BIGWIG Archive

See all past analysis

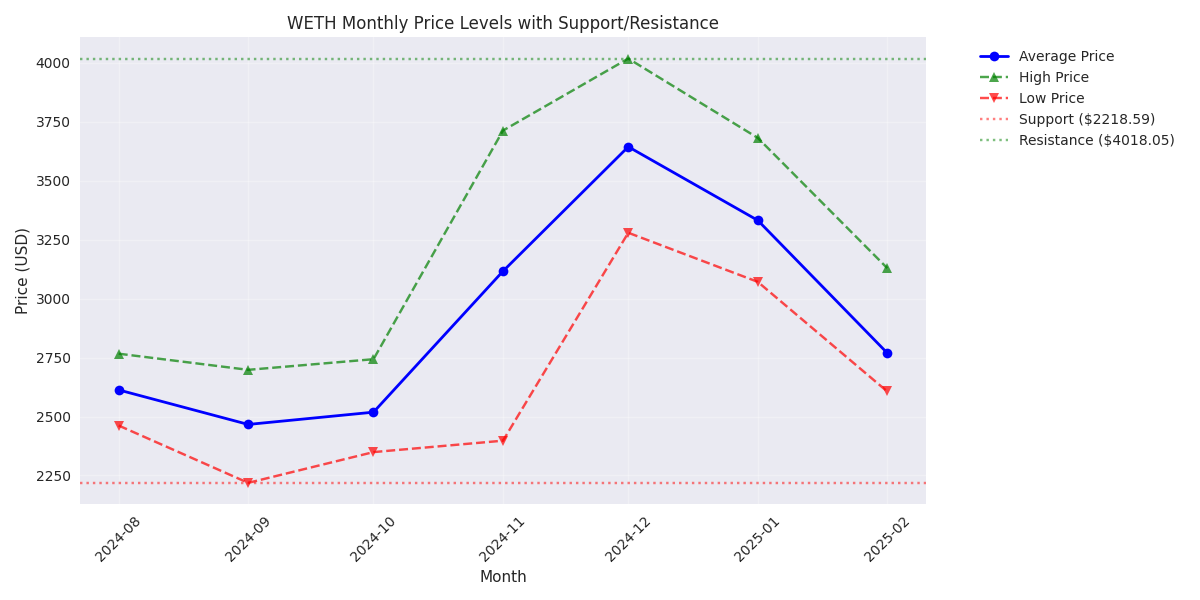

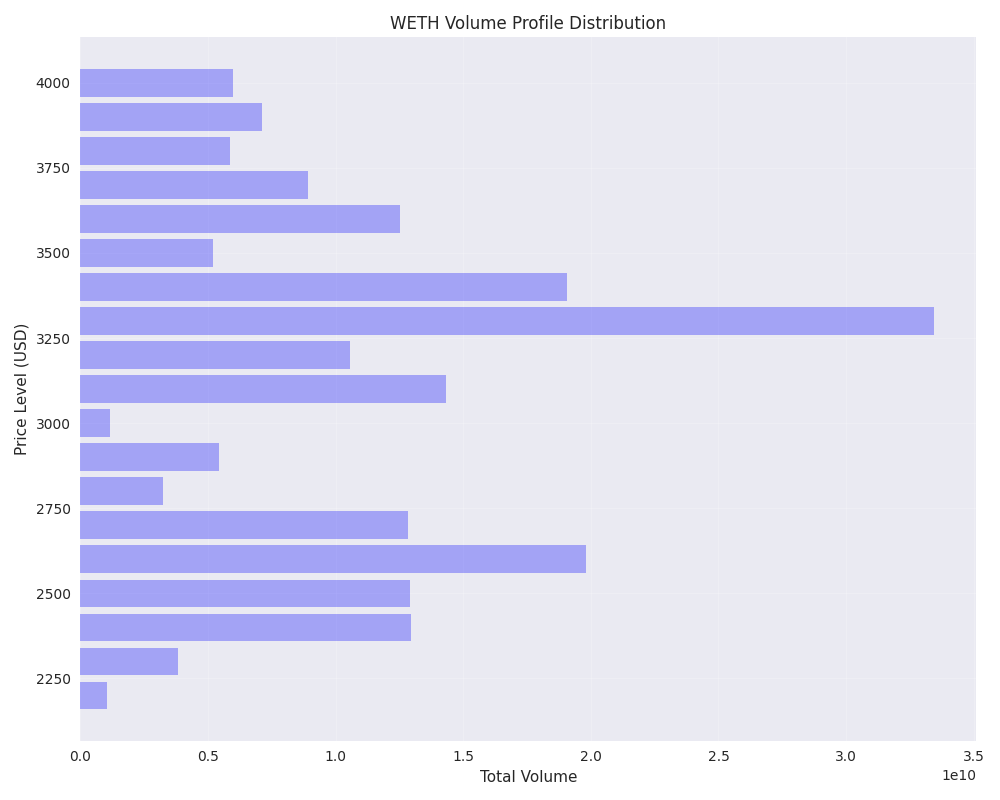

Key support level established at $2,218 from September double bottom pattern, with growing market interest shown by 118% volume increase since September.

WETH has entered bear market territory with a dramatic 20% plunge to $2,624, but massive volume spike to 2.5B suggests potential capitulation point.

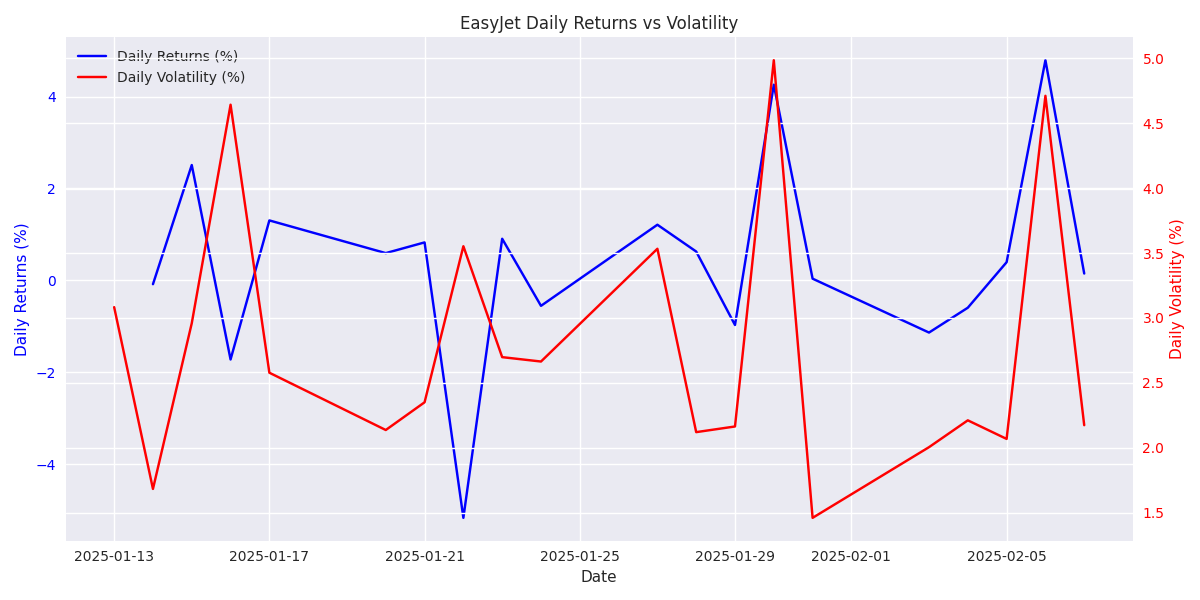

Trading opportunity emerges as volatility hits 3.78% peak with signs of oversold conditions, though traders should exercise caution amid continued downtrend.

