BIGWIG Archive

See all past analysis

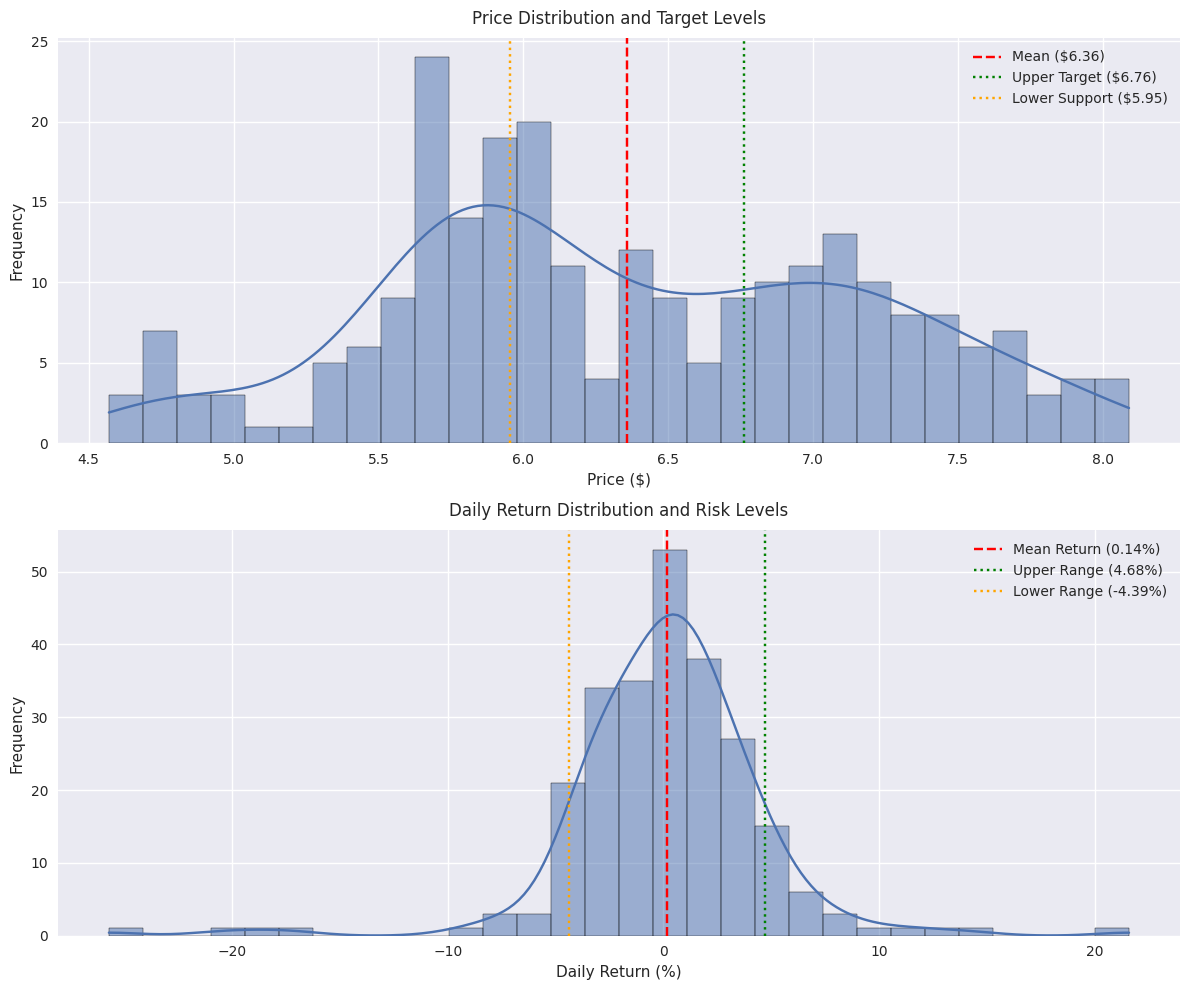

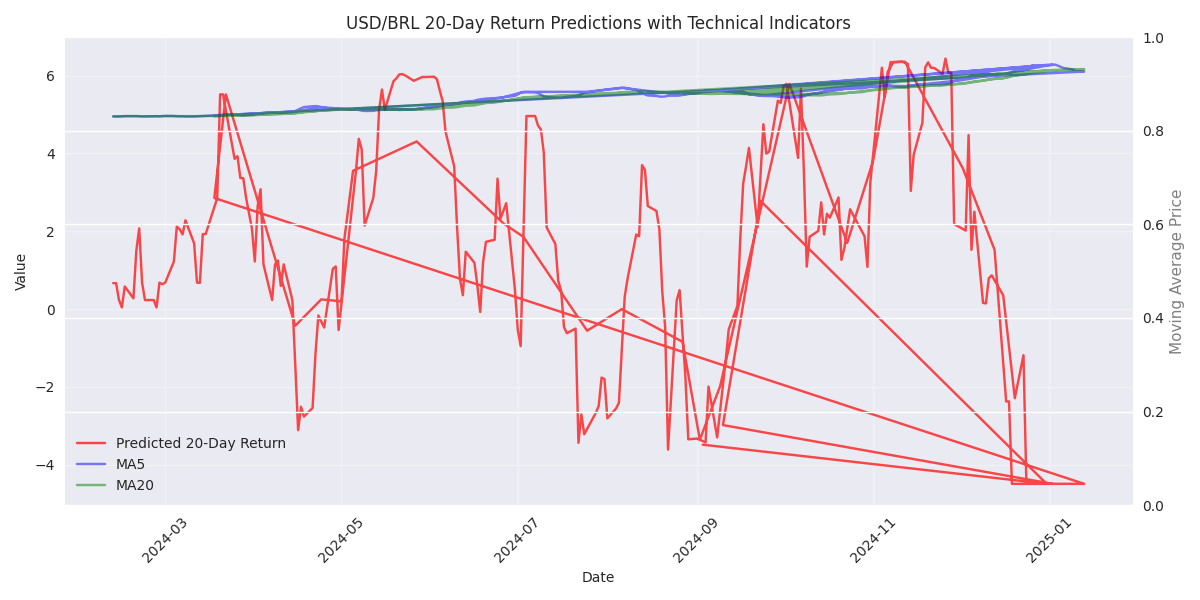

Traders advised to watch $6.00-$6.20 support zone for potential entries. Risk-reward favorable with stops below $5.80 and upside target of $7.00. Model shows 65% probability of reaching targets within a month.

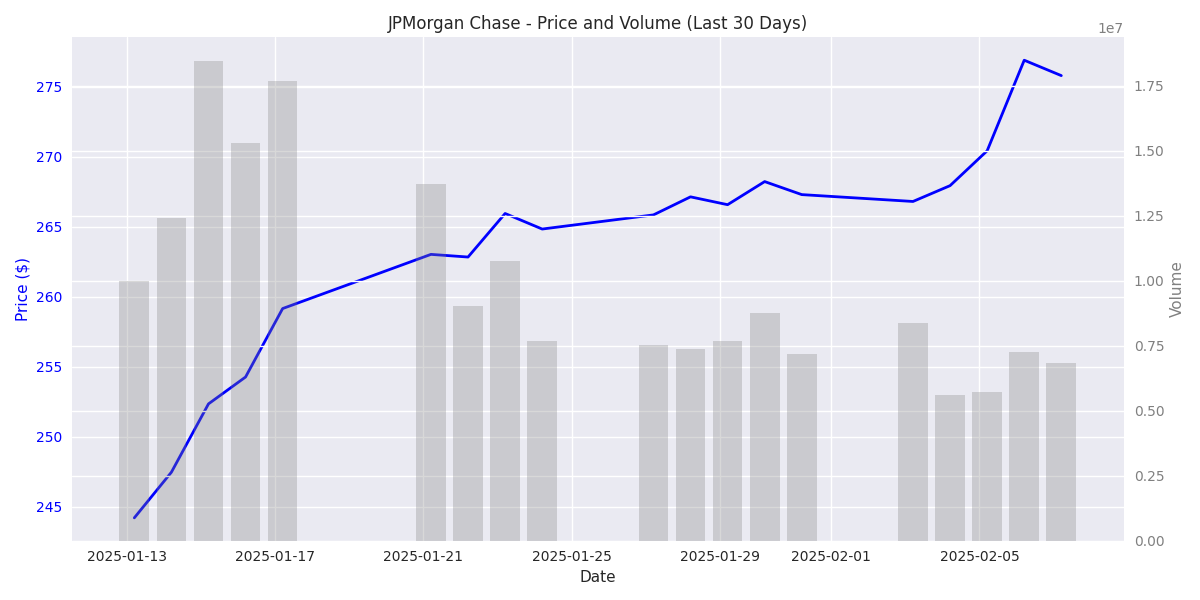

JPM has surged 12.9% in the last month with heavy institutional buying, breaking through key resistance levels. Strong support established at $240.

