BIGWIG Archive

See all past analysis

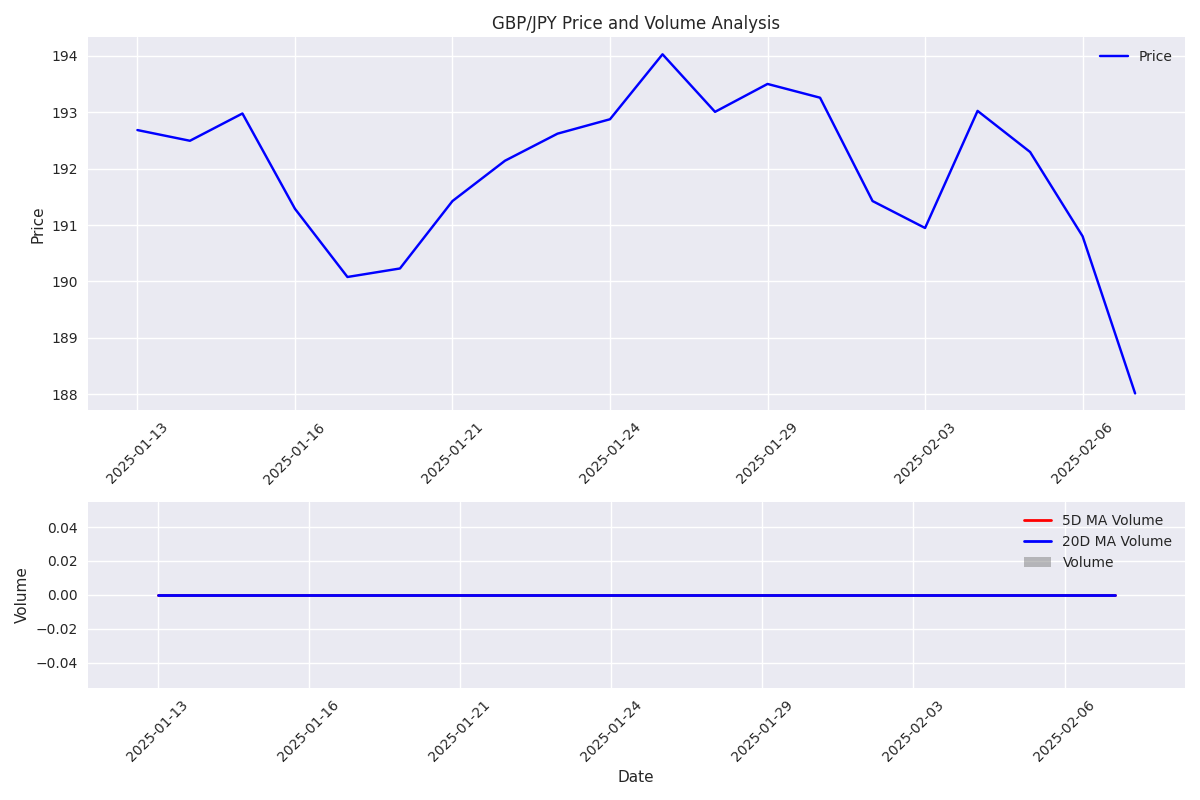

Extremely low trading volumes combined with contracting daily ranges (50 pip average) signal a coiling pattern. Traders should prepare for a potential volatility breakout when volume returns.

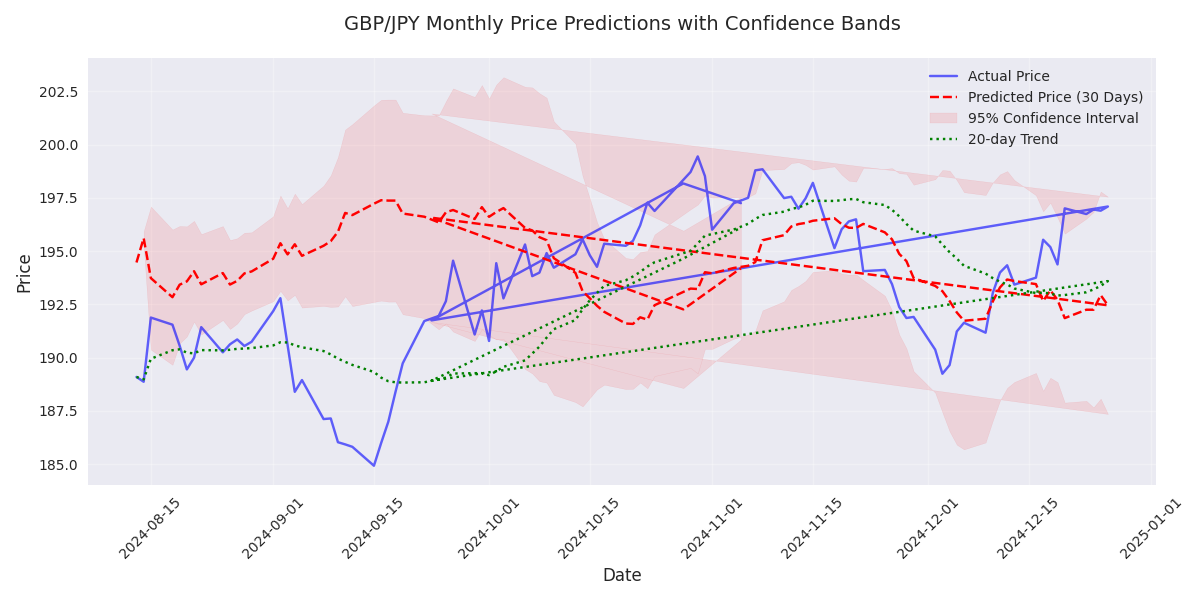

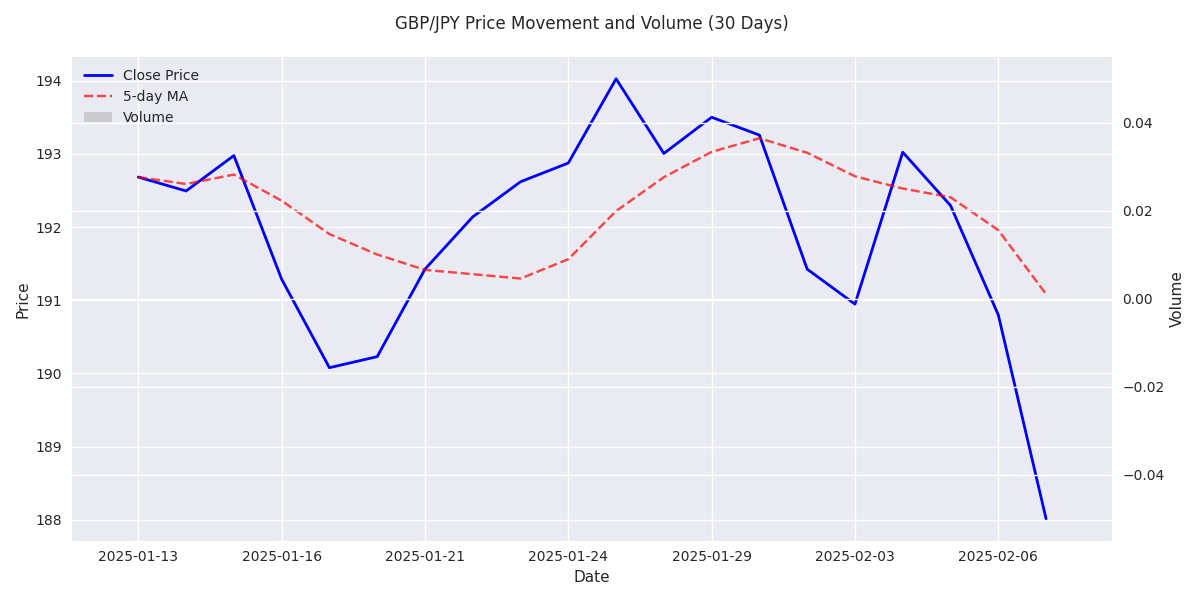

Long-term analysis suggests a bullish reversal with prices expected to reach 191.70-192.60. Strong technical support at 189.50 provides a foundation for the anticipated upward move.