Stock delivers consistent positive returns averaging +0.39% daily with healthy 2.79% volatility, supported by robust daily volume of 6.01M shares.

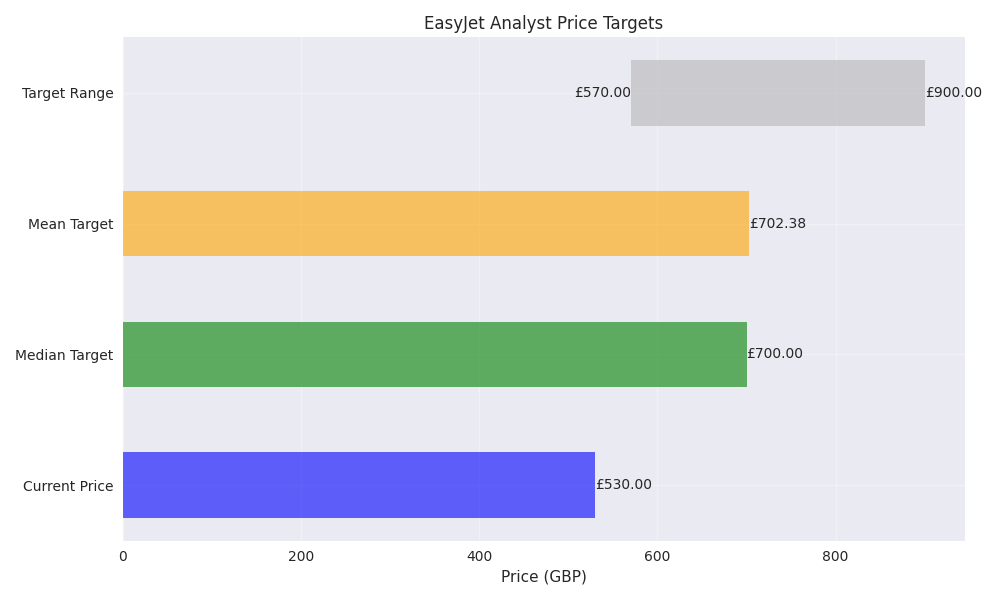

Analysts project significant upside with mean target of 702.38 (+32.5%), backed by zero sell ratings and a strong consensus around 700 level.

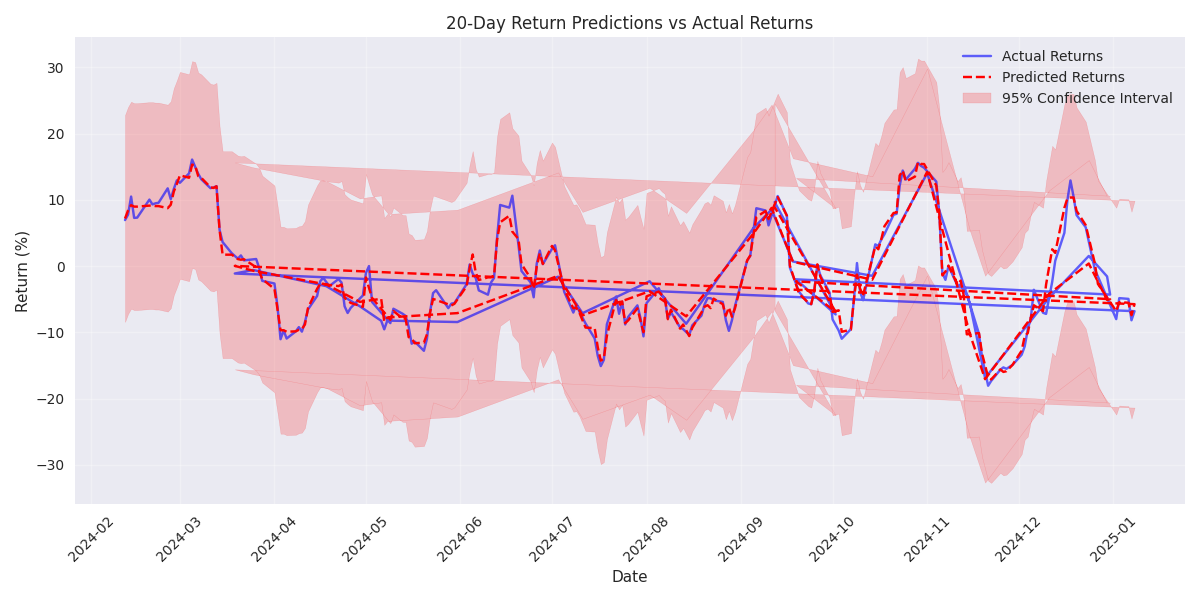

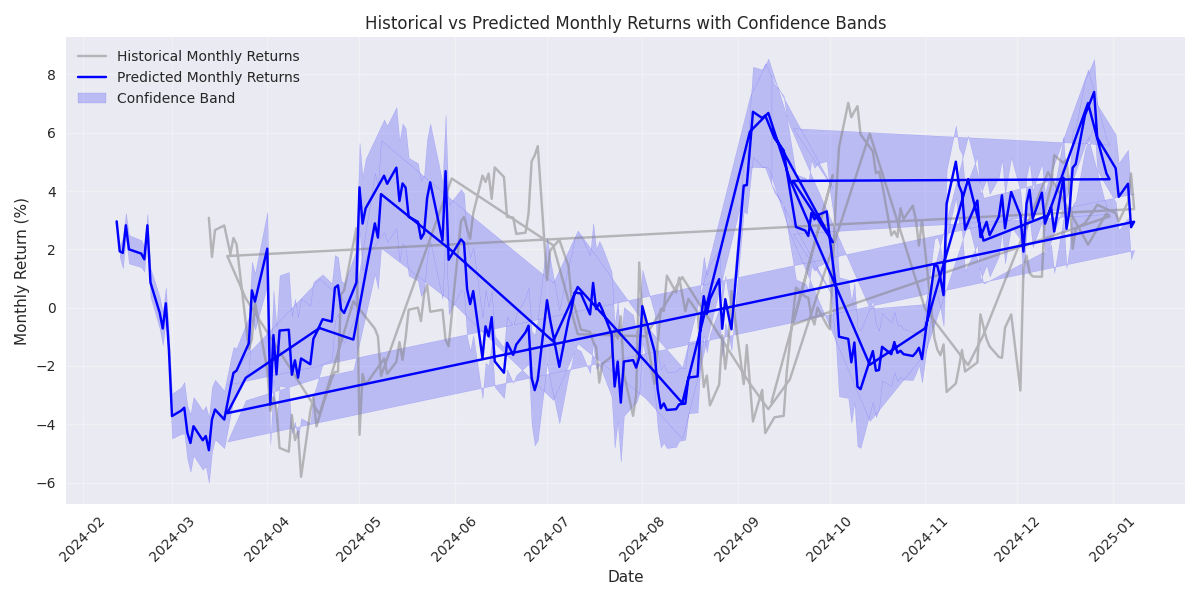

Bearish monthly outlook with predicted -0.71% decline. Technical indicators show weakening buying pressure and increased volatility, suggesting profit-taking opportunities.