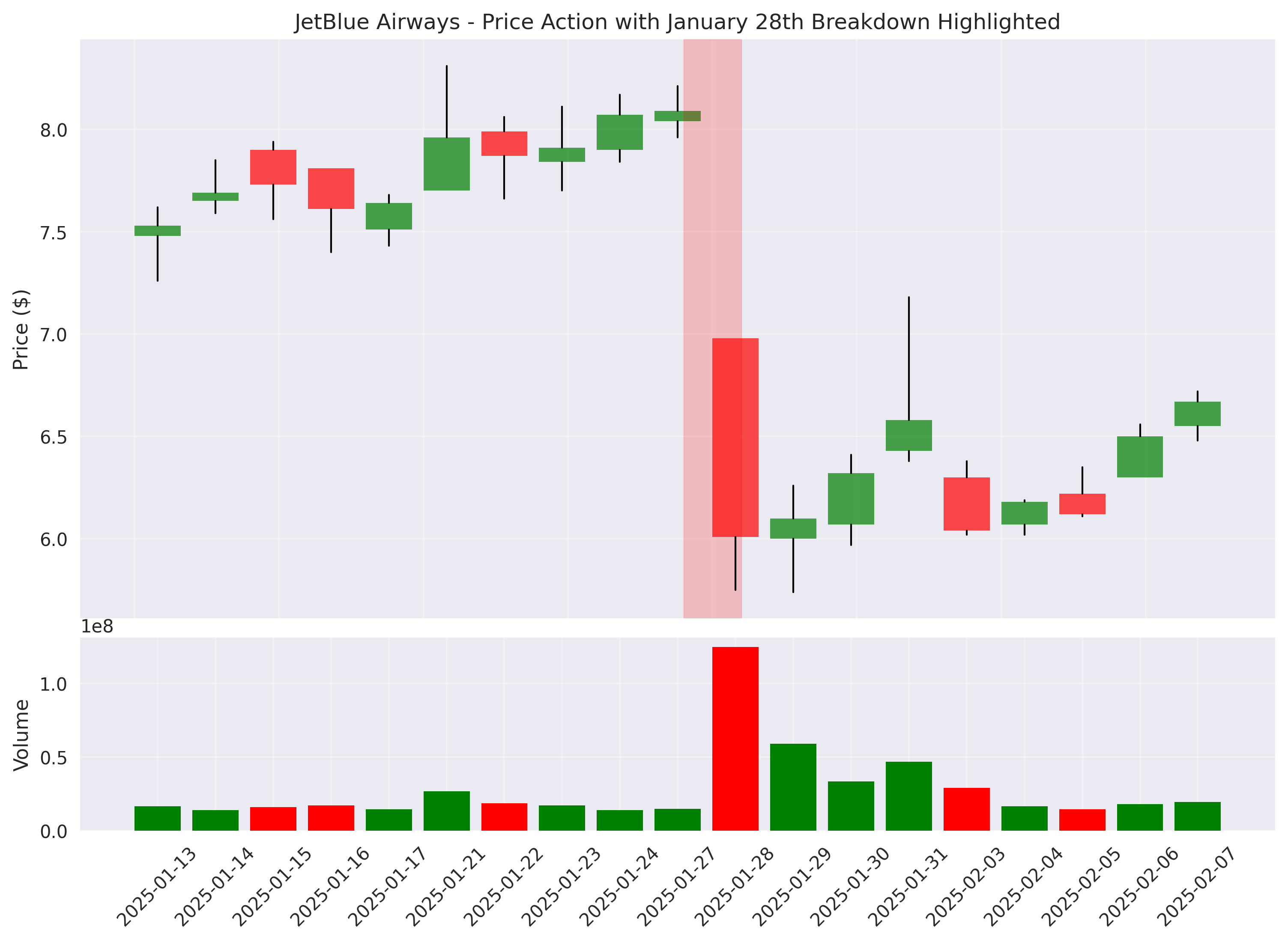

JetBlue shares saw a dramatic 25.7% plunge on January 28th with massive volume spike, but technical analysis suggests potential stabilization. Support forming at $6.00 level could provide entry opportunity.