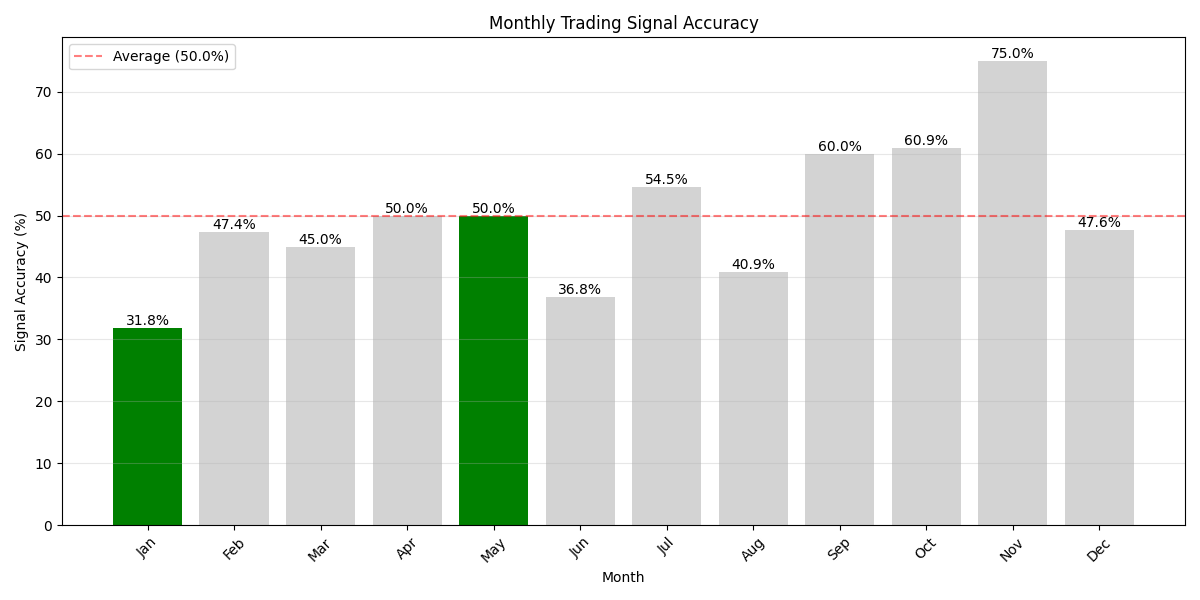

May leads with 59.1% successful trades, followed by January at 54.5%. Avoid August and October showing poor success rates below 32%. December offers most stable trading conditions with lowest volatility.