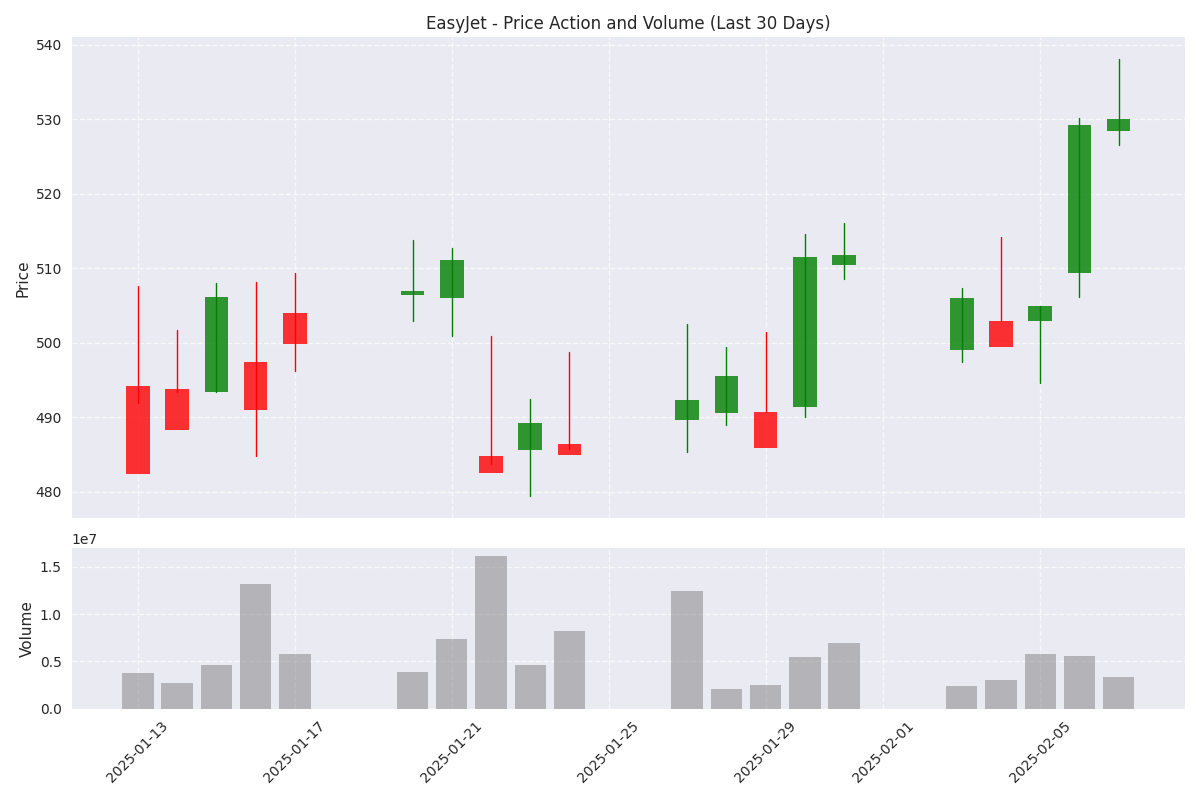

EasyJet shares hit key resistance at 530 after a 4.79% surge, with wide daily ranges of 10-24 points offering prime day trading conditions.

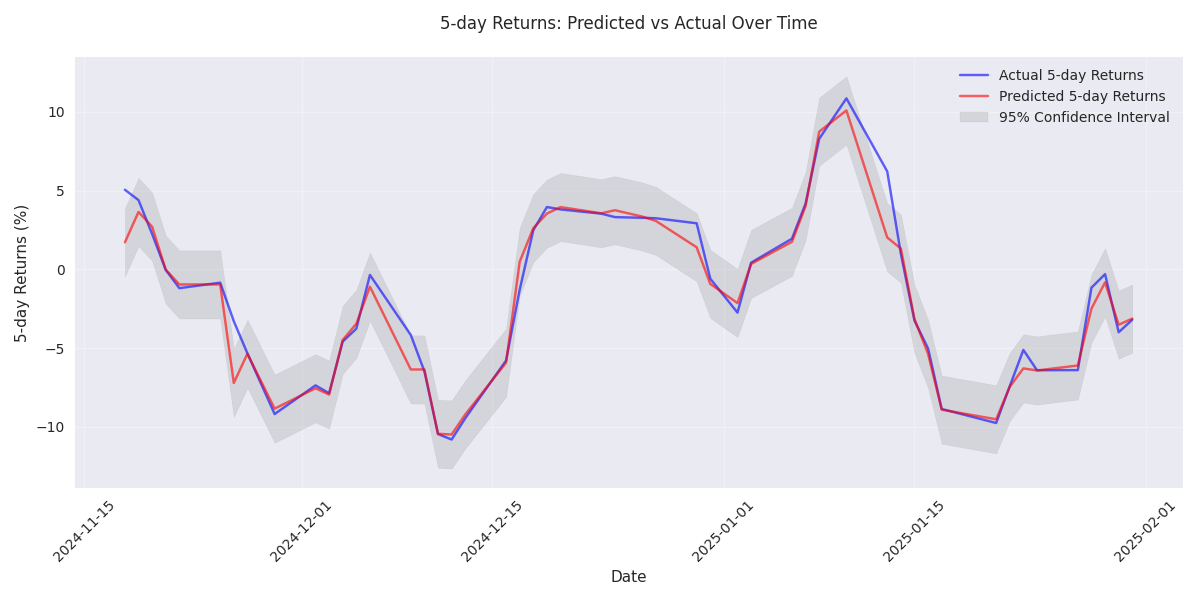

Models predict a substantial 3.32% gain next week with high confidence levels. Heavy buying volume supports bullish outlook, making this an attractive entry point for traders.

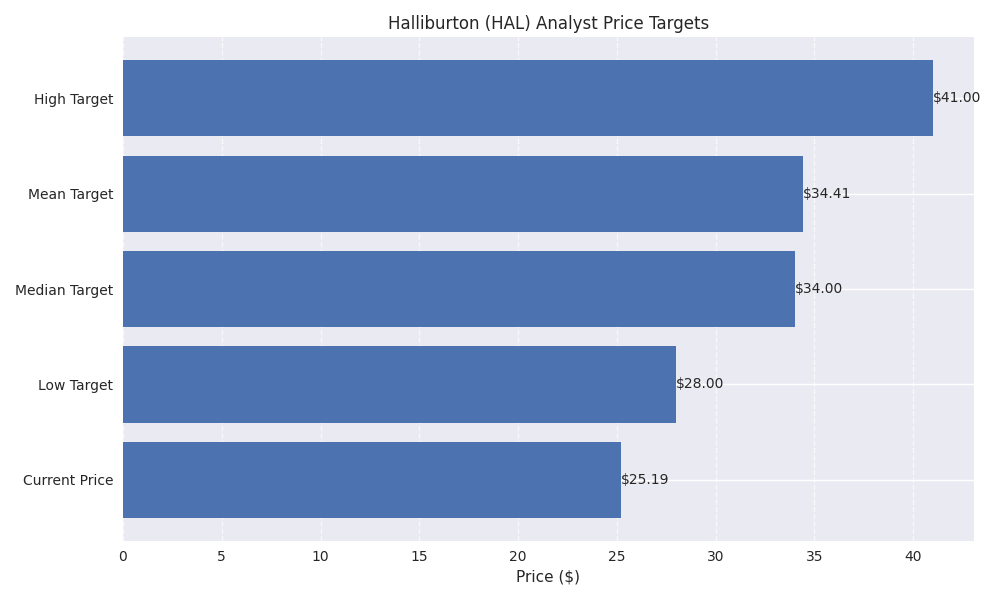

Stock currently at critical juncture with strong support levels and active trading volume. Analyst consensus target of $34.41 suggests significant upside potential, while recent Petrobras contract win adds fundamental strength.

