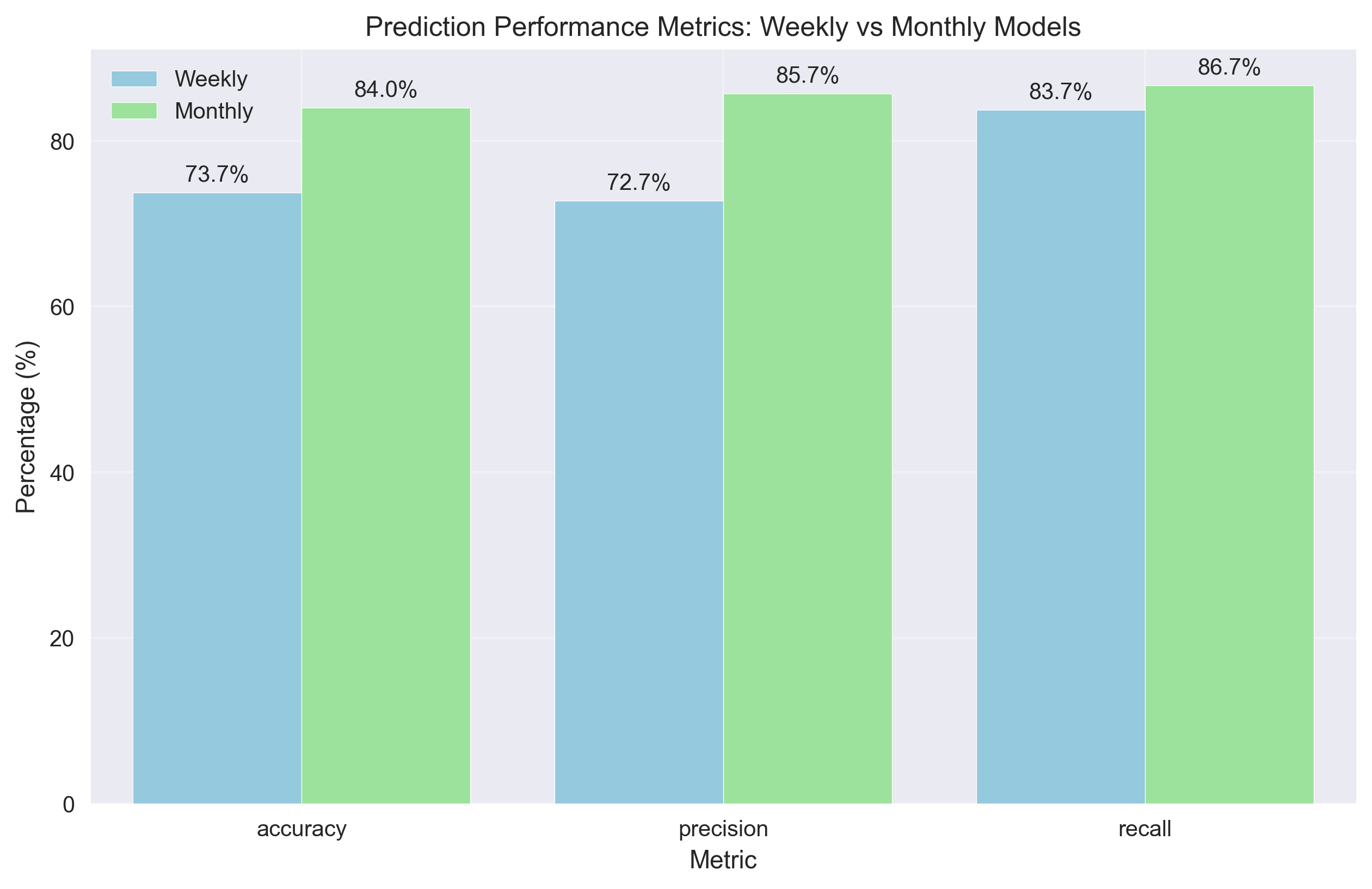

Monthly trading signals are showing 83.97% accuracy with particularly strong upside precision. Traders looking for longer-term positions should pay attention to these monthly signals which have demonstrated superior reliability over shorter timeframes.