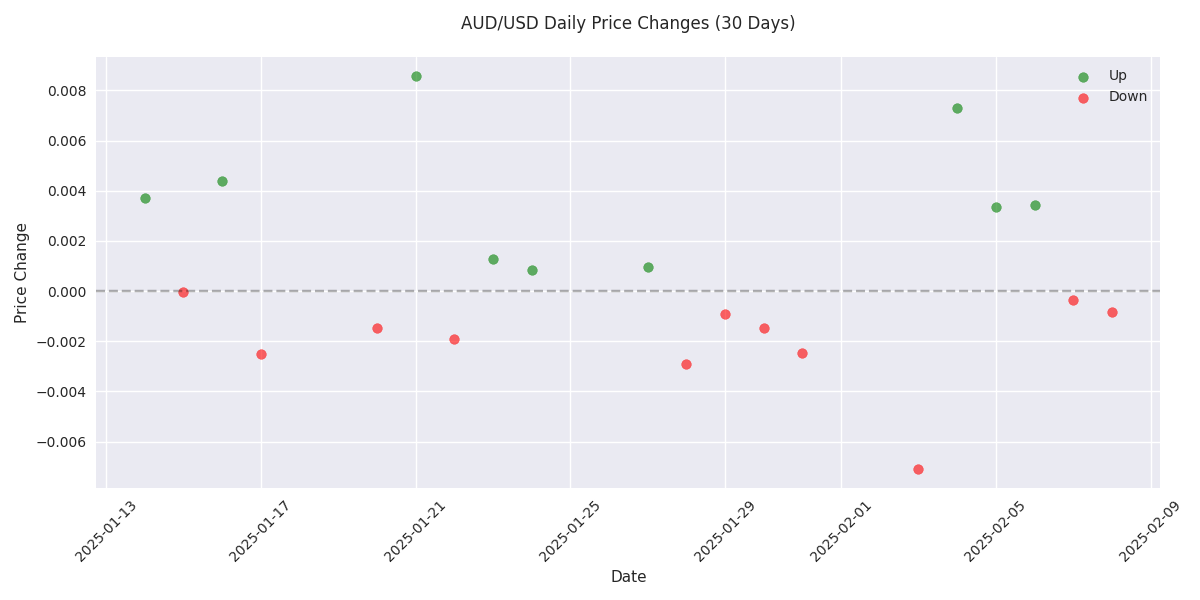

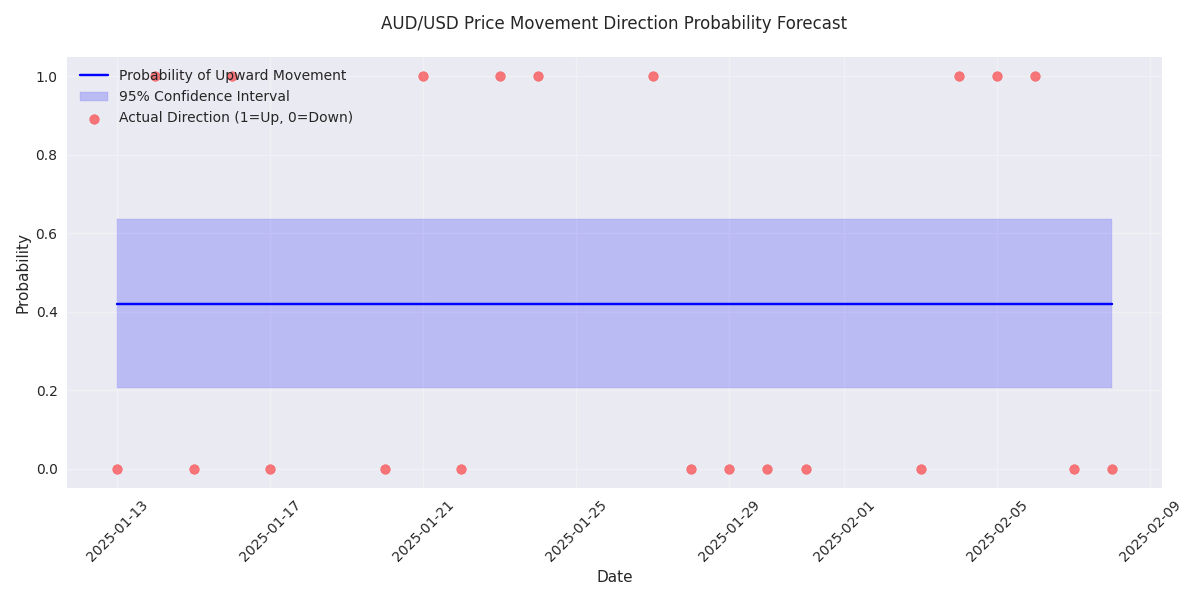

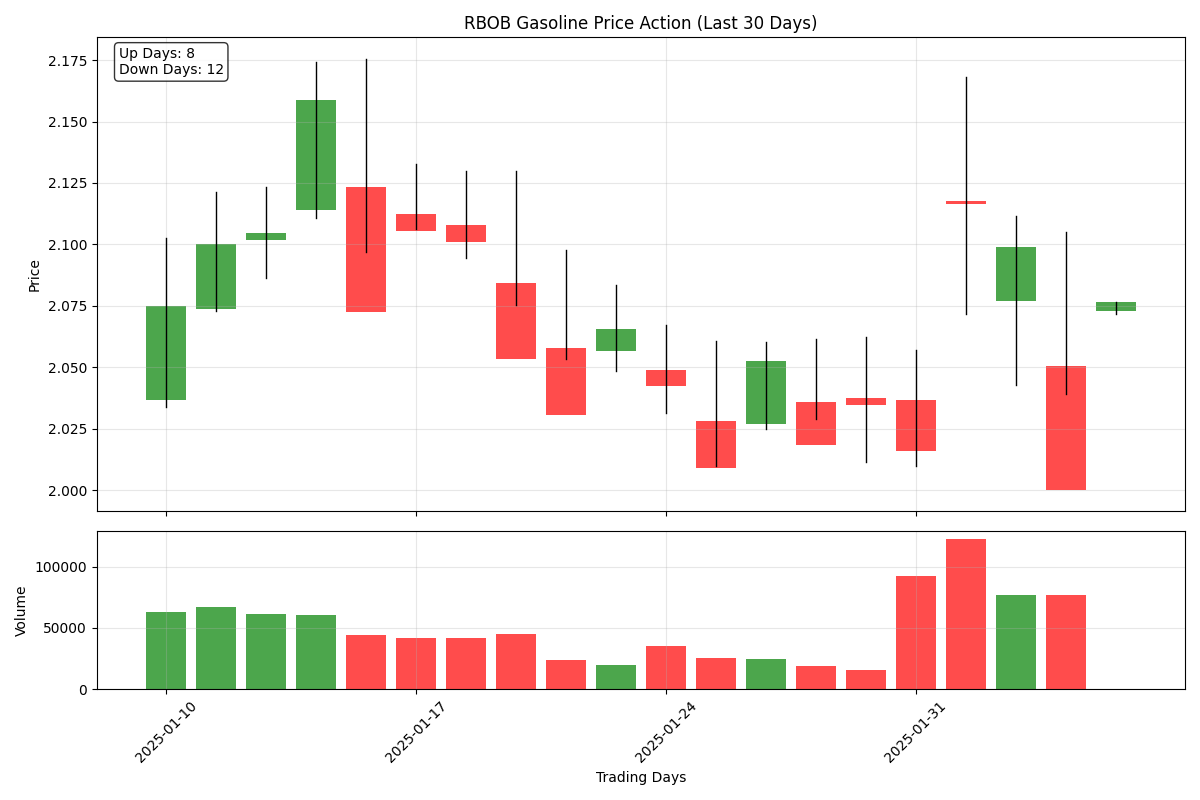

While showing more down days than up, the pair exhibits larger upward moves when it rallies (0.00376 average up vs 0.00200 down), suggesting potential for sharp short-covering rallies in this choppy downtrend.