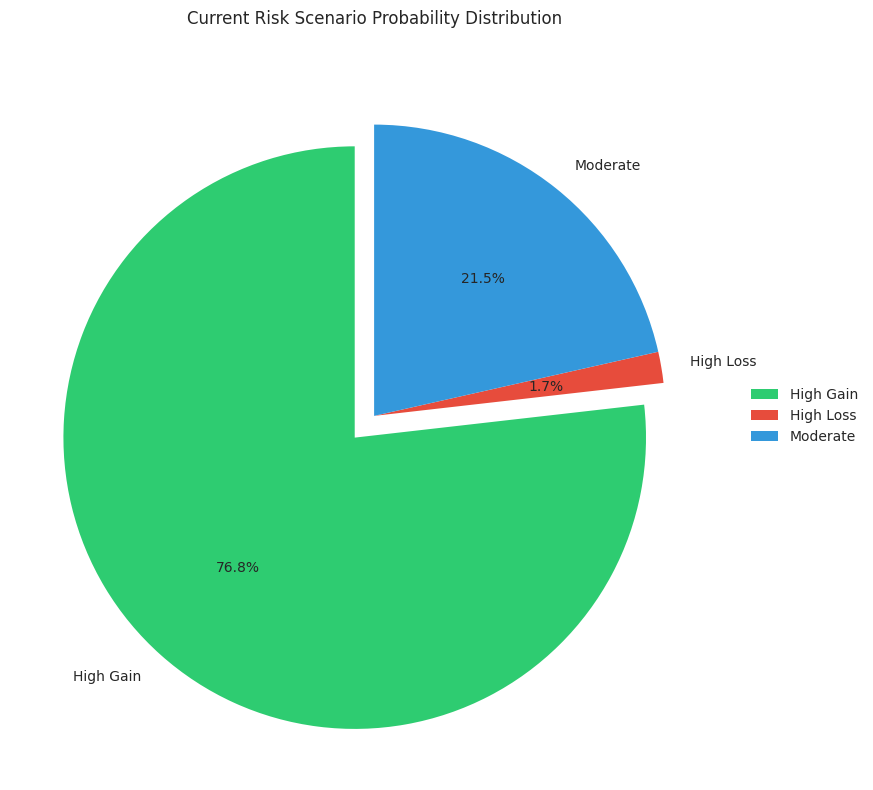

Current setup shows 77% probability of significant gains versus just 1.7% risk of major losses. Volume patterns strongly align with previous profitable periods.

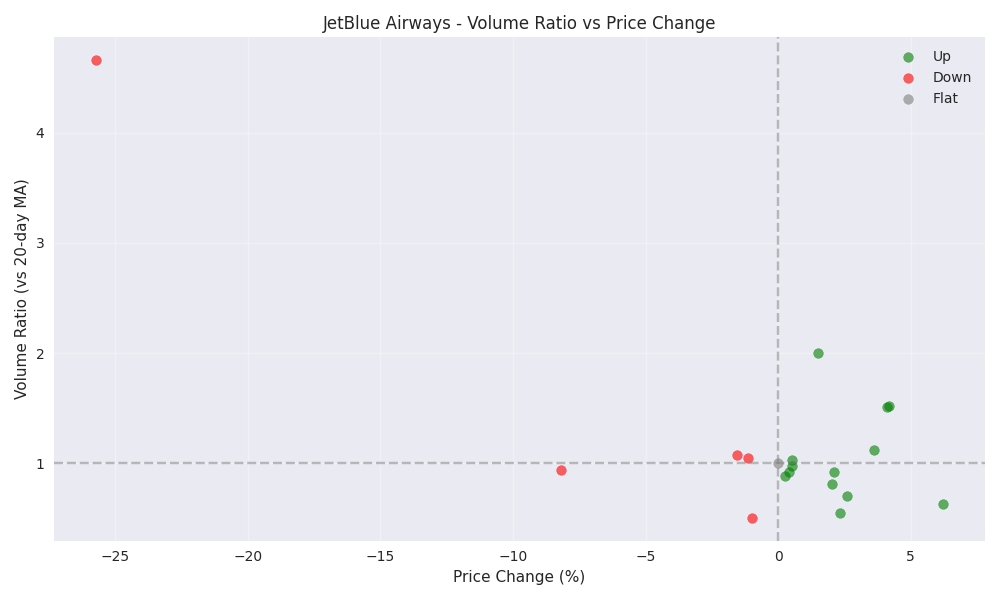

Recent sessions show stronger volume on up days, suggesting possible institutional accumulation. While overall volume has declined to 0.73x the 20-day average, the volume-price pattern indicates controlled buying.