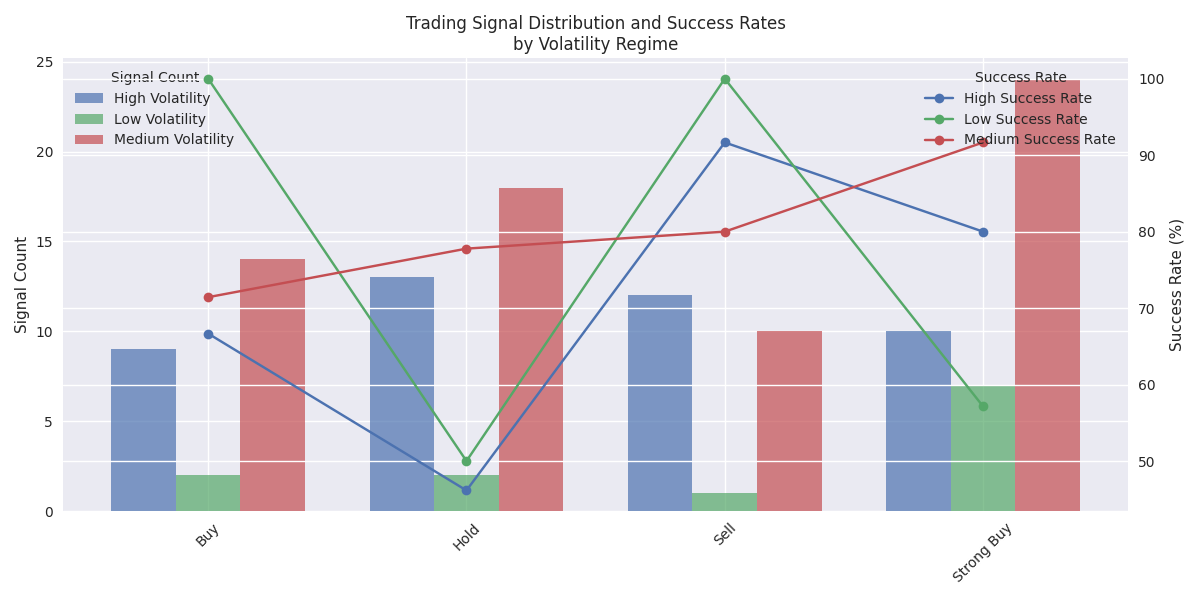

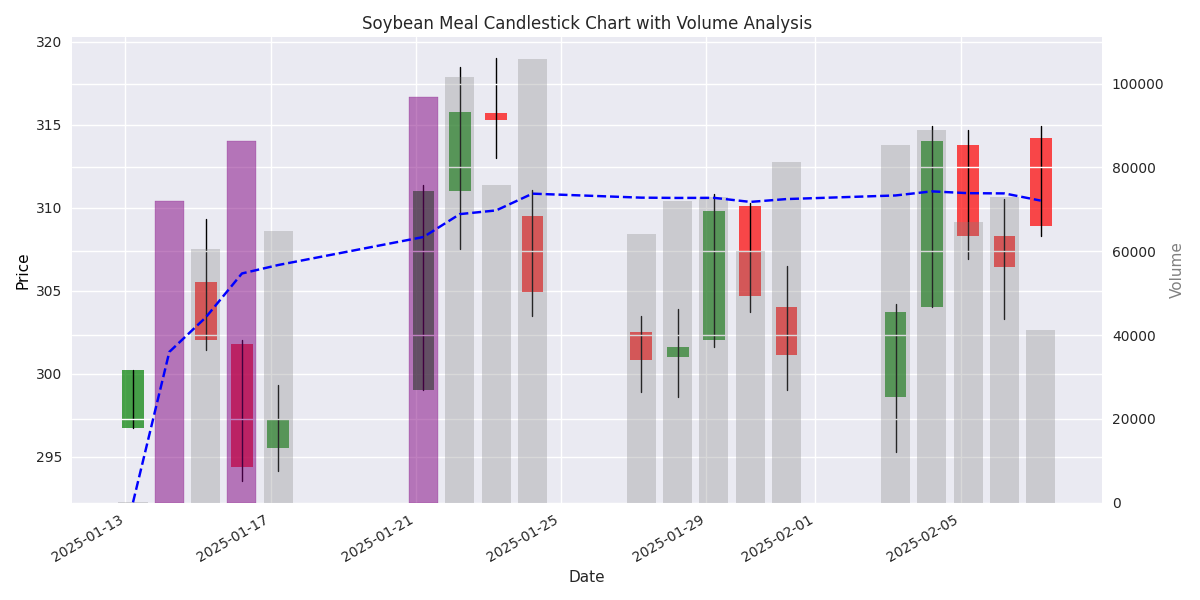

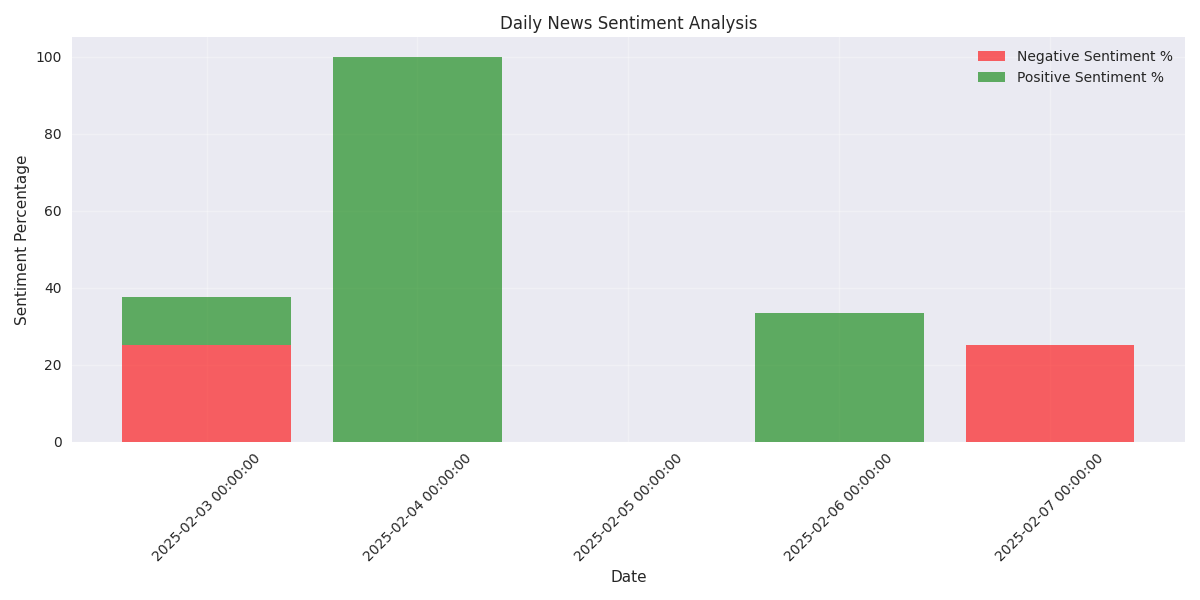

Most profitable trading signals occur when daily price range is between 1.2% and 2.5% with moderate volatility. Strong Buy signals show 82% accuracy with average returns of +0.8% under these conditions.