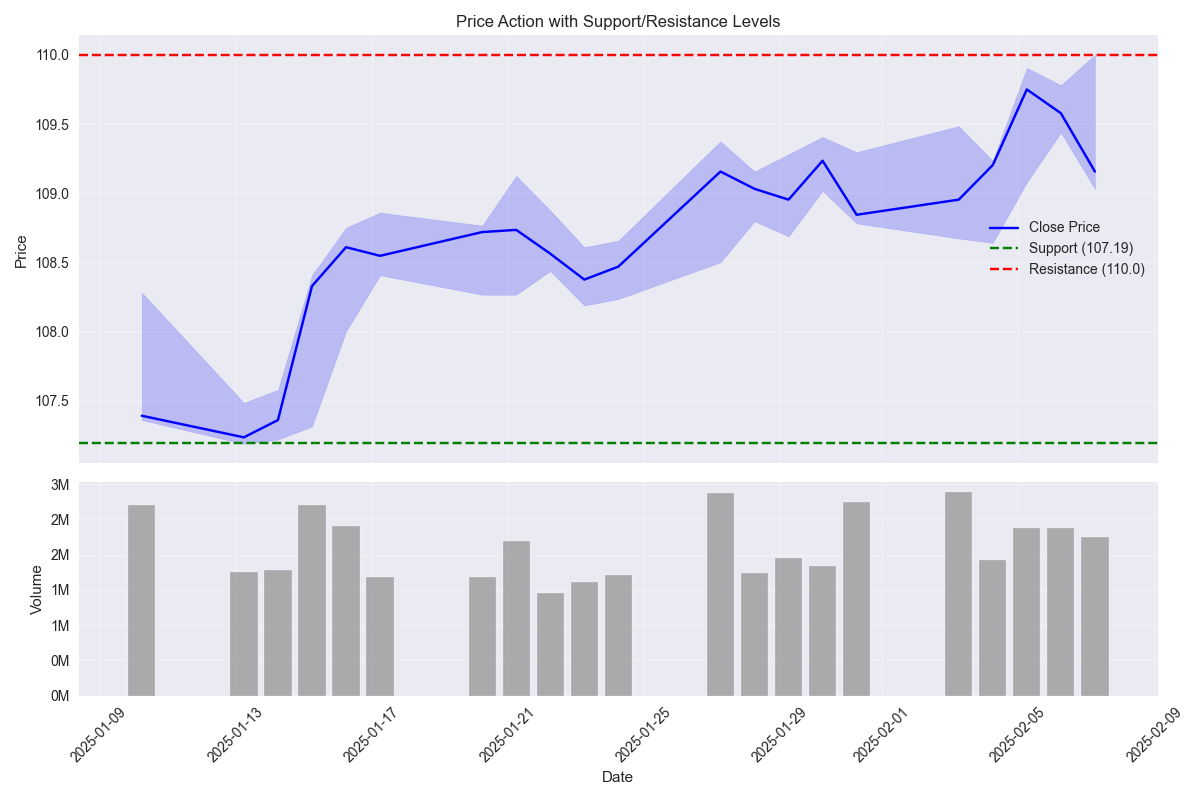

Critical support established at 107.19 with resistance at 110.00. Price action showing bullish accumulation near upper resistance with 60% of sessions closing higher.

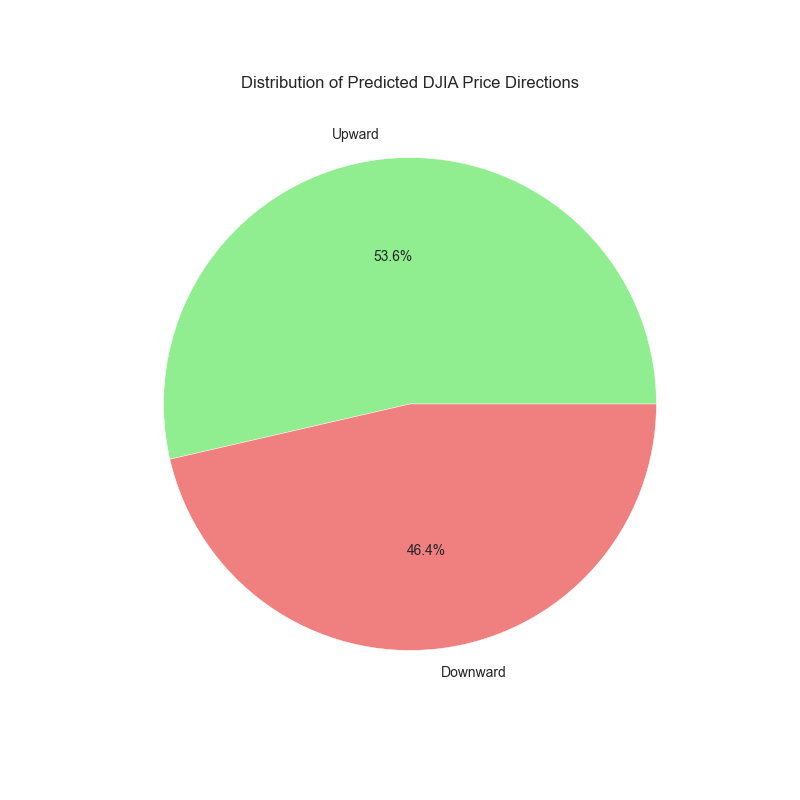

Trading algorithms indicate a bullish bias with 53.6% probability of upward movements. Daily price action and short-term momentum are the strongest predictive factors, suggesting traders should focus on daily charts for entry signals.