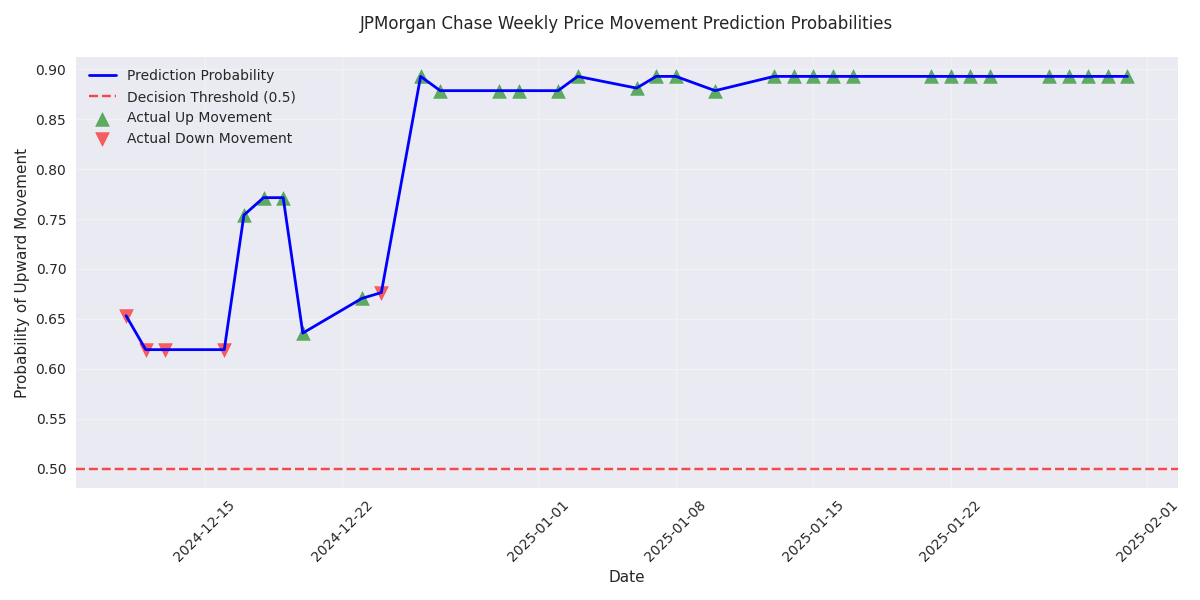

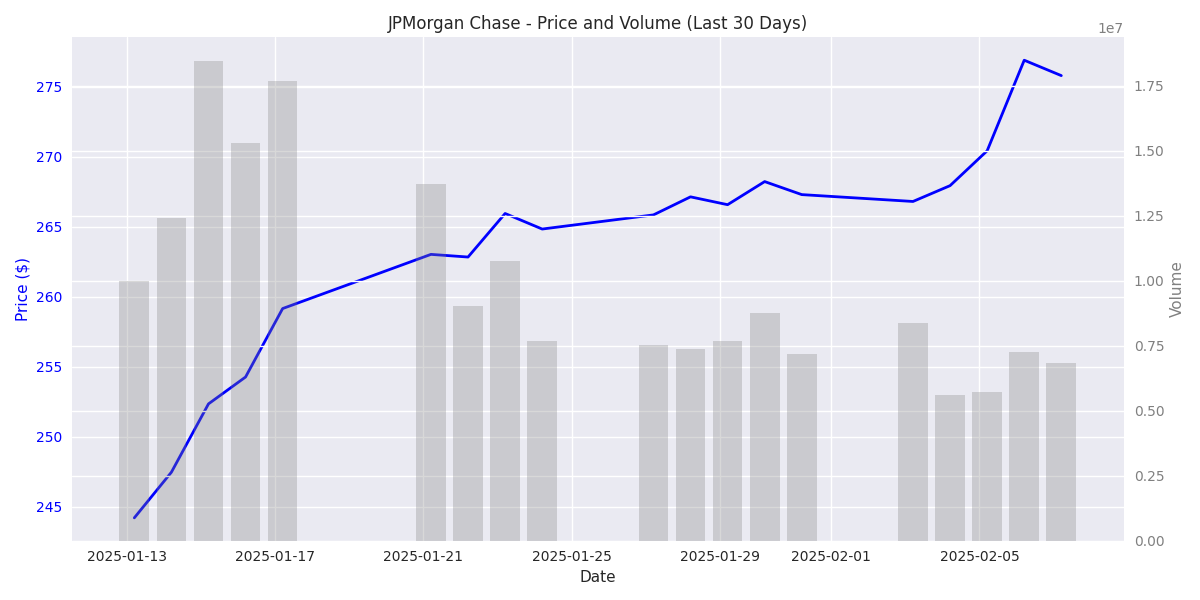

Predictive models signal strong buy opportunity with exceptional 91.6% accuracy on weekly trades. Price consolidating between $262-$268, suggesting imminent breakout.