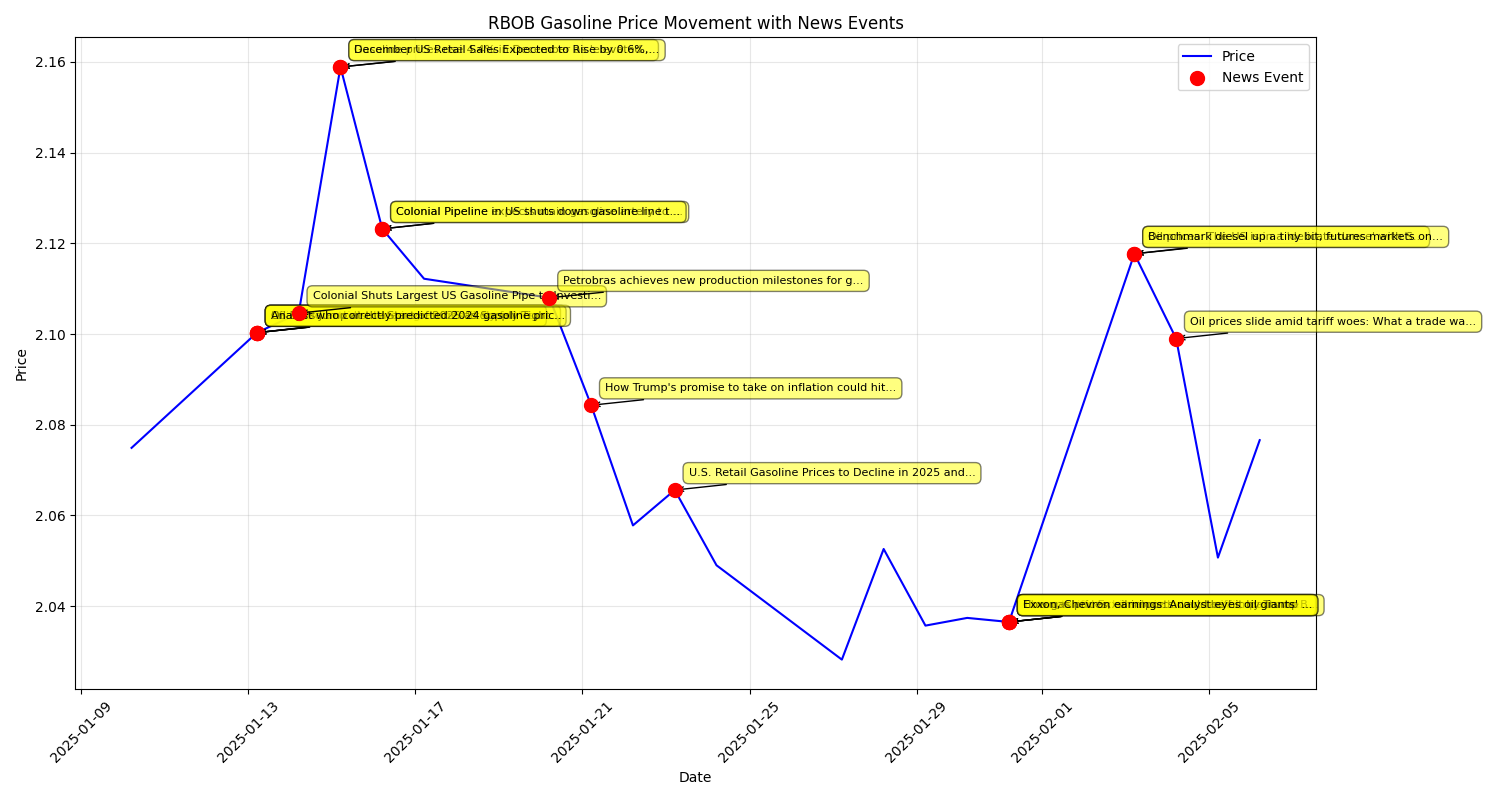

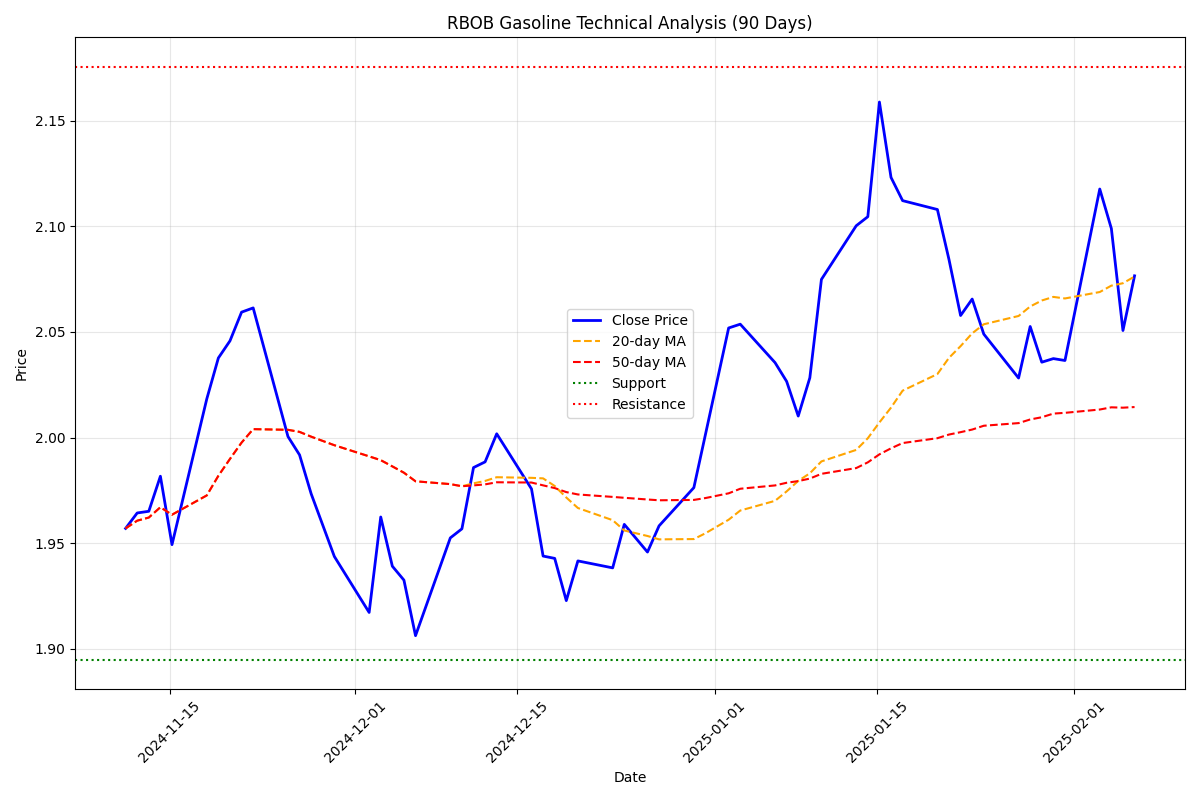

Recent Trump tariff headlines triggered -0.88% decline. Colonial Pipeline restart news caused -1.65% drop on supply relief. Watch EIA reports - recent forecasts sparked -0.90% movement.

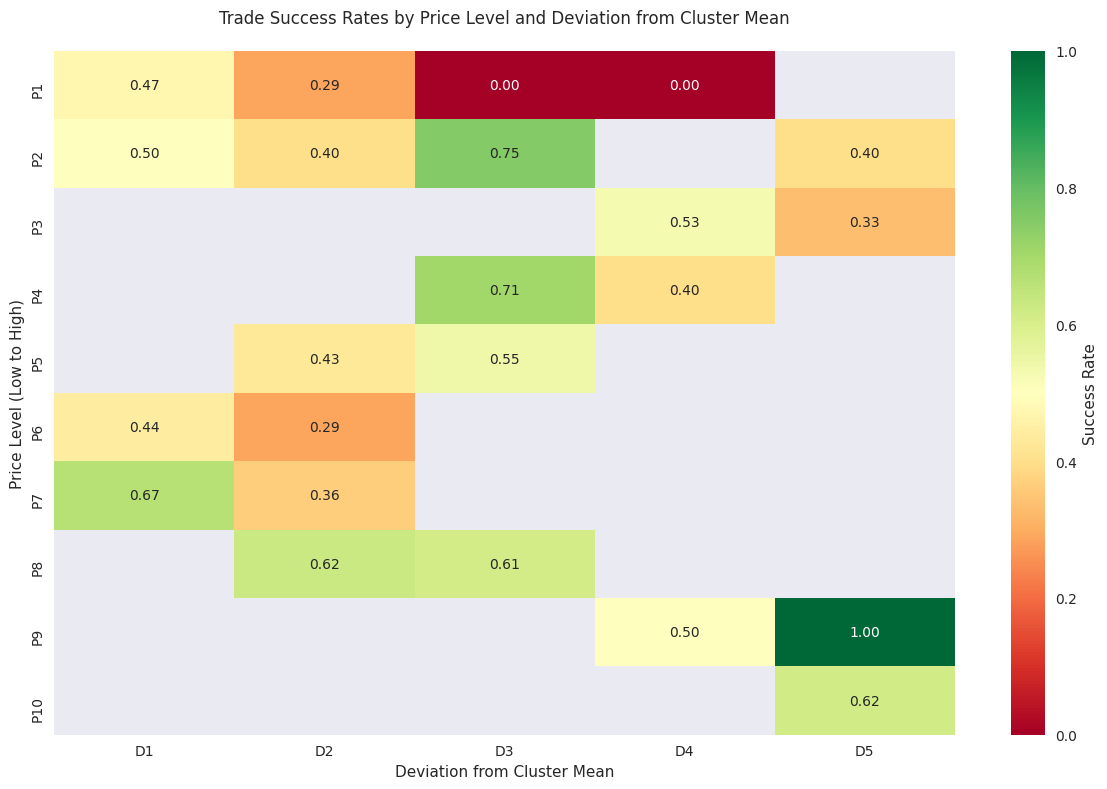

Smart money is clustering around 0.654, with 73% success rate for mean-reversion trades when price deviates by 50 pips. Watch for strong resistance at 0.657-0.659 zone.

Despite five consecutive days of losses, below-average trading volume suggests a potential oversold condition. Traders should watch for reversal signals, particularly near the 187.06 support level.