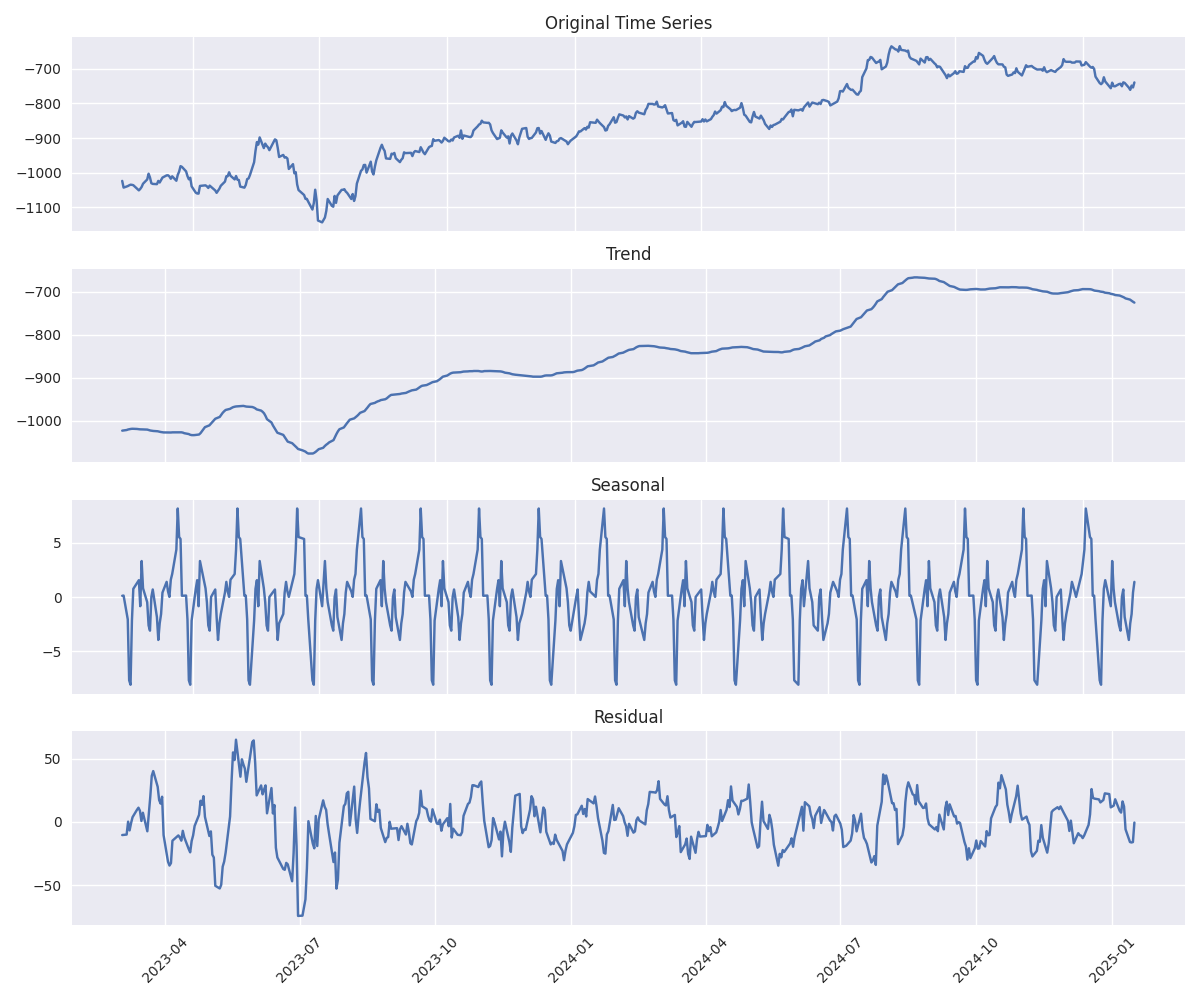

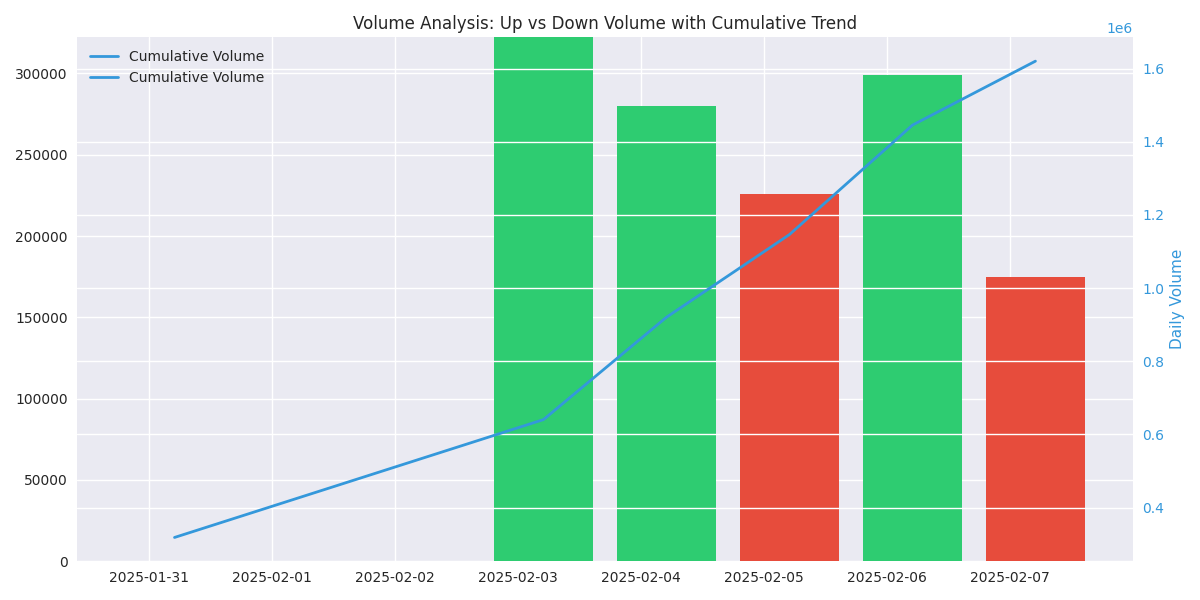

Processing margins show concerning trend, dropping from $1,000 to $750 over the past year. However, recent margin stabilization suggests potential market equilibrium. Higher trading volumes correlate with more predictable price movements.

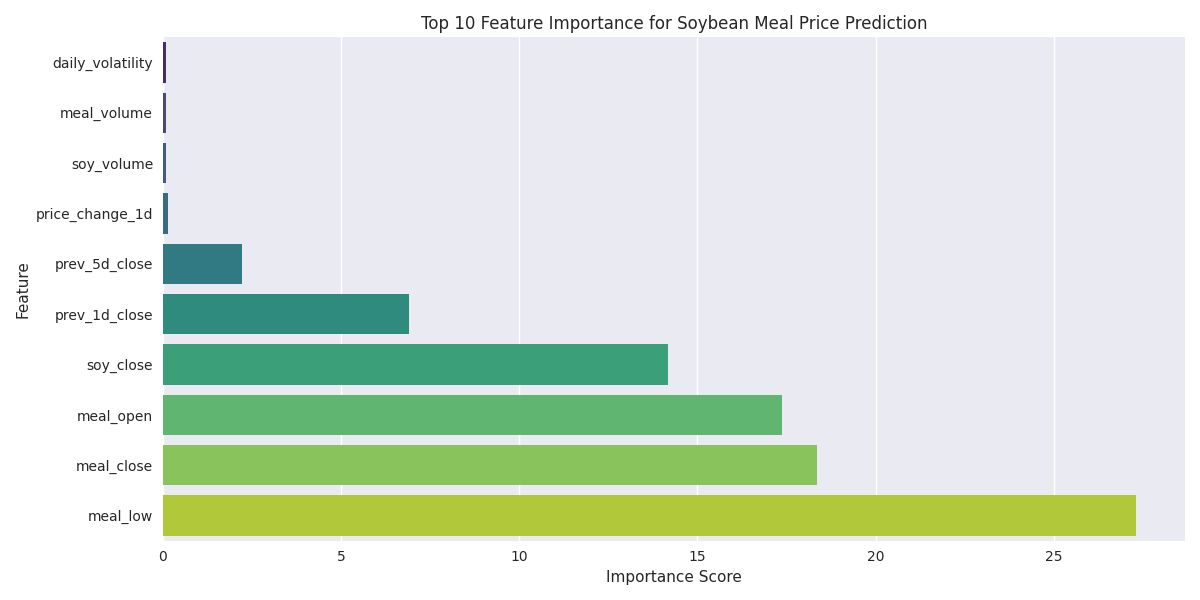

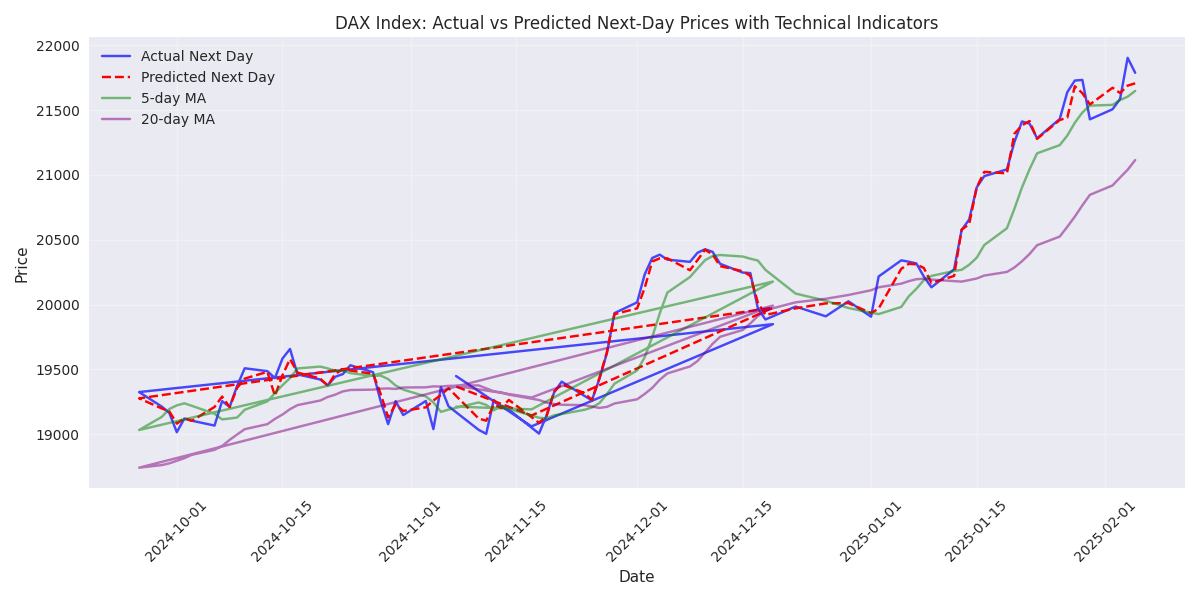

Trading model demonstrates exceptional accuracy for daily predictions with just 3.2 point average error. Best opportunities emerge during low volatility periods with potential returns of +1.16%.