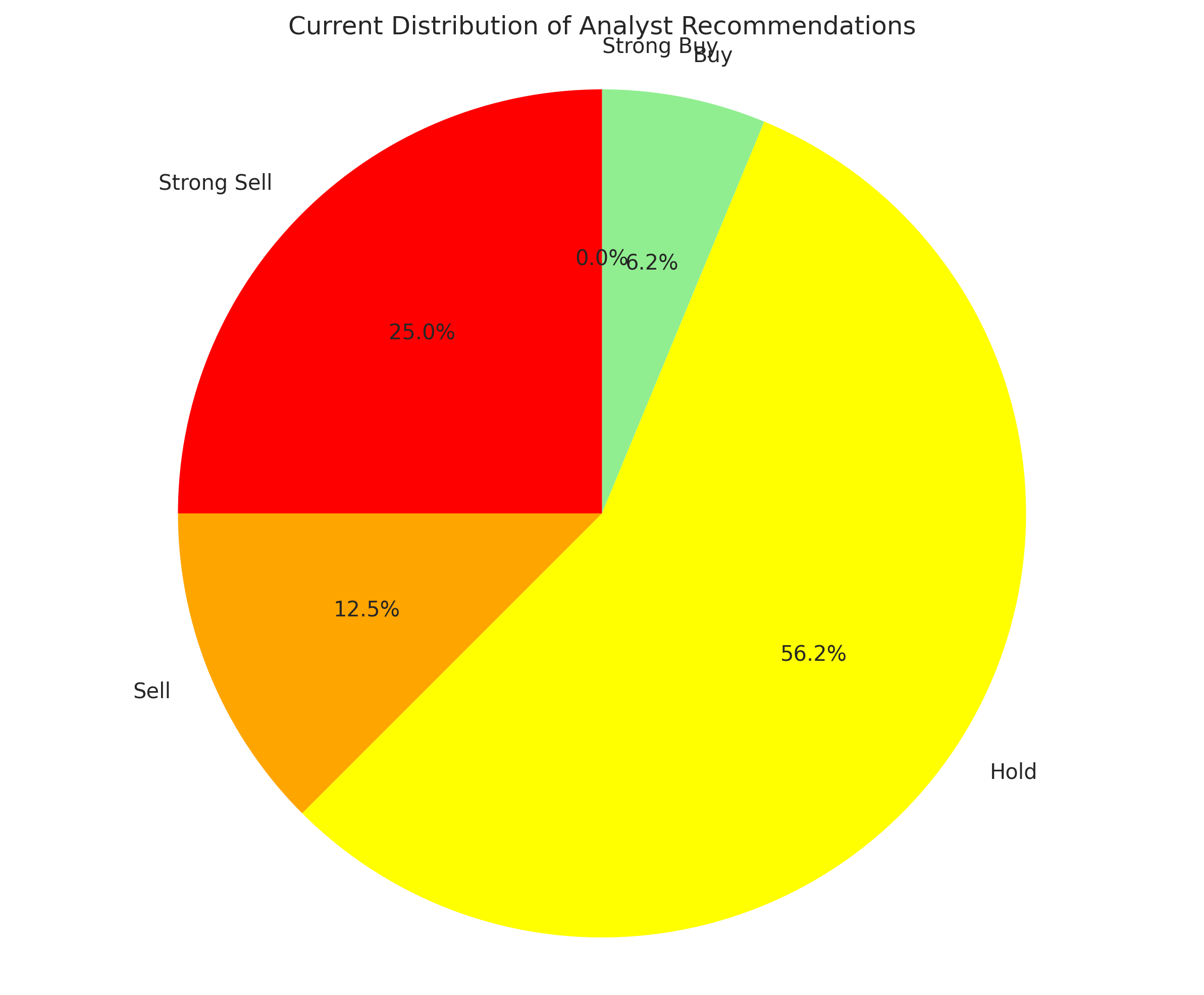

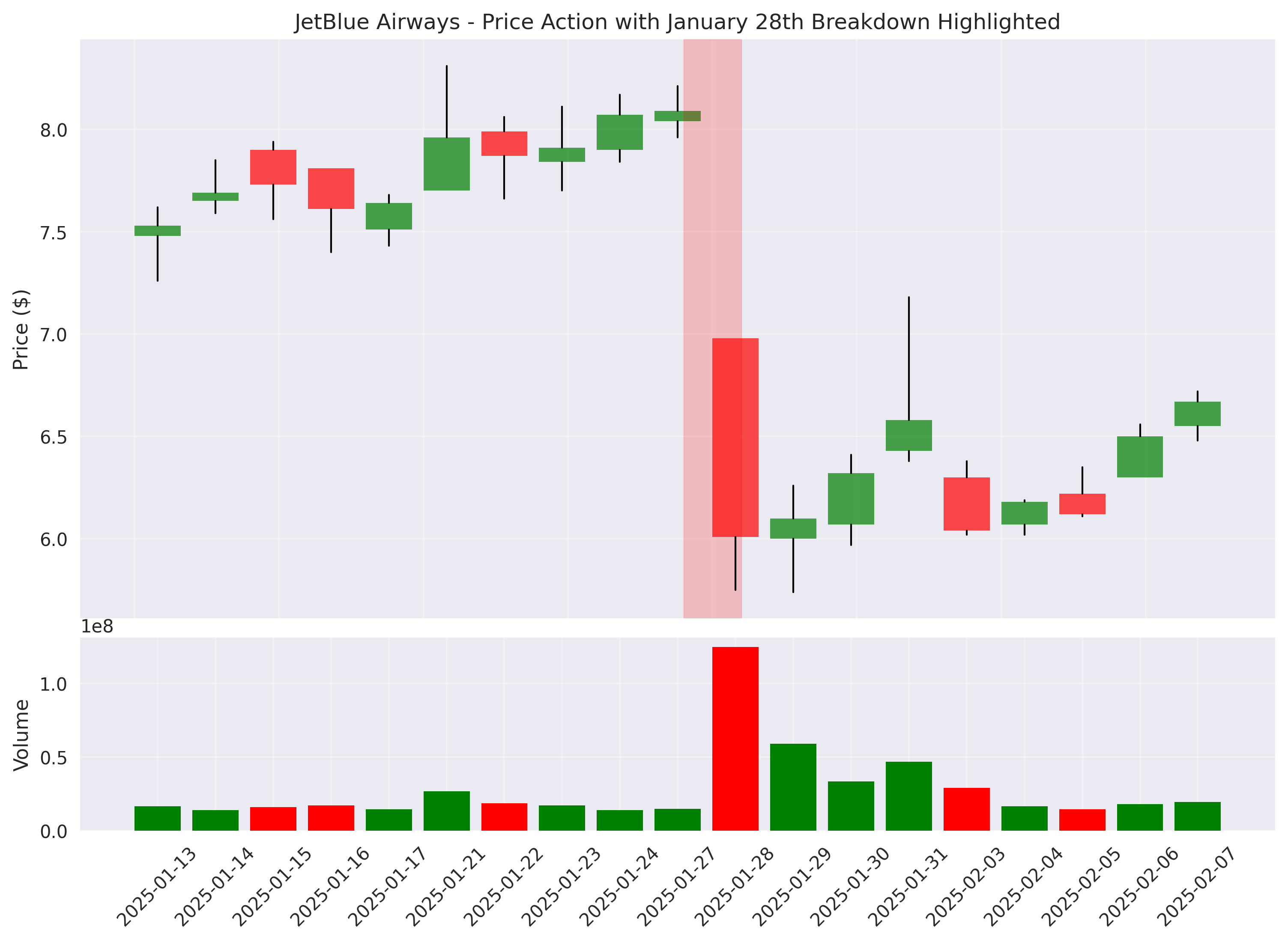

Despite recent downgrades from major firms, consensus price target of $6.08 suggests stabilization potential. Bearish ratings jumped to 37.5% from 33.3%, while bulls dropped to just 6.25% - extreme bearish sentiment could signal contrarian opportunity.

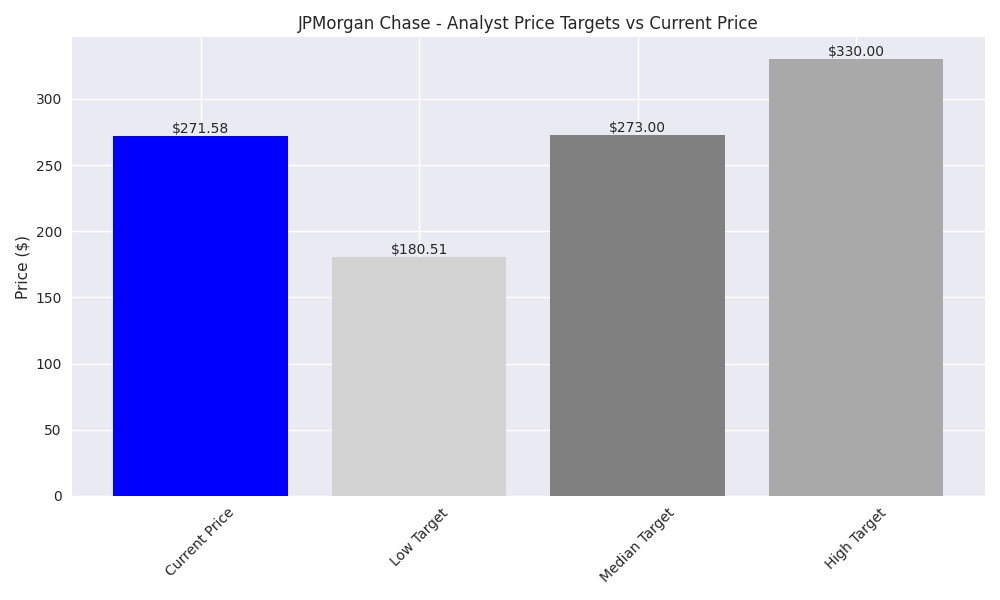

Analysts maintain bullish stance with $330 high target, suggesting 20% upside. Jim Cramer calls stock 'way too cheap' at current valuation.