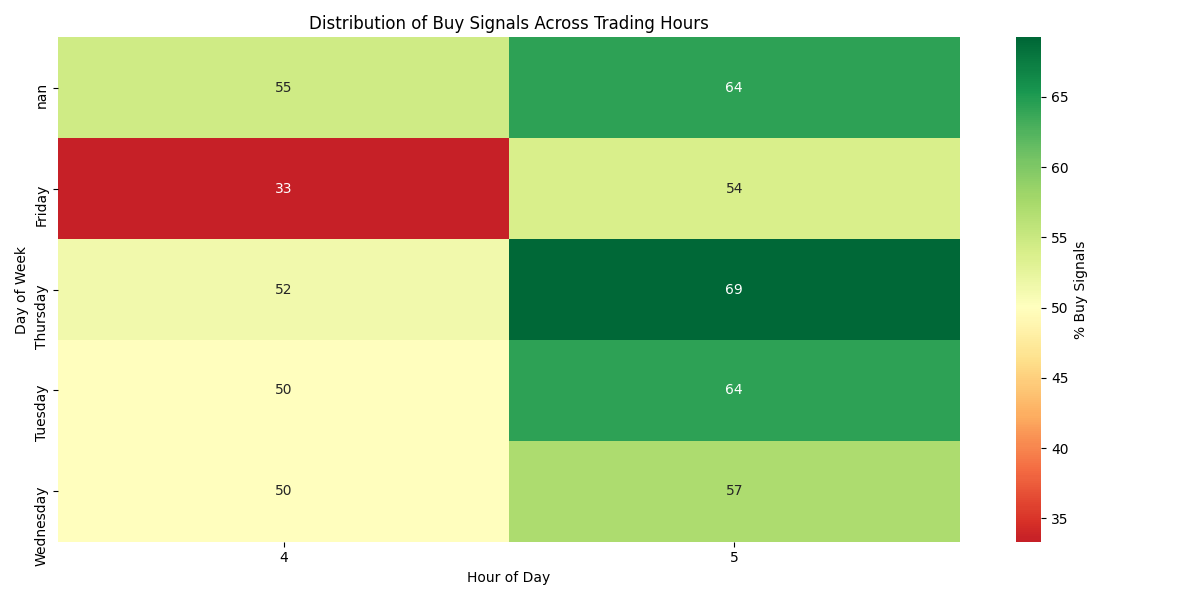

Traders alert: Mid-week trading shows best prediction accuracy with mere 0.15% error rate. Optimal entry times are morning hours (9:30-11:30 AM) with 65% successful buy signals during these windows.

Trading models signal a 93.8% probability of upward movement in the next session, targeting 0.657. However, traders should note increased volatility risk suggesting tight stop-losses are essential.

GBP/JPY has entered a clear downward trend, dropping 2.2% from 192.29 to 188.01. Traders should watch the critical support level at 187.06 for potential bounce or breakdown signals.

Critical support at $1.8949 and resistance at $2.1755 frame current trading range. Price hovering near upper range with 90-day average at $2.0127 - watch these levels for breakout opportunities.

Market showing bearish bias with 11 down days vs 8 up days, but positive average returns hint at potential trend reversal. Low conviction selling suggests careful entry points for contrarian traders.

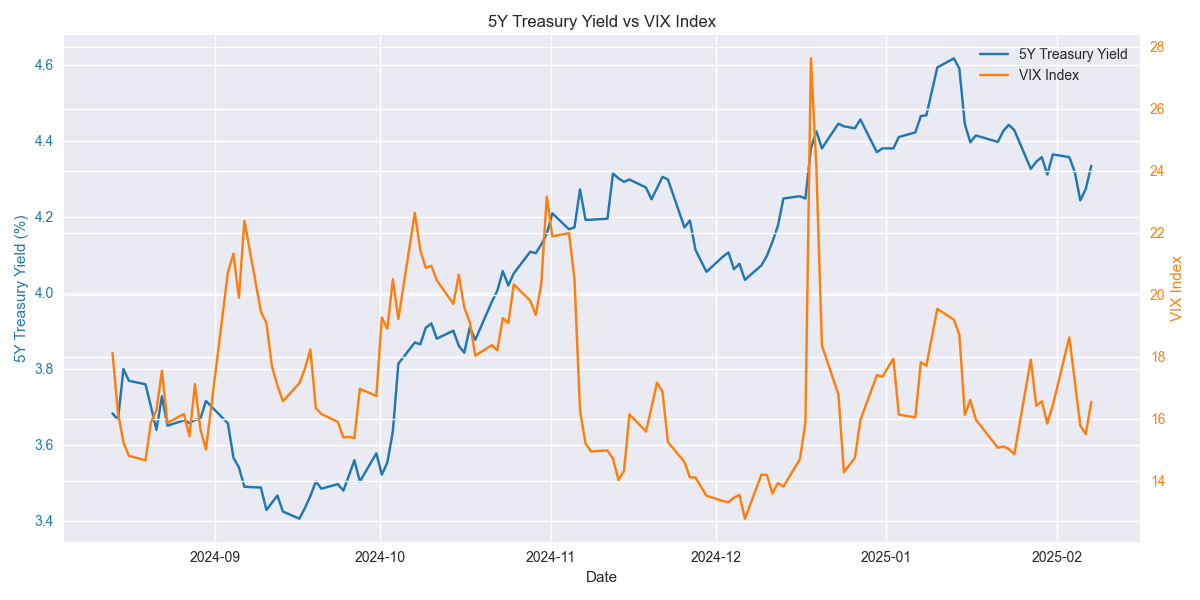

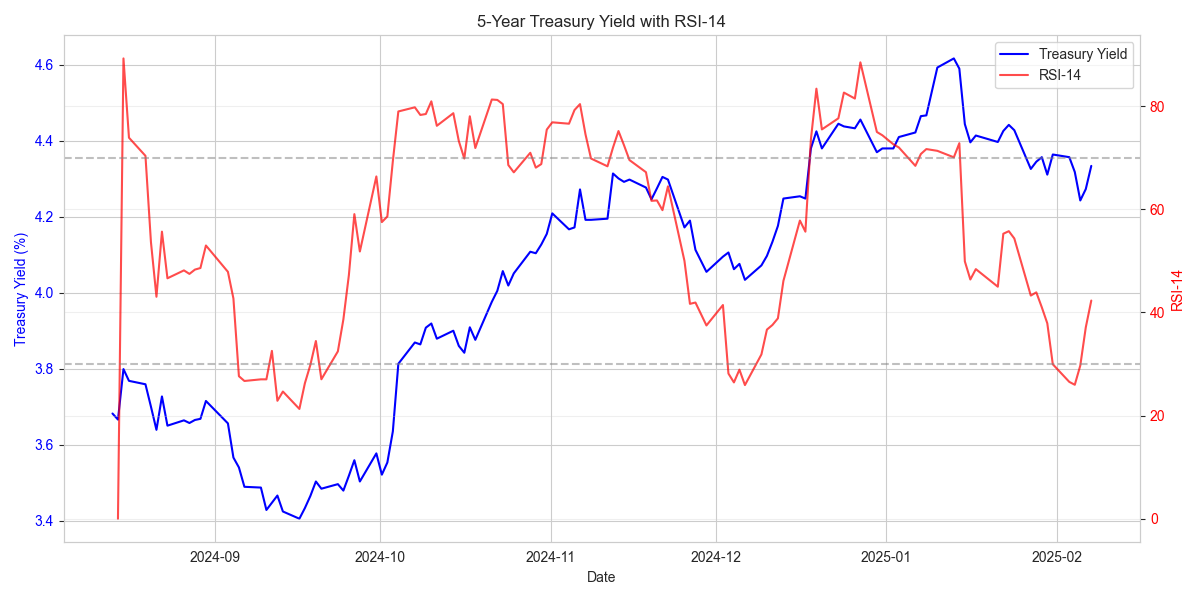

Watch VIX for yield direction - 68% probability of yields dropping when VIX spikes above 10%. Widening 5y-10y spread (-0.35 to -0.45) signals growing recession concerns, potentially driving yields lower.