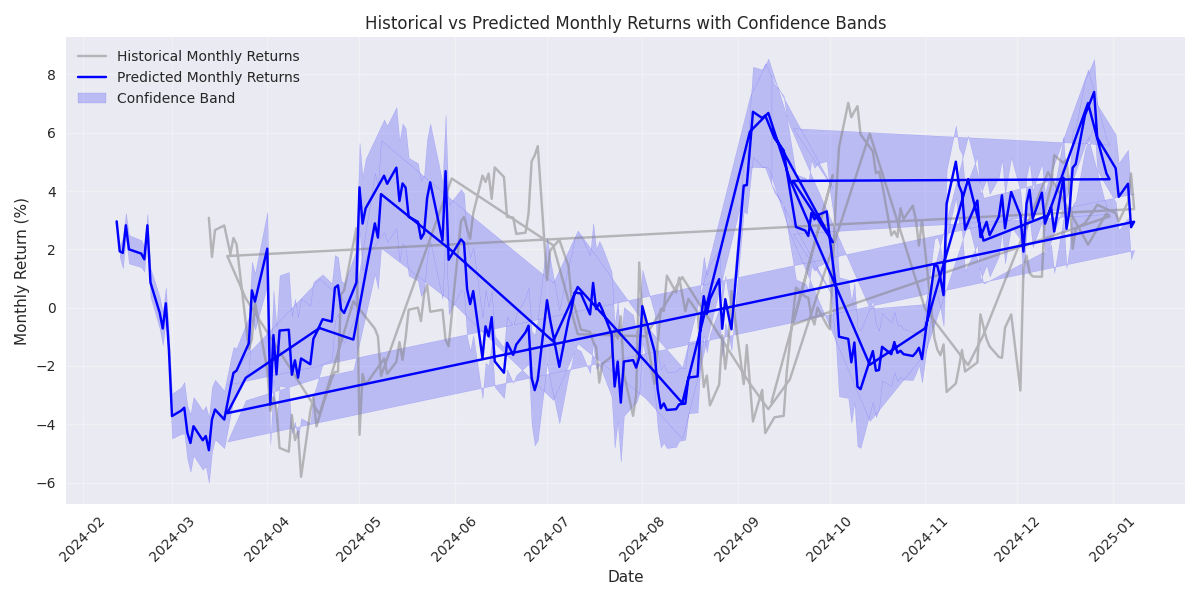

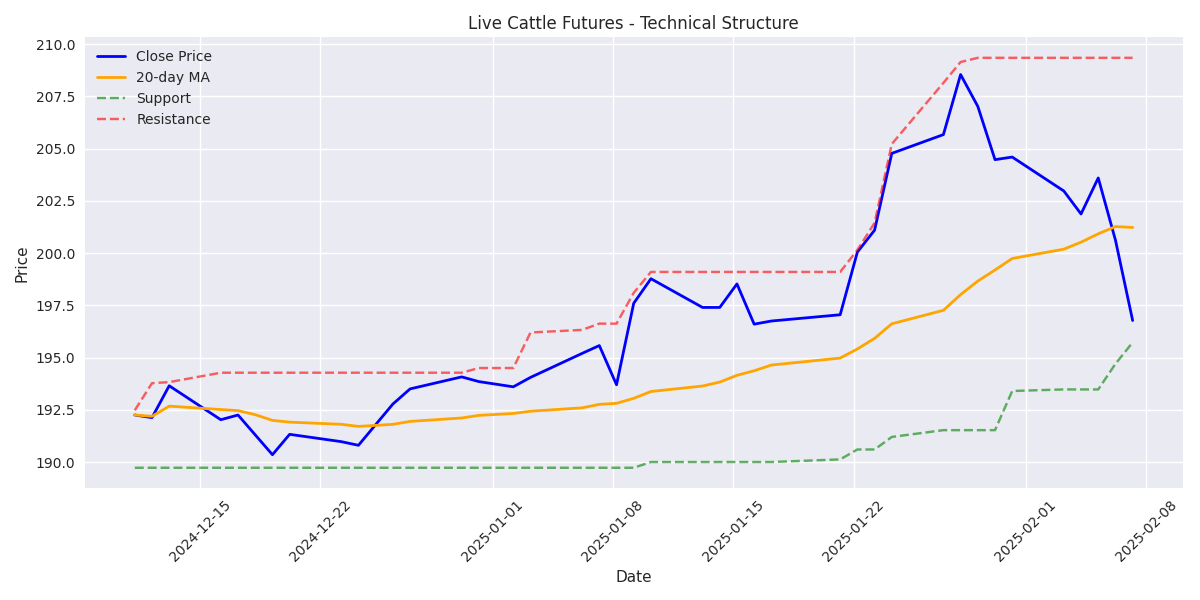

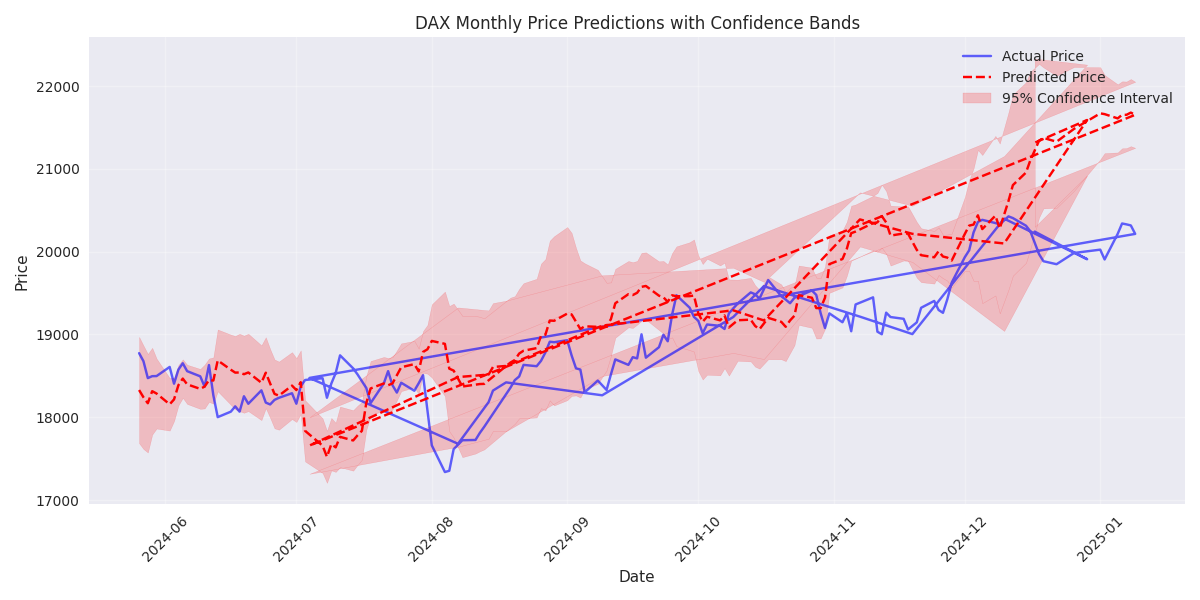

Models project bullish monthly returns of 2.5-7.3%. Key levels to watch: target price 198.50 with stop-loss at 190.80. Success probability rated at 65% based on current market conditions.