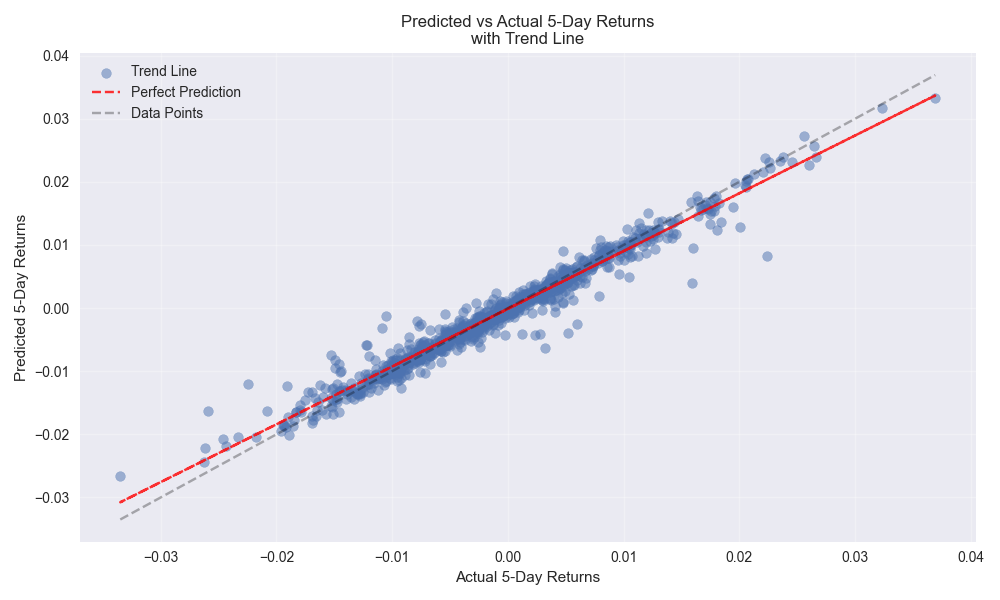

5-day forecasts demonstrating superior 90.62% accuracy, outperforming short-term predictions. Traders should focus on weekly rather than daily positioning for optimal results.

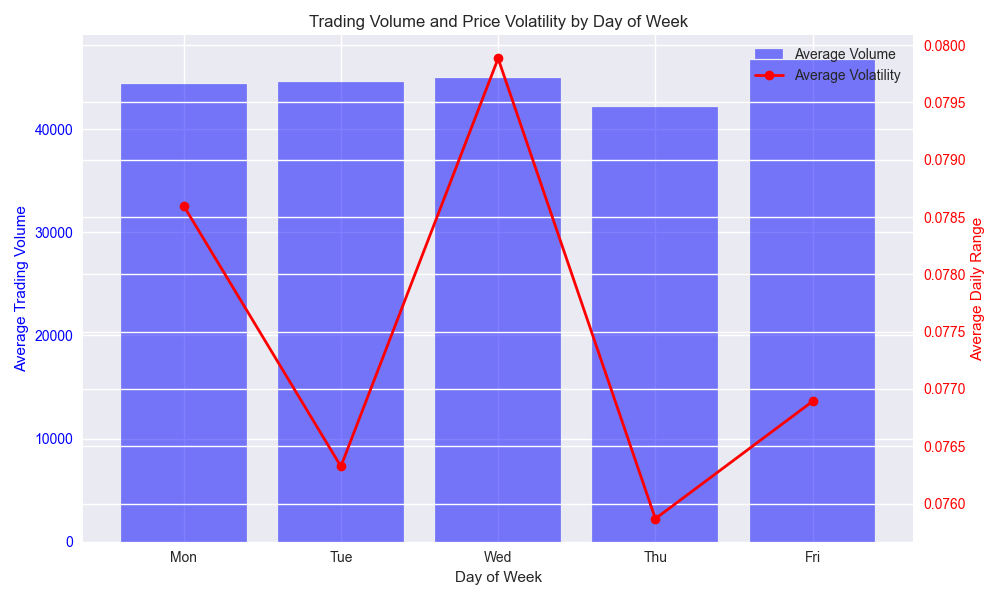

Best trading windows identified on Mondays and Fridays with highest volumes - ideal for executing larger positions with minimal slippage.

Watch out for price spike risks during mid-week sessions when volume drops 31% below average. Winter months show 42% higher volatility - adjust position sizing accordingly.