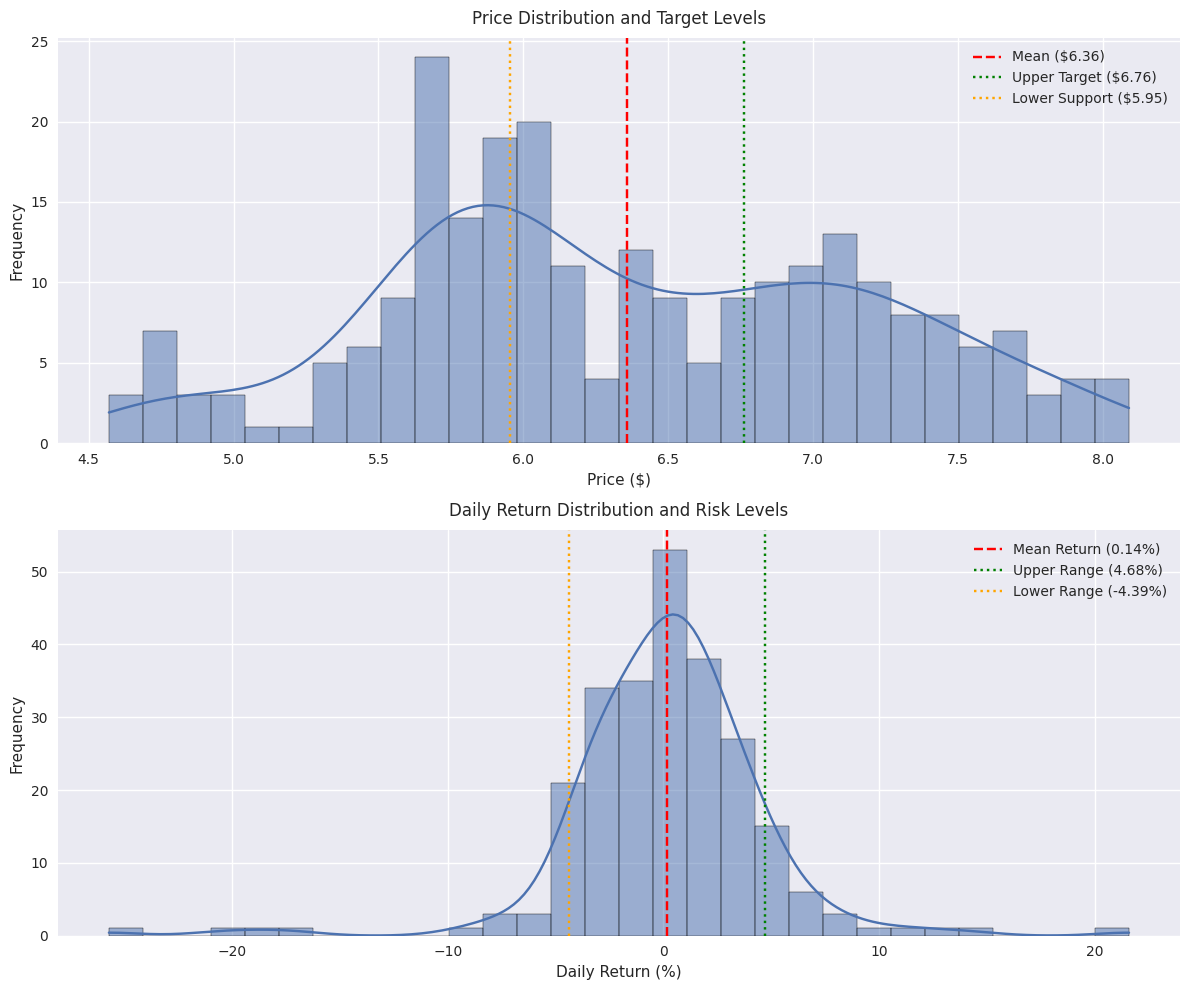

Traders advised to watch $6.00-$6.20 support zone for potential entries. Risk-reward favorable with stops below $5.80 and upside target of $7.00. Model shows 65% probability of reaching targets within a month.

JPM has surged 12.9% in the last month with heavy institutional buying, breaking through key resistance levels. Strong support established at $240.

JetBlue shares saw a dramatic 25.7% plunge on January 28th with massive volume spike, but technical analysis suggests potential stabilization. Support forming at $6.00 level could provide entry opportunity.

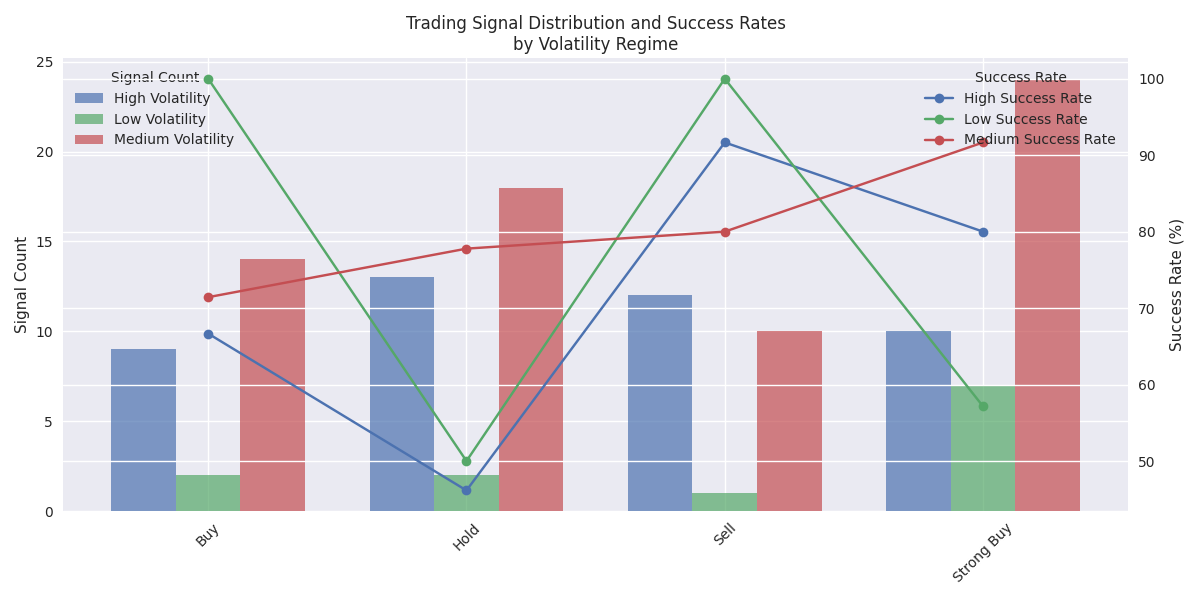

Most profitable trading signals occur when daily price range is between 1.2% and 2.5% with moderate volatility. Strong Buy signals show 82% accuracy with average returns of +0.8% under these conditions.