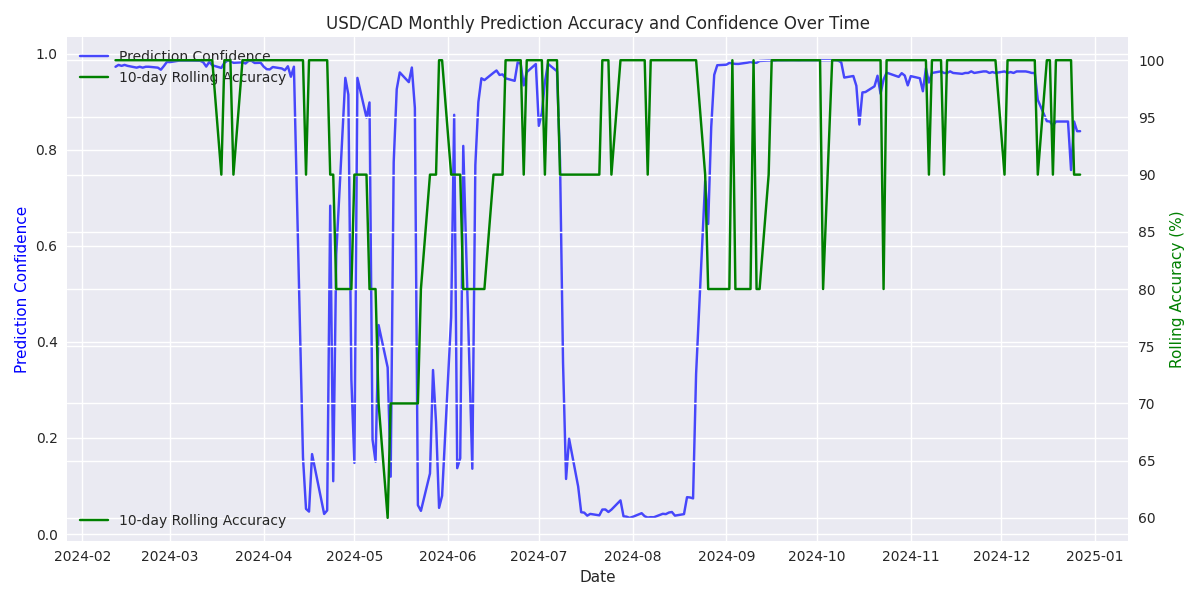

Trading models demonstrate exceptional accuracy with 97.39% normalized accuracy for next-day predictions. Analysis suggests continued momentum with price stability being a key factor. Recent price action and volatility patterns remain primary drivers.

Despite recent price declines, stronger buying volume versus selling volume suggests institutional accumulation. Declining overall volume indicates selling pressure may be exhausting, setting up potential reversal.

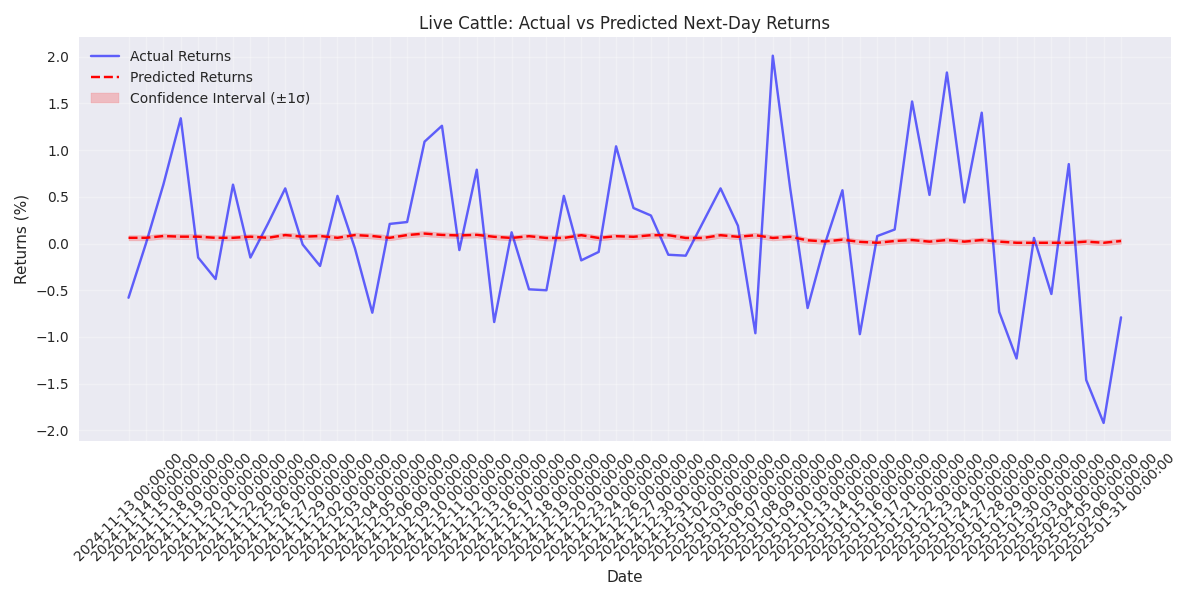

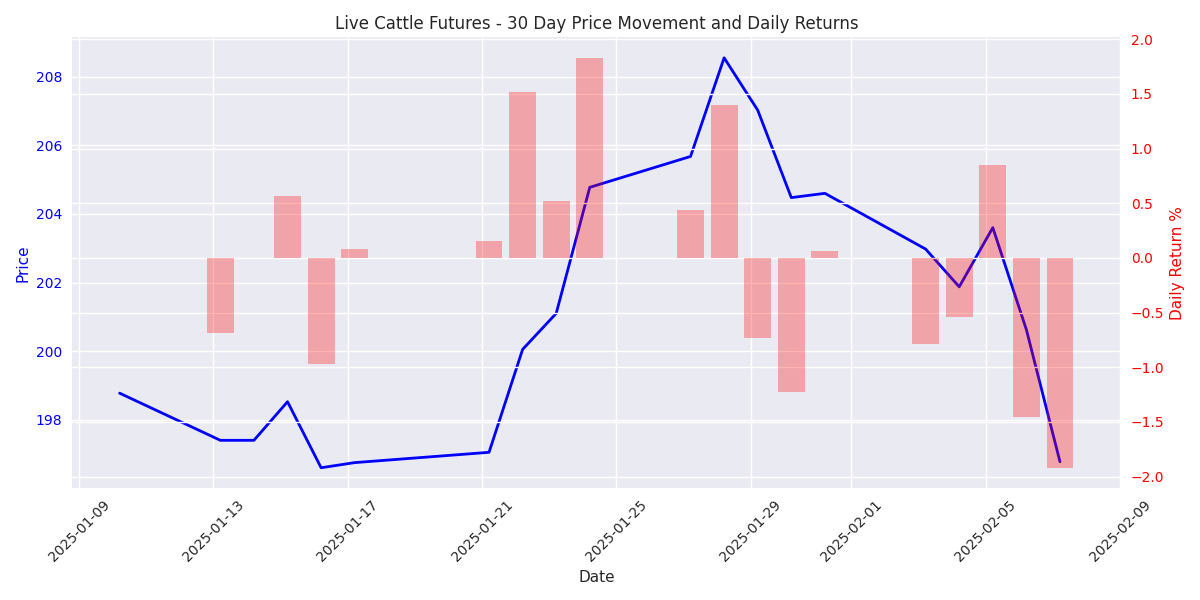

Despite recent bearish trend, models predict a potential short-term bounce with 0.37% expected return next day. Weekly outlook suggests returns of 0.9% to 1.6%. Recommended strategy: Look for entries near support with tight stops.