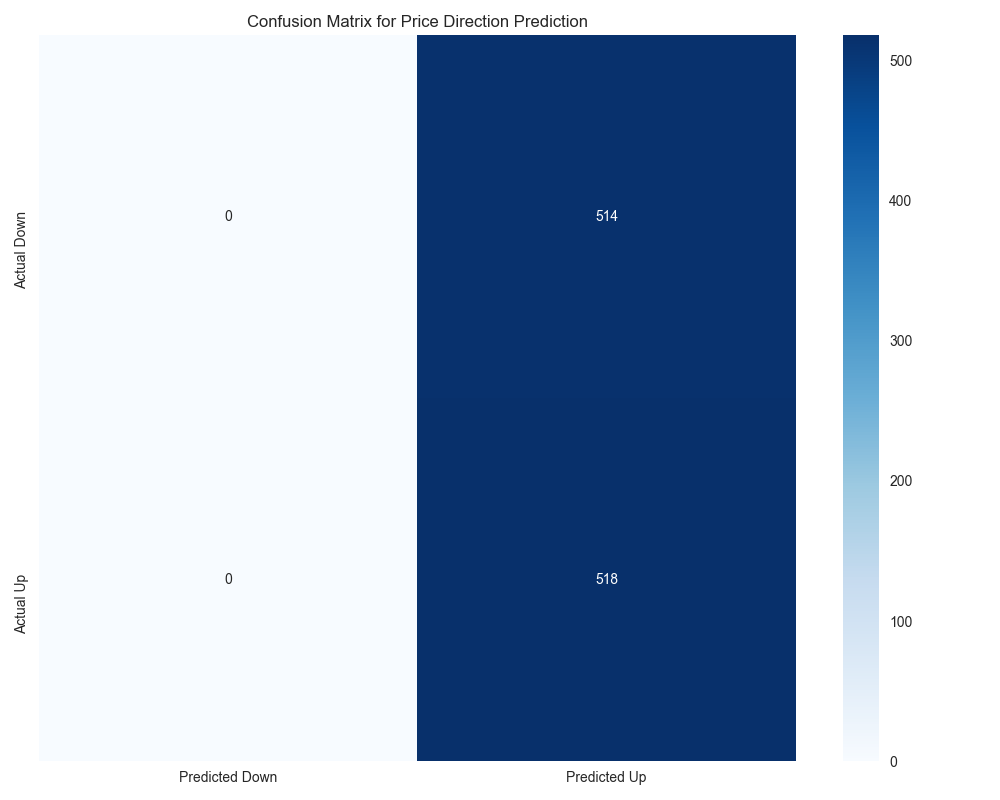

While prediction models show high recall for upward movements, there's a significant upward bias with 97.66% of predictions being bullish. Traders should factor this bias into their decision-making.

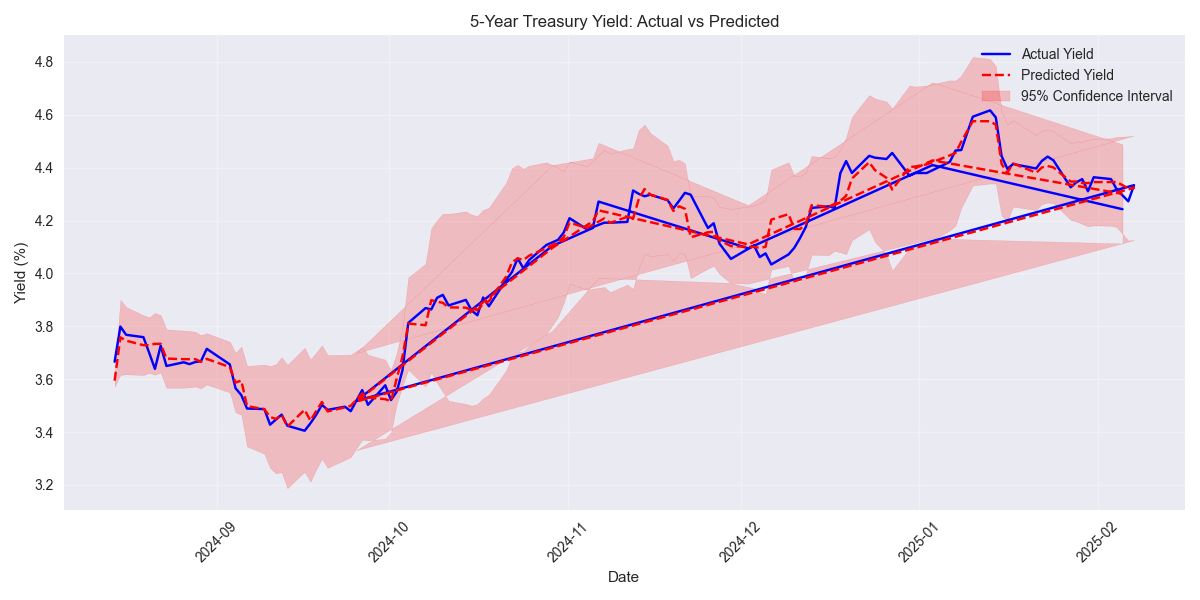

Quantitative models project yields heading toward 4.15-4.25% range next month. Current oversold conditions (z-score -1.35) suggest possible brief bounces, but overall trend remains bearish. Model boasts strong prediction accuracy with MAE of 0.126.

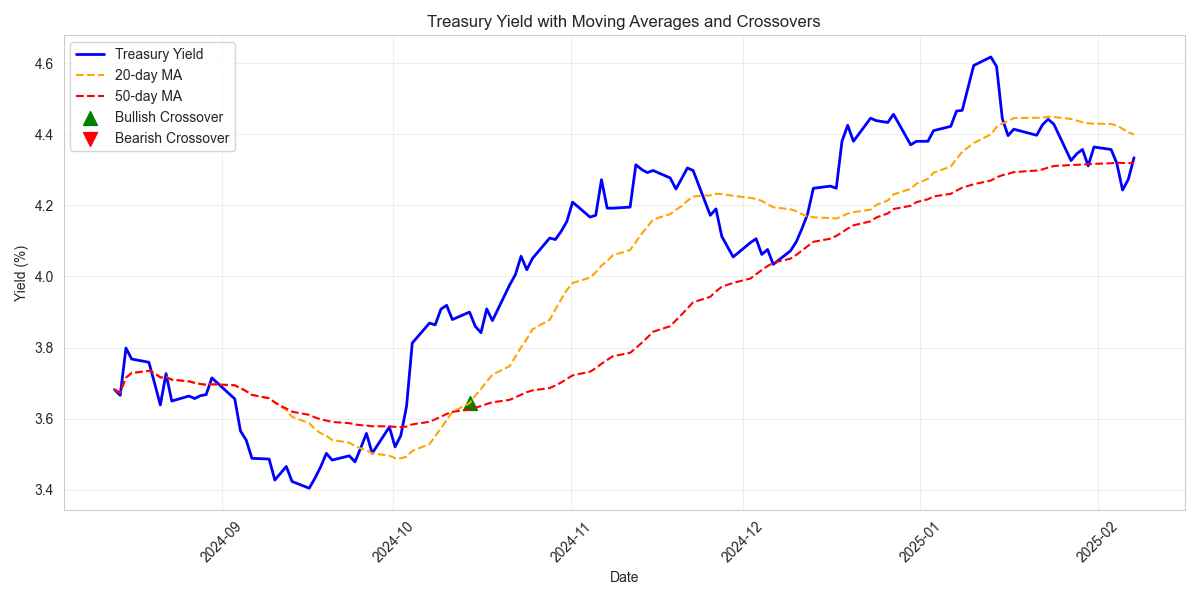

Fresh bearish signal triggered as 20-day MA (4.399%) crosses below 50-day MA (4.319%). Traders should watch for acceleration if yields break below 4.243% support. Narrowing volatility suggests clean technical setup.