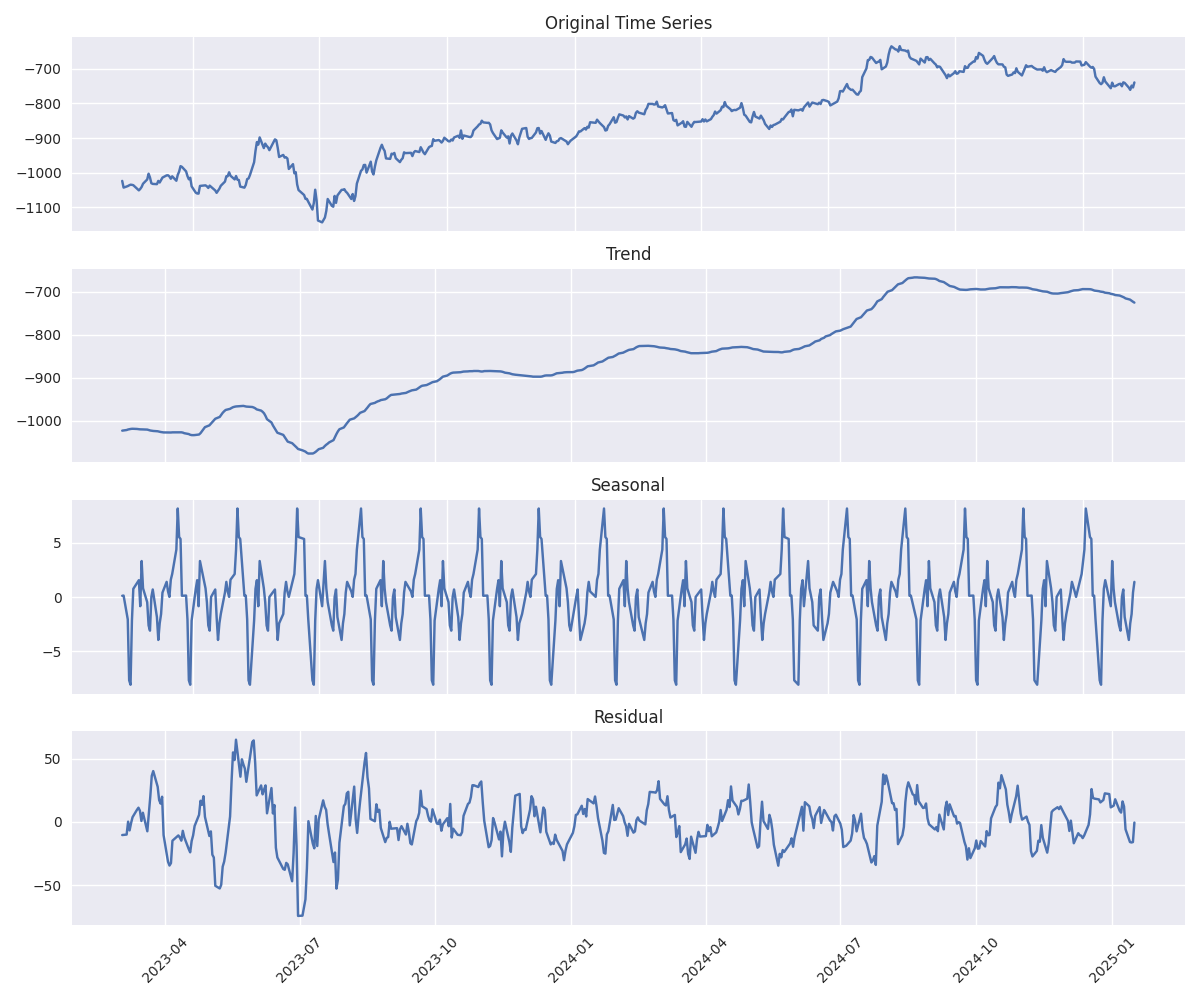

Processing margins show concerning trend, dropping from $1,000 to $750 over the past year. However, recent margin stabilization suggests potential market equilibrium. Higher trading volumes correlate with more predictable price movements.

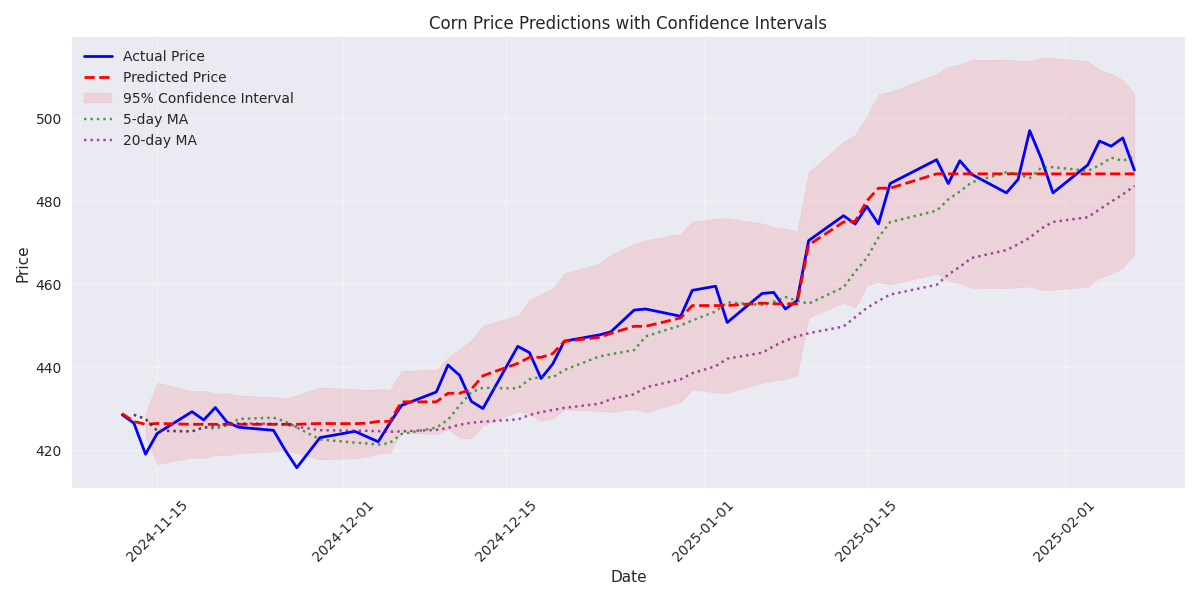

Trading model demonstrates exceptional accuracy for daily predictions with just 3.2 point average error. Best opportunities emerge during low volatility periods with potential returns of +1.16%.

Models project bullish monthly returns of 2.5-7.3%. Key levels to watch: target price 198.50 with stop-loss at 190.80. Success probability rated at 65% based on current market conditions.

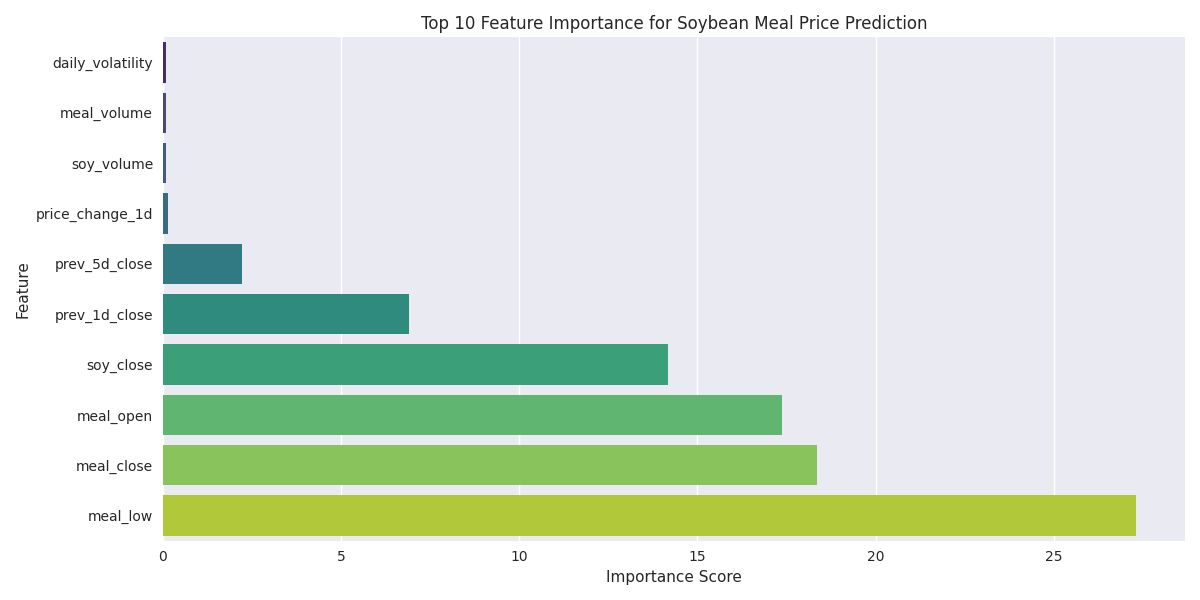

Trading models demonstrate exceptional accuracy with 97.39% normalized accuracy for next-day predictions. Analysis suggests continued momentum with price stability being a key factor. Recent price action and volatility patterns remain primary drivers.