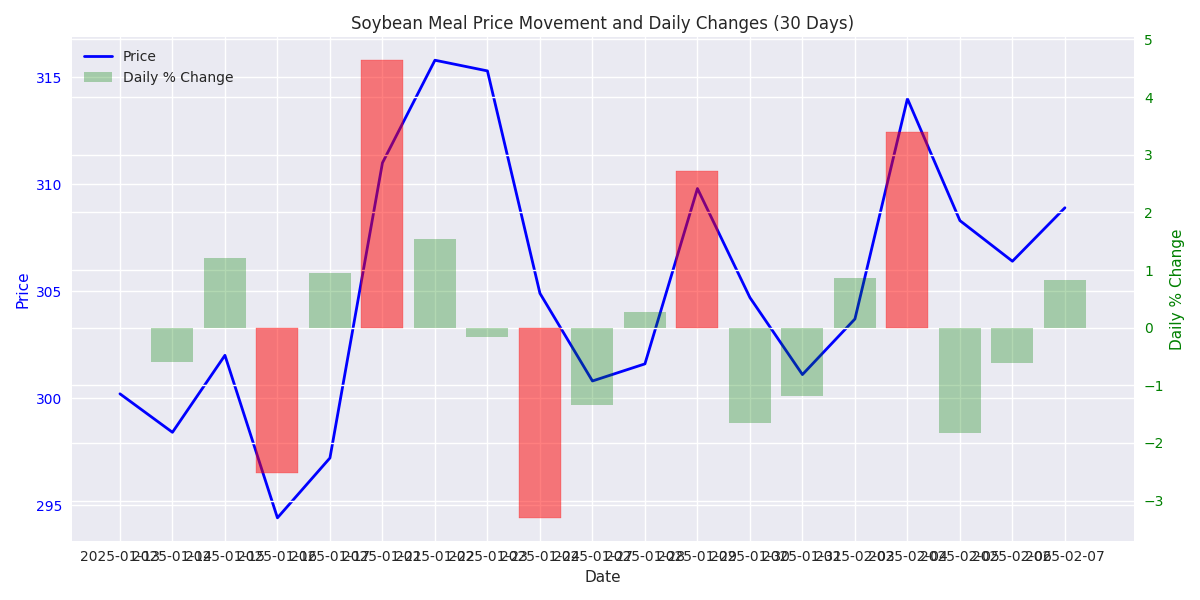

Traders should watch key support at 296.90 and resistance at 309.50. Recent bullish breakout to 314.00 backed by substantial volume suggests further upside potential. Consolidation phase now testing previous resistance as new support.

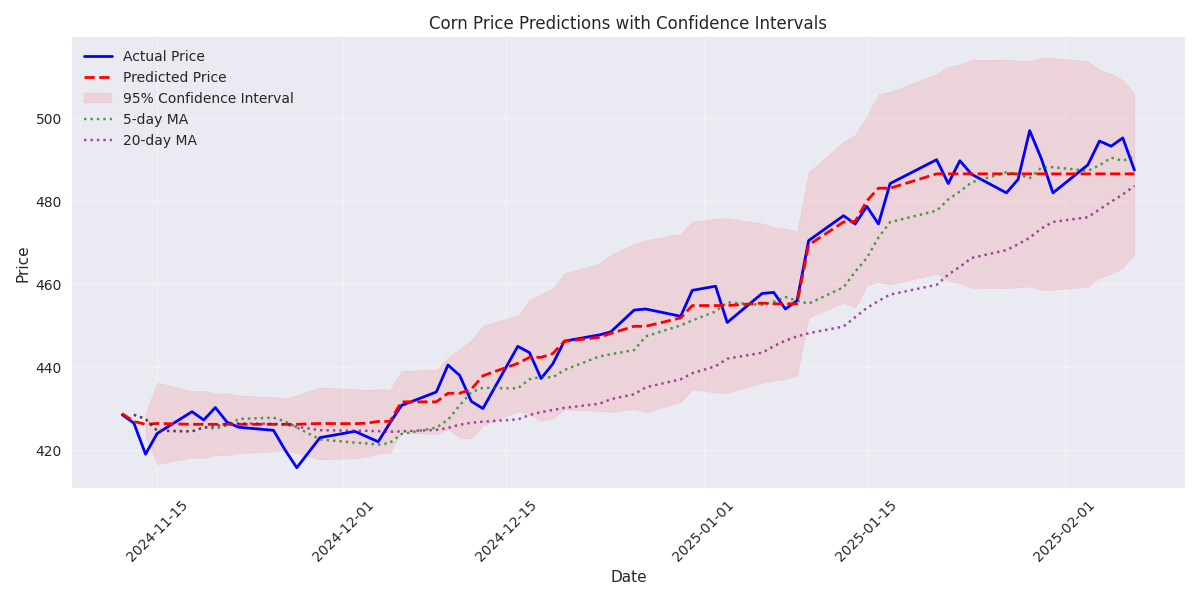

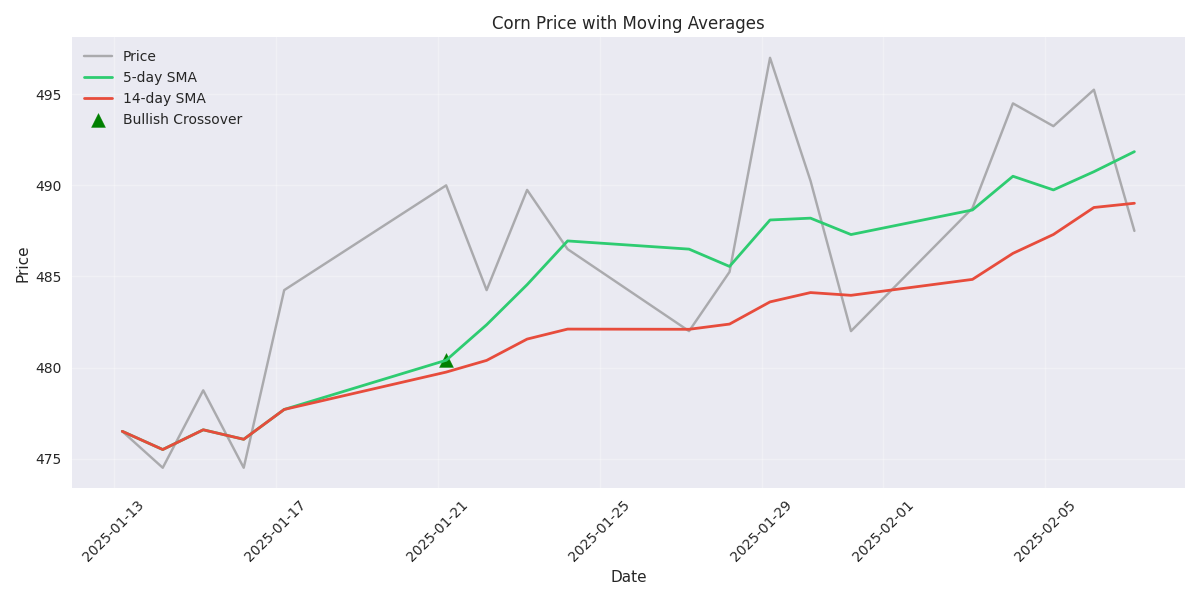

Despite recent volatility, corn maintains its bullish momentum with the 5-day moving average above the 14-day average. Short-term swings from -1.68% to +2.42% present tactical trading opportunities.

Traders should watch the crucial support at 194.70 - a break below could trigger further selling. Key resistance sits at 209.35. The widening price range suggests increased volatility ahead.

Soybean Meal shows decisive bullish action with a 5.46% monthly gain and recent breakout above 309.50. Strong institutional buying evident with nearly 89,000 contracts traded during the breakout session.