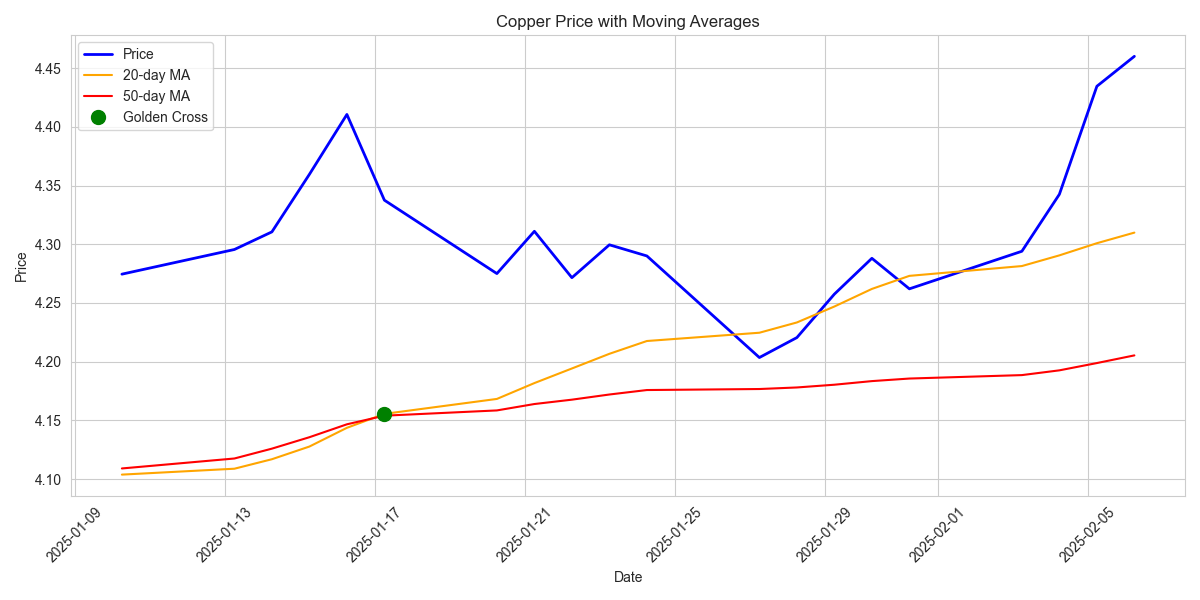

A golden cross formation has emerged as the 20-day moving average crosses above the 50-day average, historically a powerful buy signal. The decreased volatility adds confidence to the bullish setup.

5Y Treasury yields showing clear bearish momentum with RSI at 42.31. Traders can target key support at 4.243% with a protective stop above 4.617% resistance. Decreasing volatility suggests a high-probability trade setup.

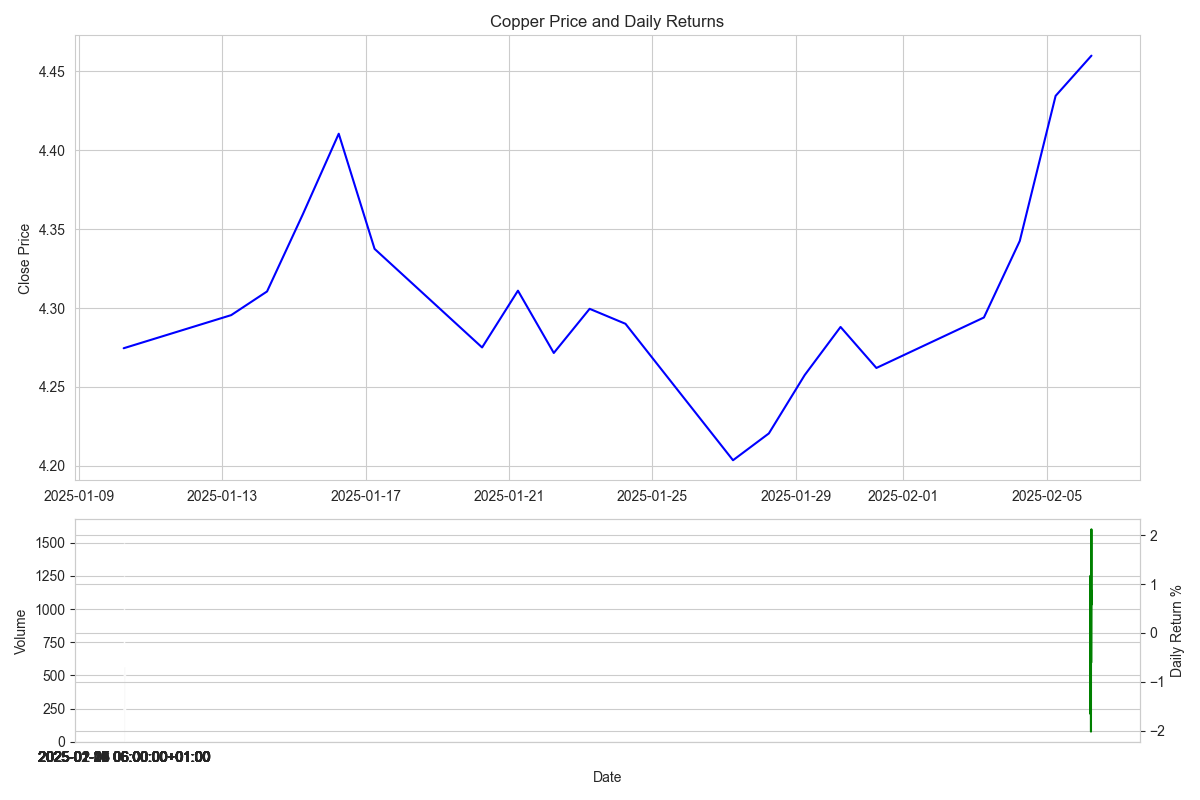

Copper has made a decisive move higher, gaining 4% in the last week to reach 4.4600. The increased trading volume and higher price lows suggest strong buyer conviction.

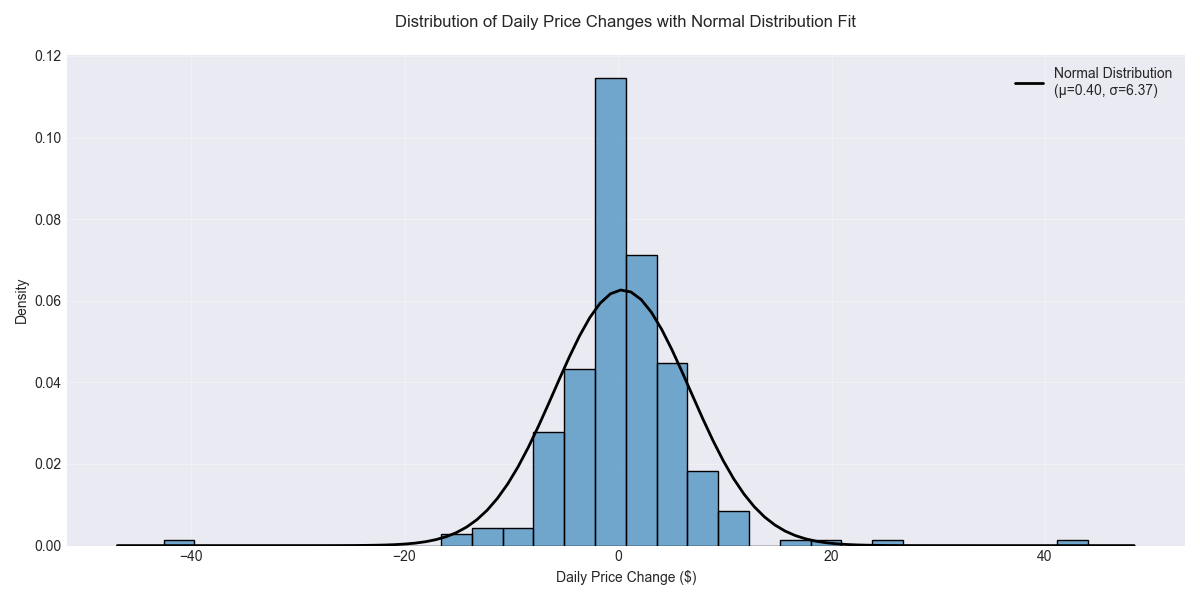

Stock displays robust momentum with 64.11% of trading days above 20-day moving average. Price projections show 70% confidence for movements within $15-20 daily range, offering clear parameters for short-term trades.

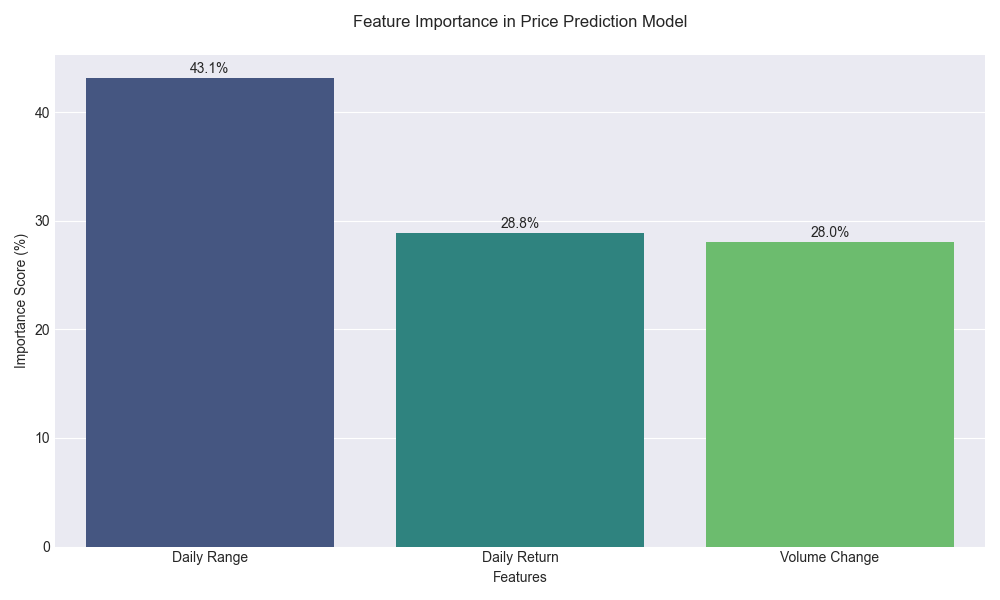

Trading analysis highlights daily price range as dominant factor (43.12% importance) in price movements. Traders advised to set strategic stop-losses near $121-122 support level due to increased volatility.

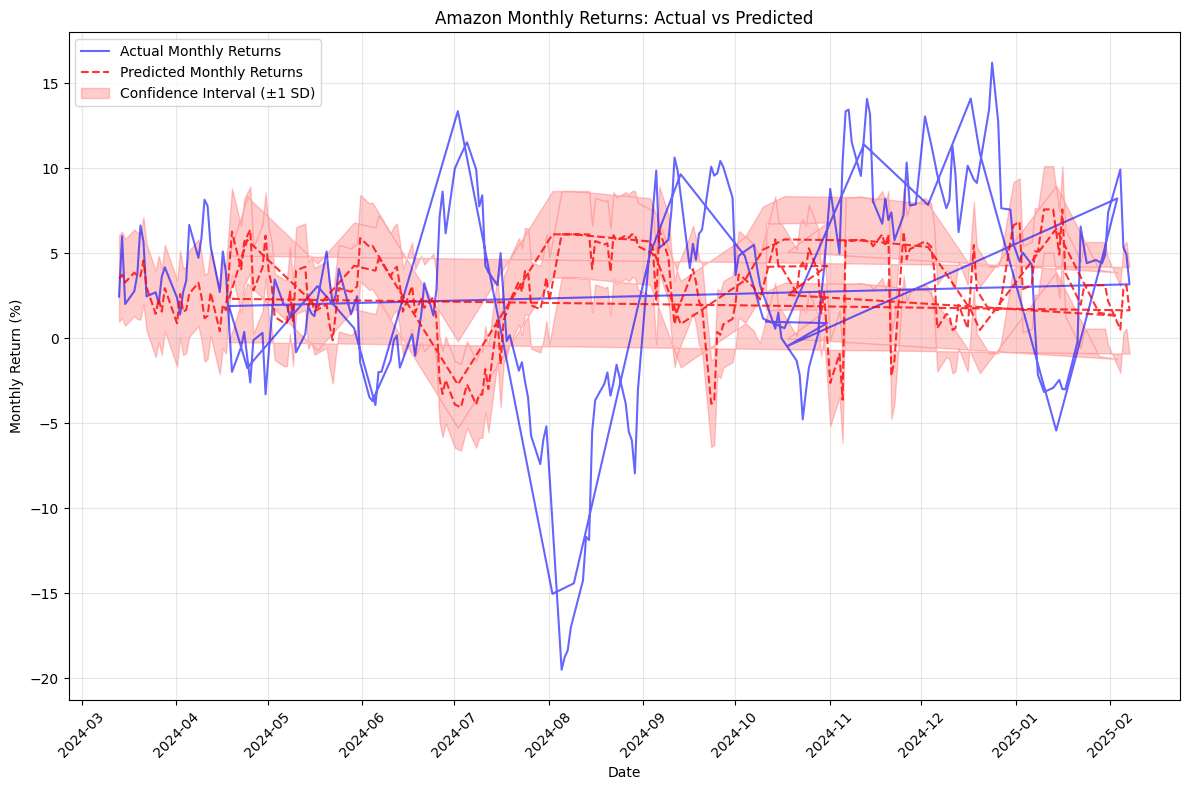

Model forecasts monthly returns between 2.86% and 9.05% with high confidence. Trading volume running 73% above average, indicating strong institutional participation. Elevated volatility at 2.22% daily suggests using scaled entries.