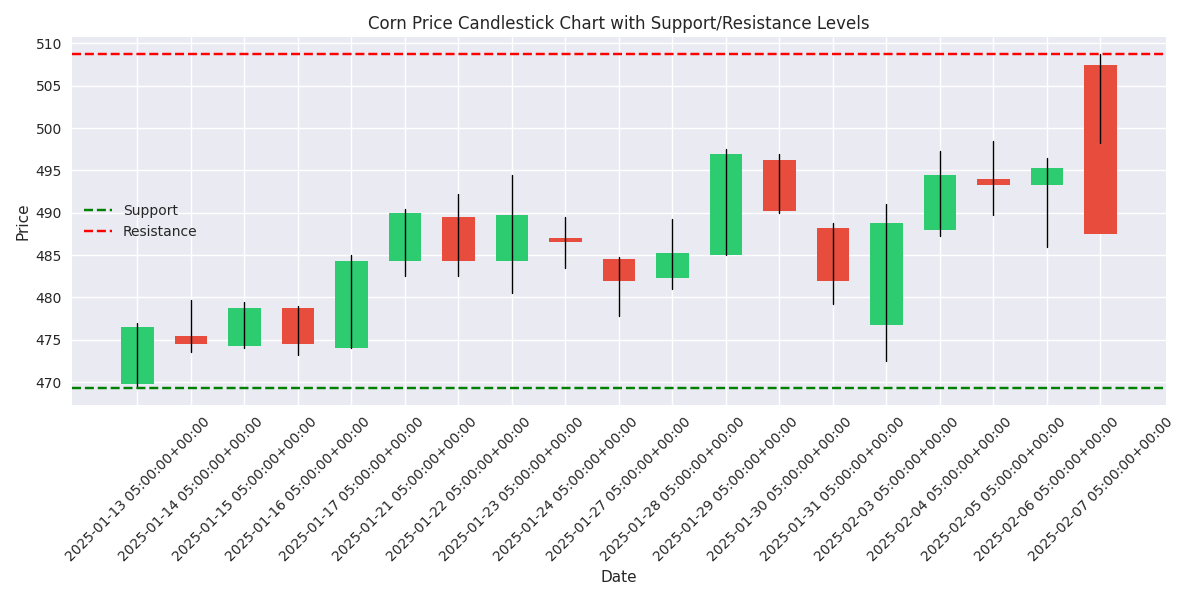

Corn futures saw their biggest single-day decline of -3.94% on Feb 7, but strong support levels at 470-475 could provide a floor for prices. Key resistance sits at 495-500, creating a clear trading range for market participants.

Live Cattle futures have taken a sharp bearish turn, dropping 3.35% in the past week. Heavy selling volume of 23,857 contracts in the latest session signals strong institutional selling pressure.

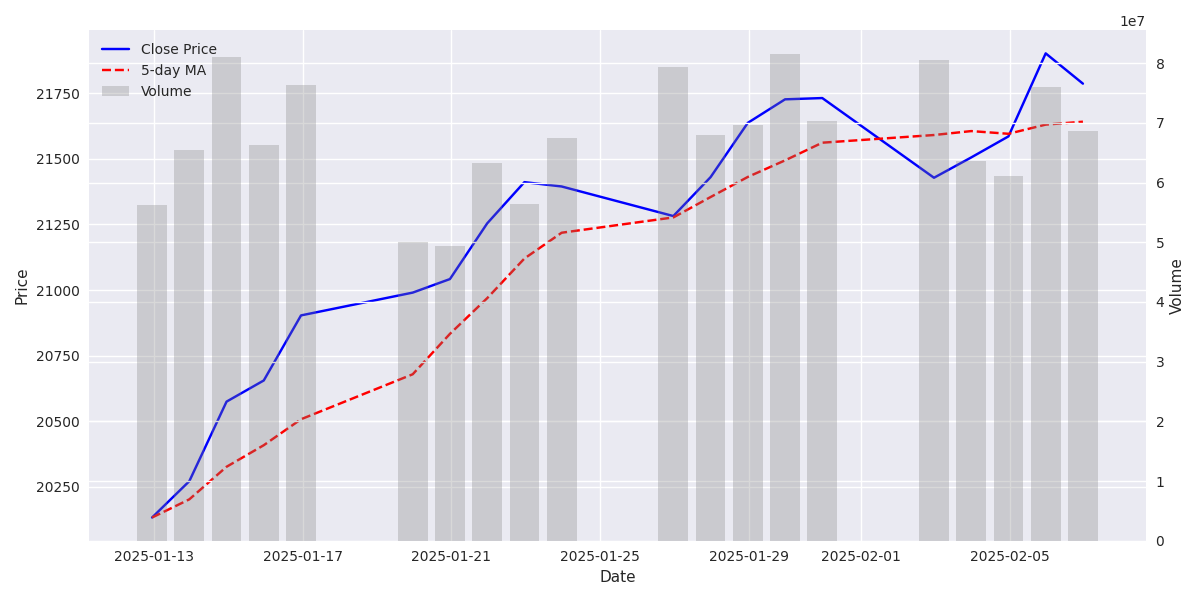

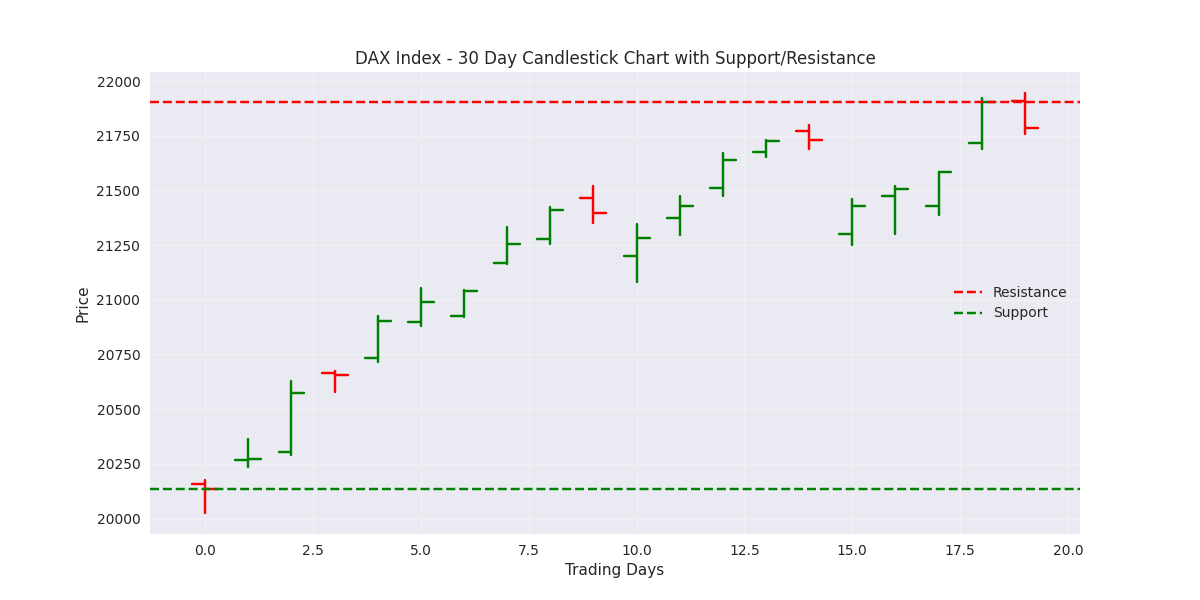

Models project 6.4% gain over next month with strong technical support at 20,192. Declining volatility and increasing volume support bullish outlook.

Technical models show high probability of continued upside, with momentum indicators remaining strong. Risk factors include increasing daily volatility - suggesting tighter stop-losses needed.

Bearish sentiment rising with 25% negative news coverage and no positive reports in latest session. However, institutional buying remains steady, suggesting underlying strength.

DAX approaching crucial resistance at 21,902 - breakout could trigger significant upside. Strong support base at 20,132 provides clear stop-loss level for long positions.

Monthly analysis reveals a dominant bullish trend with 74.24% upward movements. Model shows exceptional 97.83% accuracy in monthly predictions, suggesting high reliability for longer-term positioning.

FORECAST: Models predict bearish pressure intensifying over longer timeframes. While daily moves remain contained (-0.85% to +0.80%), 20-day outlook shows potential for 4-7% decline. Model accuracy strongest for longer-term predictions with 0.76% MAE.

DAX shows strong upward momentum with 2.8% gain over past week, despite profit-taking in latest session. Heavy trading volume supports price action credibility.